Professional Documents

Culture Documents

79082 Bos 63255

79082 Bos 63255

Uploaded by

mayankmall810Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

79082 Bos 63255

79082 Bos 63255

Uploaded by

mayankmall810Copyright:

Available Formats

Corrigendum for Study Material [June 2023 Edition] – Printed copy

Applicable for May 2024 and November 2024 Examinations

Module Chapter Page No. Remarks

(printed

copy)

1 3 3.68 The last option to Quiz Time 5 “(b) ` 9 lakh” be read as “(d) ` 9 lakh”.

1 7 7.17 In Example 9, the words “a company uses its CSR funds to pay the seller ` 30,” be read

as “a company receives price linked subsidy of ` 30 per notebook from an NGO”.

1 7 7.24, 7.30 The word “subsidy” be read as “price linked subsidy” in Illustration 1 and Question 9.

1 7 7.31 In point (iv) of Question 11, the words “goods supplied” be read as “price”.

1 7 7.29 Q. 6 and answer thereto of “Test Your Knowledge” section be ignored.

2 13 13.38 In the diagram under the heading “Interest payable on the gross tax liability [Section

50(1)], the words starting with “after commencement of proceedings….Section 74” be

substituted with “within due date”.

2 14 14.12 In example 1, the amount “` 4 lakh” be read as “` 40,000”.

2 14 14.24 Point 3 of the table “Consequences of not complying with TDS provisions” be ignored.

2 15 15.80 In Answer 2, the words “the due date for furnishing of return for the month of September

or second quarter (in case of quarterly filers)” be replaced with “30th November”.

Note – The above corrections have been carried out in the soft copy of the Study Material webhosted at the following link:

https://boslive.icai.org/sm_module.php?module=8

You might also like

- 306Document24 pages306syikinNo ratings yet

- Harrison FA IFRS 11e CH07 SMDocument85 pagesHarrison FA IFRS 11e CH07 SMJingjing Zhu0% (1)

- Operation Research Sample ExerciseDocument4 pagesOperation Research Sample ExerciseYong LiNo ratings yet

- Waterway Continuous Problem WCPDocument17 pagesWaterway Continuous Problem WCPAboi Boboi50% (4)

- corrignDocument1 pagecorrigntp.extraworkNo ratings yet

- 70590bos56509 PDFDocument1 page70590bos56509 PDFVikasNo ratings yet

- Bos 62312Document2 pagesBos 62312mahiseth72No ratings yet

- BosfndcgDocument3 pagesBosfndcgvaddepallyanil goudNo ratings yet

- 65033bos52305 PDFDocument2 pages65033bos52305 PDFswetha reddyNo ratings yet

- Corrigendum Final (New) Course Paper 7: Direct Tax Laws & International TaxationDocument1 pageCorrigendum Final (New) Course Paper 7: Direct Tax Laws & International TaxationSiddharth MishraNo ratings yet

- Addendum To COC PWD DB Rev.2010 - Rev 1Document6 pagesAddendum To COC PWD DB Rev.2010 - Rev 1Khairul AzharNo ratings yet

- Bos 50836Document3 pagesBos 50836TJ LivestrongNo ratings yet

- Corrigendum Final (Old) Course Paper 7: Direct Tax LawsDocument1 pageCorrigendum Final (Old) Course Paper 7: Direct Tax LawsPriyanka SahniNo ratings yet

- Corrigendum To Study MaterialDocument1 pageCorrigendum To Study Materialaella shivaniNo ratings yet

- Bos 63220Document2 pagesBos 63220casuryateja1992No ratings yet

- 02 Library of Standard Amendments To NEC ECC V1.0 201610Document17 pages02 Library of Standard Amendments To NEC ECC V1.0 201610Bruce WongNo ratings yet

- Bos 61832Document2 pagesBos 61832kesarwanisaumya076No ratings yet

- Cfa Level I Errata June PDFDocument4 pagesCfa Level I Errata June PDFPONo ratings yet

- Cfa Level I Errata June PDFDocument4 pagesCfa Level I Errata June PDFPONo ratings yet

- Corrigendum To The Study Material (April, 2023 Edition) CA IntermediateDocument1 pageCorrigendum To The Study Material (April, 2023 Edition) CA Intermediateanikrish2344No ratings yet

- Cfa Level I Errata DecemberDocument4 pagesCfa Level I Errata DecemberNico TuscaniNo ratings yet

- FICHT-#21101257-v1-P2 L2 - Draft Prequalification Document Rev03Document87 pagesFICHT-#21101257-v1-P2 L2 - Draft Prequalification Document Rev03dhananjay_gvit2207No ratings yet

- Final Bidding Document - NCB 092 EDTL EP 2021 Hatubuilico ManumeraDocument100 pagesFinal Bidding Document - NCB 092 EDTL EP 2021 Hatubuilico Manumerafilomeno martinsNo ratings yet

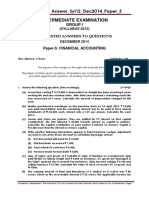

- Suggested Answer - Syl12 - Dec2014 - Paper - 5 Intermediate ExaminationDocument26 pagesSuggested Answer - Syl12 - Dec2014 - Paper - 5 Intermediate ExaminationTRAILER HUBNo ratings yet

- Law of Delict 3703Document19 pagesLaw of Delict 3703Vertozil BezuidenhoudtNo ratings yet

- Paper8 Syl22 Dec23 Set2 SolDocument13 pagesPaper8 Syl22 Dec23 Set2 Solwaranbhuvanesh81No ratings yet

- 03 Job Order CostingDocument50 pages03 Job Order CostingKevin James Sedurifa Oledan100% (1)

- Control 3 1 InstructionsDocument3 pagesControl 3 1 InstructionsroaldNo ratings yet

- Paper8 Solution PDFDocument15 pagesPaper8 Solution PDFSparsh NandaNo ratings yet

- Ch3 - Batch - Exercises and SolutionDocument9 pagesCh3 - Batch - Exercises and Solution黃群睿No ratings yet

- Paper12 Syl22 Dec23 Set1Document8 pagesPaper12 Syl22 Dec23 Set1Question BankNo ratings yet

- STUDY MATERIAL (ME-404) Unit IVDocument22 pagesSTUDY MATERIAL (ME-404) Unit IVtitanyeezNo ratings yet

- Grade 3 - Spring Semester 2020-2021: Abdulnasser M. FatahDocument11 pagesGrade 3 - Spring Semester 2020-2021: Abdulnasser M. FatahHassn LukakuNo ratings yet

- Tender Document 281221Document66 pagesTender Document 281221Jacky BrawnNo ratings yet

- Financial Accounting An Introduction To Concepts Methods and Uses 14th Edition Weil Solutions Manual 1Document36 pagesFinancial Accounting An Introduction To Concepts Methods and Uses 14th Edition Weil Solutions Manual 1richardacostaqibnfpmwxd100% (31)

- Financial Accounting An Introduction To Concepts Methods and Uses 14Th Edition Weil Solutions Manual Full Chapter PDFDocument36 pagesFinancial Accounting An Introduction To Concepts Methods and Uses 14Th Edition Weil Solutions Manual Full Chapter PDFnancy.lee736100% (9)

- Solution 14Document18 pagesSolution 14Abduselam MohammedNo ratings yet

- Assignment : DeadlineDocument12 pagesAssignment : DeadlineJoashNo ratings yet

- Bos 61832Document2 pagesBos 61832Raj DasNo ratings yet

- Cae05-Chapter 8 Leases Problem DiscussionDocument22 pagesCae05-Chapter 8 Leases Problem Discussioncris tellaNo ratings yet

- SFM MQP MergedDocument103 pagesSFM MQP Merged18kumari.nNo ratings yet

- Lockheed Tri Star and Capital Budgeting Case Analysis: ProfessorDocument8 pagesLockheed Tri Star and Capital Budgeting Case Analysis: ProfessorlicservernoidaNo ratings yet

- TDcnstrctnoftoiletDocument223 pagesTDcnstrctnoftoiletindustriesgtbNo ratings yet

- SBR Specemin 2Document26 pagesSBR Specemin 2Leamarie LimNo ratings yet

- Paper12 Solution RevisedDocument17 pagesPaper12 Solution Revised15Nabil ImtiazNo ratings yet

- Assessment 10 - Suggested Solution - 231213 - 154157 - 240120 - 141156Document15 pagesAssessment 10 - Suggested Solution - 231213 - 154157 - 240120 - 141156lebiyacNo ratings yet

- Financial Markets and Investments: Modern Portfolio Theory Session No. III 1.0Document9 pagesFinancial Markets and Investments: Modern Portfolio Theory Session No. III 1.0Lipika haldarNo ratings yet

- NCB - R - 190036Document81 pagesNCB - R - 190036vicenteNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDocument12 pagesUniversity of Cambridge International Examinations General Certificate of Education Ordinary Levelmstudy123456No ratings yet

- MI Chapter-Wise Question CompiledDocument35 pagesMI Chapter-Wise Question CompiledS.M. Hasib Ul IslamNo ratings yet

- CP1 CMP Upgrade 2020Document26 pagesCP1 CMP Upgrade 2020Toshita DalmiaNo ratings yet

- Prefinal Exam Solutions 1. DDocument7 pagesPrefinal Exam Solutions 1. DMa. Johnna TabasonNo ratings yet

- Bidding Document NCB 031 MOP 2020Document84 pagesBidding Document NCB 031 MOP 2020filomeno martinsNo ratings yet

- Becc 101Document6 pagesBecc 101Girish KumawatNo ratings yet

- ERRATA To The FIDIC Sub-Consultancy Agreement Second Edition 2017 (ISBN 978-2-88432-080-1)Document2 pagesERRATA To The FIDIC Sub-Consultancy Agreement Second Edition 2017 (ISBN 978-2-88432-080-1)Zinaw T.No ratings yet

- Spip-W-3 - 26 09 19Document243 pagesSpip-W-3 - 26 09 19Anonymous 98sE6VNo ratings yet

- Risk Management in the Air Cargo Industry: Revenue Management, Capacity Options and Financial IntermediationFrom EverandRisk Management in the Air Cargo Industry: Revenue Management, Capacity Options and Financial IntermediationNo ratings yet

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketFrom EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketNo ratings yet

- Integration of Demand Response into the Electricity Chain: Challenges, Opportunities, and Smart Grid SolutionsFrom EverandIntegration of Demand Response into the Electricity Chain: Challenges, Opportunities, and Smart Grid SolutionsNo ratings yet

- Industrial Objectives and Industrial Performance: Concepts and Fuzzy HandlingFrom EverandIndustrial Objectives and Industrial Performance: Concepts and Fuzzy HandlingNo ratings yet