Professional Documents

Culture Documents

chopra EWS SnapShot Report

chopra EWS SnapShot Report

Uploaded by

Saptarshi BhowmikCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

chopra EWS SnapShot Report

chopra EWS SnapShot Report

Uploaded by

Saptarshi BhowmikCopyright:

Available Formats

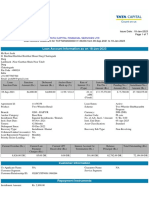

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Customer Name: CHOPRA ENTERPRISES Customer ID O38221588

1.

Status STANDARD Line of Activty

trading of electric items

Constitution PARTNERSHIP Sanctioning authority GM-HO

Sol Id 812400 Circle Office CO-KOLKATA SOUTH (BEHALA

Zonal Office ZO-KOLKATA Type Of Advance -

Last Sanction Date -

Total Exposure 202.78

Outstanding Overdue

Fund Based 202.78 200.99 0.00

Non Fund Based 0.00 0.00 0.00

Score Rank Indicator

SAJAG 94.67 5 Likely NPA

RBI SAJAG 36.88 - Severe

For Rating Purpose in

20.84 1 Healthy

Trac

EWS Score 100.00 EWS Score Dial

Parameter Transactional Financial Non-Financial

Overall Obtained EWS

12.33 26.66 1.57 EWS Score plot

Score

Max Score 40.00 33.33 26.67

RBI Score 31.48 RBI Score Dial

Parameter Transactional Financial Non-Financial

Overall Obtained RBI

1.43 8.33 0.00

Score

Max Score 40.00 33.33 26.67

Overrides

Transactional Financial Non-Financial Over all

- Last Financial Statement date is

31/03/2022

Override Invocation Date :

- Delay in submission of stock statement

- 12/03/2024 -

Override Invocation Date : 12/03/2024

- Overdue internal rating

Override Invocation Date :

12/03/2024

Internal Rating

Report Run Date/Time : 13/03/2024 Page No. 1 of 13

06:36:13:PM

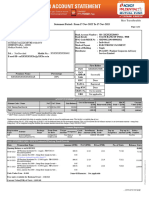

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Date of ABS Overdue Date Rating Grade Rating Score

31/03/2022 31/12/2023 PNB-B1 54.96

External Rating

Rating Amount

Rating Agency Facility Rating Assigned Rating Date Industry Instrument

(In Lakhs)

Facility Types Account Number Limit DP Balance Overdue DPD Status

TL 09047121000213 20.00 100.00 2.78 0.00 0 STANDARD

CC 09044015003837 200.00 211.28 198.21 0.00 0 STANDARD

Customer Other Details

42 PARK MANSION,57A PARK

CIN AAJFC6931B Address STREET,KOLKATA,WEST BENGAL-

700016 IN

PAN AAJFC6931B Telephone Number 919830273230

GSTIN - Mobile Number 919830273230

Authorised Capital 0.00 FAX Number -

Paid Up Capital 0.00 Email Id vivekchopra82@gmail.com

WebSite -

Sr No As On Date Sajag Score

1 12-03-2024 36.88

2 29-02-2024 39.46

Trigger

Trigger Name Trigger Reason

Generated Date

Under Insured Or Over Insured Inventory (Score = 8)

Under Insured Or AccountID Collateral_ID Insured_Value Security_Component_Value

Over Insured 2/19/2024

09044015003837 IG259678454 80.00 171.63

Inventory

Report Run Date/Time : 13/03/2024 Page No. 2 of 13

06:36:13:PM

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Close Date Closure Remark

Closure Template

selection:Optimum insurance

2/27/2024

cover since obtained Closure

Remarks:

Report Run Date/Time : 13/03/2024 Page No. 3 of 13

06:36:13:PM

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Trigger

Trigger Name Trigger Reason

Generated Date

Primary Security Under-Insured (Score = 8)

AccountID Collateral_ID Insured_Value Security_Component_Value

Primary Security

2/19/2024

Under-Insured 09044015003837 IG259678454 80.00 171.63

Significant Inconsistencies Within The Annual Report (between Various Sections) (Score =

8)Variance in the values for following heads : (Score = 8)

Column_0 CY_2022 Financial_Heads PY_2021

Significant

Inconsistencies 41.81 53.86 Short Term Borrowings 3.47

Within The -77.52 174.30 Other Current Liabilities 34.28 2/19/2024

Annual Report

(between Various -77.80 0.78 Short Term Loans And Advances 122.91

Sections) 1210.46 7.61 Long Term Borrowings 4.11

Report Run Date/Time : 13/03/2024 Page No. 4 of 13

06:36:13:PM

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Close Date Closure Remark

Closure Template

selection:Adequate insurance

2/27/2024

since obtained Closure

Remarks:

Closure Template

selection:The same is within

2/27/2024 the acceptable limits as

approved by competent

authority Closure Remarks:

Report Run Date/Time : 13/03/2024 Page No. 5 of 13

06:36:13:PM

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Trigger

Trigger Name Trigger Reason Close Date

Generated Date

TOL/TNW (Score = 8)Total Non Current Liabilities for Mar 2022 = 60.50Total Current

Liabilities for Mar 2022 = 476.41Share Capital for Mar 2022 = 304.07Reserves And Surplus

for Mar 2022 = 0.00Intangible Assets for Mar 2022 = 0.00TOL/TNW Ratio for Mar 2022 = 1

Note

TOL/TNW (Score = 8)Total Non

Current Liabilities for Mar 2022

= 60.50

Total Current Liabilities for Mar

2022 = 476.41

Share Capital for Mar 2022 =

304.07

Reserves And Surplus for Mar

2022 = 0.00

Intangible Assets for Mar 2022

= 0.00

TOL/TNW Ratio for Mar 2022 =

1.77

Total Non Current Liabilities for

TOL/TNW 2/19/2024 2/27/2024

Mar 2021 = 90.17

Total Current Liabilities for Mar

2021 = 303.11

Share Capital for Mar 2021 =

302.49

Reserves And Surplus for Mar

2021 = 0.00

Intangible Assets for Mar 2021

= 0.00

TOL/TNW Ratio for Mar 2021 =

1.30

Increase in TOL/TNW Ratio =

36.15%

Report Run Date/Time : 13/03/2024 Page No. 6 of 13

06:36:13:PM

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Closure Remark

Closure Template

selection:The same is within

the acceptable limits as

approved by competent

authority Closure Remarks:

Report Run Date/Time : 13/03/2024 Page No. 7 of 13

06:36:13:PM

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Trigger

Trigger Name Trigger Reason Close Date

Generated Date

Significant Movement In Inventory, Disproportionately Differing Vis A Vis Change In

Turnover (Score = 8)Inventory to Turnover Ratio : Mar 2022 = 0.32Inventory to Turnover

Ratio : Mar 2021 = 0.38Change in Ratio = -15.79 %

Note

Significant Movement In

Inventory, Disproportionately

Significant Differing Vis A Vis Change In

Movements In Turnover (Score = 8)Inventory

Inventory, to Turnover Ratio : Mar 2022 =

Disproportionatel 2/19/2024 2/27/2024

0.32

y Differing Vis A

Vis Change In Inventory to Turnover Ratio :

The Turnover Mar 2021 = 0.38

Change in Ratio = -15.79 %

Report Run Date/Time : 13/03/2024 Page No. 8 of 13

06:36:13:PM

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Closure Remark

Closure Template

selection:Accumulation of

inventory is in tune with the

business expansion plans

Closure Remarks:

Report Run Date/Time : 13/03/2024 Page No. 9 of 13

06:36:13:PM

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Trigger Name Trigger Reason

Current Ratio (Score = 8)Current Assets for Mar 2022 = 722.68Current Liabilities for Mar

2022 = 476.41Current Ratio for Mar 2022 = 1.52Current Assets for Mar 2021 =

581.38Current Liabilities for Mar 2021 = 303.11Current Ratio for Mar 2021 = 1.92Decline i

Note

Current Ratio (Score = 8)Current

Assets for Mar 2022 = 722.68

Current Liabilities for Mar 2022

= 476.41

Current Ratio for Mar 2022 =

1.52

Current Assets for Mar 2021 =

Current Ratio 581.38

Current Liabilities for Mar 2021

= 303.11

Current Ratio for Mar 2021 =

1.92

Decline in Current Ratio =

20.83%

Percentage Of Inward Cheques Returned To Total Inwards Cheques (Score = 8)Transactions

considered from 30/01/2024 to 29/02/2024Number of Inward Cheques Returned in Last 30

Days : 2 Cheques

Number Of Account_No. Amount Cheque_No. Date_of_return

Inward Cheque 09044015003837 1.28 142259 28/02/2024

Returns In Last

30 Days 09044015003837 8.53 142248 28/02/2024

Report Run Date/Time : 13/03/2024 Page No. 10 of 13

06:36:13:PM

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Trigger

Close Date Closure Remark

Generated Date

Closure Template

selection:The same is within

2/19/2024 2/27/2024 the acceptable limits as

approved by competent

authority Closure Remarks:

Payee SI.no.

1 3/1/2024

2

Report Run Date/Time : 13/03/2024 Page No. 11 of 13

06:36:13:PM

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Trigger

Trigger Name Trigger Reason

Generated Date

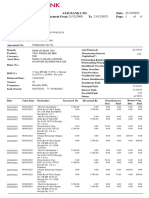

Delay In Submission Of Stock Statement (SME and Corporate/Mid-corporate) (Score = 8)

Delay In

Submission Of Account_ID Due_Date Previous_Collateral_ID

Stock Statement 09044015003837 06/11/2023 66337363 3/5/2024

(SME and

Corporate/Mid- 09044015003837 06/11/2023 66337362

corporate)

No. Of Consecutive Months Of Decline In Credit Summation (Score = 8)Month-wise Credit

SummationsTransaction data considered from 01/03/2023 To 29/02/2024

Current_Amount Current_Month Previous_Amount Previous_Month

Number Of 24.72 Nov 2023 112.63 Nov 2023

Consecutive

Months With 86.52 Dec 2023 78.54 May 2023 3/5/2024

Decline In Credit- 73.46 Jun 2023 132.26 Jun 2023

Debit Summation

112.63 Jul 2023 73.46 Oct 2023

Report Run Date/Time : 13/03/2024 Page No. 12 of 13

06:36:13:PM

EWS SnapShot Report

As On 12/03/2024

Amount in Lakhs.

Close Date Closure Remark

Report Run Date/Time : 13/03/2024 Page No. 13 of 13

06:36:13:PM

You might also like

- Isimba - A Church Management System For STDocument22 pagesIsimba - A Church Management System For STAllan Credo100% (3)

- Ace Strategy InfoDocument1 pageAce Strategy Infoapi-292206241No ratings yet

- Customer Details Loan Details Loan Financial Summary As On 08/12/2023Document5 pagesCustomer Details Loan Details Loan Financial Summary As On 08/12/2023kanhaiyakumar7673No ratings yet

- Savera India-Stock Audit Report FinalDocument13 pagesSavera India-Stock Audit Report Finalshaikhabubakar085No ratings yet

- Soa LKPLLKDB00000581XXXX 20042024 1713600304434Document6 pagesSoa LKPLLKDB00000581XXXX 20042024 1713600304434ArbindraNo ratings yet

- Soa Abw Astu000000758746 19032024 2014616Document4 pagesSoa Abw Astu000000758746 19032024 2014616AbhijeetPawarNo ratings yet

- PR Sheetal Coolproducts 4jul23Document5 pagesPR Sheetal Coolproducts 4jul23jay.futuretecNo ratings yet

- Varroc Polymers LimitedDocument7 pagesVarroc Polymers Limitedkrushna.maneNo ratings yet

- PFS Ag4861Document1 pagePFS Ag4861bristisubachanNo ratings yet

- Soa 1700471159825Document5 pagesSoa 1700471159825grv50215No ratings yet

- Bajaj loan NOCDocument3 pagesBajaj loan NOCಶಿವಾ SDNo ratings yet

- CRM StatementofAccountDocument16 pagesCRM StatementofAccountawnishkumar9518No ratings yet

- CRM StatementofAccountDocument1 pageCRM StatementofAccountRahul E ChoudharyNo ratings yet

- Soa Bltlahme00000726xxxx 19032024 1710855657286Document4 pagesSoa Bltlahme00000726xxxx 19032024 1710855657286AbhijeetPawarNo ratings yet

- Account StatementDocument3 pagesAccount StatementKoushik MukherjeeNo ratings yet

- G S BhadaniDocument2 pagesG S Bhadanigayamansukh25No ratings yet

- Aaqca3567p 2023Document5 pagesAaqca3567p 2023logeshwaranvNo ratings yet

- 2jf47ypoohmps64t2ncnddvi5rongpik85jc8hlip yDocument2 pages2jf47ypoohmps64t2ncnddvi5rongpik85jc8hlip yMayank SathoneNo ratings yet

- cas_summary_report_2024_06_27_002658Document3 pagescas_summary_report_2024_06_27_002658Vj SinghNo ratings yet

- Account StatementDocument2 pagesAccount Statementanand mishraNo ratings yet

- Marksheet R210821000893 2Document1 pageMarksheet R210821000893 2abediz2476No ratings yet

- Aur020508176724 Soa BlyDocument5 pagesAur020508176724 Soa Blyganga.ram208No ratings yet

- Acctstmt LDocument16 pagesAcctstmt LNew Age InvestmentsNo ratings yet

- CRM StatementofAccountDocument12 pagesCRM StatementofAccountawnishkumar9518No ratings yet

- Soa 1711179635584Document4 pagesSoa 1711179635584raj23.sutarNo ratings yet

- Statement of Account For 4080cdip750417: Bajaj Finance LimitedDocument3 pagesStatement of Account For 4080cdip750417: Bajaj Finance LimitedN BanuNo ratings yet

- Customer Details Loan Details Loan Financial Summary As On 27/01/2023Document3 pagesCustomer Details Loan Details Loan Financial Summary As On 27/01/2023Amit KumarNo ratings yet

- Bill of Supply of ElectricityDocument4 pagesBill of Supply of ElectricitySusmita rayNo ratings yet

- Balance SheetDocument6 pagesBalance SheetBARMER BARMENo ratings yet

- Customer Details Loan Details Loan Financial Summary As On 30/04/2023Document2 pagesCustomer Details Loan Details Loan Financial Summary As On 30/04/2023ahilraza676No ratings yet

- Statement of Account - 18:33:11Document4 pagesStatement of Account - 18:33:11ancollagepuNo ratings yet

- Vendor Opening Request Form - RPC - Bendfab AustraliaDocument1 pageVendor Opening Request Form - RPC - Bendfab AustraliaNorco TilesNo ratings yet

- Bajaj PL StatementDocument7 pagesBajaj PL Statementsrinivas rao kNo ratings yet

- Statement ReportDocument7 pagesStatement ReportRahulMahajanNo ratings yet

- MDS Abril 2022Document2 pagesMDS Abril 2022edwilsonjafarxNo ratings yet

- KBMH232152 1233247049ikm9r1kxDocument1 pageKBMH232152 1233247049ikm9r1kxmangeshmandekarmmNo ratings yet

- Annual Information Statement (AIS) : ATLPK5075H XXXX XXXX 8789 Rajiv KarnDocument2 pagesAnnual Information Statement (AIS) : ATLPK5075H XXXX XXXX 8789 Rajiv Karndevesh mishraNo ratings yet

- Soa 1713277019653Document7 pagesSoa 1713277019653sadiq.sbnNo ratings yet

- Accpd9629e 2023Document5 pagesAccpd9629e 2023wordsinditeNo ratings yet

- BajajDocument7 pagesBajajameermohammed6786No ratings yet

- Soa Mftecvlons00000520xxxx 18042023 1681800203755Document8 pagesSoa Mftecvlons00000520xxxx 18042023 1681800203755mohan MudhirajNo ratings yet

- P403FSA4332740 Statement of AccountDocument5 pagesP403FSA4332740 Statement of AccountANANDARAJ KNo ratings yet

- Portfolio 1700228693331Document3 pagesPortfolio 1700228693331Sumeet SoniNo ratings yet

- MDS Out 2022Document2 pagesMDS Out 2022edwilsonjafarxNo ratings yet

- SOA Sanjoy DasDocument9 pagesSOA Sanjoy DasSandip BanerjeeNo ratings yet

- Soa Abahmpl 000000750155 20122023 1715745Document3 pagesSoa Abahmpl 000000750155 20122023 1715745patelbhavesh724No ratings yet

- 2 B-Sheet 21-22Document4 pages2 B-Sheet 21-22Shivam SinghNo ratings yet

- SBI Mutual FundDocument2 pagesSBI Mutual FundAvijeet ChakrabortyNo ratings yet

- Soa Abbaibil000000712575 12062024 113142Document4 pagesSoa Abbaibil000000712575 12062024 113142hardeepcok123No ratings yet

- TWR 028207101374Document6 pagesTWR 028207101374ganga.ram208No ratings yet

- Loan Account Statement For 417rplhy480831Document3 pagesLoan Account Statement For 417rplhy480831Er Dnyaneshwar PatilNo ratings yet

- Soa Abbaibil000000712575 21012024 1951743Document4 pagesSoa Abbaibil000000712575 21012024 1951743hardeepcok123No ratings yet

- StatementDocument10 pagesStatementchefrinkuNo ratings yet

- Loan Account Detail As On 12/04/2022: Issue Date: 12/04/2022 Page 1 of 15Document15 pagesLoan Account Detail As On 12/04/2022: Issue Date: 12/04/2022 Page 1 of 15Shamim ShaikhNo ratings yet

- Credit Perspective GetRationaleFile 103495Document6 pagesCredit Perspective GetRationaleFile 103495anil1820No ratings yet

- TNB Lab 28.08.2020Document1 pageTNB Lab 28.08.2020Surendran RadhakrishnanNo ratings yet

- Statement of Account - 15 - 43 - 54Document3 pagesStatement of Account - 15 - 43 - 54Raghav SharmaNo ratings yet

- DRL1 CRDocument3 pagesDRL1 CRpankaj_xaviersNo ratings yet

- Aafpa6533k 2024Document4 pagesAafpa6533k 2024AravamudhanNo ratings yet

- Noble Tech Industries Private LimitedDocument3 pagesNoble Tech Industries Private Limitedkarthikeyan A INo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- Passive VoiceDocument2 pagesPassive VoiceJoseph HopperNo ratings yet

- Hots Advance MiraeDocument36 pagesHots Advance MiraeHabibie BoilerNo ratings yet

- Perfecto Floresca Vs Philex Mining CorporationDocument11 pagesPerfecto Floresca Vs Philex Mining CorporationDelsie FalculanNo ratings yet

- 107 Hand Tool Field Maintenance v0311Document8 pages107 Hand Tool Field Maintenance v0311rabbit_39No ratings yet

- 7 - Miaa V AlaDocument10 pages7 - Miaa V AlaBelle MaturanNo ratings yet

- Passive Form (1) This Test Comes From - The Site To Learn English (Test N°5733)Document2 pagesPassive Form (1) This Test Comes From - The Site To Learn English (Test N°5733)Maria Rajendran MNo ratings yet

- 1 Cyber Law PDFDocument2 pages1 Cyber Law PDFKRISHNA VIDHUSHANo ratings yet

- Optimization Module For Abaqus/CAE Based On Genetic AlgorithmDocument1 pageOptimization Module For Abaqus/CAE Based On Genetic AlgorithmSIMULIACorpNo ratings yet

- Adhd Add Individualized Education Program GuideDocument40 pagesAdhd Add Individualized Education Program Guidelogan0% (1)

- Capr-Iii En4115 PDFDocument49 pagesCapr-Iii En4115 PDFYT GAMERSNo ratings yet

- Writing Project: A. Write A 800 - 1,000 Words Essay or Monograph in A Word Processor in FormatDocument4 pagesWriting Project: A. Write A 800 - 1,000 Words Essay or Monograph in A Word Processor in FormatEbri OjeNo ratings yet

- Bio-Valley Day Spa (Final Proposal To Submit) MDocument85 pagesBio-Valley Day Spa (Final Proposal To Submit) MAtiqah Hasan100% (4)

- BMR 2105 PDFDocument6 pagesBMR 2105 PDFSitoraKodirovaNo ratings yet

- Mass Transfer in Fermentation ProcessDocument5 pagesMass Transfer in Fermentation ProcessSimone Bassan Zuicker ElizeuNo ratings yet

- Joaquin E. David v. Court of Appeals and People of The Philippines, G.R. Nos. 111168-69. June 17, 1998Document1 pageJoaquin E. David v. Court of Appeals and People of The Philippines, G.R. Nos. 111168-69. June 17, 1998Lemrose DuenasNo ratings yet

- Easy Chicken Satay With Peanut Chilli SauceDocument18 pagesEasy Chicken Satay With Peanut Chilli SauceCarina LopesNo ratings yet

- Ax88796B With Ali M3602 Mcu Reference Schematic IndexDocument4 pagesAx88796B With Ali M3602 Mcu Reference Schematic IndexdistefanoNo ratings yet

- Testable Concepts in MCQDocument188 pagesTestable Concepts in MCQrami100% (1)

- Manual For Personnel: ProposedDocument11 pagesManual For Personnel: Proposedjsopena27No ratings yet

- Narasimha Kavacham by Bhakta Prahlada - Bengali - PDF - File5475Document11 pagesNarasimha Kavacham by Bhakta Prahlada - Bengali - PDF - File5475Raghavendra RaghavendraNo ratings yet

- Tesla Levitating SphereDocument4 pagesTesla Levitating Spheremathias455No ratings yet

- MATH CHALLENGE GRADE 2 - Google FormsDocument5 pagesMATH CHALLENGE GRADE 2 - Google FormsAivy YlananNo ratings yet

- Kawng - Ha Leh Kawng Hlunte: Kristian - Halai Pawl ThiltumteDocument4 pagesKawng - Ha Leh Kawng Hlunte: Kristian - Halai Pawl ThiltumteChanmari West Branch KtpNo ratings yet

- Report of Micro Project (2) - 1Document8 pagesReport of Micro Project (2) - 1ythNo ratings yet

- Portfolio Output No. 17: Reflections On Personal RelationshipsDocument3 pagesPortfolio Output No. 17: Reflections On Personal RelationshipsKatrina De VeraNo ratings yet

- Diagnostic-Test English5 2022-2023Document5 pagesDiagnostic-Test English5 2022-2023Queen Ve NusNo ratings yet

- Masonic SymbolismDocument19 pagesMasonic SymbolismOscar Cortez100% (7)

- Prince Ganai NuclearDocument30 pagesPrince Ganai Nuclearprince_ganaiNo ratings yet