Professional Documents

Culture Documents

Task 4b UBO

Task 4b UBO

Uploaded by

Edem Augustin AGBEVE0 ratings0% found this document useful (0 votes)

2 views3 pagesUnderstanding business organisations

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentUnderstanding business organisations

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views3 pagesTask 4b UBO

Task 4b UBO

Uploaded by

Edem Augustin AGBEVEUnderstanding business organisations

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Task 4

b)

Spigot Inc. Income Statement for the period ending December 31,

2021.

1. Sales $200,000

2. Cost of goods sold $130,000

3.Gross Profit $70,000

4.Operating expenses

5. Selling expenses $22,000

6. General expenses $10,000

7. Administrative expenses $4,000

8. Total operating expenses $36,000

9. Operating income $34,000

10. Other income $2,500

11. Interest income $500

12. Income before taxes $36,000

13. Income taxes $1,800

14. Net profit $34,200.

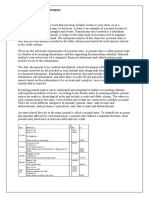

PROFITABILITY RATIOS

Here are the profitability ratios that Spigot Inc. owners look at

regularly:

Gross Profit Margin Ratio.

Operating Profit Margin Ratio.

Net Profit Margin Ratio.

Gross Profit Margin Ratio

Gross profit is what is left after the costs of goods sold have been subtracted from net sales. (Cost of

goods sold, also called "cost of sales," is the price paid by your company for the products it sold

during the period you are looking at.

The ratio of gross profit as a percentage of sales is an important indicator of your company's financial

health. Without an adequate gross margin, a company will be unable to pay its operating and other

expenses and build for the future.

Here is the formula to compute the gross profit margin ratio:

Gross profit margin ratio = (Gross profit/sales) x 100

Your company's gross margin is a very important measure of its profitability, because it looks at your

company's major inflows and outflows of money: sales (money in) and the costs of goods sold

(money out.) It is a real measure of profitability, because it must be high enough to cover costs and

provide for profits.

Operating Profit Margin

The operating profit margin is an indicator of your company's earning power from its current

operations. This is the core source of your company's cash flow, and an increase in the operating

profit margin from one period to the next is considered a sign of a healthy, growing company.

Here is the formula to compute the operating profit margin ratio:

Operating Profit Margin = (Operating Income/Sales) x 100

Because it looks at a company's operating income before taxes are subtracted, the operating profit

margin is sometimes considered a more objective evaluator than the net profit margin ratio.

(However, as you will see, this is not true for the Doobie Company. Given the small amount paid in

taxes, the gross profit margin and the net profit margin ratios are nearly identical.)

Net Profit Margin Ratio

As you can see, each of these three terms is simply a way of expressing profit when different

categories of expense are included. Gross profit is the difference between sales and the costs of goods

sold. Operating profit is the difference between sales and the costs of goods sold PLUS selling and

administrative expenses. And finally, net profit is the difference between net sales and ALL expenses,

including income taxes.

The formula for the net profit margin ratio is as follows:

Net Profit Margin Ratio = (Net Income/Sales) x 100

Comment on financial statements such as the Balance Sheet and

Profit and Loss statement:

Balance Sheet

balance sheet refers to a financial statement that reports a company's assets, liabilities, and

shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of

return for investors and evaluating a company's capital structure.

Profit and Loss (P&L) Statement

profit and loss (P&L) statement refers to a financial statement that summarizes the revenues, costs,

and expenses incurred during a specified period, usually a quarter or fiscal year. These records

provide information about a company's ability or inability to generate profit by increasing revenue,

reducing costs, or both.

https://www.investopedia.com/terms/b/balancesheet.asp

You might also like

- CH 06Document23 pagesCH 06Ahmed Al EkamNo ratings yet

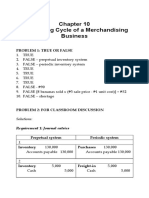

- Sol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument65 pagesSol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessPeter Piper67% (3)

- Chart of AccountDocument6 pagesChart of AccountSophath Sky100% (1)

- ASSIGNMENTSDocument13 pagesASSIGNMENTSJpzelleNo ratings yet

- Gross ProfitDocument3 pagesGross ProfitRafeh2No ratings yet

- Far 4Document9 pagesFar 4Sonu NayakNo ratings yet

- Income StatementDocument3 pagesIncome StatementMamta LallNo ratings yet

- What is Operating Profit Margin_ - Sage SoftwareDocument6 pagesWhat is Operating Profit Margin_ - Sage SoftwaredatNo ratings yet

- Key Performance IndicesDocument38 pagesKey Performance IndicesSuryanarayana TataNo ratings yet

- PAT and EBITDADocument2 pagesPAT and EBITDATravel DiaryNo ratings yet

- Profitability RatiosDocument40 pagesProfitability Ratios401 KALAVALA SAI NAVEENNo ratings yet

- Financial Statements Across Periods: Learning ObjectivesDocument53 pagesFinancial Statements Across Periods: Learning ObjectivesNoreenNo ratings yet

- CH 4 - Financial AnalysisDocument13 pagesCH 4 - Financial AnalysisbavanthinilNo ratings yet

- Business Finance FormulaDocument9 pagesBusiness Finance FormulaGeorge Nicole BaybayanNo ratings yet

- Business Finance FormulaDocument9 pagesBusiness Finance FormulaGeorge Nicole BaybayanNo ratings yet

- Understanding The Income StatementDocument4 pagesUnderstanding The Income Statementluvujaya100% (1)

- Financial Ratio & LeverageDocument25 pagesFinancial Ratio & Leverageankushrasam700No ratings yet

- Profitability and Liquidity Ratio AnalysisDocument10 pagesProfitability and Liquidity Ratio AnalysisSiham KhayetNo ratings yet

- Income StatementDocument6 pagesIncome Statementkyrian chimaNo ratings yet

- Ratio AnalysisDocument32 pagesRatio AnalysisVignesh NarayananNo ratings yet

- Equity Capital: Shari WatersDocument6 pagesEquity Capital: Shari WatersMirza ShoaibbaigNo ratings yet

- Clo-3 Assignment: Chemical Engineering Economics 2016-CH-454Document9 pagesClo-3 Assignment: Chemical Engineering Economics 2016-CH-454ali ayanNo ratings yet

- Cost & Management Accounting: A Report On Following TermsDocument17 pagesCost & Management Accounting: A Report On Following TermsAarti GajulNo ratings yet

- Ratio Analysis Is A Form of FinancialDocument18 pagesRatio Analysis Is A Form of FinancialAmrutha AyinavoluNo ratings yet

- _The_Ultimate_Income_Statement_Guide__1716347256Document7 pages_The_Ultimate_Income_Statement_Guide__1716347256Amy Ong Ee HengNo ratings yet

- Financial Accounting: Salal Durrani 2020Document12 pagesFinancial Accounting: Salal Durrani 2020Rahat BatoolNo ratings yet

- All AccountingDocument122 pagesAll AccountingHassen ReshidNo ratings yet

- Financial Statements GuideDocument16 pagesFinancial Statements Guidehenaa sssaaaaeeeett0% (1)

- Chapter Four - Financial AnalysisDocument27 pagesChapter Four - Financial AnalysisbavanthinilNo ratings yet

- How To Prepare A Profit and Loss (Income) Statement: Zions Business Resource CenterDocument16 pagesHow To Prepare A Profit and Loss (Income) Statement: Zions Business Resource CenterSiti Asma MohamadNo ratings yet

- Financial Statements: Presented by Faye ColacoDocument26 pagesFinancial Statements: Presented by Faye ColacoDeepika D. MisalNo ratings yet

- RoarDocument19 pagesRoarFrank HernandezNo ratings yet

- Profit Margin PDFDocument2 pagesProfit Margin PDFbungaNo ratings yet

- Teaching Note On Financial StatementsDocument36 pagesTeaching Note On Financial StatementsMilton StevensNo ratings yet

- Terms of Share MarketDocument6 pagesTerms of Share Marketsearchanirban6474No ratings yet

- Accounting DocumentsDocument6 pagesAccounting DocumentsMae AroganteNo ratings yet

- FNCE Assignment Week 6Document10 pagesFNCE Assignment Week 6Rajeev ShahdadpuriNo ratings yet

- How To Write A Traditional Business Plan: Step 1Document5 pagesHow To Write A Traditional Business Plan: Step 1Leslie Ann Elazegui UntalanNo ratings yet

- Inc StatmentDocument3 pagesInc StatmentDilawarNo ratings yet

- A Study On Profitability Analysis atDocument13 pagesA Study On Profitability Analysis atAsishNo ratings yet

- Understanding Profit & LossDocument3 pagesUnderstanding Profit & Lossnmvel100% (1)

- Key Takeaways: DirectDocument13 pagesKey Takeaways: DirectSB CorporationNo ratings yet

- Key Financial Performance IndicatorsDocument19 pagesKey Financial Performance Indicatorsmariana.zamudio7aNo ratings yet

- Analysis of Annual ReportDocument8 pagesAnalysis of Annual ReportyrockonuNo ratings yet

- 2-Income StatementDocument22 pages2-Income StatementSanz GuéNo ratings yet

- Module 8 and 9 EntrepDocument16 pagesModule 8 and 9 EntrepmarieenriquezsalitaNo ratings yet

- 3-Computing Gross ProfitDocument5 pages3-Computing Gross ProfitAquisha MicuboNo ratings yet

- A Project Report ON: Profitability Analysis of FMCG CompaniesDocument8 pagesA Project Report ON: Profitability Analysis of FMCG CompaniesTarun BhatiaNo ratings yet

- Zooming in On NOIDocument8 pagesZooming in On NOIandrewpereiraNo ratings yet

- Ratio Analysis - (Profitability Ratios)Document2 pagesRatio Analysis - (Profitability Ratios)Care TutorialNo ratings yet

- Net Block DefinitionsDocument16 pagesNet Block DefinitionsSabyasachi MohapatraNo ratings yet

- ROEDocument7 pagesROEfrancis willie m.ferangco100% (1)

- Financial Accounting & AnalysisDocument5 pagesFinancial Accounting & AnalysisSourav SaraswatNo ratings yet

- FSA Chapter 8 NotesDocument9 pagesFSA Chapter 8 NotesNadia ZahraNo ratings yet

- CFI Team 05072022 - Income StatementDocument8 pagesCFI Team 05072022 - Income StatementDR WONDERS PIBOWEINo ratings yet

- 21.understanding Retail ViabilityDocument23 pages21.understanding Retail ViabilitySai Abhishek TataNo ratings yet

- How To Evaluate FSDocument8 pagesHow To Evaluate FSStephany PolinarNo ratings yet

- Du Pont IdentityDocument3 pagesDu Pont Identitykishorepatil8887No ratings yet

- SSF From LinnyDocument80 pagesSSF From Linnymanojpatel51No ratings yet

- Income StatementsDocument5 pagesIncome StatementsAdetunbi TolulopeNo ratings yet

- Summary Ch4 & Ch5Document10 pagesSummary Ch4 & Ch5beenishyousafNo ratings yet

- Profitability RatiosDocument24 pagesProfitability RatiosEjaz Ahmed100% (1)

- Annual Report 2020 PT Berlina TBKDocument348 pagesAnnual Report 2020 PT Berlina TBKBrown kittenNo ratings yet

- Audit of Equity InvestmentsDocument5 pagesAudit of Equity Investmentsdummy accountNo ratings yet

- Inclusions To Gross Income Illustrative ExamplesDocument5 pagesInclusions To Gross Income Illustrative ExamplesMary Rose CredoNo ratings yet

- Endterm Paper Finmgt - FinalDocument46 pagesEndterm Paper Finmgt - FinalJenniveve ocenaNo ratings yet

- Question Bank - Tax LawDocument6 pagesQuestion Bank - Tax LawNiraj PandeyNo ratings yet

- CH-1 The Accounting Equation2Document47 pagesCH-1 The Accounting Equation2Yasin Arafat ShuvoNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsZeth Nathaniel TominesNo ratings yet

- Tax Optimization and The Firm 'S Value: Evidence From The Tunisian ContextDocument8 pagesTax Optimization and The Firm 'S Value: Evidence From The Tunisian ContextInes KatebNo ratings yet

- MPERs Disclosure ChecklistDocument25 pagesMPERs Disclosure ChecklistFAUZAN WAHABNo ratings yet

- Kajaria PDFDocument20 pagesKajaria PDFvaibhav surekaNo ratings yet

- Chapter 6Document13 pagesChapter 6norleen.sarmientoNo ratings yet

- Daftar Akun PT Niko ElektronikDocument4 pagesDaftar Akun PT Niko ElektronikYulitaNo ratings yet

- Chapter 1Document59 pagesChapter 1bawarraiNo ratings yet

- Economic For Managers Task (1) 7.9.21Document3 pagesEconomic For Managers Task (1) 7.9.21RahmahtikaNo ratings yet

- Notes On National IncomeDocument9 pagesNotes On National IncomesaravananNo ratings yet

- CFAS - Lec. 5 PAS 7, PAS8, PAS10Document28 pagesCFAS - Lec. 5 PAS 7, PAS8, PAS10latte aeriNo ratings yet

- DLL Tle-He 6 q3 w3Document6 pagesDLL Tle-He 6 q3 w3EL FRANCE MACATENo ratings yet

- Statement of Income, Changes in EquityDocument6 pagesStatement of Income, Changes in EquityAdrian CallanganNo ratings yet

- Computation Mumbai Bazaar 2022Document3 pagesComputation Mumbai Bazaar 2022Sanjeev RanjanNo ratings yet

- Household Economic Strengthening in Tanzania: Framework For PEPFAR ProgrammingDocument50 pagesHousehold Economic Strengthening in Tanzania: Framework For PEPFAR ProgrammingJason Wolfe100% (1)

- Reviewer Pfrs 15 Revenue From Contracts With CustomersDocument4 pagesReviewer Pfrs 15 Revenue From Contracts With CustomersMaria TheresaNo ratings yet

- Factor Markets and Income Distribution: Presented By: Sbac-1CDocument45 pagesFactor Markets and Income Distribution: Presented By: Sbac-1CHartin StylesNo ratings yet

- Entrep Mind Module 6Document10 pagesEntrep Mind Module 6Wynnie RondonNo ratings yet

- Problems I: P4-5 Eamirrgr)Document1 pageProblems I: P4-5 Eamirrgr)Amel LiaNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet