Professional Documents

Culture Documents

Operating Statements- Notes

Operating Statements- Notes

Uploaded by

genevieveonyinyechi02Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Operating Statements- Notes

Operating Statements- Notes

Uploaded by

genevieveonyinyechi02Copyright:

Available Formats

Equity Professional

(Accountancy & Financial Tutors) PM

Operating Statements

This is also known as income statement. It is use for the presentation of operating result

or performance of an organization for a particular period. Basically, there are two

methods of presenting income statement, and these include:

▪ Marginal Costing Approach

▪ Absorption Costing Approach

Marginal Costing Approach

This is a costing technique that charged all direct or variable cost of production such

as direct material, direct labour, direct expenses, and variable part of overhead to

cost unit of a product. It is the accounting system in which variable costs are charged

to cost units and fixed costs of the period are written off in full against the aggregate

contribution.

Marginal costing is the principal costing technique designed to aid managerial

decisions. The key reason for this is that the marginal costing approach allows

management's attention to be focused on the changes which result from the decision

under consideration.

Advantages of Marginal Costing

1. Contribution per unit is constant unlike profit per unit which varies with changes

in sales volume.

2. There is no under or over absorption of overheads (and hence no adjustment

is required in the income statement).

3. Fixed costs are a period cost and are charged in full to the period under

consideration.

4. Marginal costing is useful in the decision-making process.

5. It is simple to operate.

The main disadvantages of marginal costing include:

➢ Closing inventory is not valued in accordance with accounting standards.

➢ Fixed production overheads are not 'shared' out between units of production

but written off in full instead.

Format:

Income Statement Using Marginal Costing Approach

N N

Sales xx

Production Costs:

Opening Stock (Valued at TVC per unit) x

Direct Material x

Direct Labour x

Direct Expenses x

Variable Overhead x

Cost of Goods Available for Sale (COGAS) x

Closing Stock (Valued at TVC per unit) (x)

Cost of Goods Sold (COGS) x

Add: Variable Non-Production Costs:

Selling & Distribution Expenses x

Victoria Island Centre Isolo Centre

Address: King’s College Annex, 2/4 Adeyemo Address: Holy Saviour’s College, College Road, By

1

Alakija Street, Victoria Island, Lagos, Nigeria Aiye Bus Stop, Off Aswani-Osolo Road, Isolo, Lagos.

Phone: 0708 086 8079 Phone: 0818 242 9689

Equity Professional

(Accountancy & Financial Tutors) PM

Administrative Expenses x (x)

Contribution xx

Period Costs:

Fixed Production Overhead x

Fixed Selling & Distribution Expenses x

Fixed Administrative Expenses x (x)

Profit Before Tax (PBT) xx

Income Tax (Tax Rate x PBT) (x)

Net Profit / (Loss) xx / (xx)

Points to note under Marginal Costing Method:

▪ Opening and closing stocks are valued using total variable cost (i.e. direct

material, direct labour, direct expenses and variable production overhead)

per unit

▪ Fixed production overhead is written off from contribution in determining net

profit. In this case, fixed production overhead is calculated as budgeted

output or normal capacity multiply by fixed overhead absorption rate

▪ Under / (over) absorbed overhead is not considered.

Absorption Costing Approach

This is a costing technique that charged total cost of production (i.e. variable and

fixed costs) to unit cost of a product. It is also known as full costing or total costing

method. Absorption costing is a managerial accounting method of charging all costs

associated with manufacturing a particular product and is required for generally

accepted accounting principles (GAAP) external reporting. Some of the direct costs

associated with manufacturing a product includes wages for workers physically

manufacturing a product, the raw materials used in producing a product, and all of

the overhead costs, such as rent and rates, heat and light, building insurance etc.,

used in producing the good.

Advantages

1. Absorption costing includes an element of fixed overheads in inventory values.

2. Analyzing under/over absorption of overheads is a useful exercise in controlling

costs of an organization.

3. In small organizations, absorbing overheads into the costs of products is the

best way of estimating job costs and profits on jobs.

4. It will result in more accurate accounting regarding ending inventory.

Disadvantages

1. Fixed overheads cannot be easily attributable to each unit because it is based

on apportionment which is subjective.

2. The cost allocated to each unit of production is based on the cost incurred

relative to volume of production.

Victoria Island Centre Isolo Centre

Address: King’s College Annex, 2/4 Adeyemo Address: Holy Saviour’s College, College Road, By

2

Alakija Street, Victoria Island, Lagos, Nigeria Aiye Bus Stop, Off Aswani-Osolo Road, Isolo, Lagos.

Phone: 0708 086 8079 Phone: 0818 242 9689

Equity Professional

(Accountancy & Financial Tutors) PM

Format:

Income Statement Using Absorption Costing Approach

N N

Sales xx

Production Costs:

Opening Stock (Valued at TC per unit) x

Direct Material x

Direct Labour x

Direct Expenses x

Variable Overhead x

Fixed Production Overhead x

Cost of Goods Available for Sale (COGAS) x

Closing Stock (Valued at TC Per Unit) (x)

Cost of Good Sold (COGS) (x)

(Under) / Over Absorption x/(x) (x)

Gross Profit xx

Non-Production Expenses:

Selling & Distribution Expenses x

Administrative Expenses x (x)

Profit Before Tax xx

Income Tax (Tax Rate x PBT) (x)

Net Profit xx / (xx)

Points to note under Absorption Costing Method:

▪ Opening and closing stocks are valued at total cost (i.e. variable cost + fixed

production overhead) per unit.

▪ Fixed production overhead is considered part of production cost in

determining unit cost of a product. In this case, fixed production overhead is

calculated as number of units produced multiply by fixed overhead absorption

rate.

▪ Under / over absorbed overhead is adjusted from cost of goods sold.

Note:

• Under-absorbed overhead occurs when budgeted overhead or output is lower

than the actual overhead incurred, or actual unit produced. In this case, the

under absorbed overhead is deducted from cost of goods sold.

• Over-absorbed overhead arises when the budgeted overhead or output is

higher than the actual overhead incurred, or actual unit produced. Under this

situation, the most important thing to do is to add the over-absorbed overhead

to the cost of goods sold.

Fixed overhead absorption rate can be calculated as follows:

Fixed Production Overhead

FOAR =

Normal Capacity or budgeted Output

Victoria Island Centre Isolo Centre

Address: King’s College Annex, 2/4 Adeyemo Address: Holy Saviour’s College, College Road, By

3

Alakija Street, Victoria Island, Lagos, Nigeria Aiye Bus Stop, Off Aswani-Osolo Road, Isolo, Lagos.

Phone: 0708 086 8079 Phone: 0818 242 9689

Equity Professional

(Accountancy & Financial Tutors) PM

Reconciliation Statement

Income statement prepared using marginal and absorption costing techniques will

usually bring about conflicting results. This is due to the treatment of stock valuation

under each method. Opening and closing stocks are valued at variable cost per unit

under marginal costing method while absorption costing method valued stocks at

total cost per unit.

Therefore, the difference in net profit before tax can be reconciled from the

difference in stock values under the two methods (i.e. the difference in net profit

before tax will equate the difference in stock values under the two methods).

This can be shown as follows:

Reconciliation Statement

Profit Before Tax: N N

Absorption Costing Method xx

Marginal Costing Method (xx)

Difference in Profit (a) xx

Stock Valuation:

Closing Stock:

Absorption Costing Method xx

Marginal Costing Method (xx)

xx

Opening Stock:

Absorption Costing Method xx

Marginal Costing Method (xx) (xx)

Difference in Stock Valuation (b) xx

a=b=0

Victoria Island Centre Isolo Centre

Address: King’s College Annex, 2/4 Adeyemo Address: Holy Saviour’s College, College Road, By

4

Alakija Street, Victoria Island, Lagos, Nigeria Aiye Bus Stop, Off Aswani-Osolo Road, Isolo, Lagos.

Phone: 0708 086 8079 Phone: 0818 242 9689

Equity Professional

(Accountancy & Financial Tutors) PM

Illustrations

Victoria Island Centre Isolo Centre

Address: King’s College Annex, 2/4 Adeyemo Address: Holy Saviour’s College, College Road, By

5

Alakija Street, Victoria Island, Lagos, Nigeria Aiye Bus Stop, Off Aswani-Osolo Road, Isolo, Lagos.

Phone: 0708 086 8079 Phone: 0818 242 9689

Equity Professional

(Accountancy & Financial Tutors) PM

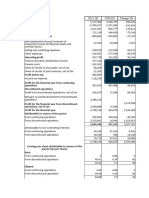

Illustration 1

Fernandez Company Ltd manufactured face towel, the standard unit costs of its

production are given below:

N

Direct Material 1.60

Direct Labour 1.50

Variable Manufacturing Overheads 1.20

Fixed Manufacturing Overheads 3.00

7.30

At normal operating capacity, 200,000 units of product should be manufactured.

Variable selling and administrative expenses amount to 50kobo per unit and fixed

selling and administrative expenses amount to N75,000 a year. Income taxes at 40%

of net income before taxes.

Production and sales data for year 2008 and 2009 in unit:

Inventory on hand, January 2008 28,000

Production for year 2008 200,000

Sales for year 2008 160,000

Production for year 2009 150,000

Sales for year 2009 180,000

In both years each towel is sold for N10.50

Required:

Prepare income statement for the years by:

a. Absorption Costing Method

b. Variable Costing Method

c. Prepare a reconciliation statement to show why there is difference between

the results of the two methods.

Illustration 2

Panama Ltd makes and sells one product, which has the following standard

production cost.

N

Direct Labour 3 hours at N6 per hour 18

Direct Material 4 kilograms at N7 per kg 28

Variable Production Overhead 3

Fixed Production Overhead 20

Standard Production Cost per unit 69

Normal output is 16,000 units per annum. Variable selling, distribution, and

administration costs are 20% of sales value. Fixed selling, distribution, and

administration costs are N180,000 per annum. There are no units in finished goods

inventory on 1 October 2021. The fixed overhead expenditure is spread evenly

throughout the year.

Victoria Island Centre Isolo Centre

Address: King’s College Annex, 2/4 Adeyemo Address: Holy Saviour’s College, College Road, By

6

Alakija Street, Victoria Island, Lagos, Nigeria Aiye Bus Stop, Off Aswani-Osolo Road, Isolo, Lagos.

Phone: 0708 086 8079 Phone: 0818 242 9689

Equity Professional

(Accountancy & Financial Tutors) PM

The selling price per unit is N140. Production and sales budgets are shown in the table

below:

Six months ending Six months ending

31st March 2022 30th September 2022

Production 8,500 7,000

Sales 7,000 8,000

Required:

Prepare operating statement for each of the six-monthly periods using:

a. Marginal Costing Technique

b. Absorption Costing Technique

Victoria Island Centre Isolo Centre

Address: King’s College Annex, 2/4 Adeyemo Address: Holy Saviour’s College, College Road, By

7

Alakija Street, Victoria Island, Lagos, Nigeria Aiye Bus Stop, Off Aswani-Osolo Road, Isolo, Lagos.

Phone: 0708 086 8079 Phone: 0818 242 9689

You might also like

- Full Download PDF of (Ebook PDF) Accounting: What The Numbers Mean 12th Edition by David Marshall All ChapterDocument43 pagesFull Download PDF of (Ebook PDF) Accounting: What The Numbers Mean 12th Edition by David Marshall All Chapterpesimogeose82100% (5)

- Marginal Costing & Absorption CostingDocument56 pagesMarginal Costing & Absorption CostingHoàng Phương ThảoNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- F5 Cenit Online Notes P1Document23 pagesF5 Cenit Online Notes P1Izhar MumtazNo ratings yet

- 1491820614costing by CA Jitender Singh (Overhead, Labour, Material, Marginal, Ratio, Machine Hour RateDocument311 pages1491820614costing by CA Jitender Singh (Overhead, Labour, Material, Marginal, Ratio, Machine Hour RateRam IyerNo ratings yet

- Variable and Absorption CostingDocument2 pagesVariable and Absorption CostingLaura OliviaNo ratings yet

- Unit 2 - Manufacturing Accounts Lecture NotesDocument9 pagesUnit 2 - Manufacturing Accounts Lecture Noteslashy123booNo ratings yet

- Lecture 4 - 5 17102022 032709am 07032023 090715pm 17102023 015148pmDocument41 pagesLecture 4 - 5 17102022 032709am 07032023 090715pm 17102023 015148pmmurtaza haiderNo ratings yet

- Chapter 10 - Marginal and Absorption CostingDocument8 pagesChapter 10 - Marginal and Absorption CostingkundiarshdeepNo ratings yet

- Absorption Marginal CostingDocument36 pagesAbsorption Marginal CostingsamiNo ratings yet

- Marginal CostingDocument42 pagesMarginal CostingAbdifatah SaidNo ratings yet

- Chapter 4 Income Measurement and ReportingDocument13 pagesChapter 4 Income Measurement and ReportingOmisha KhatiwadaNo ratings yet

- 03 MAS - Var. & Absorption CostingDocument6 pages03 MAS - Var. & Absorption CostingManwol JangNo ratings yet

- Absorption and Variable Costing: Types of Product Costing MethodDocument2 pagesAbsorption and Variable Costing: Types of Product Costing MethodKuya ANo ratings yet

- Marginal Costing TYBAFDocument13 pagesMarginal Costing TYBAFAkash BugadeNo ratings yet

- 006 Camist Ch04 Amndd Hs PP 79-102 Branded BW RP SecDocument25 pages006 Camist Ch04 Amndd Hs PP 79-102 Branded BW RP SecMd Salahuddin HowladerNo ratings yet

- F2 Marginal Costing & Contribution TheoryDocument7 pagesF2 Marginal Costing & Contribution TheoryCourage KanyonganiseNo ratings yet

- Tutorial 02 - Absorption and Marginal CostingDocument23 pagesTutorial 02 - Absorption and Marginal CostingtoddpetersonsellsNo ratings yet

- Management Accounting NotesDocument8 pagesManagement Accounting NotesNafiz RahmanNo ratings yet

- Variable CostingDocument2 pagesVariable CostingMutia Novita SariNo ratings yet

- Product CostingDocument34 pagesProduct CostingrhearomefranciscoNo ratings yet

- Marginal Costing and Absorption Costing: Department OF Accounting ACC322 - Advanced Cost AccountingDocument34 pagesMarginal Costing and Absorption Costing: Department OF Accounting ACC322 - Advanced Cost AccountingDavid ONo ratings yet

- Study Guide Variable Versus Absorption CostingDocument9 pagesStudy Guide Variable Versus Absorption CostingFlorie May HizoNo ratings yet

- Ma Costing Ac570-AmcmDocument33 pagesMa Costing Ac570-Amcmnamrata.hedaoo2No ratings yet

- Strat Cost Notes (Prelims)Document2 pagesStrat Cost Notes (Prelims)Raf Ezekiel MayaoNo ratings yet

- 103 Sample Chapter PDFDocument28 pages103 Sample Chapter PDFKomal MusaleNo ratings yet

- 103 Sample ChapterDocument28 pages103 Sample ChapterRithik VisuNo ratings yet

- Chapter 9 Marginal Costing and Absorption CostingDocument7 pagesChapter 9 Marginal Costing and Absorption CostingLinyVatNo ratings yet

- Absorption CostingDocument10 pagesAbsorption Costingberyl_hst100% (1)

- Ringkasan Materi - Akuntansi ManajemenDocument7 pagesRingkasan Materi - Akuntansi ManajemenFahmi Nur AlfiyanNo ratings yet

- I. Product Costs and Service Costs: Absorption CostingDocument12 pagesI. Product Costs and Service Costs: Absorption CostingLinyVatNo ratings yet

- CMA-Unit 5 - Absorbtion Costing, Operation Costing & by Product Costing - 18-19Document23 pagesCMA-Unit 5 - Absorbtion Costing, Operation Costing & by Product Costing - 18-19rohit vermaNo ratings yet

- Features of Marginal CostingDocument3 pagesFeatures of Marginal CostingBarno NicholusNo ratings yet

- Classification of Costs, Profits, Contribution: Costs Quick Quiz Cost Centres and Profit CentresDocument20 pagesClassification of Costs, Profits, Contribution: Costs Quick Quiz Cost Centres and Profit CentressomutasuNo ratings yet

- Variable CostingDocument34 pagesVariable CostingScraper LancelotNo ratings yet

- Manufacturing AccountsDocument5 pagesManufacturing AccountsADEYANJU AKEEMNo ratings yet

- Costing NotesDocument48 pagesCosting NotesOckouri BarnesNo ratings yet

- Unit Cost Calculation: Afzal Ahmed, Fca Finance Controller NagadDocument27 pagesUnit Cost Calculation: Afzal Ahmed, Fca Finance Controller NagadsajedulNo ratings yet

- Variable and Absorption CostingDocument5 pagesVariable and Absorption CostingAllan Jay CabreraNo ratings yet

- MI Synopsis PDFDocument54 pagesMI Synopsis PDFTaufik AhmmedNo ratings yet

- Marginal Costing: by - Jatin Pundhir I.I.L.M CmsDocument11 pagesMarginal Costing: by - Jatin Pundhir I.I.L.M CmsJatin PundhirNo ratings yet

- Marginal Costing NotesDocument16 pagesMarginal Costing NotesFarrukhsg100% (2)

- CostDocument21 pagesCostAhmed El Khateeb أحمد الخطيبNo ratings yet

- Garrison/Libby/Webb Managerial Accounting 11 Edition Formula SummaryDocument4 pagesGarrison/Libby/Webb Managerial Accounting 11 Edition Formula Summaryمنیر ساداتNo ratings yet

- Management Accounting NotesDocument212 pagesManagement Accounting NotesFrank Chinguwo100% (1)

- Absorption and Variable Costing NotesDocument4 pagesAbsorption and Variable Costing NotesGerald Nitz PonceNo ratings yet

- Management Responsibility & Performance MeasurementDocument30 pagesManagement Responsibility & Performance MeasurementsamiNo ratings yet

- A - Relevant Costing With Linear ProgrammingDocument9 pagesA - Relevant Costing With Linear Programmingian dizonNo ratings yet

- Ebook Cornerstones of Managerial Accounting Canadian 3Rd Edition Mowen Solutions Manual Full Chapter PDFDocument51 pagesEbook Cornerstones of Managerial Accounting Canadian 3Rd Edition Mowen Solutions Manual Full Chapter PDFxaviaalexandrawp86i100% (14)

- Marginal Costing and Absorption CostingDocument12 pagesMarginal Costing and Absorption CostingStili MwasileNo ratings yet

- Variable Costing & Segment Reporting-FINALDocument29 pagesVariable Costing & Segment Reporting-FINALTin Bernadette DominicoNo ratings yet

- Management Accounting Sheet: Profit Statement of Imperial ToysDocument25 pagesManagement Accounting Sheet: Profit Statement of Imperial ToysShanaya PatelNo ratings yet

- ACT121 - Topic 5Document5 pagesACT121 - Topic 5Juan FrivaldoNo ratings yet

- Team Work Makes The Dream Work Acctg15 Var. Absorption CostingDocument4 pagesTeam Work Makes The Dream Work Acctg15 Var. Absorption Costinggeorgia cerezoNo ratings yet

- Cost ManagementDocument23 pagesCost ManagementEswara ReddyNo ratings yet

- SCM Unit 4 Variable and Absorption CostingDocument9 pagesSCM Unit 4 Variable and Absorption CostingMargie Garcia LausaNo ratings yet

- Variable Costing: A Decision-Making Perspective: True-False StatementsDocument8 pagesVariable Costing: A Decision-Making Perspective: True-False StatementsJanina Marie GarciaNo ratings yet

- RN Week 2 - Costs & Costing StudentsDocument14 pagesRN Week 2 - Costs & Costing Studentsdredre463No ratings yet

- ACC2203 HandoutsDocument17 pagesACC2203 HandoutsbeaudecoupeNo ratings yet

- Five-Page Summary of Key Concepts:: Cost ClassificationsDocument16 pagesFive-Page Summary of Key Concepts:: Cost ClassificationsDar FayeNo ratings yet

- Strategic Financial ManagementDocument5 pagesStrategic Financial Managementranjitghosh684No ratings yet

- ESOPDocument17 pagesESOPSumantha SahaNo ratings yet

- Audit of CFS Mind MapDocument1 pageAudit of CFS Mind Mapgovarthan1976No ratings yet

- Chapter 2, Accounting For Plant Assets and IntagiblesDocument20 pagesChapter 2, Accounting For Plant Assets and IntagiblesAbdi Mucee TubeNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash FlowsDaniel PeterNo ratings yet

- Cost Accounting OMDocument26 pagesCost Accounting OMJohn CenaNo ratings yet

- Illustrative Problems With Solution Problem 1 To 7Document10 pagesIllustrative Problems With Solution Problem 1 To 7Viky Rose EballeNo ratings yet

- To Make The Necessary Entries and Calculate The Gain or LossDocument5 pagesTo Make The Necessary Entries and Calculate The Gain or LossMaryam IkhlaqeNo ratings yet

- SWIFT Notes To Financial StatementsDocument11 pagesSWIFT Notes To Financial StatementsArvin TejonesNo ratings yet

- ACT1106-Midterm Quiz No. 3 With AnswerDocument6 pagesACT1106-Midterm Quiz No. 3 With AnswerPj Dela VegaNo ratings yet

- InvestingDocument65 pagesInvestingLuluNo ratings yet

- Kumpulan 2 - Kancil Group ProjectDocument58 pagesKumpulan 2 - Kancil Group ProjectYamunasri Mari100% (2)

- Informe en Inglés Escuela de Contabilidad 2023 - IIDocument10 pagesInforme en Inglés Escuela de Contabilidad 2023 - IIDeivid Jârëd BrönčånōNo ratings yet

- IS Excel Participant (Risit Savani) - Simplified v2Document9 pagesIS Excel Participant (Risit Savani) - Simplified v2risitsavaniNo ratings yet

- Company Law 2Document30 pagesCompany Law 22slice.workNo ratings yet

- Accounting AssignmentDocument5 pagesAccounting AssignmentFelix blayNo ratings yet

- IFSA Income StatementDocument2 pagesIFSA Income StatementYaesnavy ParamesvaranNo ratings yet

- Samuel Owa Milestone 2Document10 pagesSamuel Owa Milestone 2Sam Olamibode OwaNo ratings yet

- Zscaler AnalysisDocument3 pagesZscaler AnalysisChuheng GuoNo ratings yet

- Reflection Paper 4 - DMCIDocument3 pagesReflection Paper 4 - DMCIIversonNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document16 pagesCambridge International AS & A Level: ACCOUNTING 9706/32Kristen NallanNo ratings yet

- Del Monte Food Inc (Financial Statements)Document10 pagesDel Monte Food Inc (Financial Statements)Stephanie CollinsNo ratings yet

- Partnership Formation and OperationDocument77 pagesPartnership Formation and OperationLorraine GrimaldoNo ratings yet

- Merger ChecklistDocument6 pagesMerger Checklistgannusingh1112No ratings yet

- Accounting 7th Edition Horngren Solutions ManualDocument75 pagesAccounting 7th Edition Horngren Solutions ManualAdrianHayescgide100% (14)

- CERTIFICATE OF INCREASE NEW - AsdDocument2 pagesCERTIFICATE OF INCREASE NEW - AsdEphraim LopezNo ratings yet

- 3rd QTR Financials PDFDocument2 pages3rd QTR Financials PDFSubash AryalNo ratings yet

- Accounts Theory 21 Marks CTC ClassesDocument8 pagesAccounts Theory 21 Marks CTC Classeskhushalpareek8584No ratings yet

- Chapter 5 - Security Market IndexesDocument24 pagesChapter 5 - Security Market IndexesImejah FaviNo ratings yet