Professional Documents

Culture Documents

Talbots Management & Board Beyond Contempt - Kinnaras Capital Blog

Talbots Management & Board Beyond Contempt - Kinnaras Capital Blog

Uploaded by

Anonymous Feglbx5Copyright:

Available Formats

You might also like

- Micro Econ 6 Principles of Microeconomics 6Th Edition William A Mceachern Full ChapterDocument67 pagesMicro Econ 6 Principles of Microeconomics 6Th Edition William A Mceachern Full Chapterchristine.parsons231100% (6)

- Carlyle Model Interview Test - InstructionsDocument2 pagesCarlyle Model Interview Test - Instructionsjorgeetcheverria100% (1)

- Silverlake-Financial Alchemy PDFDocument42 pagesSilverlake-Financial Alchemy PDFInvest Stock0% (1)

- 2012 q3 Letter DdicDocument5 pages2012 q3 Letter DdicDistressedDebtInvestNo ratings yet

- Voss Capital On BlucoraDocument4 pagesVoss Capital On BlucoraCanadianValueNo ratings yet

- Blain Kitchenware Inc.: Capital StructureDocument7 pagesBlain Kitchenware Inc.: Capital StructureRoy Lambert100% (4)

- Kinnaras Capital Management LLCDocument4 pagesKinnaras Capital Management LLCamit.chokshi2353No ratings yet

- Seminar On Corporate Restructuring: Topic: Leveraged BuyoutDocument24 pagesSeminar On Corporate Restructuring: Topic: Leveraged BuyoutNIDHI SAROANo ratings yet

- Telus Dividend Policy FinalDocument7 pagesTelus Dividend Policy Finalmalaika12No ratings yet

- Corsair Capital Q4 2011Document3 pagesCorsair Capital Q4 2011angadsawhneyNo ratings yet

- Financing Strategy at Tata Steel: Mergers and AcquisitionsDocument10 pagesFinancing Strategy at Tata Steel: Mergers and AcquisitionsPrasun SharmaNo ratings yet

- A Case Hand-In: Dogloo and Opportunity CapitalDocument1 pageA Case Hand-In: Dogloo and Opportunity Capital/jncjdncjdnNo ratings yet

- What Dividend Policy Would Be Appropriate For TelusDocument4 pagesWhat Dividend Policy Would Be Appropriate For Telusmalaika12No ratings yet

- SEC Filing: Starboard Value, AOL/Huffington Post GroupDocument96 pagesSEC Filing: Starboard Value, AOL/Huffington Post GroupMatthew Keys100% (1)

- Quarterly Letter Q1 2012Document8 pagesQuarterly Letter Q1 2012nsathishkNo ratings yet

- Exhibit #41Document52 pagesExhibit #41Jeremy W. GrayNo ratings yet

- Aswath CDocument2 pagesAswath CSonai DasNo ratings yet

- Performance Summary: Market OutlookDocument2 pagesPerformance Summary: Market OutlookAnonymous Feglbx5No ratings yet

- Alliance Holdings Limited: Credit Rating ReportDocument5 pagesAlliance Holdings Limited: Credit Rating ReportrontterNo ratings yet

- Organ Oseph: Land O' LakesDocument8 pagesOrgan Oseph: Land O' LakesAlex DiazNo ratings yet

- Brenner West - 2010 Fourth Quarter LetterDocument4 pagesBrenner West - 2010 Fourth Quarter LettergatzbpNo ratings yet

- Pledge (And Hedge) Allegiance To The CompanyDocument6 pagesPledge (And Hedge) Allegiance To The CompanyBrian TayanNo ratings yet

- Third Point Q1'09 Investor LetterDocument4 pagesThird Point Q1'09 Investor LetterDealBook100% (2)

- Element Global Value - 2Q14Document6 pagesElement Global Value - 2Q14FilipeNo ratings yet

- David Hurwitz Opportunities For Activism in KoreaDocument15 pagesDavid Hurwitz Opportunities For Activism in KoreaValueWalkNo ratings yet

- Submitted To:-: An Assignment of Strategic Human Resource Management (Module - V)Document14 pagesSubmitted To:-: An Assignment of Strategic Human Resource Management (Module - V)mintu1982No ratings yet

- Midyear Outlook: Five Distinct Macro Disconnects: InsightsDocument28 pagesMidyear Outlook: Five Distinct Macro Disconnects: Insightsastefan1No ratings yet

- KKR Investor PresentationDocument229 pagesKKR Investor Presentationcjwerner100% (1)

- Week 4 5 Ulob - Working Capital ManagementDocument7 pagesWeek 4 5 Ulob - Working Capital ManagementKezzi Ervin UngayNo ratings yet

- CR2013Assignment#5-ICS Recovery Fund - NattDocument11 pagesCR2013Assignment#5-ICS Recovery Fund - NattNatt NiljianskulNo ratings yet

- Corporate Secretarial Practice November 2021 Quesion PaperDocument6 pagesCorporate Secretarial Practice November 2021 Quesion PaperTawanda HerbertNo ratings yet

- FMA - Ethical Case A, RevisedDocument12 pagesFMA - Ethical Case A, RevisedYezena Tegegne75% (4)

- Casablanca Capital Presentation On Cliffs Natural ResourcesDocument33 pagesCasablanca Capital Presentation On Cliffs Natural ResourcesCanadianValueNo ratings yet

- Ex1dfan14a12664002 06182020Document6 pagesEx1dfan14a12664002 06182020Robert CohenNo ratings yet

- Chapter 9: Consolidation: Controlled Entities: ACCT6005 Company Accounting Tutorial QuestionsDocument5 pagesChapter 9: Consolidation: Controlled Entities: ACCT6005 Company Accounting Tutorial QuestionsujjwalNo ratings yet

- Colgate Palmolive AnalysisDocument5 pagesColgate Palmolive AnalysisprincearoraNo ratings yet

- Emp Capital Partners - 4Q12 Investor LetterDocument7 pagesEmp Capital Partners - 4Q12 Investor LetterLuis AhumadaNo ratings yet

- Chapter 4. Financial Statements: Spring 2003Document17 pagesChapter 4. Financial Statements: Spring 2003izzati adibahNo ratings yet

- Steelpath MLP InfographicDocument2 pagesSteelpath MLP Infographicapi-247644767No ratings yet

- USMO White Paper (Updated)Document3 pagesUSMO White Paper (Updated)ContrarianIndustriesNo ratings yet

- Gage College School of Graduate Studies Mba Program: FMA - Ethical Mini Case 01 - Assigned To Group 1 StudentsDocument12 pagesGage College School of Graduate Studies Mba Program: FMA - Ethical Mini Case 01 - Assigned To Group 1 StudentsEyasu JaworNo ratings yet

- Financial & Managerial Acct-Group Ass-01Document12 pagesFinancial & Managerial Acct-Group Ass-01Noah GunnNo ratings yet

- Quick Analysis of A CompanyDocument1 pageQuick Analysis of A CompanyDhananjay MallyaNo ratings yet

- Elliott Presentation On HessDocument161 pagesElliott Presentation On HessshortmycdsNo ratings yet

- Olam Dismisses Muddy Waters Report FindingsDocument45 pagesOlam Dismisses Muddy Waters Report Findingsstoreroom_02No ratings yet

- Financial Analysis of A CompanyDocument10 pagesFinancial Analysis of A CompanyRupesh PuriNo ratings yet

- TAC LetterDocument5 pagesTAC Lettereditorial.onlineNo ratings yet

- How To Read A Balance SheetDocument17 pagesHow To Read A Balance Sheetismun nadhifahNo ratings yet

- Note On Leveraged Buyouts Case #5-0004Document23 pagesNote On Leveraged Buyouts Case #5-0004vikhyatraiNo ratings yet

- Inancial Ngineering Laybook: January 2014Document18 pagesInancial Ngineering Laybook: January 2014Ayush AggarwalNo ratings yet

- CH 15Document36 pagesCH 15BryanaNo ratings yet

- Gaap-Uccino 1.5 - Part I of III - FinalDocument39 pagesGaap-Uccino 1.5 - Part I of III - FinalmistervigilanteNo ratings yet

- Finding The Next AppleDocument75 pagesFinding The Next AppleForbesNo ratings yet

- Tata Steel - B - C2 - FINA608 - MBA2022Document8 pagesTata Steel - B - C2 - FINA608 - MBA2022satyam mishraNo ratings yet

- Owning Up: The 14 Questions Every Board Member Needs to AskFrom EverandOwning Up: The 14 Questions Every Board Member Needs to AskRating: 4 out of 5 stars4/5 (2)

- The Pros and Cons of Closed-End Funds: How Do You Like Your Income?: Financial Freedom, #136From EverandThe Pros and Cons of Closed-End Funds: How Do You Like Your Income?: Financial Freedom, #136No ratings yet

- ValeportDocument3 pagesValeportAnonymous Feglbx5No ratings yet

- Houston's Office Market Is Finally On The MendDocument9 pagesHouston's Office Market Is Finally On The MendAnonymous Feglbx5No ratings yet

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocument6 pagesHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5No ratings yet

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocument7 pagesUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5No ratings yet

- Asl Marine Holdings LTDDocument28 pagesAsl Marine Holdings LTDAnonymous Feglbx5No ratings yet

- The Woodlands Office Submarket SnapshotDocument4 pagesThe Woodlands Office Submarket SnapshotAnonymous Feglbx5No ratings yet

- THRealEstate THINK-US Multifamily ResearchDocument10 pagesTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5No ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Greenville Americas Alliance MarketBeat Office Q32018Document1 pageGreenville Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Five Fast Facts - RIC Q3 2018Document1 pageFive Fast Facts - RIC Q3 2018Anonymous Feglbx5No ratings yet

- Project Title: (Company Name) (Project Lead)Document3 pagesProject Title: (Company Name) (Project Lead)Harsha SamagaraNo ratings yet

- Rutgers University, Department of Electrical and Computer Engineering Abet Course Syllabus COURSE: 14:332:366Document3 pagesRutgers University, Department of Electrical and Computer Engineering Abet Course Syllabus COURSE: 14:332:366HUANG YINo ratings yet

- Identifying The Health-Conscious Consumer: Targeting Strategies For Image-Conscious, Ethical Workaholics by Ben LongmanDocument6 pagesIdentifying The Health-Conscious Consumer: Targeting Strategies For Image-Conscious, Ethical Workaholics by Ben LongmanADVISONo ratings yet

- HW3 SolDocument6 pagesHW3 Solmary_nailynNo ratings yet

- Sodium Stannate Preparation From Stannic Oxide by A Novel SodaDocument7 pagesSodium Stannate Preparation From Stannic Oxide by A Novel SodaGiar Maulana S100% (1)

- Cable - Datasheet - (En) NSSHCÖU, Prysmian - 2013-06-10 - Screened-Power-CableDocument4 pagesCable - Datasheet - (En) NSSHCÖU, Prysmian - 2013-06-10 - Screened-Power-CableA. Muhsin PamungkasNo ratings yet

- Python Range and Enumerate FunctionsDocument4 pagesPython Range and Enumerate FunctionsSyed Azam ShahNo ratings yet

- ABMM2Document3 pagesABMM2QAISER IJAZNo ratings yet

- Busy Accounting Software Standard EditionDocument4 pagesBusy Accounting Software Standard EditionpremsinghjaniNo ratings yet

- Solve Splits Feedback ToolDocument6 pagesSolve Splits Feedback ToolkabyaNo ratings yet

- AI and Digital BankingDocument13 pagesAI and Digital BankingFarrukh NaveedNo ratings yet

- Behavioural and Psychiatric Symptoms in People With Dementia Admitted To The Acute Hospital Prospective Cohort StudyDocument8 pagesBehavioural and Psychiatric Symptoms in People With Dementia Admitted To The Acute Hospital Prospective Cohort StudyJosue GarciaNo ratings yet

- Bore Hole DesignDocument11 pagesBore Hole DesignJede LukaNo ratings yet

- Dipad Vs OlivanDocument8 pagesDipad Vs OlivanFrancis De CastroNo ratings yet

- V 12 - Schedule of Important Labor Laws - 22.02.2023Document6 pagesV 12 - Schedule of Important Labor Laws - 22.02.2023haris hafeezNo ratings yet

- Specification of ZXDC02 HP400Document2 pagesSpecification of ZXDC02 HP400huynhphucthoNo ratings yet

- Cell Type: IMR18650E22: Lithium-Ion Rechargeable BatteriesDocument1 pageCell Type: IMR18650E22: Lithium-Ion Rechargeable Batteriesvenugopalan srinivasanNo ratings yet

- Inventory - Product Catalogue: Code Description / Location / UOM BarcodeDocument93 pagesInventory - Product Catalogue: Code Description / Location / UOM Barcodefireman100% (1)

- Dinner PlateDocument29 pagesDinner PlateSABA ALINo ratings yet

- Research, Design and Develop A Prototype of Multi-Spindle Drilling HeadDocument6 pagesResearch, Design and Develop A Prototype of Multi-Spindle Drilling HeadtimrompiescommunityNo ratings yet

- Owners ManualDocument24 pagesOwners ManualYouness AlamiNo ratings yet

- The Perfect Site GuideDocument59 pagesThe Perfect Site GuideconstantrazNo ratings yet

- Catálogo de Bombas de Diafragma - ARODocument52 pagesCatálogo de Bombas de Diafragma - AROIvan RodrigoNo ratings yet

- Casing Collar LocatorDocument4 pagesCasing Collar LocatorHammad ShouketNo ratings yet

- Midterm Exam DM 213 Fiscal ManagementDocument8 pagesMidterm Exam DM 213 Fiscal Managementbplo aguilarNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Bunkers Quality and Quantity ClaimsDocument36 pagesBunkers Quality and Quantity ClaimsParthiban NagarajanNo ratings yet

- ProjectDocument61 pagesProjectgoodvijay143No ratings yet

- The Embassy in Jakarta - Overview (2012) PDFDocument17 pagesThe Embassy in Jakarta - Overview (2012) PDFHo Yiu YinNo ratings yet

Talbots Management & Board Beyond Contempt - Kinnaras Capital Blog

Talbots Management & Board Beyond Contempt - Kinnaras Capital Blog

Uploaded by

Anonymous Feglbx5Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Talbots Management & Board Beyond Contempt - Kinnaras Capital Blog

Talbots Management & Board Beyond Contempt - Kinnaras Capital Blog

Uploaded by

Anonymous Feglbx5Copyright:

Available Formats

12/8/11 Talbots Management & Board Beyond Contempt Kinnaras Capital Blog

1/5 www.kinnaras.com/blog2/?p=384

Tpe our search and hit ent er

Archives

December 2011 (1)

November 2011 (3)

October 2011 (2)

September 2011 (2)

January 2011 (1)

June 2010 (2)

May 2010 (2)

January 2010 (5)

December 2009 (1)

October 2009 (2)

September 2009 (1)

June 2009 (1)

May 2009 (2)

February 2009 (2)

January 2009 (1)

December 2008 (4)

November 2008 (1)

October 2008 (1)

September 2008 (1)

August 2008 (2)

July 2008 (2)

June 2008 (1)

May 2008 (1)

April 2008 (1)

March 2008 (3)

February 2008 (1)

January 2008 (4)

December 2007 (4)

November 2007 (4)

October 2007 (6)

Decembe 2011

S M T T F S

Nov

1 2 3

4 5 6 7 8 9 10

11 12 13 14 15 16 17

18 19 20 21 22 23 24

25 26 27 28 29 30 31

Deep Value Investing Thoughts

Kinnaras Capital Blog

Talbots Management & Board Beyond Contempt

By achokshi | TLB | Be the f irst to comment!

It takes a special type of management team and board to reach new lows for corporate governance when

such benchmarks of fiduciary duty and competence are established by companies such as Hewlett-Packard

(HPQ) and MF Global (MFGLQ.PK) but the executive team and Board at Talbots (TLB) is working hard to

exceed those benchmarks. As it currently stands, Sycamore Partners (SP) a significant shareholder of TLB

is offering to buyout the entire company for at least $3/share. This is good news in so far as that it validates

there is considerable value above the $1.56 closing price the day before the unsolicited offer. However, it also

demonstrates how much value TLBs management team and board have destroyed in recent years,

particularly in 2011, and the need for shareholders to demand more either in terms of an entirely new

board/executive team and/or buyout from SP.

Its important to address Sycamores offer and its likely strategy in turning TLB around because as a previous

and now current shareholder of TLB, I think a turnaround should have been more than achievable by a

competent management team. There is major low-hanging fruit that SP will likely capitalize on that investors

need to be cognizant of meaning that TLB should fetch more than $3/share. However, before doing that TLB

shareholders should review the track record of the board and executive team for several reasons. The first is

to demonstrate broad managerial incompetence, the second to highlight major lack of fiduciary responsibility

to TLB shareholders by rebuking prior overtures by SP, and lastly, perhaps to develop a case that

shareholders could suspend/freeze any termination payments and packages due to the outgoing

management team.

History of executive incompetence: Outgoing CEO Trudy Sullivan became CEO of TLB on August 1, 2007. At

the time TLBs share price was $22/share. Since Ms. Sullivans tenure, TLBs share price has declined from

$22 to $1.56 as of December 6, 2011, representing a decline of 93% over essentially five years. As an

investor, once can recognize stock volatility can sometimes decouple from fundamental performance.

However, Exhibit I demonstrates that TLBs stock performance very well seems to be tied to the underlying

performance of the company with sales, gross margins, and operating margins all steadily deteriorating since

Ms. Sullivan took over.

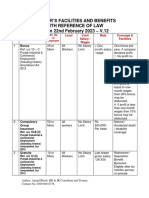

EXHIBIT I: TLB SUMMARY OPERATING PERFORMANCE SINCE SULLIVAN BECAME CEO ($MM)

There is no room to quibble, in every meaningful area TLB has performed poorly since Sullivans appointment

as CEO. Sales declined, gross margins have steadily declined, and operating expenses have been

deleveraging despite aggressive cuts due to poor sales and weak pricing of TLB merchandise. However,

while Sullivan and her cronies have been able to aggressively cut a number of operating expense areas, one

About Kinnaras Capital Management Disclaimer & General Terms of Use

12/8/11 Talbots Management & Board Beyond Contempt Kinnaras Capital Blog

2/5 www.kinnaras.com/blog2/?p=384

Categories

BIOS (5)

CFC (1)

COST (2)

CPN (1)

CROX (4)

Deep Value Investing (3)

DSL (8)

EEI (1)

General (15)

GS (1)

HBI (2)

IMN (1)

JAH (5)

KFT (1)

LWAY (1)

LXK (1)

Media General (2)

MEG (2)

PCLN (2)

S (4)

SBH (1)

TGT (3)

TLB (2)

Uncategorized (1)

Value Investing (41)

ZLC (1)

area that has been spared has been her compensation. Despite this abysmal performance, Ms. Sullivan

reaped significant financial rewards as illustrated in Exhibit II (source TLB Form DEF14A).

EXHIBIT II: TRUDY SULLIVAN COMPENSATION ($MM)

Keep in mind that this does not include those on her executive team including CFO Michael Scarpa and

others, all of whom have reaped significant gains for being little more than yes-men/women.

Board served Ms. Sullivans Interest and Not Shareholders: The illustration of TLBs operating performance,

stock performance, and Ms. Sullivans compensation demonstrate that TLBs board ignored its duty to

shareholders, allowing Ms. Sullivan and her team to essentially pillage the company, extracting unjustifiable

compensation and impairing TLBs operations. Aside from the historical negligence of the board during Ms.

Sullivans reign, the board also recently cost TLB shareholders by rebuking earlier overtures by SP. SP

acquired shares of TLB from June through July 2011 at what looks to be an average share price of $3.09.

According to Reuters SP was considering the possibility of acquiring TLB in August 2011, after establishing

its stake.

At that time, TLB had LTM EBITDA (LTM Q2 2011) of roughly $65MM. The company now is at roughly $25MM in

LTM EBITDA (pro forma for restructuring and M&A charges), representing a decline of over 60%. Considering

SPs average cost basis was $3.09 and that TLB had better operating performance earlier in the year, it is very

conceivable that SP could have offered at least $4.50+ to acquire TLB, especially since shares in August

touched $4 in anticipation of a buyout. This would represent a 50% increase from SPs current offer and about

another $100MM in value that the board could have secured for investors. However, the board chose to protect

Ms. Sullivan and the rest of the executive team by implementing a poison pill. At the time, shares traded well

over $4 in anticipation of a buyout offer by SP.

Now, after Ms. Sullivans strategy or lack of strategy has resulted in further deterioration of TLBs share price

and operating performance, the Board has at last decided to remove her, although having no replacement in

mind. This follows Ms. Sullivans decision several months ago to remove its chief designer while having no

replacement for him. Notwithstanding the egregious compensation Ms. Sullivan secured since her tenure for

overseeing a 93% decline in TLBs share price, the Board has agreed to reward Ms. Sullivan for the

following:

The Separation Agreement provides that, pursuant to Ms. Sullivans existing employment agreement with the

Company, dated June 28, 2007, as amended June 16, 2009, she will receive the following payments and

benefits following the Retirement Date: (i) cash severance of $5,000,000, which equals two times the sum

of her current base salar of $1,000,000 and target bonus of $1,500,000, paable in equal installments

over the 24-month period following the Retirement Date; (ii) a pro rata annual bonus for the fiscal year in

which the Retirement Date occurs; (iii) continued medical, dental, disability and life insurance for up to 24

months following the Retirement Date; (iv) accelerated vesting under the Companys Supplemental Executive

Retirement Plan; (v) accelerated vesting of stock options; and (vi) 24 months of continued vesting of restricted

stock. The severance payments and benefits are subject to Ms. Sullivans execution and nonrevocation of a

release of claims against the Company. Ms. Sullivan continues to be subject to post-employment non-

disclosure, non-solicitation of employees, vendors and suppliers, non-disparagement, non-competition and

cooperation covenants. The Separation Agreement also contains other customary provisions.

The Board has no shame given the lack of any positive achievements during Ms. Sullivans tenure. TLB

currently has $105MM in net debt during a challenging and promotional holiday shopping environment. The

Company intends to finish 2011 with $40MM in capital expenditures and a weak holiday season may result in

TLB becoming somewhat cash flow constrained. Nonetheless, the Board, despite Ms. Sullivans pitiful

performance as CEO, has seen no issue or cause to revoke or adjust the termination agreement to benefit

shareholders.

There is a massive lack of fiduciary representation and it is unfortunate that TLB shareholders have not

12/8/11 Talbots Management & Board Beyond Contempt Kinnaras Capital Blog

3/5 www.kinnaras.com/blog2/?p=384

worked together in an effort to better align the company. Even in an environment of significant litigation, it is

hard to not see that the Board and executive team should have some personal liability for this atrocious and

blatant disregard of investor rights. Nonetheless, SP has moved on to offer $3 to acquire all of TLB and this

gives TLB shareholders a few things to consider.

Current Situation: SP is offering $3/share for TLB but as indicated in its 13D letter that it could offer more than

$3/share. First its important to understand that SPs founders have a track record of buying undervalued

assets and turning them around, particularly during their time at Golden Gate Capital (GGC). At GGC, SPs

principals invested in retailers such as Express, Eddie Bauer, Zales Corporation, and J. Jill.

J. Jill was purchased by TLB in 2006 for about $366MM and sold to GGC for about $75MM in 2009. In just two

years GGC was able to sell J. Jill to Arcapita and while terms were not publicly available, it seems a

turnaround in less than two years involved a lot of low hanging fruit which GGC seized upon. This is what TLB

shareholders should consider.

As it currently stands, TLB has just one problem merchandise. Its a huge problem in the context of being a

fashion retailer but consider that in 2008 TLB was struggling with underperforming J. Jill, a heavy debt load, a

mens and children division, and an international segment. At this point TLB has just one core focus women

55-75 y/o and the main problem facing TLB is that the company spiced up its clothing too much to attract

younger shoppers while alienating its core customer. This is an achievable turnaround if not for the

incompetent executive team TLB shareholders had to tolerate and I believe SP will probably seize on a

number of low hanging items to immediately boost the companys performance.

First, investors should keep in mind that TLB gross margins should improve in 2012. The last half of 2011

was a merchandising disaster for TLB and the fire sale prices for TLB merchandise have crushed gross

margins. However, heading into the holiday season it appears that the company had a nice return to classic

apparel that resonated with its core customer. In addition, TLB has been working to close poorly performing

stores and as those are shuttered, the aggregate gross margin drag should diminish. TLBs 2012 same

store sales figures should also improve off weaker 2011 numbers. These factors alone could very well yield

gross margins of roughly 32% compared to what could be 28.5% in 2011. What should be noted is that TLB

gross margins were nearly 38% in 2010 and except for 2009, the current year and my modest projection for

2012 would be the next two lowest years for gross margins.

SP knows this as should any informed TLB investor. Another tailwind for TLB will be the implementation of a

$50MM expense savings program which will reduce SG&A. On a business that generates about $1.1B in

sales, this translates into an operating margin boost of 4.5%. This means that TLB will be near roughly break

even on an EBIT basis and close to $50MM on an EBITDA basis for 2012. These calculations are fairly

conservative and are what TLB investors could achieve with a mediocre executive as opposed to the current

team.

I would guess the next item SP would work on if they could take over TLB would be to improve the companys

sourcing model. Competitors such as Chicos FAS (CHS) and Ann Inc. (ANN) generate gross margins in

the 50% level compared to at best mid to high 30% for TLB. The discrepancy can probably be tied to sourcing

of material, product pricing, and product mix. For example, while CHS has a number of retail concepts, it is

known for doing well in terms of selling accessories and not just apparel at its flagship store. SP has already

hinted at assisting TLB with sourcing through Mast Global Fashions, of which SP is a part owner along with

Limited Brands. Implementing changes to sign on with a better sourcing agent and making efforts to push

increased sales of accessories are not transformative changes yet can allow TLB to generate some

improvements on a relatively easy basis.

Another likely change by SP will be to halt the companys spending on existing store refreshes and accelerate

the build-out of outlet locations. According to TLB management, sales per square foot at TLB outlet locations

is $400 compared to $290 at normal TLB retail locations. When one considers that rent at outlet locations is

typically cheaper compared to normal retail locales, the return on invested capital for expanding the outlet

base is very appealing. TLB management believes that there is a ~100 outlet store opportunity for TLB. This

is significant compared to the roughly 450 (net of expected closures) store base TLB maintains. Compared

to other retail peers, TLB is under-represented in the outlet space and should focus on that given the attractive

capital return metrics.

As can be seen, there is a lot of low hanging fruit that SP can take advantage of that frankly should be executed

12/8/11 Talbots Management & Board Beyond Contempt Kinnaras Capital Blog

4/5 www.kinnaras.com/blog2/?p=384

on by current shareholders that could remove the current board and management team and find even a

mundane management team as opposed to the atrocious one currently at the helm. Fixing the easy items

alone will allow TLB to start generating stronger operating profit and then simply hiring a designer that has

resonated with the core customer would be the next step. With fashion retailers, value is driven by gross

margins. If the merchandise is on target, the retailer can charge the appropriate price to drive operating

leverage. Expanding outlet stores, improving sales of accessories, obtaining a better sourcing company, the

rolling off of closed stores, and implementation of the $50MM expense savings plan could all contribute 5-7%

in operating margin for TLB. SP probably knows this as should existing TLB investors. Stabilization of TLB

operations alone can get a share price of about $4.50-$5.00.

However, if one can find a halfway decent designer with historical success targeting TLBs core customer,

gross margins could meaningfully expand beyond 32%. If a good designer could drive store sales and

margins even closer to historical levels, TLB could be worth much closer to $7-9. The problem is that Ms.

Sullivan has so thoroughly wrecked TLB that a current buyout from a financial sponsor like SP would likely be

an asset backed financed deal as opposed to a cash flow deal. On an ABL basis, the max SP would offer

without over-equitizing a deal would be under $5. However, I would not be surprised to see SP successfully

execute on the items listed above and refinance an ABL deal into a dividend refinancing and new, typical

leveraged finance deal once operations stabilize.

SP is positioning itself as the only potential buyer but there have been other investors in the retail space.

Leonard Green & Partners is renowned for investing in retail companies. TLB could also be attractive to a

strategic buyer, specifically CHS. CHS owns a number of concepts including Chicos, White House|Black

Market, Soma Intimates, and recently acquired Boston Proper. TLB could fit well into CHS given that the

Chicos brand targets a similar demographic. CHS could acquire the stores, bringing them onto their superior

operating platform while eliminating redundant SG&A. CHS acquired Boston Proper for $213MM and still has

$240MM in net cash. Through 2011, CHS has generated $244MM in LTM operating cash flow, $113MM in

capex, and then returned $33MM to shareholders in the form of dividends and another $153MM in share

repurchases.

Basically, CHS has the cash flow capabilities, credit quality, and balance sheet to easily acquire TLB and

leverage a solid brand across its platform. As a strategic buyer, CHS would also have the ability to likely shed

much of TLBs SG&A. Shedding 50% of TLBs SG&A would reap about $200MM in savings for CHS. Exhibit III

assumes a 50% savings rate on SG&A to illustrate what TLBs figures would look like to CHS on an

acquisition basis.

EXHIBIT III: TLB 2011E PRO FORMA TO CHS

Recognizing TLBs current situation and ability to achieve those SG&A savings could warrant a conservative

12/8/11 Talbots Management & Board Beyond Contempt Kinnaras Capital Blog

5/5 www.kinnaras.com/blog2/?p=384

View More Posts:

Recognizing TLBs current situation and ability to achieve those SG&A savings could warrant a conservative

EV/EBITDA multiple of 3.0x Pro Forma 2011E EBITDA. With about $100MM in net debt, this would translate

into a share price of $6.50 or about 6.5x pro forma 2011E EPS.

In either case, the Boards responsibility to shareholders would warrant that it shops TLB to all potential

buyers to evaluate the company. Given the Boards track record, TLB shareholders may wish to push for an

emergency general meeting to consider outright removal of the board and management, suspension of

termination contract terms for existing management, and work to have legitimate shareholder representation

on the Board to either push for a full blown auction of the company or find a management team that can

execute an achievable turnaround. As it stands SPs offer at $3 establishes a valuation that a clever and

judicious investor would offer, but given the easy value creation levers that will occur in 2012, legitimate sale

discussions should be much closer to $4.50-$5.00 with a financial sponsor, let alone a strategic buyer.

At $5/share, TLB would be valued at 0.4x EV/LTM Sales while peers such as ANN and CHS trade at 0.55x and

0.73x EV/Sales. Given TLBs current depressed operating margins, EV/S is an appropriate metric to gauge

value and a $5/share price is still a significant discount to more profitable peers. If the holiday season can

lead to a reduction in TLBs revolver, the overall enterprise value could be closer to $400MM. As discussed,

with no changes beyond what has been covered in conference calls and TLB filings, the company could very

well generate $50MM in EBITDA in 2012, implying a EV/EBITDA multiple of 8.0x, representing a depressed

EBITDA multiple. SPs ability to bring Mast Global Fashions and generate additional margin could also drive

EBITDA higher leading to an actual lower purchase price multiple than 8.0x.

In either case, the Board should recognize that without a head designer and a lameduck CEO, it should seek

a way to maximize value for existing shareholders.

DICLOE: AHO MANAGE A HEDGE FND AND MANAGED ACCON LONG LB.

Add your comment 0 Comments

Leave your comment below!

Submit Comment

Your Name (required) Your Email (required) Your Websit e (opt ional)

Powered by the inLine Minimal WordPress Theme

You might also like

- Micro Econ 6 Principles of Microeconomics 6Th Edition William A Mceachern Full ChapterDocument67 pagesMicro Econ 6 Principles of Microeconomics 6Th Edition William A Mceachern Full Chapterchristine.parsons231100% (6)

- Carlyle Model Interview Test - InstructionsDocument2 pagesCarlyle Model Interview Test - Instructionsjorgeetcheverria100% (1)

- Silverlake-Financial Alchemy PDFDocument42 pagesSilverlake-Financial Alchemy PDFInvest Stock0% (1)

- 2012 q3 Letter DdicDocument5 pages2012 q3 Letter DdicDistressedDebtInvestNo ratings yet

- Voss Capital On BlucoraDocument4 pagesVoss Capital On BlucoraCanadianValueNo ratings yet

- Blain Kitchenware Inc.: Capital StructureDocument7 pagesBlain Kitchenware Inc.: Capital StructureRoy Lambert100% (4)

- Kinnaras Capital Management LLCDocument4 pagesKinnaras Capital Management LLCamit.chokshi2353No ratings yet

- Seminar On Corporate Restructuring: Topic: Leveraged BuyoutDocument24 pagesSeminar On Corporate Restructuring: Topic: Leveraged BuyoutNIDHI SAROANo ratings yet

- Telus Dividend Policy FinalDocument7 pagesTelus Dividend Policy Finalmalaika12No ratings yet

- Corsair Capital Q4 2011Document3 pagesCorsair Capital Q4 2011angadsawhneyNo ratings yet

- Financing Strategy at Tata Steel: Mergers and AcquisitionsDocument10 pagesFinancing Strategy at Tata Steel: Mergers and AcquisitionsPrasun SharmaNo ratings yet

- A Case Hand-In: Dogloo and Opportunity CapitalDocument1 pageA Case Hand-In: Dogloo and Opportunity Capital/jncjdncjdnNo ratings yet

- What Dividend Policy Would Be Appropriate For TelusDocument4 pagesWhat Dividend Policy Would Be Appropriate For Telusmalaika12No ratings yet

- SEC Filing: Starboard Value, AOL/Huffington Post GroupDocument96 pagesSEC Filing: Starboard Value, AOL/Huffington Post GroupMatthew Keys100% (1)

- Quarterly Letter Q1 2012Document8 pagesQuarterly Letter Q1 2012nsathishkNo ratings yet

- Exhibit #41Document52 pagesExhibit #41Jeremy W. GrayNo ratings yet

- Aswath CDocument2 pagesAswath CSonai DasNo ratings yet

- Performance Summary: Market OutlookDocument2 pagesPerformance Summary: Market OutlookAnonymous Feglbx5No ratings yet

- Alliance Holdings Limited: Credit Rating ReportDocument5 pagesAlliance Holdings Limited: Credit Rating ReportrontterNo ratings yet

- Organ Oseph: Land O' LakesDocument8 pagesOrgan Oseph: Land O' LakesAlex DiazNo ratings yet

- Brenner West - 2010 Fourth Quarter LetterDocument4 pagesBrenner West - 2010 Fourth Quarter LettergatzbpNo ratings yet

- Pledge (And Hedge) Allegiance To The CompanyDocument6 pagesPledge (And Hedge) Allegiance To The CompanyBrian TayanNo ratings yet

- Third Point Q1'09 Investor LetterDocument4 pagesThird Point Q1'09 Investor LetterDealBook100% (2)

- Element Global Value - 2Q14Document6 pagesElement Global Value - 2Q14FilipeNo ratings yet

- David Hurwitz Opportunities For Activism in KoreaDocument15 pagesDavid Hurwitz Opportunities For Activism in KoreaValueWalkNo ratings yet

- Submitted To:-: An Assignment of Strategic Human Resource Management (Module - V)Document14 pagesSubmitted To:-: An Assignment of Strategic Human Resource Management (Module - V)mintu1982No ratings yet

- Midyear Outlook: Five Distinct Macro Disconnects: InsightsDocument28 pagesMidyear Outlook: Five Distinct Macro Disconnects: Insightsastefan1No ratings yet

- KKR Investor PresentationDocument229 pagesKKR Investor Presentationcjwerner100% (1)

- Week 4 5 Ulob - Working Capital ManagementDocument7 pagesWeek 4 5 Ulob - Working Capital ManagementKezzi Ervin UngayNo ratings yet

- CR2013Assignment#5-ICS Recovery Fund - NattDocument11 pagesCR2013Assignment#5-ICS Recovery Fund - NattNatt NiljianskulNo ratings yet

- Corporate Secretarial Practice November 2021 Quesion PaperDocument6 pagesCorporate Secretarial Practice November 2021 Quesion PaperTawanda HerbertNo ratings yet

- FMA - Ethical Case A, RevisedDocument12 pagesFMA - Ethical Case A, RevisedYezena Tegegne75% (4)

- Casablanca Capital Presentation On Cliffs Natural ResourcesDocument33 pagesCasablanca Capital Presentation On Cliffs Natural ResourcesCanadianValueNo ratings yet

- Ex1dfan14a12664002 06182020Document6 pagesEx1dfan14a12664002 06182020Robert CohenNo ratings yet

- Chapter 9: Consolidation: Controlled Entities: ACCT6005 Company Accounting Tutorial QuestionsDocument5 pagesChapter 9: Consolidation: Controlled Entities: ACCT6005 Company Accounting Tutorial QuestionsujjwalNo ratings yet

- Colgate Palmolive AnalysisDocument5 pagesColgate Palmolive AnalysisprincearoraNo ratings yet

- Emp Capital Partners - 4Q12 Investor LetterDocument7 pagesEmp Capital Partners - 4Q12 Investor LetterLuis AhumadaNo ratings yet

- Chapter 4. Financial Statements: Spring 2003Document17 pagesChapter 4. Financial Statements: Spring 2003izzati adibahNo ratings yet

- Steelpath MLP InfographicDocument2 pagesSteelpath MLP Infographicapi-247644767No ratings yet

- USMO White Paper (Updated)Document3 pagesUSMO White Paper (Updated)ContrarianIndustriesNo ratings yet

- Gage College School of Graduate Studies Mba Program: FMA - Ethical Mini Case 01 - Assigned To Group 1 StudentsDocument12 pagesGage College School of Graduate Studies Mba Program: FMA - Ethical Mini Case 01 - Assigned To Group 1 StudentsEyasu JaworNo ratings yet

- Financial & Managerial Acct-Group Ass-01Document12 pagesFinancial & Managerial Acct-Group Ass-01Noah GunnNo ratings yet

- Quick Analysis of A CompanyDocument1 pageQuick Analysis of A CompanyDhananjay MallyaNo ratings yet

- Elliott Presentation On HessDocument161 pagesElliott Presentation On HessshortmycdsNo ratings yet

- Olam Dismisses Muddy Waters Report FindingsDocument45 pagesOlam Dismisses Muddy Waters Report Findingsstoreroom_02No ratings yet

- Financial Analysis of A CompanyDocument10 pagesFinancial Analysis of A CompanyRupesh PuriNo ratings yet

- TAC LetterDocument5 pagesTAC Lettereditorial.onlineNo ratings yet

- How To Read A Balance SheetDocument17 pagesHow To Read A Balance Sheetismun nadhifahNo ratings yet

- Note On Leveraged Buyouts Case #5-0004Document23 pagesNote On Leveraged Buyouts Case #5-0004vikhyatraiNo ratings yet

- Inancial Ngineering Laybook: January 2014Document18 pagesInancial Ngineering Laybook: January 2014Ayush AggarwalNo ratings yet

- CH 15Document36 pagesCH 15BryanaNo ratings yet

- Gaap-Uccino 1.5 - Part I of III - FinalDocument39 pagesGaap-Uccino 1.5 - Part I of III - FinalmistervigilanteNo ratings yet

- Finding The Next AppleDocument75 pagesFinding The Next AppleForbesNo ratings yet

- Tata Steel - B - C2 - FINA608 - MBA2022Document8 pagesTata Steel - B - C2 - FINA608 - MBA2022satyam mishraNo ratings yet

- Owning Up: The 14 Questions Every Board Member Needs to AskFrom EverandOwning Up: The 14 Questions Every Board Member Needs to AskRating: 4 out of 5 stars4/5 (2)

- The Pros and Cons of Closed-End Funds: How Do You Like Your Income?: Financial Freedom, #136From EverandThe Pros and Cons of Closed-End Funds: How Do You Like Your Income?: Financial Freedom, #136No ratings yet

- ValeportDocument3 pagesValeportAnonymous Feglbx5No ratings yet

- Houston's Office Market Is Finally On The MendDocument9 pagesHouston's Office Market Is Finally On The MendAnonymous Feglbx5No ratings yet

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocument6 pagesHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5No ratings yet

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocument7 pagesUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5No ratings yet

- Asl Marine Holdings LTDDocument28 pagesAsl Marine Holdings LTDAnonymous Feglbx5No ratings yet

- The Woodlands Office Submarket SnapshotDocument4 pagesThe Woodlands Office Submarket SnapshotAnonymous Feglbx5No ratings yet

- THRealEstate THINK-US Multifamily ResearchDocument10 pagesTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5No ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Greenville Americas Alliance MarketBeat Office Q32018Document1 pageGreenville Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Five Fast Facts - RIC Q3 2018Document1 pageFive Fast Facts - RIC Q3 2018Anonymous Feglbx5No ratings yet

- Project Title: (Company Name) (Project Lead)Document3 pagesProject Title: (Company Name) (Project Lead)Harsha SamagaraNo ratings yet

- Rutgers University, Department of Electrical and Computer Engineering Abet Course Syllabus COURSE: 14:332:366Document3 pagesRutgers University, Department of Electrical and Computer Engineering Abet Course Syllabus COURSE: 14:332:366HUANG YINo ratings yet

- Identifying The Health-Conscious Consumer: Targeting Strategies For Image-Conscious, Ethical Workaholics by Ben LongmanDocument6 pagesIdentifying The Health-Conscious Consumer: Targeting Strategies For Image-Conscious, Ethical Workaholics by Ben LongmanADVISONo ratings yet

- HW3 SolDocument6 pagesHW3 Solmary_nailynNo ratings yet

- Sodium Stannate Preparation From Stannic Oxide by A Novel SodaDocument7 pagesSodium Stannate Preparation From Stannic Oxide by A Novel SodaGiar Maulana S100% (1)

- Cable - Datasheet - (En) NSSHCÖU, Prysmian - 2013-06-10 - Screened-Power-CableDocument4 pagesCable - Datasheet - (En) NSSHCÖU, Prysmian - 2013-06-10 - Screened-Power-CableA. Muhsin PamungkasNo ratings yet

- Python Range and Enumerate FunctionsDocument4 pagesPython Range and Enumerate FunctionsSyed Azam ShahNo ratings yet

- ABMM2Document3 pagesABMM2QAISER IJAZNo ratings yet

- Busy Accounting Software Standard EditionDocument4 pagesBusy Accounting Software Standard EditionpremsinghjaniNo ratings yet

- Solve Splits Feedback ToolDocument6 pagesSolve Splits Feedback ToolkabyaNo ratings yet

- AI and Digital BankingDocument13 pagesAI and Digital BankingFarrukh NaveedNo ratings yet

- Behavioural and Psychiatric Symptoms in People With Dementia Admitted To The Acute Hospital Prospective Cohort StudyDocument8 pagesBehavioural and Psychiatric Symptoms in People With Dementia Admitted To The Acute Hospital Prospective Cohort StudyJosue GarciaNo ratings yet

- Bore Hole DesignDocument11 pagesBore Hole DesignJede LukaNo ratings yet

- Dipad Vs OlivanDocument8 pagesDipad Vs OlivanFrancis De CastroNo ratings yet

- V 12 - Schedule of Important Labor Laws - 22.02.2023Document6 pagesV 12 - Schedule of Important Labor Laws - 22.02.2023haris hafeezNo ratings yet

- Specification of ZXDC02 HP400Document2 pagesSpecification of ZXDC02 HP400huynhphucthoNo ratings yet

- Cell Type: IMR18650E22: Lithium-Ion Rechargeable BatteriesDocument1 pageCell Type: IMR18650E22: Lithium-Ion Rechargeable Batteriesvenugopalan srinivasanNo ratings yet

- Inventory - Product Catalogue: Code Description / Location / UOM BarcodeDocument93 pagesInventory - Product Catalogue: Code Description / Location / UOM Barcodefireman100% (1)

- Dinner PlateDocument29 pagesDinner PlateSABA ALINo ratings yet

- Research, Design and Develop A Prototype of Multi-Spindle Drilling HeadDocument6 pagesResearch, Design and Develop A Prototype of Multi-Spindle Drilling HeadtimrompiescommunityNo ratings yet

- Owners ManualDocument24 pagesOwners ManualYouness AlamiNo ratings yet

- The Perfect Site GuideDocument59 pagesThe Perfect Site GuideconstantrazNo ratings yet

- Catálogo de Bombas de Diafragma - ARODocument52 pagesCatálogo de Bombas de Diafragma - AROIvan RodrigoNo ratings yet

- Casing Collar LocatorDocument4 pagesCasing Collar LocatorHammad ShouketNo ratings yet

- Midterm Exam DM 213 Fiscal ManagementDocument8 pagesMidterm Exam DM 213 Fiscal Managementbplo aguilarNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Bunkers Quality and Quantity ClaimsDocument36 pagesBunkers Quality and Quantity ClaimsParthiban NagarajanNo ratings yet

- ProjectDocument61 pagesProjectgoodvijay143No ratings yet

- The Embassy in Jakarta - Overview (2012) PDFDocument17 pagesThe Embassy in Jakarta - Overview (2012) PDFHo Yiu YinNo ratings yet