Professional Documents

Culture Documents

Export of Taxable Service

Export of Taxable Service

Uploaded by

Nitish BansalCopyright:

Available Formats

You might also like

- Laws - Guide For Freelancers in IndiaDocument9 pagesLaws - Guide For Freelancers in Indiaranjithxavier100% (4)

- Topic 11 To 14 Answer PDFDocument11 pagesTopic 11 To 14 Answer PDFSrinivasa Reddy SNo ratings yet

- Binary Options Trading Winning System EnglishDocument104 pagesBinary Options Trading Winning System EnglishLucas Nolla100% (1)

- Chapter 14 - Financial Statement AnalysisDocument58 pagesChapter 14 - Financial Statement AnalysisPradipta Gitaya0% (1)

- English Khmer Glossary of Accounting and Auditing Terminology p1 PDFDocument181 pagesEnglish Khmer Glossary of Accounting and Auditing Terminology p1 PDFKon Khmer100% (4)

- Export of ServicesDocument9 pagesExport of ServicesshantX100% (1)

- India's Software, Services Exports Forecast at $40BDocument3 pagesIndia's Software, Services Exports Forecast at $40BgauravsavaleNo ratings yet

- S.L. Peeran (J) and T.K. Jayaraman (T), MembersDocument4 pagesS.L. Peeran (J) and T.K. Jayaraman (T), MembersBhan WatiNo ratings yet

- Service Tax ProcedureDocument23 pagesService Tax ProcedureBhavin ShahNo ratings yet

- Export of Service Rules, 2005Document2 pagesExport of Service Rules, 2005mads70No ratings yet

- Export of Services Rules 2005Document2 pagesExport of Services Rules 2005Venkata ChalapathyNo ratings yet

- Export of Service Rules, 2005Document4 pagesExport of Service Rules, 2005Nalini BhorNo ratings yet

- Service TaxDocument12 pagesService TaxdeepikaNo ratings yet

- Service Tax: Some of The Major Services That Come Under The Ambit of Service Tax AreDocument7 pagesService Tax: Some of The Major Services That Come Under The Ambit of Service Tax AreChetan ShivankarNo ratings yet

- Service Exports From India SchemeDocument5 pagesService Exports From India Schemeswarna lathaNo ratings yet

- Contract Agreement NCRMP TPQA Part I of IIIDocument55 pagesContract Agreement NCRMP TPQA Part I of IIIHenRique Xavi InestaNo ratings yet

- Taxation of Non-Residents With Special Reference To Chapter Xii and Xii ADocument16 pagesTaxation of Non-Residents With Special Reference To Chapter Xii and Xii APJ 123No ratings yet

- 2nd Schedule 30.06.15 FinalDocument6 pages2nd Schedule 30.06.15 FinalMuhammad Ali DaanishNo ratings yet

- Sindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFDocument64 pagesSindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFrohail51No ratings yet

- Bimal Jain BGM Service Tax 051014Document67 pagesBimal Jain BGM Service Tax 051014Aayushi AroraNo ratings yet

- Karnatka Vat RulesDocument49 pagesKarnatka Vat RulesshanoboghNo ratings yet

- Transfer Pricing Draft Safe GHarbour RulesDocument17 pagesTransfer Pricing Draft Safe GHarbour RulesAbhay DesaiNo ratings yet

- B.C.A.S.: Negative List Based Taxation of Services - Important Issues by Ca Puloma DalalDocument6 pagesB.C.A.S.: Negative List Based Taxation of Services - Important Issues by Ca Puloma DalaltwodpassNo ratings yet

- Gantry Rails Bidding DocumentsDocument95 pagesGantry Rails Bidding DocumentsDaniel EvansNo ratings yet

- FTS Course PPT - 07112020Document55 pagesFTS Course PPT - 07112020sanket.tatedNo ratings yet

- Service TaxDocument15 pagesService TaxMonu TulsyanNo ratings yet

- IDT SupplemantaryDocument77 pagesIDT SupplemantarykanchanthebestNo ratings yet

- Service Tax NotesDocument11 pagesService Tax NotesLaw Classes KolkataNo ratings yet

- M.Fakhrul Alam Commissioner Customs, Excise &vatDocument29 pagesM.Fakhrul Alam Commissioner Customs, Excise &vatshammeeNo ratings yet

- Site Info ClearanceDocument9 pagesSite Info ClearanceAnuppur Amlai RangeNo ratings yet

- Travel by Air ServicesDocument15 pagesTravel by Air ServicesvijaykoratNo ratings yet

- Application of WHT Under The Double Taxation AgreementDocument19 pagesApplication of WHT Under The Double Taxation Agreementrizzwan4uNo ratings yet

- 62e11a8f3dc57order GST Food Business 27 07 2022Document7 pages62e11a8f3dc57order GST Food Business 27 07 2022sheela bethapudiNo ratings yet

- 22229paper4st cp1Document9 pages22229paper4st cp1TejTejuNo ratings yet

- Service Tax Qick RevisionDocument91 pagesService Tax Qick RevisiongouthamNo ratings yet

- FEM Unit2 PDFDocument48 pagesFEM Unit2 PDFSurjan SinghNo ratings yet

- Taxation of Financial Services Sybbi FinalDocument24 pagesTaxation of Financial Services Sybbi Finalsheenu152005No ratings yet

- CA Final IDT RTP For May 2023Document19 pagesCA Final IDT RTP For May 2023Nick VincikNo ratings yet

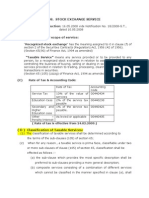

- Stock Exchange Service (A) Date of IntroductionDocument7 pagesStock Exchange Service (A) Date of Introductionarshad89057No ratings yet

- III. Special Conditions of Contract 98Document2 pagesIII. Special Conditions of Contract 98Anonymous ufMAGXcskMNo ratings yet

- ST Ajk2015Document21 pagesST Ajk2015asadNo ratings yet

- Services Exports From India Scheme ("SEIS") : Comprehensive Solutions For Complex MattersDocument13 pagesServices Exports From India Scheme ("SEIS") : Comprehensive Solutions For Complex MattersRajdeep SharmaNo ratings yet

- Press Note No.3-2007 SeriesDocument4 pagesPress Note No.3-2007 SeriesPari BasuNo ratings yet

- Rfe 2021Document119 pagesRfe 2021nietgrNo ratings yet

- Vietnam Foreign Contractor Withholding TaxDocument4 pagesVietnam Foreign Contractor Withholding TaxThanh TuongNo ratings yet

- RFP Volume 1 - Bidding Terms and ConditionsDocument146 pagesRFP Volume 1 - Bidding Terms and ConditionsRamesh CNo ratings yet

- GatsDocument47 pagesGatsSreyashi MukherjeeNo ratings yet

- SAC Codes & GST Rates For Services - Chapter 99Document26 pagesSAC Codes & GST Rates For Services - Chapter 99mn_sundaraam67% (3)

- (B) Definition and Scope of ServiceDocument9 pages(B) Definition and Scope of ServiceAPI SupportNo ratings yet

- Annexure-A Deduction From The Payment of Certain Services (Section 52AA)Document8 pagesAnnexure-A Deduction From The Payment of Certain Services (Section 52AA)Masum GaziNo ratings yet

- Service TaxDocument55 pagesService Taxtushar vatsNo ratings yet

- Service TaxDocument18 pagesService TaxRajavati NadarNo ratings yet

- Comments On Sindh Finance Bill - 2015: Haroon Zakaria & Company Chartered AccountantsDocument12 pagesComments On Sindh Finance Bill - 2015: Haroon Zakaria & Company Chartered AccountantsssssNo ratings yet

- Vietnam - Schedule of CommitmentDocument60 pagesVietnam - Schedule of CommitmentThanh Thủy TrầnNo ratings yet

- Memarts For Amalgam ConsultantsDocument24 pagesMemarts For Amalgam ConsultantsHulka KihangaNo ratings yet

- UntitledDocument479 pagesUntitledshantanuNo ratings yet

- Note On Blocked ITC - PDF - CompressedDocument2 pagesNote On Blocked ITC - PDF - CompressedCA Ishu BansalNo ratings yet

- The Second Schedule of It SoftwearDocument1 pageThe Second Schedule of It SoftwearAshar AsifNo ratings yet

- CG-07-03 - Final - 20M2021-2Document120 pagesCG-07-03 - Final - 20M2021-2Rushikesh kulkarniNo ratings yet

- Service TaxDocument9 pagesService TaxakshatkhaleNo ratings yet

- Cenvat Credit Rules, 2004 An Overview: Gopi Donthireddy Deputy CommissionerDocument39 pagesCenvat Credit Rules, 2004 An Overview: Gopi Donthireddy Deputy CommissionerAnuragNo ratings yet

- Circular - 111-05-2009-STDocument2 pagesCircular - 111-05-2009-STjayamurli19547922No ratings yet

- The Foreign Trade (Development and Regulation) Act, 1992Document12 pagesThe Foreign Trade (Development and Regulation) Act, 1992Mishail BakshiNo ratings yet

- Cap Bud - UltDocument11 pagesCap Bud - UltKhaisarKhaisarNo ratings yet

- Role of Capital Market in IndiaDocument6 pagesRole of Capital Market in Indiajyoti verma100% (1)

- Annuities Practice Problem Set 2: Future Value of An AnnuityDocument2 pagesAnnuities Practice Problem Set 2: Future Value of An AnnuityJeric Marasigan EnriquezNo ratings yet

- Geodynamics Investor CircularDocument12 pagesGeodynamics Investor CircularBlack_and_Blue_DogNo ratings yet

- CMS Report PDFDocument8 pagesCMS Report PDFRecordTrac - City of OaklandNo ratings yet

- Jyoti CNC Automation Limited: History and Certain Corporate MattersDocument388 pagesJyoti CNC Automation Limited: History and Certain Corporate MattersRAJAMANICKAMNo ratings yet

- iSave-IPruMF FAQsDocument6 pagesiSave-IPruMF FAQsMayur KhichiNo ratings yet

- Corpo NotesDocument206 pagesCorpo NotesThalia SalvadorNo ratings yet

- Different Types of Capital IssuesDocument5 pagesDifferent Types of Capital IssuesUdhayakumar ManickamNo ratings yet

- Forfeiture and Reissue of SharesDocument118 pagesForfeiture and Reissue of SharesFredhope Mtonga100% (1)

- Value Investing The Sanjay Bakshi-Way PDFDocument64 pagesValue Investing The Sanjay Bakshi-Way PDFmilandeepNo ratings yet

- Company Law Samadhan BookDocument338 pagesCompany Law Samadhan Bookcs LakshmiNo ratings yet

- Ch01.Ppt OverviewDocument55 pagesCh01.Ppt OverviewMohammadYaqoob100% (1)

- 05) Money MarketDocument56 pages05) Money MarketNaina GoyalNo ratings yet

- Problems Chapter 6-7 International Parity ConditionsDocument12 pagesProblems Chapter 6-7 International Parity Conditionsarmando.chappell1005No ratings yet

- Chapter Two: Security Markets: Present and FutureDocument41 pagesChapter Two: Security Markets: Present and FutureTram TruongNo ratings yet

- Summer Internship: "Comparison Between Religare and Stock Trading Service"Document9 pagesSummer Internship: "Comparison Between Religare and Stock Trading Service"Mohammed SaadNo ratings yet

- ReviewerDocument15 pagesReviewerALMA MORENANo ratings yet

- Reading List AC3091 Financial ReportingDocument3 pagesReading List AC3091 Financial ReportingZhengyu LimNo ratings yet

- Financial Mathematics Course FIN 118 Unit Course 10 Number Unit Ordinary Annuity Annuity Due Unit SubjectDocument26 pagesFinancial Mathematics Course FIN 118 Unit Course 10 Number Unit Ordinary Annuity Annuity Due Unit Subjectayadi_ezer6795No ratings yet

- Patricio Caceres MBA ResumeDocument2 pagesPatricio Caceres MBA Resumeashish ojhaNo ratings yet

- Cash FlowsDocument12 pagesCash FlowsEjaz AhmadNo ratings yet

- Corpo Sec 12-22Document6 pagesCorpo Sec 12-22ronaldNo ratings yet

- Equity ResearchDocument4 pagesEquity ResearchChandanNo ratings yet

- CCM - Directory of Service Providers - 11-2011Document13 pagesCCM - Directory of Service Providers - 11-2011Stelu OlarNo ratings yet

- Akshay NidhiDocument5 pagesAkshay NidhiGuru RamanathanNo ratings yet

Export of Taxable Service

Export of Taxable Service

Uploaded by

Nitish BansalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Export of Taxable Service

Export of Taxable Service

Uploaded by

Nitish BansalCopyright:

Available Formats

Export of Taxable Services CA.

Rajendra Kumar P, FCA, Chennai Section 93 of the Finance Act, 1994 empowers the Central Government to grant exemption from service tax and section 93A contains powers to grant rebate. The Central Government under Section 94 of the Finance Act, 1994 is also vested with the Powers to make Rules for the purpose of carrying out the provisions of the Finance Act. Section 94(2) (f), (g), (h) and (hh) empowers the Central Government to make rules for the following matters:

(f) provisions for determining export of taxable services;

(g) grant of exemption to, or rebate of service tax paid on, taxable services which are exported out of India; (h) rebate of service tax paid or payable on the taxable services consumed or duties paid or deemed to have been paid on goods used for providing taxable services which are exported out of India; (hh) rebate of service tax paid or payable on the taxable services used as input services in the manufacturing or processing of goods exported out of India under section 93A

Being empowered by the sections referred above Export of Services Rules, 2005 were notified with effect from March 15, 2005 vide Notification No.9/2005 dated 03-03-2005. This notification has been amended number of times since its inception. The content of this paper contains the position as on May 14, 2011. Export of Services Rules contains 5 rules. Rule 3 contains the rules to determine when a taxable service shall be treated as export. Rule 3(1)(i) deals with situation criteria, 3(1)(ii) deals with performance criteria and 3(1)(iii) deals with usage criteria. A taxable service becomes eligible for consideration under these rules only when it is first covered under either rule 3(1)(i), 3(1)(ii) or 3(1)(iii). If the taxable service is not covered in either of these rules it is outside the ambit of these rules.

Situation Criteria As per rule 3(1)(i) in respect of the services listed below the immovable property in relation to which such taxable service is provided should be situated outside India. General Insurance service (d) Mandap Keeper service (m) Architect Services (p) Interior Decorator service (q) Real Estate Agents service (v) Commercial or Industrial Construction service (zzq) Site formation and clearance, excavation and earth moving and demolition service (zza) Dredging service (zzzb) Survey and map making service (zzzc) Construction of Complex service (zzzh) Auctioneers service (zzzr) Mining of mineral, oil or gas service (zzzv) Renting of immovable property service (zzzz) Works contract (zzzza) Legal consultancy service (zzzzm) Preferential location services (zzzzu) Restaurant services (zzzzv) Hotel accommodation service (zzzzw)

Performance Criteria Rule 3(1)(ii) lays down that in respect of the following services the service shall be performed outside India. Stock brokers service (a) Courier (f) Custom House Agent service (h) Steamer Agents service (i) Clearing and Forwarding Agents service (i) Air Travel Agent service (l) Tour Operator service (n) Rent- a- Cab operators service (o) Security Agency service (w) Underwriter services (z) Photography service (zb)

Convention service (zc) Video Production Agencys service (zi) Sound recording service (zj) Port services (zn) Authorised service stations service (zo) Beauty treatment service (zq) Cargo handling service (zr) Dry cleaning service (zt) Event Management service (zu) Fashion designing service (zv) Health and Fitness services (zw) Rail travel agent service (zz) Storage and warehousing service (zza) Commercial training or coaching service (zzc) Erection, commissioning & installation service (zzd) Internet Cafe service (zzf) Management, maintenance or repair service (zzg) Technical inspection and certification service (zzi) Port other than those covered in zn above (zzl) Airport Services (zzm) Business Exhibition services (zzo) Outdoor Catering Service (zzt) Survey and Exploration of Mineral, Oil and Gas service (zzv) Pandal or Shamiana Contractors service (zzw) Travel Agent service (zzx) Forward Contract service (zzv) Cleaning activity service (zzzd) Club or association service (zzze) Packaging activity service (zzzf) Stock Exchange services (zzzzg) Commodity Exchange services (zzzzh) Processing and Clearing house service (zzzzi) Cosmetic or Plastic surgery service (zzzzk) Transport of Coastal goods and goods through National waterways and Inland water services (zzzzl) Health Check-up and treatment services/ clinical establishment services (zzzzo) The first proviso clarifies that when a taxable service is partly performed outside India it shall be treated as performed outside India. The second proviso contains that when management, maintenance or repair service or technical inspection and certification service is

provided in relation to any good or material or in relation to any immovable property which is situated outside India at the time of provision of service through internet or an electronic network including computer network or by any other means (telephone, video conf etc..) then the said taxable service shall be treated as taxable service performed outside India whether or not the same is performed outside India. Usage Criteria In respect of the taxable services listed in this category, when the service is provided in relation to business or commerce then the recipient of the service should be located outside India. However, if the service that is provided is not in relation to business or commerce then the recipient of the said service shall be located outside India at the time of provision of the said service. The first proviso to this sub rule lays down that if the recipient of the service has any commercial establishment or any office relating to his business in India then the taxable service so provided shall be treated as export only when the order for providing the service is made by the recipient from any of his commercial establishment or office which is located outside India. The second proviso contains that in respect of the taxable service supply of tangible goods the said service shall be treated as export only if the tangible goods supplied for use are located outside India during the period of use of such tangible goods by the recipient of the service. The following are the taxable services covered under this category: Advertising agency (e) Assets management service (zzzzc) Auction service (other than immovable property- related services) (zzzr) Automated teller machine operation , management, maintenance service (zzzk) Banking and other financial service (zm) Broadcasting service (zk) Business auxiliary service (zzb) Business support service (zzzq)

Cable Operators service (zs) Chartered Accountant service (s) Commercial use or exploitation of any event (zzzzr) Company secretary services (u) Computer network services (zh) Consulting Engineer services (g) Copyright services (zzzzt) Cost Accountant (t) Credit/debit/charge card or other payment card related services (zzzw) Credit Rating agency (x) Design Services (zzzzd) Development and supply of contents services in telecom services etc (zzzzb) Electricity exchanges' services (zzzzs) Franchise services (zze) General Insurance service (other than immovable propertyrelated services) (d) Information technology software services (zzzze) Insurance auxiliary service (zl) Intellectual Property Service (zzr) Internet Telecommunication services (zzzu) Legal Consultancy service (other than immovable property related services) (zzzzm) Life Insurance service (zx) Mailing list compilation and mailing (zzzg) Management Consultant (r) Management of Investment in ULIP services (zzzzf) Manpower Recruitment or supply Agency's service (k) Market Research agency (y) Medial records maintenance services (zzzzp) Opinion Poll Service (zzs) Programme Producer's service (zzu) Promotion of 'brand' of goods, services, events, business entity etc (zzzzq) Promotion, marketing or organising of games of chance, including lottery (zzzzn) Public Relations Management service (zzzs) Recovery Agent's service (zzzl) Registrar to an Issue's service (zzzi) Sale of space for advertisement (zzzm) Scientific and technical consultancy (za) Share transfer agent(zzzj)

Ship management (zzzt) Sponsorship services (zzzn) Supply of tangible goods services (zzzzj) Survey and map making services (other than immovable property related services) (zzzc) Technical testing and analysis services (zzh) Telecommunication service (zzzx) Transport of goods by Air (zzn) Transport of goods by Road (zzp) Transport of goods by Rail (zzzp) Transport of goods other than water through pipeline or other conduit (zzz) In respect of the following services which are covered under 3(1)(i) when the said services are not in relation to immovable property they will merit consideration under this sub rule. General Insurance service (d) Survey and map making service (zzzc) Auction service (zzzr) Legal service (zzzzm)

Services which are not covered under these Rules Passenger embarking in India for domestic journey or international journey service (zzzo) Tour on Cruise ship service (zzzv) Export A taxable service which is covered in any one of the above criterion will be considered as export only if the condition specified in Rule 3(2) is satisfied. Rule 3(2) lays down that a taxable service shall be treated as export of service only when the payment for such service is received by the service provider in convertible foreign exchange. Export without payment of service tax Rule 4 lays down that any taxable service may be exported without payment of service tax. Rebate

Rule 5 provides that the Central Government by way of a notification can grant rebate of service tax paid on export of taxable service or service tax paid on input services or duty paid on inputs which are used in providing such taxable service. The rebate shall be granted subject to fulfillment of conditions and procedure as maybe specified in the said notification. Empowered by this rule the Central Government has by Notification No.11/2005-ST dated 19-04-2005 and 12/2005-ST dated 19-04-2005 prescribed the Form and procedure for claim of rebate. Conclusion From the times we have known taxes in the Indian context we have been fed that realization in convertible foreign exchange is not taxable. Service Tax law makes us to unlearn and relearn. The above provisions contained in the Export of Services Rules make it amply clear that mere realization of money in convertible foreign exchange will not suffice to avail the exemption from payment of service tax. It is true that Exports should not be burdened with taxes but if the activity begins in India and ends in India then such transaction cannot be clothed as export, the Export of Service Tax Rules teach us this principle.

You might also like

- Laws - Guide For Freelancers in IndiaDocument9 pagesLaws - Guide For Freelancers in Indiaranjithxavier100% (4)

- Topic 11 To 14 Answer PDFDocument11 pagesTopic 11 To 14 Answer PDFSrinivasa Reddy SNo ratings yet

- Binary Options Trading Winning System EnglishDocument104 pagesBinary Options Trading Winning System EnglishLucas Nolla100% (1)

- Chapter 14 - Financial Statement AnalysisDocument58 pagesChapter 14 - Financial Statement AnalysisPradipta Gitaya0% (1)

- English Khmer Glossary of Accounting and Auditing Terminology p1 PDFDocument181 pagesEnglish Khmer Glossary of Accounting and Auditing Terminology p1 PDFKon Khmer100% (4)

- Export of ServicesDocument9 pagesExport of ServicesshantX100% (1)

- India's Software, Services Exports Forecast at $40BDocument3 pagesIndia's Software, Services Exports Forecast at $40BgauravsavaleNo ratings yet

- S.L. Peeran (J) and T.K. Jayaraman (T), MembersDocument4 pagesS.L. Peeran (J) and T.K. Jayaraman (T), MembersBhan WatiNo ratings yet

- Service Tax ProcedureDocument23 pagesService Tax ProcedureBhavin ShahNo ratings yet

- Export of Service Rules, 2005Document2 pagesExport of Service Rules, 2005mads70No ratings yet

- Export of Services Rules 2005Document2 pagesExport of Services Rules 2005Venkata ChalapathyNo ratings yet

- Export of Service Rules, 2005Document4 pagesExport of Service Rules, 2005Nalini BhorNo ratings yet

- Service TaxDocument12 pagesService TaxdeepikaNo ratings yet

- Service Tax: Some of The Major Services That Come Under The Ambit of Service Tax AreDocument7 pagesService Tax: Some of The Major Services That Come Under The Ambit of Service Tax AreChetan ShivankarNo ratings yet

- Service Exports From India SchemeDocument5 pagesService Exports From India Schemeswarna lathaNo ratings yet

- Contract Agreement NCRMP TPQA Part I of IIIDocument55 pagesContract Agreement NCRMP TPQA Part I of IIIHenRique Xavi InestaNo ratings yet

- Taxation of Non-Residents With Special Reference To Chapter Xii and Xii ADocument16 pagesTaxation of Non-Residents With Special Reference To Chapter Xii and Xii APJ 123No ratings yet

- 2nd Schedule 30.06.15 FinalDocument6 pages2nd Schedule 30.06.15 FinalMuhammad Ali DaanishNo ratings yet

- Sindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFDocument64 pagesSindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFrohail51No ratings yet

- Bimal Jain BGM Service Tax 051014Document67 pagesBimal Jain BGM Service Tax 051014Aayushi AroraNo ratings yet

- Karnatka Vat RulesDocument49 pagesKarnatka Vat RulesshanoboghNo ratings yet

- Transfer Pricing Draft Safe GHarbour RulesDocument17 pagesTransfer Pricing Draft Safe GHarbour RulesAbhay DesaiNo ratings yet

- B.C.A.S.: Negative List Based Taxation of Services - Important Issues by Ca Puloma DalalDocument6 pagesB.C.A.S.: Negative List Based Taxation of Services - Important Issues by Ca Puloma DalaltwodpassNo ratings yet

- Gantry Rails Bidding DocumentsDocument95 pagesGantry Rails Bidding DocumentsDaniel EvansNo ratings yet

- FTS Course PPT - 07112020Document55 pagesFTS Course PPT - 07112020sanket.tatedNo ratings yet

- Service TaxDocument15 pagesService TaxMonu TulsyanNo ratings yet

- IDT SupplemantaryDocument77 pagesIDT SupplemantarykanchanthebestNo ratings yet

- Service Tax NotesDocument11 pagesService Tax NotesLaw Classes KolkataNo ratings yet

- M.Fakhrul Alam Commissioner Customs, Excise &vatDocument29 pagesM.Fakhrul Alam Commissioner Customs, Excise &vatshammeeNo ratings yet

- Site Info ClearanceDocument9 pagesSite Info ClearanceAnuppur Amlai RangeNo ratings yet

- Travel by Air ServicesDocument15 pagesTravel by Air ServicesvijaykoratNo ratings yet

- Application of WHT Under The Double Taxation AgreementDocument19 pagesApplication of WHT Under The Double Taxation Agreementrizzwan4uNo ratings yet

- 62e11a8f3dc57order GST Food Business 27 07 2022Document7 pages62e11a8f3dc57order GST Food Business 27 07 2022sheela bethapudiNo ratings yet

- 22229paper4st cp1Document9 pages22229paper4st cp1TejTejuNo ratings yet

- Service Tax Qick RevisionDocument91 pagesService Tax Qick RevisiongouthamNo ratings yet

- FEM Unit2 PDFDocument48 pagesFEM Unit2 PDFSurjan SinghNo ratings yet

- Taxation of Financial Services Sybbi FinalDocument24 pagesTaxation of Financial Services Sybbi Finalsheenu152005No ratings yet

- CA Final IDT RTP For May 2023Document19 pagesCA Final IDT RTP For May 2023Nick VincikNo ratings yet

- Stock Exchange Service (A) Date of IntroductionDocument7 pagesStock Exchange Service (A) Date of Introductionarshad89057No ratings yet

- III. Special Conditions of Contract 98Document2 pagesIII. Special Conditions of Contract 98Anonymous ufMAGXcskMNo ratings yet

- ST Ajk2015Document21 pagesST Ajk2015asadNo ratings yet

- Services Exports From India Scheme ("SEIS") : Comprehensive Solutions For Complex MattersDocument13 pagesServices Exports From India Scheme ("SEIS") : Comprehensive Solutions For Complex MattersRajdeep SharmaNo ratings yet

- Press Note No.3-2007 SeriesDocument4 pagesPress Note No.3-2007 SeriesPari BasuNo ratings yet

- Rfe 2021Document119 pagesRfe 2021nietgrNo ratings yet

- Vietnam Foreign Contractor Withholding TaxDocument4 pagesVietnam Foreign Contractor Withholding TaxThanh TuongNo ratings yet

- RFP Volume 1 - Bidding Terms and ConditionsDocument146 pagesRFP Volume 1 - Bidding Terms and ConditionsRamesh CNo ratings yet

- GatsDocument47 pagesGatsSreyashi MukherjeeNo ratings yet

- SAC Codes & GST Rates For Services - Chapter 99Document26 pagesSAC Codes & GST Rates For Services - Chapter 99mn_sundaraam67% (3)

- (B) Definition and Scope of ServiceDocument9 pages(B) Definition and Scope of ServiceAPI SupportNo ratings yet

- Annexure-A Deduction From The Payment of Certain Services (Section 52AA)Document8 pagesAnnexure-A Deduction From The Payment of Certain Services (Section 52AA)Masum GaziNo ratings yet

- Service TaxDocument55 pagesService Taxtushar vatsNo ratings yet

- Service TaxDocument18 pagesService TaxRajavati NadarNo ratings yet

- Comments On Sindh Finance Bill - 2015: Haroon Zakaria & Company Chartered AccountantsDocument12 pagesComments On Sindh Finance Bill - 2015: Haroon Zakaria & Company Chartered AccountantsssssNo ratings yet

- Vietnam - Schedule of CommitmentDocument60 pagesVietnam - Schedule of CommitmentThanh Thủy TrầnNo ratings yet

- Memarts For Amalgam ConsultantsDocument24 pagesMemarts For Amalgam ConsultantsHulka KihangaNo ratings yet

- UntitledDocument479 pagesUntitledshantanuNo ratings yet

- Note On Blocked ITC - PDF - CompressedDocument2 pagesNote On Blocked ITC - PDF - CompressedCA Ishu BansalNo ratings yet

- The Second Schedule of It SoftwearDocument1 pageThe Second Schedule of It SoftwearAshar AsifNo ratings yet

- CG-07-03 - Final - 20M2021-2Document120 pagesCG-07-03 - Final - 20M2021-2Rushikesh kulkarniNo ratings yet

- Service TaxDocument9 pagesService TaxakshatkhaleNo ratings yet

- Cenvat Credit Rules, 2004 An Overview: Gopi Donthireddy Deputy CommissionerDocument39 pagesCenvat Credit Rules, 2004 An Overview: Gopi Donthireddy Deputy CommissionerAnuragNo ratings yet

- Circular - 111-05-2009-STDocument2 pagesCircular - 111-05-2009-STjayamurli19547922No ratings yet

- The Foreign Trade (Development and Regulation) Act, 1992Document12 pagesThe Foreign Trade (Development and Regulation) Act, 1992Mishail BakshiNo ratings yet

- Cap Bud - UltDocument11 pagesCap Bud - UltKhaisarKhaisarNo ratings yet

- Role of Capital Market in IndiaDocument6 pagesRole of Capital Market in Indiajyoti verma100% (1)

- Annuities Practice Problem Set 2: Future Value of An AnnuityDocument2 pagesAnnuities Practice Problem Set 2: Future Value of An AnnuityJeric Marasigan EnriquezNo ratings yet

- Geodynamics Investor CircularDocument12 pagesGeodynamics Investor CircularBlack_and_Blue_DogNo ratings yet

- CMS Report PDFDocument8 pagesCMS Report PDFRecordTrac - City of OaklandNo ratings yet

- Jyoti CNC Automation Limited: History and Certain Corporate MattersDocument388 pagesJyoti CNC Automation Limited: History and Certain Corporate MattersRAJAMANICKAMNo ratings yet

- iSave-IPruMF FAQsDocument6 pagesiSave-IPruMF FAQsMayur KhichiNo ratings yet

- Corpo NotesDocument206 pagesCorpo NotesThalia SalvadorNo ratings yet

- Different Types of Capital IssuesDocument5 pagesDifferent Types of Capital IssuesUdhayakumar ManickamNo ratings yet

- Forfeiture and Reissue of SharesDocument118 pagesForfeiture and Reissue of SharesFredhope Mtonga100% (1)

- Value Investing The Sanjay Bakshi-Way PDFDocument64 pagesValue Investing The Sanjay Bakshi-Way PDFmilandeepNo ratings yet

- Company Law Samadhan BookDocument338 pagesCompany Law Samadhan Bookcs LakshmiNo ratings yet

- Ch01.Ppt OverviewDocument55 pagesCh01.Ppt OverviewMohammadYaqoob100% (1)

- 05) Money MarketDocument56 pages05) Money MarketNaina GoyalNo ratings yet

- Problems Chapter 6-7 International Parity ConditionsDocument12 pagesProblems Chapter 6-7 International Parity Conditionsarmando.chappell1005No ratings yet

- Chapter Two: Security Markets: Present and FutureDocument41 pagesChapter Two: Security Markets: Present and FutureTram TruongNo ratings yet

- Summer Internship: "Comparison Between Religare and Stock Trading Service"Document9 pagesSummer Internship: "Comparison Between Religare and Stock Trading Service"Mohammed SaadNo ratings yet

- ReviewerDocument15 pagesReviewerALMA MORENANo ratings yet

- Reading List AC3091 Financial ReportingDocument3 pagesReading List AC3091 Financial ReportingZhengyu LimNo ratings yet

- Financial Mathematics Course FIN 118 Unit Course 10 Number Unit Ordinary Annuity Annuity Due Unit SubjectDocument26 pagesFinancial Mathematics Course FIN 118 Unit Course 10 Number Unit Ordinary Annuity Annuity Due Unit Subjectayadi_ezer6795No ratings yet

- Patricio Caceres MBA ResumeDocument2 pagesPatricio Caceres MBA Resumeashish ojhaNo ratings yet

- Cash FlowsDocument12 pagesCash FlowsEjaz AhmadNo ratings yet

- Corpo Sec 12-22Document6 pagesCorpo Sec 12-22ronaldNo ratings yet

- Equity ResearchDocument4 pagesEquity ResearchChandanNo ratings yet

- CCM - Directory of Service Providers - 11-2011Document13 pagesCCM - Directory of Service Providers - 11-2011Stelu OlarNo ratings yet

- Akshay NidhiDocument5 pagesAkshay NidhiGuru RamanathanNo ratings yet