Professional Documents

Culture Documents

Risk Magnitude

Risk Magnitude

Uploaded by

TAKELE NEDESACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Magnitude

Risk Magnitude

Uploaded by

TAKELE NEDESACopyright:

Available Formats

RISK MAGNITUDE

Risk Magnitude calculation is easier when done with magnitude numbers. Risk Magnitude is

calculated as the sum of the Severity Magnitude and the Likelihood Magnitude. (This is possible

because adding exponents is the same as multiplying integers;

In scientific notation, 1000 x 0.1 = 100 in scientific notation is 103 x 10-1 = 102 , and

10(3+(-1)) = 102). It is to be noted that a frequency of once a year could be considered the "base"

frequency. The Risk Magnitude will be the same as the Severity Magnitude if an Unwanted

Outcome has a Likelihood Magnitude of 0. The Risk Magnitude will be more than the Severity

Magnitude if the Outcome occurs more frequently than once a year and vice versa.

Risk Likelihood and Magnitude

A risk map, also known as a risk matrix, is one of the best ways to show the likelihood and

magnitude of the danger. Risk maps can be created in different formats. A risk map, in whatever style

it is presented, is an extremely useful tool for risk managers. The basic type of risk map shows the

likelihood of an event happening as compared to its magnitude or its effect on its occurrence.

A simple risk matrix also referred to as a heat map, is a common way of expressing the

probability of a risk occurring and the magnitude of the occurrence if it does. The use of a risk matrix

to indicate the probability of the risk occurring and the scale of its occurrence is an important risk

management technique. The risk matrix is adopted to define the nature of a specific hazard,

allowing the organization to assess if the risk is acceptable and falls within the risk

appetite and/or risk capacity of the organization.

Because the word frequency suggests that occurrences will undoubtedly occur, whereas the map is

tracking how frequently these events occur, the term likelihood is used instead of frequency. The

term "likelihood" covers both frequency and the likelihood of unexpected events occurring. However,

the word probability is frequently employed in risk management studies to characterize the chance of

a risk materializing.

© 2024 Athena Global Education. All Rights Reserved

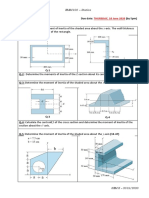

Fig Risk Likelihood and Magnitude

In Figure, the vertical and the horizontal axis denote magnitude and likelihood respectively. As a

single risk map can depict hazard, control, and opportunity risks, the term magnitude is used instead

of severity. The term "severity" refers to the degree to which an occurrence is unpleasant and, as a

result, it is associated with hazard risks.

The figure above plots the likelihood of an event against its magnitude. The impact or

repercussions of the incident, rather than the magnitude of the occurrence, are the most essential

considerations for risk managers.

A huge fire, for example, might completely damage the distribution and logistics of a company's

facility. Though the incident is huge in severity, if the organization has prepared strategies to deal

with it, the total impact on the business could be far less than what would otherwise be expected.

The effect of an event could be considered as the risk-managed level, whereas the magnitude could

be considered as the inherent level of the event. As the effect of an event is often more significant

than the degree of its occurrence, every risk matrix in the upcoming segments will indicate impact

versus likelihood rather than magnitude versus likelihood.

The risk matrix helps in the visual depiction of risk. It is also used to show which risk control

techniques are most likely to be implemented. The inherent, current (or residual), and target levels of

risk can all be recorded using the risk matrix. Color coding is typically used on the risk matrix to

allow a visual depiction of the significance of each risk under consideration. As one moves

toward the upper right-hand corner of the risk matrix, risks become more likely and have a greater

impact. As a result, the risk becomes more severe, which necessitates an immediate and effective

execution of risk control measures.

Consider the uncertainties surrounding the merger of Delta Airlines and Northwest Airlines as a

typical illustration of risk management in action at the strategic level. This demonstrates how

businesses make strategic decisions that are fraught with risk and uncertainty.

© 2024 Athena Global Education. All Rights Reserved

You might also like

- Mathematics: Stage 6 Paper 2Document18 pagesMathematics: Stage 6 Paper 2Mortis Lupus25% (4)

- 44R-08 Risk Analysis and Contingency Determination Using Expected ValueDocument8 pages44R-08 Risk Analysis and Contingency Determination Using Expected ValueDody BdgNo ratings yet

- EN - 840Dsl Kinematic Chain Milling 0408 - 2019-03Document322 pagesEN - 840Dsl Kinematic Chain Milling 0408 - 2019-03F.C100% (1)

- Risk-Impact-Probability-Chart PresentationDocument9 pagesRisk-Impact-Probability-Chart PresentationDhyey SakariyaNo ratings yet

- Probability and Impact MatrixDocument1 pageProbability and Impact MatrixTawanda KurasaNo ratings yet

- LESSON 3 Business Ethics and Risk ManagementDocument4 pagesLESSON 3 Business Ethics and Risk ManagementEvelyn DamianNo ratings yet

- Concept: Individual Risk AssessmentDocument2 pagesConcept: Individual Risk AssessmentRohit TharejaNo ratings yet

- Risk AnalysisDocument3 pagesRisk AnalysisKévin EonNo ratings yet

- Implementing Major Accident Hazard Management - Silo Busting in PracticeDocument19 pagesImplementing Major Accident Hazard Management - Silo Busting in PracticeJorge D BalseroNo ratings yet

- Xecutive Ummary: T M S M SDocument3 pagesXecutive Ummary: T M S M Sneha1009No ratings yet

- Confusion Over Risk CriteriaDocument9 pagesConfusion Over Risk CriteriaDavid RodriguesNo ratings yet

- Introduct Ion To Risk Managem ENT: Jessica Lile - 18042044Document32 pagesIntroduct Ion To Risk Managem ENT: Jessica Lile - 18042044Jessica LileNo ratings yet

- Quantitative Risk Analysis: TEJ PANDYA 80303160091Document5 pagesQuantitative Risk Analysis: TEJ PANDYA 80303160091Tej PandyaNo ratings yet

- Quantiify RiskDocument8 pagesQuantiify Risk2p9vpj5g9cNo ratings yet

- How To Map Your RisksDocument3 pagesHow To Map Your RisksBheki TshimedziNo ratings yet

- T1-FRM-1-Ch1-Risk-Mgmt-v3.3 - Study NotesDocument21 pagesT1-FRM-1-Ch1-Risk-Mgmt-v3.3 - Study NotescristianoNo ratings yet

- What Is A Risk MatrixDocument7 pagesWhat Is A Risk Matrixpoo12122No ratings yet

- Risk ManagementDocument12 pagesRisk ManagementParasYadavNo ratings yet

- Introducing - A Risk - Based - Approach To Regulate BusinessesDocument8 pagesIntroducing - A Risk - Based - Approach To Regulate Businessesyin920No ratings yet

- Risk AssessmentDocument4 pagesRisk AssessmentVPF StephenNo ratings yet

- Risk QnA CardsDocument4 pagesRisk QnA CardsHaitham El HanbolyNo ratings yet

- What Is Risk ManagementDocument4 pagesWhat Is Risk ManagementSamanNo ratings yet

- Dealing With Dependent Risks: Claudia KL Uppelberg Robert StelzerDocument32 pagesDealing With Dependent Risks: Claudia KL Uppelberg Robert Stelzernikhilesh kumarNo ratings yet

- Engineering Professsional Ethics EPE 203Document4 pagesEngineering Professsional Ethics EPE 203Nirob ShikderNo ratings yet

- Risk 3Document4 pagesRisk 3ali sameerNo ratings yet

- P1.T1. Foundations of Risk Chapter 1. The Building Blocks of Risk Management Bionic Turtle FRM Study NotesDocument21 pagesP1.T1. Foundations of Risk Chapter 1. The Building Blocks of Risk Management Bionic Turtle FRM Study NotesChristian Rey MagtibayNo ratings yet

- RM Lesson #1 (Jan 28 2022)Document16 pagesRM Lesson #1 (Jan 28 2022)SonnyNo ratings yet

- Risk and ButterflyDocument5 pagesRisk and ButterflyNur Fajri AjieNo ratings yet

- Risk Appetite and Risk ToleranceDocument25 pagesRisk Appetite and Risk Tolerancebrendos0% (1)

- Risk Management ReviewerDocument3 pagesRisk Management ReviewerCherie Joie TaladtadNo ratings yet

- IISITv6p595 615nikolic673 PDFDocument21 pagesIISITv6p595 615nikolic673 PDFJack MisterouffeNo ratings yet

- Risk Management - 1Document8 pagesRisk Management - 1Mora Al-gheyatiNo ratings yet

- Analysis of Risk and Return: TopicDocument9 pagesAnalysis of Risk and Return: TopicSatyam JaiswalNo ratings yet

- 1554207916unit 6 Risk Assessment, Evaluation and ManagementDocument20 pages1554207916unit 6 Risk Assessment, Evaluation and ManagementWongNo ratings yet

- Qualitative Risk AnalysisDocument3 pagesQualitative Risk AnalysisAnonymous AEt3M9T100% (1)

- Risk Management NotesDocument18 pagesRisk Management Notesusman javaidNo ratings yet

- Risk Assessment Guide: Hazard Likelihood Severity Risk Control MeasureDocument5 pagesRisk Assessment Guide: Hazard Likelihood Severity Risk Control MeasureGabriela MogosNo ratings yet

- Review of Risk Assessment Methods: Journal of Information, Control and Management Systems, Vol. 5, (2007), No. 2Document8 pagesReview of Risk Assessment Methods: Journal of Information, Control and Management Systems, Vol. 5, (2007), No. 2Mego PlamoniaNo ratings yet

- Decision TheoryDocument5 pagesDecision Theoryw_sampathNo ratings yet

- Risk AssessmentDocument2 pagesRisk Assessmentahmed.s.alzahrani94No ratings yet

- Risk MatrixDocument3 pagesRisk MatrixSagar KulkarniNo ratings yet

- Project Risk Management - PM0007 SET-1Document5 pagesProject Risk Management - PM0007 SET-1mbaguideNo ratings yet

- Cost-Benefit Analysis in Disaster Risk Management: Cees Van Westen Westen@itc - NLDocument66 pagesCost-Benefit Analysis in Disaster Risk Management: Cees Van Westen Westen@itc - NLsyukria laptopNo ratings yet

- Operational Risk Assessment: Next Generation MethodologyDocument46 pagesOperational Risk Assessment: Next Generation Methodologynat_harNo ratings yet

- Business Risk CalculationDocument2 pagesBusiness Risk CalculationzayrpiNo ratings yet

- RiskDocument30 pagesRiskSuhaib SghaireenNo ratings yet

- EMV of ALTERNATIVES - Final RequirementDocument28 pagesEMV of ALTERNATIVES - Final RequirementClarisse De VeneciaNo ratings yet

- ERM and Risk MeasurementDocument9 pagesERM and Risk Measurementfrancis280No ratings yet

- Guide On Risk RegistersDocument24 pagesGuide On Risk Registersnadeem bajiNo ratings yet

- Understanding risk culture and decision-makingDocument8 pagesUnderstanding risk culture and decision-makingEstebanNo ratings yet

- Fundamentals of Project Management: Submitted By: M Saleem 01-398182-055Document9 pagesFundamentals of Project Management: Submitted By: M Saleem 01-398182-055ChSaleemNo ratings yet

- Acertasc PDFDocument9 pagesAcertasc PDFPablo SalcedoNo ratings yet

- PRisk MGTDocument11 pagesPRisk MGTjj jmNo ratings yet

- Notes On Risk ManagementDocument17 pagesNotes On Risk Managementdwimukh360No ratings yet

- Ccomposita Risk IndexDocument1 pageCcomposita Risk IndexAnonymous uNMUFVvLANo ratings yet

- Risk Management and Analysis: Risk Assessment (Qualitative and Quantitative)Document5 pagesRisk Management and Analysis: Risk Assessment (Qualitative and Quantitative)vasilev100% (1)

- Risk Management Is The Identification, Assessment, andDocument11 pagesRisk Management Is The Identification, Assessment, andAhmed AliNo ratings yet

- Riskmanagement ProcessDocument61 pagesRiskmanagement ProcessNugi DragneelNo ratings yet

- Government Engineering College, Bharuch.: Department of Electronics CommunicationDocument11 pagesGovernment Engineering College, Bharuch.: Department of Electronics Communicationphr201289No ratings yet

- Study Notes The Building Blocks of Risk ManagementDocument19 pagesStudy Notes The Building Blocks of Risk Managementalok kundaliaNo ratings yet

- Unit - %Document14 pagesUnit - %402 ABHINAYA KEERTHINo ratings yet

- Project Life CycleDocument3 pagesProject Life CycleTAKELE NEDESANo ratings yet

- Fundamental account 3Document16 pagesFundamental account 3TAKELE NEDESANo ratings yet

- Fundamental account 6Document22 pagesFundamental account 6TAKELE NEDESANo ratings yet

- Chapter 2 Fundamentals of Project Procurement PolicyDocument35 pagesChapter 2 Fundamentals of Project Procurement PolicyTAKELE NEDESANo ratings yet

- 548-sage50-certificateDocument25 pages548-sage50-certificateTAKELE NEDESANo ratings yet

- 1 Airline ExamDocument11 pages1 Airline ExamTAKELE NEDESANo ratings yet

- Advanced Financial Accounting - II CH 1-4Document24 pagesAdvanced Financial Accounting - II CH 1-4TAKELE NEDESANo ratings yet

- LN9 PDFDocument89 pagesLN9 PDFelty TanNo ratings yet

- Inequalities - Daniel Spivak - 2014 Winter CampDocument5 pagesInequalities - Daniel Spivak - 2014 Winter CampResul HojageldıyevNo ratings yet

- Canet, 2015 AcoculcoDocument7 pagesCanet, 2015 AcoculcoNina HagenNo ratings yet

- AI Lab ManualDocument14 pagesAI Lab Manualksaipraneeth1103No ratings yet

- hw4 sp11 PDFDocument18 pageshw4 sp11 PDFKint MackeyNo ratings yet

- Identifying Proper Fraction, Improper Fraction, and Mixed NumbersDocument5 pagesIdentifying Proper Fraction, Improper Fraction, and Mixed NumbersMichael GrampaNo ratings yet

- Transformation Parameters Between ETRS89-realisations and WGS84-realisations For The NetherlandsDocument9 pagesTransformation Parameters Between ETRS89-realisations and WGS84-realisations For The NetherlandskamipenNo ratings yet

- 8 BT It 2021Document102 pages8 BT It 2021BHARATH YOUVARAZNo ratings yet

- Cost EstimationDocument11 pagesCost EstimationTamiko MitzumaNo ratings yet

- Blind 75 PDFDocument129 pagesBlind 75 PDFAlex WangNo ratings yet

- Solution To Assignment 15 Emm1021920 PDFDocument7 pagesSolution To Assignment 15 Emm1021920 PDFaiman amirNo ratings yet

- Business MathematicsDocument2 pagesBusiness MathematicsShahim MaindalaNo ratings yet

- Cadenas de MarkovDocument53 pagesCadenas de MarkovolsolerNo ratings yet

- Adobe Scan 19-Mar-2024Document1 pageAdobe Scan 19-Mar-2024Daily cravingsNo ratings yet

- General Physics 1Document9 pagesGeneral Physics 1Guenn RamosNo ratings yet

- Assignment 1 2020Document5 pagesAssignment 1 2020Zhori DuberryNo ratings yet

- Important Topics For GATE 2024 by S K MondalDocument19 pagesImportant Topics For GATE 2024 by S K Mondalroseri100% (1)

- Unit Digits, Exponents, - Remainder ProblemsDocument5 pagesUnit Digits, Exponents, - Remainder ProblemsDuc AnhNo ratings yet

- General Heat Conduction Equations: Rectangular/cartesian CoordinatesDocument29 pagesGeneral Heat Conduction Equations: Rectangular/cartesian CoordinatesSyarifah Anis AqilaNo ratings yet

- Aspen DMC3 Builder Jump Start Guide JSGDocument33 pagesAspen DMC3 Builder Jump Start Guide JSGnazmul hasanNo ratings yet

- 6 Projection of PlanesDocument42 pages6 Projection of PlanesRavi BanothNo ratings yet

- API - STD - 521 Fire Gas ExpansionDocument3 pagesAPI - STD - 521 Fire Gas Expansioneliealtawil100% (2)

- Taylor and Maclaurin Series: An Important Result From Calculus Used in Numerical AnalysisDocument21 pagesTaylor and Maclaurin Series: An Important Result From Calculus Used in Numerical AnalysisVandhana AshokNo ratings yet

- Mechanics M2: Pearson Edexcel GCEDocument11 pagesMechanics M2: Pearson Edexcel GCE블루2SNo ratings yet

- RLC Resonant Circuits: Prepared By: - Zanyar AwezDocument24 pagesRLC Resonant Circuits: Prepared By: - Zanyar AwezSul SyaNo ratings yet

- Senturk D. - Covariate-Adjusted Varying Coefficient Models (2006)Document17 pagesSenturk D. - Covariate-Adjusted Varying Coefficient Models (2006)Anonymous idBsC1No ratings yet

- Model QP - MPMC Lab - Wo Split UpDocument3 pagesModel QP - MPMC Lab - Wo Split Upsujaganesan20090% (1)