Professional Documents

Culture Documents

Syllabus FIN 326 Fall 2011

Syllabus FIN 326 Fall 2011

Uploaded by

TheSenator89Copyright:

Available Formats

You might also like

- BCBA Exam Study Guide 5th Edition PDFDocument39 pagesBCBA Exam Study Guide 5th Edition PDFMarquisha Sadé100% (7)

- Course Outline FINA 320 WINTER 2022Document6 pagesCourse Outline FINA 320 WINTER 2022ChrisNo ratings yet

- COMM314 - 2021W - Syllabus and Reading ListDocument9 pagesCOMM314 - 2021W - Syllabus and Reading ListchilleralexNo ratings yet

- MGMT 3P98 Course Outline S20Document6 pagesMGMT 3P98 Course Outline S20Jeffrey O'LearyNo ratings yet

- Syllabus Corporate FinanceDocument6 pagesSyllabus Corporate FinanceTara PNo ratings yet

- UT Dallas Syllabus For Fin6350.5u1.10u Taught by Carolyn Reichert (Carolyn)Document6 pagesUT Dallas Syllabus For Fin6350.5u1.10u Taught by Carolyn Reichert (Carolyn)UT Dallas Provost's Technology GroupNo ratings yet

- Fina-4332 001Document7 pagesFina-4332 001Kiều Thảo AnhNo ratings yet

- FIN333 2012 Spring - REVISEDDocument5 pagesFIN333 2012 Spring - REVISEDHa MinhNo ratings yet

- IE 305 Syllabus F14 - FinalDocument4 pagesIE 305 Syllabus F14 - FinalYuqianHuNo ratings yet

- 773 SyllabusDocument8 pages773 SyllabusTarun GoelNo ratings yet

- Semester Two 2020 Exam - Alternative Assessment TaskDocument13 pagesSemester Two 2020 Exam - Alternative Assessment Tasksardar hussainNo ratings yet

- TCM 703 Fall 2021Document4 pagesTCM 703 Fall 2021SAI VAMSI POLISETTINo ratings yet

- 2020 Summer - 2205 Fina 4324 001Document8 pages2020 Summer - 2205 Fina 4324 001bobNo ratings yet

- 2020 Summer - 2205 Fina 4324 001Document8 pages2020 Summer - 2205 Fina 4324 001bobNo ratings yet

- Dipasri FIN321 Syllabus Fall 2013 MW1130amDocument4 pagesDipasri FIN321 Syllabus Fall 2013 MW1130amJGONo ratings yet

- TIM 305 Financial Management of Travel Industry SPRING 2022 W F 09:00 - 10:15 A.M. Jan 10 - May 13 Kwanglim SeoDocument6 pagesTIM 305 Financial Management of Travel Industry SPRING 2022 W F 09:00 - 10:15 A.M. Jan 10 - May 13 Kwanglim SeoS JNo ratings yet

- Course Outline - Econ 5100F W2023Document6 pagesCourse Outline - Econ 5100F W2023Jaspreet Singh SidhuNo ratings yet

- B6301 Foundations of Valuation Syllabus Spring 2023 Supera PDFDocument5 pagesB6301 Foundations of Valuation Syllabus Spring 2023 Supera PDFTrialNo ratings yet

- UT Dallas Syllabus For Fin6321.501.11f Taught by George DeCourcy (Gad075000)Document6 pagesUT Dallas Syllabus For Fin6321.501.11f Taught by George DeCourcy (Gad075000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Fin6314.501.10f Taught by Feng Zhao (fxz082000)Document7 pagesUT Dallas Syllabus For Fin6314.501.10f Taught by Feng Zhao (fxz082000)UT Dallas Provost's Technology GroupNo ratings yet

- SyllabusDocument3 pagesSyllabusHenry LiuNo ratings yet

- Syllabus - Economic Decision Making - EMGT6225 - Spring 2017Document5 pagesSyllabus - Economic Decision Making - EMGT6225 - Spring 2017Utkarsh Singh100% (1)

- UT Dallas Syllabus For Pa6337.501.10f Taught by Teodoro Benavides (tjb051000)Document4 pagesUT Dallas Syllabus For Pa6337.501.10f Taught by Teodoro Benavides (tjb051000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Acct6344.501.11f Taught by (Jad044000)Document10 pagesUT Dallas Syllabus For Acct6344.501.11f Taught by (Jad044000)UT Dallas Provost's Technology GroupNo ratings yet

- Updated FIN812 Capital Budgeting - 2015 - SpringDocument6 pagesUpdated FIN812 Capital Budgeting - 2015 - Springnguyen_tridung2No ratings yet

- MBA 707 51 Financial Management8Document9 pagesMBA 707 51 Financial Management8Sitara QadirNo ratings yet

- WEEK 12 Review: 4.1 Attendance RequirementsDocument4 pagesWEEK 12 Review: 4.1 Attendance RequirementsIntan Permata SariNo ratings yet

- Instructor's Contact Information: Polkovn@utdallas - EduDocument5 pagesInstructor's Contact Information: Polkovn@utdallas - EduronsarsNo ratings yet

- Syllabus FNCE 3030 Spring 2017Document3 pagesSyllabus FNCE 3030 Spring 2017list_friendlyNo ratings yet

- CSCU9T4 Assignment2 Instructions Spring2024Document6 pagesCSCU9T4 Assignment2 Instructions Spring2024Uzair KabeerNo ratings yet

- A FNCE 4304 FALL 2016 August 24 - 8Document5 pagesA FNCE 4304 FALL 2016 August 24 - 8new england brickNo ratings yet

- Acct 587Document6 pagesAcct 587socalsurfyNo ratings yet

- UT Dallas Syllabus For Ba3341.001.08f Taught by Mary Chaffin (Chaf)Document5 pagesUT Dallas Syllabus For Ba3341.001.08f Taught by Mary Chaffin (Chaf)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Fin6314.501.11s Taught by Feng Zhao (fxz082000)Document6 pagesUT Dallas Syllabus For Fin6314.501.11s Taught by Feng Zhao (fxz082000)UT Dallas Provost's Technology GroupNo ratings yet

- Course Outline F2000TDocument6 pagesCourse Outline F2000Txixi.cz7651No ratings yet

- PM0012-Project Finance and BudgetingDocument2 pagesPM0012-Project Finance and BudgetingsmumbasolutionsNo ratings yet

- Syllabus: ENT 2000 - Intro To EntrepreneurshipDocument7 pagesSyllabus: ENT 2000 - Intro To EntrepreneurshipBrandon E. PaulNo ratings yet

- Assignment 1: 1) IntroductionDocument7 pagesAssignment 1: 1) IntroductionRennyNo ratings yet

- Digital Finance - Prof KunalDocument6 pagesDigital Finance - Prof KunalsumanNo ratings yet

- Graphing Calculators (Eg: TI 89) Cannot Be Used in Exams or QuizzesDocument6 pagesGraphing Calculators (Eg: TI 89) Cannot Be Used in Exams or QuizzesVishal GuptaNo ratings yet

- UT Dallas Syllabus For Opre6302.mbc.09s Taught by Divakar Rajamani (dxr020100)Document6 pagesUT Dallas Syllabus For Opre6302.mbc.09s Taught by Divakar Rajamani (dxr020100)UT Dallas Provost's Technology GroupNo ratings yet

- Syllabus-Finc3351 Spring2024Document6 pagesSyllabus-Finc3351 Spring2024z8s927n5ffNo ratings yet

- Syllabus 5161 MasterDocument13 pagesSyllabus 5161 Masterhsnpdr365No ratings yet

- UT Dallas Syllabus For Fin6314.501.11s Taught by Feng Zhao (fxz082000)Document6 pagesUT Dallas Syllabus For Fin6314.501.11s Taught by Feng Zhao (fxz082000)UT Dallas Provost's Technology GroupNo ratings yet

- 310 - 2019summerIIDocument8 pages310 - 2019summerIIJimmy TengNo ratings yet

- Compben Syllabus2Document5 pagesCompben Syllabus2Edgar L. AlbiaNo ratings yet

- UT Dallas Syllabus For Cs6388.0u1.10u Taught by Rym Zalila-Wenkstern (Rmili)Document9 pagesUT Dallas Syllabus For Cs6388.0u1.10u Taught by Rym Zalila-Wenkstern (Rmili)UT Dallas Provost's Technology GroupNo ratings yet

- Kelkhal@usi - Edu: Edition, by Jeff MaduraDocument4 pagesKelkhal@usi - Edu: Edition, by Jeff MaduraTalib DoaNo ratings yet

- UT Dallas Syllabus For Aim6333.521 06u Taught by Michael Tydlaska (Tydlaska)Document3 pagesUT Dallas Syllabus For Aim6333.521 06u Taught by Michael Tydlaska (Tydlaska)UT Dallas Provost's Technology GroupNo ratings yet

- Syllabus FINA210 Business Finance FALL 2013Document6 pagesSyllabus FINA210 Business Finance FALL 2013Mahmoud KambrisNo ratings yet

- UT Dallas Syllabus For Opre6302.mbc.10s Taught by Divakar Rajamani (dxr020100)Document6 pagesUT Dallas Syllabus For Opre6302.mbc.10s Taught by Divakar Rajamani (dxr020100)UT Dallas Provost's Technology GroupNo ratings yet

- BUSFIN 3300 Krempley - 0Document8 pagesBUSFIN 3300 Krempley - 0Faith KamauNo ratings yet

- BSAD 183 Fall 2018 SyllabusDocument4 pagesBSAD 183 Fall 2018 SyllabusConstantinos ConstantinouNo ratings yet

- 2012 PROP 6600 Outline (Draft2)Document7 pages2012 PROP 6600 Outline (Draft2)bert1423No ratings yet

- HRM and Finance PDFDocument5 pagesHRM and Finance PDFAnonymous T3KH2cctRaNo ratings yet

- Fa11 Fin 650 SagnerDocument7 pagesFa11 Fin 650 SagnerFuzael AminNo ratings yet

- MBAA 518 Online Syllabus 0515Document6 pagesMBAA 518 Online Syllabus 0515HeatherNo ratings yet

- Essentials of Managerial FinanceDocument12 pagesEssentials of Managerial FinanceAarti JNo ratings yet

- Opim101 - Low Chee SengDocument3 pagesOpim101 - Low Chee SengKelvin Lim Wei LiangNo ratings yet

- MGMT102 TerenceFanDocument5 pagesMGMT102 TerenceFanDon JohnyNo ratings yet

- CISSP Domain 1 Study Guide ( Updated 2024 ) With Practice Exam Questions, Quizzes, Flash Cards: CISSP Study Guide - Updated 2024, #1From EverandCISSP Domain 1 Study Guide ( Updated 2024 ) With Practice Exam Questions, Quizzes, Flash Cards: CISSP Study Guide - Updated 2024, #1No ratings yet

- Cultural, Social and Political ChangeDocument15 pagesCultural, Social and Political ChangeKyoya HibariNo ratings yet

- Lesson Plan Sketch 6Document4 pagesLesson Plan Sketch 6api-521963623No ratings yet

- KW 633 Math Major ApplicationDocument2 pagesKW 633 Math Major ApplicationxenkyrattvNo ratings yet

- Latino Hispanic Presentation 2Document17 pagesLatino Hispanic Presentation 2api-265782144No ratings yet

- Strategic Management ModuleDocument36 pagesStrategic Management ModulenachtandyNo ratings yet

- The Nuts and Bolts of Teaching WritingDocument6 pagesThe Nuts and Bolts of Teaching WritingCourtney WenstromNo ratings yet

- BISE LHR Gazette 11th 2022Document1,299 pagesBISE LHR Gazette 11th 2022ImranNo ratings yet

- Cortiz-Eng17-Majoroutput 2Document22 pagesCortiz-Eng17-Majoroutput 2Leonido Jr. CortizNo ratings yet

- People Also Ask: Average To Gpa ChartDocument1 pagePeople Also Ask: Average To Gpa ChartSoliyana GizawNo ratings yet

- Case Study Delta AirlinesDocument15 pagesCase Study Delta Airlinesdiamond elf11No ratings yet

- This Study Resource Was: Performance Mangement System: A Case Study of NTPCDocument7 pagesThis Study Resource Was: Performance Mangement System: A Case Study of NTPCsharathNo ratings yet

- School Milk in Britain 1900-1934Document45 pagesSchool Milk in Britain 1900-1934Valeria Resendiz FloresNo ratings yet

- Theoretical Framework of Core, Peripheral and Interdisciplinary Disciplines in LinguisticsDocument7 pagesTheoretical Framework of Core, Peripheral and Interdisciplinary Disciplines in LinguisticsAsif DaughterNo ratings yet

- 50 Ways To Use Office 365 For EducationDocument39 pages50 Ways To Use Office 365 For Educationapi-260881210No ratings yet

- Clos Assessment - Abet (Template) Filled in Dr. MagdyDocument2 pagesClos Assessment - Abet (Template) Filled in Dr. MagdyAhmed MohammedNo ratings yet

- Lecture 10 Foundation of Control PDFDocument25 pagesLecture 10 Foundation of Control PDF石偉洛No ratings yet

- Procrastination Vs GoalsDocument22 pagesProcrastination Vs GoalsCathy Carson-WatsonNo ratings yet

- Discipline Report: Greenbrier High School Columbia CountyDocument4 pagesDiscipline Report: Greenbrier High School Columbia CountyJeremy TurnageNo ratings yet

- Receipt - 1 - 15 - 2023 12 - 00 - 00 AMDocument1 pageReceipt - 1 - 15 - 2023 12 - 00 - 00 AMOshnicNo ratings yet

- Reflective Writing of Gifted Hands-The Ben Carson StoryDocument2 pagesReflective Writing of Gifted Hands-The Ben Carson StoryfufuNo ratings yet

- Cracking The Creativity Code: Week TwoDocument55 pagesCracking The Creativity Code: Week TwoDorcas OuattaraNo ratings yet

- ProposalDocument14 pagesProposalapi-255760950No ratings yet

- Annual Accomplishment (S.Y. 2021-2022)Document8 pagesAnnual Accomplishment (S.Y. 2021-2022)moira machateNo ratings yet

- Agus Prayitno, Mufida Nofiana: PendahuluanDocument10 pagesAgus Prayitno, Mufida Nofiana: PendahuluanAfrini MaidaNo ratings yet

- Theory X and YDocument3 pagesTheory X and YInés Perazza0% (1)

- Phiếu học sinh - UNIT 3Document12 pagesPhiếu học sinh - UNIT 3Phạm Ngọc HuyềnNo ratings yet

- List of Polling Stations for 205 34: சிவகாசி Assembly Segment within the விருதுநகர் Parliamentary ConstituencyDocument46 pagesList of Polling Stations for 205 34: சிவகாசி Assembly Segment within the விருதுநகர் Parliamentary ConstituencyjeyasankarNo ratings yet

- Chapter FourDocument9 pagesChapter FourSayp dNo ratings yet

- Lesson Plan: Previous KnowledgeDocument6 pagesLesson Plan: Previous KnowledgeshakeitoNo ratings yet

Syllabus FIN 326 Fall 2011

Syllabus FIN 326 Fall 2011

Uploaded by

TheSenator89Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Syllabus FIN 326 Fall 2011

Syllabus FIN 326 Fall 2011

Uploaded by

TheSenator89Copyright:

Available Formats

Financial Institutions Management Finance 326

Fall 2011 College of Business Administration San Diego State University

Instructor Dr. David Ely Office: Phone: Email: Office Hours: SS 3410 619.594.6842 david.ely@sdsu.edu T 11:00 12:15; W 12:30 1:15; and by appointment

Course Objective The primary objectives of this course are to acquire the skills necessary to contribute toward the management of a financial firm, to describe and apply financial concepts, theories, and tools, and to evaluate the role of technology and the legal, ethical and economic environment as it relates to financial institutions including the Federal Reserve, commercial banks, insurance companies, mutual funds, investment banks, pension funds, federal regulatory agencies, and federal and state guaranty institutions. Primary Learning After completing this course, you should be able to: Outcomes 1. Describe the dimensions of performance and risk relevant to financial firms. 2. Calculate contemporary measures of financial measures of performance and risk. 3. Describe contemporary managerial risk management oversight processes. 4. Explain how the financial services component industries (insurance, banking, securities, real estate and financial planning) interact. 5. Design hedging strategies to manage market risks (e.g., currency, commodity, economic and political). 6. Evaluate the economic environment and the impact of governmental economic policies on consumers and financial institutions. 7. Describe the impact that financial innovation, advances in technology, and changes in regulations has had on the structure of the financial firms/industry Course Prerequisite FIN 323 or equivalent Required materials Anthony Saunders and Marcia Millon Cornett, Financial Markets and Institutions, 4th edition, McGraw Hill. ProBanker Bank Management Simulation access. Blackboard Course material, including supplemental readings and my lecture notes, will be provided on Blackboard. In addition to posting material, we will use the assessment and grade book features of the system. To access Blackboard at SDSU, go to http://blackboard.sdsu.edu

Course Activities Text Readings The Saunders/Cornett text describes the theory and practice of providing financial services from a risk management perspective. The listed reading assignments should be completed prior to class meetings. Solutions to the endof-chapter questions should be prepared for the following class meeting. Bank Management Simulation We will play a bank management game beginning in late September. Groups of 3 students will manage a bank in a simulated competitive market. Decisions on strategy, pricing, capital, investments, and risk management will be made following an analysis of your bank's financial position and markets. One class session will be devoted to introducing the game and organizing teams. Several exercises will be completed individually. Then five rounds of the game will be played in a competitive mode. The grade for the game will be based on: the bank's performance and your ability to explain and justify your bank's decisions. Additional details on this assignment will be provided in class. Instructions on how to access the simulation website will be provided in class. The charge is $25 per student. Examinations The midterm exams and the comprehensive final exam will cover material from the textbook and lectures and will consist of multiple-choice, problems, shortanswer, and essay questions. It will be in a closed-book and closed-notes format. You will need a calculator for exams. No other electronic device (e.g., phone, laptop, iPad, etc.) are permitted during exams. To take exams, students must present a photo ID such as an SDSU ID card or a driver's license. All exams will be retained. Commonly missed questions will be reviewed in class and students are welcome to discuss their individual exams during office hours. Online Quizzes A series of short quizzes will be completed using the quiz feature of Blackboard. These are individual assignments. The schedule of these quizzes will be announced in class. Classroom etiquette Students are expected to attend every class meeting and to participate in a variety of course activities. You may use a labtop/iPad during class sessions for taking notes and viewing lecture notes. However, refrain from activities unrelated to the class discussion.

Finance 326 Financial Institutions Management

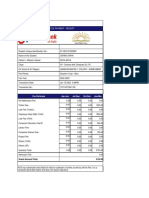

Assessment Course grades will be assigned in accordance with San Diego State University policy (see General Catalog, pp. 461-462). Undergraduate grades shall be: A, outstanding achievement; B, praiseworthy performance; C satisfactory performance; D, minimally passing and F, failing. The grade for average undergraduate achievement shall be C. Your course grade will be based on six components with the following weights:

Component Exam 1 Exam 2 Final Exam Probanker Assignment 1 (individual) Probanker Assignment 2 (individual) Probanker Assignment 3 (group) Probanker performance (group) Probanker Summary Report (individual) Online quizzes Total Percentage of total points 93 to 100 90 to 92 87 to 89 83 to 86 80 to 82 77 to 79 73 to 76 70 to 72 67 to 69 63 to 66 60 to 62 0 to 59

Points 100 100 150 10 15 10 15 50 50 500

Guaranteed Course Grade A AB+ B BC+ C CD+ D DF

Cheating and SDSU defines cheating and plagiarism in the following manner.1 Plagiarism Cheating shall be defined as the act of obtaining or attempting to obtain credit for academic work by the use of dishonest, deceptive, or fraudulent means. Examples of cheating include, but are not limited to (a) copying, in part or in whole, from anothers test or other examination; (b) discussing answers or ideas relating to the answers on a test or other examination without the permission of the instructor; (c) obtaining copies of a test, an examination, or other course material without the permission of the instructor; (d) using notes, cheat sheets, or other devices considered inappropriate under the prescribed testing condition; (e) collaborating with another or others in work to be presented without the permission of the instructor; (f) falsifying records,

1

San Diego State University Policy File. pp. 18. 3

Finance 326 Financial Institutions Management

laboratory work, or other course data; (g) submitting work previously presented in another course, if contrary to the rules of the course; (h) altering or interfering with the grading procedures; (i) plagiarizing, as defined; and (j) knowingly and intentionally assisting another student in any of the above. Plagiarism shall be defined as the act of incorporating ideas, words, or specific substance of another, whether purchased, borrowed, or otherwise obtained, and submitting same to the university as ones own work to fulfill academic requirements without giving credit to the appropriate source. Plagiarism shall include but not be limited to (a) submitting work, either in part or in whole, completed by another; (b) omitting footnotes for ideas, statements, facts, or conclusions that belong to another; (c) omitting quotation marks when quoting directly from another, whether it be a paragraph, sentence, or part thereof; (d) close and lengthy paraphrasing of the writings of another; (e) submitting another persons artistic works, such as musical compositions, photographs, paintings, drawings, or sculptures; and (f) submitting as ones own work papers purchased from research companies. Policies on sanctions and due process in review of alleged violations are available at: http://newscenter.sdsu.edu/universitysenate/index.aspx The penalty for academic dishonesty in this course is an F grade. Cases of academic dishonesty will be reported to the Center for Student Rights and Responsibilities.

Tentative Schedule*

August 30, Topic: Introduction September 1 Reading: Chapter 1 End-of-chapter (EOC) Questions: Ch 1 [1,9,11,12,13,14,15,16] September 6, 8 Topic: Commercial banking industry; Bank performance analysis Readings: Chapter 11, 12 EOC Questions: Ch 11 [4,6,10,13,18,19]; Ch 12 [3,8,14,16,17,19,20,21] September 13, 15 Topic: Bank regulation Reading: Chapter 13 EOC Questions: Ch 13 [1,6,9,10,11,12,14,20,23] September 20, 22 Topic: FI risk overview Reading: Chapter 19 EOC Questions: Ch 19 [1,3,4,8,13,17,20] September 27, 29 Topic: Probanker introduction Readings: Probanker Manual October 4 Exam over Chapters 1, 11, 12, 13, and 19 October 6 Topic: Interest rate models Reading: Chapter 2 EOC Questions: Ch 2 [9,11,16,17,18,19,20,23,26,29]

Finance 326 Financial Institutions Management

October 11, 13 Topics: Security valuation; Duration Reading: Chapters 3 EOC Questions: Ch 3 [4,6,14,15,18,19,21,22,23,27] Probanker Assignment #1 due October 13 October 18, 20 Topic: Federal Reserve; Monetary policy Reading: Chapter 4 EOC Questions: Ch 4 [1,8,9,15] Probanker Assignment #2 due October 20 October 25, 27 Topics: Depository institutions; Insurance companies Reading: Chapters 14, 15 EOC Questions: Ch 14 [2,13,15,18,21,25]; Ch 15 [2,10,15,17] Probanker Competitive Decisions #1 due October 25 November 1, 3 Topics: Securities firms; Mutual and hedge funds; Pension funds Readings: Chapter 16, 17, 18 EOC Questions: Ch 16 [1,21,22]; Ch 17 [1,2,5,11,15,22,24]; Ch 18 [3,7,9,12,13] Probanker Competitive Decisions #2 due November 1 November 8 Topic: Managing credit risk Reading: Chapter 20 EOC Questions: Ch 20 [3,4,9,11,13,16,21] November 10 Exam 2 over Chapters 2, 3, 4, 14, 15, 16, 17, and 18 November 15, 17 Topic: Managing liquidity risk Reading: Chapter 21 EOC Questions: Ch 21 [6,8,11,12] ProbankerCompetitive Decisions #3 due November 15 Probank Assignment #3 due November 15 November 22 Topic: Managing Interest-rate risk Reading: Chapter 22 Probanker Decisions #4 due November 22 November 29, Topic: Managing interest rate and insolvency risk December 1 EOC Questions: Ch 22 [2,5,8,10,12,19] Probanker Decisions #5 due November 29 December 6, 8 Topic: Using derivatives to manage risk Readings: Chapters 10, 23 EOC Questions: Ch 10 [9,23,24,25,27]; Ch 23 [5,13,14] Probanker Summary Report due December 8 December 13 Comprehensive Final Exam 10:30-12:30

* Changes, if any, will be announced in class.

Finance 326 Financial Institutions Management

You might also like

- BCBA Exam Study Guide 5th Edition PDFDocument39 pagesBCBA Exam Study Guide 5th Edition PDFMarquisha Sadé100% (7)

- Course Outline FINA 320 WINTER 2022Document6 pagesCourse Outline FINA 320 WINTER 2022ChrisNo ratings yet

- COMM314 - 2021W - Syllabus and Reading ListDocument9 pagesCOMM314 - 2021W - Syllabus and Reading ListchilleralexNo ratings yet

- MGMT 3P98 Course Outline S20Document6 pagesMGMT 3P98 Course Outline S20Jeffrey O'LearyNo ratings yet

- Syllabus Corporate FinanceDocument6 pagesSyllabus Corporate FinanceTara PNo ratings yet

- UT Dallas Syllabus For Fin6350.5u1.10u Taught by Carolyn Reichert (Carolyn)Document6 pagesUT Dallas Syllabus For Fin6350.5u1.10u Taught by Carolyn Reichert (Carolyn)UT Dallas Provost's Technology GroupNo ratings yet

- Fina-4332 001Document7 pagesFina-4332 001Kiều Thảo AnhNo ratings yet

- FIN333 2012 Spring - REVISEDDocument5 pagesFIN333 2012 Spring - REVISEDHa MinhNo ratings yet

- IE 305 Syllabus F14 - FinalDocument4 pagesIE 305 Syllabus F14 - FinalYuqianHuNo ratings yet

- 773 SyllabusDocument8 pages773 SyllabusTarun GoelNo ratings yet

- Semester Two 2020 Exam - Alternative Assessment TaskDocument13 pagesSemester Two 2020 Exam - Alternative Assessment Tasksardar hussainNo ratings yet

- TCM 703 Fall 2021Document4 pagesTCM 703 Fall 2021SAI VAMSI POLISETTINo ratings yet

- 2020 Summer - 2205 Fina 4324 001Document8 pages2020 Summer - 2205 Fina 4324 001bobNo ratings yet

- 2020 Summer - 2205 Fina 4324 001Document8 pages2020 Summer - 2205 Fina 4324 001bobNo ratings yet

- Dipasri FIN321 Syllabus Fall 2013 MW1130amDocument4 pagesDipasri FIN321 Syllabus Fall 2013 MW1130amJGONo ratings yet

- TIM 305 Financial Management of Travel Industry SPRING 2022 W F 09:00 - 10:15 A.M. Jan 10 - May 13 Kwanglim SeoDocument6 pagesTIM 305 Financial Management of Travel Industry SPRING 2022 W F 09:00 - 10:15 A.M. Jan 10 - May 13 Kwanglim SeoS JNo ratings yet

- Course Outline - Econ 5100F W2023Document6 pagesCourse Outline - Econ 5100F W2023Jaspreet Singh SidhuNo ratings yet

- B6301 Foundations of Valuation Syllabus Spring 2023 Supera PDFDocument5 pagesB6301 Foundations of Valuation Syllabus Spring 2023 Supera PDFTrialNo ratings yet

- UT Dallas Syllabus For Fin6321.501.11f Taught by George DeCourcy (Gad075000)Document6 pagesUT Dallas Syllabus For Fin6321.501.11f Taught by George DeCourcy (Gad075000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Fin6314.501.10f Taught by Feng Zhao (fxz082000)Document7 pagesUT Dallas Syllabus For Fin6314.501.10f Taught by Feng Zhao (fxz082000)UT Dallas Provost's Technology GroupNo ratings yet

- SyllabusDocument3 pagesSyllabusHenry LiuNo ratings yet

- Syllabus - Economic Decision Making - EMGT6225 - Spring 2017Document5 pagesSyllabus - Economic Decision Making - EMGT6225 - Spring 2017Utkarsh Singh100% (1)

- UT Dallas Syllabus For Pa6337.501.10f Taught by Teodoro Benavides (tjb051000)Document4 pagesUT Dallas Syllabus For Pa6337.501.10f Taught by Teodoro Benavides (tjb051000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Acct6344.501.11f Taught by (Jad044000)Document10 pagesUT Dallas Syllabus For Acct6344.501.11f Taught by (Jad044000)UT Dallas Provost's Technology GroupNo ratings yet

- Updated FIN812 Capital Budgeting - 2015 - SpringDocument6 pagesUpdated FIN812 Capital Budgeting - 2015 - Springnguyen_tridung2No ratings yet

- MBA 707 51 Financial Management8Document9 pagesMBA 707 51 Financial Management8Sitara QadirNo ratings yet

- WEEK 12 Review: 4.1 Attendance RequirementsDocument4 pagesWEEK 12 Review: 4.1 Attendance RequirementsIntan Permata SariNo ratings yet

- Instructor's Contact Information: Polkovn@utdallas - EduDocument5 pagesInstructor's Contact Information: Polkovn@utdallas - EduronsarsNo ratings yet

- Syllabus FNCE 3030 Spring 2017Document3 pagesSyllabus FNCE 3030 Spring 2017list_friendlyNo ratings yet

- CSCU9T4 Assignment2 Instructions Spring2024Document6 pagesCSCU9T4 Assignment2 Instructions Spring2024Uzair KabeerNo ratings yet

- A FNCE 4304 FALL 2016 August 24 - 8Document5 pagesA FNCE 4304 FALL 2016 August 24 - 8new england brickNo ratings yet

- Acct 587Document6 pagesAcct 587socalsurfyNo ratings yet

- UT Dallas Syllabus For Ba3341.001.08f Taught by Mary Chaffin (Chaf)Document5 pagesUT Dallas Syllabus For Ba3341.001.08f Taught by Mary Chaffin (Chaf)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Fin6314.501.11s Taught by Feng Zhao (fxz082000)Document6 pagesUT Dallas Syllabus For Fin6314.501.11s Taught by Feng Zhao (fxz082000)UT Dallas Provost's Technology GroupNo ratings yet

- Course Outline F2000TDocument6 pagesCourse Outline F2000Txixi.cz7651No ratings yet

- PM0012-Project Finance and BudgetingDocument2 pagesPM0012-Project Finance and BudgetingsmumbasolutionsNo ratings yet

- Syllabus: ENT 2000 - Intro To EntrepreneurshipDocument7 pagesSyllabus: ENT 2000 - Intro To EntrepreneurshipBrandon E. PaulNo ratings yet

- Assignment 1: 1) IntroductionDocument7 pagesAssignment 1: 1) IntroductionRennyNo ratings yet

- Digital Finance - Prof KunalDocument6 pagesDigital Finance - Prof KunalsumanNo ratings yet

- Graphing Calculators (Eg: TI 89) Cannot Be Used in Exams or QuizzesDocument6 pagesGraphing Calculators (Eg: TI 89) Cannot Be Used in Exams or QuizzesVishal GuptaNo ratings yet

- UT Dallas Syllabus For Opre6302.mbc.09s Taught by Divakar Rajamani (dxr020100)Document6 pagesUT Dallas Syllabus For Opre6302.mbc.09s Taught by Divakar Rajamani (dxr020100)UT Dallas Provost's Technology GroupNo ratings yet

- Syllabus-Finc3351 Spring2024Document6 pagesSyllabus-Finc3351 Spring2024z8s927n5ffNo ratings yet

- Syllabus 5161 MasterDocument13 pagesSyllabus 5161 Masterhsnpdr365No ratings yet

- UT Dallas Syllabus For Fin6314.501.11s Taught by Feng Zhao (fxz082000)Document6 pagesUT Dallas Syllabus For Fin6314.501.11s Taught by Feng Zhao (fxz082000)UT Dallas Provost's Technology GroupNo ratings yet

- 310 - 2019summerIIDocument8 pages310 - 2019summerIIJimmy TengNo ratings yet

- Compben Syllabus2Document5 pagesCompben Syllabus2Edgar L. AlbiaNo ratings yet

- UT Dallas Syllabus For Cs6388.0u1.10u Taught by Rym Zalila-Wenkstern (Rmili)Document9 pagesUT Dallas Syllabus For Cs6388.0u1.10u Taught by Rym Zalila-Wenkstern (Rmili)UT Dallas Provost's Technology GroupNo ratings yet

- Kelkhal@usi - Edu: Edition, by Jeff MaduraDocument4 pagesKelkhal@usi - Edu: Edition, by Jeff MaduraTalib DoaNo ratings yet

- UT Dallas Syllabus For Aim6333.521 06u Taught by Michael Tydlaska (Tydlaska)Document3 pagesUT Dallas Syllabus For Aim6333.521 06u Taught by Michael Tydlaska (Tydlaska)UT Dallas Provost's Technology GroupNo ratings yet

- Syllabus FINA210 Business Finance FALL 2013Document6 pagesSyllabus FINA210 Business Finance FALL 2013Mahmoud KambrisNo ratings yet

- UT Dallas Syllabus For Opre6302.mbc.10s Taught by Divakar Rajamani (dxr020100)Document6 pagesUT Dallas Syllabus For Opre6302.mbc.10s Taught by Divakar Rajamani (dxr020100)UT Dallas Provost's Technology GroupNo ratings yet

- BUSFIN 3300 Krempley - 0Document8 pagesBUSFIN 3300 Krempley - 0Faith KamauNo ratings yet

- BSAD 183 Fall 2018 SyllabusDocument4 pagesBSAD 183 Fall 2018 SyllabusConstantinos ConstantinouNo ratings yet

- 2012 PROP 6600 Outline (Draft2)Document7 pages2012 PROP 6600 Outline (Draft2)bert1423No ratings yet

- HRM and Finance PDFDocument5 pagesHRM and Finance PDFAnonymous T3KH2cctRaNo ratings yet

- Fa11 Fin 650 SagnerDocument7 pagesFa11 Fin 650 SagnerFuzael AminNo ratings yet

- MBAA 518 Online Syllabus 0515Document6 pagesMBAA 518 Online Syllabus 0515HeatherNo ratings yet

- Essentials of Managerial FinanceDocument12 pagesEssentials of Managerial FinanceAarti JNo ratings yet

- Opim101 - Low Chee SengDocument3 pagesOpim101 - Low Chee SengKelvin Lim Wei LiangNo ratings yet

- MGMT102 TerenceFanDocument5 pagesMGMT102 TerenceFanDon JohnyNo ratings yet

- CISSP Domain 1 Study Guide ( Updated 2024 ) With Practice Exam Questions, Quizzes, Flash Cards: CISSP Study Guide - Updated 2024, #1From EverandCISSP Domain 1 Study Guide ( Updated 2024 ) With Practice Exam Questions, Quizzes, Flash Cards: CISSP Study Guide - Updated 2024, #1No ratings yet

- Cultural, Social and Political ChangeDocument15 pagesCultural, Social and Political ChangeKyoya HibariNo ratings yet

- Lesson Plan Sketch 6Document4 pagesLesson Plan Sketch 6api-521963623No ratings yet

- KW 633 Math Major ApplicationDocument2 pagesKW 633 Math Major ApplicationxenkyrattvNo ratings yet

- Latino Hispanic Presentation 2Document17 pagesLatino Hispanic Presentation 2api-265782144No ratings yet

- Strategic Management ModuleDocument36 pagesStrategic Management ModulenachtandyNo ratings yet

- The Nuts and Bolts of Teaching WritingDocument6 pagesThe Nuts and Bolts of Teaching WritingCourtney WenstromNo ratings yet

- BISE LHR Gazette 11th 2022Document1,299 pagesBISE LHR Gazette 11th 2022ImranNo ratings yet

- Cortiz-Eng17-Majoroutput 2Document22 pagesCortiz-Eng17-Majoroutput 2Leonido Jr. CortizNo ratings yet

- People Also Ask: Average To Gpa ChartDocument1 pagePeople Also Ask: Average To Gpa ChartSoliyana GizawNo ratings yet

- Case Study Delta AirlinesDocument15 pagesCase Study Delta Airlinesdiamond elf11No ratings yet

- This Study Resource Was: Performance Mangement System: A Case Study of NTPCDocument7 pagesThis Study Resource Was: Performance Mangement System: A Case Study of NTPCsharathNo ratings yet

- School Milk in Britain 1900-1934Document45 pagesSchool Milk in Britain 1900-1934Valeria Resendiz FloresNo ratings yet

- Theoretical Framework of Core, Peripheral and Interdisciplinary Disciplines in LinguisticsDocument7 pagesTheoretical Framework of Core, Peripheral and Interdisciplinary Disciplines in LinguisticsAsif DaughterNo ratings yet

- 50 Ways To Use Office 365 For EducationDocument39 pages50 Ways To Use Office 365 For Educationapi-260881210No ratings yet

- Clos Assessment - Abet (Template) Filled in Dr. MagdyDocument2 pagesClos Assessment - Abet (Template) Filled in Dr. MagdyAhmed MohammedNo ratings yet

- Lecture 10 Foundation of Control PDFDocument25 pagesLecture 10 Foundation of Control PDF石偉洛No ratings yet

- Procrastination Vs GoalsDocument22 pagesProcrastination Vs GoalsCathy Carson-WatsonNo ratings yet

- Discipline Report: Greenbrier High School Columbia CountyDocument4 pagesDiscipline Report: Greenbrier High School Columbia CountyJeremy TurnageNo ratings yet

- Receipt - 1 - 15 - 2023 12 - 00 - 00 AMDocument1 pageReceipt - 1 - 15 - 2023 12 - 00 - 00 AMOshnicNo ratings yet

- Reflective Writing of Gifted Hands-The Ben Carson StoryDocument2 pagesReflective Writing of Gifted Hands-The Ben Carson StoryfufuNo ratings yet

- Cracking The Creativity Code: Week TwoDocument55 pagesCracking The Creativity Code: Week TwoDorcas OuattaraNo ratings yet

- ProposalDocument14 pagesProposalapi-255760950No ratings yet

- Annual Accomplishment (S.Y. 2021-2022)Document8 pagesAnnual Accomplishment (S.Y. 2021-2022)moira machateNo ratings yet

- Agus Prayitno, Mufida Nofiana: PendahuluanDocument10 pagesAgus Prayitno, Mufida Nofiana: PendahuluanAfrini MaidaNo ratings yet

- Theory X and YDocument3 pagesTheory X and YInés Perazza0% (1)

- Phiếu học sinh - UNIT 3Document12 pagesPhiếu học sinh - UNIT 3Phạm Ngọc HuyềnNo ratings yet

- List of Polling Stations for 205 34: சிவகாசி Assembly Segment within the விருதுநகர் Parliamentary ConstituencyDocument46 pagesList of Polling Stations for 205 34: சிவகாசி Assembly Segment within the விருதுநகர் Parliamentary ConstituencyjeyasankarNo ratings yet

- Chapter FourDocument9 pagesChapter FourSayp dNo ratings yet

- Lesson Plan: Previous KnowledgeDocument6 pagesLesson Plan: Previous KnowledgeshakeitoNo ratings yet