Professional Documents

Culture Documents

Phil Stocks Daily Research 081211

Phil Stocks Daily Research 081211

Uploaded by

John Michael VidaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Phil Stocks Daily Research 081211

Phil Stocks Daily Research 081211

Uploaded by

John Michael VidaCopyright:

Available Formats

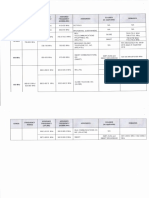

DATE PROJECT DETAILS STAGE

: : : :

081211 PHILSTOCKS 3.0 POWER & TELECOM SECTOR NEWS [x] FIRST DRAFT [] REVISION#5

[ ] FINAL

page 1

Global stocks seem to have bounced up and down this week, leading traders to struggle to keep their sanity intact. Then again, the global market seems to be in a not-so-well state in any case as confidence continues to wane. At the very least, the Philippine stock market seems to be recovering from the tremors around Asia, with some semblance of gains showing up for the stock market. The PSE index ended last Thursday to reveal a somewhat comforting 0.49% gain from its previous rate, and has recovered around 1% at its Friday opening, with the hopes that it might pull itself up back to pre-US downgrade levels. Somewhat comfortingly, the stock market index ended in the green side, gaining a somewhat measly 0.248% from its previous price. Sectors all appear to be on the green at the onset of the day, with special notice to the Mining and Oil sector, which had improved its previous standing by around 2% at the get-go. The day ended with almost all sectors gaining some ground from yesterday, save the Industrial and Services sectorial tickers. As usual, Mining and Oil ended up quite ahead of everyone else, with a notable 2.605% upward change in value from Thursdays value. The PNOC Exploration Corporation has just posted its profits to the PSE, standing at 52% growth in net income, attributable to higher average gas and condensate prices, among other factors. The government-owned and controlled corporation also reported a 7.5% gain in its revenues due in part to its 10% stake in the profitable Malampaya gas project which shows a lot of potential in gas production, as well as its other businesses in the energy supplication. This, along with declining costs of sales from its other businesses, allowed PNOC to achieve such gains in net income. In another segment, the National Grid Corporation of the Philippines publicized its pleasure at the news that President Benigno Aquino decided to curtail the imposition of electricity transmission taxes. As expressed by Henry Sy Jr., president of NGCP, consumers will be adversely affected due to higher transmission rates imposed on them, which is understandable as electricity providers tend to pass taxes for the general consumers to shoulder upon. While this could potentially mean lost revenues in the government side, the energy sector (and theoretically speaking through trickle-down economics, the average consumer) seems to have been saved from a potential rise in electricity rates. Of course, such news would mean that investors can at expect some gains to be had from lower costs of electricity transmission. Finally, in another episode of the long-running drama between PLDT and Globe Telecommunications, the Pangilinan-led telecommunications firm wants the National Telecommunications Commission to junk the motion of its long-standing rival to nullify the permits and frequencies awarded to PLDT and its many subsidiaries. Connected to that (pun unintended), PLDT is also seeking a similar action against Globes motion to put a halt to PLDTs acquisition of Digitel

DATE PROJECT DETAILS STAGE

: : : :

081211 PHILSTOCKS 3.0 POWER & TELECOM SECTOR NEWS [x] FIRST DRAFT [] REVISION#5

[ ] FINAL

page 2

Telecommunications, one of the Big Three in the telecommunications industry in due part to its Sun Cellular lineup. Pointing to the apparent hypocrisy of Globe in its acquisition of Islacom, as well as the allegations of ownership of Globe by other foreign telecommunications firms, PLDT says that Globe is in no position to allege the nature of the deal between PLDT and Digitel, and still insisting for them to push through with their deal with Digitel. When this fiasco will end, one cannot say but then again, it keeps investors hanging on to their seats and onto their stocks. Best for long-term investors to hold on and sell telecommunications stocks at strength.

You might also like

- InterGen and Quezon CaseDocument2 pagesInterGen and Quezon CaseVasanth SubramanyamNo ratings yet

- Nano SolarDocument5 pagesNano SolarAkwasNo ratings yet

- A Study On Retailing Mobile Phone Credits by Electronic Loading and Its ImplicationsDocument205 pagesA Study On Retailing Mobile Phone Credits by Electronic Loading and Its Implicationsepra75% (12)

- Globe Recontracting FormDocument1 pageGlobe Recontracting FormAirene Tolentino0% (1)

- Utilities and Power Industry Update - Deutsche Bank (2010) PDFDocument24 pagesUtilities and Power Industry Update - Deutsche Bank (2010) PDFTom van den BeltNo ratings yet

- DOA With Contract of Sale SampleDocument5 pagesDOA With Contract of Sale SampleJohn Michael VidaNo ratings yet

- Phil Stocks Daily Research 062811Document2 pagesPhil Stocks Daily Research 062811John Michael VidaNo ratings yet

- Phil Stocks Daily Research 081111Document2 pagesPhil Stocks Daily Research 081111John Michael VidaNo ratings yet

- Presentation3 FINMAN Working CapitalDocument5 pagesPresentation3 FINMAN Working CapitalPaulineBiroselNo ratings yet

- PHPSP Q1 UtDocument5 pagesPHPSP Q1 Utfred607No ratings yet

- PHP AAj PVXDocument5 pagesPHP AAj PVXfred607No ratings yet

- Videocon Industries LTD: Key Financial IndicatorsDocument4 pagesVideocon Industries LTD: Key Financial IndicatorsryreddyNo ratings yet

- Bellsystem InfoDocument137 pagesBellsystem InfoMichael AddingtonNo ratings yet

- OCI.Q1 2012 IR - EngDocument23 pagesOCI.Q1 2012 IR - EngSam_Ha_No ratings yet

- Clock Ticking: ECONOMIC DATA With ImpactDocument5 pagesClock Ticking: ECONOMIC DATA With Impactfred607No ratings yet

- Case StudyDocument2 pagesCase StudyRomar De LunaNo ratings yet

- 2Q13 Power Transactions and TrendsDocument8 pages2Q13 Power Transactions and TrendsEuglena VerdeNo ratings yet

- Itr 2Document91 pagesItr 2LightRINo ratings yet

- WB-Electricty Sector Overview 2008Document88 pagesWB-Electricty Sector Overview 2008warwarkingNo ratings yet

- Press Release 3T09 CAUDIT Eng Rev FinalDocument35 pagesPress Release 3T09 CAUDIT Eng Rev FinalLightRINo ratings yet

- Month in Review:: December 2011Document8 pagesMonth in Review:: December 2011api-117755361No ratings yet

- BEL Annual Report 2010Document44 pagesBEL Annual Report 2010Lisa ShomanNo ratings yet

- Quanta Services Inc. Initiating Coverage ReportDocument12 pagesQuanta Services Inc. Initiating Coverage Reportmikielam23No ratings yet

- Energy PDFDocument22 pagesEnergy PDFSultan AhmedNo ratings yet

- Infected Count Death Toll Total Recovered: Top StoryDocument2 pagesInfected Count Death Toll Total Recovered: Top StoryJNo ratings yet

- 澳大利亚电价趋势分析Document118 pages澳大利亚电价趋势分析ashoho1No ratings yet

- Larsen & Toubro LTD 1QFY12 Result UpdateDocument8 pagesLarsen & Toubro LTD 1QFY12 Result UpdatekamleshkotakNo ratings yet

- Presentation - Acquisition of Interest in Belo Monte Hydro PlantDocument15 pagesPresentation - Acquisition of Interest in Belo Monte Hydro PlantLightRINo ratings yet

- Service: Banks Must Publish Top Salaries - AlmostDocument4 pagesService: Banks Must Publish Top Salaries - Almostapi-18815167No ratings yet

- Spanish Utilities: Uncertainty Reigns. Downgrade Iberdrola To NEUTRALDocument8 pagesSpanish Utilities: Uncertainty Reigns. Downgrade Iberdrola To NEUTRALpdoorNo ratings yet

- BoozCo Renewable Energy Technologies CrossroadsDocument24 pagesBoozCo Renewable Energy Technologies CrossroadsSikander GirgoukarNo ratings yet

- ManagementDocument2 pagesManagementScrunchies AvenueNo ratings yet

- Energy Data Highlights: Sinopec To Buy Daylight Energy For $2.1BDocument11 pagesEnergy Data Highlights: Sinopec To Buy Daylight Energy For $2.1BchoiceenergyNo ratings yet

- A Bengoa 2011Document50 pagesA Bengoa 2011pocholoshop7No ratings yet

- Market Monitor Week Ending July 15 2011Document5 pagesMarket Monitor Week Ending July 15 2011Empire OneoneNo ratings yet

- Effects of Covid-19 On Energy InvestmentDocument4 pagesEffects of Covid-19 On Energy InvestmentSaagar SenniNo ratings yet

- PHP XgsukaDocument5 pagesPHP Xgsukafred607No ratings yet

- Press Release 1T10 FinalengDocument29 pagesPress Release 1T10 FinalengLightRINo ratings yet

- McKinsey Global Institute Report On Promoting Energy Efficiency in The Developing WorldDocument5 pagesMcKinsey Global Institute Report On Promoting Energy Efficiency in The Developing WorldankurtulsNo ratings yet

- 13th Annual Needham Growth Stock Conference January 2011Document27 pages13th Annual Needham Growth Stock Conference January 2011handyaccountNo ratings yet

- PHPG KWZAYDocument5 pagesPHPG KWZAYfred607No ratings yet

- China ElectricityDocument2 pagesChina ElectricitynguyenvulnNo ratings yet

- Pib Tandik MHP 2015Document3 pagesPib Tandik MHP 2015yonportesNo ratings yet

- Electric Utilities - Fine Tuning 2009.05Document36 pagesElectric Utilities - Fine Tuning 2009.05Leandro PereiraNo ratings yet

- RHB Report My Utilities Power Sector Update 20230630 RHB 462467147648382649e0be1684eeDocument9 pagesRHB Report My Utilities Power Sector Update 20230630 RHB 462467147648382649e0be1684eeSteven TimNo ratings yet

- NE 06-09 - em InglDocument101 pagesNE 06-09 - em InglLightRINo ratings yet

- PHP LMs Ea LDocument5 pagesPHP LMs Ea Lfred607No ratings yet

- Corporate Finance: Submitted ToDocument9 pagesCorporate Finance: Submitted ToalirazaNo ratings yet

- Natural Gas/ Power NewsDocument10 pagesNatural Gas/ Power NewschoiceenergyNo ratings yet

- Consumption in The Concession Area Increases by 3.1% in The QuarterDocument90 pagesConsumption in The Concession Area Increases by 3.1% in The QuarterLightRINo ratings yet

- Indonesia IPP ReportDocument41 pagesIndonesia IPP ReportUranika L WireksoNo ratings yet

- Solar Power: Darkest Before DawnDocument14 pagesSolar Power: Darkest Before Dawncfalevel123No ratings yet

- Ey Renewable MarketDocument40 pagesEy Renewable MarketRaveesh SrinivasNo ratings yet

- State Clean Energy Policies Analysis (SCEPA) Project: An Analysis of Renewable Energy Feed-In Tariffs in The United StatesDocument51 pagesState Clean Energy Policies Analysis (SCEPA) Project: An Analysis of Renewable Energy Feed-In Tariffs in The United StatesAlvin John BalagbagNo ratings yet

- Energ CrisisDocument9 pagesEnerg CrisisRocky LawajuNo ratings yet

- TELUS Corporation: Dividend Policy: Canadian Telecommunication IndustryDocument7 pagesTELUS Corporation: Dividend Policy: Canadian Telecommunication Industrymalaika12No ratings yet

- Environmental Implications of Electricity Trading Main Paper FinalDocument18 pagesEnvironmental Implications of Electricity Trading Main Paper FinalMartin AnikweNo ratings yet

- Ernst & Young - Renewable Energy Country Attractiveness IndecesDocument36 pagesErnst & Young - Renewable Energy Country Attractiveness IndecesSofia KentNo ratings yet

- Achievements Under EpiraDocument6 pagesAchievements Under EpiraLyn Dela Cruz DumoNo ratings yet

- Energy Saving Trust FIT Review Fact SheetDocument9 pagesEnergy Saving Trust FIT Review Fact SheetAdamVaughanNo ratings yet

- Investment Report 2022/2023 - Key Findings: Resilience and renewal in EuropeFrom EverandInvestment Report 2022/2023 - Key Findings: Resilience and renewal in EuropeNo ratings yet

- VAWC NotesDocument5 pagesVAWC NotesJohn Michael VidaNo ratings yet

- MemorandumDocument2 pagesMemorandumJohn Michael VidaNo ratings yet

- Labor Law Primer (Part 1)Document15 pagesLabor Law Primer (Part 1)John Michael VidaNo ratings yet

- VIDA - Daabay vs. Coca-ColaDocument2 pagesVIDA - Daabay vs. Coca-ColaJohn Michael VidaNo ratings yet

- G.R. No. 181881 (J. Bersamin Concurring and Dissenting)Document15 pagesG.R. No. 181881 (J. Bersamin Concurring and Dissenting)John Michael VidaNo ratings yet

- 084 Malayang Samahan Vs RamosDocument4 pages084 Malayang Samahan Vs RamosJohn Michael VidaNo ratings yet

- VIDA - Camarines Norte vs. GonzalesDocument3 pagesVIDA - Camarines Norte vs. GonzalesJohn Michael Vida100% (1)

- 099 Salunga Vs CIRDocument3 pages099 Salunga Vs CIRJohn Michael VidaNo ratings yet

- VIDA - Nagkakaisang Maralita vs. Military ShrineDocument2 pagesVIDA - Nagkakaisang Maralita vs. Military ShrineJohn Michael VidaNo ratings yet

- Philstocks Daily Swim Econ Update 08242012Document3 pagesPhilstocks Daily Swim Econ Update 08242012John Michael VidaNo ratings yet

- (Vida) Domingo v. RayalaDocument4 pages(Vida) Domingo v. RayalaJohn Michael VidaNo ratings yet

- 115 Sukhothai Cuisine Vs CADocument3 pages115 Sukhothai Cuisine Vs CAJohn Michael VidaNo ratings yet

- Villa Vs Garcia BosqueDocument2 pagesVilla Vs Garcia BosqueJohn Michael VidaNo ratings yet

- RPT RemediesDocument25 pagesRPT RemediesJohn Michael VidaNo ratings yet

- 01 Osmena v. OrbosDocument6 pages01 Osmena v. OrbosJohn Michael VidaNo ratings yet

- MEETING 12 - Additional CasesDocument25 pagesMEETING 12 - Additional CasesJohn Michael VidaNo ratings yet

- Revenue Regs 10-98Document4 pagesRevenue Regs 10-98John Michael VidaNo ratings yet

- 61 Register of Deeds Vs ChinabankDocument1 page61 Register of Deeds Vs ChinabankJohn Michael VidaNo ratings yet

- Case DigestDocument7 pagesCase DigestTeddyboy AgnisebNo ratings yet

- Valuation: Philippine Residential Broadband MarketDocument5 pagesValuation: Philippine Residential Broadband MarketNico Angeles MenesesNo ratings yet

- Ayala Corporation - SEC Form 17-A - 8april2020 - 0 - FY2019Document932 pagesAyala Corporation - SEC Form 17-A - 8april2020 - 0 - FY2019Captain ObviousNo ratings yet

- Globe at Home E-Bill - 907335244-2021-07-08Document6 pagesGlobe at Home E-Bill - 907335244-2021-07-08Speakup CampNo ratings yet

- Calipayan, Shahanie A. Bsba MM 3-1: Module 7 ActivityDocument4 pagesCalipayan, Shahanie A. Bsba MM 3-1: Module 7 ActivityCalipayan ShahanieNo ratings yet

- GR147324Document1 pageGR147324nvmndNo ratings yet

- 2022 List of Assigned Returned and Vacant Mobile Access FreqDocument8 pages2022 List of Assigned Returned and Vacant Mobile Access FreqPatrick DiazNo ratings yet

- List of Mobile Number Prefixes (Globe, Smart, and Sun) - TxtBuff NewsDocument20 pagesList of Mobile Number Prefixes (Globe, Smart, and Sun) - TxtBuff NewsremramirezNo ratings yet

- Details About Merger and Acquisition: I. Overview of Ayala and Zalora II. Rationale For Merger and AcquisitionDocument4 pagesDetails About Merger and Acquisition: I. Overview of Ayala and Zalora II. Rationale For Merger and AcquisitionAdam SmithNo ratings yet

- Philippine Stock Exchange: Head, Disclosure DepartmentDocument15 pagesPhilippine Stock Exchange: Head, Disclosure DepartmentKarl Anthony Rigoroso MargateNo ratings yet

- AC Bonds Due 2025 Final ProspectusDocument546 pagesAC Bonds Due 2025 Final ProspectusKelvin DacasinNo ratings yet

- Globe Telecom Annual Report 2015Document922 pagesGlobe Telecom Annual Report 2015Michael NoelNo ratings yet

- Phil Tel Comms at GlanceDocument15 pagesPhil Tel Comms at GlanceEgbert Encarguez100% (1)

- PLDT vs. Province of Laguna, G.R. No. 151899Document5 pagesPLDT vs. Province of Laguna, G.R. No. 151899Ronz RoganNo ratings yet

- Globe vs. NTCDocument15 pagesGlobe vs. NTCMichiko HakuraNo ratings yet

- Country Overview: Philippines Growth Through Innovation: AnalysisDocument35 pagesCountry Overview: Philippines Growth Through Innovation: AnalysisJasmine YlayaNo ratings yet

- 2022 Revised LETTER CONVENTION INVITATION and CONFIRMATION SLIPDocument2 pages2022 Revised LETTER CONVENTION INVITATION and CONFIRMATION SLIPKenneth JapsonNo ratings yet

- Organized DataDocument381 pagesOrganized DatajomelvirayNo ratings yet

- Ranopa, Jan A. 4 BLMDocument17 pagesRanopa, Jan A. 4 BLMClaire BarrettoNo ratings yet

- Telephone Network System Part 1Document109 pagesTelephone Network System Part 1MelvirNo ratings yet

- EFE MatrixDocument16 pagesEFE MatrixHilaryNo ratings yet

- Company'S Vision and Mission: Table 1 Vision Statement AnalysisDocument54 pagesCompany'S Vision and Mission: Table 1 Vision Statement AnalysisAiko PandaNo ratings yet

- Presumptively The Acts of The Chief Executive: Unconstitutionality of RA 6975 With Prayer For Temporary Restraining OrderDocument21 pagesPresumptively The Acts of The Chief Executive: Unconstitutionality of RA 6975 With Prayer For Temporary Restraining Orderralph_atmosferaNo ratings yet

- IM Jan 2014Document12 pagesIM Jan 2014Jovi DacanayNo ratings yet

- Auto Charge Payment Enrollment FormDocument4 pagesAuto Charge Payment Enrollment Formlorraine82_jayNo ratings yet

- GSMA Moile Money Philippines Case Study V X21 21Document23 pagesGSMA Moile Money Philippines Case Study V X21 21davidcloud99No ratings yet

- Philosophies (Private)Document30 pagesPhilosophies (Private)Anonymous PcPkRpAKD5No ratings yet

- List of Mobile Number PrefixesDocument3 pagesList of Mobile Number PrefixesporepreeNo ratings yet