Professional Documents

Culture Documents

IB Assignment

IB Assignment

Uploaded by

Rubayet Hossain IdleCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- August Bank StatementDocument4 pagesAugust Bank StatementAlexander Barno Alex100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Assessment 5TH of May 2023Document8 pagesAssessment 5TH of May 2023Francesca BogdanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Modern Trade Outlet List-SouthDocument91 pagesModern Trade Outlet List-SouthBasavaraj Hugar67% (9)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- LOI For BL SurrenderDocument1 pageLOI For BL SurrenderSaief DipNo ratings yet

- Valuing Home Delivery 2008 ReportDocument36 pagesValuing Home Delivery 2008 ReportMeido_000No ratings yet

- Cox's Bazar PPDocument9 pagesCox's Bazar PPRubayet Hossain IdleNo ratings yet

- Kerala Tourism Marketing StrategiesDocument5 pagesKerala Tourism Marketing StrategiesRubayet Hossain IdleNo ratings yet

- ApplicationDocument2 pagesApplicationRubayet Hossain IdleNo ratings yet

- Professional EthicsDocument123 pagesProfessional EthicsRubayet Hossain IdleNo ratings yet

- Organic Product Development and Marketing PlanDocument17 pagesOrganic Product Development and Marketing PlanRubayet Hossain IdleNo ratings yet

- Past Papers Solved ch-9 Industries PDFDocument65 pagesPast Papers Solved ch-9 Industries PDFMohammad FaizanNo ratings yet

- TrademanDocument2 pagesTrademansamohat libyaNo ratings yet

- Intermediate Accounting - ReviewerDocument29 pagesIntermediate Accounting - ReviewerEthelyn Cailly R. ChenNo ratings yet

- VAT Rate When Importing Antiques Into The UK BADADocument2 pagesVAT Rate When Importing Antiques Into The UK BADAc40334No ratings yet

- Eum Edgenta Sofp & Sopl 2020Document4 pagesEum Edgenta Sofp & Sopl 2020ariash mohdNo ratings yet

- Import ClearanceDocument26 pagesImport ClearanceSamNo ratings yet

- Cambridge Assessment International Education: EconomicsDocument21 pagesCambridge Assessment International Education: Economicsganza.dorian.sNo ratings yet

- Retail Management Notes of All Modules - BCA 2nd SemDocument24 pagesRetail Management Notes of All Modules - BCA 2nd Semlabeebahuda2003No ratings yet

- 4 - Growth in Vietnam's Furniture Export Industry - SGSDocument4 pages4 - Growth in Vietnam's Furniture Export Industry - SGSTrucNo ratings yet

- Flipkart Labels 26 Feb 2024 08 29Document2 pagesFlipkart Labels 26 Feb 2024 08 29royalskhatriNo ratings yet

- TaskDocument10 pagesTaskFalak HanifNo ratings yet

- Simple Annuity: General MathematicsDocument18 pagesSimple Annuity: General MathematicsAezcel SunicoNo ratings yet

- Chapter 3Document20 pagesChapter 3abebe kumelaNo ratings yet

- Al Ameen Funds-Fund Manager Report-Jan-2024Document21 pagesAl Ameen Funds-Fund Manager Report-Jan-2024aniqa.asgharNo ratings yet

- Cfi1203 Module 2 Interest Rates Determination & StructureDocument8 pagesCfi1203 Module 2 Interest Rates Determination & StructureLeonorahNo ratings yet

- Studi Kasus 6 - Korespondensi Ekspor-Impor: Contoh Surat Perkenalan/Promosi (Gambar 1)Document7 pagesStudi Kasus 6 - Korespondensi Ekspor-Impor: Contoh Surat Perkenalan/Promosi (Gambar 1)Lyli Nurindah SariNo ratings yet

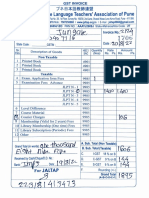

- JLPT ReceiptDocument1 pageJLPT ReceiptSanchita RahadeNo ratings yet

- Materi Inisiasi Bahasa Inggris NiagaDocument37 pagesMateri Inisiasi Bahasa Inggris NiagadhmldsNo ratings yet

- Contemporary World Pre-TestDocument5 pagesContemporary World Pre-TestTANAWAN, REA MAE SAPICONo ratings yet

- INCOME AND BUSINESS TAXATION FinalsDocument21 pagesINCOME AND BUSINESS TAXATION FinalsAbegail BlancoNo ratings yet

- Global SC Logistics Management Mba LSCM 3rd SemDocument8 pagesGlobal SC Logistics Management Mba LSCM 3rd SemAnil SharmaNo ratings yet

- Repayment Report-33Document1 pageRepayment Report-33Prashant B. YedkeNo ratings yet

- E Corporate Manager June 2022 - FINALDocument90 pagesE Corporate Manager June 2022 - FINALlegal shuruNo ratings yet

- Ias 7 8 PDF FreeDocument3 pagesIas 7 8 PDF FreeRaffli FirmansyahNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet

IB Assignment

IB Assignment

Uploaded by

Rubayet Hossain IdleOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IB Assignment

IB Assignment

Uploaded by

Rubayet Hossain IdleCopyright:

Available Formats

World Trade Organization (WTO)

The World Trade Organization (WTO) is an organization that intends to supervise and liberalize international trade. The organization officially commenced on January 1, 1995 under the Marrakech Agreement, replacing the General Agreement on Tariffs and Trade (GATT), which commenced in 1948. The organization deals with regulation of trade between participating countries; it provides a framework for negotiating and formalizing trade agreements, and a dispute resolution process aimed at enforcing participants' adherence to WTO agreements which are signed by representatives of member governments and ratified by their parliaments. Most of the issues that the WTO focuses on derive from previous trade negotiations, especially from the Uruguay Round (19861994). The organization is currently endeavoring to persist with a trade negotiation called the Doha Development Agenda (or Doha Round), which was launched in 2001 to enhance equitable participation of poorer countries which represent a majority of the world's population. The WTO has 153 members, representing more than 97% of the world's population, and 30 observers, most seeking membership. The WTO is governed by a ministerial conference, meeting every two years; a general council, which implements the conference's policy decisions and is responsible for day-to-day administration; and a director-general, who is appointed by the ministerial conference. The WTO's headquarters is at the Centre William Among the various functions of the WTO, these are regarded by analysts as the most important:

It oversees the implementation, administration and operation of the covered agreements. It provides a forum for negotiations and for settling disputes.

Additionally, it is the WTO's duty to review and propagate the national trade policies, and to ensure the coherence and transparency of trade policies through surveillance in global economic policy-making. Another priority of the WTO is the assistance of developing, least-developed and low-income countries in transition to adjust to WTO rules and disciplines through technical cooperation and training. The WTO is also a center of economic research and analysis: regular assessments of the global trade picture in its annual publications and research reports on specific topics are produced by the organization. Finally, the WTO cooperates closely with the two other components of the Bretton Woods system, the IMF and the World Bank.

The WTO describes itself as "a rules-based, member-driven organization all decisions are made by the member governments, and the rules are the outcome of negotiations among members". The WTO Agreement foresees votes where consensus cannot be reached, but the practice of consensus dominates the process of decision-making.

Finally we say the World Trade Organization (WTO) is the only international organization dealing with the global rules of trade between nations. Its main function is to ensure that trade flows as smoothly, predictably and freely as possible.

The General Agreement on Tariffs and Trade (GATT):

UN agency for promotion of free trade between signatory countries (called contracting parties). Formed in 1947 in Geneva, its objective was to counter the devastating effect of protectionist measures (such as the US Smoot-Hawley tariff that raised import duties from 39 percent to 53 percent) supposedly intended to mitigate impact of the great depression. GATT instituted a rulebased multilateral trading system for trade in both goods and services through a series of negotiations (called 'rounds'). It succeeded in achieving reduction in the average tariff on manufactured goods from 40 percent to about 5 percent in the industrialized nations, and in obtaining varying degrees of promised reductions from less developed nations. Its approach was based on two non-discriminatory principles, the (1) Most favored nation and national treatment, and (2) Reciprocity. It worked to eliminate all non-tariff barriers and import quotas, and advocated use of countervailing duties to fight dumping and to negate the effects of subsidies. On January 1, 1995, after the culmination of Uruguay Round, GATT was replaced by World Trade Organization (WTO).

or

The General Agreement on Tariffs and Trade (GATT) originated with a meeting of 22 nations meeting in 1947 in Geneva, Switzerland. By 2000, there were 142 member nations, with another 30 countries seeking admission. The detailed commitments by each country to limit tariffs on particular items by the amount negotiated and specified in its tariff schedule is the central core of the GATT system of international obligation. The obligations relating to the tariff schedules are contained in Article II of GATT. For each commodity listed on the schedule of a country, that country agrees to charge a tariff that will not exceed an amount specified in the schedule. It can, if it wishes, charge a lower tariff. The World Trade Organization (WTO) heavily influences the workings of the GATT treaties through the efforts of various committees. Representatives of member countries of the WTO comprise the Council for the Trade in Goods (Goods Council), which oversees the work of 11 committees responsible for overseeing the various sectors of GATT. The committees focus on such issues as agriculture, sanitary measures, subsidies, customs valuation, and rules of origin.

Bill of exchange (BOE):

A written, unconditional order by one party (the drawer) to another (the drawee) to pay a certain sum, either immediately (a sight bill) or on a fixed date (a term bill), for payment of goods and/or services received. The drawee accepts the bill by signing it, thus converting it into a post-dated check and a binding contract. A bill of exchange is also called a draft but, while all drafts are negotiable instruments, only "to order" bills of exchange can be negotiated. According to the 1930 Convention Providing A Uniform Law For Bills of Exchange and Promissory Notes held in Geneva (also called Geneva Convention) a bill of exchange contains: (1) The term bill of exchange inserted in the body of the instrument and expressed in the language employed in drawing up the instrument. (2) An unconditional order to pay a determinate sum of money. (3) The name of the person who is to pay (drawee). (4) A statement of the time of payment. (5) A statement of the place where payment is to be made. (6) The name of the person to whom or to whose order payment is to be made. (7) A statement of the date and of the place where the bill is issued. (8) The signature of the person who issues the bill (drawer). A bill of exchange is the most often used form of payment in local and international trade, and has a long history- as long as that of writing.

Balance of payments (BOP):

Balance of payments (BOP) accounts are an accounting record of all monetary transactions between a country and the rest of the world.[1] These transactions include payments for the country's exports and imports of goods, services, financial capital, and financial transfers. The BOP accounts summarize international transactions for a specific period, usually a year, and are prepared in a single currency, typically the domestic currency for the country concerned. Sources of funds for a nation, such as exports or the receipts of loans and investments, are recorded as positive or surplus items. Uses of funds, such as for imports or to invest in foreign countries, are recorded as negative or deficit items. The balance of payments (BOP) is the method countries use to monitor all international monetary transactions at a specific period of time. Usually, the BOP is calculated every quarter and every calendar year. All trades conducted by both the private and public sectors are accounted for in the BOP in order to determine how much money is going in and out of a country. If a country has received money, this is known as a credit, and, if a country has paid or given money, the transaction is counted as a debit. Theoretically, the BOP should be zero, meaning that assets (credits) and liabilities (debits) should balance. But in practice this is rarely the case and, thus, the BOP can tell the observer if a country has a deficit or a surplus and from which part of the economy the discrepancies are stemming.

Letter of credit (L/C):

A written commitment to pay, by a buyer's or importer's bank (called the issuing bank) to the seller's or exporter's bank (called the accepting bank, negotiating bank, or paying bank). A letter of credit guarantees payment of a specified sum in a specified currency, provided the seller meets precisely-defined conditions and submits the prescribed documents within a fixed timeframe. These documents almost always include a clean bill of lading or air waybill, commercial invoice, and certificate of origin. To establish a letter of credit in favor of the seller or exporter (called the beneficiary) the buyer (called the applicant or account party) either pays the specified sum (plus service charges) up front to the issuing bank, or negotiates credit. Letters of credit are formal trade instruments and are used usually where the seller is unwilling to extend credit to the buyer. In effect, a letter of credit substitutes the creditworthiness of a bank for the creditworthiness of the buyer. Thus, the international banking system acts as an intermediary between far flung exporters and importers. However, the banking system does not take on any responsibility for the quality of goods, genuineness of documents, or any other provision in the contract of sale. Since the unambiguity of the terminology used in writing a letter of credit is of vital importance, the International Chamber Of Commerce (ICC) has suggested specific terms (called Incoterms) that are now almost universally accepted and used. Unlike a bill of exchange, a letter of credit is a nonnegotiable instrument but may be transferable with the consent of the applicant. Although letters of credit come in numerous types, the two most basic ones are (1) Revocable-credit letter of credit and (2) Irrevocable-credit letter of credit, which comes in two versions (a) Confirmed irrevocable letter of credit and (b) Not-confirmed irrevocable letter of credit.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- August Bank StatementDocument4 pagesAugust Bank StatementAlexander Barno Alex100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Assessment 5TH of May 2023Document8 pagesAssessment 5TH of May 2023Francesca BogdanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Modern Trade Outlet List-SouthDocument91 pagesModern Trade Outlet List-SouthBasavaraj Hugar67% (9)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- LOI For BL SurrenderDocument1 pageLOI For BL SurrenderSaief DipNo ratings yet

- Valuing Home Delivery 2008 ReportDocument36 pagesValuing Home Delivery 2008 ReportMeido_000No ratings yet

- Cox's Bazar PPDocument9 pagesCox's Bazar PPRubayet Hossain IdleNo ratings yet

- Kerala Tourism Marketing StrategiesDocument5 pagesKerala Tourism Marketing StrategiesRubayet Hossain IdleNo ratings yet

- ApplicationDocument2 pagesApplicationRubayet Hossain IdleNo ratings yet

- Professional EthicsDocument123 pagesProfessional EthicsRubayet Hossain IdleNo ratings yet

- Organic Product Development and Marketing PlanDocument17 pagesOrganic Product Development and Marketing PlanRubayet Hossain IdleNo ratings yet

- Past Papers Solved ch-9 Industries PDFDocument65 pagesPast Papers Solved ch-9 Industries PDFMohammad FaizanNo ratings yet

- TrademanDocument2 pagesTrademansamohat libyaNo ratings yet

- Intermediate Accounting - ReviewerDocument29 pagesIntermediate Accounting - ReviewerEthelyn Cailly R. ChenNo ratings yet

- VAT Rate When Importing Antiques Into The UK BADADocument2 pagesVAT Rate When Importing Antiques Into The UK BADAc40334No ratings yet

- Eum Edgenta Sofp & Sopl 2020Document4 pagesEum Edgenta Sofp & Sopl 2020ariash mohdNo ratings yet

- Import ClearanceDocument26 pagesImport ClearanceSamNo ratings yet

- Cambridge Assessment International Education: EconomicsDocument21 pagesCambridge Assessment International Education: Economicsganza.dorian.sNo ratings yet

- Retail Management Notes of All Modules - BCA 2nd SemDocument24 pagesRetail Management Notes of All Modules - BCA 2nd Semlabeebahuda2003No ratings yet

- 4 - Growth in Vietnam's Furniture Export Industry - SGSDocument4 pages4 - Growth in Vietnam's Furniture Export Industry - SGSTrucNo ratings yet

- Flipkart Labels 26 Feb 2024 08 29Document2 pagesFlipkart Labels 26 Feb 2024 08 29royalskhatriNo ratings yet

- TaskDocument10 pagesTaskFalak HanifNo ratings yet

- Simple Annuity: General MathematicsDocument18 pagesSimple Annuity: General MathematicsAezcel SunicoNo ratings yet

- Chapter 3Document20 pagesChapter 3abebe kumelaNo ratings yet

- Al Ameen Funds-Fund Manager Report-Jan-2024Document21 pagesAl Ameen Funds-Fund Manager Report-Jan-2024aniqa.asgharNo ratings yet

- Cfi1203 Module 2 Interest Rates Determination & StructureDocument8 pagesCfi1203 Module 2 Interest Rates Determination & StructureLeonorahNo ratings yet

- Studi Kasus 6 - Korespondensi Ekspor-Impor: Contoh Surat Perkenalan/Promosi (Gambar 1)Document7 pagesStudi Kasus 6 - Korespondensi Ekspor-Impor: Contoh Surat Perkenalan/Promosi (Gambar 1)Lyli Nurindah SariNo ratings yet

- JLPT ReceiptDocument1 pageJLPT ReceiptSanchita RahadeNo ratings yet

- Materi Inisiasi Bahasa Inggris NiagaDocument37 pagesMateri Inisiasi Bahasa Inggris NiagadhmldsNo ratings yet

- Contemporary World Pre-TestDocument5 pagesContemporary World Pre-TestTANAWAN, REA MAE SAPICONo ratings yet

- INCOME AND BUSINESS TAXATION FinalsDocument21 pagesINCOME AND BUSINESS TAXATION FinalsAbegail BlancoNo ratings yet

- Global SC Logistics Management Mba LSCM 3rd SemDocument8 pagesGlobal SC Logistics Management Mba LSCM 3rd SemAnil SharmaNo ratings yet

- Repayment Report-33Document1 pageRepayment Report-33Prashant B. YedkeNo ratings yet

- E Corporate Manager June 2022 - FINALDocument90 pagesE Corporate Manager June 2022 - FINALlegal shuruNo ratings yet

- Ias 7 8 PDF FreeDocument3 pagesIas 7 8 PDF FreeRaffli FirmansyahNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet