Professional Documents

Culture Documents

BI 12-5-11 Post

BI 12-5-11 Post

Uploaded by

Chris TurnerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BI 12-5-11 Post

BI 12-5-11 Post

Uploaded by

Chris TurnerCopyright:

Available Formats

Lets Get PhysicalS&P 500 2012 Earnings Shaping up As 99% of earnings are in the books as of December 8th, todays

update continues to reflect the S&P 500 trading at a premium around 18% based on all indicators of average earnings. While futures reflect 1250ish as of this writing, the S&P 500 bolsters a 23% premium over fair value based on a nominal and CPI adjusted fair value metrics. The following table illustrates Fair Market Value for the S&P 500 using timeframes of 5, 10, 15, 20, and 30 year average earnings (full report available from the following location: (http://www.scribd.com/doc/75450531/CFMV-Q3-11-Final)

Based on both a nominal and CPI-adjusted basis, the averages of all time periods for both of these calculations nearly match at 964 pretty crazy. Remember that these valuations are tied to Q3-11 earnings and match the average of daily index closes for September 11. This quarterly earnings study uses both nominal and CPI-adjusted data (popularized by Professor Robert Shiller). A primer on the study is available here (http://www.businessinsider.com/will-the-real-sp-500-fair-value-please-stand-up-2010-11). As one can determine from the table, regardless of time horizon for investors, the S&P 500 remains overvalued.

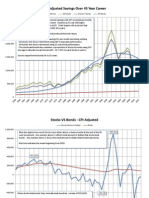

When viewing the chart below for the combined Fair Market Value readers can clearly see that the S&P 500 will ALWAYS return to a fair value (and can remain undervalued for a period of time):

Readers have asked questions concerning how the S&P will return to fair value. The answer can be met by two methods. The first is easy, the S&P 500 Index drops below the calculated fair value (using whichever time horizon or method you prefer). The second is not so easy, because the earnings must accelerate and remain high for a prolonged period of time (such as 5 years) before the metric averages those numbers into the equation. We all remember in 5 years what has happened, 12 month trailing earnings went from 80s in 2007 to 7.00 in late 08 (when financials threw the baby out with the bathwater). The chart below reprises a former post concerning how skewed or out of the norm earnings have been over the past decade. The first chart below shows the regression lines for every earnings average listed above in the table with the S&P 500 Index in purple through 1995. The only real item to view is the angle of the regression lines. The magic behind 1995 is that in 1996, Greenspan issued his irrational exuberance speech.

The next chart adds the last 15 years of data and notice the angle of the regression lines slope much higher. This simply shows that the high rate of earnings impacted all the averages.

Everyone has the option to decide whether easy money, company growth, or some other parameter helped the rapid growth in earnings that defied the other 125 years of data. Maybe its different this time!

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Reading Starbucks Case StudyDocument35 pagesReading Starbucks Case StudyArun Prashanth BNo ratings yet

- CIMA P3 Management Accounting Risk and Control Strategy Solved Past PapersDocument261 pagesCIMA P3 Management Accounting Risk and Control Strategy Solved Past PapersShahid Imtiaz100% (3)

- CFMV Q2 13 Final PDFDocument19 pagesCFMV Q2 13 Final PDFChris TurnerNo ratings yet

- CFMV Q2 13 Final PDFDocument19 pagesCFMV Q2 13 Final PDFChris TurnerNo ratings yet

- CFMV Q4 13 RevisedDocument19 pagesCFMV Q4 13 RevisedChris TurnerNo ratings yet

- CFMV Q3-12 FinalDocument19 pagesCFMV Q3-12 FinalChris TurnerNo ratings yet

- Life Study CPI DivDocument80 pagesLife Study CPI DivChris TurnerNo ratings yet

- Life Study NominalDocument79 pagesLife Study NominalChris TurnerNo ratings yet

- Life Study CPI DivDocument80 pagesLife Study CPI DivChris TurnerNo ratings yet

- CFMV Q4-10 FinalDocument15 pagesCFMV Q4-10 FinalChris TurnerNo ratings yet

- Life Study CPI AnimationDocument80 pagesLife Study CPI AnimationChris TurnerNo ratings yet

- CFMV Q3 11 RevDocument17 pagesCFMV Q3 11 RevChris TurnerNo ratings yet

- CFMV Q2 13 Final PDFDocument19 pagesCFMV Q2 13 Final PDFChris TurnerNo ratings yet

- Q2-11 Final Combined Fair Market Value (CFMV) : (Using S&P Earnings As of 30 Sep 2011)Document17 pagesQ2-11 Final Combined Fair Market Value (CFMV) : (Using S&P Earnings As of 30 Sep 2011)Chris TurnerNo ratings yet

- Q1-11 Combined Fair Market Value (CFMV) : (Using S&P Estimates As of 27 April 2011)Document17 pagesQ1-11 Combined Fair Market Value (CFMV) : (Using S&P Estimates As of 27 April 2011)Chris TurnerNo ratings yet

- Q1-11 Combined Fair Market Value (CFMV) : (Using S&P Estimates As of 31 May 2011)Document17 pagesQ1-11 Combined Fair Market Value (CFMV) : (Using S&P Estimates As of 31 May 2011)Chris TurnerNo ratings yet

- CFMV q3 10 FinalDocument15 pagesCFMV q3 10 FinalChris TurnerNo ratings yet

- CFMV Q4 10 First LookDocument3 pagesCFMV Q4 10 First LookChris TurnerNo ratings yet

- Q2-10 Combined Fair Market Value (CFMV) : by Chris TurnerDocument15 pagesQ2-10 Combined Fair Market Value (CFMV) : by Chris TurnerChris TurnerNo ratings yet

- One-Time Settlement (Ots) Scheme of Npas For Micro, Small & Medium Enterprises (Msme) SectorDocument7 pagesOne-Time Settlement (Ots) Scheme of Npas For Micro, Small & Medium Enterprises (Msme) SectorMadhav KotechaNo ratings yet

- para Sa Mga Kukuha NG Excavation PermitDocument6 pagespara Sa Mga Kukuha NG Excavation PermitCarl AbarabarNo ratings yet

- CrackVerbal's Guide To ISB AdmissionsDocument32 pagesCrackVerbal's Guide To ISB AdmissionsAbhijnan ChaudhuriNo ratings yet

- MAS 01 Management AccountingDocument6 pagesMAS 01 Management AccountingTin BulaoNo ratings yet

- Question Paper Financial Risk Management - II (232) : April 2006Document16 pagesQuestion Paper Financial Risk Management - II (232) : April 2006api-27548664100% (2)

- Final Annual NGBIRR FY 2022.23Document208 pagesFinal Annual NGBIRR FY 2022.23Dunson MuhiaNo ratings yet

- CV1 Shubhaditya Choudhary 61920460Document1 pageCV1 Shubhaditya Choudhary 61920460Harmandeep singhNo ratings yet

- 4 Questions ReceivablesDocument16 pages4 Questions ReceivablesYafasfasNo ratings yet

- Philippine Seven Corporation Corporate InformationDocument5 pagesPhilippine Seven Corporation Corporate InformationJenne LeeNo ratings yet

- About Arya - AgDocument1 pageAbout Arya - AganuradhaNo ratings yet

- Perfect Hedge: What It IsDocument7 pagesPerfect Hedge: What It IsEvan JordanNo ratings yet

- Sbi BB Apr16Document15 pagesSbi BB Apr16Sridhar GandikotaNo ratings yet

- ImfDocument19 pagesImfAashay AgarwalNo ratings yet

- CAF 3 BLW Model PaperDocument7 pagesCAF 3 BLW Model PaperM HunainNo ratings yet

- RR 3-2015 (Other Benefits 82000)Document2 pagesRR 3-2015 (Other Benefits 82000)Judith De los ReyesNo ratings yet

- Bai Aldayn 062006Document7 pagesBai Aldayn 062006AnneHumayraAnasNo ratings yet

- Amendments To IFRS 2 'Share-Based Payment'Document1 pageAmendments To IFRS 2 'Share-Based Payment'Rizshelle D. AlarconNo ratings yet

- Corporate Accounting - IiDocument26 pagesCorporate Accounting - Iishankar1287No ratings yet

- Sample3-351, Online - Sfsu.edu Quiz and SolutionDocument5 pagesSample3-351, Online - Sfsu.edu Quiz and SolutionBikal MagarNo ratings yet

- Q1 2017 Letter Conscious CapitalistsDocument5 pagesQ1 2017 Letter Conscious CapitalistsAnonymous Ht0MIJNo ratings yet

- SPOUSES DAVID B. CARPO & and RECHILDA S. CARPO V. ELEANOR CHUA and ELMA DY NGDocument3 pagesSPOUSES DAVID B. CARPO & and RECHILDA S. CARPO V. ELEANOR CHUA and ELMA DY NGRengie GaloNo ratings yet

- Capital Gains by R. Devarajan Additional Director, ICAIDocument43 pagesCapital Gains by R. Devarajan Additional Director, ICAIkiranshingoteNo ratings yet

- Final AssignementDocument22 pagesFinal AssignementArunim MehrotraNo ratings yet

- Breads Bakery BattleDocument15 pagesBreads Bakery BattleEaterNo ratings yet

- Inter Audit 24 7Document3 pagesInter Audit 24 7rounakagarwal2630No ratings yet

- Report Fire Service Task Force Final Report News Release 2017-07-31Document24 pagesReport Fire Service Task Force Final Report News Release 2017-07-31Chelsea April NovakNo ratings yet

- Prudential RegulationsDocument11 pagesPrudential RegulationsBishnu DhamalaNo ratings yet