Professional Documents

Culture Documents

Letter To Vermillion Shareholders

Letter To Vermillion Shareholders

Uploaded by

GeorgeBessenyeiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Letter To Vermillion Shareholders

Letter To Vermillion Shareholders

Uploaded by

GeorgeBessenyeiCopyright:

Available Formats

Vermillion CEO accused of deceiving shareholders

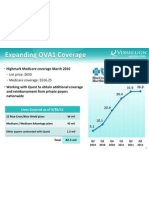

Actively concealed extremely high (over 80%) Medicare denial rate for OVA1

Dear Fellow Shareholders, I am writing to inform you of some shocking and very disturbing information I have learned regarding the wilful failure of Vermillion Inc. (Nasdaq: VRML) CEO to disclose to its investors material information regarding Medicare reimbursement denials of OVA1 test and related issues. Specifically, in the Vermillion earning releases and the earnings calls in 2011, the company has reported the number of tests performed by Quest Diagnostics Inc. (NYSE: DGX) to its investors. However, I have learned from persons with knowledge that these figures and descriptions are highly misleading with regard to the revenue that Vermillion can ever hope to realize from its OVA1 sales for 2011. Specifically, Gail Page, the CEO of the company (Page), and other members of the Board of Directors (Board) colluded to conceal material information from us. Indeed, Page and the Board were aware no later than December 2010 that Medicare had been denying over 80% of OVA1 claims (in comparison I understand the average denial rate for by Medicare on general claims is only 6%). This left the company with absolutely no practical recourse, and I presently believe that the thousands of denied claims will never likely be paid by anyone. This denial rate continued through 2011. It is outrageous that this information has never been disclosed to the shareholders. Page and the Board knew or should have known that Medicare is their single largest payer, responsible for reimbursement as to approximately 50% of all OVA1 sales. Therefore, simple math dictates that around 40% of total reported OVA1 sales will never get any reimbursement, with the result being that Vermillion management has purported to disclose sales that will never be reimbursed. To the contrary, despite having been aware of this extremely high denial rate, Vermillion management has continued to report the number of performed tests as though Medicare will reimburse them, creating expectations for 2011 that are not couched in reality. Even more troubling is that I have learned that Page was encouraged to disclose this information to shareholders, and she simply refused, apparently preferring to leave her shareholders in the dark regarding this inconvenient truth. Perhaps Pages reluctance to disclose this fact was motivated by her desire to raise more cash. In February of 2011, Vermillion proceeded with a secondary offering, selling shares for $21.8 million to investors who had no idea that claims on OVA1 tests performed by Quest Diagnostics were being denied and/or grossly reduced. While the company was bleeding cash and badly needed the influx of new capital, such demands cannot excuse Pages silence --- she owed us more candor. In light of the above, which I learned after relatively perfunctory research, one begins to wonder what else we do not know. As a concerned shareholder since 2010, I have decided to take various actions in order to preserve the remaining assets of the company: Expect to engage the law firm Novak Druce + Quigg regarding the issues presented above and expect them to investigate all of the matters raised and to determine appropriate legal action

I am in the process of requesting that the Board undertake the following actions: o Immediately remove Page as CEO and board member of Vermillion o Establish an independent and unbiased audit committee (not to include any current Board member) to launch a thorough investigation into Vermillion's disclosure practices and generate a report releasing all material information that heretofore has been concealed o As a result of the investigation, have any board member with knowledge of concealed information removed. Initiate discussion with shareholders for replacements

The company has no future with people who lost their credibility, damaged shareholder value and were involved in such duplicitous activities. Once we have an honest and capable board in place, we can finally start to unlock shareholder value. Stay tuned.

December 15, 2011

George Bessenyei Tel: +1-561-444-8180 Email: gb@oba.co.uk

Disclaimer: Long Vermillion (VRML) since 2010

You might also like

- Newtek Business Services Part IDocument66 pagesNewtek Business Services Part ICopperfield Research100% (3)

- Accounting Fraud at WorldCom Case Study SolutionDocument8 pagesAccounting Fraud at WorldCom Case Study SolutionKuldip50% (2)

- Alternative Investments Angus Cartwright, JR Case AnalysisDocument9 pagesAlternative Investments Angus Cartwright, JR Case Analysissharanya86No ratings yet

- Adelphia Case StudyDocument5 pagesAdelphia Case StudySuprabhat Tiwari50% (2)

- Case 4 WorldCom AnswerDocument6 pagesCase 4 WorldCom AnswerEzzah Derham90% (20)

- TYCO Independent Auditor Auditors ResponsibilityDocument4 pagesTYCO Independent Auditor Auditors ResponsibilityYuki-Pauline NagatoNo ratings yet

- What Are The Pressures That Lead Executives and Managers To Cook The BooksDocument4 pagesWhat Are The Pressures That Lead Executives and Managers To Cook The Booksarnabdas1122100% (1)

- Accounting Fraud at Worldcom Corporate Governance AssignmentDocument4 pagesAccounting Fraud at Worldcom Corporate Governance AssignmentTarun BansalNo ratings yet

- Law and Ethics Case StudyDocument6 pagesLaw and Ethics Case Studyiman.zawadiNo ratings yet

- The Molex Inc Case StudyDocument4 pagesThe Molex Inc Case StudyWan Lie100% (2)

- Celltrion ReportDocument33 pagesCelltrion ReportGhost Raven Research50% (4)

- Ackman's Letter To PWC Regarding HerbalifeDocument52 pagesAckman's Letter To PWC Regarding Herbalifetheskeptic21100% (1)

- Hockey Canada: Financial StatementsDocument21 pagesHockey Canada: Financial StatementsBob MackinNo ratings yet

- Case Study Session 1 Group 7Document4 pagesCase Study Session 1 Group 7rifqi salmanNo ratings yet

- Accounting Fraud 1Document5 pagesAccounting Fraud 1Nantha Kumaran100% (1)

- HealthSouth Scam - Reason, Investigation & AftermathDocument4 pagesHealthSouth Scam - Reason, Investigation & AftermathgihoyitNo ratings yet

- Dove AffidavitDocument5 pagesDove AffidavitAda C. MontagueNo ratings yet

- Paper Dragons: Definition of Investment TypesDocument9 pagesPaper Dragons: Definition of Investment Typeschuff6675No ratings yet

- Presentation On Corporate Governance and Business Ethics FailuresDocument16 pagesPresentation On Corporate Governance and Business Ethics FailuresAruna SurapureddyNo ratings yet

- Case Study Report (Group 8)Document4 pagesCase Study Report (Group 8)Kenneth PoncialNo ratings yet

- LARK (6/12) : Discuss The Implications of The Circumstances Described in The Audit Senior's Note andDocument31 pagesLARK (6/12) : Discuss The Implications of The Circumstances Described in The Audit Senior's Note andHarsh KhandelwalNo ratings yet

- Alphatec Final V2Document25 pagesAlphatec Final V2Zhou Yuan ZhanNo ratings yet

- Case Assignment2Document11 pagesCase Assignment2Manan PatelNo ratings yet

- ch13 SM RankinDocument10 pagesch13 SM Rankinhasan jabrNo ratings yet

- Royal AholdDocument5 pagesRoyal AholdRajaSaein0% (1)

- DocxDocument7 pagesDocxHeni OktaviantiNo ratings yet

- VenutiDocument5 pagesVenutihanifkhairullahNo ratings yet

- Fin STM Fraud 2Document6 pagesFin STM Fraud 2Okwuchi AlaukwuNo ratings yet

- COMPANY BACKGROUND of Valeant Pharmaceutical (Corporate Governance)Document2 pagesCOMPANY BACKGROUND of Valeant Pharmaceutical (Corporate Governance)Tharindu WeerasingheNo ratings yet

- Questions Chapter 2Document4 pagesQuestions Chapter 2Minh Thư Phạm HuỳnhNo ratings yet

- The Accounting Fraud in WorldComDocument12 pagesThe Accounting Fraud in WorldComsyahirah77100% (1)

- Possible SolutionsDocument9 pagesPossible SolutionsElla Marie LopezNo ratings yet

- Chapter 4Document28 pagesChapter 4divyadeoNo ratings yet

- Week12 AccountingEthicsDocument15 pagesWeek12 AccountingEthicsyow jing peiNo ratings yet

- Ways of Manipulating Accounting StatementsDocument5 pagesWays of Manipulating Accounting StatementsSabyasachi ChowdhuryNo ratings yet

- GuloDocument2 pagesGulohakdogNo ratings yet

- Jamaica Water Properties Case 1.1 (v1)Document4 pagesJamaica Water Properties Case 1.1 (v1)indiradewieNo ratings yet

- Ocean ManufacturingDocument5 pagesOcean ManufacturingАриунбаясгалан НоминтуулNo ratings yet

- Assignment 1 Final Paper (Edited)Document8 pagesAssignment 1 Final Paper (Edited)paterneNo ratings yet

- 3rd PartiesDocument63 pages3rd PartieskiubiuNo ratings yet

- Viceroy 2Document18 pagesViceroy 2OinkNo ratings yet

- Metlife To Pay $10M Over Internal Control FailuresDocument2 pagesMetlife To Pay $10M Over Internal Control FailuresheyNo ratings yet

- Creative AccountingDocument5 pagesCreative Accountingvikas_nair_2No ratings yet

- Bill Ackman's Letter To PricewaterhouseCoopersDocument52 pagesBill Ackman's Letter To PricewaterhouseCoopersNew York PostNo ratings yet

- Bear Stearn CaseDocument4 pagesBear Stearn CaseAkim AgbolahanNo ratings yet

- Report 3-Governance&Debtb PDFDocument31 pagesReport 3-Governance&Debtb PDFIceberg Research100% (1)

- Worldcom - Executive Summary Company BackgroundDocument4 pagesWorldcom - Executive Summary Company BackgroundYosafat Hasvandro HadiNo ratings yet

- Chapter 4 and 5 EssaysDocument10 pagesChapter 4 and 5 EssaysRhedeline LugodNo ratings yet

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- Red Flags of Enron's of Revenue and Key Financial MeasuresDocument24 pagesRed Flags of Enron's of Revenue and Key Financial MeasuresJoshua BailonNo ratings yet

- Effect of Misrepresentation of Information in A Financial StatementDocument82 pagesEffect of Misrepresentation of Information in A Financial Statementachiever usangaNo ratings yet

- Pre-Class, Minority RuleDocument3 pagesPre-Class, Minority RuleRamlat Arfah ZubairuNo ratings yet

- Bài Tập Chương iDocument3 pagesBài Tập Chương iLê Ngọc Vân NhiNo ratings yet

- Pure Circle H1FY11 Interim SLIDESDocument28 pagesPure Circle H1FY11 Interim SLIDESuva_uvaNo ratings yet

- Voluntary Disclosure in Financial ReportingDocument19 pagesVoluntary Disclosure in Financial ReportingJaya SinhaNo ratings yet

- Introduction/Background:: The Causes of Enron's BankruptcyDocument4 pagesIntroduction/Background:: The Causes of Enron's BankruptcyRao Haris Rafique KhanNo ratings yet

- Financial ShenanigansDocument13 pagesFinancial ShenanigansCLEO COLEEN FORTUNADONo ratings yet

- 中期报告2011815Document26 pages中期报告2011815yf zNo ratings yet

- JetDocument5 pagesJetsunil kumarNo ratings yet

- Compensation For The Named Executive Officers in 2011 and 2010Document1 pageCompensation For The Named Executive Officers in 2011 and 2010GeorgeBessenyeiNo ratings yet

- Forecast From Plan of Reorganization Dec 3 2009Document3 pagesForecast From Plan of Reorganization Dec 3 2009GeorgeBessenyeiNo ratings yet

- Consulting Agreement Page F-37 From VRML 2010 10K-2Document1 pageConsulting Agreement Page F-37 From VRML 2010 10K-2GeorgeBessenyeiNo ratings yet

- Vermillion Claimed On 12/12 That Medicare Insures 55% of Covered Lives.Document1 pageVermillion Claimed On 12/12 That Medicare Insures 55% of Covered Lives.GeorgeBessenyeiNo ratings yet

- Chapter 11Document12 pagesChapter 11BharatSubramonyNo ratings yet

- Section B: Dividend Policy and Capital Structure: Testing EndogeneityDocument5 pagesSection B: Dividend Policy and Capital Structure: Testing EndogeneityGopinath GovindarajNo ratings yet

- Dawood Islamic BankDocument57 pagesDawood Islamic BankMimi ZamanNo ratings yet

- Cambridge Assessment International Education: Accounting 9706/33 October/November 2018Document17 pagesCambridge Assessment International Education: Accounting 9706/33 October/November 2018Anusha Sheikh JavaidNo ratings yet

- Maybankib CG Statement LatestDocument39 pagesMaybankib CG Statement LatestMuhammad SyazwanNo ratings yet

- QuestionaireDocument4 pagesQuestionaireanindya_kunduNo ratings yet

- Suggestion Aset ManagementDocument27 pagesSuggestion Aset ManagementRatnawatyNo ratings yet

- Commodity Covariance ContractingDocument18 pagesCommodity Covariance Contractingpacman_dellNo ratings yet

- Annex A. LTG FS 2013. NarraCapital FS 2012&2013 PDFDocument331 pagesAnnex A. LTG FS 2013. NarraCapital FS 2012&2013 PDFJohn Alfer Bag-oNo ratings yet

- Cebu Roosevelt Memorial Colleges College of CommerceDocument9 pagesCebu Roosevelt Memorial Colleges College of Commerceber tingNo ratings yet

- Wipro EnterprisesDocument17 pagesWipro EnterprisesathiraNo ratings yet

- Rural Banking - SCRIPTDocument16 pagesRural Banking - SCRIPTArchisha GargNo ratings yet

- Kenneth Andrade & Sunil Singhania Buy Cheap Blue-Chip MNC StockDocument9 pagesKenneth Andrade & Sunil Singhania Buy Cheap Blue-Chip MNC StockSam vermNo ratings yet

- TreasuryDocument31 pagesTreasuryrasiga6735100% (1)

- A Tale of Two City Parishes: January 2011Document8 pagesA Tale of Two City Parishes: January 2011JoeCascioNo ratings yet

- The Proposed Maharlika Investment Fund PDFDocument2 pagesThe Proposed Maharlika Investment Fund PDFArthur LeywinNo ratings yet

- Organisation Case StudiesDocument37 pagesOrganisation Case Studies9987303726100% (1)

- Tata Steel Share AnalysisDocument9 pagesTata Steel Share AnalysisArchit JainNo ratings yet

- Corporate Social ResponsibilityDocument6 pagesCorporate Social ResponsibilitySulianur NasuhaNo ratings yet

- Business ImplementationDocument21 pagesBusiness Implementationmark turbanada100% (1)

- MAF759/904: Quantitative Methods For FinanceDocument46 pagesMAF759/904: Quantitative Methods For FinanceSangVoNo ratings yet

- Top 15 Financial RatiosDocument25 pagesTop 15 Financial RatiosAlexandra Elena BrinzeaNo ratings yet

- WCM of Cipla LTDDocument53 pagesWCM of Cipla LTDChanderNo ratings yet

- Sutlej Textiles Industries LTD 30 July 2015Document13 pagesSutlej Textiles Industries LTD 30 July 2015Yakub PashaNo ratings yet

- Case Study AssignmentDocument5 pagesCase Study AssignmentTeh TLNo ratings yet

- 17 Answers To All ProblemsDocument25 pages17 Answers To All ProblemsRaşitÖnerNo ratings yet

- ch23 PDFDocument8 pagesch23 PDFnidal charaf eddineNo ratings yet