Professional Documents

Culture Documents

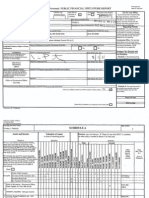

12-16-11 Perry FEC Report

12-16-11 Perry FEC Report

Uploaded by

AustinBureau0 ratings0% found this document useful (0 votes)

249 views20 pagesExecutive Branch Personnel PUBLIC FINANCIAL DISCLOSURE REPORT from Rick Perry.

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentExecutive Branch Personnel PUBLIC FINANCIAL DISCLOSURE REPORT from Rick Perry.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

249 views20 pages12-16-11 Perry FEC Report

12-16-11 Perry FEC Report

Uploaded by

AustinBureauExecutive Branch Personnel PUBLIC FINANCIAL DISCLOSURE REPORT from Rick Perry.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 20

sF278(Rev.

o3/2ooo> Executive Branch Personnel PUBLIC FINANCIAL DISCLOSURE REPORT

Form Approved:

OMB No. 3209 - 0001

5 C.F.R. Part 2634

u.s. Office of Government Ethics

Date of Appointment, CandidaL-y, Election,

Reporting Incumbent

Calendar Year New Entrant, Termination Termination Date (If Appli-

or Nomination (Month Day, Yea.r)

Status

D

Covered by Report

Nominee, or Filer 0

cable) (Month, Day, Year) .

(Check Appropriate

I I

Candidate

I I

Boxes)

Last Name First Name and Middle Initial

Reporting

Individual's Name

C'rftJMEr -1<.

Title of Position Department or Agency {If Applicable)

Position for Which

Filing

Location of

Address {Number, Street, City, State , and ZIP Code) Telephone No. {Include Area Code)

Present Office

/DJO j Ays.-r,rJ t\"J..

'10b-&-s"Z<

(or forwarding address)

Positlon(s) Held with the Federal

Title of Position(s) and Date(s) Held

Government During the Preceding

12 Months {If Not Same as Above)

Presidential Nominees Subject

Name of Congressional Committee Considering Nomination Do You Intend to Create a Qualified Diversified Trust?

to Senate Confirmation

NIA

DYes 0No

Certification Signature of Reporting Individual Date {Month, Day, Year)

I CERTIFY that the statements I have

'?:/CK

made on this form and all attached

schedules are true, complete and correct

to--{t-s'/ll

to the best of my knowledge.

Other Review

Signature of Other Reviewer

.../

Date {Month, Day, Year)

(If desired by

agency)

Agency Ethics Official's Opinion Signature of Designated Agency Ethics Official/Reviewing Official Date {Month, Day, Year)

On the basis of infonnation contained in this

report, I conclude that the filer is in 'i:ompliance

with applicable laws and regulations (subject to

any conunents in the box below).

Office of Government Ethics

Signature Date {Month, Day, Year)

Use Only

Comments of Reviewing Officials {If additional space is required, use the reverse side of this sheet)

(Check box if filing extension granted & Indicate number of days jb__) [3'

{Check box If comments are continued on the reverse side) 0

Supersedes Prior Editions, Which Cannot Be Used.

278-113

Fee for Late Filing

Any individual who is required to file

this report and does so more than 30 days

after the date the report is required to be

fll.ed, or, if an extension is granted, more

than 30 days after the last day of the

filing extension period, shall be subject

to a $200 fee.

Reporting Periods

Incumbents: The reporting period Is

the preceding calendar year except Part

II of Schedule C and Part I of ScheduleD

where you must also include the filing

year up to the date you file. Part II of

Schedule D is not applicable.

Termination Filers: The reporting

period begins at the end of the period

covered by your previous filing and ends

at the date of termination. Part II of

Schedule D is not applicable.

Nominees, New Entrants and

Candidates for President and

Vice President:

Schedule A--The reporting period

for income (BLOCK C) is the preceding

calendar year and the current calendar

year up to the date of filing. Value assets

as of any date you choose that is within

. 31 days of the date of filing.

Schedule B--Not applicable.

Schedule C, Part I (Liabilities)-The

reporting period is the preceding calendar

year and the current calendar year up to

any date you choose that is within 31 days

of the date of filing.

Schedule C, Part II (Agreements or

Arrangements)-Show any agreements or

as of the date of filing.

-

ScheduleD --The reporting period is

the preceding two calendar years and

the current calendar year up to the date

of filing.

0

,.....,

,., <.::;)

--r

Agency

--

<-:: j"l

C:i

..

m :. :.I -

-- -

r .')

(J.; i-:

'. :1 :

(_)

--- ir r

(i i

r---

NSN7o549-0l-070;s444 -

en

w

c::1

SF 278 (Rev. 03/2000)

5 C.F.R. Part 2634

-

S. Office of Government EtM

--

Reporting Individual's Name

PERRY, JAMES R.

Assets and Income

BLOCK A

For you, your spouse, and dependent children,

report each asset held for investment or the

production of income which had a fair market

vaiue exceeding $1,000 at the close of the re$>Ort-

ing period, or which generated more than 200

in income during the reporting period, together

with such income.

For yourself, also report the source and actual

amount of earned income exceeding $200 (other

than from the U.S. Government). For your spouse,

report the source but not the amount of earned

income of more than $1,000 (except report the

actuai amount of any honoraria over $200 of

your spouse).

NoneD

Central Airlines Common

1------------

Doejones&Smlth, Hometown, State

Examples

1-------------

Kempstone Equity Fund

1-------------

IRA: Heartland 500 Index Fund

1

State of Texas, Austin, TX

2

State of Texas, Austin, TX

3

RP 2010 Management Trust

4

AP 2010 Management Trust

5

Texas Association Against Sexual Assault,

Austin, TX (spouse)

6

Revocable Blind Trust F/B/0 Rick Perry

(terminated August, 2011)

.-I

0

0

,_.;-

{,17

~

-3

"'

"'

Q)

-1-<

.3

~

-

-

-

X

SCHEDULE A

Page Number

:>-

of

S'

Valuation of Assets Income: type and amount. If "None (or less than $201)" is

at close of reporting period

checked, no other entry is needed in Block C for that item.

BLOCKB

BLOCKC

Type Amount

0

'0

0 0

0 0 0

~

~

0

.-I

0

0

o.

0 0 0

0

Other Date q

0

0 0

0 0 0

i:l

N 0

0

Income (Mo., Day, 0 0 0

0 0 0 0 {,17

0

0

0 0 0 0 0

0 q

0

0

Q)

"'

~

0 0 0

0

(Specify Yr.) 0 0 0

0 0

0

b

o. If) If)

!3

Q)

0 0 0 0

8

0

0 p

vi

0

Type&

0 0

0

If)

0

o. 0

If) N {,17

0 ... ...

~ -3

8

0 0 0

0

0

0

0

0

{,17 {,17

"'

0 0

o" ,_.;-

{,17

Only if

0 N If) .-I 0 I

0

Q)

~

"'

0 0 0 0 Actual

vi If) .-I {,17 {,17 {,17

0

I I

.-I

~ ~

;>,

"'

"'

0

If)

0

vi If) .-1 {,17

0

I

0

0

~

~

] N" vi

Amount) Honoraria .-I {,17 {,17

I I I

0

.-1 .-1

0

q

q .-I {,17 {,17

I

0

.-1

0 {,17

I I

.-1 .-1 q

0 0 0

.-I

{,17 {,17 {,17

I I

q

0

o.

.-1

0 0

0

0

'0

I

'0

1

]

(.!) 1-< .-1

0

I

.-1 0 0 0 {,17 I I I

.-I .-I

0

.-1 .-1

0 0

If)

~

.S:l

.3

.-1

0

If)

.-1 0 0 0 0 0 {,17 0 {,17

I

~

I .-I .-1 .-I 0 0 0 {,17 {,17

0 0 0

0 0 0

0 0 0

~

;";:::

~

.-I

0 0 0 0 0

0

0

o.

vi 0

g

q

o. r.n"

1-<

!

o.

If) 0

vi 0

g

0

g

0 If) 0

~ ~

~

~

~

0

vi

0

,_.;- .-1 .-I If) .-1 N If) .-I If)

N

a :s ~

N .-I N" .-1 If)

.-I

{,17 {,17 {,17 {,17 {,17 {,17 {,17 {,17 ~ ~ u {,17 {,17 {,17 {,17 {,17 {,17 {,17 {,17

X X X

1-

X [ ~ [ ~

1- 1- 1- 1--

- - -

1-

- ~ -

l-- 1- 1- 1-

- -

,_

= [ ~ [

1- I-

1- 1-- 1--1---- 1----

Law Partnership

Income $130,000

- -

1-- -

1--

- -

,_

1-

1-- 1-- - t-

- - -

1--

- - -

r-- ----

1----

_1_1...:

X

=I=

.:.I __

1-

-

1-- 1-- 1--

- - -

1-

- 1-- - f.- -

- - - - ----r-- ~ - - -

----

X

X

X

$132,99-5.00

(annual salary)

$7698.96

(monthly

annuity)

X X X X

X X X

$65,000.00

(annual

consulting fee)

X X X X

* This category applies only if the asset/income is solely that of the filer's spouse or dependent children. If the asset/income is either that of the filer or jointly held

by the filer with the spouse or dependent children, mark the other higher categories of value, as appropriate.

Prior Editions Cannot Be Used.

OGE/Adobe Acrobat version 1.0.1 (3/29/01)

SF 278 (Rev. 03/2000)

5 C.P.R. Part 2634

U.S. Office of Government Ethics

Reporting Individual's Name

PERRY, JAMES R.

Assets and Income

BLOCK A

1

Phoenix Companies, Winston-Salem, NC

(insurance policy)

2

J.R. Perry & Co,. Haskell, TX (ranch-1/3 interest)

3

Deutsche Bank - SEP IRA

4

Terry McDaniel & Co., Austin, TX (money

market fund)

5

Lincoln National Life (variable life insurance

policy)

6

7

8

q

.--!

0

o.

.--!

~

~

"'

"'

~

s

'-'

I

X

SCHEDULE A continued

Page Number

(Use only if needed)

3

of

S"

Valuation of Assets Income: type and amount. If "None (or less than $201)" is

at close of reporting period checked, no other entry is needed in Block C for that item.

BLOCKB BLOCKC

Type Amount

0

]

0 0

~

0

0 0

.--! 0

0

0

o. 0 0

0

0

Other Date 0

0

0

8

0

0

8

0

I

N

0

0 Income (Mo., Day, 0 0 0 0 ~

0

0

0

0

o. 0

"'

0

0 0 0 0 0

8

q 0 C!)

~

0 0

...

0

(Specify Yr.) 0 0 0

0 0

0 ll'l ll'l

0

'..:1

0 0 0 0

0

vi

0

Type&

0 0

0 ll'l

0

0

ll'l

N ~

0

~

~

I

8

0 0 0

0

0

0

0

0

0 0 N ll'l

.....;-

0

~

~ I

0

~

0

0 q

0 0

.....;-

0

~ 0

Actual Only if ll'l.

ll'l .--! ~

~

0

I

I

.--!

~

~

"'

0

ll'l

0

ll'l .--! ~

0

I

0

~

0

Jl

N'

vi

ll'l

Amount) Honoraria .--! ~ ~

I I I

0

.--! .--! 0

0

0 .--! ~ ~ I

0

.--! 0

~

8

0 0

1

.....;- ~

~ ~ 0 0

I I

.--! .--! .--! q

0

I I

al

]

1;.!1

,

I I

.--! 0 I

o. 0 ~

I

I 0 ll'l .--! .--! 0

0 0 .--!

0

ll'l

t;

I

.--! .--! 0 .....;-

0

.--! 0 0 0

0 0 ~ 0 0

~

~

Cil

I .--!

.--! .--! 0 0 0 ~

~

0 0 0

0

0 0

0

0 o.

~

~

j

. ~

I

.--!

0

0 0 0 0

0

0

~

o. vi 0

~

q

o.

~

0

0

ll'l 0

vi 0

~

0 0 ll'l 0 ll'l

~ ~

~

.....;- 0

.--! .--! ll'l .--!

N ll'l

.--!

ll'l N

Q

N N' vi .--! ll'l .--!

.....;-

~ ~ ~ ~ ~ ~ ~ ~ ~ u ~ ~

~ ~ ~ ~ ~ ~

X

X X X

X X X

X X X

X X

* This category applies only if the asset/income is solely that of the filer's spouse or dependent children. If the asset/income is either that of the filer or jointly held

by the filer with the spouse or dependent children, mark the other higher categories of value, as appropriate.

Prior Editions Cannot Be Used.

OGE/Adobe Acrobat version 1.0.1 (3/29/01)

SF 278 (Rev. 03/2000)

5 C.F.R. Part 2634

U.S. Office of Government EtM

--

--

Reporting Individual's Name

PERRY, JAMES R.

Part I: Liabilities

Report liabilities over $10,000 owed

to any one creditor at any time

during the reporting period by you,

your spouse, or dependent children.

Check the highest amount owed

during the reporting period. Exclude

Creditors (Name and Address)

SCHEDULE C

a mortgage on your personal residence NoneO

unless it is rented out; loans secured by

automobiles, household furniture

or appliances; and liabilities owed to

certain relatives listed in instructions.

See instructions for revolving charge

accounts.

Date Interest

Type of Liability Incurred Rate

Examples __ ___

1991 8%

r-1999

1-lo%--

john] ones, 123 JSt., Washington, DC Promissory note

1

EdFinancial (Student Loan) Guaranteed By TN Student Asst. Corp.

2006 3.875%

2

EdFinancial (Student Loan) Paid In Full on 6/20/11 - Interest Paid 7/2011

2006 8.25%

3

4

5

Term if

applicable

f- 25 Y!!:., _

on demand

30YRS.

Paid

Page Number

of

Category of Amount or Value (x)

b '

'O

'

'

.o ..... o .-<0

' '

'O .-<0

,....o 0 00 00

..... o

oCl.

0 q_q_ 0

.-<O .-<0 .-<O 00 00

0

.o

00 00

go.

00 q_q_ 00 00 00

00 q_q_

00 00 og

lilg

00

go.

otri' ll"lO og

Oll"l ll"lO 0

q_q_

.ll"l

.......... .-<1/"l ll"l-< ,....N Nll"l 1/"l .....

..... 1/"l 1/"lN

........ ........ ........ ........ ........ ........ .... .... .......

-

1--

_!_

- f--

--

1-- r---

--

X

X

*This category applies only if the liability is solely that of the filer's spouse or dependent children. If the liability is that of the filer or a joint liability of the filer

with the spouse or dependent children, mark the other higher categories, as appropriate.

Part II: Agreements or Arrangements

'

.-<O 0

00 0

00 0

00 0

00 0

q_q_ 0

ll"lO

Nll"l

.......

1--- 1---

Report your agreements or arrangements for: ( 1) continuing participation in an

of absence; and (4) future employment. See instructions regarding the report-

employee benefit plan (e.g. pension, 401k, deferred compensation); (2) continua-

tion of payment by a former employer (including severance payments); (3) leaves

ing of negotiations for any of these arrangements or benefits.

Nonel81

Status and Terms of any Agreement or Arrangement Parties Date

Example

I

Pursuant to partnership agreement, will receive lump sum payment of capital account & partnership share

calculated on service performed through 1/00.

Doe jones & Smith, Hometown, State

7/85

1

2

3

4

5

6

Prior Editions Cannot Be Used.

OGE/Adobe Acrobat version 1.0.1 (3/29/01)

SF 278 (Rev. 03/2000)

5 C.F.R. Part 2634

U.S. Office of Government Ethics

Page Number

Reporting Individual's Name

PERRY, JAMES R.

SCHEDULED

of

s

Part I: Positions Held Outside U.S. Government

Report any positions held during the applicable reporting period, whether compen- organization or educational institution. Exclude positions with religious,

sated or not. Positions include but are not limited to those of an officer, director, social, fraternal, or political entities and those solely of an honorary

trustee, general partner, proprietor, representative, employee, or consultant of nature.

any corporation, firm, partnership, or other business enterprise or any non-profit

Organization (Name and.Address) Type of Organization Position Held From (Mo., Yr.) To (Mo.,Yr.)

Assn. of Rock Collectors, NY, NY

Non-profit education President 6/92 Present

--------------------

f---------------

----------

---- ----

oe Jones & Smith, Hometown, State Law firm Partner 7/85 1/00

1

2

3

4

5

6

Part II: Compensation in Excess of $5,000 Paid by One Source

Do not complete this part if you are an

Incumbent, Termination Filer, or Vice

Report sources of more than $5,000 compensation received by you or your non-profit organization when Presidential or Presidential Candidate.

business affiliation for services provided directly by you during any one year of you directly provided the

the reporting period. This includes the names of clients and customers of any services generating a fee or payment of more than $5,000. You

None D

corporation, firm, partnership, or other business enterprise, or any other need not report the U.S. Government as a source.

Source (Name and Address) Brief Description of Duties

Jones & Smith, Hometown, State

Legal services

Examples (cll;rt ;;rD;j;;s st;t;;'- ----

1

State of Texas, Austin, TX- Office of the Governor Executive Duties as Governor

2

3

4

5

6

Prior Editions Cannot Be Used.

OGEI Adobe Acrobat version 1.0.1 (3/29/0 I)

August 12, 20 11

Ms Natalia Luna Ashley

General Texas Ethics Commission

P 0 Box 12070

Austin., Texas 7871.1-2070

HAND DJELIVERE6-

RECE'!VED

AUG 3 0 2011

Texas fthks Commrssic!f;

Re: Amendment of Personal Financial Statement Relating to Dissolution of Blind Trust

Dear Ms Ashley:

On August9, 2011, I revoked my Blind Trust. In accordance wjth Texas Govenunent

Code section 572.023( d). please consider this, along with the attached documents, an

amendment to my most recent Personal Financial Statewent.

Ifi can provide you with anything else please let me know.

Sincerely,

Rick Perry

Texas Ethics Commission P.O. Sox 12:070 Allstin, 7S1112070 _(612)463-5800 1-B00-3258506

STOCK

PART 2

0 NOT APPLICABLE

'

H ...... -

Ust each business entity in which you, your spouse, or a dependent child held or acquired stock during

and Indicate the category of the number of shares held or acquired. If some or all of the stock was sold, also indicate e

category of the amount of the net gain or loss realized from the sale. For more information, see FORM Al;l-3 :J? 0 11

INSTRUCTION GUIDE. -

When reporting information about a dependent child's activity, indicate the child about whom you

providing the under which the child is listed on the Cover Sheet.

1 BUSINESS ENTITY

NAMIO

Coca Cola Co.

2 STOCK HELD OR ACQUIRED BY [&J FI!.E;R 0 SPOUSE D DEPENDENT CHILD

3 NUMBER OF SHARES

(&] LESS THAN 100 D 1oo10499 D 500T0999 0 1,000 TO 4,999

[J 5,000 TO 9,999 D 10,000 OR MORE

4 IF SOLD

0 NET GAIN

0 LESS THAN $5,000 0 $5,000- $9,999 D $1o,ooo- $24,999 0 $25,000.-0R, MORE

D NE.T LOSS

BUSINESS ENTITY

NAME

FedEx Corp

STOCK HELD OR ACQUIRED BY IZI FILER D SPOUSE D oEF>i:NDENrcHILo _

NUMBER OF SHARES tzl LESS THAN 100 D 100T0499 D 500 TO 999 D 1,000 TO 4,999

0 5,000 TO 9,999 D 10,000 OR MORE

IF SOLD

0 NET GAIN

P lESS THAN $5,000 0 $5,000. $9,999 0 $10,000 $24,999 0 MORE

D NET!.OSS

BUSINESS ENTITY

NAME

Illinois Tool Works

'

STOCK HELD OR ACQUIRED BY !ZI FILER D SPOUSE D DEPENDENT CHILD -

NUMSER OF SHARES IZ]LESS 1'HAN 100 0 100TO 499 D 500T0999 D 1,000 TO 4,999

0 5,000 TO 9,999 D 10,000 OR MORE

IF SOLD

D NET GAIN

0 U!SS THAN $5.000 D $s,ooo- $9,999 D s1o,ooo- $24,999 0 MORE

0 NETI.OSS

BUSINESS ENTITY

NAMIO

National Instruments Corp

STOCK HELD OR ACQUIRED BY

[Z1 FILER 0 SPOUSE 0 OEPE;NDENT CHILD _

NUMBER:OF SHARES lZJ!.ESS THAN 100 0 100TO 499 D soomss9 D 1,000 TO 4,999

!

D 5,000 TO 9,999 D 10,000 OR MORE

IF SOLD:

D NET GAIN

D LESS THAN $5,000 0 $5,000 $9,999 D s1o,ooo- $24,999 0 $25,000-0R. MORE

..

0 NET LOSS

BUSINESS ENTin'

NAME

Nordson Corp

STOCK HELD OR ACQUIRED BY

IZ) FILER 0 SPOUSE 0 DEPENDENT CHILD _

NUMBER OF SHARES [gj LESS THAN 1 00 D 100 T0499 0 500TO 999 0 1,000 TO 4,999

D 5,000 TO 9,999 D 10,000 OR MORE

IF SOLD

0 NETGAlN

0 LESS iHAN $5,000 D $S,ooo- $9,999 0 $10,000. $24.,999 D $25,000-0R MORE

D NETI.OSS

COPY AND ATTACH ADDITIONAL PAGES AS NeCESSARY

TX-PFS ScHWaN! 1.1.0

Texas Ethics Commission FI.O. Box 12070 Austin, Texas 78711-2070 (512)4635800 1-8003258506

STOCK

PART 2

0 NOi APPLICABLE

List each business entity in which you, your spouse, or a dependent child held or acquired stock during the calender year

end indicate the category of the number of shares held or acquired. If some or all of the stock was sold, also indicat the

category of the amount of the net gain or loss realized from the sale. For more information, see FORM PFS--

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the c:hild about whom you are reporting by

providing the number under which the chfld Is .listed on the Cover Sheet.

1 BUSINESS ENTITY

NAME

Novartis ADR

2 STOCK HELD OR ACQUIRED BY IZJ FILER D SPOUSE D DEPENOENT CHIL.O --

3 NUMBER OF SHARES IZI LE;SS THAN 1 00 D 100 T0499 D 500TO!il99 D 1 ,ODD TO 4,999

D 5,000 TO 9,999 D 10,000 OR MORE

4 IF SOLD

D NEiGAIN

D l.ESS THAN $5,000 D ss,ooo- $9,999 D S1o,ooo-$24,999 D $25,000--0R. MOR.E

0 NETLOSS

BUSINESS ENTITY

NAMEt

PepsiCo Inc

STOCK HELD OR ACQUIRED BY

IZ] FILER D SPOUSE 0 DEPENDENT CHILD __

NUMSER OF SHARES L.ESS THAN 100 D 100 TO 499 D 500T0999 D 1 ,000 TO 4, 999

D 5,ooo ro 9,999 D 10,000 OR MORE

IF SOLD

0 NETGAIN

0 LESS THAN $5,000 D $5,ooo - $9,999 0 $10,000 - $24,999 0 $25,0000R MORE

0

BUSINESS ENTITY

Procter & Gamble

STOCK HELD OR ACQUIRED BY IZI FILER D SPOUSE

0 DEPENDENT CHILD __

NUMBER OF SHARES IZI LESS THAN 1 DO D 100 TO 499 D l.'iOOT0999 0 1 ,000 TO 4,999

0 5,000 TO 9,999 0 10,000 OR MORE

IF SOLD

D NET GAIN

D Ll;;SS THAN $5,000 D $5,ooo- $9.999 0 $10,000.$24,999 0 $25,000-0R MORE

0 NET LOSS

BUSINESS ENTITY

NAME

Sc:hlumberger Ltd

STOCK HELD OR ACQUIRED SY IZI FILER D SPOUSE 0 DEPENDENT CHILD __

NUMBER OF SHARES [Z] LESS THAN 100 0 100 TO 499 D 500T0999 D 1 ,000 TO 4,999

0 5,000 TO 9,999 D 10,000 OR MORE

IF SOLD

D NETGAIN

0 LESS THAN $5,000 0 $5,000- $9,999 D s1o,ooo- $24,999 D $:25,000--QR MORIO:

D NET LOSS

BUSINESS ENTITY

NAME

Sigma Aldrich

STOCK HELD OR ACQUIRED BY IZI FILER D SPOUSE 0 DEPENDENT CHILD __

NUMBER OF SHARES IZI LESS THAN 100 0 100 TO 499 D soo ros9s D 1,000 TO 4,999

D 5,000 TO 9,999 0 10,000 OR MORE

IF SOL.D

0 NET GAIN

D LESS THAN $5,000 D sB,ooo- $9,999 D $1o,ooo. $24,999 D $2S,OOO-OR MORE

0 NETL.OS$

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

TX-FFS 1,1 ,Q

Ethics Commission P.O. Bo)( 12070 Austin, Texas 7a711-2070 (512)463-5800 1800325-8506

STOCK

PART 2

0 NOT APPLICAI3LE

Llst each business entity in which you, your spouse, or a dependent chlld held or acquired stock during the calendar year

the category of the number of shares held or acquired. If some or all of the stock sold, also indicate the

category of the amount of the net gain or loss realized from the sale. For more information, see FORM

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 BUSINESS ENTITY

NAMI'::

United Parcel :;lsrvic:e Cl B

2 STOCK HELD OR ACQUIRED BY !ZJ FILER D SPOUSE

0 OEPENOENT CHILD __

3 NUMBER OF SHARES IZ] LESS THAN 1 00 D 100 T0499 D 500 TO 999 D 1,000 iO 4, 999

0 5,000 TO 9,999 0 10,000 OR MORE

4 IF SOLD

D NETGAIN

D LESS THAN $5,000 D $5,ooo - $9,999 D s1o,ooo- $24,999 D $25,000--0R MORE

0 NET LOSS

BUSINESS ENTITY

NAME

ww Grainger

STOCK HELD OR ACQUIRED BY IZ) FILER D SPOUSE

0 DEPENDENT CHILD __

NUMBER OF SHARES IZJ LESS THAN 1 00 D 100 T0499 D !;)00TO!il99 D 1,000 TO 4,999

D 5,000 TO 9,999 D 10,000 OR MORE

IF SOLD

D NET GAIN

D LESS THAN $5,000 D S5,ooo- S9,9es D s1o,ooo -$24.999 D $25,000--0R MORE;

0 NET LOSS

BUSINESS ENTITY

NAME

Apache Corp

STOCK HEL..D OR ACQUIRED BY

IZ] FIL.ER D SPOUSE

0 DEPENDENT CHILD __

NUMBER OF SHARES IZI LESS THAN 1 00 D 100 T0499 D 500TO 999 D 1,000 TO 4,999

0 5,000 TO 9,999 D 10,000 OR MORE

IF SOLD

0 NETGAIN

IE! LESS THAN $5,000 D $5.ooo $9.999 D $1o.ooo. $24,999 0 $25,000-0R MORE

IZI NET LOSS

BUSINESS ENTITY

NAME

Chevron Corp

SIOCK HELD OR ACQUIRED BY IZI FILER D SPOUSE D DEPENDENT CHII..D --

NUMBER OF SHARES IZI LESS THAN 100 D 100 T0499 D 500T0999 D 1,000 TO 4,999

0 5,000 TO 9,999 D 10,000 OR MORE

IF SOLD

IZI NET GAIN

IZJ LESS THAN $5,000 0 $5,000- $9,999 D $1o.ooo- S24.999 0 $25,000-0R MORE

D NETLOSS

BUSINESS ENTITY

NAME

Covidien Pic

STOCK HEL..D OR ACQUIRED SY

IZj FILER D SPOUSE 0 DEPENDENT CHILD __

NUMBER OF SHARES IZJ LESS THAN 100 D 100 T0499 D 500T0999 D 1,000 TO 4,999

D 5,000 TO 9,999 D 10,000 OR MORE

IF SOLD

IZI Nf:T GAIN

IZI LESS THAN $5,000 0 $5,000-$9,999 D s1o,ooo- $24,999 D $2$,000-0R MORE

0 NETLOSS

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

TXPFS Soflwilro Vor.:oton 1.1.0

Texas E:.thies Commis9ion P 0 Sox 12070 .. Austin Texas 78711-2070 (512)463-5SDO 1-800-225-8506

STOCK

PART 2

0 NOT APPLICABLE

List each business entity in which you, your spouse, or a dependent child held or acquired stock during the calendar year

and indicate the category of the number of shares held or acquired. If some or all of the stock was sold, also Indicate the

category of the amount of the net gain or loss realized from the sale. For more information, see FORM PFS-

INSTRUCTION GUIDI:.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 BUSINESS I::NTITY

NAME

Data Processing Inc.

2 STOCK HELD OR ACQUIRED BY [ZJ Ffi.ER D SPOUSE 0 DEPENDENT CHILD __

3 NUMBER OF SHARES

0 LESS THAN 100 lZJ100 TO 499 0 500T0999 D 1,000 TO 4,999

D 5,000 TO 9,9!il9 D 10,000 OR MORE

4 IF SOLD

D NET GAIN

0 LESS THAN $5,000 D ss.ooo- $9.99!il D s1o,ooo- $24,999 D $25,000-..0R MORE

D NET LOSS

BUSINESS ENTITY

NAME

Canon rnc ADR

STOCK HELD OR ACQUIRED BY

IZJ FILER D SPOUSE 0 DEPENDENT CHILO __

NUMBER OF SHARE;S 0 I.ESS THAN 100 fZJ100 TO 4913 D 500T0999 D 1,000 TO 4,999

D 5.000 TO 9,99!il 0 10,000 OR MORE

IF SOLD

D Nf!i:TGAIN

D LESS THAN $5,000 D ss,ooo - $9,999 0 $10,000. Si24,999 D $25,000-0R MORE

D NETLOSS

BUSINESS ENTITY

NAME

Cisco Systems

STOCK HELD OR ACQUIRED BY

fZ) FILER 0 SPOUSE

0 DEPENDENT CHILD __

NUMBER OF SHARES 0 LESS THAN 100 IZJ 1 00 TO 499 0 600 T0999 D 1 ,000 TO 4,999

0 5,000 TO 9,999 0 10,000 OR MORE

IF SOLD

0 NET GAIN

0 LESS THAN $5,000 0 $5,000 $9,999 D $1o,ooo. $24,999 0 $::!5,000-0R MORE

D NE'fLOS$

BUSINESS ENTITY

NAME

Donaldson Inc

STOCK HELD OR ACQUIRED BY [ZI FII.E;R D SFOUSF. D DEPE;NDE;NT CHILD

NUMBER OF SHARC:S D LESS THAN 100 IZI100 TO 499 D 500T0999 0 1 ,000 TO 4,999

0 !i,OOO TO 9,999 0 to,OOD MORE

IF SOLD

0 NETGAIN

0 L.ESS THAN $5,000 0 $5,000-$9,999 0 $10,000-$24,999 D $25,000-0R

D NET LOSS

BUSINESS ENTITY

NAME

Dover Corp.

STOCK HELD OR ACQUIRED BY IZI FILER 0 SPOUSE 0 DEPENDENT CHILD __

NUMBER OF SHARES D LESS THAN 100 IZI1 00 TO 499 0 500 T0999 D 1,000 TO 4,999

0 5,000 TO 9,999 0 10,000 OR MORE

IF SOLD

0 NETGAIN

D LEi$$ THAN $5,000 0 $5,000-$9,999 D $1o.ooo- $24,999 0 $25,000-0R MORE

D NETL.OSS

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

n<-PI'S !;\nOwre 1.1.0

Texas Etllics Commission P.O. Sox 12070 Austin, Texas 787112070 (512)483-5800 1-M0-325-8$06

STOCK

PART 2

0 NOT APPLICABLE

List each business entity in which you, your spouse, or a dependent child hsld or acquired stock during the calendar year

and indicate the category of the number of sheres held or acquired. If some or all of the stock was sold, also indicate the

category of the amount of the net gain or loss realized from the sale. For more information. see FORM

INSTRUCTION GUIDE.

When reporting information about a dependent child's ectivity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 BUSINESS ENTITY

NAME

Ecolab Inc.

2 STOCK HELD OR ACQUIRED BY IZJ FILER D SPOUSE 0 DEPENDENT CrfiLD __

3 NUMSER OF SHARES

D L.ESS THAN 100 [ZJ 100 TO 499 D 500T0999 D 1,000 TO 4,999

D 5,000 TO 9,999 D 10,000 OR MORE

4 IF SOLD

D NET GAIN

0 LESS THAN $5,000 D S5,000. $9,999 D s1o,ooo- $24,999 D $25,000-0R MORE

D NET LOSS

BUSINESS ENTITY

NAMP.

Emerson Electric Co.

STOCK HELD OR ACQUIRED BY I&J FILER D SPOUSE 0 DEPENDENT CHILD __

NUMBER OF SHARES D LE;SS THAN 100 IZJ100 TO 499 D D 1 ,ooo ro 4,999

0 5,000 TO 9,999 0 1 0,000 OR MORE

IF SOLD

0 NET GAIN

0 LESS THAN $5,000 0 $5,000. $9,999 D s1o.ooo. $24,999 D $25,000-0R MORE;

0 NET LOSS

BUSINESS ENTITY

NAMS

Molex Inc

STOCK HELD OR ACQUIRED BY IZI FILER 0 SPOUSE 0 DEPENDENT CHILD __

NUMBER OF SHARES D LESS THAN 100 !Zj100 TO 499 D SOOT0999 D 1 ,000 iO 4,999

D 5,000 TO 9,999 D 10,000 OR MORE

IF SOLD

D NET GAIN

0 LESS THAN $5,000 0 $5,000. $9,999 0 $10,000-$24,999 D $25,000-0R MORE

0 NET LOSS

BUSINESS ENTITY

NAMI:

Paccar

"

STOCK HELD OR ACQUIRED BY [XI Fll.ER D SPOUSE D DEPENDENT CHII.D --

NUMBER OF SHARES 0 LESS THAN 100 IZI 1 00 TO 499 D 500T0999 0 1,000 TO 4,999

0 5,000 TO 9,999 0 10,000 OR MORE:

IF SOLD

D NET GAIN

D LESS THAN $5,000 D s5,ooo. $9.999 D 5i1o,ooo. $24,999 D $25,000-0R MORE

0 NET LOSS

BUSINESS ENTITY

NAME

Sysco Corp

STOCK HELD OR ACQUIRED BY IZI FILER 0 SPOUSE 0 DEPENDENT CHILD __

NUMBER OF SHARES D u::ss THAN 100 [EI 1 00 TO 499 D 500 TO 999 D 1,000 TO 4,999

D 5,000 TO 9,999 0 10,000 OR MORE

IF SOLD

D NET GAIN

0 LESS THAN $5,000 0 $5,000 - $9,999 D $1o.ooo- $24.999 0 $25,000-0R MORE

D NET LOSS

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

TXPFS SoflWllruVorolon 1.1.0

Texas Ethics Commission P 0 Box 12070 .. Austin Texas 713711-2070

"

I

(512)4635800 1-800-3258506

STOCK

PART 2

0 NOT APPLICABLE

List each business entity in which you, your spouse, or a dependent child held or acquired stock during the calendar year

and indicate the category of the number of shares or ecquired. If some or all of the stock was sold, also indicate the

category of amount of the net gain or Joss realized from the safe. For more information, see FORM PFS--

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 BUSINESS ENTITY

NAME

Wai"Mart Stores

2 STOCK HELD OR ACQUIRED BY IZI FILER D SPOUSE 0 DEPENDENT CHILD --

3 NUMBER OF SHARES

D I.ESS THAN 100 I2S] 100 TO 499 D 500TOQ99 D 1,000 TO 4,999

D 5,000 TO 9,999 D 10,000 OR MORE

4 IF SOLD

0 NET GAIN

D L.ES$ THAN $5,000 D $5,ooo - $9,999 0 $10,000. $24,999 0 $25,000-0R MORE

0 NET LOSS

BUSINESS ENTITY

NAMI:

Hewlett.Packard Co

STOCK HELD OR ACQUIRED BY

IZI FILER D SPOUSE; D DEPENDENT CHILD

NUMBER OF SHARES D l.!;SS THAN 1 00 1&1100 iO 499 D 500T0999 0 1,000 TO 4,999

D 5,000 TO 9,999 D 10,000 OR MoREO

IF SOLD

D NET GAIN

!Zl LESS THAN $5,000 0 $5,000 - $9,999 D s1o.ooo. $24,999 D $25,000-0R MORE

IZI NET LOSS

BUSINESS ENTITY

lllionois Tool Works Inc

STOCK HELD OR ACQUIRED BY

IZI FILER D SPOUSE

0 DEPENDENT CHILD __

NUMBER OF SHARES D I.F.SS THAN 100 !Z1100 iO 499 0 500T0999 D 1,000 TO 4,999

0 5,000 TO 9,999 0 10,000 OR MORE

IF SOLD

D NET GAIN

0 LESS THAN $5,000 D $s,ooo- $9,999 0 $10,000-$24,999 D $25,000-0" MORE

D NET LOSS

BUSINESS ENTITY

NAMF.

Intel Corp

STOCK HELD OR ACQUIRED BY

(8] FIL.E:R D SPOUSE

0 DEPENDENT CHILD __

NUMBER OF SHARES D LESS THAN 100 IZI 1 00 TO 499 D sooro999 D 1,000 iO 4,999

D 5,000 TO 9,9EIEI 0 10,000 OR MORE

IF SOLD

0 NET GAIN

0 LESS THAN $5,000 D $s.ooo. $9.999 0 $10.000.$24,999 D szs,ooo-OR MORE

D NET LOSS

BUSINESS ENTITY

NAME

Johnson & Johnson

STOCK HELD OR ACQUIRED BY IZI FILER D SPOUSE 0 DEPENDENT CHILD __

NUMBER OF SHARES 0 I.ESS THAN 100 (2SJ 1 00 TO 499 D 500 TO 999 D 1,000 TO 4,999

0 5,000 TO 9,999 0 10,000 OR MORE

IF SOLD

D NETt3AIN

[ZI LESS fHAN $5,000 D $5,ooo. $9,999 D s1o,ooo. $24,999 D $25,000..0R MORP.

IZJ NET LOSS

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

lXPFS SoftYr.lno 1.1.0

Texas Ethics Commission P 0 Box 12070 .. Austin iex8s 76711-2070

'

(512)46:3-5800 1-800-325-8506

STOCK PART 2

0 NOT APPLICABLE

List each business entity in which you, your spouse, or a dependent child held or acquired stock during the calendar year

and indicate the category of the number of shares held or acquired. If some or all of th!ll stock was sold, also indicatGJ the

category of the amount of the net gain or loss realized from the sale. For more Information, see FORM PFS-

INSTRUCTION GUIDE.

When reporting information abo1.1t a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 BUSINESS ENTITY

NAME

Baker Hughes, Inc.

2 STOCK HELD OR ACQUIRED BY IXI FILER D Sf='OUSE 0 PEPI:NbE;Nl' CHILD

3 NUMBER OF SHARI::S 0 LESS THAN 100 D 100TO 499 IZJ 500 TO 999 D 1,000T04,999

D 5,000 TO 9,999 D 10,000 OR MORE

4 IF SOLD

IZI N!;.T c;;AIN

D L.!;SS THAN $0,000 IX! $5,000- $9,999 D s1o.ooo -$24.ss9 0 $25,00(}.-0R MORE

0 NET LOSS

BUSINESS ENTITY

NAME

Conoco Phillips

STOCK HELD OR ACQUIRED BY

IZ] f'ILER D SPOUSE 0 DEPENDENTCHILO __

NUMBER OF SHARES D LESS THAN 100 D 100 TO 499 lZJ 500 TO 999 D 1,000 TO 4,999

0 5,000 TO 9,999 D 10,000 OR

IF SOLD

[ZJ NET GAIN

0 LESS THAN $5,000 D ss,ooo- $9,999 IZl $10,000.$24,999 D MORE

D NET LOSS

BUSINESS ENTITY

NAMe

General Electric Co.

STOCK HELD OR ACQUIRED BY

[ZJ FILER 0 SPOUSE! 0 DEPENDENT CHILD __

NUMBER OF SHARES D LESS THAN 100 D 100 TO 499 IZ.J 500 TO 999 D 1,000T04,999

D 5,000 TO 9,999 D 10,000 OR MORE

IF SOLD

D NET GAIN

D LESS THAN $5,000 1Z1 s5,ooo- $9,999 0 $10,000. $24,999 D $25,000-QR MORE

IZ] NET LOSS

BUSINESS I:NTITY

NAME

Microl;;oft Corp

STOCK HELD OR ACQUIRED BY IZJ FILER D SPOUSE D DEPENDENT CHILD --

NUMBER OF SHARES D LESS THAN 100 D 100T0499 IZJ 500 TO 999 D 1 ,ooo m 4.999

D 5,000 TO 9,999 D 10,000 OR MORE:

IF SOLD

0 NETGAIN

IZJ LESS THAN $5,000 D ss,ooo - $9,999 D $1o.ooo. $24,999 D $25,000--0R MORE

[ZJ NET LOSS

BUSINESS ENTilY

NAME

Multimedia Games Inc.

STOCK HELD OR ACQUIRED BY iZJ FILER D SPOUSE D DEPENDENT CHILD --

NUMBER OF SHARES D LESS THAN 100 D 100T0499 500T0999 D 1 ,000 TO 4,999

D 5,000 TO 9,999 0 10,000 OR MORE

IF SOLD

D NET GAIN

[8J I.F-SS THAN $5,000 D $s,ooo ss,9ss D $1o,ooo. sz4,99s D MORe

IZI NET LOSS

COPY AND ATTACH ADDITIONAL PAGES .AS NECESSARY

TXPI'S Scflworo 1.1.0

Texas Ethics

"

P 0 Box 12070 .. Austin Texas 78711-2070

'

(512)4S:3-5SOO 1-800-325-6506

-

STOCK

PART 2

0 NOT APPLICABLE

List each business entity in which you, your spouse, or a dependent child held or acquired stock during tha calendar year

and the category o'fthe number of shares held or acquired. If some or all of the stock was sold, also indicate the

category of the amount of the nat gain or loss realized from the sale. For more information, see FORM

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate tile child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 BUSINESS ENTITY

NAME

Del Monte Foods Co

2 STOCK HELD OR ACQUIRED BY lZJ FILER D SPOUSE D DEPENDENT CHli.D -

3 NUMBER OF SHARES D LESS THAN 100 0 100TO 499 D SOOTO 999 [ZJ1 ,000 TO

D 5,000 TO 9,999 D 10,000 OR MORE

4 IF SOLD

IZ] NET GAIN

D LESS THAN $5,000 $5,000 $9.999 D $1o,ooo sz4.999 0 $?.t;,OOD-OR MORE

D NET LOSS

BUSINESS ENTITY

NAME

M D U Resources Grp

STOCK HELD OR ACQUIRED BY

IZI FILER D SPOUSE 0 bE:F>ENDENT CHILD

NUMBER OF SHARES D LESS THAN 100 0 100 T0499 D 500T0999 [ZI1 ,000 TO 4,999

0 5,000 TO 9,999 D 10,000 OR

IF SOLD

IZI NET GAIN

D LESS THAN $5,000 1Z1 $s,ooo. $9,999 D $1o,ooo- $24,999 D $25,000-0R MORI;;

D NET LOSS

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

l;o!lworo 1, 1.0

T ex as Ethl c 1 cs ommss1on .0. Sox 12070 Austin, Texas 787112070 (512)463-5800 1-800-32!S-8506

BONDS, NOTES & OTHER COMMERCIAL PAPER

PART 3

0 NOT APPLICABLE

List all bonds, notes and other commercial paper held or acquired by you, your spous1;1, or a dependent child during the

calendar year. If sold, indicate the category of the amount of the net gain or loss realized from the sale. For more

information, see FORM PFSINSTRUCTION GUIDE

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 DESCRIPTION Milwaukee Cnty Wis Go Prom N

OF INSTRUMENT

2 HELD OR ACQUIRED BY

[Z] FILER 0 SPOUSE 0 DEPENDENTCHILD __

3 IF SOLD

D D LESS THAN $5,000 D So,ooo- $g,see D $1o,ooo- $24,999 D $25,000-0R MORF.

D N!:.TLOSS

DESCRIPTION Oklahoma St Wtr Res Brd St l.n Rev Bds

OF INSTRUMENT

HELD OR ACQUIRED BY

IZI FILER D SPOUSE D DEPI;NOENT CHILD --

IF SOLD

0 NET GAIN 0 LESS THAN $5,000 0 $5,000- $9,999 0 $10,000- $24,999 0 $25,oao-OR MORE

D NETLOSS

DESCRIPTION South Carolina Assn Government Cops

OF INSTRUMENT

HELD OR ACQUIRED BY

IZJ 0 SPOUSE; 0 DEPENDENT CHILD

IF SOLD

D NETGAIN 0 LESS THAN S5,000 D $S.Ooo- $9,99g D s1o,ooo- $24,999 0 $25,000-0!=l MORI::

D NET LOSS

COPY AND AITACH ADDITIONAL PAGES AS NECESSARY

TX"PFS Scf1wilfo Vor.:lon 1.1.0

Texas Etnics Commission FI.O. Box 12070 Austin, lexas 78711-2070 1512)46:3-5800 1-800-325-8506

BONDS, NOTES & OTHER COMMERCIAL PAPER

PART 3

0 NOT APPLICABLE

List .all bonds, notes and other commercial paper held or acquired by you, your spouse, or a dependent child during the

calendar year. If sold, Indicate the category of the amount of the net gain or loss realized from the sale. For more

information, see FORM PFS--INSTRUCTION GUIDE

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on tlw Cover Sheet.

1 DESCRIPTION Virginia St Pub Sch Auth Sch Fing

OF INSTRUMENT

2 HELD OR ACQUIRED BY

0 SPOUSE 0 DEPENDENT CHILD __

3 IF SOLD

D NETGAIN 0 LESS THAN $5,000 D $o,ooo -$9,999 D s1o,ooo. $24.999 0 $25,000-0R MORI:

D NET LOSS

DESCRIPTION New York St Environmental Facs Rv Bds

OF INSTRUMENT

HELD OR ACQUIRED BY

IZI FILER D SPOUSE 0 DEPENDENT CHILD --

IF SOLD

0 NET GAIN 0 LESS THAN $5,000 D $o,ooo- $9,999 D s1o,ooo. $24.999 D $25,000--0R MORE

0 NET LOSS

DESCRIPTION Manhattan Kansas Go Bds

OF INSTRUMENT

HELD OR ACQUIRED BY

!Z) FILER D SPOUSE D DEPi:;NDENi CHILD --

IF SOLD

0 NE;TGAIN D LESS THAN $5,000 D $5,ooo- $9,999 0 $10,000-$24,999 D $25,000-0R MORE

D NET I.OSS

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

TX-I'FS ver9lon 1.1.0

Texas E;1hics Commission P.O. Box 17.070 Austin, Texas 78711-2070 (512)463-5800 1-800-325-8506

BONDS, NOTES & OTHER COMMERCIAL PAPER

PART 3

0 NOT APPLICABLE

List bonds, notes other commercial paper held or acquired by you, your spouse, or a dependent child during the

calendar year. If sold, indicate the category of the amount of the net gain or loss realizEld from the sale. For more

information, see FORM PFSINSTRUCTION GUIDE

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child Is listed on the Gover Sheet.

1 DESCRIPTION

OF INSTRUMENT

2 HELD OR ACQUIRED BY

3 IF SOLD

0 NETGAJN

D NETI.OSS

DESCRIPTION

OF INSTRUMENT

HELD OR ACQUIRED BY

IP SOLD

D NET GAIN

0 NET LOSS

Santa Fe NM Cmnty College D Go Bds

IEJ FILER D SPOUSE 0 DEPENDENT CHILD __

D LESS THAN $5,000 D $5,000 "$9,999 D $10,000-$24,999 D $25,000--QR MORE

Beaufort Cnty SC Go Ref Bd

lZJ FILER D 0 DEPENDENTCHil.D --

D LESS THAN $5,000 D $5,000- $9,ggg D $10,000.$24,999 D $25,000-0R MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

TX-PFS SoRwote Vorolon 1.1.0

Texes E:thies Commission P.O. Box 12070 Austin, Texas 787112070 (512}4635800 18003258506

MUTUAL FUNDS

PART 4

0 NOT APPLICABLE

List each fund and the number of shares in that mutual fund that you, your spouse, or a dependent child held or

acquired during the calendar year and indicate the category of the number of shares of mutual funds held or acquired. If

some or all of the shares of a mutual fund were sold, also indicate the category of the amount of the net gain or loss realized

from the sale. For more information, see FORM PFS--INSTRUCTION GUIDE

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child Is listed on the Cover Sheet.

1 MUTUAL FUND

2 SHARES OF MUTUAL FUND

HELD OR ACQUIRED BY

3 NUMBER OF SHARES

OF MUTUAL FUND

4 IF SOLD

D NET GAIN

D NET LOSS

NAME

Schwab Government Money Fd

IZI FILER

0 LESS THAN 100

D 5,000 TO 9,SI99

0 SPOUSE D DEPENDENT CHIL.O --

D 100 TO 499 D 500 TO 999 0 1,000T04,999

[81 10,000 OR. MORE

D LESS THAN $5,000 D $5,000- $9,999 0 $10,000. $24,999 D $25,000--0R MOR.E

COPY AND ATTACH ADDITIONAL AS NECESSARY

TX-PFS Sof!WRn>VArolnn 1,1,0

Texas Ethics Commission P 0 Soli: ' . Austin Texas 78711"2070

'

(512)4635800 18003258506

INCOME FROM INTEREST, DIVIDENDS, ROYALTIES & RENTS

PART 5

0 NOT APPLICABLE

List each source of income you, your spouse, or a dependent child received in excess of $500 that was derived from

interest. dividends, royalties and rents during the calendar year and indicats the category of the amount of the income. For

more information, see FORM PFS-INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 SOURCE OF INCOME

NAME AND ADDRESS

ConocoPhillips

P.O. Box 2197

Houston, TX 77252

2 RECEIVED BY

IZJ D SPOUSE 0 DEPENDENT CHILD __

3 AMOUNT

IZl $500 $4,999 D $S,OOO - $9,999 D $1o,ooo- $24,999 D $25,000--0R MORE

SOURCE OF INCOME

NAME: AND ADDRF.SS

Johnson & Johnson

One Johnson &. Johnson

New Brunswick, NJ 08933

RECEIVED BY

IZI FILER. D SPOUSI: 0 DEPENDENT CHILD __

AMOUNT

lZl $500- $4,999 0 $5,000- $9,999 D $1o.ooo- $24,9ss D $25,000-0R MORE

SOURCE OF INCOME

NAME /\NO ADORE:SS

MKS Natural Gas Co

P.O. Box 1290

Weatherford, TX 76086

RECEIVED BY

IZJ FILER 0 SF'OUSE 0 DEPENDENT CHILD _

AMOUNT

0 $500- 0 $5,000- $9,999 lEI $10,000-$24,999 0 $25,000-0R MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

TX-PFS Soflw"" 1.1 ,0

Texas Ethics Commission P.O. Box 12070 Austin, 78711-2070 (512)4635800 1-800-325-8506

INTERESTS IN BUSINESS ENTITIES

PART 78

0 NOT APPLICABLE

Describe all beneficial interests in business entitles held or acquired by you, your spouse, or a dependent child dvring the

calendar year. If the interest was sold, also indicate the category of the amount of the net gain or toes realized from the sale.

For an explanation of 'beneficial interest' and other specific directions for completing this section, see FORM PFS-

INSTRUCTION GUIDE

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 HELD OR ACQUIRED BY

2 DESCRIPTION

3 IF SOLD

0 NET GAIN

D NF.T LOSS

IZJ FILER

MKS Natural Gas Company

P.O. Box 1209

Weatherford, TX, TX 76086

D SPOUSE 0 DEPENDENT CHILD __

NAME AND ADDRESS

0 (c;hsck If Mclrc.'\:S)

D LESS THAN $5,000 0 $5.000-$9,999 D $10,000-$24,999 0 $25,000-0R MORE;

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

TX-PFS Vn,..lcn 1.1.0

You might also like

- Soal Tes Accounting PT. KKGSDocument7 pagesSoal Tes Accounting PT. KKGSMora SyahroniNo ratings yet

- Joe StackDocument6 pagesJoe Stacknews404397% (59)

- Porter 5 Forces ArticleDocument11 pagesPorter 5 Forces ArticleAndy K DiepNo ratings yet

- Palmares V CA DigestDocument5 pagesPalmares V CA DigestStefan Salvator100% (1)

- RMC 35-06 Clarifying Proper VAT and EWT Treatment of Freight and Other Incidental Charges Billed by Freight ForwardersDocument19 pagesRMC 35-06 Clarifying Proper VAT and EWT Treatment of Freight and Other Incidental Charges Billed by Freight ForwardersPrintet080% (1)

- Executive Branch Personnel PUBLIC FINANCIAL DISCLOSURE REPORTDocument13 pagesExecutive Branch Personnel PUBLIC FINANCIAL DISCLOSURE REPORTtom_scheckNo ratings yet

- Executive Branch Personnel Public Financial Disclosure ReportDocument7 pagesExecutive Branch Personnel Public Financial Disclosure ReportRachel E. Stassen-BergerNo ratings yet

- Gerald Simon PDFDocument16 pagesGerald Simon PDFRecordTrac - City of OaklandNo ratings yet

- OCC Thompson SFIDocument4 pagesOCC Thompson SFInebraskawatchdogNo ratings yet

- Martha C Daughtrey Financial Disclosure Report For 2009Document8 pagesMartha C Daughtrey Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Mitt Romney 2012Document20 pagesMitt Romney 2012OpenSecrets.orgNo ratings yet

- Kenneth M Karas Financial Disclosure Report For 2010Document7 pagesKenneth M Karas Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Henry C Morgan JR Financial Disclosure Report For 2009Document7 pagesHenry C Morgan JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Jefferson Wells Contract With Houston Airport SystemDocument178 pagesJefferson Wells Contract With Houston Airport SystemTexas WatchdogNo ratings yet

- PF FormDocument8 pagesPF FormRohini GhadgeNo ratings yet

- Richard T Haik Financial Disclosure Report For 2009Document11 pagesRichard T Haik Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Oaklanders First - Brown For Mayor 460 - 10-22-06 To 12-31-06 REDACTED PDFDocument3 pagesOaklanders First - Brown For Mayor 460 - 10-22-06 To 12-31-06 REDACTED PDFRecordTrac - City of OaklandNo ratings yet

- Tom Stagg Financial Disclosure Report For 2010Document21 pagesTom Stagg Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Thomas A Varlan Financial Disclosure Report For 2009Document9 pagesThomas A Varlan Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Jose A Fuste Financial Disclosure Report For 2009Document8 pagesJose A Fuste Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Raymond W Gruender Financial Disclosure Report For 2009Document8 pagesRaymond W Gruender Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Dean Whipple Financial Disclosure Report For 2009Document7 pagesDean Whipple Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Michael Bardsley Campaign Finance Report - November 2011Document11 pagesMichael Bardsley Campaign Finance Report - November 2011Adam Rabb CohenNo ratings yet

- Jackson L Kiser Financial Disclosure Report For 2009Document8 pagesJackson L Kiser Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Tim Leonard Financial Disclosure Report For 2009Document8 pagesTim Leonard Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William R Furgeson Financial Disclosure Report For 2009Document9 pagesWilliam R Furgeson Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Stephan P Mickle Financial Disclosure Report For 2009Document7 pagesStephan P Mickle Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- R Fruin Richard LDocument7 pagesR Fruin Richard LmveincenNo ratings yet

- Joseph A DiClerico JR Financial Disclosure Report For 2009Document15 pagesJoseph A DiClerico JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Philip A Brimmer Financial Disclosure Report For 2009Document7 pagesPhilip A Brimmer Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Wesley E Brown Financial Disclosure Report For 2009Document6 pagesWesley E Brown Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Arthur J Gajarsa Financial Disclosure Report For 2009Document12 pagesArthur J Gajarsa Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Amalya L Kearse Financial Disclosure Report For 2009Document6 pagesAmalya L Kearse Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- JR Solomon Oliver Financial Disclosure Report For 2009Document9 pagesJR Solomon Oliver Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Jeremy D Fogel Financial Disclosure Report For 2009Document7 pagesJeremy D Fogel Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Sidney A Fitzwater Financial Disclosure Report For 2009Document9 pagesSidney A Fitzwater Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Harris L Hartz Financial Disclosure Report For 2010Document10 pagesHarris L Hartz Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Joe L Heaton Financial Disclosure Report For 2010Document8 pagesJoe L Heaton Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Kermit E Bye Financial Disclosure Report For 2006Document7 pagesKermit E Bye Financial Disclosure Report For 2006Judicial Watch, Inc.No ratings yet

- Samuel James Otero Financial Disclosure Report For 2010Document11 pagesSamuel James Otero Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- LeRoy Hansen Financial Disclosure Report For 2009Document7 pagesLeRoy Hansen Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Thomas N ONeill JR Financial Disclosure Report For 2009Document6 pagesThomas N ONeill JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Joni Ernst Amended Personal Financial DisclosureDocument6 pagesJoni Ernst Amended Personal Financial DisclosuredmronlineNo ratings yet

- Richard H Kyle Financial Disclosure Report For 2009Document8 pagesRichard H Kyle Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Larry J McKinney Financial Disclosure Report For 2009Document8 pagesLarry J McKinney Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- For Instructions, See Back of Form Form DR-1: De-CC VCL (Document1 pageFor Instructions, See Back of Form Form DR-1: De-CC VCL (Zach EdwardsNo ratings yet

- R Walters MimiDocument19 pagesR Walters MimiCalWonkNo ratings yet

- Leonard E Davis Financial Disclosure Report For 2009Document7 pagesLeonard E Davis Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- John P Gilbert Financial Disclosure Report For 2009Document11 pagesJohn P Gilbert Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Simeon T Lake Financial Disclosure Report For 2009Document9 pagesSimeon T Lake Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Orinda D Evans Financial Disclosure Report For 2009Document6 pagesOrinda D Evans Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Jane R Roth Financial Disclosure Report For 2009Document7 pagesJane R Roth Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Spiegel S Financial Disclosure Report For 2009Document9 pagesSpiegel S Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Robert B Propst Financial Disclosure Report For 2009Document9 pagesRobert B Propst Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Sharon Prost Financial Disclosure Report For 2010Document9 pagesSharon Prost Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Myron H Thompson Financial Disclosure Report For 2010Document14 pagesMyron H Thompson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Azam SwatiDocument30 pagesAzam SwatiPTI OfficialNo ratings yet

- Saxo Bank ApplicationDocument6 pagesSaxo Bank ApplicationWilsonHiewNo ratings yet

- Lawrence J ONeill Financial Disclosure Report For 2010Document19 pagesLawrence J ONeill Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- 2006 05 22 - DR1Document1 page2006 05 22 - DR1Zach EdwardsNo ratings yet

- Michael A Telesca Financial Disclosure Report For 2009Document6 pagesMichael A Telesca Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- James C Turk Financial Disclosure Report For 2009Document7 pagesJames C Turk Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Judge Mary Ann Grilli 2011 Statement of Economic Interests California Form 700: Judge Mary Ann Grilli Santa Clara County Superior Court - Presiding Judge Rise Jones Pinchon - Cleveland State Law Review: Socioeconomic Bias in the Judiciary - California Code of Judicial Ethics Canons 3B(5),(6), 3C(2)(5) Prohibiting Bias Based on Socioeconomic StatusDocument17 pagesJudge Mary Ann Grilli 2011 Statement of Economic Interests California Form 700: Judge Mary Ann Grilli Santa Clara County Superior Court - Presiding Judge Rise Jones Pinchon - Cleveland State Law Review: Socioeconomic Bias in the Judiciary - California Code of Judicial Ethics Canons 3B(5),(6), 3C(2)(5) Prohibiting Bias Based on Socioeconomic StatusCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNo ratings yet

- Speaker Statement On Continuing Budget Negotiations 5 19 11Document1 pageSpeaker Statement On Continuing Budget Negotiations 5 19 11AustinBureauNo ratings yet

- Speaker Statement To House Members 5 16 11Document1 pageSpeaker Statement To House Members 5 16 11AustinBureauNo ratings yet

- January 15 Biden-Reid EventDocument2 pagesJanuary 15 Biden-Reid EventAustinBureauNo ratings yet

- Saark Associates Report For InternshipDocument13 pagesSaark Associates Report For InternshippratikNo ratings yet

- Tanggal Uraian Transaksi Nominal Transaksi SaldoDocument3 pagesTanggal Uraian Transaksi Nominal Transaksi SaldoSalfa Dila RahmantaNo ratings yet

- Statistics Chapter 3Document30 pagesStatistics Chapter 3Ishaan ChotaiNo ratings yet

- Custom Clearnence ProcedureDocument7 pagesCustom Clearnence ProcedureAdeeb AkmalNo ratings yet

- Partnership Agreement TemplateDocument8 pagesPartnership Agreement TemplateMariane Jean Dela CruzNo ratings yet

- Remote Deposit CaptureDocument60 pagesRemote Deposit Capture4701sandNo ratings yet

- Account Statement From 1 Jul 2022 To 31 Dec 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument10 pagesAccount Statement From 1 Jul 2022 To 31 Dec 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAyush RajendraNo ratings yet

- Activity 1.2Document5 pagesActivity 1.2RITIKANo ratings yet

- For Internal Use Only: Bharat Sanchar Nigam LimitedDocument19 pagesFor Internal Use Only: Bharat Sanchar Nigam LimitedGobinda RayNo ratings yet

- The Role of Internal Audit in AntiDocument11 pagesThe Role of Internal Audit in AntiEVERLYNE MUNYIVANo ratings yet

- 6 Deposit ManagementDocument34 pages6 Deposit ManagementNabarun Saha50% (2)

- Internal Control and Firm PerformanceDocument37 pagesInternal Control and Firm PerformancemalikalirazaNo ratings yet

- David York - Sales Management - ResumeDocument2 pagesDavid York - Sales Management - Resumeapi-371388168No ratings yet

- Chief Credit Officer, Chief Risk Officer, Head of Distressed AssDocument3 pagesChief Credit Officer, Chief Risk Officer, Head of Distressed Assapi-79240515No ratings yet

- Description: Tags: 06 Top 100 Current Holders PublicDocument3 pagesDescription: Tags: 06 Top 100 Current Holders Publicanon-603613No ratings yet

- Sales Tax Payment Challan: PSID #: 139351126Document3 pagesSales Tax Payment Challan: PSID #: 139351126solid_impactNo ratings yet

- Project Report On Credit Card1Document4 pagesProject Report On Credit Card1Yug SoniNo ratings yet

- Org Study Canara Bank 150904183048 Lva1 App6892Document81 pagesOrg Study Canara Bank 150904183048 Lva1 App6892shivaraj p yNo ratings yet

- FleetBoston FinancialDocument5 pagesFleetBoston FinancialChris.No ratings yet

- Multiple Choice Question/Answers Introduction To Insurance: Model Questions BankDocument1 pageMultiple Choice Question/Answers Introduction To Insurance: Model Questions BankBhavesh KumarNo ratings yet

- Auditing Theory MULTIPLE CHOICE. Read Carefully The Questions Below and Choose The Best Statement Among The ChoicesDocument12 pagesAuditing Theory MULTIPLE CHOICE. Read Carefully The Questions Below and Choose The Best Statement Among The ChoiceschimchimcoliNo ratings yet

- SCM DeepakDocument12 pagesSCM Deepaksai500No ratings yet

- Chronology of EventsDocument3 pagesChronology of EventsMonicaShayneVillafuerteNo ratings yet

- UBL ReportDocument86 pagesUBL ReportadnanirshadNo ratings yet

- Case 2 PDFDocument3 pagesCase 2 PDFHari KrishnanNo ratings yet

- Islamic Republic of Iran : GeneralDocument15 pagesIslamic Republic of Iran : GeneralSyma BNo ratings yet