Professional Documents

Culture Documents

M13 Pensions

M13 Pensions

Uploaded by

Jimtuttle19Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M13 Pensions

M13 Pensions

Uploaded by

Jimtuttle19Copyright:

Available Formats

M13 Pensions

Defined Benefit Plan Defined Contribution Plan Vested Benefit Obligation Accumulated Benefit Obligation Projected Benefit Obligation Prior Service Cost Methods/ Terminating the Assignment of PSC (1) Expected Years of Service Method (2) Straight-line Basis over Avg. Remaining Service Period

Corridor Approach used to find Excess Amortization of Deferred Gain. - Take 10% of the greater of the F.V. of Plan Assets or PBO If greater subtract that from the 10%() Interest Cost Settlement Rate Beg. PBO Pension Benefit Obligation Contribution Benefits Paid Excess Pension Liability Prepaid Pension Asset Adjustment on Accumulated Other Comprehensive income Pension Cost of Period Fair Value of Plan Assets

Pension Expense/Cost

+ Service Cost + Prior Service Cost Amortization + Interest Cost - Actual Return on Plan Assets +/- Deferred Gain/Loss - Excess Amortization of Deferred G/L - Amortization of Existing Net Obligation/NA@I Net Pension Expense Gains are Subtracted Losses are Added ASPIDER Service Cost What the Actuary told you to set aside Interest Cost Increase in the PBO due to the passage of time. Interest Earnings on the PBO Interest Cost = Beg. PBO X Disc/Settlement Rate Actual Return Amount we wanted, minus because its money we dont have to set aside Deferred Gain/ Unrecognized Pension Gain Difference b/w Actual Return & Expected Return. Deferred G/L = Actual Return Expected Return T-account Plan Assets Beg. PA + Contributions <Benefits Paid> **Actual Return** Ending Plan Assets Expected Return Expected Beg. PA x Expected Rate of Return Pension Expense 5 factors (1) Service Cost (2) Interest on Projected Benefit Obligation (3) Expected Return on Plan Assets (4) Amortization of Unrecognized Prior Service Cost or Credit (5) Effects of Gains and Losses Prior Service Cost Amortization of Prior Service Cost Prior Service Cost/Service Life Amortization of Existing Net Obligation or Net Asset at Implementation ** @ end of year compare the End PBO and FV PA = Target Liability/Asset

Change in the Projected Benefit Obligation

Beg. year PBO + Service Cost + Interest Cost + Prior Service Cost or Credit +/- Actuarial Gain or Loss - Benefits Paid End of Year PBO

Prior Service Cost or Credit From changes to plan in current year in full

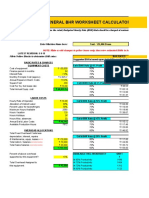

Pension Worksheet

Beginning Balance + Prior Service Cost +Prior Service Cost Amortization + Interest Cost - Actual Return on Plan Assets Amortization of Unrecognized Loss Contribution Def. Tax Adjustment Ending Balance +/-Asset Gain Deferred Journ. Ent [PBO - F.V. PA] Other Comp. Income Pension Liability Unrecognized Prior Service Cost Unrecognized Net Gain or Loss Pension Liability = Unfunded Projected Obligation Adjustment to F/S Debit/Credit to Pension Asset/Liability MEMO Accounts ONLY Dont Make F/S Get Zeroed Out Plan Assets Projected Benefit Obligation

Reconciliation Schedule to Defined Pension Plans

- Benefits Paid - Actual Return on Plan Assets - Contributions by Employer

- Contributions by Plan Participants - Settlements & Divestitures

- Minor Differences, Terminology, Calculations Projected Benefit Obligation - PBO to Calculate PBO

Post Retirement Benefits Other than Pensions

Net Periodic Post Retirement Benefit

GAAP Benefit Years of Service Method - Projected Benefit Obligation IFRS Projected Unit Credit Method - Present Value of the Defined Benefit Obligation

** Input Pension Cost Step (1) Journal Entry Prepaid Pension Cost Pension Expense/Cost Cost Accrued Cost

GAAP Accumulated Benefit Obligation IFRS Accrued Benefit Obligation Pension Cost 50 40 10 IFRS Current Service Cost, Effects of Curtailments/Settlements GAAP Discount Rate = Settlement Rate IFRS Discount Rate = Market Yield of High Quality Corporate Bond @ End Yr IFRS Elect all Actuarial G/L Immediately or Deferred IFRS Can only Net Pension Plan Assets/Liabilities if have legally enforceable right to use other companys assets to settle another GAAP Net Assets and Net Liabilities

T-account Accrued Pension Cost Beg. = 20 (given) Liability = 10 (J.Entry) Excess Adj. = 50 (FIND THIS) Target Liability = 80 (Diff End PBO.FV PA) @ End of Year Compare End PBO > < F.V. Plan Assets Thought Owe 200 > 180 Set Aside = 80 Target Liability in Accrued Pension Cost * Increase Accrued Pension Cost 50, Debit Excess (OCI) Excess Adjustment of PBO over FV Increase Liability, Decrease Equity Excess Adjustment(OCI) Accrued Pension Cost 50 50

Postretirement Health-care Benefits

Per Capita Claims Accumulated other comprehensive income will consist of prior service costs, unamortized gains/losses from changes in actuarial assumptions and differences in the expected versus actual returns on plan assets, and the existing net obnligation or net asset at implementation. AS they are amortized they are removed from other comprehensive income but will not impact the funded status. Service Cost Discounted Present Value of the amount added to planned future retirement pay for this ears work

* Excess Adjustment should be Net of Tax Excess Adjustment(OCI) Deferred Tax Asset Accrued Pension Cost

Deferred Tax Liability

105 45 150

Funded Status of Plan is difference between Ending PBO and Ending Plan Assets. Overfund cannot be netted with Under fund. *Either have a Prepaid or Accrued Pension Cost *Accrued Cost is a Liability either Current or Non Current *Prepaid Pension Cost is always Current Journal Entry to Record Pension Expense OCI (G/L) Pension Expense Cash Pension/Liability OCI (PSC) Debit the Pension Expense after Determining the Change in the PBO Either a Prepaid Pension Cost or Accrued Pension Cost Disclosures Both Overfunded and Underfunded Plans Assets/Liabilities Show Funded Status of Plan

Wiley MCQs

1.2.3.4.5.6.7.11.14.15.19.20

IFRS

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Buckwold 21e - CH 4 Selected SolutionsDocument18 pagesBuckwold 21e - CH 4 Selected SolutionsLucy50% (2)

- Employee Benefits 03Document11 pagesEmployee Benefits 03Nelva Quinio33% (3)

- CFA Level 2 FSADocument3 pagesCFA Level 2 FSA素直和夫No ratings yet

- MFRS 119 Employee BenefitsDocument38 pagesMFRS 119 Employee BenefitsAin YanieNo ratings yet

- IAS 19 - Employee BenefitsDocument1 pageIAS 19 - Employee BenefitsClarize R. MabiogNo ratings yet

- Chapter 6 Emplooyee Benefit Part 2Document8 pagesChapter 6 Emplooyee Benefit Part 2maria isabellaNo ratings yet

- Phuket Beach Hotel: Valuing Mutually Exclusive Capital ProjectsDocument23 pagesPhuket Beach Hotel: Valuing Mutually Exclusive Capital Projectsdarwin_butonNo ratings yet

- Class Case3 - Wake Up and Smell The CoffeeDocument24 pagesClass Case3 - Wake Up and Smell The CoffeeHannahPojaFeria0% (1)

- Pederson CPA Review FAR Notes PensionDocument8 pagesPederson CPA Review FAR Notes Pensionboen jaymeNo ratings yet

- Notes Chapter 6 FARDocument5 pagesNotes Chapter 6 FARcpacfa100% (6)

- Postemployment BenefitsDocument2 pagesPostemployment Benefitsbuenaflorgladys11No ratings yet

- FAR - Post-Employement Employee BenefitsDocument5 pagesFAR - Post-Employement Employee BenefitsJohn Mahatma Agripa100% (1)

- IFRS - IAS19 - Employee BenefitsDocument16 pagesIFRS - IAS19 - Employee BenefitsFendy YamiNo ratings yet

- IFRS - IAS19 - Employee BenefitsDocument16 pagesIFRS - IAS19 - Employee BenefitsPramita RoyNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsJohn Mark FernandoNo ratings yet

- Analysis of Finanacing ActivitiesDocument48 pagesAnalysis of Finanacing ActivitiesPrateek SinglaNo ratings yet

- Unit 7 E-Tutor PresentationDocument18 pagesUnit 7 E-Tutor PresentationKatrina EustaceNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsKezNo ratings yet

- Employee Benefit PlanDocument8 pagesEmployee Benefit PlantinydmpNo ratings yet

- 1FU491 Employee BenefitsDocument14 pages1FU491 Employee BenefitsEmil DavtyanNo ratings yet

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpNo ratings yet

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpNo ratings yet

- Cfas Pas 19Document4 pagesCfas Pas 19Zyribelle Anne JAPSONNo ratings yet

- FARAP-4413 (Post-Employment Benefits)Document5 pagesFARAP-4413 (Post-Employment Benefits)Dizon Ropalito P.No ratings yet

- Employee BenefitsDocument7 pagesEmployee BenefitsJANN HANNAH FAITH CRUTANo ratings yet

- Slide Chapter 3 Analyzing Financing ActivitiesDocument40 pagesSlide Chapter 3 Analyzing Financing ActivitiesardhikasatriaNo ratings yet

- CH20 PDFDocument81 pagesCH20 PDFelaine aureliaNo ratings yet

- Post Employment BenefitsDocument31 pagesPost Employment BenefitsSky SoronoiNo ratings yet

- Employee Benefits Ias19Document42 pagesEmployee Benefits Ias19krishnaguptaNo ratings yet

- IAS 19 Employee Benefits StudentDocument40 pagesIAS 19 Employee Benefits StudentYI WEI CHANGNo ratings yet

- Chapter 17Document11 pagesChapter 17Daniel BalchaNo ratings yet

- Pas 19Document5 pagesPas 19elle friasNo ratings yet

- FARAP-4513 (Post-Employment Benefits)Document5 pagesFARAP-4513 (Post-Employment Benefits)Rinoah Mae OlorosoNo ratings yet

- Frs 119 Employee BenefitDocument54 pagesFrs 119 Employee BenefitNahar SabirahNo ratings yet

- Chapter 03 Analyzing Financing ActivitiesDocument40 pagesChapter 03 Analyzing Financing Activitiesshabrina rNo ratings yet

- SBR - Chapter 5Document6 pagesSBR - Chapter 5Jason KumarNo ratings yet

- Chapter 14 - Post Employment BenefitsDocument4 pagesChapter 14 - Post Employment Benefitslooter198No ratings yet

- Taxation Chapter 4Document8 pagesTaxation Chapter 4Rica CoNo ratings yet

- Defined Benefit Pension PlanDocument2 pagesDefined Benefit Pension PlanAyesha IqbalNo ratings yet

- Dependents or Insurance Companies.: Sharing, Paid Annual Leave, Paid Sick Leave, Non Monetary Benefits)Document3 pagesDependents or Insurance Companies.: Sharing, Paid Annual Leave, Paid Sick Leave, Non Monetary Benefits)Niranjan JainNo ratings yet

- Ia ReportDocument1 pageIa Reportmaubrick khianNo ratings yet

- 29 Ias 19 Employee BenefitsDocument14 pages29 Ias 19 Employee BenefitsSuryaNo ratings yet

- Postemployment BenefitsDocument22 pagesPostemployment BenefitsChoco ButternutNo ratings yet

- Pre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsDocument11 pagesPre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsKristine JarinaNo ratings yet

- Reading 14 - Employee Compensation: Post Employment and Share-BasedDocument6 pagesReading 14 - Employee Compensation: Post Employment and Share-BasedJuan MatiasNo ratings yet

- Liabilities - Debt RestructuringDocument4 pagesLiabilities - Debt RestructuringChinchin Ilagan DatayloNo ratings yet

- Ias 19 Employee BenefitsDocument43 pagesIas 19 Employee BenefitsHasan Ali BokhariNo ratings yet

- Employee Benefits: Retirement PlansDocument28 pagesEmployee Benefits: Retirement Plansbose3508No ratings yet

- REVISION Retirement BenefitsDocument23 pagesREVISION Retirement BenefitsREGINo ratings yet

- IAS 19 Employee BenefitsDocument22 pagesIAS 19 Employee Benefitsanon_419651076No ratings yet

- Contribut Ions To Pension and TrustsDocument3 pagesContribut Ions To Pension and TrustsMiracle GraceNo ratings yet

- IAS 19 Employee BenefitsDocument32 pagesIAS 19 Employee BenefitsTamirat Eshetu WoldeNo ratings yet

- Gross Income Regular Tax: MARCH 2019Document57 pagesGross Income Regular Tax: MARCH 2019tyineNo ratings yet

- Ias 19Document9 pagesIas 19Hammad SarwarNo ratings yet

- Ias 19-Employee BenefitsDocument3 pagesIas 19-Employee Benefitsbeth alviolaNo ratings yet

- Week 1-3Document26 pagesWeek 1-3Aliah OdinNo ratings yet

- IAS 19 - Employee BenefitDocument49 pagesIAS 19 - Employee BenefitShah Kamal100% (2)

- LKAS 19 2021 UploadDocument31 pagesLKAS 19 2021 Uploadpriyantha dasanayake100% (2)

- Accounting For Employee BenefitsDocument2 pagesAccounting For Employee BenefitshoneyNo ratings yet

- Dynamic Risk Assessment Template - SafetyCultureDocument4 pagesDynamic Risk Assessment Template - SafetyCulturebarrfranciscoNo ratings yet

- S 37 L 0Document23 pagesS 37 L 0anon-475496No ratings yet

- 04 Republic v. PNBDocument5 pages04 Republic v. PNBCharles MagistradoNo ratings yet

- Research Paper On Working Capital Management in IndiaDocument4 pagesResearch Paper On Working Capital Management in Indiagepuz0gohew2No ratings yet

- Percentages: Multiple-Choice QuestionsDocument4 pagesPercentages: Multiple-Choice QuestionsJason Lam Lam100% (1)

- Chapter 1 The Accountancy ProfessionDocument7 pagesChapter 1 The Accountancy ProfessionJoshua Sapphire AmonNo ratings yet

- IIMA Ph.D. Prog. Brochure 2022-23Document87 pagesIIMA Ph.D. Prog. Brochure 2022-23Amritesh RayNo ratings yet

- Workfile - ZCDocument25 pagesWorkfile - ZCirshadpp999iNo ratings yet

- AnnuityDocument46 pagesAnnuityJeffreyMitra100% (2)

- Hotel Franchising in Europe The Push Continues For New Ways To Expand 9Document1 pageHotel Franchising in Europe The Push Continues For New Ways To Expand 9wloghuntNo ratings yet

- Blue Print,.... Accunting & FinanceDocument21 pagesBlue Print,.... Accunting & FinanceRobel Addis100% (9)

- Luxury in France Mazars Survey 2014 25092014 PDFDocument56 pagesLuxury in France Mazars Survey 2014 25092014 PDFfaizan iqbalNo ratings yet

- Instructions For Completing Form 4506-C (Individial Taxpayer)Document1 pageInstructions For Completing Form 4506-C (Individial Taxpayer)GlendaNo ratings yet

- Chapter 06 - Merchandising ActivitiesDocument114 pagesChapter 06 - Merchandising ActivitiesElio BazNo ratings yet

- Midterm L3L4Document2 pagesMidterm L3L4Nicole LukNo ratings yet

- Alternative Capital Sources For Social EnterprisesDocument12 pagesAlternative Capital Sources For Social EnterprisesADBSocialDevelopmentNo ratings yet

- Bretton Wood SystemDocument17 pagesBretton Wood SystemUmesh Gaikwad0% (1)

- Retained Earnings: Appropriation and Quasi-ReorganizationDocument25 pagesRetained Earnings: Appropriation and Quasi-ReorganizationtruthNo ratings yet

- Extinguishment of Obligations: General ProvisionsDocument72 pagesExtinguishment of Obligations: General ProvisionsSergio ConjugalNo ratings yet

- General BHR Worksheet CalculatorDocument2 pagesGeneral BHR Worksheet CalculatorEmba MadrasNo ratings yet

- 2008 L2 Mock01 - QDocument46 pages2008 L2 Mock01 - QRavi RanjanNo ratings yet

- Madhucon Projects Result UpdatedDocument14 pagesMadhucon Projects Result UpdatedAngel BrokingNo ratings yet

- Cryptocurrency - A New Investment OpportunityDocument26 pagesCryptocurrency - A New Investment OpportunityMohd. Anisul IslamNo ratings yet

- Wei Peng Handbook-of-quantitative-finance-and-risk-management-2010-Chap 92Document17 pagesWei Peng Handbook-of-quantitative-finance-and-risk-management-2010-Chap 9220222991No ratings yet

- Unicorn ValuationDocument12 pagesUnicorn ValuationTony TranNo ratings yet

- Proabg Project Financial FreedomDocument32 pagesProabg Project Financial FreedomUttam Manas100% (1)

- Automation, Manual & Computerised AccountingDocument16 pagesAutomation, Manual & Computerised AccountingAayush AnandNo ratings yet

- Asian Life InsDocument34 pagesAsian Life InsLaxman Thapa100% (1)