Professional Documents

Culture Documents

Bank of Kigali Announces Q1 2010 Results

Bank of Kigali Announces Q1 2010 Results

Uploaded by

Bank of KigaliOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank of Kigali Announces Q1 2010 Results

Bank of Kigali Announces Q1 2010 Results

Uploaded by

Bank of KigaliCopyright:

Available Formats

BANQUE DE KIGALI S.A.

Your trusted partner in wealth creation

Kigali, 29 July 2010

562.3 RwF/US$ Period End Exchange Rate as at 31 March 2010 560.2 RwF/US$ Period End Exchange Rate as at 31 December 2009 558.8 RwF/US$ Period End Exchange Rate as at 31 March 2009

Bank of Kigali Announces Q1 2010 Audited Results Q1 2010 US$ 8.2 3.6 4.6 2.1 1.5 Change Q-o-Q 16% 26% 9% 221% -35% Change YTD 2% 10% 4% 4% -9%

Millions, unless otherwise noted Total Operating Income (Revenue) Total Recurring Operating Costs Profit Before Provisions Net Provision Expense Net Income (Loss)

RwF 4,595 2,038 2,557 1,203 850

Y-o-Y 29% 64% 10% 785% -39%

Total Assets Net Loans Client Deposits Total Liabilities Shareholders' Equity

As at 31 March 2010 US$ RwF 278.4 156,527 150.3 84,517 202.2 113,727 243.9 137,137 34.5 19,390 As at 31 March 2010 54.0% 74.3% 7.8% 75.6% 2.2% 16.8%

Y-o-Y 27% 18% 30% 30% 11%

Net Loans/Total Assets Net Loans/Client Deposits NPLs/Gross Loans NPL Coverage Ratio ROAA, annualised ROAE, annualised

As at 31 December 2009 50.4% 70.5% 7.1% 58.3% 3.8% 26.9%

Bank of Kigali (the Bank), the leading bank in Rwanda, announced today its audited, non-IFRS results, reporting Net Income of RwF 850 million (US$1.5 million) in Q1 2010. Total Operating Income (Revenue) reached RwF 4,595 million in Q1 2010, up 16.0% q-o-q and 28.5% y-o-y. Net Fee & Commission Income amounted to RwF 191 million in Q1 2010, up 202.7% q-o-q and 310.6% y-o-y. Net Interest Income equalled RwF 2,770 million in Q1 2010, up 7.7% q-o-q and 17.9% y-o-y. Total Recurring Operating Costs grew by 25.9% q-o-q and 63.8% y-o-y to RwF 2,038 in Q1 2010. Cost/Income ratio reached 46.8% in Q1 2010, up from 40.9% in Q4 2009 and 34.8% in Q1 2009. Annualised ROAA reached 2.2% in Q1 2010, whereas annualised ROAE equalled 16.8% in Q1 2010.

About Bank of Kigali Established in 1966, Bank of Kigali is the largest bank in Rwanda by total assets, with a 27% market share as of 31 December 2009 The Bank today has 24 branches in Rwanda and provides commercial banking services to approximately 35,856 individuals and 3,549 legal entities. For further information, please visit www.bk.rw or contact: Frances Ihogoza Head of Corporate Affairs/Company Secretary Tel: +250 252 593 100 or +250 252 593 200 Fax: +250 252 575 504 or +250 252 573 461 Email: fihogoza@bk.rw SWIFT: BKIGRWRW R.C. A 019 Kigali TIN n 10.000.3458 B.P. 175 - KIGALI Parcelle 6112, Avenue de la Paix Kigali (Rwanda)

BANQUE DE KIGALI S.A.

Your trusted partner in wealth creation

Kigali, 29 July 2010

Total Assets grew by 2.3% q-o-q and 26.9% y-o-y, reaching RwF 156,527 million as at 31 March 2010. Net Loans grew by 9.6% q-o-q (18.1% y-o-y) and amounted to RwF 84,517 million as at 31 March 2010. Client Deposits reached RwF 113,727 million, up 4.1% q-o-q and 29.5% y-o-y. Net Loans/Total Assets ratio stood at 54.0% as at 31 March 2010 vs. 50.4% as at YE 2009 and 58.0% as at 31 March 2009. Net Loans/Client Deposits ratio reached 74.3% as at 31 March 2010 vs. 70.5% as at YE 2009 and 81.5% as at 31 March 2009. I am pleased that the Bank is growing its balance sheet especially in the loans and deposits. Although the growth will assert pressure on profitability, I am particularly pleased with the growth achieved in our Net Fee and Commission Income, commented James Gatera, Chief Executive Officer.

Q1 2010 Performance Highlights Total Operating Income

RwF millions 5,000 4,500 4,595 RwF millions 2,500 2,038

Recurring Operating Costs

4,000 3,500

3,000 2,500 2,000 1,500 1,000 500 -

3,962

3,577

2,000

1,620 1,500 1,000 500 -

1,244

Q1 2009

Q4 2009

Q1 2010

Q1 2009

Q4 2009

Q1 2010

Net Income

RwF millions 1,600 1,400 1,200 1,000 800 600 850 1,382 RwF millions 180,000

Total Assets

156,527

1,296

160,000 140,000 120,000 100,000 80,000 60,000 123,316

153,022

400 200

Q1 2009 Q4 2009 Q1 2010

40,000 20,000

Q1 2009 Q4 2009 Q1 2010

Net Loans

RwF millions 90,000 80,000 70,000 60,000 50,000 40,000 30,000 77,096 71,550 100,000 80,000 60,000 40,000 87,818 84,517 RwF millions 120,000

Client Deposits

109,282 113,727

20,000 10,000

Q1 2009 Q4 2009 Q1 2010

20,000

Q1 2009 Q4 2009 Q1 2010

BANQUE DE KIGALI S.A.

Your trusted partner in wealth creation

Kigali, 29 July 2010

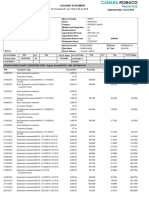

Q1 2010 INCOME STATEMENT

Q1 2010 RwF millions, unless otherwise noted Interest Income Interest Expense Net Interest Income Fee & Commission Income Fee & Commission Expenses Net Fee & Commission Income Income From Documentary Operations Expense On Documentary Operations Net Income From Documentary Operations Other Non-Interest Income Other Non-Interest Expense Net Other Non-interest Income FX Trading Income Net Non-Interest Income Total Operating Income Overseas Directors Remuneration Local Directors Remuneration Personnel Costs Other Operating Expenses Depreciation Total Recurring Operating Costs Profit Before Provisions Loan Loss Provisions & Provision On Other Assets Gains On Asset Sale & Recovery Net Provisions Net Profit Before Tax Bonuses (Paid & Accrued) Accrued Or Paid Income Tax Net Income US$ 6.8 1.9 4.9 0.3 0.3 0.1 RwF 3,816 1,047 2,769 191 191 48 US$ 6.1 1.5 4.6 0.2 0.2 0.1 RwF 3,395 853 2,542 92 92 48 US$ 5.1 1.0 4.1 0.1 0.1 0.1 RwF 2,923 595 2,328 69 69 48 Q4 2009 Q1 2009 Q-o-Q Change 12.4% 27.1% 7.7% 107.7% NMF 202.7% 1.0% NMF 1.0% 11.8% NMF 16.5% 28.2% 31.3% 16.0% -37.6% -74.5% 83.1% -8.8% -8.1% 25.9% 9.1% 17.1% NMF 221.0% -31.2% -13.6% -27.6% -34.5% Y-o-Y Change 30.60% 82.60% 17.90% 177.30% NMF 310.60% -0.10% NMF -0.10% 20.50% NMF 23.70% 50.40% 48.70% 28.50% NMF 70.60% 90.10% 42.70% 19.80% 63.80% 9.60% 53.2% NMF 785.2% -38.4% -13.9% -42.8% -38.5%

0.1 1.0 1.0 1.9 3.3 8.2 2.0 1.2 0.4 3.6 4.6 2.1 2.1 2.4 0.2 0.7 1.5

48 541 541 1,046 1,826 4,595 18 1 1,139 672 208 2,038 2,557 1,203 1,203 1,354 114 390 850

0.1 0.9 0.9 1.5 2.7 7.3 0.1 1.1 1.3 0.4 2.9 4.4 1.8 1.2 0.7 3.5 0.2 1.0 2.3

48 484 19 465 815 1,420 3,962 29 6 622 737 226 1,620 2,342 1,027 652 375 1,967 132 539 1,296

0.1 0.8 0.8 1.2 2.2 6.3 1.1 0.8 0.3 2.2 4.1 1.4 1.1 0.2 3.9 0.2 1.2 2.4

48 449 12 437 695 1,249 3,577 1 599 471 173 1,244 2,333 785 649 136 2,197 132 682 1,383

Notes: (1) Growth calculations are based on RwF values (2) US$ values have been derived from period-end RwF/US$ exchange rates set out on page 1 of this news report

BANQUE DE KIGALI S.A.

Your trusted partner in wealth creation

Kigali, 29 July 2010

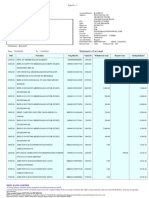

Q1 2010 BALANCE SHEET

Q1 2010 RwF millions, unless otherwise noted Cash Balances With BNR Cash Balances With Banks Treasuries Other Fixed Income Instruments Gross Loans Net Loans To Clients Net Investments Net Property, Plant & Equipment Net Intangible Assets Net Other Assets Total Assets Interbank Deposits Client Deposits Borrowed Funds Payable Interest & Dividends Other Liabilities Total Liabilities Ordinary Shares Retained Earnings Revaluation Reserve Net Income Shareholder's Equity Total liabilities & Shareholders' Equity US$ 9.2 7.9 43.9 31.0 14.5 159.0 150.3 0.6 11.4 0.1 9.6 278.4 21.0 202.2 4.7 15.9 243.9 8.9 24.1 1.5 34.5 278.4 RwF 5,148 4,430 24,686 17,410 8,158 89,410 84,517 340 6,386 45 5,407 156,527 11,812 113,727 2,643 8,954 137,137 5,005 13,535 850 19,390 156,527 US$ 8.3 6.1 3.7 75.7 22.0 144.5 137.6 0.6 11.4 0.1 7.9 273.2 27.0 195.1 13.3 235.4 8.9 26.6 2.3 37.8 273.2 RwF 4,624 3,399 2,066 42,389 12,313 80,914 77,096 340 6,358 34 4,404 153,022 15,104 109,282 7,452 131,838 5,005 14,882 1,297 21,184 153,022 US$ 7.7 10.6 6.8 38.4 7.9 138.0 125.5 0.6 10.3 0.0 8.6 216.3 19.9 154.0 11.8 185.7 8.8 19.1 2.7 30.5 216.3 RwF 4,369 6,033 3,883 21,889 4,495 78,671 71,550 340 5,847 15 4,895 123,316 11,341 87,818 6,744 105,904 5,005 10,892 1,515 17,412 123,316 Q4 2009 Q1 2009 YTD Change 11.3% 30.3% 1094.9% -58.9% -33.7% 10.5% 9.6% 0.0% 0.4% 32.6% 22.8% 2.3% -21.8% 4.1% NMF NMF 20.2% 4.0% 0.0% -9.0% NMF -34.5% -8.5% 2.3% Y-o-Y Change 17.8% -26.6% 535.7% -20.5% 81.5% 13.7% 18.1% 0.0% 9.2% 195.5% 10.5% 26.9% 4.2% 29.5% NMF NMF 32.8% 29.5% 0.0% 24.3% NMF -43.9% 11.4% 26.9%

Notes: (1) Growth calculations are based on RwF values (2) US$ values have been derived from period-end RwF/US$ exchange rates set out on page 1 of this news report

BANQUE DE KIGALI S.A.

Your trusted partner in wealth creation

Kigali, 29 July 2010

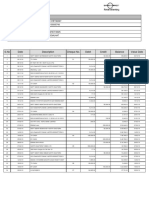

KEY RATIOS Profitability Return On Average Assets, Annualised,% Return On Average Equity, Annualised, % Net Interest Margin, Annualised, % Loan Yield, Annualised, % Interest Expense/Interest Income, % Cost Of Funds, Annualised, % Net Fee & Commission Income/Total Operating Income, % Net Fee & Commission Income/Average Total Assets, % Annualised Net Non-Interest Income/Total Operating Income,% Efficiency Cost To Income, % Cost/Average Total Assets, Annualised Overhead to Total Operating Income Personnel Costs/Average Total Assets, %, Annualised Personnel Costs/Total Recurring operating costs, % Personnel Costs/Total Operating Income, % Net Income/Total Operating Income, % Liquidity Net Loans/Total Assets,% Average Net Loans/Average Total Assets, % Net Loans/Client Deposits, % Average Net Loans/Average Client Deposits, % Net Loans/Total Deposits, % Net Loans/Total Liabilities, % Time Deposits/Client Deposits,% Current Account Balances/Client Deposits, % Client Deposits/Total Deposits,% Interest Earning Assets/Total Assets,% Average Interest Earning Assets/Average Total Assets,% Liquid Assets/Total Assets,% Liquid Assets/Total Liabilities,% Client Deposits/Total Assets,% Total Deposits/Total Assets Total Deposits/Total Liabilities,% Client Deposits/Shareholders' Equity (Times) Short-Term Liquidity Gap Liquid Assets / Total Deposits Interbank Borrowings / Total Deposits BNR Borrowings / Total Deposits Gross Loans / Total Deposits Q1 2010 2.2% 16.8% 10.0% 17.9% 27.4% 3.1% 4.1% 0.5% 39.7% Q1 2010 46.8% 5.6% 36.5% 3.0% 56.84% 25.21% 18.50% Q1 2010 54.0% 52.2% 74.3% 72.5% 67.3% 61.6% 24.0% 1.4% 90.6% 86.1% 87.5% 33.01% 36.65% 72.66% 80.20% 91.54% 5.9 14.0% 66.0% 9.41% 0.0% 71.22% Q4 2009 3.8% 26.9% 9.7% 17.0% 24.3% 2.8% 1.6% 0.2% 35.1% Q4 2009 40.9% 4.7% 32.4% 1.9% 40.5% 16.6% 32.7% Q4 2009 50.4% 53.8% 70.5% 75.4% 62.0% 58.5% 27.4% 1.3% 87.9% 87.5% 88.5% 34.29% 43.1% 71.4% 81.3% 94.3% 5.2 29.6% 73.0% 12.1% 0.0% 65.1% Q1 2009 4.5% 33.2% 9.9% 14.8% 19.6% 2.2% 1.3% 0.2% 34.3% Q1 2009 34.8% 4.1% 26.7% 2.0% 48.2% 16.8% 38.6% Q1 2009 58.0% 58.6% 81.5% 79.4% 72.2% 67.6% 25.4% 0.0% 88.6% 82.6% 90.1% 29.33% 28.6% 71.2% 80.4% 93.6% 5.0 16.0% 63.8% 11.4% 0.0% 79.3%

BANQUE DE KIGALI S.A.

Your trusted partner in wealth creation

Kigali, 29 July 2010

KEY RATIOS CONTINUED Asset Quality NPLs / Gross Loans, % Provisions / NPLs Fixed Assets / Core Capital Large Exposures / Gross Loans Shareholders' Equity/Net Loans, % Cost Of Risk, Annualised, % Leverage (Total Liabilities/Equity), Times Capital Adequacy Core Capital / Risk Weighted Assets Total Qualifying Capital / Risk Weighted Assets Off Balance Sheet Items / Total Qualifying Capital Large Exposures / Core Capital NPLs Provisions / Core Capital Market Sensitivity Forex Exposure / Core Capital Forex Loans / Forex Deposits Forex Assets / Forex Liabilities Selected Operating Data Full Time Employees (FTEs) Assets per FTE (RwF 000s) Number of Active Branches Number of ATMS Number of POS Terminals Q1 2010 7.78% 75.56% 33.9% 12.4% 22.94% 5.65% 7.1 Q1 2010 17.7% 17.7% 441.5% 58.5% 24.0% Q1 2010 7.9% 1.0% 104.4% Q1 2010 370 423,046 19 6 60 Q4 2009 7.1% 58.3% 35.4% 12.3% 27.5% 1.9% 6.2 Q4 2009 16.9% 16.9% 425.8% 55.3% 17.7% Q4 2009 -5.4% 0.9% 97.3% Q4 2009 303 505,024 19 6 54 Q1 2009 11.7% 77.6% 35.5% 12.7% 24.3% 0.7% 6.1 Q1 2009 15.7% 15.7% 443.4% 60.3% 33.0% Q1 2009 0.3% 0.9% 100.2% Q1 2009 318 387,787 12 6 42

BANQUE DE KIGALI S.A.

Your trusted partner in wealth creation

Kigali, 29 July 2010

Ratio Definitions 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Return On Average Total Assets (ROAA) equals Net Income of the period divided by average Total Assets for the same period; Return On Average Total Equity (ROAE) equals Net Income of the period divided by average Total Shareholders Equity for the same period; Average Interest Earning Assets are calculated on a quarterly basis; Interest Earning Assets include: Cash & Balances With Banks, Treasuries and Net Loans To Clients; Net Interest Margin equals Net Interest Income of the period divided by Average Interest Earning Assets for the same period; Loan Yield equals Interest Income of the period divided by average Gross Loans for the same period; Cost Of Funds equals Interest Expense of the period divided by average Total Liabilities for the same period; Total Operating Income includes Net Interest Income and Non-Interest Income; Cost/Income equals Total Recurring Operating Costs plus Net Non-Recurring Costs of the period divided by Total Operating Income; Client Deposits include Corporate and Retail deposits; Total Deposits include Interbank Deposits and Client Deposits; Shareholders Equity equals to Total Shareholders Equity; NPLs are loans overdue by more than 90 days; NPL Coverage ratio equals Loan Loss Reserve as of the period end divided by NPLs as of the same date; Cost Of Risk equals Net Provision For Loan Losses of the period, plus provisions for (less recovery of) other assets, divided by average Gross Loans To Clients for the same period; Total Capital Adequacy equals Total Capital as of the period end divided by Total Risk Weighted Assets as of the same date, both calculated in accordance with the requirements of the National Bank of Rwanda.

You might also like

- Payslip LIM559 13082019Document1 pagePayslip LIM559 13082019SonuNo ratings yet

- Arun B KadamDocument3 pagesArun B KadamRohit KumardeyNo ratings yet

- DP 40116969 01022021 28022021Document2 pagesDP 40116969 01022021 28022021Nirav ChauhanNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLoan starNo ratings yet

- Account Statement-1603759922693Document3 pagesAccount Statement-1603759922693Fanny Ardhitunggal HakimNo ratings yet

- Account Statement: Date Value Date Description Cheque Deposit Withdrawal BalanceDocument1 pageAccount Statement: Date Value Date Description Cheque Deposit Withdrawal BalanceJagannath MandalNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHEES GPT NZB 005No ratings yet

- Central Recordkeeping AgencyDocument3 pagesCentral Recordkeeping AgencyAnuj SoniNo ratings yet

- Account Statement From 1 Dec 2020 To 20 Jan 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 1 Dec 2020 To 20 Jan 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceNiranjanPandeyNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLohit MataniNo ratings yet

- AXIS BANK Statement for August 2018-अनलॉक की हुईDocument2 pagesAXIS BANK Statement for August 2018-अनलॉक की हुईRaj Bihari RajakNo ratings yet

- Comm G198327 03012022Document2 pagesComm G198327 03012022MUTHYALA NEERAJANo ratings yet

- Statement of Account: State Bank of IndiaDocument10 pagesStatement of Account: State Bank of IndiaChandrasekar SekarNo ratings yet

- Statement Feb 21 XXXXXXXX7571Document4 pagesStatement Feb 21 XXXXXXXX7571Achilles AbhimanyuNo ratings yet

- Acct Statement XX6194 28072023Document4 pagesAcct Statement XX6194 28072023Mohammad Sharafat KhanNo ratings yet

- Address:: Account Statement For The Period 01 Jan 1900 To 20 Feb 2017Document2 pagesAddress:: Account Statement For The Period 01 Jan 1900 To 20 Feb 2017shalu haiderNo ratings yet

- 01 Aug 2011 To 31 Oct 2011Document1 page01 Aug 2011 To 31 Oct 2011Pradeep ChauhanNo ratings yet

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument2 pagesStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits Balancech shanmugamNo ratings yet

- Statement of Account: State Bank of IndiaDocument9 pagesStatement of Account: State Bank of IndiaBhati HusenshaNo ratings yet

- Acctstmt LDocument3 pagesAcctstmt LIshwaryaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument34 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMehndi HasanNo ratings yet

- Loan Account Statement For LUCHD00037184487Document4 pagesLoan Account Statement For LUCHD00037184487abhishek parasarNo ratings yet

- 546602010003219Document27 pages546602010003219PriyankaNo ratings yet

- K SSG 9 Ob HZGN 9 o YxbDocument14 pagesK SSG 9 Ob HZGN 9 o Yxbdhivya sNo ratings yet

- EMIloan PDFDocument2 pagesEMIloan PDFZeubayr KabliNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument57 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNagendrababu VasaNo ratings yet

- State Bank of India PDFDocument2 pagesState Bank of India PDFJayesh RavalNo ratings yet

- Unit Holder Previleges: Account Statement 3192455114 Folio NumberDocument2 pagesUnit Holder Previleges: Account Statement 3192455114 Folio NumberDheeraj SharmaNo ratings yet

- Booking DetailsDocument1 pageBooking DetailsBaren RoyNo ratings yet

- Op Transaction History 04!07!2023Document13 pagesOp Transaction History 04!07!2023Sachin PatelNo ratings yet

- Please Check This Account Statement and Call Us at 1-888-424-2422 Immediately If You Find Any DiscrepancyDocument2 pagesPlease Check This Account Statement and Call Us at 1-888-424-2422 Immediately If You Find Any DiscrepancySonuNo ratings yet

- Statement 6590792236 20220613 152348 8Document1 pageStatement 6590792236 20220613 152348 8mohamed arabathNo ratings yet

- AccountStatement 80030597571 Apr11 112730Document2 pagesAccountStatement 80030597571 Apr11 112730Shivaji KokaneNo ratings yet

- Jan2017Document4 pagesJan2017mageshminiNo ratings yet

- 1569389513913Document3 pages1569389513913sanddepiNo ratings yet

- Fastag E-Statement: Customer Details Bank DetailsDocument2 pagesFastag E-Statement: Customer Details Bank DetailsKunjemy EmyNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument6 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMahi ThakurNo ratings yet

- PDFDocument3 pagesPDFRamesh UpadhyaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument10 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceram kumarNo ratings yet

- Ref - No. 2203166-16309213-4: Prashant KaushikDocument4 pagesRef - No. 2203166-16309213-4: Prashant KaushikVicky GunaNo ratings yet

- Estatement PDFDocument4 pagesEstatement PDFDhanapan KeithellakpamNo ratings yet

- Deepak ComputationDocument3 pagesDeepak ComputationRavi YadavNo ratings yet

- PDFDocument1 pagePDFAnkit JainNo ratings yet

- Acct Statement - XX6002 - 22112023Document23 pagesAcct Statement - XX6002 - 22112023sanchitNo ratings yet

- 1 1 PDFDocument6 pages1 1 PDFKarthik Clinical LabNo ratings yet

- Acct Statement - XX6268 - 13062023Document11 pagesAcct Statement - XX6268 - 13062023Rishi AgarwalNo ratings yet

- Detailed StatementDocument2 pagesDetailed StatementEr. Rajesh ChatterjeeNo ratings yet

- My - Statement - 12 Jan, 2022 - 18 Jan, 2022 - 9880560175Document5 pagesMy - Statement - 12 Jan, 2022 - 18 Jan, 2022 - 9880560175Sunanda BidariNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument6 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancemr. NaveenNo ratings yet

- 2A. HDFC May2018 EstatementDocument7 pages2A. HDFC May2018 EstatementNanu PatelNo ratings yet

- 1564265508256Document7 pages1564265508256siddhesh yewaleNo ratings yet

- BankStatement 3326083Document1 pageBankStatement 3326083Mmatjie caswellNo ratings yet

- Subrata Dhara Paytm StatementDocument2 pagesSubrata Dhara Paytm StatementShúbhám ChoúnipurgéNo ratings yet

- Folio 2430437 82 AllMonthsDocument4 pagesFolio 2430437 82 AllMonthsPravin AwalkondeNo ratings yet

- Acct Statement - XX6097 - 06042023Document5 pagesAcct Statement - XX6097 - 06042023SAGAR STATIONERYNo ratings yet

- Acct Statement XX2856 09062023Document19 pagesAcct Statement XX2856 09062023debsudipto93No ratings yet

- United Bank of India HO: 11, Hemanta Basu Sarani, Kolkata 700001 Internet BankingDocument3 pagesUnited Bank of India HO: 11, Hemanta Basu Sarani, Kolkata 700001 Internet Bankingrajeshroy1No ratings yet

- 1574317819091Document17 pages1574317819091JohnsonNo ratings yet

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlNo ratings yet

- Bank of IndiaDocument12 pagesBank of IndiaAngel BrokingNo ratings yet

- Bank of Kigali Investor Presentation 1H2012Document44 pagesBank of Kigali Investor Presentation 1H2012Bank of KigaliNo ratings yet

- Bank of Kigali Investor Presentation Q1 & 3M 2012Document43 pagesBank of Kigali Investor Presentation Q1 & 3M 2012Bank of Kigali100% (1)

- Bank of Kigali Receives Best East African BankDocument1 pageBank of Kigali Receives Best East African BankBank of KigaliNo ratings yet

- 2011 Annual ReportDocument96 pages2011 Annual ReportOsman SalihNo ratings yet

- Bank of Kigali Annual Report 2010Document92 pagesBank of Kigali Annual Report 2010Bank of Kigali0% (3)

- Bank of Kigali Limited: Financially Transforming LivesDocument3 pagesBank of Kigali Limited: Financially Transforming LivesBank of KigaliNo ratings yet

- Bank of Kigali Annual Report 2009Document80 pagesBank of Kigali Annual Report 2009Bank of KigaliNo ratings yet

- Bank of Kigali Announces Q2 2011 & 1H 2011 ResultsDocument9 pagesBank of Kigali Announces Q2 2011 & 1H 2011 ResultsBank of KigaliNo ratings yet

- Bank of Kigali 2010 9M 2010 Results UpdateDocument59 pagesBank of Kigali 2010 9M 2010 Results UpdateBank of KigaliNo ratings yet

- Bank of Kigali 1H 2010 Results UpdateDocument48 pagesBank of Kigali 1H 2010 Results UpdateBank of KigaliNo ratings yet

- Speakout Vocabulary Extra Intermediate Plus Unit 6Document3 pagesSpeakout Vocabulary Extra Intermediate Plus Unit 6Geronimo A100% (1)

- Gleim CIA Review - Part 3: Changes To CIA Exam Effective January 1, 2012Document3 pagesGleim CIA Review - Part 3: Changes To CIA Exam Effective January 1, 2012Ahmed Adel Attiya100% (1)

- Officer International TaxationDocument19 pagesOfficer International TaxationIsaac OkengNo ratings yet

- 120 Câu Tìm Từ Đồng Nghĩa-Trái Nghĩa-Dap AnDocument9 pages120 Câu Tìm Từ Đồng Nghĩa-Trái Nghĩa-Dap AnAlex TranNo ratings yet

- Spelling PDFDocument36 pagesSpelling PDFHelen Salazar Sagastegui100% (4)

- DlcoDocument49 pagesDlcoCristina RaduleaNo ratings yet

- Interjection: Law Kai Xin Chiew Fung LingDocument17 pagesInterjection: Law Kai Xin Chiew Fung LingLaw Kai XinNo ratings yet

- SCM How Could A Grocery Retailer Use InvDocument3 pagesSCM How Could A Grocery Retailer Use InvNAYOKO PRASETYO JATINo ratings yet

- DQ Ensorcelements EnchantmentsDocument2 pagesDQ Ensorcelements EnchantmentsTracy BloomNo ratings yet

- Acetonitrile 0260E-CHBDocument1 pageAcetonitrile 0260E-CHBVeralord De VeraNo ratings yet

- Psychological Assessment of Trauma Survivors: January 2011Document21 pagesPsychological Assessment of Trauma Survivors: January 2011abcdNo ratings yet

- BESO2D Getting StartedDocument13 pagesBESO2D Getting StartedPanji Ginaya TaufikNo ratings yet

- Privilege 11 - Vocabulary and Phrasal VerbsDocument19 pagesPrivilege 11 - Vocabulary and Phrasal VerbsEdanur ŞahanNo ratings yet

- Cognitive Dissonance TheoryDocument3 pagesCognitive Dissonance TheoryJelena RodicNo ratings yet

- Aced SNFDocument12 pagesAced SNF김성곤No ratings yet

- Marma PointsDocument4 pagesMarma PointsArivalzakan Muthusamy100% (1)

- The Relationship Between Transformational Leadership and Organizational Commitment: A Study On The Bank EmployeesDocument13 pagesThe Relationship Between Transformational Leadership and Organizational Commitment: A Study On The Bank EmployeesgedleNo ratings yet

- 6.5 - Pie ChartDocument7 pages6.5 - Pie ChartKhánh An VũNo ratings yet

- Communication and GlobalizationDocument14 pagesCommunication and GlobalizationJOHN LEE VALDEZNo ratings yet

- For Management Quota Seats in Minority / Non-Minority Self Financing CollegesDocument30 pagesFor Management Quota Seats in Minority / Non-Minority Self Financing Collegesmaruthuvan's vlogNo ratings yet

- Mass Interview ProgrammeDocument2 pagesMass Interview ProgrammeVISHRANTI M NNo ratings yet

- Mapeh 10 1 Grading Examination: E. Modern NationalismDocument3 pagesMapeh 10 1 Grading Examination: E. Modern NationalismMildred Abad SarmientoNo ratings yet

- School Supplies For Immokalee: Dr. Hayes Wicker Senior PastorDocument2 pagesSchool Supplies For Immokalee: Dr. Hayes Wicker Senior PastorFirst Baptist Church NaplesNo ratings yet

- Instant Download Solution Manual For Human Anatomy Laboratory Manual With Cat Dissections 7 e 7th Edition PDF ScribdDocument32 pagesInstant Download Solution Manual For Human Anatomy Laboratory Manual With Cat Dissections 7 e 7th Edition PDF Scribdkathleenbaileytcgsrikobx100% (18)

- Newton's Law of Cooling EquationDocument4 pagesNewton's Law of Cooling EquationnishagoyalNo ratings yet

- Aug2009 Management AccountantDocument80 pagesAug2009 Management AccountantPrashant VazeNo ratings yet

- Resume As Brgy. SecDocument3 pagesResume As Brgy. SecShelly GumiyaoNo ratings yet

- BankDocument1 pageBankFabricio TrulloNo ratings yet

- International Economics and Trade Theory Chapter 15 QuizDocument3 pagesInternational Economics and Trade Theory Chapter 15 QuizMeghana1205No ratings yet

- Case Commentary On Vishakha Vs State of RajasthanDocument6 pagesCase Commentary On Vishakha Vs State of RajasthanDebapom PurkayasthaNo ratings yet