Professional Documents

Culture Documents

New Microsoft Office Word Document

New Microsoft Office Word Document

Uploaded by

Basavaraj OkkundOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Microsoft Office Word Document

New Microsoft Office Word Document

Uploaded by

Basavaraj OkkundCopyright:

Available Formats

1. When goods are sold on hire price 2. Hire Purchase trading A/c Dr 3.

To Goods sold on hire purchase A/c 4. On receipt of instalmens Cash A/c Dr. To Hire Purchase trading A/c For instalments due at the end of the year Instalment due A/c To Hire Purchase trading A/c Dr. For Goods reposed on default Goods repossessed A/c Dr. To Hire purchase trading A/c For instalments not yet due at the end of the year Hire purchase stock A/c Dr. (H.P.Price) To Hire Purchase trading A/c To remove the loading in H.P sales Goods sold on Hire Purchase A/c Dr. To Hire purchase trading A/c To remove loading in closing stock Hire Purchase trading A/c To Stock reserve A/c LF Rs. Rs.

The hire purchase trading account will not show profit or loss and should be closed by transferring to P & L A/c . The Instalment due A/c , Hire purchase stock A/c and Stock reserve A/c will be transferred to Hire purchase trading A/c of the next year. Proforma Hire Purchase Trading Account

Dr. Cr.

To Opening Balance Hire Purchase Stock Hire Purchase Debtors To Goods sold on Hire Purchase To Hire Purchase Stock Reserve A/c To Profit t/f to General P & L A/c Rs.

By Hire Purchase Stock Reserve By Bank A/c By Goods sold on Hire Purchase A/c By Goods Repossessed A/c (at revalued figure) By Closing Balances: Hire Purchase Stock Hire Purchase Debtors. Rs. 9.4.1 COMPUTATION OF INTEREST EXAMPLE-1 (When rate of interest ,total cash price and instalments are given)

X purchase a car a hire purchase system. The total cash price of the car is Rs. 15,980 , payable Rs.4,000 down and three instalments of Rs.6,000 , Rs.5,000 and Rs.2000 payable at the end of first, second and third years respectively. Interest is charged at 5% p.a.You are required to calculate the interest paid by the buyer to the seller each year.

Solution Calculation of Interest paid each year.

Year & Date 1 Total Cash Price Rs. 2 Instalment Paid Rs. 3 Interest Paid Rs. 4 Cash Price Paid (i.e.2-3)

Rs. Down payment End of 1 year

End of II year

End of III year 15,980 -4,000 11,980 5,401 6,579 4,671 1,908 1,908 4,000

6,000

5,000

2,000

599

329

092

4,000

5,401

4,671

1,908

Note: Interest is calculated on the total of cash price remaining unpaid at the end of each year.

Example-2 (When rate of interest is not givein) On 1st January 1980 Messrs .ABC and Co., took delivery from XYZ and Co., of a machine of hire purchase system .Rs.1,500 being paid on delivery and the balance in five instalments of Rs.3,000 each , payable annually on 31st December . The cash price fo the machine was Rs. 15,000. Calculated the amount of interest paid for each year.

Solution In case where the rate of interest is missing , total interest which is the difference between total cash price paid and total instalment price paid is Rs.1,500 (Rs.16,500 15,000) is simply divided in the ratio of outstanding balance of instalment price as done below

Total instalment Instalments Ratio Price Rs.16,300 Outstanding Outstanding

instalments At the end of 1st year 15,000 3 At the end of 2nd year 12,000 4 At the end of 3rd year 9,000 3 At the end of 4th year 6,000 2 At the end of 5th year 3,000 1 ---15 ---Interest charge should be: In 1st year 5/15 x Rs.1,500 = Rs.500 In 2nd year 4/15 x Rs.1,500 = Rs.400 In 3rd Year 3/15 x Rs.1,500 = Rs.300 In 4th year 2/15 x Rs.1,500 = Rs. 200 In 5th year 1/15 x Rs. 1,500 = Rs. 100

Example 3 (When cash price is not given) Thiru Rajan purchased a washing machine under hire purchase system. As per agreement he has to pay Rs.8,000 down. Rs.4,000 at the end of the 1st year Rs.3,000 at the end of 2nd year and Rs.7,000 at the end of the 3rd year. Interest is charged at 5% p.a. Calculate the Cash price of the machine and amount of interest payable on each instalment. Solution Calculation of cash and amount of interest payable in cash instalment Year Instalment Interest paid Cash Price

Down payment At the end of 1 year At the end of 11 year

At the end III year Rs.

8,000 4,000

3,000

7,000 Rs. Nil (6,667 +2540 +4,000)x5/105=629 (6,667 + 3,000) x5/105= Rs. 460

7,000 x5/105 = 333

Rs. 8,000

3,371

2,540

6,667

Total cash price 29,578

Calculation are to be started from 3rd year to 1st year Rs. Total cash price 20,578 Total Interest (629 + 460+333) 1,422 Hire purchase price 22,000 Example 4 Mr. Raju purchased 4 cars for Rs.14,000 each on 1.1.92 under the hire purchase

system. The hire purchase price for all the 4 cars was Rs.60,000 to be paid as Rs.15,000 down payment and 3 equal instalments of Rs.15,000 each at the end of each year . Interest is charged at 5% p.a . The buyer depreciates the car at 10% p.a on straight line method.

From the above particulars give journal entries and relevant accounts in the books of Mr.P and in the books of hire vendor.

Solution Table showing calculation of interest Date of payment

(1) Total cash price

(2) Instal paid

(3) Interest paid

(4) Cash price paid

(3) (4) =(5)

Down Payment

Ist instalment

II nd Instalment

III instalment 56,000 (14,000x4) 15,000 41,000 12,950 28,050 13,597 14,453 14,453 Nil 15,000

15,000

15,000

15,000

(41,000x5%)=2,050

(28,050 x5%)=1,403

(15,000 14,453=547 -------4,000 15,000

12,950

13,597

14,453 -------56,000

Journal Entries in the books of Mr.P 1992 1993 1994 Dr. Cr. Dr. Cr. Dr. Cr. Jan.1

Jan.1

Dec.31

Dec.31

Dec.31

Dec.31 Cash A/c Dr To Hire vendor A/c (Being purchase of cars on H.P)

Hire Vendor A/c Dr. To Bank A/c (Being cash down payment)

Interest A/c Dr. To Hire Vendor A/c (Being interest credited to vendor)

Hire Vendor A/c Dr. To Bank A/c (Being payment of instalment)

Depreciation A/c Dr. To Cars A/c (Being dep. Charged on cars)

Profit & Loss A/c Dr. To Interest A/c To Depreciation A/c (Being int.& dep. Transferred)

56,000

15,000

2,050

15,000

5,600

7,650

56,000

15,000

2,050

15,000

5,600

2,050 5,600

1,403

15,000

5,600

7,003

1,403

15,000

5,600

1,403 5,600

547

15,000

5,600

6,147

547

15,000

5,600

547 5,600 Journal Entries in the books of Hire Vendor 1992 1993 1994 Dr. Cr. Dr. Cr. Dr. Cr. Jan.1

Jan.1

Dec.31

Dec.31

Dec.31

Ps A/c Dr To Hire Sales A/c (Being cars sold on HP)

Bank A/c Dr. To Ps A/c (Being down payment received)

Ps A/c Dr. To interest A/c (Being interest credited to Mr. P.A/c)

Bank A/c Dr. To Ps A/c (Being instalment received)

Interest A/c Dr. To P & L A/c (Being interest transferred) 56,000

15,000

2,050

15,000

2,050

56,000

15,000

2,050

15,000

2,050

1,403

15,000

5,600

1,403

15,000

1,403

547

15,000

547

547

15,000

547

Leger Accounts in the books of P (Hirer) Cars A/c Dr. Cr.

1.1.92

1.1.93

1.1.94

1.1.95

To Vendor A/c

To Balance b/d

To Balance b/d

To Balance b/d Rs. 56,000

56,000

50,400

50,400 44,800

44,800

39,200 31.12.92

31.12.93

31.12.94 By Depreciation By Balance c/d

By Depreciation By Balance c/d

By Depreciation By Balance c/d

Rs. 5,600 50,400

56,000

5,600 44,800 50,400 5,600 39,200

44,800

Hire Vendor s A/c Dr. Cr.

1.1.92 31.12.92

31.12.93

31.12.94

To Bank A/c To Bank A/c To Balance c/d

To Bank A/c

To Balance c/d

To Bank A/c

Rs. 15,000 15,000 28,050 58,050

15,000 14,453 29,453 15,000

15,000

1.1.92 31.12.92

31.12.93

31.12.94

By Cash A/c By interest A/c

By Balance c/d By interest

By Balance b/d By Interest Rs. 56,000 2,050

58,050

28,050 1,403 29,453 14,453 547

15,000

Ledger Accounts in the Books of Hire Vendor Interest A/c Dr. Cr.

31.12.92 31.12.93 31.12.94 To P & L A/c To P & L A/c To P & L A/c Rs.

2,050 1,403 547 31.12.92 31.12.93 31.12.94 By Mr.Ps A/c By Mr Ps A/c By Mr.Ps A/c Rs. 2,050 1,403 547 Mr.Ps A/c Dr. Cr.

1.1.92 31.12.92

1.1.93

1.1.94

31.12.94

To Hire Sale A/c To Interest

To Balance b/d To Interest

To Balance b/d

To Interest Rs. 56,000 2,050

58,050

28,050 1,403 29,453 14,453

547 15,000

1.1.92

31.12.93

31.12.94 By Bank A/c

By Bank A/c By Balance c/d

By Bank A/c By Balance c/d

By Bank

Rs. 15,000 15,000 28,050 58,050

15,000 14,453 29,453 15,000

15,000

Calculation of Depreciation Since depreciation is charged under straight line method. The same amount (56,000x10% = 5,600) is to be charged for all the three years. Example Rakesh purchased a motor car on Hire purchase system. The total cash price of the car is Rs.15,980 payable Rs.4,000 down and three instalments of Rs.6000

Rs. 5,000 and Rs.2000 payable at the end of first, second and third year respectively. Interest is charged at 5% You are required to prepare leder accounts in the books of Rakesh, Rate of depreciation is 10% on straight line method. (Calculation are to be made to the nearest rupees) Solution

Ledger Accounts in the books of Rakesh Motor Car Account.

I Year To Hire vendor A/c

II year To Balance b/d

III year To Balance b/d

Rs.

15,980 15,980

14,382 14,382

12,784 12,784 By Depreciation A/c (10%) By Balance c/d

By Depreciation A/c By Balance c/d

By Depreciation A/c By Balance c/d Rs. 1,598 14,382 15,980 1,598 12,784 14,382 1,598 11,186 12,784

Hire Vendor Account.

I Year To Cash down A/c To Cash (1 Inst) To Balance c/d

II year To Cash (II Inst c/d) To Balance c/d

III year To Cash(III Inst) Rs.

4,000 6,000 6,579 16,579

5,000 1,908 6,908 2,000

2,000

By Motor Car A/c By Interest

By Balance b/d By Interest

By Balance b/d By Interest Rs.

15,980 599

16,579

6,579 329 6,908

1,908 92 2,000

9.4.2 DEFAULT AND REPOSSESSION (A)Complete Repossession Example:Parimala purchases a machine for Rs.56,000, Payment to be made Rs.15,000 down and 3 instalments of Rs. 15,000 each at the end of each year. Rate of interest is charged at 5% p.a Buyer depreciates Machine at 10% p.a on written down value method.

Because of financial difficulties, parimal after having paid down payment and 1st instalment at the end of 1 year , could not pay second instalment and seller took possession of Machine. Seller after spending Rs.350 on repair of the asset, sold it away for Rs. 30,110. Show ledger accounts in the books of both the parties. Solution In the Books of P Machinery Account

To Hire Vendor a/c

To Balance b/d

Rs. 56,000

56,000 50,400

50,400 By Depreciation a/c By Balance c/d

By Depreciation a/c By Hire Vendor a/c (Repossession) By P & L (bal.fig) Rs. 5,600 50400 56,000 5,040 29,453

15,907 50,400

Hire Vendor Account

To Bank a/c To Cash (I Inst) To Balance c/d

To Asset (Repossession) Rs.

15,000 15,000 28,050 58,050 29,453

29,453 By Truck a/c By Interest

By Balance b/d By Interest

Rs. 56,000 2,050

58,050 28,050 1,403

29,453

Parimala Account

To Sales a/c

To Interest

To Asset (Repossession) Rs. 56,000 2,050

58,050 29,453

29,453 By Cash (down) By Cash (I Inst.) By Balance c/d

By Goods repossessed (bal.fig) Rs. 15,000 15,000 28,050 58,050 29,453

29,453

Goods repossessed Account

To Parimalas a/c (repossessed) To Cash (repair) To P & L a/c (Profit on resale)

Rs. 29,453

350 307

30,110 By Cash (resale)

Rs. 30,110

30,110

Interest Calculation 1 Year 56,000 15,000 = 41,000 x5/100 = 2,050 II Year 41,000 - 12,950 = 28,950 x 5/100 = 1,403. (B) Partial repossession

Example-14 Ramu Purchased four machines of Rs.14,000 each by the Hire purchase system. The hire purchase price for all the four machines was Rs.60,000 to be paid as Rs.15,000 down and three instalments of Rs.15,000 each at the end of each year. Depreciation is written off at 10% per annum on the straight line method.

Down payment and first installment were paid. On the default, vendor took possession of three machines leaving one machine with buyer. The machines were taken by the vendor at a depreciated value of 20% per annum under written down value method. Vendor has spent Rs.1,200 on repairs and sold the three machines for Rs.35,000. Required: Give the ledger accounts in the books of Ramu and Hire Vendor Solution Table showing calculation of interest Particulars Instalments Interest Cash price

I = 45,000 ------------ x 4000 90,000

II = 30,000 ---------- x 4,000 90,000

III = 15,000 --------- x 4,000 90,000 15,000 (Down payment)

15,000

15,000

15,000

60,000

2,000

1,333

667

4,000 15,000

13,000

13,667

14,333

56,000

Outstanding Balance on each Instalment Hire Purchase price 60,000 Less: Down payment 15,000 On I outstanding balance 45,000 On II instalment outstanding balance 30,000 On III instalment outstanding balance 15,000 Total outstanding Balance 90,000 Interest = 60,000 56,000 = Rs.4,000 Value of machine left with the buyer Rs. Value of machine taken away Rs. No. of machine one Cost price :1xRs.14,000 Depreciation : @ 10% p.a SLM for 2 years 14,000 x 10/100x2

Value of asset left with the buyer at the end of 2nd year 14,000 2,800

11,200 No.of macnines three Cost of price 3x14,000 Depreciation : @ 20% p.a WDV method for 2 years (Rs.8,400 + 6,720)

Value of asset taken away at the end of 2nd year 42,000 15,120

26,880 Ramus Books Machinery Account

To Hire Vendors A/c (4 machine)

To Balance b/d Rs. 56,000

56,000

50,400

50,400 By Depreciation A/c By Balance c/d

By Depreciation A/c

By Hire Vendors A/c (taken value) By P & L (Loss) By Balance c/d (left value) Rs. 5,600 50,400 56,000

5,600 26,880

6,720 11,200

50,400 Hire Vendor Account

To Cash A/c (Down payment) To Cash A/c (1st Year) To Balance c/d

To Machinery A/c To Balance c/d Rs. 15,000 15,000 28,000

58,000

26,880 2,453 29,333 29,333

By Machinery A/c By Interest A/c

By balance b/d By Interest A/c

Rs. 56,000 2,000

58,000

28,000 1,333

29,333 Hire vendor Books Ramus Account

To Sales A/c To Interest A/c

To Balance b/d To Interest A/c Rs. 56,000 2,000 _____ 58,000 28,000 1,333

29,333

By Cash A/c By Cash A/c By Balance c/d

By Goods Repossessed A/c By Balance c/d Rs. 15,000 15,000 28,000 58,000 26,880 2,453

29,333 Goods Repossessed Account.

To Ramus A/c To Cash A/c (Repairs) To Profit /Loss Rs. 26,880 1,200 6,920 35,000 By Cash A/c (sales)

Rs. 35,000

35,000

9.4.3 HIRE PURCHASE TRADING ACCOUNT Debtors Method Example A trader sells goods on hire purchase adding 60% to cost, from the following particulars, prepare Hire Purchase Trading Account and as certain profit or loss made by him. 1995 Jan.1 Stock with customers at selling price Rs. 21,600 Dec.31 Goods sold on hire purchase during The year at selling price Rs. 87,120 Cash received during the year Rs. 57,720 Stock with customers at selling price Rs. 48,000 Instalments due but not received Rs. 5,000 Solution Hire Purchase Trading Account for the year ended 31st Dec. 1995.

To Opening Stock To Goods sent on H.P To Stock Reserve To Profit & Loss A/c Rs. 21,600 87,120 18,000 24,770

1,51,490 By Bank By Instalments By Closing stock B Stock Reseve By Goods sent on H.P Rs. 57,720 5,000 48,000 8,100 32,670 1,51,490 Calculation of Loading Cost Rs. 100 Profit Rs. 60 --------Selling Price Rs. 160 --------Loading = 60 /160

Loading on opening stock = 21,600 x 60/160 = Rs. 8,100 Loading on goods sent on hire purchase= 87,120 x60/160= Rs. 32,670 Loading on closing stock = 48,000 x60/160= Rs.18,000 Example

Revathi & Co sells goods on H.P system at cost plus 60% .From the following information prpare Hire purchase Trading account to ascertain the Profit or Loss for the year 1996.

1.1.96 Goods with H.P customers (at H.P Price) 16,000 31.12.96 Goods sold on H.P during the year at H.P Price 80,000 Cash received during the year from customers 56,000 (Instalments due Rs.2,000) valued at 300 Goods with the H.P customers at H.P Price 36,000 Solutuion Hire Purchase Trading Account for the year ended 31st Dec.1996

To H.P Stock at cost price (16,000 x100/160)

To Goods sold during the year At cost (80,000 x100/160)

To Profit & Loss A/c Rs. 10,000

50,000

20,800

80,800 By cash received By Goods repossessed A/c (market value) By Instalment due and unpaid By H.P Stock at cost Price(36,000x100/160)

Rs. 56,000 300

2,000 22,500

80,800 Instalment due A/c

To Instalment not yet due To H.P Sales Rs. 16,000 80,000

96,000 By Cash By Goods repossessed By Instralments not yet due By Instalmens due and unpaid (b/f)

Rs. 56,000 2,000 36,000 2,000

96,000

Unit Questions

1. What do you mean by Hire Purchase system? 2. What is stock and debtors system? 3. Distinguish between hire purchase system and instalment purchase system. 4. How to prepare hire purchase trading account? 5. From the following information, calculate the amount to be paid to the owner if the hire purchaser intends to complete the purchase of goods. Rs. Cash Price 36,000 Down payment 3,600 Hire purchase price 39,000 No. of instalments 24 Instalments paid by the hire purchaser 18 When rate of interest , cash price and instalements are given.

6. On 1.1.2001 ,X purchased machinery on the hire purchase system. The payment is to be made Rs.4,000 down (on signing of the contract) and Rs. 4,000 annually for three years. The cash price of the machinery is Rs. 14,900 and the rate of interest is 5% . Calculate the interest included in each years instalment.

7. The Madras Trading co. purchased a mote car from Bombay Motors Co, on hire purchase agreement on 1.1.201 paying cash Rs.10,000 and agreeing to pay

further three instalments of Rs.10,000 each on 31st December each year. The cash price of the car is Rs.37,250 and the Bombay Motor co, charges interest at 5% p.a . The Madras Trading co., written off 10% p.a as depreciation on the reducing balance method Jouranlise the above in the books of both the parties.

8. Mr.Raman purchased a T.V. on Hire Purchase on the following terms.

Rs. 1,200 to be paid on signing the agreement. Rs.1,700 at the end of the first year. Rs.1,600 at the end of second year. Rs. 5,500 at the end of third and last year.

The hire vendors charge interest at 10% annum on each value of the T.V Mr.Raman wished to provide depreciation at 10% p.a on the diminishing balance method.

Required : Write up the necessary ledger accounts in the books of both the parties.

9. On 1.1.2002 kannan purchased a machinery from sukumar on hire purchase system. Cash price of the machinery was Rs.1,80,000. Rs.46,440 has to be paid on the date of purchase and a 5 annual instalments of Rs.30,000 are payable on 31st December every year. Sukumar charged intrest @ 4% p.a on the yearly balances. Kannan fixed to pay the instalment due on 31.12.2002. onereupon sukumar took possession of the machinery and valued the same in his books after charging 15% depreciation under straight line method. So the ledger accounts in the books of kannan.

10. Mr. S.R.S. sells goods on HP at cost plus 50% from the following particulars prepare the necessary ledger accounts for the year ended 31.12.2004.

Rs. Jan 1. Stock with HP customers at selling price 45,000 Stock at shop at cost 90,000 Instalments due 25,000 Dec 31. Cash received from customers 3, 00,000 Goods repossessed instalments due 2,500 Instalments due customers paying 45,000 Stock at shop at cost excluding re possessed Goods) 1,00,000 Goods purchased during the year 3,00,000

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Nyse Listed Company Manual PDFDocument2 pagesNyse Listed Company Manual PDFKatie0% (1)

- Chapter 9-45 Excel TemplateDocument10 pagesChapter 9-45 Excel TemplateAlee Di VaioNo ratings yet

- Depreciation Lesson 8Document39 pagesDepreciation Lesson 8Charos Aslonovna100% (6)

- P87 Tax Relief For Expenses of EmploymentDocument4 pagesP87 Tax Relief For Expenses of EmploymentKen Smith0% (1)

- Kelompok 4Document9 pagesKelompok 4luthfia suciNo ratings yet

- Forex Trading and IslamForex Trading and IslamDocument8 pagesForex Trading and IslamForex Trading and Islammohdfazlan1uniklNo ratings yet

- SyhpDocument3 pagesSyhpsmit9993No ratings yet

- DepreciationDocument4 pagesDepreciationeunwink eunwinkNo ratings yet

- Unit 3Document27 pagesUnit 3v9510491No ratings yet

- 5 Hire - Purchase - System PDFDocument17 pages5 Hire - Purchase - System PDFnavin_raghu0% (1)

- How To Complete Your Motor Vehicle Log Book: Before Your Start Your Business TripDocument5 pagesHow To Complete Your Motor Vehicle Log Book: Before Your Start Your Business TripSundarapandiyan SundaramoorthyNo ratings yet

- Depreciation Accounting-6Document19 pagesDepreciation Accounting-6rohitsf22 olypmNo ratings yet

- Hire Purchase For Bcom and Nepal CADocument14 pagesHire Purchase For Bcom and Nepal CANandani BurnwalNo ratings yet

- Answer Sheet v-1 24052014Document7 pagesAnswer Sheet v-1 24052014psawant77No ratings yet

- Hire PurchaseDocument123 pagesHire PurchaseNurul InaNo ratings yet

- Travel Logbook: South African Revenue ServiceDocument27 pagesTravel Logbook: South African Revenue Serviceanon_b186No ratings yet

- Unit-I: DepreciationDocument4 pagesUnit-I: DepreciationEswari GkNo ratings yet

- Unit III - DepreciationDocument5 pagesUnit III - Depreciationkailasbankar96No ratings yet

- Hire Purchase Lease Financing - Part 2Document38 pagesHire Purchase Lease Financing - Part 2KomalNo ratings yet

- Final AccountsDocument27 pagesFinal AccountsNafis Siddiqui100% (1)

- Problems On PPEDocument8 pagesProblems On PPEDibyansu KumarNo ratings yet

- Hire Purchase - Example 1 To 10Document7 pagesHire Purchase - Example 1 To 10204 TAN YONG WEINo ratings yet

- SFM CompilerDocument469 pagesSFM CompilerArchana Khapre100% (1)

- IPCC Group-II Accounts Guideline Answer Nov 2015 ExamDocument16 pagesIPCC Group-II Accounts Guideline Answer Nov 2015 ExamAkash GoelNo ratings yet

- ADL 03 Ver2+Document6 pagesADL 03 Ver2+DistPub eLearning SolutionNo ratings yet

- TallyDocument6 pagesTallySayandip MondalNo ratings yet

- Accounts Final RaoDocument190 pagesAccounts Final RaoSameer Krishna100% (1)

- Hire PurchaseDocument6 pagesHire PurchaseGanesh Bokkisam100% (1)

- 9 Depreciation 08-2022 Regular Ca FoundationDocument6 pages9 Depreciation 08-2022 Regular Ca FoundationjahnaviNo ratings yet

- c2 Partnership ProblemsDocument6 pagesc2 Partnership ProblemsSiva SankariNo ratings yet

- 2016-17 SARS ELogbookDocument17 pages2016-17 SARS ELogbookMfundo DlaminiNo ratings yet

- Leasing Vs BuyingDocument5 pagesLeasing Vs BuyingOviyan IlancheranNo ratings yet

- Accounting For Hire Purchase - PPTDocument50 pagesAccounting For Hire Purchase - PPTnikazidaNo ratings yet

- Depreciation: ConceptDocument6 pagesDepreciation: ConceptEdna OrdanezaNo ratings yet

- Accounting 50 Imp Questions 1642414963Document75 pagesAccounting 50 Imp Questions 1642414963vishal kadamNo ratings yet

- Depreciation and Its AccountingDocument4 pagesDepreciation and Its AccountingSatish SheoranNo ratings yet

- Paper 1: AccountingDocument30 pagesPaper 1: AccountingSatyajit PandaNo ratings yet

- Depreciation O Level NotesDocument5 pagesDepreciation O Level NotesBijoy SalahuddinNo ratings yet

- Hire Purchase and Credit SaleDocument16 pagesHire Purchase and Credit SaleEric HopeNo ratings yet

- FA (2010) MidtermDocument16 pagesFA (2010) MidtermRishi BiggheNo ratings yet

- Prep Trading - Profit-And-Loss-Ac Balance SheetDocument25 pagesPrep Trading - Profit-And-Loss-Ac Balance Sheetfaltumail379100% (1)

- Capital BudgetingDocument108 pagesCapital BudgetingSakib Farooquie100% (1)

- q6 TaxDocument13 pagesq6 Taxmajidpathan208No ratings yet

- Solved Answer Accounts CA IPCC May. 2010Document13 pagesSolved Answer Accounts CA IPCC May. 2010Akash GuptaNo ratings yet

- 2015-16 SARS ELogbookDocument17 pages2015-16 SARS ELogbookmhassim123No ratings yet

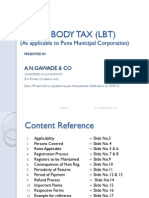

- Local Body Tax in Pune Municipal Corporation (LBT in PMC) - 0Document20 pagesLocal Body Tax in Pune Municipal Corporation (LBT in PMC) - 0nikhilpasariNo ratings yet

- How To Calculate Present Values: Fixed Income SecuritiesDocument52 pagesHow To Calculate Present Values: Fixed Income Securitiesmohitaggarwal123No ratings yet

- Review of Some Key Fundalmentals: Suggested Study Notes For F3 ACCA ExaminationsDocument11 pagesReview of Some Key Fundalmentals: Suggested Study Notes For F3 ACCA Examinationsserge222100% (2)

- Accounts Important QuestionDocument3 pagesAccounts Important Questionankitchauhan9630No ratings yet

- Accounting For DepreciationDocument6 pagesAccounting For DepreciationKaran GNo ratings yet

- Sample Cases 1-11 With SolutionsDocument10 pagesSample Cases 1-11 With SolutionsJenina Rose SalvadorNo ratings yet

- Concept of Installment SystemDocument5 pagesConcept of Installment Systemshambhuling ShettyNo ratings yet

- TRDocument15 pagesTRBhaskar BhaskiNo ratings yet

- Test 9Document23 pagesTest 9Ankit Khemani100% (1)

- 2011eLogbookV2Document16 pages2011eLogbookV2Gerhard GroblerNo ratings yet

- Financial Statement Analysis Ticker: Periodicity: Annuals Filing: Filing: For The Period Ending 2009-12-30 2010-12-30Document19 pagesFinancial Statement Analysis Ticker: Periodicity: Annuals Filing: Filing: For The Period Ending 2009-12-30 2010-12-30Mohammad ShahraeeniNo ratings yet

- QP Half Yearly Accounts XiiDocument8 pagesQP Half Yearly Accounts XiiVazahat HusainNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Bonds Payable: Intermediate Accounting 2Document38 pagesBonds Payable: Intermediate Accounting 2Rolando Verano TanNo ratings yet

- Advanced PropertyDocument8 pagesAdvanced PropertyCaroline Hilton-WebsterNo ratings yet

- Locational Arbitrage. Assume The Following InformationDocument11 pagesLocational Arbitrage. Assume The Following Informationajim87No ratings yet

- Secretos Indicador TDI MMMDocument22 pagesSecretos Indicador TDI MMMLuiz Vinhas100% (2)

- Costaccounting 170209080426Document33 pagesCostaccounting 170209080426Samayak JainNo ratings yet

- Geojit-BNP Paribas Internship ReportDocument29 pagesGeojit-BNP Paribas Internship ReportSagar Paul'g100% (1)

- Public China Titans FundDocument1 pagePublic China Titans FundEileen LauNo ratings yet

- Financial RatiosDocument30 pagesFinancial RatiosVenz LacreNo ratings yet

- Icici BankDocument13 pagesIcici BankdhwaniNo ratings yet

- WNG Capital LLC Case AnalysisDocument8 pagesWNG Capital LLC Case AnalysisMMNo ratings yet

- Chapter 03 - AnswerDocument10 pagesChapter 03 - AnswerMinsky GoceNo ratings yet

- From BMC To Financial Projection 1 Dan 2 FileDocument34 pagesFrom BMC To Financial Projection 1 Dan 2 FileJEREMIA GUNAWANNo ratings yet

- Comparative Study On Initial Public Offer (Ipo) : Management of Indian Financial SystemsDocument21 pagesComparative Study On Initial Public Offer (Ipo) : Management of Indian Financial SystemsHimanshu JoshiNo ratings yet

- Coefficient of Variation : Standard Deviation Expected EPSDocument2 pagesCoefficient of Variation : Standard Deviation Expected EPSJPNo ratings yet

- Managerial Accounting Tools For Business Decision Making 7th Edition Weygandt Test BankDocument64 pagesManagerial Accounting Tools For Business Decision Making 7th Edition Weygandt Test Bankveronicahodgeyorebxgmcd100% (32)

- IFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportDocument34 pagesIFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportWubneh AlemuNo ratings yet

- Cost Accounting Horngren 15th Edition Test BankDocument5 pagesCost Accounting Horngren 15th Edition Test BankGene Mendoza100% (41)

- Ucp-Cf 09,11-03Document78 pagesUcp-Cf 09,11-03sumaira85No ratings yet

- Accounting 11 Activity 1Document1 pageAccounting 11 Activity 1Ma Trixia Alexandra CuevasNo ratings yet

- Baggayao WACC PDFDocument7 pagesBaggayao WACC PDFMark John Ortile BrusasNo ratings yet

- Financial Statements of A Company: Earning BjectivesDocument33 pagesFinancial Statements of A Company: Earning BjectivesPathan KausarNo ratings yet

- A Survey of Management Views On Dividend Policy.Document8 pagesA Survey of Management Views On Dividend Policy.Andreas LjøstadNo ratings yet

- SBSA Statement 2022-10-17Document23 pagesSBSA Statement 2022-10-17Maestro ProsperNo ratings yet

- Hban 2018 AraDocument180 pagesHban 2018 AraMoinul HasanNo ratings yet

- Entrepreneurship - The Journey of An Entrepreneur by Sidath KalyanaratneDocument32 pagesEntrepreneurship - The Journey of An Entrepreneur by Sidath Kalyanaratne222637No ratings yet

- BYJUS Case StudyDocument18 pagesBYJUS Case Studyshaleen bansalNo ratings yet