Professional Documents

Culture Documents

TAS GoldParaFactSheet Final

TAS GoldParaFactSheet Final

Uploaded by

Navneet KaliaCopyright:

Available Formats

You might also like

- 2023 Tax Deduction Cheat Sheet and LoopholesDocument24 pages2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaNo ratings yet

- AML BrochureDocument6 pagesAML BrochuresarahconnellyNo ratings yet

- Late Charges in R12Document13 pagesLate Charges in R12venkat83% (6)

- Adventure Travel Sample Marketing PlanDocument26 pagesAdventure Travel Sample Marketing PlanPalo Alto Software100% (9)

- CELTA Tip: Language Analysis Assignment - Elt PlanningDocument6 pagesCELTA Tip: Language Analysis Assignment - Elt PlanningTeddy BroughtonNo ratings yet

- Dissertation On Revenue RecognitionDocument7 pagesDissertation On Revenue RecognitionCollegePaperGhostWriterSterlingHeights100% (1)

- Accounting - Cabcharge - 8 AugustDocument8 pagesAccounting - Cabcharge - 8 AugustAijaz ShaikhNo ratings yet

- Rc4070-09e Guide For Canadian Small BusinessesDocument56 pagesRc4070-09e Guide For Canadian Small Businessesapi-31394357No ratings yet

- Tri-Fold Brochure Ver10 Generic 102711Document2 pagesTri-Fold Brochure Ver10 Generic 102711JohnZhuangNo ratings yet

- ACCT8815 Hangu Chen, Jacob Lazar, Tanvir Rahman, Nick Takton, Yuxuan ZhaoDocument5 pagesACCT8815 Hangu Chen, Jacob Lazar, Tanvir Rahman, Nick Takton, Yuxuan ZhaoAdam GifariNo ratings yet

- Entrepreneurs DictionaryDocument46 pagesEntrepreneurs DictionaryWimby WandaryNo ratings yet

- N. K. Kalra & Associates: Firms' ProfileDocument11 pagesN. K. Kalra & Associates: Firms' ProfileSohail MavadiaNo ratings yet

- CA FIRM PROJECT ReportDocument50 pagesCA FIRM PROJECT ReportsaurabhNo ratings yet

- Case Study BSBMGT803Document6 pagesCase Study BSBMGT803Muhammad MubeenNo ratings yet

- Grupo PRF - EnglishDocument2 pagesGrupo PRF - EnglishAndre TintilioNo ratings yet

- PolicyCenter9 0PracticalExerciseDocument8 pagesPolicyCenter9 0PracticalExerciseolena.vitiuk123No ratings yet

- Accounting Fees 2023Document12 pagesAccounting Fees 2023processingNo ratings yet

- Week 13Document2 pagesWeek 13roxananicoleta00No ratings yet

- Audit Firms in Dubai, Audit Firm, Bookkeeping, Business Setup, LiquidationDocument12 pagesAudit Firms in Dubai, Audit Firm, Bookkeeping, Business Setup, LiquidationImtiaz JavedNo ratings yet

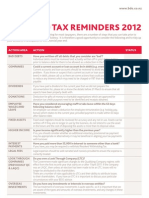

- Year-End Tax Reminders 2012: Action Area Action StatusDocument2 pagesYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783No ratings yet

- Taxpayer Charter: Your Rights and ObligationsDocument15 pagesTaxpayer Charter: Your Rights and ObligationskevotooNo ratings yet

- LLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessFrom EverandLLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessNo ratings yet

- Disaster Recovery ToolkitDocument34 pagesDisaster Recovery ToolkitChiso PhiriNo ratings yet

- Actuarial AnalysisDocument12 pagesActuarial AnalysisNikita MalhotraNo ratings yet

- Employer's Guide Payroll Deductions and RemittancesDocument59 pagesEmployer's Guide Payroll Deductions and RemittancesWill100% (2)

- A Quick Guide To Taxation in GhanaDocument55 pagesA Quick Guide To Taxation in GhanaEnoch DaviesNo ratings yet

- DanOwa VAT & ERP Services Proposal 2019 KeepersDocument9 pagesDanOwa VAT & ERP Services Proposal 2019 KeepersMohamed EzzatNo ratings yet

- Building An Effective EtaxplanDocument3 pagesBuilding An Effective EtaxplanverycoolingNo ratings yet

- See It, Understand It, Use It: Accounting DefinitionsDocument29 pagesSee It, Understand It, Use It: Accounting DefinitionsSirajMeerNo ratings yet

- 2 Credit Risk Management ServicesDocument2 pages2 Credit Risk Management ServiceschemersonNo ratings yet

- ©Jani-King Southwest Exhibit I Page 1 Revised April 2006Document2 pages©Jani-King Southwest Exhibit I Page 1 Revised April 2006usnbjtwvhtNo ratings yet

- Strategic Tax Management Chapter 5Document1 pageStrategic Tax Management Chapter 5Angelly EsguerraNo ratings yet

- Mazars Co TH Payroll Services in Thailand: HighlightsDocument10 pagesMazars Co TH Payroll Services in Thailand: HighlightsAnton HPNo ratings yet

- Your Insurance Audit - How To Save Time and MoneyDocument4 pagesYour Insurance Audit - How To Save Time and MoneyCheick AbdoulNo ratings yet

- Importance of Ethics in AccountingDocument3 pagesImportance of Ethics in AccountingPratish RanjanNo ratings yet

- Research Paper Revenue RecognitionDocument7 pagesResearch Paper Revenue Recognitionorlfgcvkg100% (1)

- Key Man InsuranceDocument2 pagesKey Man InsuranceAditya IyerNo ratings yet

- AL MARZAAN Company ProfileDocument14 pagesAL MARZAAN Company ProfileMohammad ZeeshanNo ratings yet

- International Tax Consulting & Compliance Services: Structuring of Foreign Investments (Outbound Advice)Document5 pagesInternational Tax Consulting & Compliance Services: Structuring of Foreign Investments (Outbound Advice)parthaanikNo ratings yet

- Marketing and Design PortfolioDocument33 pagesMarketing and Design PortfolioMelissa YorkNo ratings yet

- Business ValuationDocument5 pagesBusiness ValuationUmairHussain4943100% (7)

- Starting A Business Checklist 2023 GovDocument10 pagesStarting A Business Checklist 2023 Govjcgoku9No ratings yet

- Taxation of Fringe BenefitsDocument5 pagesTaxation of Fringe BenefitsTawanda Tatenda HerbertNo ratings yet

- FINFO Week 3 Learner GuideDocument14 pagesFINFO Week 3 Learner GuideAngelica Caballes TabaniaNo ratings yet

- Capital V RevenueDocument18 pagesCapital V RevenueFaizan FaruqiNo ratings yet

- ACCT1101 Wk2 Tutorial 1 SolutionsDocument12 pagesACCT1101 Wk2 Tutorial 1 SolutionskyleNo ratings yet

- Nabtrade Financial Services GuideDocument12 pagesNabtrade Financial Services GuideksathsaraNo ratings yet

- E-File IT Returns For Your Clients. It's FREE.: Accounts and AuditDocument7 pagesE-File IT Returns For Your Clients. It's FREE.: Accounts and Auditsundeep tayalNo ratings yet

- IncomeTaxation VirreyDocument14 pagesIncomeTaxation VirreyAdilyn Grace VirreyNo ratings yet

- Chapter 14Document40 pagesChapter 14Ivo_NichtNo ratings yet

- Green Modern Financial Management PresentationDocument17 pagesGreen Modern Financial Management PresentationsikeNo ratings yet

- Trucking Incorporation GuideDocument9 pagesTrucking Incorporation GuideladrendlavindraNo ratings yet

- Entrepreneurs Wealth Management ChecklistDocument7 pagesEntrepreneurs Wealth Management ChecklistThree Bell CapitalNo ratings yet

- Tourism AsiignmentDocument2 pagesTourism AsiignmentSarah Jane ApellidoNo ratings yet

- Sip Report 1Document17 pagesSip Report 1nikhil KumarNo ratings yet

- Achieving Financial Success: An Essential Guide For Small Business (New Zealand)Document89 pagesAchieving Financial Success: An Essential Guide For Small Business (New Zealand)akita_1610No ratings yet

- Research Paper On Tax ComplianceDocument8 pagesResearch Paper On Tax Compliancelemvhlrif100% (1)

- Reporting and Analyzing Revenues and Receivables: Learning Objectives - Coverage by QuestionDocument34 pagesReporting and Analyzing Revenues and Receivables: Learning Objectives - Coverage by QuestionpoollookNo ratings yet

- Finance Accounts Outsourcing Proposal 2015 16Document9 pagesFinance Accounts Outsourcing Proposal 2015 16guyasaababa898No ratings yet

- ACH Debit Blocking Product SheetDocument2 pagesACH Debit Blocking Product Sheetalex rodmanNo ratings yet

- News Paper AdDocument1 pageNews Paper AdNavneet KaliaNo ratings yet

- PCT Fee Tables: (Amounts On 10 December 2010, Unless Otherwise Indicated)Document6 pagesPCT Fee Tables: (Amounts On 10 December 2010, Unless Otherwise Indicated)Navneet KaliaNo ratings yet

- AgendaDocument3 pagesAgendaNavneet KaliaNo ratings yet

- Universal Efficiency at Optimal Work With Bayesian StatisticsDocument5 pagesUniversal Efficiency at Optimal Work With Bayesian StatisticsNavneet KaliaNo ratings yet

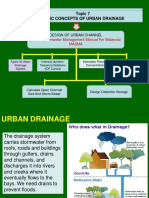

- Topic 7 Basic Concepts of Urban Drainage: (Urban Stormwater Management Manual For Malaysia) MasmaDocument29 pagesTopic 7 Basic Concepts of Urban Drainage: (Urban Stormwater Management Manual For Malaysia) MasmaAzhar SabriNo ratings yet

- Gastroenterología y Hepatología: Use of Electrosurgical Units in The Endoscopic Resection of Gastrointestinal TumorsDocument12 pagesGastroenterología y Hepatología: Use of Electrosurgical Units in The Endoscopic Resection of Gastrointestinal TumorsJesús MaríñezNo ratings yet

- Anil Laul BharaniDocument30 pagesAnil Laul BharaniBharani MadamanchiNo ratings yet

- Memory Hierarchy & Cache MemoryDocument40 pagesMemory Hierarchy & Cache MemorybiliNo ratings yet

- Codex: Night LordsDocument5 pagesCodex: Night LordsM. WoodsNo ratings yet

- Beyond Science (Alternity)Document98 pagesBeyond Science (Alternity)Quintus Domitius VinskusNo ratings yet

- Product Sheet Damen FCS 5009Document2 pagesProduct Sheet Damen FCS 5009Juan ResendizNo ratings yet

- Group Medical Insurance - 2020-21Document2 pagesGroup Medical Insurance - 2020-21Vilaz VijiNo ratings yet

- Jurnal SdaDocument7 pagesJurnal SdaPeten AmtiranNo ratings yet

- ChangelogDocument46 pagesChangelogcoolharshit123No ratings yet

- System Analysis & Design in A Changing World Chapter 13 Problems and ExercisesDocument8 pagesSystem Analysis & Design in A Changing World Chapter 13 Problems and ExercisesbriandonaldNo ratings yet

- The Mechanical Properties of Polypropylene - Polylactic Acid (PP-PLA) Polymer Blends - 24 PagesDocument24 pagesThe Mechanical Properties of Polypropylene - Polylactic Acid (PP-PLA) Polymer Blends - 24 PagesSiddharthBhasneyNo ratings yet

- IoT - Internet of Things Based Energy Management For Smart HomeDocument4 pagesIoT - Internet of Things Based Energy Management For Smart HomeEditor IJTSRDNo ratings yet

- Week 1: Learning Activity 1 Short Quiz 1Document39 pagesWeek 1: Learning Activity 1 Short Quiz 1yagami100% (1)

- ILRAP HandbookDocument40 pagesILRAP Handbooknaren_3456No ratings yet

- Short Notes For Heat Transfer - Docx 97.docx 93Document18 pagesShort Notes For Heat Transfer - Docx 97.docx 93kumarsumit1942No ratings yet

- Effects of Composition and Processing SEBS OIL PPDocument25 pagesEffects of Composition and Processing SEBS OIL PPBahadır Uğur AltunNo ratings yet

- UntitledDocument15 pagesUntitledAfiq AimanNo ratings yet

- Analgesics in ObstetricsDocument33 pagesAnalgesics in ObstetricsVeena KaNo ratings yet

- DIY GREENHOUSE by KMS - ChangelogDocument4 pagesDIY GREENHOUSE by KMS - Changeloglm pronNo ratings yet

- 11 RECT TANK 4.0M X 3.0M X 3.3M H - Flocculator PDFDocument3 pages11 RECT TANK 4.0M X 3.0M X 3.3M H - Flocculator PDFaaditya chopadeNo ratings yet

- Biology WaterDocument22 pagesBiology WaternurhanisahmohamadnorNo ratings yet

- Mechanical Engineering Undergraduate ResumeDocument2 pagesMechanical Engineering Undergraduate ResumeAndré ArayaNo ratings yet

- Front Office Final ExaminationDocument5 pagesFront Office Final ExaminationLeonardo FloresNo ratings yet

- Form 5 ElectrolysisDocument2 pagesForm 5 ElectrolysisgrimyNo ratings yet

- Operating Instructions Dixie Cerradora de LatasDocument22 pagesOperating Instructions Dixie Cerradora de LatasMario Amieva BalsecaNo ratings yet

- TWITCH INTERACTIVE, INC. v. JOHN AND JANE DOES 1-100Document18 pagesTWITCH INTERACTIVE, INC. v. JOHN AND JANE DOES 1-100PolygondotcomNo ratings yet

- Driver Licence & Learner Permit FeesDocument9 pagesDriver Licence & Learner Permit FeesAnatoly IvanovNo ratings yet

TAS GoldParaFactSheet Final

TAS GoldParaFactSheet Final

Uploaded by

Navneet KaliaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAS GoldParaFactSheet Final

TAS GoldParaFactSheet Final

Uploaded by

Navneet KaliaCopyright:

Available Formats

C O M P E N S AT I O N A N D B E N E F I T S S E R V I C E S

TAX ADVISORY SERVICES, LLC

G O L D E N P A R A C H U T E A N A LY Z E R

A N A LY Z I N G E X E C U T I V E S C O M P E N S AT I O N A N D G O L D E N PA R AC H U T E S As part of Alvarez & Marsal Tax Advisory Services, our Compensation and Benefits Practice has designed the Golden Parachute Analyzer. Mergers and acquisitions are common in business these days. So, too, are the executive compensation packages called golden parachutes, which can help soften the blow to executives when they are unexpectedly forced to leave the company due to a merger, acquisition, hostile takeover, or downsizing. Designing and maintaining executive compensation packages so that they comply with strict tax laws and still offer protection to skilled executives can be challenging for even the most competitive organizations. S E R V I N G YO U R N E E D S Alvarez & Marsals Compensation and Benefits Practice has designed the Golden Parachute Analyzer to assess the tax effect on corporations and employees when golden parachutes are triggered by a change in control of the employer. Under the Internal Revenue Code (IRC), corporations that make excess parachute payments lose significant tax deductions. The recipient of parachute compensation is also subject to a 20 percent excise tax on such excess payments. Our clients generally find our Golden Parachute Analyzer helpful in various circumstances: Executive Compensation Disclosure. Proposed SEC regulations will require greater disclosure of executive compensation, including the amount payable upon a change in control and the excise tax amount. The Golden Parachute Analyzer Program helps your organization to quantify these amounts. Change in Control Planning. Your business needs to design and implement competitive control provisions. We can assist your team in this process, and gauge the potential tax implications of existing agreements to make recommendations for remedial redesigns. Change in Control in Process: Once the process of a change in control is underway, it is critical to calculate the amount of the parachute payment and the amount of any excess parachute payments that would trigger excise tax consequences under various scenarios. In addition, planning opportunities still exist to mitigate the excise tax and lost deduction.

T H E A LV A R E Z & M A R S A L A P P R O A C H Alvarez & Marsal looks at your executive compensation packages and develops a set of services that best fit the needs of your company and executives. Our services in a Golden Parachute Analyzer include: For each affected individual, calculation of the parachute payments received, such as severance payments, acceleration of equity awards, enhanced benefits, and other non-cash compensation. For each affected individual, assessment of whether excess parachute amounts exist and, if so, calculating the excise tax due for each individual. Calculation of overall parachute costs, gross-ups, and deduction losses to the company.

N O R T H A M E R I CA E U R O P E A S I A L AT I N A M E R I CA

T H E A LV A R E Z & M A R S A L A P P R O A C H ( C o n t i n u e d ) Implementation of alternative calculations based on different assumptions and scenarios (e.g., best payment, cutback and gross-ups). Development of a detailed written report, outlining individual parachute calculations and combined cost to the company, and fact-based recommendations to avoid triggering the application of IRC section 280G deductions denials and IRC section 4999 excise taxes.

C O N TA C T I N F O R M AT I O N As part of Alvarez & Marsal Tax Advisory Services, LLC, the Compensation and Benefit Practice assists tax, finance, and human resource departments in designing new compensation and benefit plans, evaluating and enhancing existing plans, and reviewing programs for compliance with changing laws and regulations. Our goal is to help your business minimize the tax, financial, and regulatory burdens related to such plans. For more information about Alvarez & Marsals Golden Parachute Analyzer and other compensation and benefit service offerings, contact Brian Cumberland, Managing Director, Compensation and Benefits, at (214) 599-8311 or bcumberland@alvarezandmarsal.com.

ABOUT ALVAREZ & MARSAL TAX ADVISORY SERVICES, LLC Alvarez & Marsal Tax Advisory Services, LLC is an independent tax group comprised of experienced tax professionals dedicated to providing customized tax advice to clients in a broad range of industries. Our professionals extend Alvarez & Marsal's commitment to offering clients a choice in tax advisors not subject to audit-based conflicts of interest. We serve clients with knowledge, experience and a commitment to excellence in client service. Our professionals advocate our clients interests with the highest integrity. Alvarez & Marsal Tax Advisory Services, LLC, is a founding member of the Taxand global alliance, which is comprised of independent tax firms in countries around the world that provide our multinational clients with international tax advice. With tax professionals worldwide, Taxand provides clients with an alternative to the Big Four audit firms for global tax services. Alvarez & Marsal Tax Advisory Services, LLC is a division of Alvarez & Marsal, a global professional services firm that excels in problem solving and value creation for businesses around the world.

TAX ADVISORY SERVICES, LLC

w w w. a l v a r e z a n d m a r s a l . c o m

You might also like

- 2023 Tax Deduction Cheat Sheet and LoopholesDocument24 pages2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaNo ratings yet

- AML BrochureDocument6 pagesAML BrochuresarahconnellyNo ratings yet

- Late Charges in R12Document13 pagesLate Charges in R12venkat83% (6)

- Adventure Travel Sample Marketing PlanDocument26 pagesAdventure Travel Sample Marketing PlanPalo Alto Software100% (9)

- CELTA Tip: Language Analysis Assignment - Elt PlanningDocument6 pagesCELTA Tip: Language Analysis Assignment - Elt PlanningTeddy BroughtonNo ratings yet

- Dissertation On Revenue RecognitionDocument7 pagesDissertation On Revenue RecognitionCollegePaperGhostWriterSterlingHeights100% (1)

- Accounting - Cabcharge - 8 AugustDocument8 pagesAccounting - Cabcharge - 8 AugustAijaz ShaikhNo ratings yet

- Rc4070-09e Guide For Canadian Small BusinessesDocument56 pagesRc4070-09e Guide For Canadian Small Businessesapi-31394357No ratings yet

- Tri-Fold Brochure Ver10 Generic 102711Document2 pagesTri-Fold Brochure Ver10 Generic 102711JohnZhuangNo ratings yet

- ACCT8815 Hangu Chen, Jacob Lazar, Tanvir Rahman, Nick Takton, Yuxuan ZhaoDocument5 pagesACCT8815 Hangu Chen, Jacob Lazar, Tanvir Rahman, Nick Takton, Yuxuan ZhaoAdam GifariNo ratings yet

- Entrepreneurs DictionaryDocument46 pagesEntrepreneurs DictionaryWimby WandaryNo ratings yet

- N. K. Kalra & Associates: Firms' ProfileDocument11 pagesN. K. Kalra & Associates: Firms' ProfileSohail MavadiaNo ratings yet

- CA FIRM PROJECT ReportDocument50 pagesCA FIRM PROJECT ReportsaurabhNo ratings yet

- Case Study BSBMGT803Document6 pagesCase Study BSBMGT803Muhammad MubeenNo ratings yet

- Grupo PRF - EnglishDocument2 pagesGrupo PRF - EnglishAndre TintilioNo ratings yet

- PolicyCenter9 0PracticalExerciseDocument8 pagesPolicyCenter9 0PracticalExerciseolena.vitiuk123No ratings yet

- Accounting Fees 2023Document12 pagesAccounting Fees 2023processingNo ratings yet

- Week 13Document2 pagesWeek 13roxananicoleta00No ratings yet

- Audit Firms in Dubai, Audit Firm, Bookkeeping, Business Setup, LiquidationDocument12 pagesAudit Firms in Dubai, Audit Firm, Bookkeeping, Business Setup, LiquidationImtiaz JavedNo ratings yet

- Year-End Tax Reminders 2012: Action Area Action StatusDocument2 pagesYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783No ratings yet

- Taxpayer Charter: Your Rights and ObligationsDocument15 pagesTaxpayer Charter: Your Rights and ObligationskevotooNo ratings yet

- LLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessFrom EverandLLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessNo ratings yet

- Disaster Recovery ToolkitDocument34 pagesDisaster Recovery ToolkitChiso PhiriNo ratings yet

- Actuarial AnalysisDocument12 pagesActuarial AnalysisNikita MalhotraNo ratings yet

- Employer's Guide Payroll Deductions and RemittancesDocument59 pagesEmployer's Guide Payroll Deductions and RemittancesWill100% (2)

- A Quick Guide To Taxation in GhanaDocument55 pagesA Quick Guide To Taxation in GhanaEnoch DaviesNo ratings yet

- DanOwa VAT & ERP Services Proposal 2019 KeepersDocument9 pagesDanOwa VAT & ERP Services Proposal 2019 KeepersMohamed EzzatNo ratings yet

- Building An Effective EtaxplanDocument3 pagesBuilding An Effective EtaxplanverycoolingNo ratings yet

- See It, Understand It, Use It: Accounting DefinitionsDocument29 pagesSee It, Understand It, Use It: Accounting DefinitionsSirajMeerNo ratings yet

- 2 Credit Risk Management ServicesDocument2 pages2 Credit Risk Management ServiceschemersonNo ratings yet

- ©Jani-King Southwest Exhibit I Page 1 Revised April 2006Document2 pages©Jani-King Southwest Exhibit I Page 1 Revised April 2006usnbjtwvhtNo ratings yet

- Strategic Tax Management Chapter 5Document1 pageStrategic Tax Management Chapter 5Angelly EsguerraNo ratings yet

- Mazars Co TH Payroll Services in Thailand: HighlightsDocument10 pagesMazars Co TH Payroll Services in Thailand: HighlightsAnton HPNo ratings yet

- Your Insurance Audit - How To Save Time and MoneyDocument4 pagesYour Insurance Audit - How To Save Time and MoneyCheick AbdoulNo ratings yet

- Importance of Ethics in AccountingDocument3 pagesImportance of Ethics in AccountingPratish RanjanNo ratings yet

- Research Paper Revenue RecognitionDocument7 pagesResearch Paper Revenue Recognitionorlfgcvkg100% (1)

- Key Man InsuranceDocument2 pagesKey Man InsuranceAditya IyerNo ratings yet

- AL MARZAAN Company ProfileDocument14 pagesAL MARZAAN Company ProfileMohammad ZeeshanNo ratings yet

- International Tax Consulting & Compliance Services: Structuring of Foreign Investments (Outbound Advice)Document5 pagesInternational Tax Consulting & Compliance Services: Structuring of Foreign Investments (Outbound Advice)parthaanikNo ratings yet

- Marketing and Design PortfolioDocument33 pagesMarketing and Design PortfolioMelissa YorkNo ratings yet

- Business ValuationDocument5 pagesBusiness ValuationUmairHussain4943100% (7)

- Starting A Business Checklist 2023 GovDocument10 pagesStarting A Business Checklist 2023 Govjcgoku9No ratings yet

- Taxation of Fringe BenefitsDocument5 pagesTaxation of Fringe BenefitsTawanda Tatenda HerbertNo ratings yet

- FINFO Week 3 Learner GuideDocument14 pagesFINFO Week 3 Learner GuideAngelica Caballes TabaniaNo ratings yet

- Capital V RevenueDocument18 pagesCapital V RevenueFaizan FaruqiNo ratings yet

- ACCT1101 Wk2 Tutorial 1 SolutionsDocument12 pagesACCT1101 Wk2 Tutorial 1 SolutionskyleNo ratings yet

- Nabtrade Financial Services GuideDocument12 pagesNabtrade Financial Services GuideksathsaraNo ratings yet

- E-File IT Returns For Your Clients. It's FREE.: Accounts and AuditDocument7 pagesE-File IT Returns For Your Clients. It's FREE.: Accounts and Auditsundeep tayalNo ratings yet

- IncomeTaxation VirreyDocument14 pagesIncomeTaxation VirreyAdilyn Grace VirreyNo ratings yet

- Chapter 14Document40 pagesChapter 14Ivo_NichtNo ratings yet

- Green Modern Financial Management PresentationDocument17 pagesGreen Modern Financial Management PresentationsikeNo ratings yet

- Trucking Incorporation GuideDocument9 pagesTrucking Incorporation GuideladrendlavindraNo ratings yet

- Entrepreneurs Wealth Management ChecklistDocument7 pagesEntrepreneurs Wealth Management ChecklistThree Bell CapitalNo ratings yet

- Tourism AsiignmentDocument2 pagesTourism AsiignmentSarah Jane ApellidoNo ratings yet

- Sip Report 1Document17 pagesSip Report 1nikhil KumarNo ratings yet

- Achieving Financial Success: An Essential Guide For Small Business (New Zealand)Document89 pagesAchieving Financial Success: An Essential Guide For Small Business (New Zealand)akita_1610No ratings yet

- Research Paper On Tax ComplianceDocument8 pagesResearch Paper On Tax Compliancelemvhlrif100% (1)

- Reporting and Analyzing Revenues and Receivables: Learning Objectives - Coverage by QuestionDocument34 pagesReporting and Analyzing Revenues and Receivables: Learning Objectives - Coverage by QuestionpoollookNo ratings yet

- Finance Accounts Outsourcing Proposal 2015 16Document9 pagesFinance Accounts Outsourcing Proposal 2015 16guyasaababa898No ratings yet

- ACH Debit Blocking Product SheetDocument2 pagesACH Debit Blocking Product Sheetalex rodmanNo ratings yet

- News Paper AdDocument1 pageNews Paper AdNavneet KaliaNo ratings yet

- PCT Fee Tables: (Amounts On 10 December 2010, Unless Otherwise Indicated)Document6 pagesPCT Fee Tables: (Amounts On 10 December 2010, Unless Otherwise Indicated)Navneet KaliaNo ratings yet

- AgendaDocument3 pagesAgendaNavneet KaliaNo ratings yet

- Universal Efficiency at Optimal Work With Bayesian StatisticsDocument5 pagesUniversal Efficiency at Optimal Work With Bayesian StatisticsNavneet KaliaNo ratings yet

- Topic 7 Basic Concepts of Urban Drainage: (Urban Stormwater Management Manual For Malaysia) MasmaDocument29 pagesTopic 7 Basic Concepts of Urban Drainage: (Urban Stormwater Management Manual For Malaysia) MasmaAzhar SabriNo ratings yet

- Gastroenterología y Hepatología: Use of Electrosurgical Units in The Endoscopic Resection of Gastrointestinal TumorsDocument12 pagesGastroenterología y Hepatología: Use of Electrosurgical Units in The Endoscopic Resection of Gastrointestinal TumorsJesús MaríñezNo ratings yet

- Anil Laul BharaniDocument30 pagesAnil Laul BharaniBharani MadamanchiNo ratings yet

- Memory Hierarchy & Cache MemoryDocument40 pagesMemory Hierarchy & Cache MemorybiliNo ratings yet

- Codex: Night LordsDocument5 pagesCodex: Night LordsM. WoodsNo ratings yet

- Beyond Science (Alternity)Document98 pagesBeyond Science (Alternity)Quintus Domitius VinskusNo ratings yet

- Product Sheet Damen FCS 5009Document2 pagesProduct Sheet Damen FCS 5009Juan ResendizNo ratings yet

- Group Medical Insurance - 2020-21Document2 pagesGroup Medical Insurance - 2020-21Vilaz VijiNo ratings yet

- Jurnal SdaDocument7 pagesJurnal SdaPeten AmtiranNo ratings yet

- ChangelogDocument46 pagesChangelogcoolharshit123No ratings yet

- System Analysis & Design in A Changing World Chapter 13 Problems and ExercisesDocument8 pagesSystem Analysis & Design in A Changing World Chapter 13 Problems and ExercisesbriandonaldNo ratings yet

- The Mechanical Properties of Polypropylene - Polylactic Acid (PP-PLA) Polymer Blends - 24 PagesDocument24 pagesThe Mechanical Properties of Polypropylene - Polylactic Acid (PP-PLA) Polymer Blends - 24 PagesSiddharthBhasneyNo ratings yet

- IoT - Internet of Things Based Energy Management For Smart HomeDocument4 pagesIoT - Internet of Things Based Energy Management For Smart HomeEditor IJTSRDNo ratings yet

- Week 1: Learning Activity 1 Short Quiz 1Document39 pagesWeek 1: Learning Activity 1 Short Quiz 1yagami100% (1)

- ILRAP HandbookDocument40 pagesILRAP Handbooknaren_3456No ratings yet

- Short Notes For Heat Transfer - Docx 97.docx 93Document18 pagesShort Notes For Heat Transfer - Docx 97.docx 93kumarsumit1942No ratings yet

- Effects of Composition and Processing SEBS OIL PPDocument25 pagesEffects of Composition and Processing SEBS OIL PPBahadır Uğur AltunNo ratings yet

- UntitledDocument15 pagesUntitledAfiq AimanNo ratings yet

- Analgesics in ObstetricsDocument33 pagesAnalgesics in ObstetricsVeena KaNo ratings yet

- DIY GREENHOUSE by KMS - ChangelogDocument4 pagesDIY GREENHOUSE by KMS - Changeloglm pronNo ratings yet

- 11 RECT TANK 4.0M X 3.0M X 3.3M H - Flocculator PDFDocument3 pages11 RECT TANK 4.0M X 3.0M X 3.3M H - Flocculator PDFaaditya chopadeNo ratings yet

- Biology WaterDocument22 pagesBiology WaternurhanisahmohamadnorNo ratings yet

- Mechanical Engineering Undergraduate ResumeDocument2 pagesMechanical Engineering Undergraduate ResumeAndré ArayaNo ratings yet

- Front Office Final ExaminationDocument5 pagesFront Office Final ExaminationLeonardo FloresNo ratings yet

- Form 5 ElectrolysisDocument2 pagesForm 5 ElectrolysisgrimyNo ratings yet

- Operating Instructions Dixie Cerradora de LatasDocument22 pagesOperating Instructions Dixie Cerradora de LatasMario Amieva BalsecaNo ratings yet

- TWITCH INTERACTIVE, INC. v. JOHN AND JANE DOES 1-100Document18 pagesTWITCH INTERACTIVE, INC. v. JOHN AND JANE DOES 1-100PolygondotcomNo ratings yet

- Driver Licence & Learner Permit FeesDocument9 pagesDriver Licence & Learner Permit FeesAnatoly IvanovNo ratings yet