Professional Documents

Culture Documents

Energy Data Highlights: Heating Costs Look To Cool

Energy Data Highlights: Heating Costs Look To Cool

Uploaded by

choiceenergyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Energy Data Highlights: Heating Costs Look To Cool

Energy Data Highlights: Heating Costs Look To Cool

Uploaded by

choiceenergyCopyright:

Available Formats

Follow

October 19, 2011

Energy Data Highlights

Crude oil futures price 10/17/2011: $86.38/bbl up$0.97 from week earlier up$5.13 from year earlier Natural gas futures price 10/17/2011: $3.688/mmBtu up$0.147 from week earlier up$0.148 from year earlier Retail gasoline price 10/17/2011: $3.476/gal up$0.059 from week earlier up$0.642 from year earlier Retail diesel price 10/17/2011: $3.801/gal up$0.080 from week earlier up$0.728 from year earlier Weekly coal production 10/8/2011: 21.602 million tons down0.309 million tons from week earlier up0.137 million tons from year earlier http://www.eia.gov/

Natural Gas/ Power News

EIA Storage Release 10/13/11 (Actual): +112 Bcf Previous Week: +97 Bcf -1.6% Change from 1 Year Ago +2.0% Change 5-year Average Heating Costs Look to Cool High gasoline prices have tugged at household budgets this year, but relief from energy costs might arrive, surprisingly, when temperatures start to tumble this winter. Natural gas, used to heat nearly half of U.S. homes, is expected to hit some of the lowest winter prices in years as rising production and a mild autumn send U.S. stockpiles of the fuel to record levels. Natural gas, used to heat nearly

half of U.S. homes, is expected to hit some of the lowest winter prices in years as rising production and a mild autumn send U.S. stockpiles of the fuel to record levels. Normally, natural-gas prices surge beginning in December, as cold blankets the U.S. and residents heat their homes. But the supply glut is pushing down futures prices, and utilities have responded by locking in low prices they can pass on to consumers. http://online.wsj.com/article/SB1000142405297020365880457663933347622854 2.html?mod=WSJ_Commodities_LEFTTopNews EU regulatory agency adopts gas balancing framework guidelines The EU's energy regulatory agency ACER has adopted framework guidelines for gas balancing, the agency said Wednesday. Under the EU's third package of energy market reforms, which came into force on March 3, ACER is to prepare framework guidelines on a number of issues that can then be translated into network codes by the new transmission system operator bodies for electricity (Entso-e) and gas (Entsog). The guidelines set out an obligation on gas transmission system operators to buy and sell so-called "flexible" gas so that they can keep their gas systems operating within safe limits. But they stress that TSOs should buy flexible gas and related gas balancing services in a way that helps minimize the cost of balancing the system by accepting lowest offers and highest bids. They should also do this on wholesale markets in a transparent way, the guidelines state. http://www.platts.com/RSSFeedDetailedNews/RSSFeed/NaturalGas/8480760

Green/ Alternative Energy News

Officials see increased accountability for US-funded clean-energy projects Declining government budgets and a flagging global economy will lead federal and state agencies to demand clearer results and more accountability from cleanenergy developers that receive government funding, officials said Tuesday. "The days of getting some government money and maybe hitting your milestones and maybe not, and maybe getting some more time and limping along, and sort of being successful and maybe not, or maybe you hit the jackpot, those days are over," said Sarah Bittleman, a senior adviser to US Agriculture Secretary Tom Vilsack. http://www.platts.com/RSSFeedDetailedNews/RSSFeed/Oil/6590755

Crude Oil News

OPEC Daily Basket Price 10/17/2011- $107.94

(10/17/2011- $110.13)

Oil Trades Near Highest Price in a Month After Goldman Cites Upside Risk Oil traded near the highest price in more than a month after Goldman Sachs Group Inc. predicted upside potential, amid signs U.S. crude stockpiles are increasing less rapidly than previously forecast. Futures gained as much as 0.6 percent, extending yesterdays 2.3 percent gain. Energy Department data today may show that supplies climbed 2 million barrels. Yesterdays report by the industry-funded American Petroleum Institute indicated they dropped for a third week. Goldman Sachs said an improving economic outlook in Europe and declining crude supplies may present a real upside risk to Brent prices. The market certainly drew some support from pronounced crude and product draws in the API data, as well as more optimism creeping back in about the euro-zone bailout, said Andrey Kryuchenkov, an analyst at VTB Capital in London, who predicts prices will end the year little changed from current levels. Libya will come back on line, but not especially fast, and geopolitical risks surrounding Iran will give support. http://www.bloomberg.com/news/2011-10-19/oil-trades-near-highest-in-a-monthas-goldman-sees-upside-risk-.html

Oil Moves Cautiously Higher With Europe Stocks U.S. crude oil prices edged higher Wednesday after losing ground during Asia market hours, appearing to take their cue from a higher move among European stocks. http://www.cnbc.com/id/44953802 European discord over Greek debt undermines markets The price of crude oil topped $88/bbl in intraday trading Oct. 17 in New York but closed at a small loss for the day as commodities and equities retreated after French and German officials clashed over a second rescue package for Greece. Germany wants banks to accept cuts of 50-60% on their Greek bond holdings to reduce Greeces overall debt load that otherwise could reach 180% of the countrys economic output next year. German officials say a solution must be found to allow Greece to repay its debts over the long run. http://www.ogj.com/articles/2011/10/market-watch-european-discord-over-greekdebt-undermines-markets.html Oil Giants in $100 Billion Iraq Investment Exxon Mobil Corp., BP PLC and Italy's Eni SpA will spend around $100 billion to upgrade three oilfields in southern Iraq, the top energy adviser to the Iraqi Prime Minister said Wednesday. Thamer Ghadhban said some $50 billion would be spent to upgrade the supergiant West Qurna Phase 1 oilfield which is being developed by Exxon Mobil. The remaining $50 billion will be spent by BP and Eni to upgrade the Rumaila and Zubair oil fields respectively, he said. http://online.wsj.com/article/SB1000142405297020448530457664067415312577 8.html?mod=WSJ_hp_LEFTWhatsNewsCollection

Anadarko may dodge a ratings bullet with BP settlement One could probably hear the sigh of relief from outside Anadarko Petroleums headquarters in The Woodlands on Monday when the company said it would pay BP $4 billion to settle its liabilities around the clean-up following the Deepwater Horizon accident. Anadarkos 25 percent stake in the well could have stuck the booming E&P with a hefty piece of the clean-up bill and exposure to even more payments in the future. The deal puts a ceiling on the largest piece of the bill, but still leaves Andarko exposed to some future civil, criminal and administrative fines that could be as much as $1.85 billion. The settlement is good news for Anadarkos credit rating, which Moodys said it will review for an upgrade. http://fuelfix.com/blog/2011/10/18/anadarko-may-dodge-a-ratings-bullet-with-bpsettlement/ Mexican Presidential Hopeful Wants Private Sector Involved In Pemex Enrique Pena Nieto, a candidate for Mexico's presidency, wants to open up the country's state-owned oil sector to private interests, the Financial Times reported Tuesday. The state-owned oil firm Petroleos Mexicanos, or Pemex, "can achieve more, grow more and do more through alliances with the private sector," Pena Nieto told the newspaper. He said that Mexico could follow the example of Brazil, whose Petroleo Brasileiro (PBR, PETR4.BR) held a minority-share issue in 2010. http://www.foxbusiness.com/markets/2011/10/18/mexican-presidential-hopefulwants-private-sector-involved-in-pemex-ft/

Brazils Odebrecht plans oil expansion The oil and gas arm of Odebrecht, one of Brazils biggest multinationals, is hoping to treble revenues over the next three years as it seeks to tap the potential of the Latin American countrys vast offshore oilfields. The ambitious plans from Odebrecht Oil and Gas, which is part-owned by Temasek, Singapores sovereign wealth fund, follow the companys sale of a separate stake to JPMorgans flagship Brazilian hedge fund and private equity group, Gvea Investments. We want to create the largest provider of services to Petrobras and we are making investments with that in mind, said Roberto Ramos, chief executive. http://www.ft.com/intl/cms/s/0/b62f0cc0-f980-11e0-bf8f00144feab49a.html#axzz1b8IkMBRu IEA sees less potential for Q4 oil price spike than earlier The International Energy Agency now sees less potential for oil prices to spike in the fourth quarter than it did in June, David Fyfe, head of the agency's oil industry and markets division, said Wednesday. Fyfe told journalists in Paris that the IEA had been scaling back its economic growth forecasts, although he said the consensus view among macro-economic forecasters was for slowdown rather than a double-dip recession. Nevertheless, he said, "we don't think that this is a market [in which] producers should be looking to scale back supply" and that there was "an ample market for OPEC production at or above current levels" of around 30.1 million b/d.

http://www.platts.com/RSSFeedDetailedNews/RSSFeed/Oil/8480850

Recent Rig Counts Change from Prior Count +11 -10 -9 Date of Prior Count 7 Oct 11 7 Oct 11 August 2011 Change Date of from Last Last Year's Year Count +353 +89 +54 15 Oct 10 15 Oct 10 September 2010

Area U.S. Canada

Last Count 14 Oct 11 14 Oct 11

Cou nt 2023 512

Internatio Septemb 1174 nal er 2011

http://investor.shareholder.com/bhi/rig_counts/rc_index.cfm

Weather

6 to 10 Day Outlooks Temperature

Precipitation

8 to 14 Day Outlooks Temperature

Precipitation

You might also like

- Case Studies PetroDocument20 pagesCase Studies PetroMichelle MendozaNo ratings yet

- 15 18 049 0H - Notice - 8M26.2 - ENDocument119 pages15 18 049 0H - Notice - 8M26.2 - ENsxturboNo ratings yet

- 60-2326 Grass Trimmer Final Apr10 - EnglishDocument18 pages60-2326 Grass Trimmer Final Apr10 - EnglishantunmatNo ratings yet

- Natural Gas/ Power News: Market Changes Contribute To Growing Marcellus Area Spot Natural Gas TradingDocument9 pagesNatural Gas/ Power News: Market Changes Contribute To Growing Marcellus Area Spot Natural Gas TradingchoiceenergyNo ratings yet

- Natural Gas/ Power News: From King Coal To King GasDocument10 pagesNatural Gas/ Power News: From King Coal To King GaschoiceenergyNo ratings yet

- Natural Gas/ Power NewsDocument10 pagesNatural Gas/ Power NewschoiceenergyNo ratings yet

- Energy Data Highlights: Japan Utilities' LNG Imports, Consumption Climb To RecordDocument7 pagesEnergy Data Highlights: Japan Utilities' LNG Imports, Consumption Climb To RecordchoiceenergyNo ratings yet

- Energy Data Highlights: Shale Attracts Heavy HittersDocument9 pagesEnergy Data Highlights: Shale Attracts Heavy HitterschoiceenergyNo ratings yet

- Energy Data Highlights: Frosty Air Heating Up Gas FuturesDocument8 pagesEnergy Data Highlights: Frosty Air Heating Up Gas FutureschoiceenergyNo ratings yet

- Energy Data Highlights: Chesapeake Energy Continues March To Liquids: CEODocument8 pagesEnergy Data Highlights: Chesapeake Energy Continues March To Liquids: CEOchoiceenergyNo ratings yet

- Energy Data Highlights: Greek Turmoil Threatens Europe's Gas Pipe ProjectsDocument8 pagesEnergy Data Highlights: Greek Turmoil Threatens Europe's Gas Pipe ProjectschoiceenergyNo ratings yet

- Energy and Markets Newsletter 091911Document9 pagesEnergy and Markets Newsletter 091911choiceenergyNo ratings yet

- Energy Data Highlights: Natural Gas Key To US Energy Security: Former President Carter The USDocument9 pagesEnergy Data Highlights: Natural Gas Key To US Energy Security: Former President Carter The USchoiceenergyNo ratings yet

- Energy Data Highlights: Big Gas Find For Italy's EniDocument9 pagesEnergy Data Highlights: Big Gas Find For Italy's EnichoiceenergyNo ratings yet

- Energy Data Highlights: Obama To Speed Up Power Line Projects in 12 StatesDocument10 pagesEnergy Data Highlights: Obama To Speed Up Power Line Projects in 12 StateschoiceenergyNo ratings yet

- Energy Data Highlights: North Dakota Bakken Shale Infrastructure Projects Reach $3 Billion MarkDocument8 pagesEnergy Data Highlights: North Dakota Bakken Shale Infrastructure Projects Reach $3 Billion MarkchoiceenergyNo ratings yet

- Energy Data Highlights: Canadian Natural Gas Advances As Midwest Braces For Cold NightsDocument10 pagesEnergy Data Highlights: Canadian Natural Gas Advances As Midwest Braces For Cold NightschoiceenergyNo ratings yet

- Energy and Markets Newsletter 091611Document7 pagesEnergy and Markets Newsletter 091611choiceenergyNo ratings yet

- Energy Data Highlights: Natural Gas: Boom or BustDocument8 pagesEnergy Data Highlights: Natural Gas: Boom or BustchoiceenergyNo ratings yet

- Crude Oil News: OPEC Daily Basket Price 11/22/2011-$108.34 (OPEC Daily Basket Price 11/21/2011 - $107.74)Document11 pagesCrude Oil News: OPEC Daily Basket Price 11/22/2011-$108.34 (OPEC Daily Basket Price 11/21/2011 - $107.74)choiceenergyNo ratings yet

- Natural Gas/ Power News: Proposed KMI and El Paso Merger Would Create Largest U.S. Natural Gas Pipeline CompanyDocument7 pagesNatural Gas/ Power News: Proposed KMI and El Paso Merger Would Create Largest U.S. Natural Gas Pipeline CompanychoiceenergyNo ratings yet

- Energy Data Highlights: Tennessee Gas Pipeline Places 300 Line Project in ServiceDocument9 pagesEnergy Data Highlights: Tennessee Gas Pipeline Places 300 Line Project in ServicechoiceenergyNo ratings yet

- Energy Data Highlights Energy Data HighlightsDocument8 pagesEnergy Data Highlights Energy Data HighlightschoiceenergyNo ratings yet

- Natural Gas/ Power News: Shale Gas Opens Door To U.S. LNG ExportsDocument9 pagesNatural Gas/ Power News: Shale Gas Opens Door To U.S. LNG ExportschoiceenergyNo ratings yet

- Energy Data Highlights: Electric Generating Capacity Additions in The First Half of 2011Document8 pagesEnergy Data Highlights: Electric Generating Capacity Additions in The First Half of 2011choiceenergyNo ratings yet

- Energy Data Highlights: Sierra Club Wants Natural Gas ReformsDocument7 pagesEnergy Data Highlights: Sierra Club Wants Natural Gas ReformschoiceenergyNo ratings yet

- Natural Gas/ Power News: Middle East Can Expect 'Dash For Gas', Shell Exec Tells Oman ConferenceDocument11 pagesNatural Gas/ Power News: Middle East Can Expect 'Dash For Gas', Shell Exec Tells Oman ConferencechoiceenergyNo ratings yet

- Energy Data Highlights: Gas Drillers Face Chaos' in Land Law RulingDocument10 pagesEnergy Data Highlights: Gas Drillers Face Chaos' in Land Law RulingchoiceenergyNo ratings yet

- Energy Data Highlights: Is Fracking Set To Transform The Oil Market?Document9 pagesEnergy Data Highlights: Is Fracking Set To Transform The Oil Market?choiceenergyNo ratings yet

- Natural Gas/ Power News: Africa's East Coast in Natural-Gas SpotlightDocument10 pagesNatural Gas/ Power News: Africa's East Coast in Natural-Gas SpotlightchoiceenergyNo ratings yet

- Energy Data Highlights: Crude Oil Futures PriceDocument8 pagesEnergy Data Highlights: Crude Oil Futures PricechoiceenergyNo ratings yet

- Energy and Markets Newsletter 110811Document10 pagesEnergy and Markets Newsletter 110811choiceenergyNo ratings yet

- Energy and Markets Newsletter January 18-2012Document11 pagesEnergy and Markets Newsletter January 18-2012choiceenergyNo ratings yet

- Energy Data Highlights: Sakhalin Energy Partners Could Decide On Train 3 in 2012Document9 pagesEnergy Data Highlights: Sakhalin Energy Partners Could Decide On Train 3 in 2012choiceenergyNo ratings yet

- Energy and Markets Newsletter 0801711Document7 pagesEnergy and Markets Newsletter 0801711choiceenergyNo ratings yet

- Energy Data Highlights Energy Data Highlights: Veresen, Enbridge To Build Tioga Lateral Natural Gas PipelineDocument8 pagesEnergy Data Highlights Energy Data Highlights: Veresen, Enbridge To Build Tioga Lateral Natural Gas PipelinechoiceenergyNo ratings yet

- Staggering Profits For The Fossil Fuel IndustryDocument3 pagesStaggering Profits For The Fossil Fuel IndustryjohnosborneNo ratings yet

- Energy Data Highlights: Shale Gas & The Re-Shaping of European Power PoliticsDocument8 pagesEnergy Data Highlights: Shale Gas & The Re-Shaping of European Power PoliticschoiceenergyNo ratings yet

- Energy Data Highlights: Canadian Gas Falls As Irene Pares Power, Cooling Demand DeclinesDocument7 pagesEnergy Data Highlights: Canadian Gas Falls As Irene Pares Power, Cooling Demand DeclineschoiceenergyNo ratings yet

- Natural Gas/ Power News: ERCOT Congestion Rights Value Falls in Latest AuctionDocument10 pagesNatural Gas/ Power News: ERCOT Congestion Rights Value Falls in Latest AuctionchoiceenergyNo ratings yet

- Index File FYI: Download The Original AttachmentDocument57 pagesIndex File FYI: Download The Original AttachmentAffNeg.Com100% (1)

- Energy and Markets Newsletter 111511Document9 pagesEnergy and Markets Newsletter 111511choiceenergyNo ratings yet

- Energy Data Highlights: Poland Shale Tests Show Europe Unlikely To Match U.S. Boom, Bernstein SaysDocument9 pagesEnergy Data Highlights: Poland Shale Tests Show Europe Unlikely To Match U.S. Boom, Bernstein SayschoiceenergyNo ratings yet

- Energy Data Highlights: Natural Gas Leads Gains in Raw Materials: Commodities at CloseDocument11 pagesEnergy Data Highlights: Natural Gas Leads Gains in Raw Materials: Commodities at ClosechoiceenergyNo ratings yet

- Natural Gas/ Power NewsDocument10 pagesNatural Gas/ Power NewschoiceenergyNo ratings yet

- Energy Data Highlights: Sinopec To Buy Daylight Energy For $2.1BDocument11 pagesEnergy Data Highlights: Sinopec To Buy Daylight Energy For $2.1BchoiceenergyNo ratings yet

- Energy Data Highlights: Power Outage May Have Caused More Than $100M in Losses To AreaDocument8 pagesEnergy Data Highlights: Power Outage May Have Caused More Than $100M in Losses To AreachoiceenergyNo ratings yet

- Energy Data Highlights: Retail Gasoline PriceDocument7 pagesEnergy Data Highlights: Retail Gasoline PricechoiceenergyNo ratings yet

- Energy Data Highlights: Gas Futures Climb On Inventory Data, WeatherDocument8 pagesEnergy Data Highlights: Gas Futures Climb On Inventory Data, WeatherchoiceenergyNo ratings yet

- Natural Gas/ Power News: Crestwood Midstream Plans Marcellus Pipeline in West VirginiaDocument7 pagesNatural Gas/ Power News: Crestwood Midstream Plans Marcellus Pipeline in West VirginiachoiceenergyNo ratings yet

- Energy Data Highlights: Mid-Summer Heat Pushes Up Natural Gas Use at Electric Power PlantsDocument8 pagesEnergy Data Highlights: Mid-Summer Heat Pushes Up Natural Gas Use at Electric Power PlantschoiceenergyNo ratings yet

- Natural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberDocument9 pagesNatural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberchoiceenergyNo ratings yet

- Energy and Markets Newsletter 090611Document8 pagesEnergy and Markets Newsletter 090611choiceenergyNo ratings yet

- Energy Data Highlights: Natural Gas Ends 2011 at 27-Month LowDocument9 pagesEnergy Data Highlights: Natural Gas Ends 2011 at 27-Month LowchoiceenergyNo ratings yet

- Energy and Markets Newsletter 0802611Document8 pagesEnergy and Markets Newsletter 0802611choiceenergyNo ratings yet

- Natural Gas Set To Lead Turkish Power Market: Utility ExecutiveDocument8 pagesNatural Gas Set To Lead Turkish Power Market: Utility ExecutivechoiceenergyNo ratings yet

- Natural Gas/ Power News: A Quarter of California's Electricity Comes From Outside The StateDocument9 pagesNatural Gas/ Power News: A Quarter of California's Electricity Comes From Outside The StatechoiceenergyNo ratings yet

- Peak Oil Review Vol. 3 No. 47 November 24Document6 pagesPeak Oil Review Vol. 3 No. 47 November 24api-26190745No ratings yet

- 2012 - Oil and The Global EconomyDocument6 pages2012 - Oil and The Global EconomyLogan JulienNo ratings yet

- Industry Analysts Expect That Hundreds More Rigs WillDocument6 pagesIndustry Analysts Expect That Hundreds More Rigs Willapi-26190745No ratings yet

- Natural Gas/ Power News: Shale-Gas Drilling To Add 870,000 U.S. JobsDocument10 pagesNatural Gas/ Power News: Shale-Gas Drilling To Add 870,000 U.S. JobschoiceenergyNo ratings yet

- FOCUS REPORT: U.S. Shale Gale under Threat from Oil Price PlungeFrom EverandFOCUS REPORT: U.S. Shale Gale under Threat from Oil Price PlungeRating: 2 out of 5 stars2/5 (1)

- Energy Data Highlights: Natural Gas Ends 2011 at 27-Month LowDocument9 pagesEnergy Data Highlights: Natural Gas Ends 2011 at 27-Month LowchoiceenergyNo ratings yet

- Energy Data Highlights: Barnett Shale Continues To Lose Its Luster For Producers: TradeDocument6 pagesEnergy Data Highlights: Barnett Shale Continues To Lose Its Luster For Producers: TradechoiceenergyNo ratings yet

- Energy Data Highlights: Crude Oil Futures PriceDocument8 pagesEnergy Data Highlights: Crude Oil Futures PricechoiceenergyNo ratings yet

- Energy and Markets Newsletter January 12-2012Document7 pagesEnergy and Markets Newsletter January 12-2012choiceenergyNo ratings yet

- Natural Gas/ Power News: A Quarter of California's Electricity Comes From Outside The StateDocument9 pagesNatural Gas/ Power News: A Quarter of California's Electricity Comes From Outside The StatechoiceenergyNo ratings yet

- Energy Data Highlights: Natural Gas Leads Gains in Raw Materials: Commodities at CloseDocument11 pagesEnergy Data Highlights: Natural Gas Leads Gains in Raw Materials: Commodities at ClosechoiceenergyNo ratings yet

- Energy Data Highlights: NYMEX January Gas Futures Contract Falls 2.6 Cents Midday TuesdayDocument9 pagesEnergy Data Highlights: NYMEX January Gas Futures Contract Falls 2.6 Cents Midday TuesdaychoiceenergyNo ratings yet

- Energy and Markets Newsletter January 18-2012Document11 pagesEnergy and Markets Newsletter January 18-2012choiceenergyNo ratings yet

- Natural Gas/ Power News: ERCOT Congestion Rights Value Falls in Latest AuctionDocument10 pagesNatural Gas/ Power News: ERCOT Congestion Rights Value Falls in Latest AuctionchoiceenergyNo ratings yet

- Energy and Markets Newsletter January 10-2012Document8 pagesEnergy and Markets Newsletter January 10-2012choiceenergyNo ratings yet

- Natural Gas/ Power News: Crestwood Midstream Plans Marcellus Pipeline in West VirginiaDocument7 pagesNatural Gas/ Power News: Crestwood Midstream Plans Marcellus Pipeline in West VirginiachoiceenergyNo ratings yet

- Energy and Markets Newsletter January 11-2012Document7 pagesEnergy and Markets Newsletter January 11-2012choiceenergyNo ratings yet

- Natural Gas/ Power News: Market Changes Contribute To Growing Marcellus Area Spot Natural Gas TradingDocument9 pagesNatural Gas/ Power News: Market Changes Contribute To Growing Marcellus Area Spot Natural Gas TradingchoiceenergyNo ratings yet

- Natural Gas/ Power News: Shale's Bounty Goes Beyond Oil and GasDocument10 pagesNatural Gas/ Power News: Shale's Bounty Goes Beyond Oil and GaschoiceenergyNo ratings yet

- Natural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberDocument9 pagesNatural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberchoiceenergyNo ratings yet

- Natural Gas/ Power News: From King Coal To King GasDocument10 pagesNatural Gas/ Power News: From King Coal To King GaschoiceenergyNo ratings yet

- Natural Gas/ Power News: Shale Gas Opens Door To U.S. LNG ExportsDocument9 pagesNatural Gas/ Power News: Shale Gas Opens Door To U.S. LNG ExportschoiceenergyNo ratings yet

- Natural Gas/ Power News: Shale-Gas Drilling To Add 870,000 U.S. JobsDocument10 pagesNatural Gas/ Power News: Shale-Gas Drilling To Add 870,000 U.S. JobschoiceenergyNo ratings yet

- Natural Gas Set To Lead Turkish Power Market: Utility ExecutiveDocument8 pagesNatural Gas Set To Lead Turkish Power Market: Utility ExecutivechoiceenergyNo ratings yet

- Natural Gas/ Power News: Middle East Can Expect 'Dash For Gas', Shell Exec Tells Oman ConferenceDocument11 pagesNatural Gas/ Power News: Middle East Can Expect 'Dash For Gas', Shell Exec Tells Oman ConferencechoiceenergyNo ratings yet

- Energy and Markets Newsletter 111611Document8 pagesEnergy and Markets Newsletter 111611choiceenergyNo ratings yet

- Natural Gas/ Power News: Proposed KMI and El Paso Merger Would Create Largest U.S. Natural Gas Pipeline CompanyDocument7 pagesNatural Gas/ Power News: Proposed KMI and El Paso Merger Would Create Largest U.S. Natural Gas Pipeline CompanychoiceenergyNo ratings yet

- Natural Gas/ Power News: Africa's East Coast in Natural-Gas SpotlightDocument10 pagesNatural Gas/ Power News: Africa's East Coast in Natural-Gas SpotlightchoiceenergyNo ratings yet

- Energy Data Highlights: Poland Shale Tests Show Europe Unlikely To Match U.S. Boom, Bernstein SaysDocument9 pagesEnergy Data Highlights: Poland Shale Tests Show Europe Unlikely To Match U.S. Boom, Bernstein SayschoiceenergyNo ratings yet

- Natural Gas/ Power News: NY Opens Hearings On Hydraulic FracturingDocument11 pagesNatural Gas/ Power News: NY Opens Hearings On Hydraulic FracturingchoiceenergyNo ratings yet

- Natural Gas/ Power NewsDocument10 pagesNatural Gas/ Power NewschoiceenergyNo ratings yet

- Energy and Markets Newsletter 111511Document9 pagesEnergy and Markets Newsletter 111511choiceenergyNo ratings yet

- Crude Oil News: OPEC Daily Basket Price 11/22/2011-$108.34 (OPEC Daily Basket Price 11/21/2011 - $107.74)Document11 pagesCrude Oil News: OPEC Daily Basket Price 11/22/2011-$108.34 (OPEC Daily Basket Price 11/21/2011 - $107.74)choiceenergyNo ratings yet

- Energy and Markets Newsletter 112111Document8 pagesEnergy and Markets Newsletter 112111choiceenergyNo ratings yet

- Natural Gas/ Power NewsDocument10 pagesNatural Gas/ Power NewschoiceenergyNo ratings yet

- ESAB ExtractPage14-15cDocument8 pagesESAB ExtractPage14-15cDries VandezandeNo ratings yet

- Info1 Clavus 68 PDFDocument2 pagesInfo1 Clavus 68 PDFJavier AffifNo ratings yet

- Electric Vehicles in India: A Literature ReviewDocument3 pagesElectric Vehicles in India: A Literature ReviewSatyendra Pratap SinghNo ratings yet

- C29732-01-Pid-02.0 - P&id Scrubber TT-006Document1 pageC29732-01-Pid-02.0 - P&id Scrubber TT-006omarNo ratings yet

- Maximum Allowable Amount of Water in Lube Oil Archives - Marine Engineering Study MaterialsDocument10 pagesMaximum Allowable Amount of Water in Lube Oil Archives - Marine Engineering Study MaterialsJohn GrayNo ratings yet

- Maddipati Okstate 0664M 10886 PDFDocument182 pagesMaddipati Okstate 0664M 10886 PDFFarah Talib Al-sudaniNo ratings yet

- The Engine With Integrated Water Cooling TAD734GE: Green Power Volvo Diesel EngineDocument4 pagesThe Engine With Integrated Water Cooling TAD734GE: Green Power Volvo Diesel Enginehonafa- R.O.N.ONo ratings yet

- Lecture 4 - Gas Turbines (Sept 2020) PDFDocument6 pagesLecture 4 - Gas Turbines (Sept 2020) PDFrushdiNo ratings yet

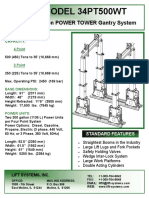

- MODEL 34PT500WT: 500 Ton POWER TOWER Gantry SystemDocument2 pagesMODEL 34PT500WT: 500 Ton POWER TOWER Gantry SystemCHRISTIAN LOPEZ FLOREZNo ratings yet

- 25-Fuel SystemDocument21 pages25-Fuel SystemПавелNo ratings yet

- Filtration With Offline Oil Filters SDN Rev Feb 2013 01Document7 pagesFiltration With Offline Oil Filters SDN Rev Feb 2013 01Dian Purwa Dewa (Babeh)No ratings yet

- Applications in Aviation HaskelDocument4 pagesApplications in Aviation HaskelMouhaNo ratings yet

- List of Withdrawn ASME Codes: (Under The Performance Test Codes Standards Committee)Document2 pagesList of Withdrawn ASME Codes: (Under The Performance Test Codes Standards Committee)igormetaldataNo ratings yet

- Gas Cutting - JKPDocument19 pagesGas Cutting - JKPavikNo ratings yet

- This Manual Includes: Repair Procedures Fault Codes Electrical and Hydraulic SchematicsDocument215 pagesThis Manual Includes: Repair Procedures Fault Codes Electrical and Hydraulic SchematicsJaime Basquez PaccoNo ratings yet

- TDS Transpro 40 - Sae 15W-40Document1 pageTDS Transpro 40 - Sae 15W-40Andaru GunawanNo ratings yet

- ITP-Interpipe - Cryogenic SolutionsDocument47 pagesITP-Interpipe - Cryogenic SolutionsLiauw Cooperation0% (1)

- Extended Functionality and Validation of Sulsim Sulfur Recovery in Aspen HYSYSDocument16 pagesExtended Functionality and Validation of Sulsim Sulfur Recovery in Aspen HYSYSIffatNo ratings yet

- User'S Manual For Centrifugal BlowerDocument20 pagesUser'S Manual For Centrifugal BlowerAmpera marzelaNo ratings yet

- Italian Speed Chip Tuning Instructions: (Download Free)Document8 pagesItalian Speed Chip Tuning Instructions: (Download Free)LittleJoe VipNo ratings yet

- Alternate Fuels For IC EnginesDocument2 pagesAlternate Fuels For IC Enginesharshasai123456No ratings yet

- CLG933E Maintenance Service 2000 ExavatorDocument4 pagesCLG933E Maintenance Service 2000 Exavatoroed shareNo ratings yet

- Gas Testing Exam Application FormDocument1 pageGas Testing Exam Application FormAjeet KumarNo ratings yet

- Service & Size DescDocument324 pagesService & Size DescRajeev KumarNo ratings yet

- Parts List Related To MotorDocument1 pageParts List Related To MotorDmytro PichkurNo ratings yet

- North American Air - Oil Ratiotrols 7052Document2 pagesNorth American Air - Oil Ratiotrols 7052haripari2k1No ratings yet

- Iveco C78 ENS M20.10 (-M55.10)Document254 pagesIveco C78 ENS M20.10 (-M55.10)gluyk100% (3)

- Deck STCW Good QuestionsDocument15 pagesDeck STCW Good QuestionsRajat KapoorNo ratings yet