Professional Documents

Culture Documents

HB 1776, The Property Tax Independence Act: A Solution That Makes Sense For Pennsylvania

HB 1776, The Property Tax Independence Act: A Solution That Makes Sense For Pennsylvania

Uploaded by

Octorara_ReportOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HB 1776, The Property Tax Independence Act: A Solution That Makes Sense For Pennsylvania

HB 1776, The Property Tax Independence Act: A Solution That Makes Sense For Pennsylvania

Uploaded by

Octorara_ReportCopyright:

Available Formats

HB 1776, The Property Tax Independence Act

A solution that makes sense for Pennsylvania

INTRODUCTION There is no Holy Grail of property tax reform. Any property tax reform measure will involve shifting the tax levy from one type of tax to another. Theres no free ride. But there are ways to fund our schools and to ensure a better education for our children that are fairer and more effective than property taxes. Many Pennsylvanians lose their homes and a lifetimes work to sheriffs sales each year because they no longer can afford to pay their property taxes. Senior citizens on fixed incomes are increasingly forced to sell their homes because of unrelenting increases in their tax burden. Young families cannot afford to purchase a home because the per-month property tax escrow is simply too high. Multigenerational family farms are being sold piece by piece to pay property taxes, devastating Pennsylvania agriculture. School districts in areas of the state with limited population and no commercial tax base are in distress and are unable to afford to give their children a quality education. Job losses, outmigration, and abysmal state economic performance caused by burdensome property taxes are devastating Pennsylvanias economy. A sensible, broad-based, statewide and state-administered property tax replacement funding source is needed to eliminate an antiquated and regressive property tax system, to end these educational inequities, to return home ownership to the homeowner instead of allowing the government to effectively own our homes, and to restore Pennsylvanias economic vitality. THE BOTTOM LINE: Our current system of school funding is crumbling. This decay has been occurring for many years and continues to escalate. Home foreclosures and tax sales are occurring at an expanding rate and the home market is at a standstill. The opportunity to fund education from a statewide source is rapidly vanishing as relentlessly rising property taxes outpace available revenue. This will have major implications for school districts statewide. It can no longer be ignored or diminished. Replacement of the school property tax must be accomplished now.

THE PLAN AND HOW IT IS FUNDED After many months of work and negotiation by key legislators, a plan to eliminate and replace school property and local school nuisance taxes has been finalized and will be formally introduced in both the Pennsylvania House of Representatives and Senate in the near future. House Bill 1776, the Property Tax Independence Act, looks in part to the former School Property Tax Elimination Act (SPTEA) for its basic structure. While the Property Tax Independence Act mirrors some of the provisions of the former SPTEA, the plan has been comprehensively rewritten to account for lawmakers concerns and preferences in order to eliminate objections common to the previous legislation. As with the former SPTEA, the Property Tax Independence Act will eliminate all school property and nuisance taxes across the Commonwealth and will replace those taxes with funding from a single state source. The most important provision of the Property Tax Independence Act is that it is tax revenue neutral. To provide absolute fairness, the legislation has been carefully crafted to ensure that the tax swap provision of the plan does not raise one dollar more than is already collected by the school property tax mechanism. The Property Tax Independence Act uses a modernized school funding plan based on 21st century economic realities. The Property Tax Independence Act will ABOLISH the school property tax on all homesteads, farmsteads, and businesses as well as eliminate the local school Earned Income Tax (EIT) and other Act 511 nuisance taxes imposed by school districts. School property tax elimination will be accomplished via a two-year phase-out of school property taxes. During the first year after enactment, school property taxes will be frozen at their current level. During the second year they will be completely eliminated except for a small portion that will be retained in each school district to retire the individual districts outstanding long-term debt. The Property Tax Independence Act uses our current sales tax mechanism to fund schools, restoring the original intent of the tax. The The PA Education Sales Tax was enacted in 1953 for this specific purpose and virtually 100 percent of the revenue from the sales tax is still dedicated to education funding. The sales tax provides a predictable and stable funding source that automatically increases revenue in sync with economic growth. This is in clear contrast to the school property tax which is not based on economic growth and is subject to much variation, forcing annual increases in the tax rate to increase revenue.

The sales tax is also the most desirable revenue source because, unlike the property tax that has no relationship to family income, it is directly tied to a persons ability to pay. While the sales tax is the Property Tax Independence Acts primary revenue source, small increases in other taxes are blended into the total to spread the cost of education over the broadest possible base. The Property Tax Independence Act moderately broadens the base of the state sales tax to include more services and purchases at a new 7 percent rate. Items to be added to the taxable base include candy and gum, newspapers and magazines, dry cleaning and laundry services, haircuts, and spectator sports admissions. Food items not included on the WIC list and individual clothing and footwear items with a value greater than $50 also will be subject to the expanded sales tax. Generally, food items exempt from the sales tax will be fresh meats, produce, and dairy, along with many packaged and canned foods that are in their natural form, without added sugar or other adulterants. While there are those who might object on an instinctual level to a sales tax on the last two items, consider this: If you spend $8,000 annually on clothing over $50 and non-WIC food purchases combined, the total sales tax would be $560. If this is less than your school property tax bill you still will realize a substantial reduction in your overall tax burden. Items that will continue to be exempt from the sales tax include food stamp purchases; all utilities; home heating fuels; health, hospital, and dental services; prescription drugs; home health care; tuition; day care; charitable organizations; and business-to-business transactions. The Property Tax Independence Act completely eliminates the local school district Earned Income Tax (generally 0.5 percent) and nuisance taxes such as the Amusement Tax, business Gross Receipts Tax, business Privilege Tax, Earned Income Tax, Mechanical Devices Tax, Mercantile Tax, Occupational Privilege Tax, and Occupation Tax, and swaps these taxes for an increase of 0.92 percent in the state Personal Income Tax, from 3.07 percent to 3.99 percent. Although those taxpayers with much non-earned income may see a slight increase in their total income taxes, for most taxpayers this will be a direct swap that is tax neutral. Because low-income families pay the EIT from the first dollar earned but receive forgiveness from the state personal income tax if they earn less than $35,000 annually, this tax swap will more than offset any additional sales tax that they may incur. In prior versions of property tax elimination legislation, each school district was provided funding sufficient to service their outstanding long-term debt. This provision raised many objections to the plan from both taxpayers and legislators who felt that it was unfair to require taxpayers in frugal school districts to pay debt incurred by those

districts that may have been financially irresponsible. Besides being politically unpopular, financing this debt from the state level would add $2.3 billion annually to the revenue that needs to be replaced, causing unnecessary tax increases. To decrease the total revenue needed for property tax elimination, the proposed North Dakota property tax elimination plan was used as a model. At enactment of the Property Tax Independence Act, existing long-term debt will remain with each school district for them to individually service. Because of this a remnant of property tax will remain past the two-year elimination phase-in but ONLY the amount of property tax necessary to meet current annual debt service. When that existing debt is retired, the final bit of property tax will disappear and no further property taxes will be allowed. After enactment of the Property Tax Independence Act, each school district will be required to state the amount of property tax necessary for annual debt service and will not be allowed to increase that amount or add any new debt financed by property taxes. The average debt service for all districts is 10 percent of their annual budget, with the highest district at 18 percent. This means that, at worst, one or more districts will enjoy an 82 percent reduction of property taxes at the end of the second year of the plan, with an average property tax reduction statewide of 90 percent. This will tremendously reduce the burden on property owners until the long term debt is retired. As mentioned above, total elimination of the property tax in every school district will be achieved when its debt is retired, although that will vary by district depending on the length of the remaining debt term. Fifteen Pennsylvania school districts are carrying no long-term debt and will see their property taxes totally eliminated immediately at the end of the two-year phase-in period. Note that none of these funding sources are particularly burdensome by themselves but, taken together, provide the funds necessary to replace all Pennsylvania local school taxes. Further, the Property Tax Independence Act will more equally distribute the cost of school funding across all of Pennsylvanias population and visitors to the state, rather than just depending on taxing homeowners.

THE DISTRIBUTION TO THE SCHOOLS The Property Tax Independence Act works to fully fund all Pennsylvania schools. All schools will initially be fully funded at their current levels. Schools will receive their property tax replacement funding directly from the state. Initially, the Property Tax Independence Act will fully fund the districts at their current per-pupil level, with funding adjustments in later years to account for changes in

student population. All students in Pennsylvania, regardless of their location or their areas economic condition, will have the opportunity for a quality education. Equity in schools is guaranteed because the state assumes the responsibility of school funding. Each school will receive the resources it needs regardless of the local ability to pay. This solves the funding problems faced by rural, urban and fast-growing districts. The Property Tax Independence Act calls for a dedicated lockbox account for all property tax replacement revenues that is separate from the General Fund. All replacement funding for the schools will be disbursed from this account through the existing Department of Education funding mechanism, requiring no growth of the current infrastructure. In addition, The Property Tax Independence Act completely eliminates the taxing ability of local school boards. The only exception would be a possible local EIT or personal income tax for major projects such as new school construction, and that will be subject to a no-exemption taxpayer referendum. It is important to note that The Property Tax Independence Act imposes NO mandates of any kind on Pennsylvania school districts. The plan provides replacement funding only and the funding provided by the plan may be used in any manner the school district deems necessary. The Property Tax Independence Act does not interfere in any manner with local school district decisions.

SPENDING CONTROLS Current school spending regularly exceeds tax revenue and the Property Tax Independence Act addresses this issue head on. When the Property Tax Independence Act is enacted, all districts will receive 100 percent of the funding necessary to meet all financial obligations. A per-student expenditure level will be determined for each district and will be re-calculated annually. Each school district will then receive annual upward or downward funding adjustments based on changes in student enrollment multiplied by the current per-pupil cost. Additionally, every district will receive identical percentage annual base funding increases that will be limited by the increase in the Consumer Price Index (CPI), effectively tying annual school budget increases to the increase in available revenue. If a district school board desires additional revenue, it can present a no-exception ballot referendum to the voters of the district to raise additional revenue by either an earned income tax or a personal income tax. However, property taxes will not be able to be reinstituted to raise revenue.

CONSTITUTIONAL AMENDMENT School property taxes need to be prohibited from ever being imposed on Pennsylvanians again. Companion legislation to the the Property Tax Independence Act will provide for a constitutional amendment which GUARANTEES that, once eliminated, school property taxes would be gone forever and that a future Legislature could never re-institute the taxing of our properties.

ADDITIONAL INFORMATION House Bill 1776, the Property Tax Independence Act, has been vetted against actual and projected revenue figures provided by the Pennsylvania House Appropriations Committee and has absolutely been shown to be fiscally viable as written.

You might also like

- Chcccs023 - Ageing Sab v3.2 TheoryDocument32 pagesChcccs023 - Ageing Sab v3.2 TheoryKanchan Adhikari38% (8)

- Solution Manual For Principles of Taxation For Business and Investment Planning 16th Edition by JonesDocument5 pagesSolution Manual For Principles of Taxation For Business and Investment Planning 16th Edition by JonesThanhTrúcc100% (1)

- ASTM D 1075 Effect of Water On Strength of Compacted BitumenDocument2 pagesASTM D 1075 Effect of Water On Strength of Compacted BitumenRajesh Kumar100% (3)

- Internal Test - 2 - FSA - QuestionDocument3 pagesInternal Test - 2 - FSA - QuestionSandeep Choudhary40% (5)

- Reforming The New York Tax Code: A Fiscal Policy Institute Report December 5, 2011Document25 pagesReforming The New York Tax Code: A Fiscal Policy Institute Report December 5, 2011fmauro7531No ratings yet

- Reichley Report Summer 2011Document4 pagesReichley Report Summer 2011PAHouseGOPNo ratings yet

- Tax Cap Brochure 10-14-11Document6 pagesTax Cap Brochure 10-14-11hhhtaNo ratings yet

- BTC Reports - Final Tax Plan2013Document10 pagesBTC Reports - Final Tax Plan2013CarolinaMercuryNo ratings yet

- Fundamental State Tax ReformDocument40 pagesFundamental State Tax ReformPaul BedardNo ratings yet

- Flat Tax Revolution Ch4Document21 pagesFlat Tax Revolution Ch4Matt RandolfNo ratings yet

- HB 1776, The Property Tax Independence Act: Frequently Asked Questions (Faqs)Document7 pagesHB 1776, The Property Tax Independence Act: Frequently Asked Questions (Faqs)Octorara_ReportNo ratings yet

- DRAFT Act 72 Version-040105 PDFDocument8 pagesDRAFT Act 72 Version-040105 PDFRudolph HarrisNo ratings yet

- 20120524132415541Document139 pages20120524132415541WisconsinOpenRecordsNo ratings yet

- Budget Background Taxes 2011 - FINAL PDFDocument2 pagesBudget Background Taxes 2011 - FINAL PDFAndi ParkinsonNo ratings yet

- Tri-Counties Libertarian Party Email To Representatives Bourne, Scherer and Halbrook: April 7, 2017Document5 pagesTri-Counties Libertarian Party Email To Representatives Bourne, Scherer and Halbrook: April 7, 2017Jake LeonardNo ratings yet

- What Are TaxesDocument7 pagesWhat Are TaxesNasir AliNo ratings yet

- Jobs, Jobs, Jobs: Follow What's Happening OnDocument4 pagesJobs, Jobs, Jobs: Follow What's Happening OnPAHouseGOPNo ratings yet

- Tax Policy Center Cruz AnalysisDocument37 pagesTax Policy Center Cruz AnalysisAndrew NeuberNo ratings yet

- Ten ReasonsDocument3 pagesTen ReasonsOctorara_ReportNo ratings yet

- Fact Sheet Huntsville Property Tax RenewalDocument2 pagesFact Sheet Huntsville Property Tax RenewalChamber of Commerce of Huntsville/Madison CountyNo ratings yet

- Top20-New York PDFDocument2 pagesTop20-New York PDFrkarlinNo ratings yet

- 10 Big Tax Breaks For The Rest of Us: Jeff SchnepperDocument4 pages10 Big Tax Breaks For The Rest of Us: Jeff Schneppergoofy101No ratings yet

- University of Central Punjab: Assignment No 1 SubjectDocument8 pagesUniversity of Central Punjab: Assignment No 1 SubjectXh MuneebNo ratings yet

- Budget AddressDocument7 pagesBudget AddressZoe GallandNo ratings yet

- US Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksFrom EverandUS Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksNo ratings yet

- Special Report: The Economic Impact of HST ReformDocument6 pagesSpecial Report: The Economic Impact of HST ReformmintcornerNo ratings yet

- Joint Tax Hearing-Ron DeutschDocument18 pagesJoint Tax Hearing-Ron DeutschZacharyEJWilliamsNo ratings yet

- Chapter Notes: Chapter 1: Finance Definitions and Property Tax InformationDocument13 pagesChapter Notes: Chapter 1: Finance Definitions and Property Tax Informationapi-309968003No ratings yet

- Fiscal PolicyDocument7 pagesFiscal Policyshalini sehgalNo ratings yet

- Taxation of An IndividualDocument15 pagesTaxation of An IndividualsahilNo ratings yet

- 2013 4 16 Week in ReviewDocument2 pages2013 4 16 Week in Reviewapi-215003736No ratings yet

- Dave Hickernell: Dear NeighborDocument4 pagesDave Hickernell: Dear NeighborPAHouseGOPNo ratings yet

- Financing Educational SystemsDocument2 pagesFinancing Educational SystemsRochelle EstebanNo ratings yet

- Budget Brochure 2011Document2 pagesBudget Brochure 2011Micah CarterNo ratings yet

- An Assignment of Tax Planning On "Tax System in United States of America"Document23 pagesAn Assignment of Tax Planning On "Tax System in United States of America"Akash NathwaniNo ratings yet

- Empire Center ReportDocument4 pagesEmpire Center ReportCara MatthewsNo ratings yet

- REPORT: The Impact of The Tax Framework On Middle Class FamiliesDocument3 pagesREPORT: The Impact of The Tax Framework On Middle Class FamiliesbwingfieldNo ratings yet

- You're Invited To My Open House: Dear NeighborDocument4 pagesYou're Invited To My Open House: Dear NeighborPAHouseGOPNo ratings yet

- Taxes and Budget Digest 2006-2009: Fund. Provides A Subtraction When Calculating Virginia Taxable Income For IndividualsDocument2 pagesTaxes and Budget Digest 2006-2009: Fund. Provides A Subtraction When Calculating Virginia Taxable Income For IndividualsTeamValentineNo ratings yet

- Answers To Chapter 12 QuestionsDocument5 pagesAnswers To Chapter 12 QuestionsManuel SantanaNo ratings yet

- Trump's Tax Plan: Income Tax Rate Income Levels For Those Filing As: 2018-2025 Single Married-JointDocument3 pagesTrump's Tax Plan: Income Tax Rate Income Levels For Those Filing As: 2018-2025 Single Married-JointJefri David SimanjuntakNo ratings yet

- Christiana Summer 2011 NewsletterDocument2 pagesChristiana Summer 2011 NewsletterPAHouseGOPNo ratings yet

- Options To Finance Medicare For All: $500 BillionDocument6 pagesOptions To Finance Medicare For All: $500 BillionBradyNo ratings yet

- The 99%'s Deficit Proposal - How To Create Jobs, Reduce The Wealth Divide and Control SpendingDocument23 pagesThe 99%'s Deficit Proposal - How To Create Jobs, Reduce The Wealth Divide and Control SpendingA.J. MacDonald, Jr.No ratings yet

- TRC News and Notes 3-15-12Document2 pagesTRC News and Notes 3-15-12James Van BruggenNo ratings yet

- PPI - Family Friendly Tax Reform (Weinstein 2005)Document13 pagesPPI - Family Friendly Tax Reform (Weinstein 2005)ppiarchiveNo ratings yet

- Emanuel Fiscal Reform AgendaDocument4 pagesEmanuel Fiscal Reform AgendaZoe GallandNo ratings yet

- T N T C: HE EW AX ReditsDocument18 pagesT N T C: HE EW AX ReditsMark FowlerNo ratings yet

- Working Families BriefDocument2 pagesWorking Families Briefaflee123No ratings yet

- Veto Letter Dayton To DaudtDocument5 pagesVeto Letter Dayton To DaudtGoMNNo ratings yet

- Property Tax 2.0Document27 pagesProperty Tax 2.0Eron LloydNo ratings yet

- FairTax Prebate Explained (Jan 2015)Document4 pagesFairTax Prebate Explained (Jan 2015)Daar FisherNo ratings yet

- Evaluating School Funding ProposalsDocument8 pagesEvaluating School Funding ProposalspublicschoolnotebookNo ratings yet

- Revenue Sharing ReportDocument12 pagesRevenue Sharing ReportMaine Policy InstituteNo ratings yet

- Empire State Freedom Plan - 9-28-18Document23 pagesEmpire State Freedom Plan - 9-28-18MolinaroNo ratings yet

- 2017 08 02 Testimony Eliminating Rising Property Tax Burden HB285 CFP VanceGinnDocument2 pages2017 08 02 Testimony Eliminating Rising Property Tax Burden HB285 CFP VanceGinnTPPFNo ratings yet

- Spotlight 418 First, Stop The Bleeding: Getting North Carolina Out of Its Unemployment Insurance CrisisDocument10 pagesSpotlight 418 First, Stop The Bleeding: Getting North Carolina Out of Its Unemployment Insurance CrisisJohn Locke Foundation100% (1)

- Taxes & Health Care ReformDocument1 pageTaxes & Health Care Reformmck_ndiayeNo ratings yet

- Newsletter 337Document11 pagesNewsletter 337Henry CitizenNo ratings yet

- Nyfff 2Document3 pagesNyfff 2Rick KarlinNo ratings yet

- Income Taxes: Key ConceptsDocument10 pagesIncome Taxes: Key ConceptsErika BNo ratings yet

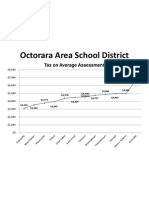

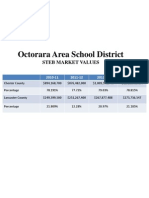

- 2013-14 Budget PResentation II Page 20Document1 page2013-14 Budget PResentation II Page 20Octorara_ReportNo ratings yet

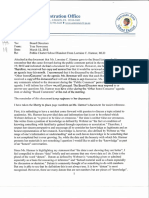

- Octorara Administration Office: Thomas L. Newcome II, Ed.DDocument5 pagesOctorara Administration Office: Thomas L. Newcome II, Ed.DOctorara_ReportNo ratings yet

- Octorara Administration Office: Thomas L. Newcome II, Ed.DDocument2 pagesOctorara Administration Office: Thomas L. Newcome II, Ed.DOctorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 19Document1 page2013-14 Budget PResentation II Page 19Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 13Document1 page2013-14 Budget PResentation II Page 13Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 16Document1 page2013-14 Budget PResentation II Page 16Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 18Document1 page2013-14 Budget PResentation II Page 18Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 14Document1 page2013-14 Budget PResentation II Page 14Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 12Document1 page2013-14 Budget PResentation II Page 12Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 6Document1 page2013-14 Budget PResentation II Page 6Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 21Document1 page2013-14 Budget PResentation II Page 21Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 7Document1 page2013-14 Budget PResentation II Page 7Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 8Document1 page2013-14 Budget PResentation II Page 8Octorara_ReportNo ratings yet

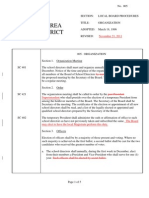

- Policy 011 11.21.11Document5 pagesPolicy 011 11.21.11Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 5Document1 page2013-14 Budget PResentation II Page 5Octorara_ReportNo ratings yet

- Harmer Rpt0001Document11 pagesHarmer Rpt0001Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 3Document1 page2013-14 Budget PResentation II Page 3Octorara_ReportNo ratings yet

- HB 1776, The Property Tax Independence Act: Frequently Asked Questions (Faqs)Document7 pagesHB 1776, The Property Tax Independence Act: Frequently Asked Questions (Faqs)Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 4Document1 page2013-14 Budget PResentation II Page 4Octorara_ReportNo ratings yet

- Newcome Response0001Document10 pagesNewcome Response0001Octorara_ReportNo ratings yet

- Octorara Area School DistrictDocument4 pagesOctorara Area School DistrictOctorara_ReportNo ratings yet

- Policy 707 11.21.11Document9 pagesPolicy 707 11.21.11Octorara_ReportNo ratings yet

- Policy 008 11.21.11Document1 pagePolicy 008 11.21.11Octorara_ReportNo ratings yet

- Ten ReasonsDocument3 pagesTen ReasonsOctorara_ReportNo ratings yet

- Policy 707-App A 11.21.11Document2 pagesPolicy 707-App A 11.21.11Octorara_ReportNo ratings yet

- Policy 006 11.21.11Document12 pagesPolicy 006 11.21.11Octorara_ReportNo ratings yet

- Policy 007 11.21.11Document3 pagesPolicy 007 11.21.11Octorara_ReportNo ratings yet

- Policy 005 11.21.11Document5 pagesPolicy 005 11.21.11Octorara_ReportNo ratings yet

- AA Soal Bedah SKL 2019 Ke 2Document4 pagesAA Soal Bedah SKL 2019 Ke 2fitrihidayatiNo ratings yet

- 65 263 1 PBDocument11 pages65 263 1 PBChinedu Martins OranefoNo ratings yet

- Chapter 4 Operation of Travel AgentDocument26 pagesChapter 4 Operation of Travel AgentJanella LlamasNo ratings yet

- PMI Agile Certified Practitioner (PMI-ACP) HandbookDocument55 pagesPMI Agile Certified Practitioner (PMI-ACP) HandbookmicheledevasconcelosNo ratings yet

- Endocrine of The Pancreas: Eman Alyaseen 20181081Document8 pagesEndocrine of The Pancreas: Eman Alyaseen 20181081ÂmoOł ÀhmdNo ratings yet

- External & Internal Communication: Standard Operating ProcedureDocument12 pagesExternal & Internal Communication: Standard Operating ProcedureAby FNo ratings yet

- VedicReport SRDocument1 pageVedicReport SRDeepakNo ratings yet

- Noida International AirportDocument4 pagesNoida International AirportAvinash SinghNo ratings yet

- TravelDocument18 pagesTravelAnna Marie De JuanNo ratings yet

- MDU Fiber WhitePaperDocument6 pagesMDU Fiber WhitePaperbuicongluyenNo ratings yet

- Food Management SystemDocument24 pagesFood Management Systemsaisridhar99No ratings yet

- Shavonne Blades, Et Al., v. City and County of Denver, Et Al.Document51 pagesShavonne Blades, Et Al., v. City and County of Denver, Et Al.Michael_Roberts2019No ratings yet

- Airport Markings Flash CardsDocument12 pagesAirport Markings Flash CardsrohokaNo ratings yet

- Sept. 5, 1969, Issue of LIFE MagazineDocument7 pagesSept. 5, 1969, Issue of LIFE MagazineDoghouse ReillyNo ratings yet

- Syllabus: SPED 120 Introduction To Special EducationDocument15 pagesSyllabus: SPED 120 Introduction To Special EducationMaridel Mugot-DuranNo ratings yet

- 01-EIA Revised Procedural Manual Main Document - NewDocument57 pages01-EIA Revised Procedural Manual Main Document - NewJo Yabot100% (1)

- There Sentences - Null ObjectsDocument44 pagesThere Sentences - Null ObjectsMissC0RANo ratings yet

- Company Information: 32nd Street Corner 7th Avenue, Bonifacio Global City @globemybusiness Taguig, PhilippinesDocument3 pagesCompany Information: 32nd Street Corner 7th Avenue, Bonifacio Global City @globemybusiness Taguig, PhilippinesTequila Mhae LopezNo ratings yet

- Emedica MSRDocument25 pagesEmedica MSRSajeewanieNo ratings yet

- Amit Varma NoticeDocument3 pagesAmit Varma NoticeparbatarvindNo ratings yet

- ItikaafDocument3 pagesItikaafmusarhadNo ratings yet

- GST - E-InvoicingDocument17 pagesGST - E-Invoicingnehal ajgaonkarNo ratings yet

- Auditing NotesDocument132 pagesAuditing Notesmuriungi2014No ratings yet

- Form 3 Accounting June 2023Document9 pagesForm 3 Accounting June 2023Bonolo RamofoloNo ratings yet

- Code of Ethics and Professional ResponsibilityDocument6 pagesCode of Ethics and Professional ResponsibilityEunice Panopio LopezNo ratings yet

- UNDPArtExhibit PressRelease191112Document1 pageUNDPArtExhibit PressRelease191112Mu Eh HserNo ratings yet

- Importance of The Marketing Environment Analysis IDocument9 pagesImportance of The Marketing Environment Analysis IkatieNo ratings yet