Professional Documents

Culture Documents

Simcoe Green Homes Investment Prospectus

Simcoe Green Homes Investment Prospectus

Uploaded by

Jim SimcoeCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Investment ProposalDocument4 pagesInvestment Proposalsibin sebastianNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MBF13e Chap08 Pbms - FinalDocument25 pagesMBF13e Chap08 Pbms - FinalBrandon Steven Miranda100% (4)

- Why Green Homes Sell FasterDocument5 pagesWhy Green Homes Sell FasterJim SimcoeNo ratings yet

- Selecting Green Markets by ClimateDocument5 pagesSelecting Green Markets by ClimateJim SimcoeNo ratings yet

- Benefits Cork FlooringDocument6 pagesBenefits Cork FlooringJim SimcoeNo ratings yet

- The Benefits of Cool RoofsDocument6 pagesThe Benefits of Cool RoofsJim SimcoeNo ratings yet

- Leveraging Local Politics On Your Green ProjectsDocument5 pagesLeveraging Local Politics On Your Green ProjectsJim SimcoeNo ratings yet

- How To Fund Green Real Estate ProjectsDocument6 pagesHow To Fund Green Real Estate ProjectsJim SimcoeNo ratings yet

- Green Real Esate Investing Formulas To Increase Appraisal ValueDocument7 pagesGreen Real Esate Investing Formulas To Increase Appraisal ValueJim SimcoeNo ratings yet

- Green Features Home Buyers WantDocument6 pagesGreen Features Home Buyers WantJim SimcoeNo ratings yet

- Altisource IIM A JDDocument2 pagesAltisource IIM A JDBipin Bansal AgarwalNo ratings yet

- Abc-Consolidation With Intercompany TransactionsDocument3 pagesAbc-Consolidation With Intercompany TransactionsLeonardo MercaderNo ratings yet

- Wa0058.Document4 pagesWa0058.Erwin PariNo ratings yet

- ACCTG - Worksheet Quality AutoDocument1 pageACCTG - Worksheet Quality AutoCab Vic100% (1)

- Chola MsDocument98 pagesChola MsDhaval224No ratings yet

- 10 - Chapter 3Document24 pages10 - Chapter 3Eloysa CarpoNo ratings yet

- Challenges of State Owned Corporations and Enterprises in AfghanistanDocument11 pagesChallenges of State Owned Corporations and Enterprises in AfghanistanNaseer Ahmad AziziNo ratings yet

- Auto Secure - Private Car Package Policy: Sincerely, For Tata AIG General Insurance Company LimitedDocument4 pagesAuto Secure - Private Car Package Policy: Sincerely, For Tata AIG General Insurance Company Limitedismail02984No ratings yet

- VP Director Finance Operations in Greater Chicago IL Resume Corby NeumannDocument3 pagesVP Director Finance Operations in Greater Chicago IL Resume Corby NeumannCorby NeumannNo ratings yet

- Government Bonds Bond - IN0020190362 Bond - IN0020170026Document4 pagesGovernment Bonds Bond - IN0020190362 Bond - IN0020170026Arif AhmedNo ratings yet

- Sarbanes-Oxley Act, Internal Control, and Management AccountingDocument2 pagesSarbanes-Oxley Act, Internal Control, and Management Accountingalexandro_novora6396No ratings yet

- Credit MonitoringDocument15 pagesCredit MonitoringSyam Sandeep67% (3)

- Managerial Accounting Prelim ExamDocument39 pagesManagerial Accounting Prelim ExamshaneNo ratings yet

- Specimen Paper - Maths A&I SL - Answers: November 23, 2021Document2 pagesSpecimen Paper - Maths A&I SL - Answers: November 23, 2021Jaime Molano Moreno0% (1)

- Professional Members Directory As On 13-02-2023Document532 pagesProfessional Members Directory As On 13-02-2023Saddam HussainNo ratings yet

- Service TaxDocument15 pagesService TaxMonu TulsyanNo ratings yet

- Resource Allocation and Financial Planning: Presented byDocument38 pagesResource Allocation and Financial Planning: Presented byAirish Roperez EsplanaNo ratings yet

- 1st Term s1 Financial AccountDocument21 pages1st Term s1 Financial AccountAsabia OmoniyiNo ratings yet

- Basic Accounting PrinciplesDocument5 pagesBasic Accounting PrinciplesGracie BulaquinaNo ratings yet

- Far160 Pyq July2023Document8 pagesFar160 Pyq July2023nazzyusoffNo ratings yet

- HDFC Mutual FundsDocument68 pagesHDFC Mutual FundsMohammed Dasthagir MNo ratings yet

- Infosys Invests in Stellaris Venture Partners (Company Update)Document4 pagesInfosys Invests in Stellaris Venture Partners (Company Update)Shyam SunderNo ratings yet

- Iowa City School District Audit ReportDocument18 pagesIowa City School District Audit ReportThe GazetteNo ratings yet

- Project Summary: A. Name of The FirmDocument9 pagesProject Summary: A. Name of The FirmeingelynNo ratings yet

- Lesson PlanDocument6 pagesLesson Plancjeffixcarreon12No ratings yet

- CA FINAL AUDIT-80 MCQs PDFDocument30 pagesCA FINAL AUDIT-80 MCQs PDFSanyam Jain100% (2)

- Fact FindDocument7 pagesFact Findovidiu.alex90No ratings yet

- Semana 10 Ingles NI EXAMENDocument31 pagesSemana 10 Ingles NI EXAMENSOLANO VIDAL RIJKAARD MAINNo ratings yet

Simcoe Green Homes Investment Prospectus

Simcoe Green Homes Investment Prospectus

Uploaded by

Jim SimcoeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Simcoe Green Homes Investment Prospectus

Simcoe Green Homes Investment Prospectus

Uploaded by

Jim SimcoeCopyright:

Available Formats

Simcoe Ventures

Investment Prospectus

Page 2

TABLE OF CONTENTS

.............................................................................. 1. EXECUTIVE SUMMARY 3

...................................................................................................... 2. TEAM 4

........................................................................... 1. Jim Simcoe-principal 4

....................................................................... 2. Kevin Gaynor-principal 4

................................................................................. 3. THE GREEN VISION 5

........................................................................ 1. Positive Green Impacts 5

.......................................................... 4. GREEN MULTIFAMILY OPPORTUNITY 7

............................................................................. 1. Green Opportunity 7

............................................................................. 2. Multifamily Benefits 9

..................................................................................... 1. Cash Flow 9

...................................................................................... 2. Demand 10

..................................................................................... 3. Leverage 10

.............................................................................. 5. MARKET SELECTION 11

...................................................................... 1. Rental Market Strength 11

..................................................................................... 2. Competition 12

......................................................... 6. CONSULTING CHANNEL REVENUE 13

....................................................................... 7. INVESTOR OPPORTUNITY 14

.................................................................................. 1. Debt Investors 14

.................................................................................. 2. Equity Investor 14

........................................................................... 3. Investment Strategy 14

....................................................................... 8. INSPIRED PHILANTHROPY 15

.................................................................... 1. Benefit to the Non-profit 15

...................................................................... 2. Benefit to our Investors 15

....................................................................... 9. INVESTMENT SNAPSHOT 16

............................................................................. 1. Property Specifics 16

........................................................................... 2. Property Overview 16

............................................................................... 3. Housing Market 16

........................................................ 4. Economic and Market Overview 16

............................................... 10. FINANCIAL SUMMARY - Multi Family Unit 17

...................................................................... 11. PROPERTY PROJECTIONS 18

......................................................................... 12. INVESTMENT GRAPHS 19

......................................................... 1. NOI (Net Operating Investment 19

.......................................................................... 2. Cash Flow (Pre-Tax) 19

................................................................ 3. ROI (Return on Investment) 20

.............................................................. 4. COC (Cash on Cash Return) 18

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

EXECUTIVE SUMMARY

We offer an investment in green multifamily properties. Our team has been

active in the green multifamily industry for the several years and is now

positioned to capitalize on it with a select group of investors.

Green multifamily represents the single highest performing real estate investment

in the next ten years. Green multifamily investments offer the following:

1. Opportunity to substantially increase profitability through green retrofits.

2. Risk mitigation Green multifamily excels in any economic climate.

3. Demand far exceeds supply for green multifamily.

4. Rebate and Incentive funds offered to offset any green retrofit expenses.

5. Accelerated appraisal value.

Currently there is a wealth of opportunity for green multifamily created by

three disparate, yet related factors:

1. As consumers grow increasingly more educated about green living they are

demanding more from their prospective landlords. As this consumer education

continues to increase, the demand for green apartments will only continue to rise.

2. Demand for green multifamily continues to outpace supply. There are very

few green multifamily properties in the US. Our properties will have little,

if any, competition.

3. Current market prices for multifamily projects is at an all-time low. We are able

to purchase properties through a variety of sources (banks, REO companies,

bulk sales, etc.) and gain very favorable lending terms. These favorable market

conditions are forecasted to last another 12-18 months.

We work with investors in two ways: as debt investors (guaranteed return)

or equity investment partners (projected return, equity position in the

project). We are looking for a small, select group of investors who are

interested in being involved in our green real estate projects.

Page 3

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

TEAM

JIM SIMCOE

Jim Simcoe is green real estate investment consultant, sustainability

speaker and author. He develops green multifamily strategies for

real estate investment companies throughout North America. Jim

has been featured on NBC, Fox, SmartMoney.com, San Diego

Insider TV, etc.

Jim writes for Personal Real Estate Investor Magazine,

BiggerPockets.com (the #1 real estate investing website in the US),

EcoHome, San Diego Business Journal,

GreenRealEstateInvestingsNews.com, RIS Media, etc. He is the co-

author of the Go Green, Bank Green study published by

Personal Real Estate Investor Magazine in March 2010.

Jim is the President of the Board of Directors of the New World Leadership School, the first

sustainable pre-school in San Diego County. Jim is a Certified Green Building Professional,

EcoBroker and Real Estate Broker.

He lives with his wife, two daughters and two very spoiled dogs in Cardiff-By-The-Sea, California.

KEVIN GAYNOR

Kevin Gaynor is a Building Performance Institute (BPI) Certified

Building Analyst, Envelope and Multifamily Building Analyst

and Civil/Environmental Engineer specializing in the areas of

Land Development and Site Design. He has managed projects

including single family homes, commercial properties, 200+

multi-unit developments, hundred acre residential subdivisions

and numerous condo conversions.

Kevins environmental consulting work consisted primarily of

preparing environmental studies, waste management design,

and overseeing construction projects. He has developed multi-million dollar cost and quantity

estimates for client projects. He has designed strategies for effectiveStorm Water

Management, Storm Water Prevention & Pollution and Low-Impact Development.

Kevin graduated from University of Massachusetts-Amherst with a degree in Civil and

Environmental Engineering in 1999. He lives in San Diego, California with his wife, Karin.

Page 4

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

THE GREEN VISION

POSITIVE GREEN IMPACTS

We are in business to not only generate revenue but to also fundamentally change how

the real estate market operates. Were creating homes that are healthy, thriving

environments that cost less to operate. In doing so our business will create positive

green impacts in eight areas.

They are:

Investors

1. Higher returns through higher cash flow, decreased expenses, reduced

vacancy expenses

2. Reduction in capital expenses as rehab expenses can be funded through a

variety of energy efficiency grants/incentives/rebates.

3. Increased appraisal values.

4. Safer investment as properties enjoy greater demand and stability.

5. Pride of Action. Investors are directly to contributing to improving our

environment, creating jobs and improving the lives of the residents.

Community

1. Healthier residents resulting in decreased public health-care expenses.

2. Economic growth through job creation, tax revenue, etc.

3. Increased home values. Green properties appraise higher and thus raise

median home prices in their neighborhoods.

4. Neighborhood beautification potentially contributing to lower crime rates.

Residents

1. Lower monthly utility bills, more disposable income.

2. Healthier lives (potentially lower health-care expenses, etc).

3. Healthier children (potentially lower incidences of childhood asthma, etc).

Page 5

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

GREEN VISION cont

Workforce

1. New green jobs are created throughout the US.

2. Unemployment is reduced as laid off workers are re-trained.

3. Green companies can leverage green employment grant subsidies to

increase employee size.

Housing Industry

1. Improve home values nationally.

2. Homes are more affordable for more people to own and operate.

3. Take bank-owned properties off the market.

4. Reduce vacancies potentially resulting in crime rate declines.

Environmental

1. Lower CO2 emissions.

2. Less energy consumed.

3. Reduction in landfill waste.

4. Recycle materials that were targeted for waste stream.

Non-Profits

1. They can focus on their core mission, not fund-raising.

2. Increased cash flow on a regular basis.

3. Opportunity to increase fundraising dollars through real estate offerings.

Green Suppliers

4. More suppliers in marketplace.

5. New products enter the market faster.

6. Larger selection of products more readily available.

Page 6

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

GREEN MULTIFAMILY OPPORTUNITY

GREEN OPPORTUNITY

High-performance green multifamily properties represent the single

greatest opportunity for real estate investors nationwide. They offer higher

profits, greater appreciation, more favorable lending parameters, rebates

and incentive money, etc.

For our business a multifamily property must conform to the following

criteria to be considered green:

1. Create a healthier (re: non-toxic) living environment for residents.

2. Offer significant utility expense savings to all residents.

3. Cost less (than comparable properties) for us to operate.

4. Create a smaller environmental footprint.

Our business model is geared to capitalize on the wealth of opportunity for

green multifamily properties. Currently three trends work in our favor:

Renters are increasingly demanding green features in prospective apartments.

Green retrofits result in lower short and long term expenses for multifamily owners.

Rebate and incentive money offered to multifamily owners is at an all-time high.

86% of renters

would prefer a

green home

55% of renters

are willing to

spend more

to live in one

Data from Rent.Coms Feb 2010 survey

86%

55%

Page 7

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

GREEN MULTIFAMILY OPPORTUNITY cont

Renters are driven to green apartments because green apartments offer cost

savings and a healthier living environment. The environmental benefits are

largely a fringe benefit for renters and NOT the main reason they chose to

rent green apartments.

Regardless of economic conditions, a majority of renters are interested in

saving money and living in a safer, less toxic apartment. Our properties offer

prospective renters a unique opportunity to both save money and live healthier.

All multifamily investments are designed to realize profits through three core

methods:

1. Increased occupancies

2. Increased rents

3. Decreased expenses

Our green apartments will maximize profits in all three areas. Occupancies

and rents increase because we offer a highly desired product that isnt

available anywhere else. Renters save money on utility bills and enjoy

healthier living environments.

For example, assume rents are $1000 and utility bills are $200 a month for a

typical apartment in Phoenix, AZ. If our utility bills are only $100/month, then

prospective renters who spend an additional $50 per month in rent actually save

money because their TOTAL monthly expense is lower with our property.

Typical multifamily operational expenses (utilities, water, sewer, etc.) will be

dramatically reduced through our green retrofit strategies. Further, well pursue

grants, rebates, incentives and Stimulus money to offset the cost of these retrofits.

We will only pursue retrofits that have an aggressive return on investment. We will

not pursue green methods unless they have a definite payback period.

Page 8

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

GREEN MULTIFAMILY OPPORTUNITY cont

Another key benefit of our green multifamily properties is that were able to

accelerate the appreciation in appraisal values much faster than comparable

properties. Multifamily appraisals are largely based on the net operating

income (NOI) generated by the property. Our NOI will be higher due to

increased rents and decreased expenses. That is the first step in increasing our

properties appraisal values.

The second step involves using the Energy Star Guidelines which state that the

increased annual savings in utility expense in a commercial property will

increase the appraised value of that property. The formula is as follows:

Net Annual Energy Savings / Capitalization Rate = Increased appraisal value (in dollars)

For example, on a $1,500,000 property assume you save $30,000/year

in a market where cap rates are 6%. Using the formula:

$30,000 / .06 = $500,000. Your $1.5M property is now worth $2M.

MULTIFAMILY BENEFITS

Weve chosen multifamily as the asset class to pursue for several reasons.

Multifamily offers the greatest return coupled with the lowest risk. Multi-

family investments also allow us to positively impact the greatest number of

families through healthier living and lower expenses.

The three key benefits of green multifamily investments are: Cash Flow,

Demand, and Leverage.

CASH FLOW

Cash flow is defined as the Net Operating Income - Mortgage. Net

Operating Income is the total income from the property minus the

expenses. In essence, when you increase income and/or lower expenses,

cash flow increases. We consistently increase cash flow by executing a

sound property management plan that maximizes rents and decreases

Page 9

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

GREEN MULTIFAMILY OPPORTUNITY cont

expenses. Additionally, our expertise in multifamily rebates and incentives will

further reduce our expenses and thus increase our cash flows.

Net Operating Income (income - expenses) Mortgage = Cash Flow

DEMAND

The demand for rental housing in the US continues to increase due to population

growth, housing affordability, etc. For example, the Echo Boomer generation

(children of the Baby Boomers) are 80 million strong, represent 1/3 of total US

population and comprise a huge percentage of the next decades rental

population. According to a study done by Harvard University Joint Center for

Housing Studies, 80% of households where people are under 25 years old are

renters. 65% of households where people are 25-29 are renters. That offers

tremendous potential for our investors.

LEVERAGE

Multifamily investments offer the ability to utilize leverage to dramatically enhance

the value of our investments. Typically we put down no more than 30-40% for any

property we purchase. Upon closing we own/control an asset that is worth

considerably more than our investment in it. At the same time, cash flows,

appraised value and appreciation rates are based on the propertys total value,

NOT just the money we have in the deal. Real estate represents one of the only

investments where what you purchase is immediately worth more than you

invested. If you invest $400,000 in mutual funds, youd have $400,000 worth of

mutual funds. If you invest $400,000 in a multifamily deal, youll own an asset

worth approximately $1,000,000.

65%

65% of households

of 25 29 year

olds are renters

80%

80% of households

of under 25 year

olds are renters

Page 10

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

MARKET SELECTION

Although we are market agnostic there are two key components a market must

meet for us to pursue investing in that market. We define market as the metro

area of a city. For example, the San Diego market would encompass any city

within the San Diego County area. The two key components we consider are:

1. Rental Market Strength

2. Competition

RENTAL MARKET STRENGTH

We determine rental market strength using three core benchmarks: job growth,

affordable housing, and supply. These three indicators have shown to most accurately

forecast the success rate of multifamily investments throughout the US.

Job growth in a market is calculated by the percentage increase in jobs per capita over a

given period of time. We look for markets that have a strong employer base and a

pro-business political environment. Markets that have a significantly higher percentage of

blue collar workers are very attractive to us as those workers are our target renters.

Our approach to affordable housing is contrarian, meaning that we look for markets

where there is a lack of affordable single family homes. In markets where home sales

prices are above the national average more people rent. In essence, the higher the

average home sales price, the higher percentage of renters.

Supply is based on both the current multifamily inventory in a market and the amount of

new multifamily construction. We look for markets where inventory is low and new

construction is slight. With fewer available properties, rental demand increases for those

properties in place. Thus, vacancy rates decrease while cash flow and profit increase.

There is a plethora of data we could consider in determining the viability of a market.

Weve chosen to stick with the three factors that have the strongest track record of

success. An increasing job market, higher home sale prices and a lack of supply all

indicate a strong market for our investments.

Page 11

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

MARKET SELECTION cont

COMPETITION

Our profit is driven by offering our target renters a compelling advantage

that they cannot get anywhere else. Offering high performance apartments

that create healthier (re: non-toxic) living while substantially reducing monthly

utility bills, results in:

1. Higher occupancies

2. Higher rents

3. Longer tenant rental periods

4. Fewer rental concessions

5. Less maintenance

All of these factors contribute to higher profits, higher appraised values,

lower expenses, etc. all of which contribute to our bottom line. Put simply,

we offer an opportunity to renters that is uncommon and highly desired.

From a competitive standpoint we chose markets where we will be the only

player in town. We seek markets where green living is not en vogue and

where there are few (if any) green multifamily projects.

This gives us first-to-market advantage. This advantage gives us:

1. Greater share of available rebates and incentive funds

2. Free, favorable PR

3. Better integration in the local community

Contrary to presumed logic, we actively seek markets that are not green

focused. These markets give us the greatest opportunity to be a major

player and set the standard for that market. All of which works to increase

our profits dramatically.

Page 12

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

CONSULTING CHANNEL REVENUE

A key aspect of the plan is the ability to earn complementary revenue via

consulting with multi-family property owners. The team, and Jim Simcoe

specifically, has a demonstrated track record in this arena. Since 2006 Jim has:

1. Worked with multi-family owners, property managers, real estate investors

throughout the US and Canada.

2. Provided green strategies for commercial owners, multi-family owners,

businesses, non-profits, schools, etc.

3. Worked on multi-family projects as large as 480 units on 20+ acres of land.

As we are already the brand in the green retrofit apartment space,

consulting revenue is a natural offshoot of our core business. To leverage

our brand and time wisely we will hire 10 sustainability consulting

franchisees to work as independent contractors for us nationwide. This will

allow us to minimize costs, our time commitment and still gain revenue

share in the consulting space.

Our 12-month revenue projections from this channel are as follows:

Q1 Q2 Q3 Q4 TOTALS

MFU Consulting $25,000 $45,000 $65,000 $75,000 $210,000

Real Estate Investor

Coaching $10,000 $25,000 $25,000 $25,000 $85,000

TOTALS $35,000 $70,000 $90,000 $100,000 $295,000

Page 13

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

INVESTOR OPPORTUNITY

Prospective investors are invited to participate in this opportunity in either of two ways:

as debt investors or equity investors. For our purposes they are defined as follows:

INVESTMENT STRATEGY

Our strategy for each project is as follows:

1. Once purchased, transform property into a high-performance green property.

2. Capture all available rebate/incentive money, stimulus and grant funds to

offset the cost of the green retrofit.

3. Optimize all internal/external systems to reduce capital and operational

expenses.

4. Launch marketing strategy positioning property as a green property. Leverage

lower utility bills and healthier living in all marketing materials, sales presentations.

5. Increase occupancy and rents resulting in NOI increases and higher appraisal

value(utilizing Energy Star Guidelines to maximize appraisal value).

6. Refinance property within 2-4 years.

7. Upon re-finance, investors will have the option to be cashed out.

DEBT INVESTORS EQUITY INVESTORS

Debt investors provide capital in exchange for

guaranteed return on their money.

Payments are made quarterly or annually.

A balloon payment (initial investment + preferred

return) will be returned within 2-4 years.

The loan is secured by the property.

Debt investors do not hold any equity in the property.

Equity investors provide capital in exchange

for a projected return on their money.

Payments are made from the net profits from

the project.

Payments are made quarterly or annually.

A balloon payment (initial investment +

profit) will be returned within 2-4 years.

Equity investors hold equity in the property.

Page 14

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

INSPIRED PHILANTHROPY

A core component of our business is supporting non-profit organizations. We offer a

revolutionary way for targeted non-profits to receive donations from us. Rather than just

receive an occasional donation check, each selected non-profit will receive a quarterly

dispersement payment based on a percentage of the selected propertys net profits.

This quarterly payment will continue for as long as we own the property. As net profits

increase over time, so will the quarterly payments. If and when we sell the property, the

non-profit will be given a percentage of the net profits of the sale in a lump sum payment.

For example:

Year Annual Net Profits

Non-Profit Annual Non-Profit

Donation% Donation

Year 1 $140,000 5% $7,000

Year 2 $180,000 5% $9,000

Year 3 $230,000 5% $11,500

Year 4 $260,000 5% $13,000

Year 5 $305,000 5% $15,250

TOTAL $1,115,000 5% $55,750

BENEFITS TO THE NON-PROFIT

1. Compounded interest- donation amounts continue to increase over time.

2. Regular donations received on a quarterly basis.

BENEFITS TO OUR INVESTORS

1. Opportunity to select the non-profit(s) to be supported.

2. Take advantage of all applicable tax write offs.

Page 15

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

INVESTMENT SNAPSHOT

PROPERTY SPECIFICS

Location: Phoenix, AZ

Property Type: 20 unit Multi-Family

Market Value: $650,000

Purchase Price: $425,000

Estimated Equity: 63%

Cash Flow: $62,000

Current Cap Rate: 9.4%

Return On Investment: 26.4%

Cash On Cash: 25.6%

PROPERTY OVERVIEW

Stabilized property with strong occupancy history.

1986 construction with 100% two-bedroom floor plans.

Close proximity to major highways, retail centers and jobs.

Individually metered for electricity, swimming pool and on-site laundry facilities.

HOUSING MARKET

Phoenix is now rated the 5th largest city in the United Sates.

One bedroom apartments in Phoenix rent for $624 a month on average and

two bedroom apartment rents average $816.

Multi-family properties have come down in price, even as occupancies have gone up.

ECONOMIC AND MARKET OVERVIEW

Phoenix is currently home to seven Fortune 1000 Companies.

Employment/Job Growth is up 28.8% over the last year.

With an average age of 34, greater Phoenix is the fifth youngest metro region in

the country with a diverse, well-educated labor force of over 2 million people.

Greater Phoenix has consistently outpaced the U.S. population growth over the

last 18 years. Projections show the region is expected to grow by nearly 60

percent by 2030, bringing the population to more than 6 million people.

Page 16

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

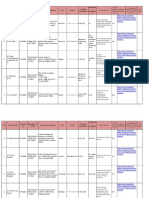

FINANCIAL SUMMARY Multi Family Unit

Mountain View Acres Apts (20 Units)

Current Property Profile Assumptions & Savings For Calculations

Multi-Family ElectricBill 35%

650,000 $ GasBill 35%

425,000 $ WaterBill 50%

170,000 $ AppraisalIncrease 0%

- $ RentalIncrease 10%

75,000 $ VacancyRate 5%

245,000 $ CC 15%

RehabMaterialC 5%

Income Summary Current(Annual) Green(1stYear) 5thYear Rebates 10%

CRentall 114,000 $ 131,957 $ 160,395 $

Otherl 5,702 $ 6,557 $ 7,970 $ Assumptions

Vacancy&CreditA 17,100 $ 6,270 $ 7,621 $ Cl 114,000 $

CCle 102,602 $ 132,245 $ 160,744 $ AMl(ifany) 5,702 $

1stML1(Fixed) 30yr

Expense Summary 1stMInterestRate 5.5%

Utility Information Current(Annual) Green(1stYear) 5thYear 1stMPrincipalA 255,000 $

ElectricityBill 2,551 $ 1,658 $ 1,546 $ PrivateMInsurance - $

GasBill 4,251 $ 2,763 $ 2,577 $ Percentu 40%

WaterBill 10,202 $ 5,101 $ 6,184 $

1uCs 17,004 $ 9,522 $ 10,307 $ taxes 10,669 $

Insurance 3,500 $

Operation Information Current(Annual) Green(1stYear) 5thYear Electric 2,551 $

MFee 4,845 $ 6,284 $ 8,037 $ Gas 4,251 $

AL - $ - $ - $ Water 10,202 $

8MS 10,000 $ 8,500 $ 9,201 $ Maintenance 10,000 $

Taxes 10,669 $ 10,669 $ 11,102 $

Insurance 3,500 $ 2,975 $ 3,096 $ ARate 6%

On-site 6,000 $ 5,100 $ 5,360 $ MFee 5%

CS 3,000 $ 2,550 $ 2,680 $ RentallIncrease 5%

M 1,000 $ 850 $ 893 $ TaxIncease 1%

General&A 2,777 $ 2,360 $ 2,555 $ InsuranceIncrease 1%

Reserves& 4,000 $ 3,400 $ 3,680 $ uIncrease 2%

1CCs 62,795 $ 52,211 $ 56,911 $ GeneralOpsIncrease 2%

TaxRate 1%

Cash Flow Assumptions Current(Annual) Green(1stYear) 5thYear PercentLandValue 20%

NetCl 39,807 $ 80,034 $ 103,833 $ CC(Purchase) 3%

M (17,374) $ (17,374) $ (17,374) $ CCS 5%

Cashl8-Tax(CFBT) 22,433 $ 62,659 $ 86,459 $

Financial Performance Green(1stYear) 5thYear

* - Based on a 30-yr Fixed Mortgage

CapRate 9.4% 10.4% 10.7%

CRentM(GRM) 5.70 5.83 6.05

CashCashReturn(COC) 25.6% 35.3%

InternalRateReturn(IRR) 250.1% 51.9%

Returnl(ROI) 26.4% 156.0%

Equity(Wealth)% 63.5% 75.7%

Equity(Wealth)$ 517,314 $ 734,918 $

NOTE: The values and data are to be used for

estimation purposes and should be verified.

u

BuyerCreditsRebates

Rehab8

1C

PurchasePrice

Projected Green Savings Purchase Information

Type

AppraisalValue

Page 17

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

PROPERTY PROJECTIONS

Mountain View Acres Apts (20 Units)

r a e Y 2 r a e Y 1 r a e Y t n e r r u C 3 Year 4 Year 5 Year 10

CASH-FLOW 1 2 3 4 5 10

Gross Scheduled Income 114,000 $ 131,957 $ 17,957 $ 131,957 $ 138,555 $ 145,483 $ 152,757 $ 160,395 $ 204,709 $

2 0 7 , 5 e m o c n I r e h t O $ 6,557.30 $ 855 $ 6,557 $ 6,885 $ 7,229 $ 7,591 $ 7,970 $ 10,173 $

Vacancy 0 0 1 , 7 1 e c n a w o l l A $ 6,270 $ 10,830 $ 6,270 $ 6,583 $ 6,913 $ 7,258 $ 7,621 $ 9,727 $

Gross Operating Income (GOI) 102,602 $ 132,245 $ 29,643 $ 132,245 $ 138,857 $ 145,800 $ 153,090 $ 160,744 $ 205,155 $

Operational Expenses

Utility Expenses (17,004) $ (9,522) $ 7,482 $ (9,522) $ (9,713) $ (9,907) $ (10,105) $ (10,307) $ (11,380) $

Property Management Fee (4,845) $ (6,284) $ (1,439) $ (6,284) $ (6,943) $ (7,290) $ (7,654) $ (8,037) $ (10,258) $

Accounting/Leg - l a $ - $ - $ - $ - $ - $ - $ - $ - $

Repairs/Mantainance/Supplies (10,000) $ (8,500) $ 1,500 $ (8,500) $ (8,670) $ (8,843) $ (9,020) $ (9,201) $ (10,158) $

Property Taxes (10,669) $ (10,669) $ - $ (10,669) $ (10,776) $ (10,883) $ (10,992) $ (11,102) $ (11,669) $

Insurance (3,500) $ (2,975) $ 525 $ (2,975) $ (3,005) $ (3,035) $ (3,065) $ (3,096) $ (3,254) $

On-site Payroll (6,000) $ (5,100) $ 900 $ (5,100) $ (5,202) $ (5,254) $ (5,307) $ (5,360) $ (5,633) $

Contract Services (3,000) $ (2,550) $ 450 $ (2,550) $ (2,601) $ (2,627) $ (2,653) $ (2,680) $ (2,817) $

Marketing (1,000) $ (850) $ 150 $ (850) $ (867) $ (876) $ (884) $ (893) $ (939) $

General & Admin (2,777) $ (2,360) $ 417 $ (2,360) $ (2,408) $ (2,456) $ (2,505) $ (2,555) $ (2,821) $

Reserves & replacement (4,000) $ (3,400) $ 600 $ (3,400) $ (3,468) $ (3,537) $ (3,608) $ (3,680) $ (4,063) $

Total Operating Expenses (62,795) $ (52,211) $ 10,584 $ (52,211) $ (53,652) $ (54,708) $ (55,795) $ (56,911) $ (62,991) $

NET OPERATING INCOME (NOI) 39,807 $ 80,034 $ 40,227 $ 80,034 $ 85,205 $ 91,091 $ 97,295 $ 103,833 $ 142,164 $

Mortgage Expenses

Mortgage Payment (17,374) $ (17,374) $ - $ (17,374) $ (17,374) $ (17,374) $ (17,374) $ (17,374) $ (17,374) $

Total Debt Service (17,374) $ (17,374) $ - $ (17,374) $ (17,374) $ (17,374) $ (17,374) $ (17,374) $ (17,374) $

Projected

Savings

After Green

Upgrades

CASH-FLOW(Before-Tax) (CFBT) 22,433 $ 62,659 $ 40,227 $ 62,659 $ 67,831 $ 73,717 $ 79,921 $ 86,459 $ 124,790 $

Monthly 1,869 $ 5,222 $ 3,352 $ 5,222 $ 5,653 $ 6,143 $ 6,660 $ 7,205 $ 10,399 $

Tax Benefits

Dep 4 6 3 , 2 1 n o i t a i c e r $ 12,364 $ 12,364 $ 12,364 $ 12,364 $ 12,364 $ 12,364 $ 12,364 $

Mortgag 9 3 9 , 3 1 d i a P t s e r e t n I e $ 13,939 $ 13,939 $ 13,939 $ 13,939 $ 13,939 $ 13,939 $ 13,939 $

Subtotal 26,303 $ 26,303 $ 26,303 $ 26,303 $ 26,303 $ 26,303 $ 26,303 $ 26,303 $

4 0 5 , 3 1 e m o c n I e l b a x a T $ 53,731 $ 53,731 $ 58,902 $ 64,788 $ 70,992 $ 77,530 $ 115,861 $

Tax Bracket Imp 6 7 3 , 3 t c a $ 13,433 $ 13,433 $ 14,726 $ 16,197 $ 17,748 $ 19,383 $ 28,965 $

CASH-FLOW(After Tax) (CFAT) 19,057 $ 49,227 $ 30,170 $ 49,227 $ 53,105 $ 57,520 $ 62,173 $ 67,076 $ 95,824 $

Monthly 1,588 $ 4,102 $ 2,514 $ 4,102 $ 4,425 $ 4,793 $ 5,181 $ 5,590 $ 7,985 $

EQUITY ACCUMULATION

Property 0 0 0 , 0 5 6 e u l a V $ 768,879 $ 118,879 $ 768,879 $ 815,012 $ 863,913 $ 915,747 $ 970,692 $ 1,299,005 $

minus Mortgage Balance 251,565 $ 251,565 $ 251,565 $ 247,936 $ 244,103 $ 240,053 $ 235,775 $ 210,480 $

5 3 4 , 8 9 3 Y T I U Q E $ 517,314 $ 118,879 $ 517,314 $ 567,076 $ 619,810 $ 675,695 $ 734,918 $ 1,088,526 $

Cash On Cash Return (COC) % 9 . 0 5 % 3 . 5 3 % 6 . 2 3 % 1 . 0 3 % 7 . 7 2 % 6 . 5 2 % 6 . 5 2

Internal Rate of Return (IRR) 250.1% 250.1% 106.4% 73.7% 59.6% 51.9% 38.7%

Return on Investment (ROI) % 7 . 1 3 9 % 0 . 6 5 1 % 6 . 9 1 1 % 0 . 6 8 % 9 . 4 5 % 4 . 6 2 % 4 . 6 2

Page 18

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

NOI and CASH FLOW PROJECTIONS

NOI(Net Operating Income)

CashFlow

(Pre-Tax)

$0

$20,000

$40,000

$0,000

$80,000

$100,000

Currenl Aller Green

pgrodes

PRC)EClED

SAVlMGS

Yeor 1 Yeor 2 Yeor 3 Yeor 4 Yeor

$3P,80Z

$80,034

$40,22Z

$103,833

$8,20

$P1,0P1

$PZ,2P

$80,034

0

20,000

40,000

0,000

80,000

100,000

120,000

Currenl Aller Green

pgrodes

PRC)EClED

SAVlMGS

Yeor 1 Yeor 2 Yeor 3 Yeor 4 Yeor

$22,433

$2,P

$40,2ZZ

$Z,831

$Z3,Z1Z

$ZP,P21

$8,4P

$2,P

$124,ZP0

Yeor 10

Page 19

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

ROI and COC

ROI(Return on Investment)

COC(Cash on Cash Return)

0.0

200

400

00

800

1000

Yeor 1 Yeor 2 Yeor 3 Yeor 4 Yeor

P31.Z

1.0

4.P

8.0

11P.

2.4

Yeor 10

0.0

10

20

30

40

0

Yeor 1 Yeor 2 Yeor 3 Yeor 4 Yeor

0.P

3.3

2Z.Z

30.1

32.

2.

Yeor 10

Page 20

Simcoe Green Homes Investment Agreement

187 Calle Magdalana, Ste105 Encinitas, CA 92024

For further information call 760-271-7128

Jim@jimsimcoe.com Copyright 2012 Simcoe Ventures, Inc

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Investment ProposalDocument4 pagesInvestment Proposalsibin sebastianNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MBF13e Chap08 Pbms - FinalDocument25 pagesMBF13e Chap08 Pbms - FinalBrandon Steven Miranda100% (4)

- Why Green Homes Sell FasterDocument5 pagesWhy Green Homes Sell FasterJim SimcoeNo ratings yet

- Selecting Green Markets by ClimateDocument5 pagesSelecting Green Markets by ClimateJim SimcoeNo ratings yet

- Benefits Cork FlooringDocument6 pagesBenefits Cork FlooringJim SimcoeNo ratings yet

- The Benefits of Cool RoofsDocument6 pagesThe Benefits of Cool RoofsJim SimcoeNo ratings yet

- Leveraging Local Politics On Your Green ProjectsDocument5 pagesLeveraging Local Politics On Your Green ProjectsJim SimcoeNo ratings yet

- How To Fund Green Real Estate ProjectsDocument6 pagesHow To Fund Green Real Estate ProjectsJim SimcoeNo ratings yet

- Green Real Esate Investing Formulas To Increase Appraisal ValueDocument7 pagesGreen Real Esate Investing Formulas To Increase Appraisal ValueJim SimcoeNo ratings yet

- Green Features Home Buyers WantDocument6 pagesGreen Features Home Buyers WantJim SimcoeNo ratings yet

- Altisource IIM A JDDocument2 pagesAltisource IIM A JDBipin Bansal AgarwalNo ratings yet

- Abc-Consolidation With Intercompany TransactionsDocument3 pagesAbc-Consolidation With Intercompany TransactionsLeonardo MercaderNo ratings yet

- Wa0058.Document4 pagesWa0058.Erwin PariNo ratings yet

- ACCTG - Worksheet Quality AutoDocument1 pageACCTG - Worksheet Quality AutoCab Vic100% (1)

- Chola MsDocument98 pagesChola MsDhaval224No ratings yet

- 10 - Chapter 3Document24 pages10 - Chapter 3Eloysa CarpoNo ratings yet

- Challenges of State Owned Corporations and Enterprises in AfghanistanDocument11 pagesChallenges of State Owned Corporations and Enterprises in AfghanistanNaseer Ahmad AziziNo ratings yet

- Auto Secure - Private Car Package Policy: Sincerely, For Tata AIG General Insurance Company LimitedDocument4 pagesAuto Secure - Private Car Package Policy: Sincerely, For Tata AIG General Insurance Company Limitedismail02984No ratings yet

- VP Director Finance Operations in Greater Chicago IL Resume Corby NeumannDocument3 pagesVP Director Finance Operations in Greater Chicago IL Resume Corby NeumannCorby NeumannNo ratings yet

- Government Bonds Bond - IN0020190362 Bond - IN0020170026Document4 pagesGovernment Bonds Bond - IN0020190362 Bond - IN0020170026Arif AhmedNo ratings yet

- Sarbanes-Oxley Act, Internal Control, and Management AccountingDocument2 pagesSarbanes-Oxley Act, Internal Control, and Management Accountingalexandro_novora6396No ratings yet

- Credit MonitoringDocument15 pagesCredit MonitoringSyam Sandeep67% (3)

- Managerial Accounting Prelim ExamDocument39 pagesManagerial Accounting Prelim ExamshaneNo ratings yet

- Specimen Paper - Maths A&I SL - Answers: November 23, 2021Document2 pagesSpecimen Paper - Maths A&I SL - Answers: November 23, 2021Jaime Molano Moreno0% (1)

- Professional Members Directory As On 13-02-2023Document532 pagesProfessional Members Directory As On 13-02-2023Saddam HussainNo ratings yet

- Service TaxDocument15 pagesService TaxMonu TulsyanNo ratings yet

- Resource Allocation and Financial Planning: Presented byDocument38 pagesResource Allocation and Financial Planning: Presented byAirish Roperez EsplanaNo ratings yet

- 1st Term s1 Financial AccountDocument21 pages1st Term s1 Financial AccountAsabia OmoniyiNo ratings yet

- Basic Accounting PrinciplesDocument5 pagesBasic Accounting PrinciplesGracie BulaquinaNo ratings yet

- Far160 Pyq July2023Document8 pagesFar160 Pyq July2023nazzyusoffNo ratings yet

- HDFC Mutual FundsDocument68 pagesHDFC Mutual FundsMohammed Dasthagir MNo ratings yet

- Infosys Invests in Stellaris Venture Partners (Company Update)Document4 pagesInfosys Invests in Stellaris Venture Partners (Company Update)Shyam SunderNo ratings yet

- Iowa City School District Audit ReportDocument18 pagesIowa City School District Audit ReportThe GazetteNo ratings yet

- Project Summary: A. Name of The FirmDocument9 pagesProject Summary: A. Name of The FirmeingelynNo ratings yet

- Lesson PlanDocument6 pagesLesson Plancjeffixcarreon12No ratings yet

- CA FINAL AUDIT-80 MCQs PDFDocument30 pagesCA FINAL AUDIT-80 MCQs PDFSanyam Jain100% (2)

- Fact FindDocument7 pagesFact Findovidiu.alex90No ratings yet

- Semana 10 Ingles NI EXAMENDocument31 pagesSemana 10 Ingles NI EXAMENSOLANO VIDAL RIJKAARD MAINNo ratings yet