Professional Documents

Culture Documents

Comparison Avg

Comparison Avg

Uploaded by

abhi_19891Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comparison Avg

Comparison Avg

Uploaded by

abhi_19891Copyright:

Available Formats

INVENTORY VALUATION METHODS

This is based on the standard periodic inventory model: Net Sales Beginning inventory + Net Purchases & Freight = Goods Available for Sale - Ending inventory = ..................................>

- Cost of goods sold =Gross Margin

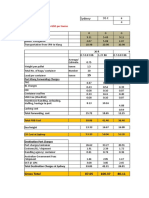

THE MAJOR OBJECTIVE: Determine the cost that will be associated with ending inventory. Notice that this will directly affect COGS and thus Gross Margin. THREE COMMON VALUATION METHODS: 1. Weighted average 2. First-in, first-out (FIFO) 3. Last-in, first-out (LIFO) Information for examples: #Items Beginning inventory Purchase #1 Purchase #2 Purchase #3 Goods Available for sale Units Sold Units Remaining 200 400 300 350 1,250 870 380 Unit Cost Total Cost $12.00 13.00 13.70 14.20 $2,400 5,200 4,110 4,970 $16,680 $17,400

At $20

A. Weighted average. Determine one average cost by dividing total costs by total units. Use units remaining to determine ending inventory. 16,680/1,250 = $13.344 x 380 = $5,071 ending inventory Goods Available for 16,680 Net sales $17,400

Sale -Ending inventory =Cost of goods sold

5,071 11,609

-Cost of Goods Sold Gross Margin

11,609 $5,791

B. First-in, first-out (FIFO). If you assume that those purchased first were sold first, then those remaining would be the last ones. This makes sense from a physical flow standpoint, but it DOESNT MATTER. You can use any of these methods for the "costs" regardless of whether you sold the first ones first or the last ones first or a combination! However, the FIFO method values the ending inventory as if you sold the first ones first. Remaining units: 350 x 14.20 30 x 13.70 380............. 4,970 411 5,38l

ending inventory

Goods Available for Sale -Ending inventory =Cost of goods sold

16,680 5,381 11,299

Net sales -Cost of Goods Sold Gross Margin

$17,400 11,299 $6,101

C. Last-in, first out (LIFO). If you assume that those purchased last were sold first, then those remaining would be the first ones. Although this doesnt usually make sense from a physical flow standpoint, again IT DOESNT MATTER. The actual flow does not need to match the one chosen for the costs. Remaining units: 200 x 12.00 180 x 13.00 380............. 2,400 2,340 4,740

ending inventory

Goods Available for Sale -Ending inventory =Cost of goods sold

16,680 4,740 11,940

Net sales -Cost of Goods Sold Gross Margin

$17,400 11,940 $5,460

SUMMARY OF THREE METHODS

FIFO Gross Margin Ending Inventory Things to notice: $6,101 $5,381

W.Avg. $5,791 $5,071

LIFO $5,460 $4,740

1. When prices are rising, LIFO gives the lowest profit and FIFO the highest. 2. The LIFO profit is the closest to measuring the cost of goods sold as the cost to replace the inventory. 3. When prices are rising, FIFO gives the best measure of the cost of the ending inventory at current prices

Advantages and Disadvantages of All Four Methods:

Method Weighted average Advantages Hard to manipulate Easy to calculate FIFO Hard to manipulate Makes physical sense Doesnt minimize taxes Good ending inventory valuation LIFO Minimizes taxes in inflation Reflects current costs Bad ending inventory valuation Easy to manipulate Physical flow unrealistic Produces "inventory" profits Disadvantages Averages may not reflect inflation well

You might also like

- Acc 201 ch6 HWDocument6 pagesAcc 201 ch6 HWTrickster TwelveNo ratings yet

- E6.21 - Determine Ending Inventory at Cost Using Retail MethodDocument15 pagesE6.21 - Determine Ending Inventory at Cost Using Retail MethodWita SaraswatiNo ratings yet

- Chapter 1 InventoryDocument12 pagesChapter 1 InventoryDaniel AssefsNo ratings yet

- Chapter - 1-Accounting For InventoriesDocument40 pagesChapter - 1-Accounting For InventoriesWonde Biru100% (2)

- Retail Inventory MethodDocument5 pagesRetail Inventory MethodEllaine CabalNo ratings yet

- Chapter 6 Solutions 2241Document22 pagesChapter 6 Solutions 2241JamesNo ratings yet

- ACC TutorialDocument4 pagesACC TutorialMuntasir AhmmedNo ratings yet

- Fifo MethodDocument36 pagesFifo Methodabhisheksachan10No ratings yet

- Lifo Fifo Exercise - SolutionDocument12 pagesLifo Fifo Exercise - Solutionrikita_17No ratings yet

- Lec 4.1 InventoryDocument6 pagesLec 4.1 InventoryAhmed ElnaggarNo ratings yet

- InventoryDocument12 pagesInventoryMesele AdemeNo ratings yet

- Inventory Practice ProblemsDocument14 pagesInventory Practice ProblemsmikeNo ratings yet

- 2010-06-23 203304 Financialaccounting 2Document6 pages2010-06-23 203304 Financialaccounting 2pi!No ratings yet

- Inventories: 15.511 Corporate AccountingDocument61 pagesInventories: 15.511 Corporate AccountingAnanda RamanNo ratings yet

- 1.1. Inventory Costing Methods Under A Periodic SystemDocument6 pages1.1. Inventory Costing Methods Under A Periodic Systembeth elNo ratings yet

- Chapter 6 Assignment Introductory Accounting Name: Nguyen Mai Phuong E6-5: (A) FIFO MethodDocument4 pagesChapter 6 Assignment Introductory Accounting Name: Nguyen Mai Phuong E6-5: (A) FIFO MethodMai Phương NguyễnNo ratings yet

- CH 09 SolDocument54 pagesCH 09 Solawilliams023No ratings yet

- Funamentals of Acct - II - Chapter 1 InventoriesDocument47 pagesFunamentals of Acct - II - Chapter 1 InventoriesibsaashekaNo ratings yet

- Accounting For InventoriesDocument29 pagesAccounting For InventoriesLakachew GetasewNo ratings yet

- HWChap 006Document67 pagesHWChap 006hellooceanNo ratings yet

- Principle of Accounting 2 - Unit 2Document17 pagesPrinciple of Accounting 2 - Unit 2Denekew asmareNo ratings yet

- Costing Methods of InventoryDocument11 pagesCosting Methods of InventoryDipika KumariNo ratings yet

- Week 8 Homework - Part 2 - Financial AccountingDocument5 pagesWeek 8 Homework - Part 2 - Financial Accountinglamvolamvo0912No ratings yet

- InventoryDocument65 pagesInventoryArunkumar KalyanasundaramNo ratings yet

- Accounting For InventoriesDocument20 pagesAccounting For InventoriesDaniela HogasNo ratings yet

- Additional Topics in Variance Analysis: Mcgraw-Hill/IrwinDocument17 pagesAdditional Topics in Variance Analysis: Mcgraw-Hill/Irwinimran_chaudhryNo ratings yet

- PPAcct II InventoryDocument9 pagesPPAcct II InventoryNigussie BerhanuNo ratings yet

- MCMDocument10 pagesMCMDhez RoblesNo ratings yet

- TQ Ans Wk9 2016Document10 pagesTQ Ans Wk9 2016seling97No ratings yet

- Inventory Accounting and ValuationDocument4 pagesInventory Accounting and ValuationFathi Salem Mohammed Abdullah100% (1)

- 06 InventoriesDocument3 pages06 InventoriesCy MiolataNo ratings yet

- Accounting 1 For IBA: ExampleDocument6 pagesAccounting 1 For IBA: ExampleLisanne Ploos van AmstelNo ratings yet

- GP AnalysisDocument25 pagesGP Analysismiles1280No ratings yet

- Inventory 2Document4 pagesInventory 2Shuvo Taufiq AhmedNo ratings yet

- Accounting For InventoriesDocument9 pagesAccounting For InventoriesPrince AngelNo ratings yet

- Workings:: Computing Cost of Sales and Ending InventoryDocument2 pagesWorkings:: Computing Cost of Sales and Ending InventoryKia PottsNo ratings yet

- Sheet 3 First YearDocument11 pagesSheet 3 First Yearmagdy kamelNo ratings yet

- Inventory EstimationDocument4 pagesInventory EstimationShy Ng0% (1)

- Chapter - 1-InventoriesDocument36 pagesChapter - 1-Inventoriesrmdn32529732No ratings yet

- Inventory Depreciation Expense RecognitionDocument9 pagesInventory Depreciation Expense RecognitionZulu MasukuNo ratings yet

- CH 1 Funamentals of Acct - II - InventoriesDocument35 pagesCH 1 Funamentals of Acct - II - InventoriesNatnael AsfawNo ratings yet

- Chapter 7 Extra Questions & SolutionsDocument8 pagesChapter 7 Extra Questions & Solutionsandrew.yerokhin1No ratings yet

- Special Inventory Valuation Methods 4.1. Valuation at Lower of Cost or Market (LCM)Document6 pagesSpecial Inventory Valuation Methods 4.1. Valuation at Lower of Cost or Market (LCM)ashegemedeNo ratings yet

- Chapter 8: Valuation of Inventories: A Cost Basis ApproachDocument28 pagesChapter 8: Valuation of Inventories: A Cost Basis ApproachChris WongNo ratings yet

- ABC and FifoDocument4 pagesABC and FifosninaricaNo ratings yet

- Homework Chapter 6Document10 pagesHomework Chapter 6Carroll MableNo ratings yet

- Chapter - 1 Inventories Definition: - Inventory Is Used To DesignateDocument14 pagesChapter - 1 Inventories Definition: - Inventory Is Used To DesignateMulugeta TsegaNo ratings yet

- Lecture 4b Cost Volume Profit EditedDocument24 pagesLecture 4b Cost Volume Profit EditedJinnie QuebrarNo ratings yet

- Bus 591 WK 3 Assignment - ReviewedDocument15 pagesBus 591 WK 3 Assignment - ReviewedJoe TongNo ratings yet

- Final Term Product (Q)Document3 pagesFinal Term Product (Q)Rosendo Bisnar Jr.No ratings yet

- Reporting and Analysing InventoriesDocument33 pagesReporting and Analysing InventoriessamaanNo ratings yet

- Taller Seis Acco 111Document44 pagesTaller Seis Acco 111api-274120622No ratings yet

- Inventory ValuationDocument12 pagesInventory Valuationcooldude690No ratings yet

- Inventory Balance Sheet: Inventory Valuation For Investors: FIFO and LifoDocument5 pagesInventory Balance Sheet: Inventory Valuation For Investors: FIFO and LiforanotabbsNo ratings yet

- POA1-Assignment - Chapter 6 - Q SentDocument6 pagesPOA1-Assignment - Chapter 6 - Q SentYusniagita EkadityaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Piece Goods, Notions, Dry Good Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandPiece Goods, Notions, Dry Good Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- OPTCL Volume - I - Part - I - 01092016Document128 pagesOPTCL Volume - I - Part - I - 01092016ajay2ksinghNo ratings yet

- AKT-SIP-SOP-004 SIP Management PlantDocument39 pagesAKT-SIP-SOP-004 SIP Management PlantSHES BBPNo ratings yet

- Corporate GovernanceDocument20 pagesCorporate GovernanceSyed Israr HussainNo ratings yet

- Impact: Natalia Adler, Chief of Social Policy, UNICEF NicaraguaDocument2 pagesImpact: Natalia Adler, Chief of Social Policy, UNICEF NicaraguaKundNo ratings yet

- Time Warner-SummaryDocument2 pagesTime Warner-SummarySK SchreaveNo ratings yet

- SAP PS (Tutorialspoint)Document77 pagesSAP PS (Tutorialspoint)LokamNo ratings yet

- LexisNexis Concepts in Customer Due DiligenceDocument11 pagesLexisNexis Concepts in Customer Due DiligenceLexisNexis Risk Division100% (2)

- Value Chain Analysis ofDocument1 pageValue Chain Analysis ofBourhan UddinNo ratings yet

- CompensationDocument36 pagesCompensationabdushababNo ratings yet

- Odoo OpenERP Implementation MethodologyDocument6 pagesOdoo OpenERP Implementation MethodologyyourreddyNo ratings yet

- Tmint Creative - Penelusuran GoogleDocument1 pageTmint Creative - Penelusuran GoogleNur ImanahNo ratings yet

- Summary 217 229Document5 pagesSummary 217 229Love alexchelle ducutNo ratings yet

- Brief Note On HRIS - Downsizing - VRS - RetrenchmentDocument2 pagesBrief Note On HRIS - Downsizing - VRS - RetrenchmentDanìél Koùichi HajongNo ratings yet

- Strategic AgilityDocument13 pagesStrategic AgilityDapoer OmaOpaNo ratings yet

- Cash FlowsDocument26 pagesCash Flowsvickyprimus100% (1)

- Sample Questionnaire For Job AnalysisDocument4 pagesSample Questionnaire For Job AnalysisJinal DamaniNo ratings yet

- Bookkeeping (Second Part)Document38 pagesBookkeeping (Second Part)Thuzar Lwin100% (3)

- Mercantile Law PDFDocument3 pagesMercantile Law PDFSmag SmagNo ratings yet

- C 19233 EntryDocument2 pagesC 19233 EntryFredrickNo ratings yet

- Thompson Et Al.2022Document20 pagesThompson Et Al.2022hanieyraNo ratings yet

- Comm BKG, Sessions 1-8Document118 pagesComm BKG, Sessions 1-8Piyush PandeyNo ratings yet

- Taxation Quizzer Quizzes For Tax PDFDocument62 pagesTaxation Quizzer Quizzes For Tax PDFCelestino AlisNo ratings yet

- Multiple Choice: - ComputationalDocument4 pagesMultiple Choice: - ComputationalCarlo ParasNo ratings yet

- Insights From The Edelman Corporate Communications Benchmarking StudyDocument3 pagesInsights From The Edelman Corporate Communications Benchmarking StudyEdelman100% (4)

- Patni Ar2009Document174 pagesPatni Ar2009chip_blueNo ratings yet

- 1471609638850Document254 pages1471609638850popushellyNo ratings yet

- Trainee'S Record Book: Technical Education and Skills Development AuthorityDocument10 pagesTrainee'S Record Book: Technical Education and Skills Development AuthorityVirgil Keith Juan PicoNo ratings yet

- Sydney 96 T: All Cost Numbers Are in USD Per TonneDocument5 pagesSydney 96 T: All Cost Numbers Are in USD Per Tonnesoumyarm942No ratings yet

- BIR Ruling DA-058-08 (Reimbursement - Affiliates)Document4 pagesBIR Ruling DA-058-08 (Reimbursement - Affiliates)joefieNo ratings yet

- Chapter 1 - The Nature of Management Control SystemsDocument21 pagesChapter 1 - The Nature of Management Control SystemsyanuarwirandonoNo ratings yet