Professional Documents

Culture Documents

Construction Spending 1-3-12

Construction Spending 1-3-12

Uploaded by

Jessica Kister-LombardoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Construction Spending 1-3-12

Construction Spending 1-3-12

Uploaded by

Jessica Kister-LombardoCopyright:

Available Formats

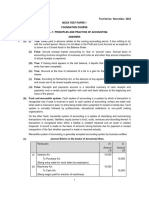

CONTINUED GAINS, WILL ADD TO Q4GDP

Construction Spending Tuesday January 3, 2012

3 2 1 Monthly % Change 0 -1 -2 -3 -4 -5 Nov-09 Feb-10 May-10 Aug-10 Nov-10 Feb-11 May-11 Aug-11 Nov-11

Monthly % Change Year-on-Year % Change

12 8 4 Yearly % Change 0 -4 -8 -12 -16 -20

Construction spending rose 1.2% in November following a downwardly revised decline of 0.2% in October. Spending in September was revised substantially higher. Construction spending is now 0.5% above its year ago level, after declining on an annual basis for the last 48 months. Moreover, annual gains have accelerated in the past few months. Residential construction spending rose 2.0% in October and is now 3.4% higher than its year ago level. Even with these gains, residential investment has been basically flat for the past two years and is just above its cyclical nadir of July 2009. A rebound will be dependent on reduction of the current large inventory of existing homes, particularly REOs and other foreclosures. Nonresidential construction spending was unchanged in November amid mixed industry performance. Nonresidential construction spending is up 4.5% over the last year, and has grown at a much faster pace in the last six months. Public construction expenditures rose 1.7% in November but remain 5.3% lower on the year. Despite the monthly gain, the major weak spot in construction spending continues to be the public sector. Fading stimulus dollars and difficult budget positions for many state and local governments significantly downgrade the outlook for public spending going forward. Of the other two categories of spending in the private sector, residential construction spending has stabilized at a weak level while non-residential investment remains volatile. Recent gains suggest that construction spending will contribute positively to Q4 economic growth and if sustained, signal that better times may be ahead for construction activity.

Forecast: Consensus**: Actual: 0.5% 0.5% 1.2% Monthly % Change Relative Weight* Nov-11 100.0% 1.2 Oct-11 -0.2 0.8 0.7 2.3 -0.6 -1.3 4.0 1.5 -3.9 -3.5 -1.8 -1.6 0.4 -3.4 Sep-11 1.1 0.2 1.5 1.5 1.5 -1.9 2.8 0.3 2.1 1.9 0.4 0.9 3.0 -1.4 PERCENT CHANGE Annual Rates of % Change for Three Six Twelve Five Month Month Month 2010 2009 Year 8.8 5.1 0.5 -6.0 -16.2 -8

Ten Year -0.4

Construction Spending Previous estimate Private Construction Residential Nonresidential Commercial Power Office Health Care All Other Public Construction Education Highways & Streets All Others

64.7% 30.2% 34.5% 5.0% 10.8% 2.8% 3.6% 12.2% 35.3% 8.9% 10.3% 16.1%

1.0 2.0 0.0 -0.8 3.0 -1.3 0.4 -1.9 1.7 0.5 1.9 2.3

13.4 26.2 3.5 -14.9 47.2 1.9 -5.9 -13.5 0.9 -1.0 23.5 -9.9

5.3 -4.2 14.9 4.5 36.9 1.3 4.2 9.6 4.6 6.9 22.7 -6.0

4.0 3.4 4.5 12.0 8.4 2.3 -4.9 2.0 -5.3 2.8 -2.2 -10.9

-8.1 -6.3 -9.7 -14.3 11.1 -19.4 -1.8 -20.1 -2.1 -10.6 5.1 -1.5

-21.9 -15.0 -27.0 -40.6 -5.2 -43.5 -21.9 -27.1 -3.7 -10.3 -3.0 -0.2

-12.2 -19.1 -1.0 -13.2 19.4 -9.7 0.7 -1.6 4.0 -0.5 4.5 6.3

-2.4 -4.0 -0.8 -5.7 10.6 -8.9 4.2 -1.8 4.7 #N/A #N/A #N/A

Source: Bureau of the Census, Department of Commerce via Haver Analytics. Data, graph & table courtesy of Insight Economics, LLC. **Bloomberg 2011 HousingMatrix, Inc. | http://www.HousingMatrix.com | All rights reserved. Reproduction and/or redistribution are expressly prohibited. Hot Sheet is a registered trademark of HousingMatrix, Inc. Information herein is based on sources we believe to be reliable, but its accuracy is not guaranteed.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Case Digest Tañada vs. TuveraDocument13 pagesCase Digest Tañada vs. TuveraMendrick Torino100% (8)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Faculty of Business Studies CIET (Shipping Co) Business PlanDocument16 pagesFaculty of Business Studies CIET (Shipping Co) Business PlanMaysaa100% (15)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Simple Asset Purchase AgreementDocument6 pagesSimple Asset Purchase AgreementFashan PathiNo ratings yet

- FIN4414 TapleyDocument31 pagesFIN4414 TapleyAnz Rosaceña CompuestoNo ratings yet

- AKPK Power - Chapter 2 - Borrowing BasicsDocument20 pagesAKPK Power - Chapter 2 - Borrowing BasicsEncik Anif100% (1)

- Economic Focus January 30, 2012Document1 pageEconomic Focus January 30, 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus April 16 2012Document1 pageEconomic Focus April 16 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus Feb. 20, 2012Document1 pageEconomic Focus Feb. 20, 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus 1-23-12Document1 pageEconomic Focus 1-23-12Jessica Kister-LombardoNo ratings yet

- Housing Starts December 2011Document1 pageHousing Starts December 2011Jessica Kister-LombardoNo ratings yet

- January Housing StartsDocument1 pageJanuary Housing StartsJessica Kister-LombardoNo ratings yet

- Economic Focus 1-16-12Document1 pageEconomic Focus 1-16-12Jessica Kister-LombardoNo ratings yet

- January Existing Home SalesDocument1 pageJanuary Existing Home SalesJessica Kister-LombardoNo ratings yet

- Economic Focus 12-19-11Document1 pageEconomic Focus 12-19-11Jessica Kister-LombardoNo ratings yet

- Construction Spending December 2011Document1 pageConstruction Spending December 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 12-5-11Document1 pageEconomic Focus 12-5-11Jessica Kister-LombardoNo ratings yet

- New Home Sales November December) 2011Document1 pageNew Home Sales November December) 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 12-12-11Document1 pageEconomic Focus 12-12-11Jessica Kister-LombardoNo ratings yet

- Housing Starts September 2011Document1 pageHousing Starts September 2011Jessica Kister-LombardoNo ratings yet

- Housing StartsDocument1 pageHousing StartsJessica Kister-LombardoNo ratings yet

- November Construction SpendingDocument1 pageNovember Construction SpendingJessica Kister-LombardoNo ratings yet

- Economic Focus 11-14-11Document1 pageEconomic Focus 11-14-11Jessica Kister-LombardoNo ratings yet

- Housing Starts Oct 2011Document1 pageHousing Starts Oct 2011Jessica Kister-LombardoNo ratings yet

- Existing Home SalesDocument1 pageExisting Home SalesJessica Kister-LombardoNo ratings yet

- Economic Focus October 24, 2011Document1 pageEconomic Focus October 24, 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 9-26-11Document1 pageEconomic Focus 9-26-11Jessica Kister-LombardoNo ratings yet

- Construction Spending Oct. 2011Document1 pageConstruction Spending Oct. 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 10-10-11Document1 pageEconomic Focus 10-10-11Jessica Kister-LombardoNo ratings yet

- Existing Home Sales October 2011Document1 pageExisting Home Sales October 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 10-17-11Document1 pageEconomic Focus 10-17-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 9-5-11Document1 pageEconomic Focus 9-5-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 9-19-11Document1 pageEconomic Focus 9-19-11Jessica Kister-LombardoNo ratings yet

- Economic Focus Sept. 12, 2011Document1 pageEconomic Focus Sept. 12, 2011Jessica Kister-LombardoNo ratings yet

- Existing Home Sales August 2011Document1 pageExisting Home Sales August 2011Jessica Kister-LombardoNo ratings yet

- Newhome 8-23-11Document1 pageNewhome 8-23-11Jessica Kister-LombardoNo ratings yet

- MB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereDocument4 pagesMB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereRajesh SinghNo ratings yet

- BIR RMC 28-2017 Annex ADocument1 pageBIR RMC 28-2017 Annex AAnonymous yKUdPvwjNo ratings yet

- MTP 14 28 Answers 1701406110Document11 pagesMTP 14 28 Answers 1701406110aim.cristiano1210No ratings yet

- Model Exit Exam - Cost and Management Accounting IIDocument12 pagesModel Exit Exam - Cost and Management Accounting IIfageenyakaraaNo ratings yet

- Accounting Workbook 2 - Answer KeyDocument57 pagesAccounting Workbook 2 - Answer KeyAbby VillagraciaNo ratings yet

- City of Oakland FY 2013-2015 Proposed Policy BudgetDocument378 pagesCity of Oakland FY 2013-2015 Proposed Policy BudgetZennie AbrahamNo ratings yet

- The Templars As Papal BankersDocument6 pagesThe Templars As Papal BankersDan ClausenNo ratings yet

- 2021 WHLP Week 1 2 Business FInance 2nd QuarterDocument4 pages2021 WHLP Week 1 2 Business FInance 2nd QuarterHa Jin KimNo ratings yet

- Befa Mid-Ii B.tech Iii YearDocument5 pagesBefa Mid-Ii B.tech Iii YearNaresh GuduruNo ratings yet

- KhatianDocument3 pagesKhatianrafiqcuNo ratings yet

- 10 Funds Flow StatementDocument13 pages10 Funds Flow Statementankush sardanaNo ratings yet

- A Study On The Awareness of Life Insurance Policy Among The Residents in UlhasnagarDocument56 pagesA Study On The Awareness of Life Insurance Policy Among The Residents in UlhasnagarManoj MondalNo ratings yet

- Tutorial 6 - TUCT6 - 2011Document3 pagesTutorial 6 - TUCT6 - 2011Talha AlamNo ratings yet

- S.4 Extra Maths Holiday Work Term 1 2016 Attempt All The Equation. 1. Without Using Tables or A Calculator, Evaluate (04 Marks)Document5 pagesS.4 Extra Maths Holiday Work Term 1 2016 Attempt All The Equation. 1. Without Using Tables or A Calculator, Evaluate (04 Marks)Athiyo MartinNo ratings yet

- Accounting Sample 1Document6 pagesAccounting Sample 1AmnaNo ratings yet

- Affairs Cloud 19-20th Nov 2023 Q&A English PDF - WatermarkDocument14 pagesAffairs Cloud 19-20th Nov 2023 Q&A English PDF - WatermarkDhipak IlayarajaNo ratings yet

- Capital RationingDocument2 pagesCapital Rationingvishesh_2211_1257207No ratings yet

- Stages of A Venture Life CycleDocument21 pagesStages of A Venture Life CycleSavita S ShettyNo ratings yet

- 8.1.22 Am Intangible-AssetsDocument8 pages8.1.22 Am Intangible-AssetsAether SkywardNo ratings yet

- Sample TORDocument5 pagesSample TORajay_vasaiNo ratings yet

- Maryam Nawaz Sharifi vs. Chairman NABDocument33 pagesMaryam Nawaz Sharifi vs. Chairman NABmohsin ali razaNo ratings yet

- ACW1120-Week 5 Practice Q-Topic 5-Prepare FSDocument8 pagesACW1120-Week 5 Practice Q-Topic 5-Prepare FSGan ZhengweiNo ratings yet

- Development & GrowthDocument9 pagesDevelopment & GrowthSachin SahooNo ratings yet

- Adamson University Intermediate Accounting 1 Property, Plant, & Equipment Quiz - Answer KeyDocument4 pagesAdamson University Intermediate Accounting 1 Property, Plant, & Equipment Quiz - Answer KeyKhai Supleo PabelicoNo ratings yet

- Cruz, Carlos Oliveira and Rui Cunha Marques (2013) Infrastructure Public-Private Partnerships - Decision, Management and Development (364236909X) (20170104)Document188 pagesCruz, Carlos Oliveira and Rui Cunha Marques (2013) Infrastructure Public-Private Partnerships - Decision, Management and Development (364236909X) (20170104)QwikRabbitNo ratings yet