Professional Documents

Culture Documents

Performance Highlights: Neutral

Performance Highlights: Neutral

Uploaded by

Angel BrokingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Performance Highlights: Neutral

Performance Highlights: Neutral

Uploaded by

Angel BrokingCopyright:

Available Formats

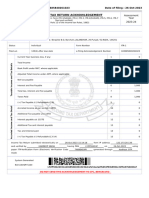

3QFY2012 Result Update | Capital Goods

January 31, 2012

BHEL

Performance Highlights

(` cr) Revenue EBITDA EBITDA margin (%) PAT

Source: Company, Angel Research

NEUTRAL

CMP Target Price

% chg (yoy) 19.1 0.4 (359)bp 2.0 3QFY12 10,546 1,959 18.6 1,412 % chg (qoq) 1.9 6.2 79bp 1.4

`251 -

3QFY12 10,743 2,080 19.4 1,432

3QFY11 9,023 2,072 23.0 1,403

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Capital Goods 61,324 0.9 459/225 1,953,594 2 17,194 5,199 BHEL.BO BHEL@IN

BHELs 3QFY2012 numbers were broadly in-line with our estimates. The company reported decent top-line growth and witnessed margin pressure, leading to flat growth in the bottom line. However, the shocker came at the order inflow front, as BHEL witnessed order cancellations, which led to a decline in order inflow for 9MFY2012 (`15,273cr) vs. 1HFY2012 (`16,777cr). The challenges outlined in the power sector (which seem far from getting resolved) coupled with the competitive landscape in the BTG space put BHEL in troubled waters. Hence, we maintain our negative stance on BHEL and our Neutral rating on the stock. Strong revenue offset by margin dip; PAT growth subdued at 2.0%: Aided by strong execution, BHELs top line grew by 19.1% yoy to `10,743cr, which was 1.2% lower than our estimate of `10,873cr. The companys EBITDAM contracted by 359bp yoy to 19.4%, in-line with our estimate. EBITDAM was mainly impacted by high raw-material cost and other expenses, which rose by 270-350bp as a percentage of sales. Led by margin dip, PAT growth was subdued at 2.0% yoy to `1,432cr, 2.2% lower than our (`1,465cr) and street (`1,485cr) estimate. Outlook and valuation: Problems on the business front, envisaged in many of our earlier notes, are coming to fore for BHEL dismal order intake, no signs of let up in competition (domestic and international) and order book growth under threat (9MFY2012 revenue exceeds 9MFY2012 order inflow), all of which put serious concerns over the companys long-term growth. Although we believe that on the valuation front the stock is undemanding at PE multiple of <11x of its FY2013E earnings, we believe earnings would face severe strain going ahead, given the structural issues. Hence, we maintain our negative stance on BHEL.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 67.7 12.2 13.5 6.5

Abs. (%) Sensex BHEL

3m (2.9)

1yr (6.2)

3yr (2.6) (39.3)

(21.2) (43.5)

Key financials

Y/E March (` cr) Net sales % chg Adj. net profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2010

33,653 24.6 4,327 38.9 17.3 17.7 14.2 3.9 30.0 37.7 1.6 8.9

FY2011

42,538 26.4 6,053 39.9 20.2 24.7 10.1 3.0 33.6 44.4 1.2 6.0

FY2012E

51,352 20.7 6,966 15.1 19.6 28.5 8.8 2.4 30.6 39.5 1.2 5.7

FY2013E

46,344 (9.8) 5,762 (17.3) 18.3 23.5 10.6 2.1 21.1 26.5 0.9 6.2

Shailesh Kanani

+91 22 3937 7600 Ext: 6829 shailesh.kanani@angelbroking.com

Hemang Thaker

+91 22 3937 7800 Ext: 6817 hemang.thaker@angelbroking.com

Please refer to important disclosures at the end of this report

BHEL | 3QFY2012 Result Update

Exhibit 1: Quarterly performance

(` cr) Net sales Other operating income Total income Stock adjustments Raw Material (% of total income) Employee Cost (% of total income) Other expenses (% of total income) Total expenditure EBITDA (EBITDA %) Interest Depreciation Other income PBT (% of total income) Total tax (% of PBT) PAT (Reported) (% of total income) EPS (`)* 3QFY12 10,548 195.1 10,743 (474.5) 6,488 56.0 1,338 12.5 1,311 12.2 8,663 2,080 19.4 14.5 186.8 196.0 2,075 19.3 643.2 31.0 1,432 13.3 5.9 3QFY11 8,849 174.1 9,023 (275.9) 5,086 53.3 1,349 14.9 793 8.8 6,952 2,072 23.0 14.5 144.7 152.9 2,065 22.9 662.3 32.1 1,403 15.6 5.7 2.0 (2.9) 0.2 29.1 28.2 0.5 24.6 0.4 65.3 (0.8) 27.6 % chg (yoy) 19.2 12.1 19.1 2QFY12 10,299 247.0 10,546 (447.9) 6,566 58.0 1,349 12.8 1,119 10.6 8,586 1,959 18.6 9.6 188.8 219.9 1,981 18.8 568.6 28.7 1,412 13.4 5.8 1.4 13.1 50.4 (1.1) (10.8) 4.8 0.9 6.2 17.2 (0.8) (1.2) % chg (qoq) 2.4 1.9 9MFY12 27,972 587.9 28,560 (1,353) 17,635 57.0 3,988 14.0 3,138 11.0 23,407 5,153 18.0 32.9 545.5 664.6 5,239 18.3 1,579 30.1 3,660 12.8 15.0 9MFY11 23,657 457.6 24,115 (794.3) 9,292 35.2 3,951 16.4 1,912 7.9 19,446 4,669 19.4 24.2 405.7 478.4 4,718 19.6 1,504 31.9 3,213 13.3 13.1 13.9 13.9 4.9 35.9 34.5 38.9 11.1 20.4 10.4 64.1 0.9 89.8 % chg (yoy) 18.2 18.4

Source: Company, Angel Research;* Note: Adjusted for stock split

Exhibit 2: Actual vs. Estimate

(` cr) Revenue EBITDA Interest Tax PAT

Source: Company, Angel Research

Actual 10,743 2,080 14.5 643.2 1,432

Estimates 10,873 2,175 10.5 705.3 1,465

Var. (%) (1.2) (4.3) 38.1 (8.8) (2.2)

January 31, 2012

BHEL | 3QFY2012 Result Update

Consistent top-line growth continues on strong order book

For 3QFY2012, BHELs revenue grew by 19.1% yoy to `10,743cr. Growth was largely driven by the power segment (aided by reclassification of revenue from industry to power), which posted robust growth of 58.3% yoy to `8,711cr and the industry segment posted a decline of 37.3% yoy to `2,367cr.

Exhibit 3: Quarterly revenue trend depicts a stable picture

20,000 16,000 12,000 8,000 4,000 0 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 28.5 23.9 23.6 17.6 16.4 10.2 10.0 28.5 26.2 24.8 45.7 31.8 24.2 19.1 50.0 40.0 30.0 20.0

Sales (` cr, LHS) Source: Company, Angel Research

Growth (yoy %, RHS)

Exhibit 4: Segment-wise performance

Y/E March (` cr) Revenue Power Industry Total revenue EBIT Power Industry Total EBIT Revenue mix (%) Power Industry EBIT margin (%) Power Industry Total

Source: Company, Angel Research

3QFY12 8,711 2,367 11,078 1,656 748.6 2,405 78.6 21.4 19.0 31.6 21.7

3QFY11 5,502 3,778 9,280 1,713 373.0 2,086 59.3 40.7 31.1 9.9 22.5

% chg (yoy) 58.3 (37.3) 19.4 (3.3) 100.7 15.3

2QFY11 7,797 2,960 10,758 1,316 800.4 2,116 72.5 27.5 16.9 27.0 19.7

% chg (qoq) 11.7 (20.0) 3.0 25.8 (6.5) 13.6

9MFY12 22,289 6,980 29,269 3,924 1,922 5,846 76.2 23.8 17.6 27.5 20.0

9MFY11 17,930 6,826 24,757 4,203 903 5,106 72.4 27.6 23.4 13.2 20.6

% chg (yoy) 24.3 2.3 18.2 (6.6) 112.9 14.5

January 31, 2012

BHEL | 3QFY2012 Result Update

Exhibit 5: Power segment posts stable growth

16,000 51.7 12,000 30.2 8,000 4,000 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 14.6 23.1 29.6 18.5 17.6 (3.6) 30.0 35.8 58.3 70.0 60.0 50.0 40.0 30.0 7.6 10.5 20.0 10.0 (10.0)

Exhibit 6: Industry segment retreats...

4,000 3,200 2,400 1,600 800 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 25.0 20.0 15.0 10.0 5.0 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 22.1 17.8 19.1 109.6 78.2 125.0 100.0 75.0 12.5 3.7 6.6 2.8 15.9 50.0 25.0 (37.3) (25.0) (50.0) 4.2 4.1

Power (` cr, LHS)

Growth (yoy %, RHS)

Industry (` cr, LHS)

Growth (yoy %, RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Margins witness a sharp contraction

On an absolute basis, the companys EBITDAM contracted by 359bp yoy to 19.4%, in-line with our estimate. EBITDAM was mainly impacted by high raw-material cost and other expenses. As a percentage of sales, raw-material cost rose by ~270bp yoy to 56%, while other expenses shot up by ~340bp yoy to 12.2% (mainly accounted by higher power, fuel, freight and transportation cost, amongst others). Segment wise, the industry segment witnessed phenomenal EBITM expansion of more than 2,000bp yoy to 31.6% mainly due to execution of high-margin orders. On the other hand, the power segments EBITM came off sharply by ~1,200bp yoy to 19%. Led by margin dip, PAT growth was subdued at 2.0% yoy to `1,432cr, 2.2% lower than our (below street) estimate of `1,465cr.

Exhibit 7: Segment EBITM trend

36.0 30.0 24.0 (%) 18.0 12.0 6.0 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

Exhibit 8: Blended EBITDA margin

5,000 4,000 3,000 2,000 1,000 0 18.7 18.5 18.3 21.6 20.6 14.6 10.4 23.0 23.4 19.2 18.6 19.4 15.3

Power segment EBITM Source: Company, Angel Research

Industry segment EBITM

EBITDA (` cr, LHS)

EBITDAM (%, RHS)

Source: Company, Angel Research

January 31, 2012

BHEL | 3QFY2012 Result Update

Order book to witness a decline this year

Order intake for 9MFY2012 totaled `15,273cr (power segment `9,465cr and industry segment `6,393cr), a yoy decline of ~60.0%. In addition, the company witnessed cancellation of orders worth `5,847cr (one large order and couple of small orders) in 3QFY2012. Dismal order intake resulted in order book slipping by 7.0% yoy to `1.4tn the first decline in the past several quarters. Declining order book (9MFY2012 revenue exceeds 9MFY2012 order inflow) puts serious concerns over the companys long-term growth. In light of the proposed FPO, management refrained to offer any sort of guidance in order inflows. We believe the current economic landscape is still not conducive for sustained inflows on account of multiple challenges. In our view, BTG orders would post a meaningful uptick once structural issues related to coal and land acquisition get credibly resolved. We estimate order inflows worth `25,324cr and `35,000cr for FY2012E and FY2013E, respectively.

Exhibit 9: OB/Sales ratio on a declining trend...

70,000 60,000 50,000

(` cr)

Exhibit 10: ...led by a drop in order backlog

5.0 200,000 160,000 120,000 80,000 40,000 1.0 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 50.0 40.0 30.0 20.0 10.0 (10.0) (20.0)

3.5

4.0 3.0 2.0

40,000 30,000 20,000 10,000 FY07 FY08 FY09 FY10 FY11 FY12E FY13E

Revenues

Order intake

OB/Sales

Avg OB/Sales

Order Backlog (` cr, LHS)

Growth (yoy %, RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Working capital deteriorates: BHELs working capital (excluding cash) stood at ~`9,000 (82 days on an absolute basis) as of 9MFY2012, which is high compared to 57 days as of 1HFY2012 and 14 days as of FY2011. This is primarily due to due to high debtors (`35,000cr as of 9MFY2012) and lower advances (amid lower order inflows), which negatively impacted the working capital cycle. Consequently, cash balance, as indicated by management, is little over `5,000cr, which has declined by roughly `3,000cr from 1HFY2012 (`7,949cr) and nearly halved when compared to FY2011 end (`9,706cr). Against the backdrop of payment delays, including milestone payments (retentions money) as well as lower advances, we expect working capital to remain at elevated levels (54 days and 95 days for FY2012E and FY2013E, respectively).

January 31, 2012

BHEL | 3QFY2012 Result Update

Recommendation rationale

Deteriorating dynamics in the BTG space: Recent trend in biddings and project wins indicate that BHELs leadership position is under threat, thus hinting for a loss in its market share going ahead. Further, given the structural issues faced by the power sector, times look tough for BTG players in the near to medium term. Concerns visible beyond FY2013: While the current operating metrics appear sound (a revenue CAGR of 24% in the past five years, strong OB/Sales of 3.8x and 20%+ EBITDA margin), we expect BHEL to face pressure going ahead. In our view, the companys growth and margins are likely to trim mainly due to 1) deceleration of order inflow growth from a 26.2% CAGR over FY2006-11 to negative growth over FY2011-14E; and 2) a 200-250bp margin dip from FY2013 due to higher imported content of supercritical equipment. Hence, we believe earnings could face severe strain in the times to come. More underperformance likely: BHEL is trading at historically low valuations of 10.6x FY2013E EPS, owing to 1) delay in big-ticket orders; 2) weak investment capex due to a high interest rate regime, which could take more time to gather momentum than earlier anticipated; and 3) changing competitive dynamics in the BTG space. We believe these concerns are far from over and, hence, expect the stock to further underperform and maintain our Neutral view on the stock. Outlook and valuation: Problems on the business front, envisaged in many of our earlier notes, are coming to fore for BHEL dismal order intake, no signs of let up in competition (domestic and international) and order book growth under threat (9MFY2012 revenue exceeds 9MFY2012 order inflow), all of which put serious concerns over the companys long-term growth. Although we believe that on the valuation front the stock is undemanding at PE multiple of <11x of its FY2013E earnings, we believe earnings would face severe strain going ahead, given the structural issues. Hence, we maintain our negative stance on BHEL. Change in estimates: We have cut our FY2012E order inflow estimates from `40,500 to `25,324cr, factoring the dull ordering scenario in the BTG space. This cut results in ~10.3% downward revision in revenue for FY2013E. In tandem with decreased top line, earnings growth is expected to decelerate by 9.4% for FY2013.

Exhibit 11: Change in estimates

FY2012E (` cr) Earlier estimates 51,482 10,193 7,015 Revised estimates 51,352 10,068 6,966 Var. (%) (0.3) (1.2) (0.7) FY2013E Earlier estimates 51,689 9,480 6,361 Revised estimates 46,344 8,474 5,762 Var. (%) (10.3) (10.6) (9.4)

Revenue EBITDA PAT

Source: Company, Angel Research

January 31, 2012

BHEL | 3QFY2012 Result Update

Exhibit 12: Angel EPS forecast vs consensus

Y/E March FY2012E FY2013E

Source: Company, Angel Research

Angel forecast 28.5 23.5

Bloomberg consensus 26.1 27.1

Var. (%) 9.1 (13.2)

Exhibit 13: Premium/Discount to Sensex P/E

900 750 600

Exhibit 14: One-year forward P/E band

120.0 100.0 80.0 60.0

(%)

May-07 May-08 May-09 May-10 May-11 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Jan-12

450 300 150 0

40.0 20.0 0.0 (20.0) (40.0) Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 May-07 May-08 May-09 May-10 May-11 Jan-12

Share Price (`)

10x

15x

20x

25x

5-yr Average Premium

Absolute Premium

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 15: Peer comparison

Company Reco. CMP Tgt. price Upside (`) ABB* BHEL BGR Energy Crompton Greaves Jyoti Structures KEC International Thermax Sell Neutral Neutral Buy Buy Neutral Neutral 812 251 231 133 47 53 492 (`) 427 168 158 54 53 P/BV(x) P/E(x) FY2011-13E RoCE (%) RoE (%) (%) FY12E FY13E FY12E FY13E (47.4) (27.4) 18.7 16.0 0.2 6.7 2.4 1.5 2.4 0.6 1.3 3.6 6.0 2.1 1.3 2.0 0.5 1.1 3.1 91.4 8.8 6.4 16.5 3.9 7.9 14.2 45.6 10.6 6.9 11.0 4.3 6.0 15.1 EPS CAGR FY12E FY13E FY12E FY13E 144.2 (2.4) (13.4) (8.2) (5.3) 5.7 0.9 11.4 39.5 14.2 16.3 21.7 17.5 32.8 20.2 26.5 10.6 20.6 18.2 18.4 26.0 7.6 30.6 25.0 15.1 15.8 24.9 28.0 13.9 21.1 23.4 20.1 12.7 26.6 21.9

Source: Company, Angel Research

January 31, 2012

BHEL | 3QFY2012 Result Update

Profit & loss statement (consolidated)

Y/E March (` cr) Total Income % chg Net Raw Materials Other Mfg costs Personnel Other Total Expenditure EBITDA % chg (% of Net Sales) Depn & Amort. EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Others Recurring PBT % chg Extraord. Exp/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) Add: earnings of associate Less: Minority interest (MI) Prior period items PAT after MI (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg FY2008 FY2009 FY2010 FY2011 19,727 12.0 10,662 2,754 2,608 16,024 3,703 3.5 18.8 297 3,406 3.1 17.3 35 1,023 23.3 4,393 18.6 (37.4) 4,430 1,571 35.5 2,859 2,859 2,860 18.5 14.5 11.7 11.7 18.5 27,012 36.9 16,234 3,593 3,020 22,846 4,166 12.5 15.4 282 3,884 14.0 14.4 35 978 20.3 4,827 9.9 (11.2) 4,838 1,723 35.6 3,115 3,115 3,115 8.9 11.5 12.7 12.7 8.9 33,653 24.6 19,626 1,612 6,590 27,828 5,825 39.8 17.3 339 5,486 41.2 16.3 37 1,165 17.6 6,614 37.0 (7.2) 6,621 2,294 34.6 4,327 4,327 4,327 38.9 12.9 17.7 17.7 38.9 42,538 26.4 22,767 5,744 5,453 33,963 8,575 47.2 20.2 478 8,097 47.6 19.0 56 1,027 11.3 9,067 37.1 1.8 9,066 3,012 33.2 6,053 6,053 6,053 39.9 14.2 24.7 24.7 39.9 FY2012E FY2013E 51,352 20.7 28,318 6,825 6,141 41,284 10,068 17.4 19.6 746 9,322 15.1 18.2 58 920 9.0 10,184 12.3 10,184 3,218 31.6 6,966 6,966 6,966 15.1 13.6 28.5 28.5 15.1 46,344 (9.8) 26,046 5,839 5,986 37,871 8,474 (15.8) 18.3 847 7,627 (18.2) 16.5 70 980 11.5 8,537 (16.2) 8,537 2,775 32.5 5,762 5,762 5,762 (17.3) 12.4 23.5 23.5 (17.3)

January 31, 2012

BHEL | 3QFY2012 Result Update

Balance Sheet (consolidated)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Preference Capital Reserves& Surplus Shareholders Funds Minority Interest Total Loans Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Mis. Exp. not written off Total Assets 4,443 3,462 981 658 8 5,501 3,836 1,665 1,157 6 6,858 4,249 2,609 1,552 6 9,856 2,662 407 8,344 4,734 3,610 2,203 11 9,706 3,076 310 9,857 5,480 4,377 2,090 11 57,187 5,759 2,568 301 39,007 18,180 4 24,662 11,315 6,327 4,987 1,932 11 54,721 9,888 3,012 230 33,005 21,716 4 28,650 490 490 490 490 490 24,857 25,347 1,480 (2,165) 24,662 490 28,846 29,335 1,480 (2,165) 28,650 FY2008 FY2009 FY2010 FY2011 FY2012E FY2013E

10,285 12,429 15,406 19,666 10,774 12,919 15,896 20,155 95 167 148 270

(1,338) (1,840) (1,529) (2,165) 9,531 11,245 14,516 18,260

27,906 36,986 43,002 51,621 8,386 10,330 1,388 421 7,884 2,342 350

20,022 28,569 32,656 39,188 8,417 10,346 12,432 2 4

9,531 11,245 14,516 18,260

January 31, 2012

BHEL | 3QFY2012 Result Update

Cash flow statement (consolidated)

Y/E March (` cr) Profit before tax Depreciation (Inc)/Dec in WC Less: Other income Direct taxes paid Others Cash Flow from Operations (Inc.)/Dec.in Fixed Assets (Inc.)/Dec. in Investments Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2008 FY2009 FY2010 FY2011 FY2012E FY2013E 4,430 297 1,336 1,023 1,947 30 3,124 (664) 1,023 359 6 873 (38) (868) 2,577 5,809 8,386 4,838 282 1,411 978 2,184 (18) 3,351 (1,557) 2 978 (577) 71 991 90 (920) 1,944 8,386 10,330 6,621 339 (2,403) 1,165 2,021 (27) 1,345 (1,752) 1,165 (587) (18) 1,332 119 (1,350) (474) 10,330 9,856 9,066 478 (2,236) 1,027 3,649 (14) 2,617 (2,137) (5) 1,027 (1,115) 122 1,774 0.1 (1,652) (150) 9,856 9,706 10,184 746 (9,695) 920 3,218 (0.2) (2,903) (1,400) 920 (480) 1,210 1,774 (564) (3,947) 9,706 5,759 8,537 847 593 980 2,775 6,222 (1,300) 980 (320) 1,774 (1,774) 4,128 5,759 9,888

January 31, 2012

10

BHEL | 3QFY2012 Result Update

Key Ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV/Total Assets OB/Sales Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value DuPont Analysis EBIT margin (%) Tax retention ratio Asset turnover (x) ROIC (Post-tax) (%) Cost of Debt (Post Tax) (%) Leverage (x) Operating RoE (%) Returns (%) RoCE (Pre-tax) Angel RoIC (Pre-tax) RoE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Int. coverage (EBIT / Int.) (0.8) (2.2) 96.2 (0.8) (2.4) 110.4 (0.6) (1.7) 149.5 (0.5) (1.1) 143.6 (0.2) (0.4) 160.7 (0.3) (1.0) 109.0 4.5 92 200 340 3 5.3 92 189 343 (16) 5.4 93 200 332 (8) 5.5 87 207 345 14 5.3 91 219 385 54 5.3 100 255 384 95 34.5 148.9 29.2 32.4 227.9 26.3 37.7 176.3 30.0 44.4 123.3 33.6 39.5 67.9 30.6 26.5 40.2 21.1 17.3 0.6 7.1 79.4 24.8 (0.8) 37.3 14.4 0.6 10.3 95.7 17.3 (0.8) 34.0 16.3 0.7 7.5 80.3 15.2 (0.6) 40.5 19.0 0.7 5.0 64.0 18.0 (0.5) 42.4 18.2 0.7 3.2 40.1 4.5 (0.2) 34.1 16.5 0.7 2.2 24.5 3.2 (0.3) 18.4 11.7 11.7 12.9 3.1 44.0 12.7 12.7 13.9 3.5 52.8 17.7 17.7 19.1 4.7 64.9 24.7 24.7 26.7 6.2 82.3 28.5 28.5 31.5 6.2 103.5 23.5 23.5 27.0 6.2 119.8 21.4 19.4 5.7 1.2 2.7 14.3 4.9 4.0 19.7 18.1 4.7 1.4 1.9 12.3 3.9 4.1 14.2 13.1 3.9 1.9 1.6 8.9 3.2 4.2 10.1 9.4 3.0 2.5 1.2 6.0 2.5 3.8 8.8 8.0 2.4 2.5 1.2 5.7 2.1 2.7 10.6 9.3 2.1 2.5 0.9 6.2 1.7 2.7 FY2008 FY2009 FY2010 FY2011 FY2012E FY2013E

January 31, 2012

11

BHEL | 3QFY2012 Result Update

Research Team Tel: 022 3935 7600

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

BHEL No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

January 31, 2012

12

You might also like

- Study+school+slides Market Risk ManagementDocument64 pagesStudy+school+slides Market Risk ManagementEbenezerNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Crompton Greaves Result UpdatedDocument14 pagesCrompton Greaves Result UpdatedAngel BrokingNo ratings yet

- Performance Highlights: NeutralDocument11 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- LNT, 25th JanuaryDocument15 pagesLNT, 25th JanuaryAngel BrokingNo ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- Steel Authority of India Result UpdatedDocument13 pagesSteel Authority of India Result UpdatedAngel BrokingNo ratings yet

- Finolex Cables: Performance HighlightsDocument10 pagesFinolex Cables: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: NeutralDocument12 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- Crompton Greaves: Performance HighlightsDocument12 pagesCrompton Greaves: Performance HighlightsAngel BrokingNo ratings yet

- HCL Technologies: Performance HighlightsDocument15 pagesHCL Technologies: Performance HighlightsAngel BrokingNo ratings yet

- Larsen & ToubroDocument15 pagesLarsen & ToubroAngel BrokingNo ratings yet

- S. Kumars Nationwide: Performance HighlightsDocument19 pagesS. Kumars Nationwide: Performance HighlightsmarathiNo ratings yet

- JP Associates Result UpdatedDocument12 pagesJP Associates Result UpdatedAngel BrokingNo ratings yet

- DB Corp: Performance HighlightsDocument11 pagesDB Corp: Performance HighlightsAngel BrokingNo ratings yet

- BGR, 12th February 2013Document10 pagesBGR, 12th February 2013Angel BrokingNo ratings yet

- Hero Motocorp: Performance HighlightsDocument14 pagesHero Motocorp: Performance HighlightsAngel BrokingNo ratings yet

- Exide Industries: Performance HighlightsDocument12 pagesExide Industries: Performance HighlightsAngel BrokingNo ratings yet

- GAIL India: Performance HighlightsDocument12 pagesGAIL India: Performance HighlightsAngel BrokingNo ratings yet

- FAG Bearings Result UpdatedDocument10 pagesFAG Bearings Result UpdatedAngel BrokingNo ratings yet

- BGR Energy Systems: Performance HighlightsDocument11 pagesBGR Energy Systems: Performance HighlightsAngel BrokingNo ratings yet

- KEC International Result UpdatedDocument11 pagesKEC International Result UpdatedAngel BrokingNo ratings yet

- Punj Lloyd: Performance HighlightsDocument12 pagesPunj Lloyd: Performance HighlightsAngel BrokingNo ratings yet

- CESC Result UpdatedDocument11 pagesCESC Result UpdatedAngel BrokingNo ratings yet

- JP Associates: Performance HighlightsDocument12 pagesJP Associates: Performance HighlightsAngel BrokingNo ratings yet

- Itnl 4Q Fy 2013Document13 pagesItnl 4Q Fy 2013Angel BrokingNo ratings yet

- Hindalco: Performance HighlightsDocument15 pagesHindalco: Performance HighlightsAngel BrokingNo ratings yet

- HCL Technologies: Performance HighlightsDocument15 pagesHCL Technologies: Performance HighlightsAngel BrokingNo ratings yet

- Motherson Sumi Systems Result UpdatedDocument14 pagesMotherson Sumi Systems Result UpdatedAngel BrokingNo ratings yet

- Exide Industries: Performance HighlightsDocument12 pagesExide Industries: Performance HighlightsAngel BrokingNo ratings yet

- Jyoti Structures: Performance HighlightsDocument10 pagesJyoti Structures: Performance HighlightsAngel BrokingNo ratings yet

- Bhel 4qfy2012ru 240512Document12 pagesBhel 4qfy2012ru 240512Angel BrokingNo ratings yet

- Coal India: Performance HighlightsDocument10 pagesCoal India: Performance HighlightsAngel BrokingNo ratings yet

- Crompton GreavesDocument12 pagesCrompton GreavesAngel BrokingNo ratings yet

- Colgate Result UpdatedDocument10 pagesColgate Result UpdatedAngel BrokingNo ratings yet

- BGR Energy Systems: Performance HighlightsDocument12 pagesBGR Energy Systems: Performance HighlightsAngel BrokingNo ratings yet

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingNo ratings yet

- Crompton Q1FY12 SystamatixDocument6 pagesCrompton Q1FY12 Systamatixkumar78sNo ratings yet

- Indraprasth Gas Result UpdatedDocument10 pagesIndraprasth Gas Result UpdatedAngel BrokingNo ratings yet

- Ashok Leyland Result UpdatedDocument13 pagesAshok Leyland Result UpdatedAngel BrokingNo ratings yet

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingNo ratings yet

- Graphite India: Performance HighlightsDocument11 pagesGraphite India: Performance HighlightsAngel BrokingNo ratings yet

- Graphite India: Performance HighlightsDocument11 pagesGraphite India: Performance HighlightsAngel BrokingNo ratings yet

- Bosch 3qcy2012ruDocument12 pagesBosch 3qcy2012ruAngel BrokingNo ratings yet

- Infosys: Performance HighlightsDocument15 pagesInfosys: Performance HighlightsAtul ShahiNo ratings yet

- HCLTech 3Q FY13Document16 pagesHCLTech 3Q FY13Angel BrokingNo ratings yet

- Hindalco: Performance HighlightsDocument14 pagesHindalco: Performance HighlightsAngel BrokingNo ratings yet

- Punj Lloyd Result UpdatedDocument10 pagesPunj Lloyd Result UpdatedAngel BrokingNo ratings yet

- Infosys: Performance HighlightsDocument15 pagesInfosys: Performance HighlightsAngel BrokingNo ratings yet

- Bosch: Performance HighlightsDocument11 pagesBosch: Performance HighlightsAngel BrokingNo ratings yet

- National Aluminium Result UpdatedDocument12 pagesNational Aluminium Result UpdatedAngel BrokingNo ratings yet

- Subros Result UpdatedDocument10 pagesSubros Result UpdatedAngel BrokingNo ratings yet

- Infosys Result UpdatedDocument14 pagesInfosys Result UpdatedAngel BrokingNo ratings yet

- Hero MotocorpDocument11 pagesHero MotocorpAngel BrokingNo ratings yet

- IVRCL, 18th February, 2013Document11 pagesIVRCL, 18th February, 2013Angel BrokingNo ratings yet

- Persistent Systems Result UpdatedDocument11 pagesPersistent Systems Result UpdatedAngel BrokingNo ratings yet

- BGR Energy Systems: Performance HighlightsDocument11 pagesBGR Energy Systems: Performance HighlightsAngel BrokingNo ratings yet

- Tech Mahindra: Performance HighlightsDocument11 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Moil 2qfy2013Document10 pagesMoil 2qfy2013Angel BrokingNo ratings yet

- MOIL Result UpdatedDocument10 pagesMOIL Result UpdatedAngel BrokingNo ratings yet

- Punj Lloyd 4Q FY 2013Document11 pagesPunj Lloyd 4Q FY 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- HB 326Document28 pagesHB 326api-284275542No ratings yet

- Pooling of Interest MethodDocument10 pagesPooling of Interest MethodSreejith ShajiNo ratings yet

- Brandywine Health Foundation 2014 Community ReportDocument14 pagesBrandywine Health Foundation 2014 Community ReportKen KnickerbockerNo ratings yet

- How To Compute Night DifferentialDocument2 pagesHow To Compute Night DifferentialKhay DheeNo ratings yet

- Samar I Electric Cooperative V CIRDocument2 pagesSamar I Electric Cooperative V CIRKristine VillanuevaNo ratings yet

- Pak Wahyu 1 - 2Document10 pagesPak Wahyu 1 - 2Fajar R. AshariNo ratings yet

- Cpa A2.1 - Strategic Corporate Finance - Study ManualDocument206 pagesCpa A2.1 - Strategic Corporate Finance - Study ManualDamascene100% (2)

- COVID-19 OT Hours Pay Run Through 04.11.2020 04.22.2020Document119 pagesCOVID-19 OT Hours Pay Run Through 04.11.2020 04.22.2020Gwen FilosaNo ratings yet

- Best Indicator For Spotting Mkt. Tops and Bottoms?: by Joe Gruender JRDocument26 pagesBest Indicator For Spotting Mkt. Tops and Bottoms?: by Joe Gruender JRMyron CheungNo ratings yet

- Tolentino Vs Secretary of Finance 235 Scra 630 Case DigestDocument1 pageTolentino Vs Secretary of Finance 235 Scra 630 Case DigestFermari John ManalangNo ratings yet

- James Biden MemoDocument13 pagesJames Biden MemoJames LynchNo ratings yet

- Mgac AnsDocument23 pagesMgac AnsMark Ivan JagodillaNo ratings yet

- MBA Syllabus III SemesterDocument59 pagesMBA Syllabus III SemesterSharmilaNo ratings yet

- Diskusi 5 TAPDocument2 pagesDiskusi 5 TAPTanti SuryaniNo ratings yet

- Business ImplementationDocument47 pagesBusiness ImplementationAllan Ella Manjares82% (11)

- Transfer Pricing: CA Final: Paper 5: Advanced Management Accounting: Chapter 7Document71 pagesTransfer Pricing: CA Final: Paper 5: Advanced Management Accounting: Chapter 7Abid Siddiq Murtazai100% (1)

- Chapter 3Document3 pagesChapter 3Anonymous XybLZfNo ratings yet

- Your Results For: "Multiple Choice Questions"Document21 pagesYour Results For: "Multiple Choice Questions"Jearick Reario AtazanNo ratings yet

- Taxation NotesDocument27 pagesTaxation NotesRound RoundNo ratings yet

- BR100 Accounts Receivable ReferenceDocument127 pagesBR100 Accounts Receivable ReferenceVenkat Subramanian RNo ratings yet

- Sage X3 - Reports Examples 2008 - TRLBAL (Trial Balance) PDFDocument2 pagesSage X3 - Reports Examples 2008 - TRLBAL (Trial Balance) PDFcaplusincNo ratings yet

- RBI Master Circular On RestructuringDocument120 pagesRBI Master Circular On RestructuringHarish PuriNo ratings yet

- Hardeep Singh ITR 2023Document1 pageHardeep Singh ITR 2023parwindersingh9066No ratings yet

- Hanjin LocalchagreDocument5 pagesHanjin LocalchagreTrần Minh CườngNo ratings yet

- Part 1 - Building Your Own Binary Classification Model - Coursera PDFDocument1 pagePart 1 - Building Your Own Binary Classification Model - Coursera PDFShiva Kumar Ramachandra0% (2)

- Leverage and Its TypesDocument5 pagesLeverage and Its TypessarkctNo ratings yet

- Assessment 113 Assessment Demand and Supply 1416608295Document3 pagesAssessment 113 Assessment Demand and Supply 1416608295api-271596792No ratings yet

- Company Rescue Under UK Administration and US Chapter 11Document4 pagesCompany Rescue Under UK Administration and US Chapter 11vidovdan9852No ratings yet

- Chapter 7: PARTNERSHIPDocument45 pagesChapter 7: PARTNERSHIPSuresh LamsalNo ratings yet