Professional Documents

Culture Documents

Steel Industry Update #269

Steel Industry Update #269

Uploaded by

Michael LockerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Steel Industry Update #269

Steel Industry Update #269

Uploaded by

Michael LockerCopyright:

Available Formats

Steel Industry Update/269

December 2011

Locker Associates, 225 Broadway, Suite 2625 New York NY 10007

Tel: 212-962-2980

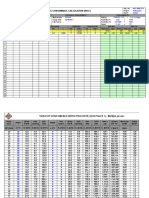

Table 1: Selected U.S. Steel Industry Data, October & Year-to-Date, 2011

Month of October

2011

2010

% Chg

7,888

7,212

9.4%

(000 net tons)

Raw Steel Production ...............

2011

79,235

Year-to-Date

2010

74,328

% Chg

6.6%

Capacity Utilization .................

71.9

67.3

--

74.5

70.8

--

Mill Shipments ..........................

7,934

6,629

19.7%

76,375

69,784

9.4%

Exports .....................................

1,151

995

15.7%

11,023

10,059

9.6%

Total Imports.............................

2,340

1,888

23.9%

24,331

20,271

20.0%

Finished Steel Imports ............

1,898

1,585

19.7%

18,607

15,855

17.4%

Apparent Steel Supply*.............

8,681

7,220

20.2%

83,959

75,579

11.1%

Imports as % of Supply* .........

21.9

22.0

--

22.2

21.0

--

Average Spot Price** ($/ton) ......

$810

$661

22.4%

$883

$704

25.4%

Scrap Price# ($/gross ton) ..........

$440

$339

29.8%

$440

$342

28.7%

Sources: AISI, SteelBenchmarker

*Excl semi-finished imports

**Avg price of 4 carbon products

#shredded scrap

Table 2: U.S. Spot Prices for Selected Steel Products, December & Year-to-Date, 2011

Hot Rolled Band....

Cold Rolled Coil.......

Coiled Plate..................

Month of December

2011

2010

% Chg

$686

$682

0.6%

788

781

0.9%

905

810

11.7%

2011

$755

853

994

Average Spot Price....

$793

$758

4.7%

$867

$705

OCTG (J55-SML)...

$2,023

$1,769

14.4%

41,920

1,748

9.9%

#1 Heavy Melt...

Shredded Scrap...

#1 Busheling.

$398

434

475

$327

354

388

21.7%

22.6%

22.4%

$399

437

473

$316

348

410

26.3%

25.7%

15.5%

($ per net ton)

Year-to-Date

2010

$619

725

770

Sources: World Steel Dynamis SteelBenchmarker, Spears & Associates, 12/11

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

% Chg

21.9%

17.5%

29.0%

23.0%

Steel Industry Update/269

Table 3: World Crude Steel Production, October & Year-to-Date, 2011

Month of October

Year-to-Date

(000 metric tons)

Region

2011

2010

% Chg

2011

2010

European Union.

15,273

15,440

-1.1%

150,781

145,505

Other Europe.

3,326

3,004

10.7%

30,744

26,157

C.I.S.

9,685

North America

South America...

94,141

89,423

% Chg

3.6%

17.5%

9,236

4.9%

5.3%

10,014

9,101

10.0%

99,086

93,226

6.3%

4,092

4,053

1.0%

40,997

36,756

11.5%

Africa...

1,206

1,382

-12.8%

11,677

13,707

-14.8%

Middle East.

1,715

1,651

3.9%

16,995

15,702

8.2%

Asia..

78,039

72,160

8.1%

806,668

735,630

9.7%

Oceania......

630

694

-9.2%

6,547

6,817

-4.0%

Total

123,979

116,721

6.2% 1,257,636 1,162,923

8.1%

China.......

Japan...

54,673

9,480

49,856

9,506

9.7%

-0.3%

United States..

7,294

6,543

India(e).

6,150

5,887

Country

580,787

90,502

522,964

91,439

11.1%

1.0%

11.5%

72,020

67,429

6.8%

4.5%

60,056

57,066

5.2%

South Korea

6,086

5,167

17.8%

56,712

47,861

18.5%

Russia(e)......

5,915

5,654

4.6%

57,453

55,382

3.7%

Germany..

3,685

3,845

-4.2%

37,813

36,813

2.7%

Turkey.....

3,084

2,747

12.3%

28,142

23,826

18.1%

Ukraine(e)....

3,070

2,939

4.5%

29,616

27,554

7.5%

Brazil

2,891

2,972

-2.7%

29,732

27,856

6.7%

All Others....

21,651

21,605

0.2%

214,803

204,733

4.9%

Source: World Steel Association, 12/11; e=estimate

Graph 1: World Crude Steel Production

Source: World Steel Association, 12/11; in million metric tons

-2-

Steel Industry Update/269

Graph 2: World Steel Capacity Utilization Ratio

Source: World Steel Association, 7/11

Table 4: Top 20 Crude Steel Producing Countries, October & YTD 2011

Rank

1

2

Country

China

Japan

Oct '11

54,673

9,480

Oct '10

49,856

9,506

% Chg

9.7%

-0.3%

YTD '11

580,787

90,502

YTD '10

522,964

91,439

% Chg

11.1%

-1.0%

US

7,294

6,543

11.5%

72,020

67,429

6.8%

India

6,150

5,887

4.5%

60,056

57,066

5.2%

South Korea

6,086

5,167

17.8%

56,712

47,861

18.5%

Russia

5,915

5,654

4.6%

57,453

55,382

3.7%

Germany

3,685

3,845

-4.2%

37,813

36,813

2.7%

Turkey

3,084

2,747

12.3%

28,142

23,826

18.1%

Ukraine

3,070

2,939

4.5%

29,616

27,554

7.5%

10

Brazil

2,891

2,972

-2.7%

29,732

27,856

6.7%

11

Italy

2,700

2,464

9.6%

24,037

21,564

11.5%

12

Taiwan

1,650

1,744

-5.4%

18,611

16,299

14.2%

13

Mexico

1,540

1,462

5.3%

15,076

13,919

8.3%

14

France

1,412

1,374

2.8%

13,325

12,999

2.5%

15

Spain

1,329

1,419

-6.3%

13,470

13,985

-3.7%

16

Iran

1,085

1,044

3.9%

10,903

9,829

10.9%

17

Canada

1,050

1,012

3.8%

10,792

10,892

-0.9%

-2.3%

18

UK

821

826

-0.6%

8,131

8,323

19

Poland

760

713

6.7%

7,338

6,807

7.8%

20

Austria

634

673

-5.8%

6,472

5,970

8.4%

Source: Worldsteel.com, 11/22/11; in 000 tonnes

-3-

Steel Industry Update/269

Table 5: US Steel Imports, October & YTD 2011

Country

Japan

EU

Canada

Brazil

Korea

Mexico

Russia

China

Australia

South Africa

Indonesia

Turkey

Ukraine

India

Others

Total

Oct 11

153

324

561

264

213

179

37

105

96

7

2

40

28

41

142

2,191

Oct '10

122

355

470

57

202

271

91

57

23

11

7

30

1

72

119

1,888

% Chg

25.6%

-8.7%

19.3%

364.0%

5.3%

-34.1%

-58.8%

83.7%

316.8%

-39.9%

32.2%

2655.0%

-43.4%

19.5%

16.0%

YTD '11

1,681

3,537

5,180

2,533

2,440

2,491

1,227

1,056

769

127

44

609

319

666

1,504

24,182

YTD '10

1,235

3,590

5,771

680

1,693

2,451

1,237

727

458

86

27

524

103

703

986

20,271

% Chg

36.1%

-1.5%

-10.2%

272.6%

44.1%

1.6%

-0.8%

45.2%

67.9%

47.2%

63.7%

16.2%

209.3%

-5.3%

52.6%

19.3%

Source: Steel Guru, 11/30/11; in 000 tons

Table 6: US Steel Exports by Region, YTD 2011

Region

NAFTA

Non NAFTA*

EU

Africa

Total Asia

Total Exports

YTD '11

8,388,231

993,711

459,316

220,678

845,376

11,022,982

YTD '10

7,839,035

931,856

356,263

95,139

768,927

10,059,250

% Chg

7.0%

6.6%

28.9%

132.0%

9.9%

9.6%

Source: AIIS, 12/19/11; *Western Hemisphere; in tons

Steel Industry Update (ISSN 1063-4339) published 12 times/year by Locker Associates, Inc. Copyright 2011 by Locker Associates, Inc. All

rights reserved. Reproduction in any form forbidden w/o permission. Locker Associates, Inc., 225 Broadway Suite 2625 New York NY 10007.

-4-

Steel Industry Update/269

Table 7: US Steel Exports by Country, October & YTD 2011

Country/Region

Canada

Mexico

Africa

EU

Other Asia

Other W. Hemi

Panama

Taiwan

Brazil

Peru

India

China

Dom Republic

Colombia

Korea

Venezuela

Australia

Pakistan

Others

Japan

Singapore

Ecuador

Trin & Tobago

Russia

UAE

Argentina

Turkey

Chile

Vietnam

Total

Oct '11

565,918

310,773

54,948

36,347

23,472

22,110

18,893

17,781

17,255

15,133

14,026

10,521

5,628

5,399

5,305

4,254

3,476

2,964

2,452

2,323

2,212

1,996

1,303

1,273

1,261

1,192

1,108

978

834

1,151,135

Oct 10

521,853

251,956

30,844

30,014

19,445

23,496

9,056

8,518

9,004

1,470

20,038

9,920

6,741

10,857

4,759

3,743

2,035

3,888

1,178

1,988

4,512

5,127

1,686

775

1,626

1,136

481

1,090

7,824

995,060

% Chg

8.4%

23.3%

78.1%

21.1%

20.7%

-5.9%

108.6%

108.7%

91.6%

929.5%

-30.0%

6.1%

-16.5%

-50.3%

11.5%

13.7%

70.8%

-23.8%

108.1%

16.9%

-51.0%

-61.1%

-22.7%

64.3%

-22.4%

4.9%

130.4%

-10.3%

-89.3%

15.7%

YTD 11

5,574,166

2,814,065

220,678

459,316

222,095

236,670

101,510

158,774

117,850

104,885

142,034

127,992

187,905

93,976

63,049

56,457

30,181

27,634

48,550

17,399

31,834

38,671

16,543

7,324

23,118

12,792

29,615

26,452

31,447

11,022,982

YTD 10

5,703,876

2,135,159

95,139

356,263

212,627

151,357

71,135

90,824

128,721

87,464

158,374

104,895

236,809

95,987

68,234

57,649

27,004

39,081

14,292

13,923

37,700

37,990

15,262

8,123

20,159

12,279

18,611

37,203

23,110

10,059,250

Source: AIIS, 12./19/11; in tons

Table 8: US Exports of Ferrous Scrap by Destination, October & YTD 2011

(in 000 tonnes)

Canada

China

Hong Kong

India

Japan

Malaysia

Mexico

South Korea

Taiwan

Thailand

Turkey

Others

Total

Sep

107

374

9

153

5

56

32

189

359

83

458

258

2,082

Aug

129

467

6

191

8

45

53

338

394

85

800

262

2,777

Source: American Metal Market, 11/18/11

-5-

Jul,

124

320

7

91

47

115

46

196

293

4

378

248

1,868

YTD 11

1,165

3,239

86

893

222

803

428

2,395

2,643

616

4,319

2,085

18,895

YTD 10

1,081

2,240

75

670

154

680

498

2,258

1,947

335

2,991

1,822

14,751

% Chg

7.8%

44.6%

15.0%

33.3%

44.1%

18.0%

-14.0%

6.1%

35.7%

83.6%

44.4%

14.4%

28.1

% Chg

-2.3%

31.8%

132.0%

28.9%

4.5%

56.4%

42.7%

74.8%

-8.4%

19.9%

-10.3%

22.0%

-20.7%

-2.1%

-7.6%

-2.1%

11.8%

-29.3%

239.7%

25.0%

-15.6%

1.8%

8.4%

-9.8%

14.7%

4.2%

59.1%

-28.9%

36.1%

9.6%

Steel Industry Update/269

Table 9: Top 15 Global Container Fleet Operators, November 2011

Current Fleet

% Global

Fleet Operator

Fleet

TEU

1

APM-Maersk

15.9%

2,507

2

Mediterranean Ship

13.1%

2,059

3

CMA CGM Group

8.5%

1,348

4

Cosco

4.1%

642

5

Hapag-Lloyd

4.0%

633

6

Evergreen Line

3.9%

616

7

APL

3.8%

599

8

China Shipping

3.3%

525

9

Hanjin

3.0%

477

10

MOL

2.7%

433

11

OOCL

2.6%

412

12

NYK Line

2.6%

412

13

CSAV Group

2.6%

408

14

Hamburg Sud Grp

2.6%

406

15

Yang Ming

2.2%

347

Source: Journal of Commerce, 12./19/11; Note: All subsidiaries are consolidated.

-6-

Orderbook

% Global

TEU

Fleet

529

21.1%

440

21.3%

125

9.3%

244

38.0%

132

20.9%

308

50.0%

301

50.3%

160

30.5%

244

51.1%

115

26.6%

133

32.1%

62

15.05

36

8.8%

197

48.5%

89

25.7%

Steel Industry Update/269

Steel Mill Products: US Imports, October & Year-to-Date

Imports: Country of Origin

(000 net tons)

Canada..

Mexico

Other W. Hemisphere..

European Union

Other Europe*..

Asia.

Oceania.

Africa..

Total

Imports: Customs District

Atlantic Coast

Gulf Coast/Mexican Border

Pacific Coast.

Gr Lakes/Canadian Border.

Off Shore

Month of October

2011

2010

% Chg

590

470

25.5%

180

271

-33.6%

299

82

264.6%

368

355

3.7%

143

130

10.0%

646

541

19.4%

106

28

278.6%

7

11

-36.4%

2,340

1,888

23.9%

2011

5,210

2,492

2,843

3,581

2,257

6,932

881

135

24,331

212

1,066

322

724

16

2,701

10,864

4,346

6,248

172

219

721

322

610

16

Source: AISI; *includes Russia

Update #269

-7-

-3.2%

47.9%

0.0%

18.7%

0.0%

Year-to-Date

2010

% Chg

5,771

-9.7%

2,451

1.7%

910

212.4%

3,590

-0.3%

1,922

17.4%

4,997

38.7%

537

64.1%

93

45.2%

20,271

20.0%

2,518

6,918

3,878

6,785

173

7.3%

57.0%

12.1%

-7.9%

-0.6%

Locker Associates, Inc.

LOCKER ASSOCIATES is a business-consulting firm that specializes in enhancing the

competitiveness of businesses and industries on behalf of unions, corporate and government

clients. By combining expert business and financial analysis with a sensitivity to labor issues,

the firm is uniquely qualified to help clients manage change by:

leading joint labor/management business improvement initiatives;

facilitating ownership transitions to secure the long-term viability of a business;

conducting strategic industry studies to identify future challenges and opportunities;

representing unions in strategic planning, workplace reorganization and bankruptcy

formulating business plans for turnaround situations; and

performing due diligence for equity and debt investors.

Over the last 28 years, the firm has directed over 225 projects spanning manufacturing,

transportation, distribution and mining industries. Typical projects involve in-depth analysis of a

firms market, financial and operating performance on behalf of a cooperative labormanagement effort. Locker Associates also produces a widely read monthly newsletter, Steel

Industry Update that circulates throughout the U.S. and Canadian steel industry.

MAJOR CLIENTS

United Steelworkers

Bank of Boston

Congress Financial

Santander Investment Securities

AEIF-IAM/AK Steel Middletown

Prudential Securities

US Steel Joint Labor-Mgmt Comm

LTV Steel Joint Labor-Mgmt Committee

Intl Union of Electrical Workers

Bethlehem Joint Labor-Mgmt Comm

Inland Steel Joint Labor-Mgmt Comm

Northwestern Steel and Wire

Boilermakers

American Federation of Musicians

USS/KOBE

Sysco Food Services of San Francisco

International Brotherhood of Teamsters

Development Bank of South Africa

J&L Structural Steel

Air Line Pilots Association/Delta Air Lines MEC

Sharpsville Quality Products

IPSCO

International Association of Machinists

CSEA/AFSCME

United Auto Workers

Service Employees International Union

American Fed of Television & Radio Artists

Supervalu

United Mine Workers

Algoma Steel

North American Refractories

UNITE/HERE

AFL-CIO George Meany Center

Watermill Ventures

Wheeling-Pittsburgh Steel

Canadian Steel Trade & Employment Congress

Minn Gov's Task Force on Mining

Special Metals

RECENT PROJECTS

Business Plan for High-Tech Startup (2009-present): drafted detailed business plan to

raise capital and promote a new hydrogen battery technology

IBT-Supervalu (2010): assist union and management to identify major operational problems

impacting warehouse performance and provide recommendations for joint improvement

Institute of Scrap Recycling Industries (2010): presented a status report on the U.S. steel

market before the Institute of Scrap Recycling Industries Commodities roundtable

Save the World Air-Marketing (2009-present): developed a marketing plan to help drive

sales of a green technology product, ELEKTRA, an electronic fuel device for trucks that

increases fuel economy (mpg's), reduces exhaust emissions and improves engine performance

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

You might also like

- The Top 100 Non-Financial TNCs From Developing and Transition Economies, Ranked by Foreign AssetsDocument3 pagesThe Top 100 Non-Financial TNCs From Developing and Transition Economies, Ranked by Foreign Assetsth_razorNo ratings yet

- AMUL Organisation StructureDocument9 pagesAMUL Organisation Structuresuraj2kaul60% (5)

- CEPCIDocument1 pageCEPCISoul00067% (3)

- GM KPSC QCDocument40 pagesGM KPSC QCMahendra M100% (1)

- Steel Industry Update #255Document7 pagesSteel Industry Update #255Michael LockerNo ratings yet

- Steel Industry Update #252Document8 pagesSteel Industry Update #252Michael LockerNo ratings yet

- 3Q 2008 PerformanceDocument31 pages3Q 2008 PerformanceAlex TefovNo ratings yet

- Steel Industry Update #254Document8 pagesSteel Industry Update #254Michael LockerNo ratings yet

- JSW Steel: Performance HighlightsDocument13 pagesJSW Steel: Performance HighlightsAngel BrokingNo ratings yet

- Steel Industry Update #250Document6 pagesSteel Industry Update #250Michael LockerNo ratings yet

- Pulau PinangDocument14 pagesPulau PinangNoelle LeeNo ratings yet

- Bhushan Steel: Performance HighlightsDocument13 pagesBhushan Steel: Performance HighlightsAngel BrokingNo ratings yet

- AluminiumDocument3 pagesAluminiumAnkit AgarwalNo ratings yet

- Sarda Energy, 30th January 2013Document12 pagesSarda Energy, 30th January 2013Angel BrokingNo ratings yet

- Sarda Energy 4Q FY 2013Document12 pagesSarda Energy 4Q FY 2013Angel BrokingNo ratings yet

- Sarda Energy and Minerals: Performance HighlightsDocument12 pagesSarda Energy and Minerals: Performance HighlightsAngel BrokingNo ratings yet

- Sterlite Industries: Performance HighlightsDocument13 pagesSterlite Industries: Performance HighlightsAngel BrokingNo ratings yet

- Welding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement ConsumablesDocument7 pagesWelding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement Consumableskeymal9195No ratings yet

- JSW Steel 4Q FY 2013Document13 pagesJSW Steel 4Q FY 2013Angel BrokingNo ratings yet

- Manufacturing ExpenditureDocument8 pagesManufacturing ExpenditureKranti SagarNo ratings yet

- Weekly Traffic of Major U.S. Railroads: For The Week Ending September 24, 2011Document4 pagesWeekly Traffic of Major U.S. Railroads: For The Week Ending September 24, 2011api-26018528No ratings yet

- 23 12 11 Yanzhou Coal NomuraDocument14 pages23 12 11 Yanzhou Coal NomuraMichael BauermNo ratings yet

- The Current Condition of The Japanese Machine Tool Industry: News ReleaseDocument4 pagesThe Current Condition of The Japanese Machine Tool Industry: News ReleaseDươngHữuPhúcNo ratings yet

- CE IndexDocument1 pageCE IndexPablo JavierNo ratings yet

- Steel ProductionDocument1 pageSteel ProductionManjunath PrasadNo ratings yet

- ACC Result UpdatedDocument11 pagesACC Result UpdatedAngel BrokingNo ratings yet

- FlyAshBricks FinancialsDocument53 pagesFlyAshBricks FinancialsTejas KotwalNo ratings yet

- Me Sail FinalDocument4 pagesMe Sail FinalNikunj BeladiyaNo ratings yet

- INFO EDGE (INDIA) LIMITED (Standalone)Document2 pagesINFO EDGE (INDIA) LIMITED (Standalone)Arjun SomanNo ratings yet

- Hindalco: Performance HighlightsDocument14 pagesHindalco: Performance HighlightsAngel BrokingNo ratings yet

- Sarda Energy and MineralsDocument12 pagesSarda Energy and MineralsAngel BrokingNo ratings yet

- Welding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement ConsumablesDocument7 pagesWelding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement Consumableskeymal9195No ratings yet

- WCC.11031MM (Rolled Pipe)Document7 pagesWCC.11031MM (Rolled Pipe)keymal9195No ratings yet

- Welding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement ConsumablesDocument7 pagesWelding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement Consumableskeymal9195No ratings yet

- Steel Industry Update #249Document8 pagesSteel Industry Update #249Michael LockerNo ratings yet

- National Aluminium: Performance HighlightsDocument12 pagesNational Aluminium: Performance HighlightsAngel BrokingNo ratings yet

- 1-Value Added by country-COMDocument17 pages1-Value Added by country-COM夏菲雪No ratings yet

- 352 ApresentaDocument28 pages352 ApresentaUsiminas_RINo ratings yet

- Selangor: Transaction Statistics Q3 2015Document14 pagesSelangor: Transaction Statistics Q3 2015Evaline JmNo ratings yet

- Welding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement ConsumablesDocument8 pagesWelding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement Consumableskeymal9195No ratings yet

- Sesa Goa: Performance HighlightsDocument12 pagesSesa Goa: Performance HighlightsAngel BrokingNo ratings yet

- Press Information Bureau Government of India New DelhiDocument10 pagesPress Information Bureau Government of India New DelhiKaushal MandaliaNo ratings yet

- Abb-2qcy2012ru 10th AugDocument12 pagesAbb-2qcy2012ru 10th AugAngel BrokingNo ratings yet

- Test EraseDocument8 pagesTest ErasejustifythisNo ratings yet

- Welding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement ConsumablesDocument7 pagesWelding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement Consumableskeymal9195No ratings yet

- Abb 1Q Cy 2013Document11 pagesAbb 1Q Cy 2013Angel BrokingNo ratings yet

- Welding Consumable Calculation (WCC) : Doc. No P.O No Project Project Details Technical Requirement ConsumablesDocument7 pagesWelding Consumable Calculation (WCC) : Doc. No P.O No Project Project Details Technical Requirement Consumableskeymal9195No ratings yet

- SL Annual Stat Report-2011Document2 pagesSL Annual Stat Report-2011Wind RsNo ratings yet

- Welding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement ConsumablesDocument8 pagesWelding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement Consumableskeymal9195No ratings yet

- Trend December 2015Document11 pagesTrend December 2015arunkumar17No ratings yet

- Sterlite, 1Q FY 2014Document13 pagesSterlite, 1Q FY 2014Angel BrokingNo ratings yet

- Flow Valuation, Case #KEL778Document20 pagesFlow Valuation, Case #KEL778SreeHarshaKazaNo ratings yet

- Welding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement ConsumablesDocument7 pagesWelding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement Consumableskeymal9195No ratings yet

- Well Fluids Sample PropertiesDocument12 pagesWell Fluids Sample PropertiesgregNo ratings yet

- Alcoa: 5.7 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDocument1 pageAlcoa: 5.7 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDekidenNo ratings yet

- National Aluminium Result UpdatedDocument12 pagesNational Aluminium Result UpdatedAngel BrokingNo ratings yet

- Monthly February 2012Document23 pagesMonthly February 2012Driss LkassbiNo ratings yet

- Financial Analysis of Pakistan Cables: Submitted To: Sir Shahbaz 9/10/2014Document25 pagesFinancial Analysis of Pakistan Cables: Submitted To: Sir Shahbaz 9/10/2014Ali RazaNo ratings yet

- Ageing and Life Extension of Offshore Structures: The Challenge of Managing Structural IntegrityFrom EverandAgeing and Life Extension of Offshore Structures: The Challenge of Managing Structural IntegrityNo ratings yet

- Steel Industry Update #255Document7 pagesSteel Industry Update #255Michael LockerNo ratings yet

- Steel Industry Update #254Document8 pagesSteel Industry Update #254Michael LockerNo ratings yet

- Steel Industry Update #252Document8 pagesSteel Industry Update #252Michael LockerNo ratings yet

- Steel Industry Update #241Document6 pagesSteel Industry Update #241Michael LockerNo ratings yet

- Steel Industry Update #250Document6 pagesSteel Industry Update #250Michael LockerNo ratings yet

- United States v. Spry, 10th Cir. (2008)Document6 pagesUnited States v. Spry, 10th Cir. (2008)Scribd Government DocsNo ratings yet

- Detroit Diesel dd15Document3 pagesDetroit Diesel dd15Ionut-alexandru Iordache100% (1)

- Finnacle Express ABG Shipyard Ltd. Scam-India's Biggest Bank Fraud?Document2 pagesFinnacle Express ABG Shipyard Ltd. Scam-India's Biggest Bank Fraud?guesswhoiamNo ratings yet

- Analogy and Probable InferenceDocument22 pagesAnalogy and Probable InferenceMarivic Asilo Zacarias-Lozano100% (2)

- Application ModificationDocument7 pagesApplication Modificationnarender707463No ratings yet

- Commissioner of Internal Revenue Vs CoaDocument4 pagesCommissioner of Internal Revenue Vs CoaAb Castil100% (1)

- Why Did America Become Involved in Cuba?: History Term 1 Chapter 5 Part II-Cuban Missile CrisisDocument5 pagesWhy Did America Become Involved in Cuba?: History Term 1 Chapter 5 Part II-Cuban Missile CrisisBianca LaoganNo ratings yet

- Self Declaration Form Applicable To Private and Public CompaniesDocument1 pageSelf Declaration Form Applicable To Private and Public CompaniesMadhusmita MishraNo ratings yet

- Encouraging Foreign InvestmentDocument3 pagesEncouraging Foreign InvestmentSarah MotolNo ratings yet

- Unit V Other National Security ConcernsDocument7 pagesUnit V Other National Security ConcernsBANTAD A-JAY, B.No ratings yet

- The Rationale Behind Choosing Arbitration Over Litigation: A Law & Economics PerspectiveDocument16 pagesThe Rationale Behind Choosing Arbitration Over Litigation: A Law & Economics PerspectiveTANNU BBA LLBNo ratings yet

- South Sudan Overview of Corruption and Anti-Corruption EffortsDocument24 pagesSouth Sudan Overview of Corruption and Anti-Corruption Effortsjonnybilek2112No ratings yet

- Grade 4 and 5 Lesson 18 - Football Rules ContinuedDocument8 pagesGrade 4 and 5 Lesson 18 - Football Rules ContinuedJoeNo ratings yet

- ACCT1101 Wk4 Tutorial 3 SolutionsDocument8 pagesACCT1101 Wk4 Tutorial 3 SolutionskyleNo ratings yet

- Articles of Incorporation of Stock CorporationDocument4 pagesArticles of Incorporation of Stock CorporationInnoKalNo ratings yet

- Madison College Extenuating CircumstanceDocument3 pagesMadison College Extenuating CircumstanceMindy ThomasNo ratings yet

- Ca 221Document15 pagesCa 221Palomo Gener DullanoNo ratings yet

- Gen 004 - Sas 11 - 14 - OrevilloDocument13 pagesGen 004 - Sas 11 - 14 - OrevilloJohn JosephNo ratings yet

- BAR MATTER No. 914 October 1, 1999 Re: Application For Admission To The Philippine Bar, vs. VICENTE D. CHING, Applicant. ResolutionDocument5 pagesBAR MATTER No. 914 October 1, 1999 Re: Application For Admission To The Philippine Bar, vs. VICENTE D. CHING, Applicant. ResolutionTalina BinondoNo ratings yet

- Sustainability 14 06576 v2Document22 pagesSustainability 14 06576 v2Abdulbaset S AlbaourNo ratings yet

- Chapter 10 Section 1Document16 pagesChapter 10 Section 1api-206809924No ratings yet

- Richardson Et Al Vs Bremerton City of Et Al - Document No. 3Document1 pageRichardson Et Al Vs Bremerton City of Et Al - Document No. 3Justia.comNo ratings yet

- Constitutional Law Notes - 1st Yr, 2nd SemDocument124 pagesConstitutional Law Notes - 1st Yr, 2nd Sembenwan700No ratings yet

- DL Moody and Joseph PrinceDocument8 pagesDL Moody and Joseph Princeadebee007No ratings yet

- Ang Mga Kaanib Sa Iglesia NG Dios Kay Kristo Hesus - V - Iglesia NG Dios Kay Cristo JesusDocument2 pagesAng Mga Kaanib Sa Iglesia NG Dios Kay Kristo Hesus - V - Iglesia NG Dios Kay Cristo Jesuserwindm84No ratings yet

- Author: The First Epistle ofDocument9 pagesAuthor: The First Epistle ofLIto LamonteNo ratings yet

- Reading List - TORTS 2020Document16 pagesReading List - TORTS 2020Edwin SabitiNo ratings yet

- Proforma Invoice Item Code Description Qty Unit Price AmountDocument1 pageProforma Invoice Item Code Description Qty Unit Price AmountTop world rankingsNo ratings yet