Professional Documents

Culture Documents

2012-13 Upperclass Financial Aid Checklist

2012-13 Upperclass Financial Aid Checklist

Uploaded by

Lufinancial AidCopyright:

Available Formats

You might also like

- Financial Management Chapters 1 4 CabreraDocument22 pagesFinancial Management Chapters 1 4 CabreraElaine Joyce GarciaNo ratings yet

- Texas Real Estate Sales Exam 4e PDFDocument287 pagesTexas Real Estate Sales Exam 4e PDFفهد محمد سليمان النمر100% (2)

- Sale Deed FORMAT FOR INDUSTRIAL LANDDocument17 pagesSale Deed FORMAT FOR INDUSTRIAL LANDsanjay singh yadav67% (3)

- 2013-2014 Upperclass Financial Aid ChecklistDocument1 page2013-2014 Upperclass Financial Aid ChecklistLufinancial AidNo ratings yet

- 2012-13 Upperclass Financial Aid ApplicationDocument4 pages2012-13 Upperclass Financial Aid ApplicationLufinancial AidNo ratings yet

- 2012-13 Transfer Aid ApplicationDocument4 pages2012-13 Transfer Aid ApplicationLufinancial AidNo ratings yet

- Tuition Assistance 2013-14Document1 pageTuition Assistance 2013-14SMSTECHNo ratings yet

- PROFILE Application IntroductionDocument3 pagesPROFILE Application IntroductionkshafzNo ratings yet

- 2011-12 Fafsa Tap Quick GuideDocument2 pages2011-12 Fafsa Tap Quick GuideModou LoNo ratings yet

- 2012-13 Graduate Financial Aid ApplicationDocument2 pages2012-13 Graduate Financial Aid ApplicationLufinancial AidNo ratings yet

- Immediate Action Required: V1 - Independent Verification Worksheet: You Were Selected For A Process Called VerificationDocument2 pagesImmediate Action Required: V1 - Independent Verification Worksheet: You Were Selected For A Process Called VerificationAnonymous m8g5rGmNo ratings yet

- International Student Fa App 1617Document4 pagesInternational Student Fa App 1617JeesonAntonyNo ratings yet

- Funds Instructions 12-13Document1 pageFunds Instructions 12-13Bernar MaNo ratings yet

- 2011-2012 Dependent Verification Worksheet: About The Verification ProcessDocument2 pages2011-2012 Dependent Verification Worksheet: About The Verification ProcessJerry WilkNo ratings yet

- FInAid - App.procDocument1 pageFInAid - App.procNaura Aisy MardianaNo ratings yet

- 2015-2016 Dependent Verification FormDocument2 pages2015-2016 Dependent Verification FormxxxtoyaxxxNo ratings yet

- Tuition Assistance 2013-14Document1 pageTuition Assistance 2013-14SMSTECHNo ratings yet

- Dependent Verification WorksheetDocument3 pagesDependent Verification Worksheetmvalenc3No ratings yet

- Federal Verification Worksheet 2019-2020: Branda Nguyen Cao 100582767Document2 pagesFederal Verification Worksheet 2019-2020: Branda Nguyen Cao 100582767Khôi WinNo ratings yet

- 300 Pleasant Valley Way West Orange, NJ 07052 973-731-0160 x224 Child'S Way Derech Hayeled A Jewish Montessori SchoolDocument1 page300 Pleasant Valley Way West Orange, NJ 07052 973-731-0160 x224 Child'S Way Derech Hayeled A Jewish Montessori Schoolapi-126795657No ratings yet

- 2011-2012 Special Circumstance FormDocument4 pages2011-2012 Special Circumstance FormJosh MorfordNo ratings yet

- WSApp 12Document1 pageWSApp 12Gio PerezNo ratings yet

- BigFuture Finanical Aid ChecklistDocument2 pagesBigFuture Finanical Aid ChecklisttcrphsNo ratings yet

- WWW Fafsa Ed GovDocument3 pagesWWW Fafsa Ed GovDarius Nathaniel WhitakerNo ratings yet

- Intensive English Program (IEP) Application For Admission & InstructionsDocument2 pagesIntensive English Program (IEP) Application For Admission & InstructionsYasser YassineNo ratings yet

- Go - Wlu.edu/portal Financialaid@wlu - Edu: Washington and Lee University Upload InstructionsDocument1 pageGo - Wlu.edu/portal Financialaid@wlu - Edu: Washington and Lee University Upload InstructionsTenebrae LuxNo ratings yet

- Florida Agricultural and Mechanical University: 2013-2014 Verification Worksheet Dependent StudentDocument4 pagesFlorida Agricultural and Mechanical University: 2013-2014 Verification Worksheet Dependent StudentdraykidNo ratings yet

- Georgia State IEP Application InstructionsDocument2 pagesGeorgia State IEP Application InstructionsKyiv EducationUSA Advising CenterNo ratings yet

- Faculty of Law Admission Bursary Application 2017 - 2018: Early Deadline: Final DeadlineDocument5 pagesFaculty of Law Admission Bursary Application 2017 - 2018: Early Deadline: Final DeadlinekarenNo ratings yet

- CUNY Standard Verification WorksheetDocument3 pagesCUNY Standard Verification Worksheethicu0No ratings yet

- 2020-2021 Verification Worksheet: A. Student InformationDocument2 pages2020-2021 Verification Worksheet: A. Student InformationHaider AliNo ratings yet

- Spring Scholarship Aid Application Form 16 17Document4 pagesSpring Scholarship Aid Application Form 16 17CHIBUIKE DANIELNo ratings yet

- Fafsa PDF Form 2011Document2 pagesFafsa PDF Form 2011MatthewNo ratings yet

- Bursary Application - New 2011-12Document7 pagesBursary Application - New 2011-12Bashir ChaudhryNo ratings yet

- 2011/2012 Dr. Amanda Perez Scholarship: EligibilityDocument5 pages2011/2012 Dr. Amanda Perez Scholarship: EligibilityuscblogsNo ratings yet

- 2012-2013 Verification Worksheet Independent StudentDocument3 pages2012-2013 Verification Worksheet Independent StudentJennifer ChinellNo ratings yet

- Procedure and Submission of Application For DSA-Sec Exercise1 RGSDocument3 pagesProcedure and Submission of Application For DSA-Sec Exercise1 RGSPennNo ratings yet

- CSS/Financial Aid PROFILE: Student GuideDocument1 pageCSS/Financial Aid PROFILE: Student GuideAnonymous MK6mHPVjNo ratings yet

- Santa Fe College Financial Aid Handbook 2011-12Document14 pagesSanta Fe College Financial Aid Handbook 2011-12sfcollegeNo ratings yet

- University of Pittsburgh: Financial Aid Application Supplement (FAAS) For The 2014-15 School YearDocument5 pagesUniversity of Pittsburgh: Financial Aid Application Supplement (FAAS) For The 2014-15 School YearAisha KannehNo ratings yet

- 2012-2013 Financial Aid InfoDocument1 page2012-2013 Financial Aid InfoJoy MooreNo ratings yet

- Financial Aid Check List: Loans and ScholarshipDocument1 pageFinancial Aid Check List: Loans and ScholarshipNaura Aisy MardianaNo ratings yet

- 1314 Verification Independent WorksheetDocument2 pages1314 Verification Independent WorksheetAngela JenkinsNo ratings yet

- Feea 2012Document2 pagesFeea 2012Ivan HuynhNo ratings yet

- (FVWD21) Parent Verification Worksheet: 1. Parent's/Step-parent's Family Information - DO NOT LEAVE BLANKDocument2 pages(FVWD21) Parent Verification Worksheet: 1. Parent's/Step-parent's Family Information - DO NOT LEAVE BLANKJohnNo ratings yet

- 2014 Undergraduate Application FormDocument4 pages2014 Undergraduate Application Formleomille2No ratings yet

- Office of Student Financial Assistance An Overview of Maryland State Financial Aid Programs 2012-2013Document37 pagesOffice of Student Financial Assistance An Overview of Maryland State Financial Aid Programs 2012-2013aehsgo2collegeNo ratings yet

- White County Lilly Endowment Scholarship ApplicationDocument11 pagesWhite County Lilly Endowment Scholarship ApplicationVoodooPandasNo ratings yet

- General Tax Information14Document2 pagesGeneral Tax Information14Mohamed Amine Bouzaghrane100% (1)

- Real$ense - CGS 2016 - UpdateDocument1 pageReal$ense - CGS 2016 - UpdatemortensenkNo ratings yet

- How To Apply For Fa 2011Document1 pageHow To Apply For Fa 2011kareenaggNo ratings yet

- Fafsa Changes 17 18 FaqDocument2 pagesFafsa Changes 17 18 Faqapi-239833147No ratings yet

- Financial Aid Cost of Attendance 2015-2016 COM/MPH DUAL Class of 2019 (First Year)Document2 pagesFinancial Aid Cost of Attendance 2015-2016 COM/MPH DUAL Class of 2019 (First Year)Steven ShaNo ratings yet

- Fee Waiver Parent LetterDocument8 pagesFee Waiver Parent LetterCristina CotraNo ratings yet

- CSS Profile InstructionsDocument10 pagesCSS Profile InstructionsVickyNo ratings yet

- Bethel Enrichment Center Scholarship Application Packet Checklist 2015-2016 A S YDocument7 pagesBethel Enrichment Center Scholarship Application Packet Checklist 2015-2016 A S Yapi-302449528No ratings yet

- He Cu Said ApplicationformDocument9 pagesHe Cu Said ApplicationformAli RazaNo ratings yet

- V1 DepDocument5 pagesV1 DepMardochee DadeNo ratings yet

- Application Process: Step 2 Step 4 Step 1Document4 pagesApplication Process: Step 2 Step 4 Step 1Duc Nguyen XuanNo ratings yet

- Application ChecklistDocument2 pagesApplication Checklist2qqqprkp8hNo ratings yet

- I-20 and DS-2019 Requests E-Forms Live Info SessionsDocument2 pagesI-20 and DS-2019 Requests E-Forms Live Info SessionsgwenferNo ratings yet

- 2013-2014 Upperclass Financial Aid ChecklistDocument1 page2013-2014 Upperclass Financial Aid ChecklistLufinancial AidNo ratings yet

- 2012-13 Transfer Aid ApplicationDocument4 pages2012-13 Transfer Aid ApplicationLufinancial AidNo ratings yet

- 2012-13 FERPA Privacy Act WaiverDocument1 page2012-13 FERPA Privacy Act WaiverLufinancial AidNo ratings yet

- Petition For Review of Financial Aid EligibilityDocument3 pagesPetition For Review of Financial Aid EligibilityLufinancial AidNo ratings yet

- 2012-13 Graduate Financial Aid ApplicationDocument2 pages2012-13 Graduate Financial Aid ApplicationLufinancial AidNo ratings yet

- 2012-13 Change of Financial Circumstances FormDocument2 pages2012-13 Change of Financial Circumstances FormLufinancial AidNo ratings yet

- 2012-13 Upperclass Financial Aid ApplicationDocument4 pages2012-13 Upperclass Financial Aid ApplicationLufinancial AidNo ratings yet

- SolutionsDocument30 pagesSolutionsNitesh AgrawalNo ratings yet

- Ex PaymentchartDocument5 pagesEx PaymentchartKrishna RukhminiNo ratings yet

- Biglang-Awa Vs Bacalla - 139927 - November 22, 2000 - J. Reyes - Third DivisionDocument5 pagesBiglang-Awa Vs Bacalla - 139927 - November 22, 2000 - J. Reyes - Third DivisionArmand Jerome CaradaNo ratings yet

- Solutions To All Assigned Practice ProblemsDocument31 pagesSolutions To All Assigned Practice ProblemsVarsha ShirsatNo ratings yet

- Government of Pakistan Finance Division (Regulations Wing)Document4 pagesGovernment of Pakistan Finance Division (Regulations Wing)Waheed AnwerNo ratings yet

- EPV SlidesDocument9 pagesEPV SlidesleekiangyenNo ratings yet

- HCCBPLDocument81 pagesHCCBPLShipra JinsiNo ratings yet

- BHAVESHDocument1 pageBHAVESHbhaveshvats194No ratings yet

- JETIR2105794Document5 pagesJETIR2105794Saranya ThangarajNo ratings yet

- E-Commerce in The Czech RepublicDocument19 pagesE-Commerce in The Czech RepublicAccaceNo ratings yet

- Tutorial Questions Equity 2020-1Document6 pagesTutorial Questions Equity 2020-1Nur Amin Nor AzmiNo ratings yet

- 8.1.22 Am Intangible-AssetsDocument8 pages8.1.22 Am Intangible-AssetsAether SkywardNo ratings yet

- SSC CGL 2019 Exam Paper - GSDocument126 pagesSSC CGL 2019 Exam Paper - GSRavindra Pratap Singh KalhanshNo ratings yet

- Sales Representative Pharmaceutical Biotechnology in Knoxville TN Resume Thomas HollidayDocument2 pagesSales Representative Pharmaceutical Biotechnology in Knoxville TN Resume Thomas HollidayThomas HollidayNo ratings yet

- SYLLABUS-ACCO 20093 - Intermediate Accounting 2Document5 pagesSYLLABUS-ACCO 20093 - Intermediate Accounting 2rachel banana hammockNo ratings yet

- Chapter 2Document4 pagesChapter 2JavNo ratings yet

- AmalgamationDocument41 pagesAmalgamationZooNo ratings yet

- Chapter Six: Business Ethics and Corporate GovernanceDocument38 pagesChapter Six: Business Ethics and Corporate GovernanceMacoyNo ratings yet

- Retention FundDocument4 pagesRetention FundNicolesChuaNo ratings yet

- CH 5 St. Guide WordDocument4 pagesCH 5 St. Guide WordarsalmoinNo ratings yet

- MTP 14 28 Answers 1701406110Document11 pagesMTP 14 28 Answers 1701406110aim.cristiano1210No ratings yet

- Quiz 3: Financial Management Quiz Instructions: D C B ADocument27 pagesQuiz 3: Financial Management Quiz Instructions: D C B AKii-anne FernandezNo ratings yet

- Simulation 1Document9 pagesSimulation 1Vamsi GunturuNo ratings yet

- Session 1-2: Building Financial Resilience Through Financial and Digital Literacy in South Asia and Sub-Saharan Africa by Angela LyonsDocument36 pagesSession 1-2: Building Financial Resilience Through Financial and Digital Literacy in South Asia and Sub-Saharan Africa by Angela LyonsADBI Events100% (1)

- Ps 3Document2 pagesPs 3King LeonidusNo ratings yet

- Composite Innovation Group, Atomic Composites V Michigan State UniversityDocument34 pagesComposite Innovation Group, Atomic Composites V Michigan State UniversityLansingStateJournalNo ratings yet

- Housing Policy in India PDFDocument26 pagesHousing Policy in India PDFabhishek yadavNo ratings yet

2012-13 Upperclass Financial Aid Checklist

2012-13 Upperclass Financial Aid Checklist

Uploaded by

Lufinancial AidOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2012-13 Upperclass Financial Aid Checklist

2012-13 Upperclass Financial Aid Checklist

Uploaded by

Lufinancial AidCopyright:

Available Formats

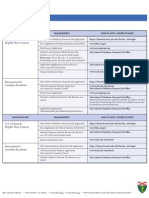

2012-2013 UPPERCLASS FINANCIAL AID CHECKLIST

All application materials are due to our office by April 16, 2012.

Complete the 2012-2013 CSS/Financial Aid PROFILE

Complete online at https://profileonline.collegeboard.com (School code: 2365)

Complete and submit the 2012-2013 non-custodial parents statement and income information (if applicable)

Complete and submit if biological parents are not married and custodial parent is not remarried. Attach signed copy of non-custodial parents 2011 federal income tax return with all accompanying W-2 forms and schedules. If non-custodial parent is self-employed or owner (part or full) of a corporation/partnership, complete and submit 2012-2013 business/farm supplement form and submit 2011 corporate/ partnership tax return.

Complete the 2012-2013 Free Application for Federal Student Aid (FAFSA)

Complete online at www.fafsa.ed.gov (available after January 1) (School code: 003289)

Application can be downloaded at www.lehigh.edu/financialaid

Complete and submit the 2012-2013 upperclass financial aid application

Submit parent(s) 2011 federal income tax return

Signed copy of parent(s) 2011 federal income tax return along with all accompanying schedules and W-2 forms. If parent(s) are not required to file a 2011 federal income tax return, complete and submit the 2012-2013 parent non-filer statement (located on website). Families who file an extension with the IRS should submit a copy of their extension request, along with draft taxes and W-2 forms to be followed by the completed tax return when available.

Check the student portal often to view outstanding requests for paperwork and to confirm receipt of all application materials. Please give us five to seven business days from the date of submission for the information to be updated. Please submit all documents via fax, e-mail or Dropbox at www.lehigh.edu/financialaid. Mailing documents is possible (but not preferred) and they may be sent to our centralized processing address at the Financial Aid/Admissions Office27 Memorial Drive West, Bethlehem, PA 18015. All documents are due by April 16.

REMINDERS!

All application materials must be completed and submitted by April 16 You must maintain satisfactory academic progress to maintain aid eligibility. Changes to your household size and number of siblings in college will affect your eligibility. The Change of Financial Circumstance Form can be submitted along with application.

Submit students 2011 federal income tax return

Please contact us if you have any questions at

Telephone: (610) 758-3181 Fax: (610) 758-6211 E-mail: financialaid@lehigh.edu Website: lehigh.edu/financialaid Office of Financial Aid Barnett House 218 West Packer Avenue Bethlehem, PA 18015

A Spanish-speaking representative is available in the Financial Aid Office to answer any questions.

Signed copy of 2011 federal income tax return along with all accompanying schedules and W-2 forms. If student is not required to file a 2011 federal income tax return, complete and submit the 2012-2013 student non-filer statement (located on website).

Complete and submit the 2012-2013 business/farm supplement (if applicable)

Complete and submit this form along with copies of the business tax returns (Schedule C, corporate tax returns and/or partnership tax returns) if either parent is self-employed or an owner (part or full) of a corporation/partnership.

You might also like

- Financial Management Chapters 1 4 CabreraDocument22 pagesFinancial Management Chapters 1 4 CabreraElaine Joyce GarciaNo ratings yet

- Texas Real Estate Sales Exam 4e PDFDocument287 pagesTexas Real Estate Sales Exam 4e PDFفهد محمد سليمان النمر100% (2)

- Sale Deed FORMAT FOR INDUSTRIAL LANDDocument17 pagesSale Deed FORMAT FOR INDUSTRIAL LANDsanjay singh yadav67% (3)

- 2013-2014 Upperclass Financial Aid ChecklistDocument1 page2013-2014 Upperclass Financial Aid ChecklistLufinancial AidNo ratings yet

- 2012-13 Upperclass Financial Aid ApplicationDocument4 pages2012-13 Upperclass Financial Aid ApplicationLufinancial AidNo ratings yet

- 2012-13 Transfer Aid ApplicationDocument4 pages2012-13 Transfer Aid ApplicationLufinancial AidNo ratings yet

- Tuition Assistance 2013-14Document1 pageTuition Assistance 2013-14SMSTECHNo ratings yet

- PROFILE Application IntroductionDocument3 pagesPROFILE Application IntroductionkshafzNo ratings yet

- 2011-12 Fafsa Tap Quick GuideDocument2 pages2011-12 Fafsa Tap Quick GuideModou LoNo ratings yet

- 2012-13 Graduate Financial Aid ApplicationDocument2 pages2012-13 Graduate Financial Aid ApplicationLufinancial AidNo ratings yet

- Immediate Action Required: V1 - Independent Verification Worksheet: You Were Selected For A Process Called VerificationDocument2 pagesImmediate Action Required: V1 - Independent Verification Worksheet: You Were Selected For A Process Called VerificationAnonymous m8g5rGmNo ratings yet

- International Student Fa App 1617Document4 pagesInternational Student Fa App 1617JeesonAntonyNo ratings yet

- Funds Instructions 12-13Document1 pageFunds Instructions 12-13Bernar MaNo ratings yet

- 2011-2012 Dependent Verification Worksheet: About The Verification ProcessDocument2 pages2011-2012 Dependent Verification Worksheet: About The Verification ProcessJerry WilkNo ratings yet

- FInAid - App.procDocument1 pageFInAid - App.procNaura Aisy MardianaNo ratings yet

- 2015-2016 Dependent Verification FormDocument2 pages2015-2016 Dependent Verification FormxxxtoyaxxxNo ratings yet

- Tuition Assistance 2013-14Document1 pageTuition Assistance 2013-14SMSTECHNo ratings yet

- Dependent Verification WorksheetDocument3 pagesDependent Verification Worksheetmvalenc3No ratings yet

- Federal Verification Worksheet 2019-2020: Branda Nguyen Cao 100582767Document2 pagesFederal Verification Worksheet 2019-2020: Branda Nguyen Cao 100582767Khôi WinNo ratings yet

- 300 Pleasant Valley Way West Orange, NJ 07052 973-731-0160 x224 Child'S Way Derech Hayeled A Jewish Montessori SchoolDocument1 page300 Pleasant Valley Way West Orange, NJ 07052 973-731-0160 x224 Child'S Way Derech Hayeled A Jewish Montessori Schoolapi-126795657No ratings yet

- 2011-2012 Special Circumstance FormDocument4 pages2011-2012 Special Circumstance FormJosh MorfordNo ratings yet

- WSApp 12Document1 pageWSApp 12Gio PerezNo ratings yet

- BigFuture Finanical Aid ChecklistDocument2 pagesBigFuture Finanical Aid ChecklisttcrphsNo ratings yet

- WWW Fafsa Ed GovDocument3 pagesWWW Fafsa Ed GovDarius Nathaniel WhitakerNo ratings yet

- Intensive English Program (IEP) Application For Admission & InstructionsDocument2 pagesIntensive English Program (IEP) Application For Admission & InstructionsYasser YassineNo ratings yet

- Go - Wlu.edu/portal Financialaid@wlu - Edu: Washington and Lee University Upload InstructionsDocument1 pageGo - Wlu.edu/portal Financialaid@wlu - Edu: Washington and Lee University Upload InstructionsTenebrae LuxNo ratings yet

- Florida Agricultural and Mechanical University: 2013-2014 Verification Worksheet Dependent StudentDocument4 pagesFlorida Agricultural and Mechanical University: 2013-2014 Verification Worksheet Dependent StudentdraykidNo ratings yet

- Georgia State IEP Application InstructionsDocument2 pagesGeorgia State IEP Application InstructionsKyiv EducationUSA Advising CenterNo ratings yet

- Faculty of Law Admission Bursary Application 2017 - 2018: Early Deadline: Final DeadlineDocument5 pagesFaculty of Law Admission Bursary Application 2017 - 2018: Early Deadline: Final DeadlinekarenNo ratings yet

- CUNY Standard Verification WorksheetDocument3 pagesCUNY Standard Verification Worksheethicu0No ratings yet

- 2020-2021 Verification Worksheet: A. Student InformationDocument2 pages2020-2021 Verification Worksheet: A. Student InformationHaider AliNo ratings yet

- Spring Scholarship Aid Application Form 16 17Document4 pagesSpring Scholarship Aid Application Form 16 17CHIBUIKE DANIELNo ratings yet

- Fafsa PDF Form 2011Document2 pagesFafsa PDF Form 2011MatthewNo ratings yet

- Bursary Application - New 2011-12Document7 pagesBursary Application - New 2011-12Bashir ChaudhryNo ratings yet

- 2011/2012 Dr. Amanda Perez Scholarship: EligibilityDocument5 pages2011/2012 Dr. Amanda Perez Scholarship: EligibilityuscblogsNo ratings yet

- 2012-2013 Verification Worksheet Independent StudentDocument3 pages2012-2013 Verification Worksheet Independent StudentJennifer ChinellNo ratings yet

- Procedure and Submission of Application For DSA-Sec Exercise1 RGSDocument3 pagesProcedure and Submission of Application For DSA-Sec Exercise1 RGSPennNo ratings yet

- CSS/Financial Aid PROFILE: Student GuideDocument1 pageCSS/Financial Aid PROFILE: Student GuideAnonymous MK6mHPVjNo ratings yet

- Santa Fe College Financial Aid Handbook 2011-12Document14 pagesSanta Fe College Financial Aid Handbook 2011-12sfcollegeNo ratings yet

- University of Pittsburgh: Financial Aid Application Supplement (FAAS) For The 2014-15 School YearDocument5 pagesUniversity of Pittsburgh: Financial Aid Application Supplement (FAAS) For The 2014-15 School YearAisha KannehNo ratings yet

- 2012-2013 Financial Aid InfoDocument1 page2012-2013 Financial Aid InfoJoy MooreNo ratings yet

- Financial Aid Check List: Loans and ScholarshipDocument1 pageFinancial Aid Check List: Loans and ScholarshipNaura Aisy MardianaNo ratings yet

- 1314 Verification Independent WorksheetDocument2 pages1314 Verification Independent WorksheetAngela JenkinsNo ratings yet

- Feea 2012Document2 pagesFeea 2012Ivan HuynhNo ratings yet

- (FVWD21) Parent Verification Worksheet: 1. Parent's/Step-parent's Family Information - DO NOT LEAVE BLANKDocument2 pages(FVWD21) Parent Verification Worksheet: 1. Parent's/Step-parent's Family Information - DO NOT LEAVE BLANKJohnNo ratings yet

- 2014 Undergraduate Application FormDocument4 pages2014 Undergraduate Application Formleomille2No ratings yet

- Office of Student Financial Assistance An Overview of Maryland State Financial Aid Programs 2012-2013Document37 pagesOffice of Student Financial Assistance An Overview of Maryland State Financial Aid Programs 2012-2013aehsgo2collegeNo ratings yet

- White County Lilly Endowment Scholarship ApplicationDocument11 pagesWhite County Lilly Endowment Scholarship ApplicationVoodooPandasNo ratings yet

- General Tax Information14Document2 pagesGeneral Tax Information14Mohamed Amine Bouzaghrane100% (1)

- Real$ense - CGS 2016 - UpdateDocument1 pageReal$ense - CGS 2016 - UpdatemortensenkNo ratings yet

- How To Apply For Fa 2011Document1 pageHow To Apply For Fa 2011kareenaggNo ratings yet

- Fafsa Changes 17 18 FaqDocument2 pagesFafsa Changes 17 18 Faqapi-239833147No ratings yet

- Financial Aid Cost of Attendance 2015-2016 COM/MPH DUAL Class of 2019 (First Year)Document2 pagesFinancial Aid Cost of Attendance 2015-2016 COM/MPH DUAL Class of 2019 (First Year)Steven ShaNo ratings yet

- Fee Waiver Parent LetterDocument8 pagesFee Waiver Parent LetterCristina CotraNo ratings yet

- CSS Profile InstructionsDocument10 pagesCSS Profile InstructionsVickyNo ratings yet

- Bethel Enrichment Center Scholarship Application Packet Checklist 2015-2016 A S YDocument7 pagesBethel Enrichment Center Scholarship Application Packet Checklist 2015-2016 A S Yapi-302449528No ratings yet

- He Cu Said ApplicationformDocument9 pagesHe Cu Said ApplicationformAli RazaNo ratings yet

- V1 DepDocument5 pagesV1 DepMardochee DadeNo ratings yet

- Application Process: Step 2 Step 4 Step 1Document4 pagesApplication Process: Step 2 Step 4 Step 1Duc Nguyen XuanNo ratings yet

- Application ChecklistDocument2 pagesApplication Checklist2qqqprkp8hNo ratings yet

- I-20 and DS-2019 Requests E-Forms Live Info SessionsDocument2 pagesI-20 and DS-2019 Requests E-Forms Live Info SessionsgwenferNo ratings yet

- 2013-2014 Upperclass Financial Aid ChecklistDocument1 page2013-2014 Upperclass Financial Aid ChecklistLufinancial AidNo ratings yet

- 2012-13 Transfer Aid ApplicationDocument4 pages2012-13 Transfer Aid ApplicationLufinancial AidNo ratings yet

- 2012-13 FERPA Privacy Act WaiverDocument1 page2012-13 FERPA Privacy Act WaiverLufinancial AidNo ratings yet

- Petition For Review of Financial Aid EligibilityDocument3 pagesPetition For Review of Financial Aid EligibilityLufinancial AidNo ratings yet

- 2012-13 Graduate Financial Aid ApplicationDocument2 pages2012-13 Graduate Financial Aid ApplicationLufinancial AidNo ratings yet

- 2012-13 Change of Financial Circumstances FormDocument2 pages2012-13 Change of Financial Circumstances FormLufinancial AidNo ratings yet

- 2012-13 Upperclass Financial Aid ApplicationDocument4 pages2012-13 Upperclass Financial Aid ApplicationLufinancial AidNo ratings yet

- SolutionsDocument30 pagesSolutionsNitesh AgrawalNo ratings yet

- Ex PaymentchartDocument5 pagesEx PaymentchartKrishna RukhminiNo ratings yet

- Biglang-Awa Vs Bacalla - 139927 - November 22, 2000 - J. Reyes - Third DivisionDocument5 pagesBiglang-Awa Vs Bacalla - 139927 - November 22, 2000 - J. Reyes - Third DivisionArmand Jerome CaradaNo ratings yet

- Solutions To All Assigned Practice ProblemsDocument31 pagesSolutions To All Assigned Practice ProblemsVarsha ShirsatNo ratings yet

- Government of Pakistan Finance Division (Regulations Wing)Document4 pagesGovernment of Pakistan Finance Division (Regulations Wing)Waheed AnwerNo ratings yet

- EPV SlidesDocument9 pagesEPV SlidesleekiangyenNo ratings yet

- HCCBPLDocument81 pagesHCCBPLShipra JinsiNo ratings yet

- BHAVESHDocument1 pageBHAVESHbhaveshvats194No ratings yet

- JETIR2105794Document5 pagesJETIR2105794Saranya ThangarajNo ratings yet

- E-Commerce in The Czech RepublicDocument19 pagesE-Commerce in The Czech RepublicAccaceNo ratings yet

- Tutorial Questions Equity 2020-1Document6 pagesTutorial Questions Equity 2020-1Nur Amin Nor AzmiNo ratings yet

- 8.1.22 Am Intangible-AssetsDocument8 pages8.1.22 Am Intangible-AssetsAether SkywardNo ratings yet

- SSC CGL 2019 Exam Paper - GSDocument126 pagesSSC CGL 2019 Exam Paper - GSRavindra Pratap Singh KalhanshNo ratings yet

- Sales Representative Pharmaceutical Biotechnology in Knoxville TN Resume Thomas HollidayDocument2 pagesSales Representative Pharmaceutical Biotechnology in Knoxville TN Resume Thomas HollidayThomas HollidayNo ratings yet

- SYLLABUS-ACCO 20093 - Intermediate Accounting 2Document5 pagesSYLLABUS-ACCO 20093 - Intermediate Accounting 2rachel banana hammockNo ratings yet

- Chapter 2Document4 pagesChapter 2JavNo ratings yet

- AmalgamationDocument41 pagesAmalgamationZooNo ratings yet

- Chapter Six: Business Ethics and Corporate GovernanceDocument38 pagesChapter Six: Business Ethics and Corporate GovernanceMacoyNo ratings yet

- Retention FundDocument4 pagesRetention FundNicolesChuaNo ratings yet

- CH 5 St. Guide WordDocument4 pagesCH 5 St. Guide WordarsalmoinNo ratings yet

- MTP 14 28 Answers 1701406110Document11 pagesMTP 14 28 Answers 1701406110aim.cristiano1210No ratings yet

- Quiz 3: Financial Management Quiz Instructions: D C B ADocument27 pagesQuiz 3: Financial Management Quiz Instructions: D C B AKii-anne FernandezNo ratings yet

- Simulation 1Document9 pagesSimulation 1Vamsi GunturuNo ratings yet

- Session 1-2: Building Financial Resilience Through Financial and Digital Literacy in South Asia and Sub-Saharan Africa by Angela LyonsDocument36 pagesSession 1-2: Building Financial Resilience Through Financial and Digital Literacy in South Asia and Sub-Saharan Africa by Angela LyonsADBI Events100% (1)

- Ps 3Document2 pagesPs 3King LeonidusNo ratings yet

- Composite Innovation Group, Atomic Composites V Michigan State UniversityDocument34 pagesComposite Innovation Group, Atomic Composites V Michigan State UniversityLansingStateJournalNo ratings yet

- Housing Policy in India PDFDocument26 pagesHousing Policy in India PDFabhishek yadavNo ratings yet