Professional Documents

Culture Documents

Changing Role of USD 2011 Linda

Changing Role of USD 2011 Linda

Uploaded by

telmercCopyright:

Available Formats

You might also like

- Letter of CancellationDocument2 pagesLetter of CancellationClark Lim79% (14)

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- Bao2001 Group AssignmentS22018SunwayDocument4 pagesBao2001 Group AssignmentS22018SunwayDessiree ChenNo ratings yet

- 50 Factors That Affect The Value of The US DollarDocument11 pages50 Factors That Affect The Value of The US DollarKamaljeet Kaur SainiNo ratings yet

- The Diminshing USD ($) TrendDocument5 pagesThe Diminshing USD ($) TrendGilani, ObaidNo ratings yet

- The Consequences of A Weakening DollarDocument1 pageThe Consequences of A Weakening DollarRuby A. SNo ratings yet

- Blog Future Dollar HegemonyDocument12 pagesBlog Future Dollar HegemonyYesica Yossary Gonzalez CanalesNo ratings yet

- Dollar ReportDocument26 pagesDollar ReportNirati AroraNo ratings yet

- ZebrawhiteDocument12 pagesZebrawhitechrisNo ratings yet

- Emad A Zikry VAAM Opportunities in Non Dollar 2Document4 pagesEmad A Zikry VAAM Opportunities in Non Dollar 2Emad-A-ZikryNo ratings yet

- Foreign Exchange Rates Headed in The Wrong DirectionDocument3 pagesForeign Exchange Rates Headed in The Wrong DirectionAin NsfNo ratings yet

- "This Is Our Currency, But Your Problem" Foreign Debt Accumulation and Its ImplicationsDocument12 pages"This Is Our Currency, But Your Problem" Foreign Debt Accumulation and Its ImplicationsJohnPapaspanosNo ratings yet

- Alan Greenspan U.S. Payments ImbalanceDocument11 pagesAlan Greenspan U.S. Payments ImbalancepschaefferNo ratings yet

- The Denigration of The Dollar and The Federal ReserveDocument3 pagesThe Denigration of The Dollar and The Federal ReserveYubin WooNo ratings yet

- The Dollar Milkshake TheoryDocument2 pagesThe Dollar Milkshake TheoryHarushika MittalNo ratings yet

- Teaching Note The Falling Dollar: Case SynopsisDocument3 pagesTeaching Note The Falling Dollar: Case Synopsisluica1968No ratings yet

- Newly Observed Financial WordsDocument5 pagesNewly Observed Financial WordsProkash MondalNo ratings yet

- CRS Report For CongressDocument19 pagesCRS Report For CongressQuantDev-MNo ratings yet

- The Dollar Dilemma The Worlds Top Currency Faces CompetitionDocument14 pagesThe Dollar Dilemma The Worlds Top Currency Faces Competitionevenwriter1No ratings yet

- US Debt CeilingDocument4 pagesUS Debt CeilingHEYNo ratings yet

- sr255 PDFDocument31 pagessr255 PDFmaimai175No ratings yet

- The Hegemony of The US DollarDocument4 pagesThe Hegemony of The US DollarJoey MartinNo ratings yet

- De DollarizationDocument8 pagesDe Dollarizationbushra farmanNo ratings yet

- International Monetary SystemDocument6 pagesInternational Monetary SystemBora EfeNo ratings yet

- Krishnamurthy LustigDocument54 pagesKrishnamurthy LustigJohn PNo ratings yet

- Risks and Vulnerabilities of the US Economy Due to Overspending and Printing DollarsFrom EverandRisks and Vulnerabilities of the US Economy Due to Overspending and Printing DollarsNo ratings yet

- Dismanteling USDominanceDocument10 pagesDismanteling USDominanceadivwadhwaNo ratings yet

- Informe DolarDocument40 pagesInforme DolarfreddyNo ratings yet

- Why Financial Repression Will FailDocument10 pagesWhy Financial Repression Will FailRon HeraNo ratings yet

- Obstfeld Zhou 2022 The Global Dollar Cycle BPEADocument79 pagesObstfeld Zhou 2022 The Global Dollar Cycle BPEAzongweiterngNo ratings yet

- The Almighty DollarDocument5 pagesThe Almighty DollarAnantaNo ratings yet

- IT 'S The End of The Dollar As We Know It (Do We Feel Fine?)Document6 pagesIT 'S The End of The Dollar As We Know It (Do We Feel Fine?)alphathesisNo ratings yet

- Emperor With No Clothes, Research PaperDocument3 pagesEmperor With No Clothes, Research PapertheadityarajgoswamiNo ratings yet

- A Must Read US Versus The WorldDocument3 pagesA Must Read US Versus The WorldvaibhavbhutraNo ratings yet

- Doomsday For The US DollarDocument7 pagesDoomsday For The US DollarklatifdgNo ratings yet

- US DefaultDocument2 pagesUS DefaultrongNo ratings yet

- Running Head: Reminbi Peg and Its Impact On World TradeDocument11 pagesRunning Head: Reminbi Peg and Its Impact On World TraderjbrowneiiiNo ratings yet

- Understanding The Strength of The DollarDocument43 pagesUnderstanding The Strength of The DollarMichael FengNo ratings yet

- Account Deficit US Financial CrisisDocument31 pagesAccount Deficit US Financial CrisisPurnendu SinghNo ratings yet

- En 2018 Q3 UsdDocument7 pagesEn 2018 Q3 Usdtanyan.huangNo ratings yet

- Moving To The Right Side of The Dollar SmileDocument7 pagesMoving To The Right Side of The Dollar SmilecmarojaNo ratings yet

- 5 Factors Affecting ForexDocument1 page5 Factors Affecting ForexAzrahNo ratings yet

- Debt Denomination and Financial Instability in Emerging Market Economies: Editors' IntroductionDocument15 pagesDebt Denomination and Financial Instability in Emerging Market Economies: Editors' Introductionkaran_champNo ratings yet

- USD-Has The King Lost Its CrownDocument2 pagesUSD-Has The King Lost Its CrownriddhitodiNo ratings yet

- HRN 20121016 Part 01 Headline A Final and Total CatastropheDocument14 pagesHRN 20121016 Part 01 Headline A Final and Total CatastropheJim LetourneauNo ratings yet

- International Financial Management: Submitted To Submitted by Mrs. Aarti Kamal Kant Baluni Mba Department 05920803911Document19 pagesInternational Financial Management: Submitted To Submitted by Mrs. Aarti Kamal Kant Baluni Mba Department 05920803911Mrinal KakkarNo ratings yet

- Dollarization - Merits and Challenges in A Modern Financial Landscape.Document3 pagesDollarization - Merits and Challenges in A Modern Financial Landscape.diegob.ramirezNo ratings yet

- 6 Factors That Influence Exchange RatesDocument2 pages6 Factors That Influence Exchange RatesfredsvNo ratings yet

- This Project Briefly Explains The Following Sections. 1.1. Is U.S. Ok With It's Trade Deficit ? 1.2 Self Test QuestionsDocument3 pagesThis Project Briefly Explains The Following Sections. 1.1. Is U.S. Ok With It's Trade Deficit ? 1.2 Self Test QuestionsSaqib AliNo ratings yet

- Relationship Between InflationDocument3 pagesRelationship Between Inflationpramodn78No ratings yet

- Dismanteling US$ DominanceDocument9 pagesDismanteling US$ DominancecasaliyaNo ratings yet

- Why We Need A Stable Currency and Financial Standard (D Popa)Document2 pagesWhy We Need A Stable Currency and Financial Standard (D Popa)Ping LiNo ratings yet

- Currency WarDocument1 pageCurrency WarmaruinaangelaNo ratings yet

- The Great CrashDocument8 pagesThe Great CrashMaggie PinzónNo ratings yet

- Project #2: The Analysis of The U.S. EconomyDocument11 pagesProject #2: The Analysis of The U.S. Economyx54z484z4bNo ratings yet

- Financial Integration and The Wealth Effect of Exchange Rate FluctuationsDocument47 pagesFinancial Integration and The Wealth Effect of Exchange Rate FluctuationsRachman GuswardiNo ratings yet

- Currency Appreciation and Depreciation BiblographyDocument3 pagesCurrency Appreciation and Depreciation BiblographyJohn Jayanth BalantrapuNo ratings yet

- 7 Bernanke Global Savings GlutDocument13 pages7 Bernanke Global Savings GlutNabyKatNo ratings yet

- Main Factors That Influence Exchange Rate.: 1. InflationDocument9 pagesMain Factors That Influence Exchange Rate.: 1. InflationHiren GanganiNo ratings yet

- Currency Devaluation and Revaluation: Home About The New York FedDocument5 pagesCurrency Devaluation and Revaluation: Home About The New York FedTawanda MagomboNo ratings yet

- Domestic Monetary STabilityDocument30 pagesDomestic Monetary STabilityJhay Zem OrtizNo ratings yet

- Constraints of DollarisationDocument6 pagesConstraints of DollarisationMohammed Shah WasiimNo ratings yet

- The Dollar's Decline: How the Shift in Oil Payments Impacts the U.S. EconomyFrom EverandThe Dollar's Decline: How the Shift in Oil Payments Impacts the U.S. EconomyNo ratings yet

- ch.3 Capital BudgetingDocument46 pagesch.3 Capital Budgetingj787No ratings yet

- Persistent Analyst Presentation and Factsheet Q4FY22Document37 pagesPersistent Analyst Presentation and Factsheet Q4FY22Vinoth KumarNo ratings yet

- V - 62 Caroni, Trinidad, Thursday 5th January, 2023-Price $1.00 N - 2Document8 pagesV - 62 Caroni, Trinidad, Thursday 5th January, 2023-Price $1.00 N - 2ERSKINE LONEYNo ratings yet

- Syllabus For Lecturer (10+2) CommerceDocument4 pagesSyllabus For Lecturer (10+2) CommerceAfad KhanNo ratings yet

- Project Ratio AnalysisDocument106 pagesProject Ratio AnalysisNital Patel33% (3)

- BCOM 204 Advance AccountingDocument269 pagesBCOM 204 Advance AccountingMelody Aludo Borja AgravanteNo ratings yet

- Ce On Current LiabilitiesDocument3 pagesCe On Current LiabilitiesCharles TuazonNo ratings yet

- Municipal Commercial Paper Master Note FormDocument2 pagesMunicipal Commercial Paper Master Note FormOneNationNo ratings yet

- BankDocument43 pagesBankLïkïth Räj100% (2)

- Indifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, IsDocument5 pagesIndifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, Ismd mehedi hasanNo ratings yet

- InterestDocument41 pagesInterestClariza Mae BaisaNo ratings yet

- And in Particular, I'm Thinking Here About The Attractiveness of Selection Versus The Attractiveness of ModificationDocument14 pagesAnd in Particular, I'm Thinking Here About The Attractiveness of Selection Versus The Attractiveness of Modificationupasana magarNo ratings yet

- BANK MANAGEMENT AND FINANCIAL SERVICES - Lê Thanh TâmDocument10 pagesBANK MANAGEMENT AND FINANCIAL SERVICES - Lê Thanh TâmQuỳnh TrangNo ratings yet

- Statement of Account: From 01-APR-2020 To 31-MAR-2021Document2 pagesStatement of Account: From 01-APR-2020 To 31-MAR-2021debanwitaNo ratings yet

- Cambridge Associates LLC U.S. Venture Capital Index and Selected Benchmark Statistics March 31, 2009Document11 pagesCambridge Associates LLC U.S. Venture Capital Index and Selected Benchmark Statistics March 31, 2009Dan Primack100% (1)

- Portfolio Management - AnswersDocument3 pagesPortfolio Management - AnswersCharu KokraNo ratings yet

- Chapter 2 - Capital Budgeting Under RiskDocument10 pagesChapter 2 - Capital Budgeting Under RiskAndualem ZenebeNo ratings yet

- As Accounting Unit 1 RevisionDocument12 pagesAs Accounting Unit 1 RevisionUmar KhanNo ratings yet

- TP Vii PDFDocument17 pagesTP Vii PDFshekarj100% (3)

- SHS Business Finance Chapter 1Document19 pagesSHS Business Finance Chapter 1Ji Baltazar100% (1)

- Matteo Gerardo PALUMBO: Personal InfoDocument2 pagesMatteo Gerardo PALUMBO: Personal InfoMatteo Gerardo PalumboNo ratings yet

- Module 1 - Partnership FormationDocument10 pagesModule 1 - Partnership FormationAnneShannenBambaDabuNo ratings yet

- 2010 ACE Limited Annual ReportDocument233 pages2010 ACE Limited Annual ReportACELitigationWatchNo ratings yet

- Financial Statement Analysis of Life Insurance CompanyDocument3 pagesFinancial Statement Analysis of Life Insurance CompanyShahebaz100% (1)

- Accounting P2 Prep Sept 2021 Memo EngDocument16 pagesAccounting P2 Prep Sept 2021 Memo EngSweetness MakaLuthando LeocardiaNo ratings yet

- IFRS - Cours 7Document4 pagesIFRS - Cours 7Paix CulNo ratings yet

- Darrell Joe O. Asuncion, Cpa, Mba Instructions: Choose The Best Answer For Each of The Following. Mark TheDocument8 pagesDarrell Joe O. Asuncion, Cpa, Mba Instructions: Choose The Best Answer For Each of The Following. Mark TheSer Crz JyNo ratings yet

Changing Role of USD 2011 Linda

Changing Role of USD 2011 Linda

Uploaded by

telmercOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Changing Role of USD 2011 Linda

Changing Role of USD 2011 Linda

Uploaded by

telmercCopyright:

Available Formats

What If the U.S. Dollars Global Role Changed? - Liberty Street Economics http://libertystreeteconomics.newyorkfed.org/2011/10/what-if-the-us-doll...

Return to Liberty Street Economics Home Page October 03, 2011

Like 13

26

24

What If the U.S. Dollars Global Role Changed?

Linda Goldberg, Mark Choi*, and Hunter Clark* It isnt surprising that the dollar is always in the news, given the prominence of the United States in the global economy and how often the dollar is used in transactions around the world (as discussed in a 2010 Current Issues article). But the dollar may not retain this dominance forever. In this post, we consider and catalog the implications for the United States of a potential lessening of the dollars primacy in international transactions. The circumstances surrounding such a possibility are important for the effects. As long as U.S. fundamentals remain strong, key consequences could be somewhat higher funding costs and somewhat lower seigniorage revenues (the excess returns to the government of creating money), some reduced U.S. spillovers to the rest of the world, and enhanced sensitivity of the domestic economy to foreign economic conditions.

Why the Context for the Dollars Potential Decline Matters Whether the rise of other currencies would present more negative or positive consequences for the United States is linked to conditions within the country. If the United States maintains the strong economic fundamentals and institutional strengths that have supported the dollars international role, the consequences of a reduced dollar role would not be a large concern. Indeed, the emergence of plausible alternatives to the dollar would signal strength in other economies and financial systems, which are positive developments. However, if poor U.S. policy decisions undermine the nations economic fundamentals and institutional strengths, a reduced international role for the dollar could be one component of a broader decline.

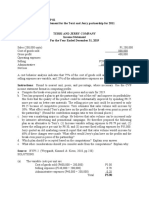

The Specific Consequences of a Declining Dollar Status Some have suggested that the large benefits extracted by the United States from the dollars privileged international status could be undermined should the currencys role decline. We examine this claim by grouping the potential consequences of a change in the dollars relative international status into five buckets. These consequences are summarized in the table below and discussed in more detail.

Possible Effects of a Reduced Role of the Dollar

Bucket Seigniorage revenues to the United States U.S. funding costs Impact Small reduction Comments Seigniorage revenues are relatively low; dollar cash holdings outside the United States are not likely to change much. While the United States does not have an exorbitant privilege in funding, reduced demand for dollar reserves can raise U.S. funding costs. Higher funding costs on debt raise interest payments to external creditors. This tightens domestic spending constraints, and some domestic expenditure could be crowded out. Dollar depreciation arises from lower net demand for dollars. International trade invoicing patterns change and U.S. import prices and consumption become more exposed to foreign shocks and exchange rate movements. Some rebalancing of country powers in international negotiations and institutions may occur.

Increase from low levels

Dollar value U.S. insulation from foreign shocks

Dollar depreciates; imports become more expensive Reduced U.S. autonomy in policy

U.S. global influence

Reduced influence

Seigniorage revenues to the United States: Total potential seigniorage losses to the United States are estimated to be moderate. Seigniorage revenues on U.S. currency outstanding can be approximated by the difference between interest earned on securities acquired in exchange for bank notes and the cost of producing and distributing those notes. In a low-interest-rate environment, seigniorage revenues have an upper bound of around $2.5 billion per year if calculated at 25 basis points, or $20 billion if calculated at an interest rate of 2 percent. Some lost foreign circulation of dollars would reduce this revenue accordingly. U.S. funding costs: The United States is sometimes argued to have an exorbitant privilege of facing lower funding costs due to the dollars central role in the international monetary system. While there remains a small advantage for the United States in official and bond financings, and the debate over the reason for this is ongoing, recent studies (such as the 2011 paper by Curcuru et al.) attribute the lower rates charged to the United States to risk premia and to differences in tax rates and the relative stability of investment returns across nationalities, rather than to the dollars international role per se.

1 of 2

10/5/2011 12:37 PM

What If the U.S. Dollars Global Role Changed? - Liberty Street Economics http://libertystreeteconomics.newyorkfed.org/2011/10/what-if-the-us-doll...

It is possible, however, that funding costs could rise on U.S. government borrowing if other country assets emerge as stronger alternative investment vehicles to U.S. Treasuries. If reduced demand for U.S. official debt leads to increased funding costs in the United States, the fiscal burden of U.S. debt would rise and could increasingly crowd out domestic spending. Another type of cost arises on transactions in financial markets. High volumes of activity in U.S. dollars keep the dollar market highly liquid and lower the effects on exchange rates of large sales or purchases of U.S. dollars. While transaction costs could potentially rise with dollar exchange rate volatility, other cost drivers are the number of dealers, quote frequency, and transaction size. Unless large volumes of international financial and international trade transactions shift away from dollar use, there is little reason to expect that U.S. dollar transaction costs will rise.

Dollar value:The dollars value is supported by its status as the primary global reserve currency. A loss of reserve demand for U.S. dollars could be associated with a depreciated U.S. dollar relative to whichever currency gets an enhanced role. A weaker dollar would make U.S. goods more competitive internationally, while also potentially raising the costs of commodity and intermediate inputs, among other imports. A weaker dollar may not be an issue for the U.S. debt burden since U.S. liabilities are expressed in dollar terms, despite the size of the external debt of the United States. However, the costs of carrying the debt could rise if further dollar depreciation is expected and compensation for that risk is required by investors. U.S. insulation from foreign shocks: Many international trade transactions use U.S. dollars as the invoicing currency. Likewise, many international financial transactions, including debt contracts, are issued and payable in U.S. dollars. This numeration of contracts in dollar terms helps insulate U.S. real activity from foreign developments. Import prices into the United States move to a lesser degree with exchange rate fluctuations compared with what is observed in other countries. This lower exchange rate pass-through into domestic import prices also keeps U.S. inflation relatively more insulated from foreign developments (Goldberg and Campa 2010). That is, when the dollar exchange rate moves, more of the expenditure switching burden is felt by the countrys foreign trading partners (Goldberg and Tille 2006). Greater invoicing in other currencies could shift more of the burden back to the United States. On the financial side, the global predominance of the dollar has enabled U.S. entities to issue their debt in dollars, helping the U.S. government and private entities avoid large currency mismatch risks on their balance sheets. In general, the increased use of other currencies in place of the dollar could lead to a directional rebalancing of international transmission of shocks and stimuli. In a potentially more multipolar and integrated global economy, foreign developments and possible feedback effects of domestic policies would have to be increasingly taken into account, even for a large economy such as the United States. U.S. global influence: Less quantifiable, but nonetheless important, could be a loss of global prestige and policy influence for the United States resulting from a shift toward a multipolar currency world. One key channel of U.S. global influence in the modern economic system has been within institutions such as the International Monetary Fund and World Bank that undergird the current international economic and financial order. A second avenue by which U.S. influence may be impacted is through the growing use of other currencies in international negotiations and transactions. This could further strengthen the reach of other countries in ways that could differ from U.S. preferences and interests.

Conclusion In general, if a decline in the dollars international primacy were to occur in the context of strong U.S. growth and institutional fundamentals, it would not be a significant threat to the countrys economic well-being. However, the changes we described could have more adverse effects if the dollars reduced role were to be associated with less auspicious U.S. policy and institutions. These changes could have the greatest impact on U.S. fiscal costs and the sensitivity of the U.S. economy to developments in foreign markets.

*Mark Choi is a senior economic analyst and Hunter Clark an officer in the Federal Reserve Bank of New Yorks Emerging Markets and International Affairs Group.

Disclaimer The views expressed in this blog are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s). Posted by Blog Author at 10:00:00 AM in Global Economy Technorati Tags: currency, Dollar, euro, international role, reserves, rmb

Like 13

26

24

Comments

You can follow this conversation by subscribing to the comment feed for this post. The comments to this entry are closed.

2 of 2

10/5/2011 12:37 PM

You might also like

- Letter of CancellationDocument2 pagesLetter of CancellationClark Lim79% (14)

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- Bao2001 Group AssignmentS22018SunwayDocument4 pagesBao2001 Group AssignmentS22018SunwayDessiree ChenNo ratings yet

- 50 Factors That Affect The Value of The US DollarDocument11 pages50 Factors That Affect The Value of The US DollarKamaljeet Kaur SainiNo ratings yet

- The Diminshing USD ($) TrendDocument5 pagesThe Diminshing USD ($) TrendGilani, ObaidNo ratings yet

- The Consequences of A Weakening DollarDocument1 pageThe Consequences of A Weakening DollarRuby A. SNo ratings yet

- Blog Future Dollar HegemonyDocument12 pagesBlog Future Dollar HegemonyYesica Yossary Gonzalez CanalesNo ratings yet

- Dollar ReportDocument26 pagesDollar ReportNirati AroraNo ratings yet

- ZebrawhiteDocument12 pagesZebrawhitechrisNo ratings yet

- Emad A Zikry VAAM Opportunities in Non Dollar 2Document4 pagesEmad A Zikry VAAM Opportunities in Non Dollar 2Emad-A-ZikryNo ratings yet

- Foreign Exchange Rates Headed in The Wrong DirectionDocument3 pagesForeign Exchange Rates Headed in The Wrong DirectionAin NsfNo ratings yet

- "This Is Our Currency, But Your Problem" Foreign Debt Accumulation and Its ImplicationsDocument12 pages"This Is Our Currency, But Your Problem" Foreign Debt Accumulation and Its ImplicationsJohnPapaspanosNo ratings yet

- Alan Greenspan U.S. Payments ImbalanceDocument11 pagesAlan Greenspan U.S. Payments ImbalancepschaefferNo ratings yet

- The Denigration of The Dollar and The Federal ReserveDocument3 pagesThe Denigration of The Dollar and The Federal ReserveYubin WooNo ratings yet

- The Dollar Milkshake TheoryDocument2 pagesThe Dollar Milkshake TheoryHarushika MittalNo ratings yet

- Teaching Note The Falling Dollar: Case SynopsisDocument3 pagesTeaching Note The Falling Dollar: Case Synopsisluica1968No ratings yet

- Newly Observed Financial WordsDocument5 pagesNewly Observed Financial WordsProkash MondalNo ratings yet

- CRS Report For CongressDocument19 pagesCRS Report For CongressQuantDev-MNo ratings yet

- The Dollar Dilemma The Worlds Top Currency Faces CompetitionDocument14 pagesThe Dollar Dilemma The Worlds Top Currency Faces Competitionevenwriter1No ratings yet

- US Debt CeilingDocument4 pagesUS Debt CeilingHEYNo ratings yet

- sr255 PDFDocument31 pagessr255 PDFmaimai175No ratings yet

- The Hegemony of The US DollarDocument4 pagesThe Hegemony of The US DollarJoey MartinNo ratings yet

- De DollarizationDocument8 pagesDe Dollarizationbushra farmanNo ratings yet

- International Monetary SystemDocument6 pagesInternational Monetary SystemBora EfeNo ratings yet

- Krishnamurthy LustigDocument54 pagesKrishnamurthy LustigJohn PNo ratings yet

- Risks and Vulnerabilities of the US Economy Due to Overspending and Printing DollarsFrom EverandRisks and Vulnerabilities of the US Economy Due to Overspending and Printing DollarsNo ratings yet

- Dismanteling USDominanceDocument10 pagesDismanteling USDominanceadivwadhwaNo ratings yet

- Informe DolarDocument40 pagesInforme DolarfreddyNo ratings yet

- Why Financial Repression Will FailDocument10 pagesWhy Financial Repression Will FailRon HeraNo ratings yet

- Obstfeld Zhou 2022 The Global Dollar Cycle BPEADocument79 pagesObstfeld Zhou 2022 The Global Dollar Cycle BPEAzongweiterngNo ratings yet

- The Almighty DollarDocument5 pagesThe Almighty DollarAnantaNo ratings yet

- IT 'S The End of The Dollar As We Know It (Do We Feel Fine?)Document6 pagesIT 'S The End of The Dollar As We Know It (Do We Feel Fine?)alphathesisNo ratings yet

- Emperor With No Clothes, Research PaperDocument3 pagesEmperor With No Clothes, Research PapertheadityarajgoswamiNo ratings yet

- A Must Read US Versus The WorldDocument3 pagesA Must Read US Versus The WorldvaibhavbhutraNo ratings yet

- Doomsday For The US DollarDocument7 pagesDoomsday For The US DollarklatifdgNo ratings yet

- US DefaultDocument2 pagesUS DefaultrongNo ratings yet

- Running Head: Reminbi Peg and Its Impact On World TradeDocument11 pagesRunning Head: Reminbi Peg and Its Impact On World TraderjbrowneiiiNo ratings yet

- Understanding The Strength of The DollarDocument43 pagesUnderstanding The Strength of The DollarMichael FengNo ratings yet

- Account Deficit US Financial CrisisDocument31 pagesAccount Deficit US Financial CrisisPurnendu SinghNo ratings yet

- En 2018 Q3 UsdDocument7 pagesEn 2018 Q3 Usdtanyan.huangNo ratings yet

- Moving To The Right Side of The Dollar SmileDocument7 pagesMoving To The Right Side of The Dollar SmilecmarojaNo ratings yet

- 5 Factors Affecting ForexDocument1 page5 Factors Affecting ForexAzrahNo ratings yet

- Debt Denomination and Financial Instability in Emerging Market Economies: Editors' IntroductionDocument15 pagesDebt Denomination and Financial Instability in Emerging Market Economies: Editors' Introductionkaran_champNo ratings yet

- USD-Has The King Lost Its CrownDocument2 pagesUSD-Has The King Lost Its CrownriddhitodiNo ratings yet

- HRN 20121016 Part 01 Headline A Final and Total CatastropheDocument14 pagesHRN 20121016 Part 01 Headline A Final and Total CatastropheJim LetourneauNo ratings yet

- International Financial Management: Submitted To Submitted by Mrs. Aarti Kamal Kant Baluni Mba Department 05920803911Document19 pagesInternational Financial Management: Submitted To Submitted by Mrs. Aarti Kamal Kant Baluni Mba Department 05920803911Mrinal KakkarNo ratings yet

- Dollarization - Merits and Challenges in A Modern Financial Landscape.Document3 pagesDollarization - Merits and Challenges in A Modern Financial Landscape.diegob.ramirezNo ratings yet

- 6 Factors That Influence Exchange RatesDocument2 pages6 Factors That Influence Exchange RatesfredsvNo ratings yet

- This Project Briefly Explains The Following Sections. 1.1. Is U.S. Ok With It's Trade Deficit ? 1.2 Self Test QuestionsDocument3 pagesThis Project Briefly Explains The Following Sections. 1.1. Is U.S. Ok With It's Trade Deficit ? 1.2 Self Test QuestionsSaqib AliNo ratings yet

- Relationship Between InflationDocument3 pagesRelationship Between Inflationpramodn78No ratings yet

- Dismanteling US$ DominanceDocument9 pagesDismanteling US$ DominancecasaliyaNo ratings yet

- Why We Need A Stable Currency and Financial Standard (D Popa)Document2 pagesWhy We Need A Stable Currency and Financial Standard (D Popa)Ping LiNo ratings yet

- Currency WarDocument1 pageCurrency WarmaruinaangelaNo ratings yet

- The Great CrashDocument8 pagesThe Great CrashMaggie PinzónNo ratings yet

- Project #2: The Analysis of The U.S. EconomyDocument11 pagesProject #2: The Analysis of The U.S. Economyx54z484z4bNo ratings yet

- Financial Integration and The Wealth Effect of Exchange Rate FluctuationsDocument47 pagesFinancial Integration and The Wealth Effect of Exchange Rate FluctuationsRachman GuswardiNo ratings yet

- Currency Appreciation and Depreciation BiblographyDocument3 pagesCurrency Appreciation and Depreciation BiblographyJohn Jayanth BalantrapuNo ratings yet

- 7 Bernanke Global Savings GlutDocument13 pages7 Bernanke Global Savings GlutNabyKatNo ratings yet

- Main Factors That Influence Exchange Rate.: 1. InflationDocument9 pagesMain Factors That Influence Exchange Rate.: 1. InflationHiren GanganiNo ratings yet

- Currency Devaluation and Revaluation: Home About The New York FedDocument5 pagesCurrency Devaluation and Revaluation: Home About The New York FedTawanda MagomboNo ratings yet

- Domestic Monetary STabilityDocument30 pagesDomestic Monetary STabilityJhay Zem OrtizNo ratings yet

- Constraints of DollarisationDocument6 pagesConstraints of DollarisationMohammed Shah WasiimNo ratings yet

- The Dollar's Decline: How the Shift in Oil Payments Impacts the U.S. EconomyFrom EverandThe Dollar's Decline: How the Shift in Oil Payments Impacts the U.S. EconomyNo ratings yet

- ch.3 Capital BudgetingDocument46 pagesch.3 Capital Budgetingj787No ratings yet

- Persistent Analyst Presentation and Factsheet Q4FY22Document37 pagesPersistent Analyst Presentation and Factsheet Q4FY22Vinoth KumarNo ratings yet

- V - 62 Caroni, Trinidad, Thursday 5th January, 2023-Price $1.00 N - 2Document8 pagesV - 62 Caroni, Trinidad, Thursday 5th January, 2023-Price $1.00 N - 2ERSKINE LONEYNo ratings yet

- Syllabus For Lecturer (10+2) CommerceDocument4 pagesSyllabus For Lecturer (10+2) CommerceAfad KhanNo ratings yet

- Project Ratio AnalysisDocument106 pagesProject Ratio AnalysisNital Patel33% (3)

- BCOM 204 Advance AccountingDocument269 pagesBCOM 204 Advance AccountingMelody Aludo Borja AgravanteNo ratings yet

- Ce On Current LiabilitiesDocument3 pagesCe On Current LiabilitiesCharles TuazonNo ratings yet

- Municipal Commercial Paper Master Note FormDocument2 pagesMunicipal Commercial Paper Master Note FormOneNationNo ratings yet

- BankDocument43 pagesBankLïkïth Räj100% (2)

- Indifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, IsDocument5 pagesIndifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, Ismd mehedi hasanNo ratings yet

- InterestDocument41 pagesInterestClariza Mae BaisaNo ratings yet

- And in Particular, I'm Thinking Here About The Attractiveness of Selection Versus The Attractiveness of ModificationDocument14 pagesAnd in Particular, I'm Thinking Here About The Attractiveness of Selection Versus The Attractiveness of Modificationupasana magarNo ratings yet

- BANK MANAGEMENT AND FINANCIAL SERVICES - Lê Thanh TâmDocument10 pagesBANK MANAGEMENT AND FINANCIAL SERVICES - Lê Thanh TâmQuỳnh TrangNo ratings yet

- Statement of Account: From 01-APR-2020 To 31-MAR-2021Document2 pagesStatement of Account: From 01-APR-2020 To 31-MAR-2021debanwitaNo ratings yet

- Cambridge Associates LLC U.S. Venture Capital Index and Selected Benchmark Statistics March 31, 2009Document11 pagesCambridge Associates LLC U.S. Venture Capital Index and Selected Benchmark Statistics March 31, 2009Dan Primack100% (1)

- Portfolio Management - AnswersDocument3 pagesPortfolio Management - AnswersCharu KokraNo ratings yet

- Chapter 2 - Capital Budgeting Under RiskDocument10 pagesChapter 2 - Capital Budgeting Under RiskAndualem ZenebeNo ratings yet

- As Accounting Unit 1 RevisionDocument12 pagesAs Accounting Unit 1 RevisionUmar KhanNo ratings yet

- TP Vii PDFDocument17 pagesTP Vii PDFshekarj100% (3)

- SHS Business Finance Chapter 1Document19 pagesSHS Business Finance Chapter 1Ji Baltazar100% (1)

- Matteo Gerardo PALUMBO: Personal InfoDocument2 pagesMatteo Gerardo PALUMBO: Personal InfoMatteo Gerardo PalumboNo ratings yet

- Module 1 - Partnership FormationDocument10 pagesModule 1 - Partnership FormationAnneShannenBambaDabuNo ratings yet

- 2010 ACE Limited Annual ReportDocument233 pages2010 ACE Limited Annual ReportACELitigationWatchNo ratings yet

- Financial Statement Analysis of Life Insurance CompanyDocument3 pagesFinancial Statement Analysis of Life Insurance CompanyShahebaz100% (1)

- Accounting P2 Prep Sept 2021 Memo EngDocument16 pagesAccounting P2 Prep Sept 2021 Memo EngSweetness MakaLuthando LeocardiaNo ratings yet

- IFRS - Cours 7Document4 pagesIFRS - Cours 7Paix CulNo ratings yet

- Darrell Joe O. Asuncion, Cpa, Mba Instructions: Choose The Best Answer For Each of The Following. Mark TheDocument8 pagesDarrell Joe O. Asuncion, Cpa, Mba Instructions: Choose The Best Answer For Each of The Following. Mark TheSer Crz JyNo ratings yet