Professional Documents

Culture Documents

Assignment Intl Bus China

Assignment Intl Bus China

Uploaded by

Harris LuiCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Esppo, En590, Gasolene, LNG Fco (Qatar Origin)Document8 pagesEsppo, En590, Gasolene, LNG Fco (Qatar Origin)Bujor Sergiu100% (1)

- Saudi Cement Company SWOT AnalysisDocument3 pagesSaudi Cement Company SWOT AnalysisDunja Sekulic0% (1)

- Chapter 2 Financial Management Environment: 1. ObjectivesDocument5 pagesChapter 2 Financial Management Environment: 1. ObjectivesHarris LuiNo ratings yet

- Class Notes - Conceptual FrameworkDocument36 pagesClass Notes - Conceptual FrameworkHarris LuiNo ratings yet

- Chapter 1 Financial Management and Financial ObjectivesDocument11 pagesChapter 1 Financial Management and Financial ObjectivesHarris LuiNo ratings yet

- Case Study - Nike Vs Adidas, Market and Comprehensive Competition AnalysisDocument12 pagesCase Study - Nike Vs Adidas, Market and Comprehensive Competition AnalysisHarris LuiNo ratings yet

- Ch1 AuditObjectivesDocument7 pagesCh1 AuditObjectivesHarris LuiNo ratings yet

- MBA 500 Managerial Economics-AssignmentDocument23 pagesMBA 500 Managerial Economics-AssignmentHarris LuiNo ratings yet

- MBA 530 Corporate Finance HomeworkDocument6 pagesMBA 530 Corporate Finance HomeworkHarris LuiNo ratings yet

- The Global Economy: Organization, Governance, and DevelopmentDocument24 pagesThe Global Economy: Organization, Governance, and DevelopmentKaye ValenciaNo ratings yet

- Port of Tacoma: Directory of Third-Party Logistic Service ProvidersDocument4 pagesPort of Tacoma: Directory of Third-Party Logistic Service ProvidersPort of TacomaNo ratings yet

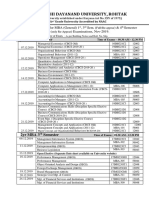

- Maharshi Dayanand University, RohtakDocument2 pagesMaharshi Dayanand University, RohtakPhogat PardeepNo ratings yet

- EU-OECS - Capacity Building in Support of Preparation of Economic Partnership Agreement - Draft Final Report (Programme 8 ACP TPS 110 - Project 091 OECS)Document181 pagesEU-OECS - Capacity Building in Support of Preparation of Economic Partnership Agreement - Draft Final Report (Programme 8 ACP TPS 110 - Project 091 OECS)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- CHAPTER V - Global and Regional Economic Cooperation ND IntegrationDocument14 pagesCHAPTER V - Global and Regional Economic Cooperation ND IntegrationSarah Motol100% (1)

- RLP Kickoff PresentationDocument18 pagesRLP Kickoff PresentationjamesmacvoyNo ratings yet

- Schengen Visa PresentationDocument17 pagesSchengen Visa PresentationRizwan Anjum ChaudhryNo ratings yet

- 18-Letter of CreditDocument25 pages18-Letter of CreditSamarth SaxenaNo ratings yet

- Costos de Transporte m3-Km y Ton-KmDocument68 pagesCostos de Transporte m3-Km y Ton-KmROBERT50% (2)

- Government Procurement AgreementDocument15 pagesGovernment Procurement AgreementSuyashRawatNo ratings yet

- China International Expo InvitationDocument8 pagesChina International Expo InvitationYousuf AzizNo ratings yet

- AseanDocument30 pagesAseanSyakir Perlis100% (1)

- Reinert Intra IndustryDocument16 pagesReinert Intra IndustrychequeadoNo ratings yet

- TLC ExpoDocument17 pagesTLC ExpomafNo ratings yet

- Import Tariffs and Quotas Under Perfect CompetitionDocument78 pagesImport Tariffs and Quotas Under Perfect CompetitionAnubhav AgarwalNo ratings yet

- Purchases ContractDocument6 pagesPurchases ContractVõ Minh HuệNo ratings yet

- Definition: The General Agreement On Tariffs and Trade Was The First Worldwide Multilateral Free Trade Agreement. It WasDocument17 pagesDefinition: The General Agreement On Tariffs and Trade Was The First Worldwide Multilateral Free Trade Agreement. It WasRizza Mae EudNo ratings yet

- MFNDocument12 pagesMFNShanky DhamijaNo ratings yet

- State Wise Steel Demand in India: ISA Steel Conclave, New Delhi, October 26, 2018Document37 pagesState Wise Steel Demand in India: ISA Steel Conclave, New Delhi, October 26, 2018Vikhyat SharmaNo ratings yet

- Freight - ForwardingDocument105 pagesFreight - ForwardingRamalingam ChandrasekharanNo ratings yet

- Yash Paper MillDocument185 pagesYash Paper Millhimanshugaurav100% (1)

- of Sri Lanka: A Future Logistic Hub of Asia Based On Sea Freight TransportationDocument52 pagesof Sri Lanka: A Future Logistic Hub of Asia Based On Sea Freight TransportationLalinda SilvaNo ratings yet

- Grimms Fairy TalesDocument348 pagesGrimms Fairy TalestaraleighNo ratings yet

- Dutch BDocument413 pagesDutch Bsrodriguezlorenzo3288100% (2)

- Green Coffee FOB, C & F, CIF Contract: (/ - .'. - .. - /J'JJ. (T:::L?!D.Document4 pagesGreen Coffee FOB, C & F, CIF Contract: (/ - .'. - .. - /J'JJ. (T:::L?!D.coffeepathNo ratings yet

- CO Handbook - SingaporeDocument28 pagesCO Handbook - SingaporeNMHaNo ratings yet

- Global Styrene Pricing Spikes On Supply TightnessDocument6 pagesGlobal Styrene Pricing Spikes On Supply Tightnessrdany3437100% (1)

- English 4 Spanish SWAN SMITHDocument23 pagesEnglish 4 Spanish SWAN SMITHmaritta617No ratings yet

Assignment Intl Bus China

Assignment Intl Bus China

Uploaded by

Harris LuiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment Intl Bus China

Assignment Intl Bus China

Uploaded by

Harris LuiCopyright:

Available Formats

American Central University

Master of Business Administration

Student Name : Law Chu Kong Kenny Student No. : LCK070267 Course Title : International Business Course No. : MBA Date : June 24 , 2008

Business Environment of the World's Fastest Developing Country - China

Executive Summary

The rapid progress that China has made in the last decade proves beyond doubt the role of politics in the economic development of a country. The rapid strides that China has made have taken it ahead of other developing countries in many areas. This paper is carried out to identify the international business environment of the world's fastest developing country China, by SWOT analysis. We will then discuss China's changes in recent years, especially after the entry of WTO. These changes will be classified into four categories: political/legal, economic, social/ecological and technological.

What come in mind when we say China? Kung-fu or kung pao chicken? Well China has gone past all the stereotypes and established itself as world's economic powerhouse. Recovering from the negatives of bloody Cultural Revolution initiated by Chairman Mao, with the help of communist-capitalist model China has surprised the world with GDP growth averaging 9% for the last decade. World's largest producer of steel, coal and cement, China has also made significant strides in social sector. Data from 2002 says that literacy is 90.9%, compared to India's 64%. Health and social services have also benefited from increased investment.

Aim of This Paper This paper is carried out to identify the international business environment of the world's fastest developing country China. We will discuss China's changes in recent years, especially after the entry of WTO. These changes will be classified into four categories: political/legal, economic, social/ecological and technological. We will also analyze the imports, exports and foreign direct investment (FDI) of the country through the official published statistic data.

International Trade Overview Since the Open Door Policy adopted by Deng Xiaoping, China has been becoming a more important trader in the global market. Numbers of foreign groups

now are setting overseas headquarters there due to the huge potential of this developing market.

Broad view based on SWOT analysis As we know that China has played a crucial role in international trade. To provide investors with a better understanding of China's business environment, we use SWOT analysis to give a clearly illustration

Strengths Provide rich and various mineral deposits. Government positive policy support. Cheap labour cost. Competitive advantage in clothing, consumer goods, fabric, toys, electrical machinery and so on. Relatively stable currency. Large domestic market. Low costs of operation, such as transportation. Well-developed infrastructure in most cities, such as power plants and water supplies. The rapid development of Hitechnology industry. Opportunities More mature products are producing More and more foreign companies. have invested in this growing country with lots of money and equipment. 2008 Olympic creates more business opportunities.

Weaknesses Different location and climate for various kinds of business. Most of technological know-how controlled by the investment companies. The unbalanced development. Communication problem, Chinese is not the world common language. Culture varies from place to place. Infrastructure is not good enough in town or countryside. Despite natural resources, insufficient energy supply. The social system is different from the investors. Over depended on foreign capital. Threats Obtain new management knowledge from foreign company. Labour in India or other South-East Asian countries become cheaper and cheaper. Great pressure from USA government

Rapid technological developments. Demand for low-cost goods in high- priced and poor countries. Increasing purchasing power creates more demand.

Table 1 SWOT analysis of Chine

to raise the RMB exchange rate. Competition for investment due to decreasing labour costs and devalued currencies in other Asian countries. Hesitation of foreign investors due to crisis along with political and legal uncertainties. Anti-dumping investigations. The economic environment of globalization, especially the recession in USA and Japan. Foreign capital based company have high competitive advantage.

The following tables indicate that China remains the foreign trade balance surplus for last 5 years (table 2). It is a good sign for the country to avoid unstable economic and political situation.

Exports Imports Import & export balance

2002 3,256.0 2,951.7 304.3

2003 4,382.3 4,127.6 254.7

2004 5,933.2 5,612.3 320.9

2005 7,619.5 6,599.5 1,020.0

2006 9,689.4 7,914.6 1,774.8

Table 2 Imports and Exports in the last five years. Unit: US$100,000,000

(Source: http://www.stats.gov.cn/tjsj/ndsj/2007/html/R1801e.htm)

Table 3 shows the top ten countries of exports and imports in 2007. 1. 2. 3. 4. 5. 6. 7. European Union USA Japan ASEAN Hong Kong South Korea Taiwan

8. 10.

Russia Australia

Table 3 The top ten countries of exports and imports in 2007

(Source: http://www.hktdc.com/report/indprof/indprof_e080308.htm) Foreign Direct Investment Chinese economic performance in recent years has impressed the entire world. A key contributor is the large inflow of FDI. From Jan to Nov, 2005, China approved and set up 39,679 foreign invested enterprises, up by 1.17% than previous year; contractual value of foreign fund was US$167,212mln, up by 23.99%; actual utilized foreign fund value was US$53,127mln, decreased by 1.90% year-on-year.

From Jan to Nov, 2005 top 10 countries and regions invested in China orderly (according to actual invest value) were Hong Kong, British Virgin Islands, Japan, Korea, US, Singapore, Taiwan, Cayman Islands, Germany and Samoa. Actual investment value of the top 10 countries and regions constituted 84.37% of Chinas actual utilized foreign fund value. (http://english.mofcom.gov.cn/aarticle/statistic/foreigninvestment/200607/200607027 00699.html) Increasing competition from counterparts such as India and Malaysia has urged the Chinese Government to offer more attractive incentives to lure foreign investors. Since becoming the member of WTO, China has been seeking to further improvement

for the investment environment. Following are some examples. Politically relaxed restrictions In 1990, Chinese government set up the Special Economics Zones (SEZS) to creating a congenial economics atmosphere. The PRC is investing significant resource to improve infrastructures, giving preferential policies and an independent authority regulates establishing the special managerial system, in where business. Tax concessions In order to encourage FDI, the Chinese government introduces low-tax policy, which is the biggest benefit for foreign investors. A typical example is that the PRC offers a tax concession to a manufactory setup: 1. 2. No tax during start-up years before making a profit. The first year that your company makes a profit starts the Tax Clock and is year one. 3. 4. 5. The first and second year after the tax clock starts, there is no tax. For years three and four, there is half of the normal tax rate. In the fifth year, the company pays the full normal tax rate.

On the other hand, Chinese government still remains the restrictions on the form of ownership of FDI. At the beginning of the 'open door policy', Chinese government restricted the share of the foreign investors in a company, maximizing at 25% and the director should be a Chinese. Therefore, the form of joint venture was the main form

of FDI. In 1985, it accounted for over 60% of the Foreign Investment. From 1998, Chinese government has been released the restrictions on foreign joint venture gradually. By 2000, the wholly foreign owned enterprises excesses the foreign joint venture reached to about 80% of the total foreign investment. Although the business environment in China is becoming more and more flexible, some industries are still restricted to the foreign investors by Chinese government, such as medicine and telecom. PEST Analysis The following PEST analysis will present a macro environment view from an international business perspective. Political/legal On 11 December 2001, China became a member of WTO. The entry of WTO has boosted China's economic growth and advanced its legal and governmental reforms although it took 15 years' negotiation. However, without government intervention, this could also bring harmful effects to China's development. Therefore, the Chinese government using the following political instruments to intervene international trade in order to protect the healthy development of certain domestic industries. Tariffs China used to charge very high tariff on importing products, however, after join

the WTO, China agreed to reduce import tariffs substantially on over 150 leading European exports machinery, ceramics and glass, textiles, clothing, footwear and leather goods, cosmetics, wines and spirits. Agreed tariffs are down to 8-10%. Subsidies The treatment of subsidies in the negotiations over China's proposed WTO accession is an important topic. Subsidies have figured prominently in Chinese industrial policy and could be increasingly problematic as China's share of world trade grows. Moreover, decisions made in connection with China's accession could profoundly affect the future direction of the WTO subsidies regime. Import quotas An import quota is used as a direct restriction on the quantity of some goods that may be imported into a China. For example, the government has taken steps to ensure increased quotas don't harm the country's auto manufacturers. It has devoted most of the quota increase to auto parts rather than completed cars. Last year, only 24 percent of the quota was allotted to completed cars. Local content requirements For example, in the early 80th, Volkswagen (VW) decided to invest capital in Shanghai to obtain more market share in Far East Asia, but according to the local government policy, they must set up the car factory with a local company and only import the engine part, all the rest parts of the VW cars must be produced locally

according to this policy. The purpose of using this instrument basically is to protect local companies and producers. Antidumping policies The ultimate objective here is to protect domestic producers from "unfair" foreign competition. China enacted the Anti-Dumping and Anti-Subsidy Regulations of the PRC (Regulations) in 1997, and the regulatory body enforcing it, the Ministry of Foreign Trade and Economic Cooperation ("MOFTEC") issued its first decision under the law in December of 1997. Last month, two Chinese steel companies, for example, won anti-dumping cases after US regulators determined that neither had sold products in the United States at prices below what they were charging for the same items at home. Administrative policies Administrative policies are bureaucratic rules designed to make it difficult for imports to enter into the Chinese market. For example, before the US is allowed to import Genetic Modified Foods such as soybean to China, it has to wait until the relative local authority has approved that such kind of foods are safe and do not harmful. However, the waiting period may range from one to one and half years.

Economic China has been one of the most promising countries in regards to their economic

growth. It can be seen that China economy is already shifting from agriculture sector to industry and service sector. With the sharp increase of both GDP and GDP per capita income, Chinese consumers are having more purchasing power to buy various products. The overall living standard of Chine is increasing. Of course, China has still a long way to go. The GNP per capita of China is still only a small fraction of USA and South Korea. It will take years for China to catch up with the rest of the world and it is the top priority for the current government to improve the living standard of the 1.4 billion of Chinese in the Mainland China. The government has to take a different approach from the conventional western economic theory to handle a highly populated land. Yet considering its growth over the past few decades, I would conclude that it has progressed well over the years and is a very good place for investment. China and globalization China being the 6th largest economy in the world and the 5th largest trading nation in the world have certainly globalizes its economy by opening its doors to the outside world. But for China, globalization was a double-edged sword that brought opportunities and challenges, advantages and disadvantages. Being member of different international trade organizations, its FDI figure has certainly been impressive. Following are the long-term benefits that China will derive from

globalization. 1. Make domestic industry more efficient and hence more competitive towards foreign industries 2. Accelerate the establishment of a sound market economy by accepting the legal and Regulatory frameworks of the modern management; 3. 4. Increase foreign direct investment. Enforce the government to reconstruct the political, economical, and legal systems to enhance 5. The compatibility of the Chinese institutions and society with the international community. Also following are the short-term disadvantages that China might face by globalizing its economy. 1. 2. Exacerbate the problem of unemployment; Enlarge the income disparities, and as a result, aggravate the existing social contradictions between the different strata; 3. Increase competitive pressures on firms in the sectors of agriculture, automobiles, and certain capital-intensive producers. But certainly having a look at the benefits and costs one can easily conclude that the benefits out weigh the cost by a large portion. Chinas membership with different organizations When we think of globalization in relation to trade, WTO is one name that leads

the rest. China became a member of WTO on 17th September 2001. Thus with this agreement China has to decrease its tariffs on agriculture products by 15% and for services by 8.9%. But it also gets access to other members market at a lower tariff rate. Thus capitalizing on this China has increased its export figures immensely. Also China has been involved with other trade agreements that are of equal importance. China has signed the Framework Agreement with ASEAN on Comprehensive Economic Cooperation with the aim of establishing China-ASEAN Free Trade Zone in 2010. The Shanghai Cooperation Organization is also forging closer economic links alongside with cooperation in security issues. China is also a member of APEC. All these important organizations have certainly helped China in their move towards a better economy. Financial system China adopted a financial system based mainly on banks i.e. it has a bank-based system. The central bank of china supervises and controls the economy of the country with the cooperation with state banks, featuring the separation of commercial finance and policy-related finance. A bank-based system may present advantages and disadvantages for a country. A benefit is that banks becoming stronger and stronger in the country and are able to finance new starting enterprises. On the other hand, if banks are strong enough, then

there is a danger of acting for their own weal e.g. setting high interest rates. According to the open door policy, a number of international banks have been permitted to open their doors in major cities in China. The role and participation of international banks in China's financial system is limited, but it can be very important and greater in the future as the people of Republic of China begin to borrow from abroad.

Social Communication problem The official language is Mandarin, most of Chinese speak Mandarin, but their preference is to use regional language to communicate with people, such as Cantonese. Although new generation of Chinese can understand English, its still a small percentage compared with the country largest population. Recommendations: Try to learn Chinese, this will reduce misunderstanding to the mimimun. In business conversation, try to transfer the meaning in a simple and direct way so that everybody can understand. Relationship Doing business in China is usually based on the notion of friendship, loyalty and trustworthiness. Therefore, normally their value of keeping business and private relations are not separate. However, Chinese society is undergoing rapid social and cultural change, relationship is less important than before. Many businesses related

rules and regulations established or to be established soon, the businessman should be capable of adjusting the balance in this tolerant environment. Culture of China management Chinese entrepreneurs are patient and not impulsive, preferring to wait for the opportunity to arise, and then to seize it firmly. They are operating based on mutual trust between employees and employers rather than based on contractual arrangement, and also doing the same way between business transactions, especially small business. However, during recent years many foreign businesses entered China market with advanced rules and regulations, and Chinese are also willing to adapt to foreign cultures to keep up with the changing environment and technology and the government also welcome them. Recommendations 1. 2. 3. 4. Be patient to do business with Chinese companies. Be prudent to sign the contract and also make sure it is a legal one. Keep an eye on China government policies and rules Be sensitive to vacation and festival periods, especially Chinese New Year and National holiday.

Technological China is now becoming one of the world's most technologically advanced

systems in many areas of business activities. Lots of companies are using high-tech to support the business. China agreed to comply with the WTO Agreement on TradeRelated Aspects of Intellectual Property Rights (TRIPs) upon its accession to the WTO, including changes to laws and administrative practices to conform to the agreement. However, China was not successfully to solve some problems, such as high levels of piracy and counterfeiting (approximately 95% in software and 80-95% in CDs). Some benefits of the agreement 1. Encourage local innovation as inventors are enabled to exploit the fruit of their own labor. 2. Foreign enterprises would be more willing to transfer technology as it became protected under local law. 3. UNCTAD has called on industrialized countries and international organizations to provide assistance to developing countries to help them adapt and implement the agreement. 4. Costs 1. 2. Lead to higher prices for protected technologies and products. The agreement requires all WTO members to enforce IPRs protection standards. It also benefits China by providing access to high technologies.

3.

Emerging markets will face very high costs in complying with the World Trade Organization's Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

Conclusion China has been developing very fast during these years. China is well positioned for competing with other countries for foreign direct investment. The amount of FDI, exports are increasing consistently, GDP and Income are also increasing continuously above the world's average level. Although there are many problems China government needs to solve, the future of China is shining. The latest Shanghai daily describes China still maintain the world's most attractive destination for foreign investment in the world. It is the signal that more and more businesses are willing to invest capital and do the business in China.

References Daniels, J. D. and Radebaugh, L. H. (2001). International business: environment and operations (10th ed.). London: Prentice Hall. Hill, C. W. L. (2003). International business: competing in the global marketplace (4th ed.). London: McGraw-Hill. Chinas Absorption of Foreign Fund (2005/1-11). Retrieved June 16, 2008. http://english.mofcom.gov.cn/aarticle/statistic/foreigninvestment/200607/20060 702700699.html China's total import and export exceed US$2 trillion in 2007. Retrieved June 15, 2008. http://www.hktdc.com/report/indprof/indprof_e080308.htm Foreign Trade and Economic Cooperation. Retrieved June 16, 2008. http://www.stats.gov.cn/tjsj/ndsj/2007/html/R1801e.htm Summary of Countries or Regions Making Investments in China in 2005. Retrieved June 15, 2008. http://www.fdi.gov.cn/pub/FDI_EN/Economy/Investment %20Environment/FDI%20in%20China/Foreign%20Direct%20Investment %20in%20China/t20060816_58634.htm

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Esppo, En590, Gasolene, LNG Fco (Qatar Origin)Document8 pagesEsppo, En590, Gasolene, LNG Fco (Qatar Origin)Bujor Sergiu100% (1)

- Saudi Cement Company SWOT AnalysisDocument3 pagesSaudi Cement Company SWOT AnalysisDunja Sekulic0% (1)

- Chapter 2 Financial Management Environment: 1. ObjectivesDocument5 pagesChapter 2 Financial Management Environment: 1. ObjectivesHarris LuiNo ratings yet

- Class Notes - Conceptual FrameworkDocument36 pagesClass Notes - Conceptual FrameworkHarris LuiNo ratings yet

- Chapter 1 Financial Management and Financial ObjectivesDocument11 pagesChapter 1 Financial Management and Financial ObjectivesHarris LuiNo ratings yet

- Case Study - Nike Vs Adidas, Market and Comprehensive Competition AnalysisDocument12 pagesCase Study - Nike Vs Adidas, Market and Comprehensive Competition AnalysisHarris LuiNo ratings yet

- Ch1 AuditObjectivesDocument7 pagesCh1 AuditObjectivesHarris LuiNo ratings yet

- MBA 500 Managerial Economics-AssignmentDocument23 pagesMBA 500 Managerial Economics-AssignmentHarris LuiNo ratings yet

- MBA 530 Corporate Finance HomeworkDocument6 pagesMBA 530 Corporate Finance HomeworkHarris LuiNo ratings yet

- The Global Economy: Organization, Governance, and DevelopmentDocument24 pagesThe Global Economy: Organization, Governance, and DevelopmentKaye ValenciaNo ratings yet

- Port of Tacoma: Directory of Third-Party Logistic Service ProvidersDocument4 pagesPort of Tacoma: Directory of Third-Party Logistic Service ProvidersPort of TacomaNo ratings yet

- Maharshi Dayanand University, RohtakDocument2 pagesMaharshi Dayanand University, RohtakPhogat PardeepNo ratings yet

- EU-OECS - Capacity Building in Support of Preparation of Economic Partnership Agreement - Draft Final Report (Programme 8 ACP TPS 110 - Project 091 OECS)Document181 pagesEU-OECS - Capacity Building in Support of Preparation of Economic Partnership Agreement - Draft Final Report (Programme 8 ACP TPS 110 - Project 091 OECS)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- CHAPTER V - Global and Regional Economic Cooperation ND IntegrationDocument14 pagesCHAPTER V - Global and Regional Economic Cooperation ND IntegrationSarah Motol100% (1)

- RLP Kickoff PresentationDocument18 pagesRLP Kickoff PresentationjamesmacvoyNo ratings yet

- Schengen Visa PresentationDocument17 pagesSchengen Visa PresentationRizwan Anjum ChaudhryNo ratings yet

- 18-Letter of CreditDocument25 pages18-Letter of CreditSamarth SaxenaNo ratings yet

- Costos de Transporte m3-Km y Ton-KmDocument68 pagesCostos de Transporte m3-Km y Ton-KmROBERT50% (2)

- Government Procurement AgreementDocument15 pagesGovernment Procurement AgreementSuyashRawatNo ratings yet

- China International Expo InvitationDocument8 pagesChina International Expo InvitationYousuf AzizNo ratings yet

- AseanDocument30 pagesAseanSyakir Perlis100% (1)

- Reinert Intra IndustryDocument16 pagesReinert Intra IndustrychequeadoNo ratings yet

- TLC ExpoDocument17 pagesTLC ExpomafNo ratings yet

- Import Tariffs and Quotas Under Perfect CompetitionDocument78 pagesImport Tariffs and Quotas Under Perfect CompetitionAnubhav AgarwalNo ratings yet

- Purchases ContractDocument6 pagesPurchases ContractVõ Minh HuệNo ratings yet

- Definition: The General Agreement On Tariffs and Trade Was The First Worldwide Multilateral Free Trade Agreement. It WasDocument17 pagesDefinition: The General Agreement On Tariffs and Trade Was The First Worldwide Multilateral Free Trade Agreement. It WasRizza Mae EudNo ratings yet

- MFNDocument12 pagesMFNShanky DhamijaNo ratings yet

- State Wise Steel Demand in India: ISA Steel Conclave, New Delhi, October 26, 2018Document37 pagesState Wise Steel Demand in India: ISA Steel Conclave, New Delhi, October 26, 2018Vikhyat SharmaNo ratings yet

- Freight - ForwardingDocument105 pagesFreight - ForwardingRamalingam ChandrasekharanNo ratings yet

- Yash Paper MillDocument185 pagesYash Paper Millhimanshugaurav100% (1)

- of Sri Lanka: A Future Logistic Hub of Asia Based On Sea Freight TransportationDocument52 pagesof Sri Lanka: A Future Logistic Hub of Asia Based On Sea Freight TransportationLalinda SilvaNo ratings yet

- Grimms Fairy TalesDocument348 pagesGrimms Fairy TalestaraleighNo ratings yet

- Dutch BDocument413 pagesDutch Bsrodriguezlorenzo3288100% (2)

- Green Coffee FOB, C & F, CIF Contract: (/ - .'. - .. - /J'JJ. (T:::L?!D.Document4 pagesGreen Coffee FOB, C & F, CIF Contract: (/ - .'. - .. - /J'JJ. (T:::L?!D.coffeepathNo ratings yet

- CO Handbook - SingaporeDocument28 pagesCO Handbook - SingaporeNMHaNo ratings yet

- Global Styrene Pricing Spikes On Supply TightnessDocument6 pagesGlobal Styrene Pricing Spikes On Supply Tightnessrdany3437100% (1)

- English 4 Spanish SWAN SMITHDocument23 pagesEnglish 4 Spanish SWAN SMITHmaritta617No ratings yet