Professional Documents

Culture Documents

TheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial Crisis

TheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial Crisis

Uploaded by

Impulsive collectorOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial Crisis

TheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial Crisis

Uploaded by

Impulsive collectorCopyright:

Available Formats

theSun | TUESDAY NOVEMBER 18 2008 13

business news Hang Seng

13,529.53

S&P/ASX200

3,653.0

TSEC

4,439.80 KLCI

884.06

STI

1,749.67

KOSPI

1,078.32 NIKKEI

13.13 95.1 12.90 9.47 9.94 8,522.58

2.41 60.19

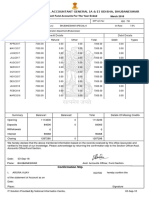

KL market summary

INDICES

NOVEMBER 17, 2008

CHANGE

PTP sees opportunities

amid global financial crisis

FBMEMAS 5,803.80 -5.46

COMPOSITE 884.06 +2.41

INDUSTRIA 2,122.51 +4.26

CONSUMER PROD 275.68 +1.23

INDUSTRIAL PROD 69.64 -0.41

CONSTRUCTION 156.66 -1.16

TRADING/SERVICES 123.83 +0.27

FINANCE 6,799.58 +38.65

PROPERTIES 528.03 -2.22

PLANTATIONS 3,896.36 +23.52 JOHOR BARU: While the shipping Asian financial crisis in late 90s when in the coming months and years.

MINING 251.28 UNCH world “groans” under the pressure of interest rates were infinitely higher “Besides ensuring long-term

FBMSHA 5,997.80 -16.27 a global recession with the prospect than now,” he said. capacity and connectivity, the

FBM2BRD 4,409.65 -76.26 of declining trade, the Port of Tanjung Arguing that customers look for the key word to our success will be

TECHNOLOGY 14.58 -0.21 Pelepas (PTP) in Johor is optimistic “bottomline” in tough times such as efficiency,” he said.

TURNOVER VALUE of “inherent opportunities” in the now, Ismail said PTP offered a “good “We must project ourselves

571.273mil RM595.515mil

current crisis. option” to operators. as different from others. Let us

Japan in “I admit that we have been affected Cargo handled at PTP comprises not forget that we are engaged

recession, by the economic downturn in the mainly electronic and electrical mainly in transshipment. Indeed,

United States and Europe and there is products and consumer goods. The transshipment is the mainstay of our

CI up on last-minute IMF needs already some impact on our volume, port handled some 8 million TEUs business. We are also looking at the

buying more but we consider this to be a short-term last year but many experts predict that gateway business and developing our

money effect. because of the global recession, the hinterland cargo business,” he said.

SHARE prices on Bursa Malaysia ended mixed “However, this crisis can also volume may decline in the current Characterising the current crisis

with some last-minute nibbling on heavyweight pg 14 provide opportunities for us because year. as of a “momentary nature”, Ismail

counters helping push the composite index (CI) we are mainly a transshipment port,” PTP is currently engaged in further averred that sea trade would continue

into blue territory in an otherwise lacklustre Ismail Hashim, PTP’s deputy chief expansion of its facilities. It is now to play a key role in future as well.

market, a dealer said. executive, told Bernama. implementing its phase two projects “We shall do some aggressive

At close, the benchmark KLCI increased 2.41 He said PTP was monitoring which include reclamation work marketing in future,” he said.

points to 884.06. It opened 6.45 points lower developments in the global trade and for eight berths, four of which have Ismail said PTP would be looking

at 875.20. shipping, and was closely working already been completed and another to expand its hinterland market in

Losers outnumbered gainers 327 to 200, with its two major customers two will be completed in the second future with the implementation of

177 counters were unchanged, 622 untraded – Evergreen and Maersk shipping half of 2009 while the remaining two the government-backed Iskandar

and 32 others suspended. lines – which have their operations at should be ready for use by 2011. Six Malaysia corridor development

KNM was the most actively traded, declining PTP. berths were already completed under which is expected to provide a strong

three sen to 64.5 sen, whereas MRCB lost four “One way to respond to the crisis is phase one. impetus to shipping and distribution.

sen to 75.5 sen, Zelan slid six sen to RM1.00 and to cut down cost and we are working “We have, so far, spent about The latest to join the PTP is MISC

Lion Industries declined two sen to 74.5 sen. towards lean management which, RM4 billion on port expansion and Bhd, which started to move its

For the heavyweights, Sime Darby shed five in turn, will enable us to pass on the development. Our aim is to become operations from Singapore in May this

sen to RM6.30, Tenaga Nasional added 10 sen benefits to our customers. the preferred port in Southeast Asia,” year.

to RM6.25, Public Bank was flat at RM8.55, “This is our way of supporting our he said. MISC’s shift will, no doubt, further

Maybank inched up 10 sen to RM5.30 and MISC customers. In my personal view, the On global shipping trends, Ismail extend PTP’s outreach in the Asia-

rose 10 sen to RM8.40. – Bernama present crisis is different from the said he expects competition to hot up Pacific region, he added.

Islamic finance viable alternative to conventional finance: Raja Nazrin

KUALA LUMPUR: The current financial principles. He said there was now a greater he said. not only achieved several industry

turmoil has provided an opportunity for “The syariah injunctions require that awareness and interest among the He said the vibrancy and dynamism “firsts”, but has also successfully de-

Islamic finance to position itself as a vi- financial transactions be accompanied world financial community of the merits of Malaysia’s Islamic financial system veloped a deep and liquid market.

able alternative to conventional finance by an underlying productive activity of Islamic finance. today was reflected in its continuous “We can lay claim to being the

by providing investors with other asset thus giving ride to a close link between The Perak Regent said there was product innovation, diversity of Islamic world’s largest and most innovative

classes and markets that provide stabil- financial and productive flows,” he said already a growing demand for Islamic financial institutions, comprehensive sukuk market.

ity, the Raja Muda of Perak Raja Nazrin in his address at the launch of The Ma- financial products in the global market, regulatory and legal infrastructure, as “At end-2007, total sukuk originat-

Shah said. laysian Sukuk Market Handbook – Your far exceeding their supply. well as the availability of Islamic finance ing from Malaysia amounted to RM213

He said there was much talk these Guide to the Malaysian Islamic Capital Raja Nazrin said in recent years, “We talent and expertise. billion, constituting 68.9% of the global

days about the creation of a new inter- Market, yesterday. have witnessed a rapid expansion of Raja Nazrin said the Islamic capital sukuk outstanding,” he said.

national economic order. Raja Nazrin said syariah principles the Islamic financial services industry”. market in Malaysia today offered a In the same year, the regent said,

“Some world leaders have called prohibited excessive leverage and “Today, Islamic finance is fast be- wide range of retail and wholesale the world’s largest sukuk, amounting to

for a Bretton Woods II. There is growing speculative financial activities thereby coming an accepted component of the products such as syariah-compliant RM15 billion was raised in the Malaysian

consensus that the unregulated capital- insulating the parties involved from too global financial system. stocks, Islamic unit trust funds, Islamic sukuk market.

ism that has led us to this crisis needs much risk exposure. “Malaysia’s direct involvement in exchange-traded funds, syariah-com- “Following the liberalisation of our

to be reconfigured to provide greater “It is worth speculating to what the development of Islamic finance has pliant real estate investment trusts, foreign exchange administration rules,

resilience and stability to the financial extent the world financial crisis could significantly transformed the financial structured products and derivatives. several foreign development banks,

system. have been averted, or at least its impact landscape at both the national and “These world-class financial prod- quasi-sovereign agencies and multina-

“The strengths of Islamic finance are considerably reduced, if the principles international levels, making the country ucts are available in both ringgit and tional corporations have joined our local

derived from syariah principles, which of Islamic finance had been more widely a leader in the international race to be- non-ringgit currencies,” he said. corporations in tapping the local sukuk

also happen to be sound business practised,” he said. come a major Islamic financial centre,” On sukuk, he said, the country has market for funds,” he said. – Bernama

You might also like

- Apporva Chandra Comm Report (ACC)Document23 pagesApporva Chandra Comm Report (ACC)ThangarajNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- Introduction To Agriculture...Document25 pagesIntroduction To Agriculture...Maryam Nisar100% (2)

- TheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpDocument1 pageTheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpImpulsive collectorNo ratings yet

- Thesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Document1 pageThesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Impulsive collectorNo ratings yet

- Thesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearDocument1 pageThesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearImpulsive collectorNo ratings yet

- TheSun 2008-11-13 Page24 PDC Getting More Land For New Foreign InvestorsDocument1 pageTheSun 2008-11-13 Page24 PDC Getting More Land For New Foreign InvestorsImpulsive collectorNo ratings yet

- Thesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabDocument1 pageThesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabImpulsive collectorNo ratings yet

- TheSun 2008-12-10 Page18 Middle East Buyers Eye Malaysian Property MarketDocument1 pageTheSun 2008-12-10 Page18 Middle East Buyers Eye Malaysian Property MarketImpulsive collectorNo ratings yet

- TheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageDocument1 pageTheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageImpulsive collectorNo ratings yet

- Thesun 2009-04-28 Page16 Msia Exports Picking Up Says MuhyiddinDocument1 pageThesun 2009-04-28 Page16 Msia Exports Picking Up Says MuhyiddinImpulsive collector100% (2)

- TheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanDocument1 pageTheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanImpulsive collectorNo ratings yet

- TheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankDocument1 pageTheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankImpulsive collectorNo ratings yet

- TheSun 2009-05-29 Page15 GM Talks With Europe Break Down in AngerDocument1 pageTheSun 2009-05-29 Page15 GM Talks With Europe Break Down in AngerImpulsive collectorNo ratings yet

- Thesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneDocument1 pageThesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneImpulsive collectorNo ratings yet

- The Sun 2008-10-24 Page28 Govt To Review Policy On Iron and Steel IndustryDocument1 pageThe Sun 2008-10-24 Page28 Govt To Review Policy On Iron and Steel IndustryImpulsive collectorNo ratings yet

- TheSun 2009-04-09 Page16 Japan Set To Boost Stimulus To US$150bDocument1 pageTheSun 2009-04-09 Page16 Japan Set To Boost Stimulus To US$150bImpulsive collectorNo ratings yet

- Thesun 2009-02-12 Page16 Ipps Against Power Purchase Pact ReviewDocument1 pageThesun 2009-02-12 Page16 Ipps Against Power Purchase Pact ReviewImpulsive collectorNo ratings yet

- Thesun 2009-08-13 Page17 Rio Employees Formally ArrestedDocument1 pageThesun 2009-08-13 Page17 Rio Employees Formally ArrestedImpulsive collectorNo ratings yet

- Thesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumDocument1 pageThesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumImpulsive collectorNo ratings yet

- Thesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataDocument1 pageThesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataImpulsive collectorNo ratings yet

- Thesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableDocument1 pageThesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableImpulsive collectorNo ratings yet

- TheSun 2009-03-13 Page17 World Bank Global Economy To Shrink 1-2pctDocument1 pageTheSun 2009-03-13 Page17 World Bank Global Economy To Shrink 1-2pctImpulsive collectorNo ratings yet

- Thesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthDocument1 pageThesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthImpulsive collectorNo ratings yet

- Thesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelDocument1 pageThesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelImpulsive collectorNo ratings yet

- Thesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeDocument1 pageThesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeImpulsive collector100% (2)

- TheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneDocument1 pageTheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneImpulsive collectorNo ratings yet

- Thesun 2008-12-22 Page20 KL Shares Likely To Be Higher This WeekDocument1 pageThesun 2008-12-22 Page20 KL Shares Likely To Be Higher This WeekImpulsive collectorNo ratings yet

- Thesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaDocument1 pageThesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaImpulsive collectorNo ratings yet

- TheSun 2008-12-05 Page27 MAS Pursues Strategic Tie-Ups With Other CarriersDocument1 pageTheSun 2008-12-05 Page27 MAS Pursues Strategic Tie-Ups With Other CarriersImpulsive collectorNo ratings yet

- Thesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementDocument1 pageThesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementImpulsive collectorNo ratings yet

- TheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsDocument1 pageTheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsImpulsive collectorNo ratings yet

- TheSun 2009-05-15 Page15 Us Currency Bill Tempts Protectionism ChinaDocument1 pageTheSun 2009-05-15 Page15 Us Currency Bill Tempts Protectionism ChinaImpulsive collectorNo ratings yet

- Thesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaDocument1 pageThesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaImpulsive collectorNo ratings yet

- Thesun 2009-08-25 Page17 Market SummaryDocument1 pageThesun 2009-08-25 Page17 Market SummaryImpulsive collectorNo ratings yet

- Amwatch: Stock Focus of The DayDocument4 pagesAmwatch: Stock Focus of The DayBrian StanleyNo ratings yet

- Thesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomDocument1 pageThesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomImpulsive collectorNo ratings yet

- TheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Document1 pageTheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Impulsive collector100% (2)

- TheSun 2009-02-13 Page14 Tariff Cut Low Demand To Dent TNB TurnoverDocument1 pageTheSun 2009-02-13 Page14 Tariff Cut Low Demand To Dent TNB TurnoverImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Thesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsDocument1 pageThesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsImpulsive collectorNo ratings yet

- Indices Other Stories:: FRI 23 DEC 2016Document3 pagesIndices Other Stories:: FRI 23 DEC 2016JajahinaNo ratings yet

- TheSun 2008-11-21 Page18 EPF Volatile Market Creates Buying OpportunituDocument1 pageTheSun 2008-11-21 Page18 EPF Volatile Market Creates Buying OpportunituImpulsive collectorNo ratings yet

- Thesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingDocument1 pageThesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingImpulsive collectorNo ratings yet

- Thesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesDocument1 pageThesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesImpulsive collectorNo ratings yet

- Kuala Lumpur Kepong Berhad: Impressive Turnaround For Retail Division - 19/08/2010Document4 pagesKuala Lumpur Kepong Berhad: Impressive Turnaround For Retail Division - 19/08/2010Rhb InvestNo ratings yet

- Thesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeDocument1 pageThesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeImpulsive collectorNo ratings yet

- TheSun 2008-11-04 Page14 ARMF Invests RM1.1b in Four Malls in MalaysiaDocument1 pageTheSun 2008-11-04 Page14 ARMF Invests RM1.1b in Four Malls in MalaysiaImpulsive collectorNo ratings yet

- Thesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaDocument1 pageThesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaImpulsive collectorNo ratings yet

- Thesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsDocument1 pageThesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsImpulsive collector100% (1)

- Top Stories:: WED 12 JULY 2017Document7 pagesTop Stories:: WED 12 JULY 2017JNo ratings yet

- TheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensDocument1 pageTheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensImpulsive collectorNo ratings yet

- TheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyDocument1 pageTheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyImpulsive collectorNo ratings yet

- TheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeDocument1 pageTheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeImpulsive collectorNo ratings yet

- Thesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiDocument1 pageThesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiImpulsive collectorNo ratings yet

- Thesun 2009-09-02 Page12 Regional Surveys Show Us Economy Picking UpDocument1 pageThesun 2009-09-02 Page12 Regional Surveys Show Us Economy Picking UpImpulsive collectorNo ratings yet

- Thesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsDocument1 pageThesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsImpulsive collectorNo ratings yet

- TheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldDocument1 pageTheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldImpulsive collectorNo ratings yet

- Thesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskDocument1 pageThesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskImpulsive collectorNo ratings yet

- Unisem Berhad: Strong 2Q Earnings But Remain Cautious - 02/08/2010Document3 pagesUnisem Berhad: Strong 2Q Earnings But Remain Cautious - 02/08/2010Rhb InvestNo ratings yet

- Sunway Holdings Berhad: Secures RM88m KLCC Building Job - 02/04/2010Document3 pagesSunway Holdings Berhad: Secures RM88m KLCC Building Job - 02/04/2010Rhb InvestNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Thesis SynopsisDocument3 pagesThesis SynopsisShivani PandaNo ratings yet

- Kantar Worldpanel Dairy Talk Summary - Part 1 - Consumer PulseDocument21 pagesKantar Worldpanel Dairy Talk Summary - Part 1 - Consumer PulseAnonymous 45z6m4eE7pNo ratings yet

- Any Need For Naira Re Denomination NowDocument10 pagesAny Need For Naira Re Denomination NowUtri DianniarNo ratings yet

- Globalisation and Its Impact - Model EssayDocument3 pagesGlobalisation and Its Impact - Model EssayjjnaseemNo ratings yet

- CBUAE 2021 Annual Report EDocument46 pagesCBUAE 2021 Annual Report EahmedNo ratings yet

- Office of The Principal Accountant General (A & E) Odisha, BhubaneswarDocument2 pagesOffice of The Principal Accountant General (A & E) Odisha, Bhubaneswarsohalsingh1No ratings yet

- The Role of Managerial EconomistDocument3 pagesThe Role of Managerial EconomistEmmanuel Kwame Ocloo100% (1)

- Unit 5 (2) Multidimensional Poverty MeasurementDocument25 pagesUnit 5 (2) Multidimensional Poverty MeasurementHeet DoshiNo ratings yet

- Test - IB Business Management - 1.1 TestDocument9 pagesTest - IB Business Management - 1.1 TestVivekNo ratings yet

- Remsa Brake Pads Commercial Presentation 2013Document13 pagesRemsa Brake Pads Commercial Presentation 2013Brandon Fowler100% (1)

- SSC 6 Module 3Document3 pagesSSC 6 Module 3Novelyn GarciaNo ratings yet

- Essay Topic-Eight Years of Competition Law Enforcement in IndiaDocument2 pagesEssay Topic-Eight Years of Competition Law Enforcement in IndiaShivam MishraNo ratings yet

- المجمعات السكنية المتكاملة ودروها في توفير بيئة عمرانية متميزة بالأحياء السكنيةDocument15 pagesالمجمعات السكنية المتكاملة ودروها في توفير بيئة عمرانية متميزة بالأحياء السكنيةMNo ratings yet

- Tabel Swasta Apr19 ValueDocument215 pagesTabel Swasta Apr19 ValueAntoNo ratings yet

- 2012 Khorasani Bike Sharing System in KLDocument6 pages2012 Khorasani Bike Sharing System in KLsamaunabihiNo ratings yet

- Investment in Food Processing in India-Kolhapur-IDistrict 1Document14 pagesInvestment in Food Processing in India-Kolhapur-IDistrict 1Rohit PawarNo ratings yet

- What Is International Trade TheoryDocument6 pagesWhat Is International Trade TheorySelcan AbdullayevaNo ratings yet

- Colours and IdiomsDocument5 pagesColours and IdiomsAnn Aden HazriNo ratings yet

- KomatsuDocument11 pagesKomatsuAmit AhujaNo ratings yet

- Language Summary: at The BankDocument2 pagesLanguage Summary: at The BankAnonymous 32kuetAU7GNo ratings yet

- The Second Term Test - 11 Form - New Edition (2018) Time Allowed: 45 Mins. - Theme 2 Teacher's Remark: . ..MarkDocument4 pagesThe Second Term Test - 11 Form - New Edition (2018) Time Allowed: 45 Mins. - Theme 2 Teacher's Remark: . ..MarkThuỳ VyNo ratings yet

- BML Islamic Board Resolution BusinessDocument4 pagesBML Islamic Board Resolution BusinessmikeNo ratings yet

- ACB Reports Q4/FY17 Results Below ExpectationsDocument2 pagesACB Reports Q4/FY17 Results Below ExpectationsAnonymous oHRghBVNo ratings yet

- Cambridge IELTS 10 Listening Test 1Document6 pagesCambridge IELTS 10 Listening Test 1Александр СтарухинNo ratings yet

- Occupy FinanceDocument128 pagesOccupy FinanceOWS_Alt_BankingNo ratings yet

- Hkdse English PP 20120116Document75 pagesHkdse English PP 20120116Barack ObamaNo ratings yet

- 183553-2012-Diageo Philippines, Inc. v. Commissioner of Internal RevenueDocument7 pages183553-2012-Diageo Philippines, Inc. v. Commissioner of Internal RevenueButch MaatNo ratings yet

- DematerlizationDocument13 pagesDematerlizationchaitu0905No ratings yet

- (123doc) - De-Minh-Hoa-Tot-Nghiep-Thpt-2022-Mon-Tieng-Anh-Soan-Boi-Trang-Anh-De-20-File-Word-Kem-Loi-Giai-Image-MarkedDocument18 pages(123doc) - De-Minh-Hoa-Tot-Nghiep-Thpt-2022-Mon-Tieng-Anh-Soan-Boi-Trang-Anh-De-20-File-Word-Kem-Loi-Giai-Image-Markednhomtienganh ThdNo ratings yet