Professional Documents

Culture Documents

Brs Worksheet

Brs Worksheet

Uploaded by

Saurabh JainCopyright:

Available Formats

You might also like

- Bank Reconciliation IDocument15 pagesBank Reconciliation IImran ZulfiqarNo ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMohammad Faizan Farooq Qadri AttariNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementasimaNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- Class Exercise Bank ReconciliationDocument6 pagesClass Exercise Bank ReconciliationDalia ElarabyNo ratings yet

- CCP102Document16 pagesCCP102api-3849444No ratings yet

- Bank Reconciliation StatementDocument7 pagesBank Reconciliation Statementsriram170100% (1)

- CA Foundation June 23 BRS Problem - CTC ClassesDocument2 pagesCA Foundation June 23 BRS Problem - CTC ClassesMohit SharmaNo ratings yet

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- Bank Reconciliation Statement: Mushtaq NadeemDocument4 pagesBank Reconciliation Statement: Mushtaq NadeemMalik SalmanNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- Bank Reconciliation Statement Practice ProblemsDocument2 pagesBank Reconciliation Statement Practice ProblemsHaya DanishNo ratings yet

- Class Exercise - Bank ReconciliationDocument5 pagesClass Exercise - Bank Reconciliationmoosanippp0% (2)

- ACCA F3 Bank Recon and Errors 09 and Fixed AssetsDocument2 pagesACCA F3 Bank Recon and Errors 09 and Fixed AssetsAmos OkechNo ratings yet

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- Bank Reconcilement Statement (BRS) AccountsDocument5 pagesBank Reconcilement Statement (BRS) AccountsVedanth RamNo ratings yet

- Bank Reconciliation StatementDocument44 pagesBank Reconciliation StatementDubai SheikhNo ratings yet

- 06 SLLC - 2021 - Acc - Review Question - Set 03Document7 pages06 SLLC - 2021 - Acc - Review Question - Set 03Chamela MahiepalaNo ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- Accounting For Manager: - CA Ankita JainDocument13 pagesAccounting For Manager: - CA Ankita JainrahulthexNo ratings yet

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- BA3 M KIT Chapter 16Document4 pagesBA3 M KIT Chapter 16Nivneth PeirisNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementRadhakrishna MishraNo ratings yet

- BANK RECONCILIATION STATEMENTS HandoutDocument14 pagesBANK RECONCILIATION STATEMENTS HandoutKiri chrisNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementMichael BwireNo ratings yet

- AUD02 - 05 Audit of Cash and Cash EquivalentsDocument3 pagesAUD02 - 05 Audit of Cash and Cash EquivalentsMark BajacanNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashant100% (1)

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- Bank Reconciliation Statement: Correct AnswerDocument4 pagesBank Reconciliation Statement: Correct AnswerFaisal Ali100% (1)

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashantNo ratings yet

- Chapter 11 - Bank Reconciliation StatementDocument29 pagesChapter 11 - Bank Reconciliation StatementRoh100% (1)

- MarksonDocument2 pagesMarksonyaregalNo ratings yet

- Audit of Cash: Problem No. 1Document4 pagesAudit of Cash: Problem No. 1Kathrina RoxasNo ratings yet

- Assignment Accounting of ReceivablesDocument2 pagesAssignment Accounting of Receivablesmisa moonNo ratings yet

- FA - Bank Rec. QuestionDocument2 pagesFA - Bank Rec. QuestionAshika JayaweeraNo ratings yet

- CA Foundation BRS Practice Questions - DRS - CTC ClassesDocument2 pagesCA Foundation BRS Practice Questions - DRS - CTC ClassesAnas AzeemNo ratings yet

- AC101 Quiz 2Document2 pagesAC101 Quiz 2irene TogaraNo ratings yet

- Bank Reconciliation Statement - Principles of AccountingDocument8 pagesBank Reconciliation Statement - Principles of AccountingAbdulla MaseehNo ratings yet

- Bank Reconciliation StatementDocument7 pagesBank Reconciliation Statementkshitijraja18No ratings yet

- Assignment - Cash and CEDocument4 pagesAssignment - Cash and CEAleah Jehan AbuatNo ratings yet

- Chapter 11 - Bank ReconciliationDocument33 pagesChapter 11 - Bank ReconciliationIqmal khushairiNo ratings yet

- 5.bank Reconcile Question and AnswerDocument42 pages5.bank Reconcile Question and AnswerSwarna Mishra100% (1)

- Additional Bank Recon QuestionsDocument4 pagesAdditional Bank Recon QuestionsDebbie DebzNo ratings yet

- Credit Repair 101: A Comprehensive Guide to Restoring Your Personal CreditFrom EverandCredit Repair 101: A Comprehensive Guide to Restoring Your Personal CreditNo ratings yet

Brs Worksheet

Brs Worksheet

Uploaded by

Saurabh JainOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Brs Worksheet

Brs Worksheet

Uploaded by

Saurabh JainCopyright:

Available Formats

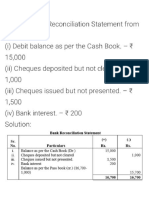

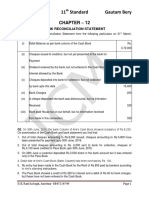

[BANK RECONCILATION STATEMENT]

JAIN COACHING CLASSES

Prepare a bank reconciliation statement as on DECMBER 31, 2005 in the books of Krishna. S.No 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Wrongly debited by the bank 500 A cash deposit of Rs. 200 was recorded in the cash book as if there is not bank, column therein. A cheque issued for Rs. 250 was recorded as Rs. 205 in the cash column. The debit balance of Rs. 1,500 as on the previous day was brought forward as a credit balance

PARTICULARS

. A cheque for Rs. 6,000 was deposited but not collected by the bank. . Cheque for Rs. 5,400 is deposited in the bank but not yet collected by the bank. A cheque for Rs. 20,000 is issued by us not presented for payment. Cheque issued before Dec 31,2005, amounting to Rs. 25,940 had not been presented for encashment Two cheques of Rs. 3,900 and Rs. 2,350 were deposited into the bank on December 31 but the bank gave credit for the same in Jan. There was also a debit in the passbook of Rs. 2,500 in respect of a cheque dishonoured on 31.12.2005. Cheque received and recorded in the cash book but not sent to the bank of collection Rs. 12,400. Payment received from a customer directly by the bank Rs. 27,300 but no entry was made in the cash book. Cheque issued for Rs. 1,75,200 not presented for payment. .

SOLUTION

Page

18

COACHING FOR ACCOUNTS, ECONOMICS, STATISTICS, MERCANTILE LAWS & CA-CPT #4381/2 Chatta Nanu Mal, NEAR GUR MANDI, PATIALA MOBILE: 9041271001 Successful people dont do different things, but they do it differently

JAIN COACHING CLASSES

[BANK RECONCILATION STATEMENT]

JAIN COACHING CLASSES

19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Credited by bank with Rs. 3,800 for interest collected by them, but the amount is not entered in the cash book. Cheques deposited into bank on November, 2005, but yet to be credited on dated December 31, 2005 Rs. 6,000. A cash discount allowed of Rs. 112 was recorded as Rs. 121 in the bank column. A cheque of Rs. 500 received from a debtor was recorded in the cash book but not deposited in the bank for collection One outgoing cheque of Rs. 300 was recorded twice in the cash book. Bank recorded a cash book deposit of Rs. 1,589 as Rs. 1,598 Withdrawal column of the passbook under cast by Rs. 100. The credit balance of Rs. 1,500 as on the pass-book was recorded in the debit balance The payment of a cheque of Rs. 350 was recorded twice in the passbook. A bill receivable for Rs. 700 previously discounted with the bank had been dishonoured and debited in the passbook. Cheques paid into bank but not collected and credited before December 31, 2005 amounted Rs. 6,000. The bank has collected interest and has credited Rs. 600 in passbook Debited by bank for Rs. 200 on account of Interest on overdraft and Rs. 50 on account of charges for collecting bills. Cheques paid into bank prior to December 31, 2005, but not credited for Rs. 10,000.

Page

COMMITED FOR CONCEPTUAL CLARITY! , Bina rattebaji

COACHING FOR ACCOUNTS, ECONOMICS, STATISTICS, MERCANTILE LAWS & CA-CPT #4381/2 Chatta Nanu Mal, NEAR GUR MANDI, PATIALA MOBILE: 9041271001 Successful people dont do different things, but they do it differently

JAIN COACHING CLASSES

You might also like

- Bank Reconciliation IDocument15 pagesBank Reconciliation IImran ZulfiqarNo ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMohammad Faizan Farooq Qadri AttariNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementasimaNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- Class Exercise Bank ReconciliationDocument6 pagesClass Exercise Bank ReconciliationDalia ElarabyNo ratings yet

- CCP102Document16 pagesCCP102api-3849444No ratings yet

- Bank Reconciliation StatementDocument7 pagesBank Reconciliation Statementsriram170100% (1)

- CA Foundation June 23 BRS Problem - CTC ClassesDocument2 pagesCA Foundation June 23 BRS Problem - CTC ClassesMohit SharmaNo ratings yet

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- Bank Reconciliation Statement: Mushtaq NadeemDocument4 pagesBank Reconciliation Statement: Mushtaq NadeemMalik SalmanNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- Bank Reconciliation Statement Practice ProblemsDocument2 pagesBank Reconciliation Statement Practice ProblemsHaya DanishNo ratings yet

- Class Exercise - Bank ReconciliationDocument5 pagesClass Exercise - Bank Reconciliationmoosanippp0% (2)

- ACCA F3 Bank Recon and Errors 09 and Fixed AssetsDocument2 pagesACCA F3 Bank Recon and Errors 09 and Fixed AssetsAmos OkechNo ratings yet

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- Bank Reconcilement Statement (BRS) AccountsDocument5 pagesBank Reconcilement Statement (BRS) AccountsVedanth RamNo ratings yet

- Bank Reconciliation StatementDocument44 pagesBank Reconciliation StatementDubai SheikhNo ratings yet

- 06 SLLC - 2021 - Acc - Review Question - Set 03Document7 pages06 SLLC - 2021 - Acc - Review Question - Set 03Chamela MahiepalaNo ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- Accounting For Manager: - CA Ankita JainDocument13 pagesAccounting For Manager: - CA Ankita JainrahulthexNo ratings yet

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- BA3 M KIT Chapter 16Document4 pagesBA3 M KIT Chapter 16Nivneth PeirisNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementRadhakrishna MishraNo ratings yet

- BANK RECONCILIATION STATEMENTS HandoutDocument14 pagesBANK RECONCILIATION STATEMENTS HandoutKiri chrisNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementMichael BwireNo ratings yet

- AUD02 - 05 Audit of Cash and Cash EquivalentsDocument3 pagesAUD02 - 05 Audit of Cash and Cash EquivalentsMark BajacanNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashant100% (1)

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- Bank Reconciliation Statement: Correct AnswerDocument4 pagesBank Reconciliation Statement: Correct AnswerFaisal Ali100% (1)

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashantNo ratings yet

- Chapter 11 - Bank Reconciliation StatementDocument29 pagesChapter 11 - Bank Reconciliation StatementRoh100% (1)

- MarksonDocument2 pagesMarksonyaregalNo ratings yet

- Audit of Cash: Problem No. 1Document4 pagesAudit of Cash: Problem No. 1Kathrina RoxasNo ratings yet

- Assignment Accounting of ReceivablesDocument2 pagesAssignment Accounting of Receivablesmisa moonNo ratings yet

- FA - Bank Rec. QuestionDocument2 pagesFA - Bank Rec. QuestionAshika JayaweeraNo ratings yet

- CA Foundation BRS Practice Questions - DRS - CTC ClassesDocument2 pagesCA Foundation BRS Practice Questions - DRS - CTC ClassesAnas AzeemNo ratings yet

- AC101 Quiz 2Document2 pagesAC101 Quiz 2irene TogaraNo ratings yet

- Bank Reconciliation Statement - Principles of AccountingDocument8 pagesBank Reconciliation Statement - Principles of AccountingAbdulla MaseehNo ratings yet

- Bank Reconciliation StatementDocument7 pagesBank Reconciliation Statementkshitijraja18No ratings yet

- Assignment - Cash and CEDocument4 pagesAssignment - Cash and CEAleah Jehan AbuatNo ratings yet

- Chapter 11 - Bank ReconciliationDocument33 pagesChapter 11 - Bank ReconciliationIqmal khushairiNo ratings yet

- 5.bank Reconcile Question and AnswerDocument42 pages5.bank Reconcile Question and AnswerSwarna Mishra100% (1)

- Additional Bank Recon QuestionsDocument4 pagesAdditional Bank Recon QuestionsDebbie DebzNo ratings yet

- Credit Repair 101: A Comprehensive Guide to Restoring Your Personal CreditFrom EverandCredit Repair 101: A Comprehensive Guide to Restoring Your Personal CreditNo ratings yet