Professional Documents

Culture Documents

Blog - 2012!01!10 Kick of Meeting - Ang

Blog - 2012!01!10 Kick of Meeting - Ang

Uploaded by

Microfinance CentreOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blog - 2012!01!10 Kick of Meeting - Ang

Blog - 2012!01!10 Kick of Meeting - Ang

Uploaded by

Microfinance CentreCopyright:

Available Formats

PRESS RELEASE

Tashkent, February 10 , 2012 The kick off meeting of Financial Education Program (FEP) took place on 30 of January between Microfinance Centre (MFC) and National Association of Microfinance Organizations and Credit Unions (NAMOCU). Representatives of Microfinance Centre Monika Milowska, Zofia Safteruk and Shaiyrgul th rd Satybaldieva visited Tashkent from 30 of January to 3 of February 2012. The purpose of the visit was to discuss the details of realization of the second phase of Financial Education Program in Uzbekistan. Meetings with different stakeholders including representatives of the Central Bank of the Republic of Uzbekistan, Delegation of the European Union to the Republic of Uzbekistan, National Association of NGOs of Uzbekistan (NANNOUZ), GIZ office in Tashkent and GIZ Regional Programme on Support to the development of Microfinance in Central Asia, commercial banks, microcredit organizations, Banking and Finance Academy, Tashkent Financial Institute took place during the week.

rd th th

The round table which gathered all the stakeholder institutions was organized on Friday 3 of Tashkent February to sum up the individual talks. During the opening part both partner organizations introduced themselves, presented the new project and short description of the previous phase and its outcomes. The main part of the round table included splitting of the participants into two groups according to the project components and brainstorming through the questions related to the implementation processes, adaptation of the materials to the local conditions and ways of cooperation between different stakeholder to achieve the goals and sustainability of the project. Discussions led to accumulation of information which is vital for decision on project structure and reaching the indicators shown on project papers. The project is funded by the European Commission under the ECs Action Programme 2010 agreed with the Government of Uzbekistan, in the framework of Institution Building and Partnership Programme (IBPP) and implemented by the Poland-based Microfinance Center (MFC) in cooperation with the local partner National Association of Microfinance Organizations and Credit Unions of Uzbekistan (NAMOCU). The overall objective of the second phase of Financial Education Program (FEP) in Uzbekistan is to improve financial capability of low-income households through continuing the process of institution building and development of relevant infrastructure at local, regional and national level, building on success of the previous EU-funded FEP project in the country. The project contains two main components. The first one base on cooperation with financial institutions through process of trainings Round table meeting, Tashkent on financial education module, while the second component is to develop a university textbook and include it into univeristy curriculum. Social compaing on financial education issues is also envisioned. Microfinance Centre (MFC): is a grass-root network of over 100 member institutions that play an active role in shaping the microfinance industry in the Europe and Central Asia region. Members range from banks, non-governmental organizations, social and commercial investors, to development institutions and international PVOs. MFC plays a catalyst role in bridging the market gap between dramatic unmet demand for microfinance services and the sector current offering through supporting development of a wide range of financial institutions, promoting microfinance among policy makers, regulators and formal banking sector. MFC have implemented a number of financial education initiatives and programs in the countries of transition including Poland, Macedonia, Bosnia, Ukraine, Russia, Bulgaria, Hungary, Georgia, Azerbaijan, Armenia, Kazakhstan, Kyrgyzstan and Tajikistan. MFC is the lead partner in this project. National Association of Microfinance Organizations and Credit Unions of Uzbekistan (NAMOCU): is an organization with the mission to consolidate the efforts of non-banking microfinance institutions to increase the quality and access of microfinance services by building the capacity of microfinance sector and creating enabling environment for its development. NAMOCU is the local partner in this project. For additional information, please visit www.mfc.org.pl. For more information, please contact: Mr Vadim Deleu, Directorate-General for Development and Cooperation - EuropeAid European Commission, Vadim.DELEU@ec.europa.eu Ms Monika Milowska, MFC Financial Education Manager monika@mfc.org.pl Mr Shukhrat Nazarov, NAMOCU Executive Director shukhrat.nazarov@gmail.com, info.namocu@gmail.com

Meeting in NAMOCUs office,

This project is implemented by MFC and NAMOCU. Microfianance Centre (MFC) ul.Noakowskiego 10/38, 00-666 Warsaw, Poland National Association of Microfinance Organizations and Credit Unions (NAMOCU) 80, Uzbekistan Avenue, 100057, Tashkent, Uzbekistan

This project is funded by the European Union. EuropeAid Co-operation Office Centralized Operations incl. Central Asia Rue Joseph II (06/65) 1040 Brussels, Belgium Tel: +32-296-8128 Fax: +32-2-296-3697

The European Commission is the EUs executive body. The European Union is made up of 27 Member States who have decided to gradually link together their know-how, resources and destinies. Together, during a period of enlargement of 50 years, they have built a zone of stability, democracy and sustainable development whilst maintaining cultural diversity, tolerance and individual freedoms. The European Union is committed to sharing its achievements and its values with countries and peoples beyond its borders.

You might also like

- Annex A1. Grant Application Form-Concept NoteDocument12 pagesAnnex A1. Grant Application Form-Concept NoteNader MehdawiNo ratings yet

- Tender Dossier - SampleDocument103 pagesTender Dossier - Samplediverhap100% (1)

- How To Access EU Structural and Investment Funds - InteractiveDocument38 pagesHow To Access EU Structural and Investment Funds - InteractiveHeddy BicskeiNo ratings yet

- CS Austrian Fund Moldova 2011-2015Document22 pagesCS Austrian Fund Moldova 2011-2015Cosmin TobolceaNo ratings yet

- Concept Paper: SlovakiaDocument7 pagesConcept Paper: SlovakiaLiz Lopega CastallaNo ratings yet

- UCA DIH Position Paper 2023 EngDocument24 pagesUCA DIH Position Paper 2023 EngyurchakNo ratings yet

- Sustainable Development of Municipalities FinanciaDocument7 pagesSustainable Development of Municipalities FinanciaMaria-Daiana CIUTACUNo ratings yet

- JRFM 16 00252 v2Document20 pagesJRFM 16 00252 v2Claire Ann LorenzoNo ratings yet

- SME Survey Report To UNIDODocument80 pagesSME Survey Report To UNIDOAkash NCNo ratings yet

- Sustainable Local DevelopmentDocument36 pagesSustainable Local DevelopmentBongani MoyoNo ratings yet

- Concept For Establishment of Center of Excellence On Information SocietyDocument35 pagesConcept For Establishment of Center of Excellence On Information Societyaksagar22100% (1)

- List Grants Awarded 01 Jun 30 Sept 2010 EngDocument9 pagesList Grants Awarded 01 Jun 30 Sept 2010 EngNicolae OlaruNo ratings yet

- KEP AUSTRIA Call For Proposals 2013Document6 pagesKEP AUSTRIA Call For Proposals 2013Eko-NEC Milisav PAJEVIĆNo ratings yet

- Banking Services in The Republic of UzbekistanDocument9 pagesBanking Services in The Republic of UzbekistanAcademic JournalNo ratings yet

- Gharsalli-Samar-PFE Version 0Document66 pagesGharsalli-Samar-PFE Version 0Hiba JenzriNo ratings yet

- P.R.FIN-EDU enDocument1 pageP.R.FIN-EDU enmfcstatNo ratings yet

- Working Papers: The Wiiw Balkan ObservatoryDocument43 pagesWorking Papers: The Wiiw Balkan ObservatorypedalaroNo ratings yet

- 1 s2.0 S2212567115004360 MainDocument10 pages1 s2.0 S2212567115004360 MainAlexandra ComșaNo ratings yet

- Towards Knowledge-Based Economy in Uzbekistan: Ensuring Sustainable Rapid Growth in The 21st CenturyDocument40 pagesTowards Knowledge-Based Economy in Uzbekistan: Ensuring Sustainable Rapid Growth in The 21st CenturyAltynai GoldenAiNo ratings yet

- Ukraine 2002Document8 pagesUkraine 2002Alfonso VelayosNo ratings yet

- Leveraging Training Skills Development in SMEsDocument104 pagesLeveraging Training Skills Development in SMEsMD TANVIR FAISALNo ratings yet

- Internship Report in NBUDocument13 pagesInternship Report in NBUMaksud MakhmudoffNo ratings yet

- The Cemes Prosecuw Project For Cemes SiteDocument2 pagesThe Cemes Prosecuw Project For Cemes Siteapi-252216552No ratings yet

- Bosnia - FactsheetDocument2 pagesBosnia - Factsheetapi-198396065No ratings yet

- The Essence, Functions and Role of Banks As Elements of The Banking SystemDocument4 pagesThe Essence, Functions and Role of Banks As Elements of The Banking SystemAcademic JournalNo ratings yet

- Formation of The Innovative Project Financing Model in Modern ConditionsDocument8 pagesFormation of The Innovative Project Financing Model in Modern ConditionssinginiwizNo ratings yet

- Vietnam Urban Forum PDFDocument0 pagesVietnam Urban Forum PDFxrosspointNo ratings yet

- Attachment 2 RecommendationsDocument3 pagesAttachment 2 RecommendationsEaP CSFNo ratings yet

- BB Guidelines and Application ENGDocument10 pagesBB Guidelines and Application ENGPredragDodićNo ratings yet

- The-Use-Of-European-Social-Fund-In-Socio-Economic-Integration-Case-Study-Romania - Content File PDFDocument17 pagesThe-Use-Of-European-Social-Fund-In-Socio-Economic-Integration-Case-Study-Romania - Content File PDFLaurenţiu PetrilaNo ratings yet

- Fund For Non-Governmental Organisations: Framework DocumentDocument18 pagesFund For Non-Governmental Organisations: Framework DocumentAmy AdamsNo ratings yet

- Best Practice Guide English VersionDocument74 pagesBest Practice Guide English VersionIon BragaNo ratings yet

- Establishing A Competence Technology Centre in SerbiaDocument130 pagesEstablishing A Competence Technology Centre in SerbiaOECD Global Relations100% (1)

- New Media Production Methodology - Final - enDocument109 pagesNew Media Production Methodology - Final - enNF.pl - Nowoczesna FirmaNo ratings yet

- LOD MetodologijaDocument162 pagesLOD MetodologijaHaris FadžanNo ratings yet

- Article Reivew of Financial Institution & Market EditedDocument4 pagesArticle Reivew of Financial Institution & Market EditedKetema AsfawNo ratings yet

- MCIC: Vision Mission StrategyDocument17 pagesMCIC: Vision Mission StrategyМЦМС100% (2)

- Calitatea in Adm Publ PDFDocument236 pagesCalitatea in Adm Publ PDFFelicia IacobacheNo ratings yet

- Aalborg Universitet: A Part of The Western World University Portfolio?Document13 pagesAalborg Universitet: A Part of The Western World University Portfolio?nck1983No ratings yet

- IVN MikosEN EUNeighbourhoodDocument2 pagesIVN MikosEN EUNeighbourhoodEugenio OrsiNo ratings yet

- International Aid Under the Microscope: European Union Project Cycle Management in JamaicaFrom EverandInternational Aid Under the Microscope: European Union Project Cycle Management in JamaicaNo ratings yet

- Bangkok Bank BBDocument41 pagesBangkok Bank BBkukuhNo ratings yet

- 5 Russian+LawDocument10 pages5 Russian+Lawavicenna.deskartian.margani-2020No ratings yet

- Programme Development Cooperation Cz-Bosnia and Herzegovina-2011-2017 enDocument16 pagesProgramme Development Cooperation Cz-Bosnia and Herzegovina-2011-2017 enpunxterNo ratings yet

- The Innovation Gap of National Innovation SystemsDocument14 pagesThe Innovation Gap of National Innovation SystemsAdeyanju Moshood AbiolaNo ratings yet

- IMFI 2021 02 RushchyshynDocument17 pagesIMFI 2021 02 Rushchyshynemati jossiNo ratings yet

- Analysis of Key Indicators of Uzbekistan's Level of Integration in The International Financial SystemDocument8 pagesAnalysis of Key Indicators of Uzbekistan's Level of Integration in The International Financial SystemAcademic JournalNo ratings yet

- Capacity Development For Quality Public Service Delivery at The Local Level in The Western BalkansDocument71 pagesCapacity Development For Quality Public Service Delivery at The Local Level in The Western BalkansUNDP in Europe and Central AsiaNo ratings yet

- Business Incubators For Sustainable Development in SPECA-2021-EnGDocument106 pagesBusiness Incubators For Sustainable Development in SPECA-2021-EnGNikhil AIC-SRS-NDRINo ratings yet

- RY-E Bilten 02 ENDocument8 pagesRY-E Bilten 02 ENМарија РашковскаNo ratings yet

- Facilitating Transnational Low Season Exchanges in Europe Through The Development of Social Tourism 7/G/ENT/TOU/11/511ADocument22 pagesFacilitating Transnational Low Season Exchanges in Europe Through The Development of Social Tourism 7/G/ENT/TOU/11/511ALuis RebeloNo ratings yet

- MCIC Annual Report 2009Document26 pagesMCIC Annual Report 2009МЦМСNo ratings yet

- Participant's Guidebook: Model European Union Symposium 2017Document23 pagesParticipant's Guidebook: Model European Union Symposium 2017Paula DronNo ratings yet

- Children Source Sweden 2008 Folder Concept Paper No 2 enDocument3 pagesChildren Source Sweden 2008 Folder Concept Paper No 2 enred_sudNo ratings yet

- Newsletter Observatory n.31Document5 pagesNewsletter Observatory n.31maura-albaNo ratings yet

- Civic Crowdfunding and ESFDocument15 pagesCivic Crowdfunding and ESFDiana VogliNo ratings yet

- p2p Leaflet enDocument2 pagesp2p Leaflet enMargarita IoannidouNo ratings yet

- Femip: Financing Operations in MoroccoDocument4 pagesFemip: Financing Operations in Moroccoaiman882No ratings yet

- Vacancy Note DELPAZ Gender and Social Inclusion Assistant enDocument7 pagesVacancy Note DELPAZ Gender and Social Inclusion Assistant enGerson Paulino RaksonNo ratings yet

- Municipal Spatial Planning Support Programme in KosovoDocument76 pagesMunicipal Spatial Planning Support Programme in KosovoSadije DeliuNo ratings yet

- Loan Management On The Socio-Economic Development of Beneficiaries PDFDocument69 pagesLoan Management On The Socio-Economic Development of Beneficiaries PDFnzayisenga adrienNo ratings yet

- OSI - Emergency Fund - CEC - EN - Doc2011.máj.3Document3 pagesOSI - Emergency Fund - CEC - EN - Doc2011.máj.3Civitas Europica CentralisNo ratings yet

- Guidelines For Grant ApplicantsDocument32 pagesGuidelines For Grant ApplicantsAndreea GrecuNo ratings yet

- Project Cycle Management Manual 2004 enDocument157 pagesProject Cycle Management Manual 2004 enanaleccoNo ratings yet

- A Guide To European Union Funging For NGOsDocument254 pagesA Guide To European Union Funging For NGOsМЦМС100% (1)

- 10 Writing Project ProposalsDocument52 pages10 Writing Project ProposalsMakewa100% (6)

- A1a Glossary enDocument11 pagesA1a Glossary enperfilma2013No ratings yet

- DisabilityDocument127 pagesDisabilityTiyes VillanuevaNo ratings yet

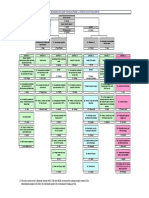

- Organisation Chart For Europeaid Co-Operation Office (01/09/10)Document1 pageOrganisation Chart For Europeaid Co-Operation Office (01/09/10)Jeffrey WheelerNo ratings yet

- ACP-EU Business Climate Facility Awarded 'Investment Climate Initiative of The Year'-2009Document1 pageACP-EU Business Climate Facility Awarded 'Investment Climate Initiative of The Year'-2009dmaproiectNo ratings yet

- Annex VI - Final Narrative ReportDocument4 pagesAnnex VI - Final Narrative ReporttijanagruNo ratings yet

- Manual For Private Sector On EU Pre-Accession AssistanceDocument26 pagesManual For Private Sector On EU Pre-Accession AssistanceteodoralexNo ratings yet

- CV - EU - Long ENDocument16 pagesCV - EU - Long ENAnakin AmeNo ratings yet

- EC JRC Final Technical Report NH4 PDFDocument103 pagesEC JRC Final Technical Report NH4 PDFImran JahanNo ratings yet

- The Securitization of The EU Development PolicyDocument14 pagesThe Securitization of The EU Development PolicyMaria-Camelia VasilovNo ratings yet

- New Prag en FinalDocument131 pagesNew Prag en Finalm_yo_yoNo ratings yet

- Project Cycle Manage and Logic Framework - Vides UndatedDocument37 pagesProject Cycle Manage and Logic Framework - Vides UndatedACENo ratings yet

- Alexis Thomas Aitken Curriculum Vitae: Personal InformationDocument9 pagesAlexis Thomas Aitken Curriculum Vitae: Personal InformationaaitkenNo ratings yet

- Journal of Ethnic and Migration Studies Volume Issue 2015 (Doi 10.1080 - 1369183X.2015.1103036) Hampshire, James - Speaking With One Voice - The European Union's Global Approach To Migration and MobilDocument17 pagesJournal of Ethnic and Migration Studies Volume Issue 2015 (Doi 10.1080 - 1369183X.2015.1103036) Hampshire, James - Speaking With One Voice - The European Union's Global Approach To Migration and MobilMihai MihaiNo ratings yet

- 2011 Resess 01 IsfereaDocument14 pages2011 Resess 01 IsfereaLeonard OdhiamboNo ratings yet

- Eprag en 10.0 PDFDocument194 pagesEprag en 10.0 PDFVali_Tronaru0% (1)

- Prag PDFDocument217 pagesPrag PDFAnte BušićNo ratings yet

- Annex Vi Interim Narrative ReportDocument3 pagesAnnex Vi Interim Narrative ReportMichelle Joy Francisco PascuaNo ratings yet

- EmploymentDocument318 pagesEmploymentximeresNo ratings yet

- Edd 2013 Programme 0711 04Document74 pagesEdd 2013 Programme 0711 04CRADALLNo ratings yet

- Annex A.2 - Full ApplicationDocument25 pagesAnnex A.2 - Full ApplicationBalša CvetkovićNo ratings yet

- Annex Vi Final Narrative ReportDocument3 pagesAnnex Vi Final Narrative ReportcarefastNo ratings yet

- Annex A2. Grant Application Form-Full Application - CLADHODocument25 pagesAnnex A2. Grant Application Form-Full Application - CLADHOKabera GodfreyNo ratings yet

- EuropeAid Annual Report 2011 On The European Union's Development and External Assistance Policies and Their ImplementationDocument200 pagesEuropeAid Annual Report 2011 On The European Union's Development and External Assistance Policies and Their ImplementationDiagram_ConsultoresNo ratings yet

- TradcvDocument1 pageTradcvashifNo ratings yet