Professional Documents

Culture Documents

CH 2 Notes

CH 2 Notes

Uploaded by

Vincent TranOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 2 Notes

CH 2 Notes

Uploaded by

Vincent TranCopyright:

Available Formats

Debits & Credits The Language of Accounting I have put together and used a mnemonic device for years

to teach the most confusing and basic language of Accounting- Debits and Credits. Before I explain these terms, I want you to: Not to relate it to the debits and credits in your checkbook Debit has nothing to do with the word Debt (owing money). Word Debit is abbreviated is Dr. and Credit is abbreviated is Cr. Meaning of the word Dr. and Cr. could be a +/- depending on the account

Listed below are six account categories that you need to learn about: Assets Liabilities Common stock Dividends Revenue Expenses After Eating Dinner Lets Read Comics First letter of each of these words in the mnemonic is the first letter of the account category. So: After = Assets Eating = Expenses Dinner = Dividends Lets = Liabilities Read = Revenue Comics = Common Stock

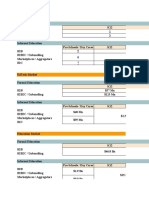

After Eating Dinner on the Dr. side means that Assets, Expenses and Dividends have a normal Dr. balances, which also means that they increase on the Dr. side and also that they decrease on the Cr. side (opposite side ) Lets Read Comics on the Cr. side means that Liabilities, Revenue and Common Stock have a normal Cr. balances, which also means that they increase on the Cr. side and also that they decrease on the Dr. side (opposite side). Below is a T account. Left side of the T account is the Dr. and right side is Cr. T Account Debit side After Eating Dinner Assets Expenses Dividends Increased with debits Normal balance is Debit Credit side Lets Read Comics Liabilities Revenue Common stock Increased with credits Normal balance is Credit

to lps nd He ersta ing t d un oun acc cess pro

ACCOUNTING CYCLE

Chart of Accounts is a list of accounts that the business uses and sits on the side to be referred for account titles to be used. Account numbers do not matter, as long as you understand that every category starts with the same digit or start with digits within a certain range. Following is the flowchart showing the accounting cycle process. Source Document (receipts, invoices, bills, check stubs etc)

General Journal (aka Book of original entry) Daily

General Ledger (formal T accounts that keep track on acct balances) Daily

Trial Balance-(shows balances of accounts) End of month/acctg period

Adjusting entries (worksheet optional)

Financial Statements-(Income Statement,Retained Earnings,Balance Sheet,Cash Flow) End of month/acctg period.

Closing Entries

Post closing trial balance

Following are some of the tips that you can use to journalize transactions:

Learn Dr./Cr. by account category not individual accts. E.g. Assets have normal Dr. balance. There is no to memorize by each asset account. Re'd cash/$=Cash Dr. because Cash is increasing Paid $ =Cash Cr. because it is decreasing Paid on account=Cash Cr. because it is decreasing but A/P Dr.because it is decreasing too. Bought on account=A/P increase, cr. Re'd $ on account=A/R Payables are liabilities. Liabilities almost always have a word PAYABLE except the Unearned Revenue. Expense and Dividends will always be debited for the time being. Revenue and Common Stock will always be credited for the time being. Journal entries should always list the account/accounts to be debited first.

You might also like

- Introduction To Accounting - Lecture NotesDocument25 pagesIntroduction To Accounting - Lecture NotesMUNAWAR ALI96% (110)

- Bookkeeping 101Document4 pagesBookkeeping 101bjaykc_46100% (1)

- Case 2-The Beer IndustryDocument13 pagesCase 2-The Beer IndustrypatiseNo ratings yet

- Assignment 1Document2 pagesAssignment 1Usmän MïrżäNo ratings yet

- Accounting Survival Guide: An Introduction to Accounting for BeginnersFrom EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNo ratings yet

- Chapter 4 Books of Accounts and Double Entry SystemDocument61 pagesChapter 4 Books of Accounts and Double Entry SystemMonica BuscatoNo ratings yet

- Introduction To Debits and CreditsDocument12 pagesIntroduction To Debits and CreditskjvillNo ratings yet

- CIPD Job EvaluationDocument5 pagesCIPD Job EvaluationMathew Jc100% (2)

- The Practice of Civil EngineeringDocument4 pagesThe Practice of Civil EngineeringMirabella Di Bastida71% (7)

- A Framework For The Design of Warehouse Layout: Mohsen M.D. HassanDocument9 pagesA Framework For The Design of Warehouse Layout: Mohsen M.D. HassanHo Van RoiNo ratings yet

- Post Market Surveillance SOPDocument8 pagesPost Market Surveillance SOPgopinathNo ratings yet

- Imt Online Assignments & Project ReportDocument3 pagesImt Online Assignments & Project ReportEDUCARE INSTITUTE100% (1)

- General Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementDocument11 pagesGeneral Ledger Debits and Credits Normal Account Balances Journal Entries The Income Statementpri_dulkar4679No ratings yet

- 2 Rules of Debit and CreditDocument3 pages2 Rules of Debit and Creditapi-2992659160% (1)

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!From EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Rating: 2 out of 5 stars2/5 (1)

- Chapter 4Document70 pagesChapter 4api-358995037No ratings yet

- Debit Credit 2 RevDocument23 pagesDebit Credit 2 RevRuffa GarciaNo ratings yet

- CH 03Document12 pagesCH 03bbaahmad89No ratings yet

- Accounting For Management: Mba 1 Semester Amity Global Business School Ms. Kavitha MenonDocument41 pagesAccounting For Management: Mba 1 Semester Amity Global Business School Ms. Kavitha Menongurudeep25100% (3)

- Debits and CreditsDocument6 pagesDebits and CreditsmelisaNo ratings yet

- Accounting PrinciplesDocument13 pagesAccounting PrinciplesDGTM online platformNo ratings yet

- Ebook Bookkeeping Accounting Basics PDFDocument30 pagesEbook Bookkeeping Accounting Basics PDFRohit Kumar MohantyNo ratings yet

- General Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementDocument15 pagesGeneral Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementPriyashini RajasegaranNo ratings yet

- CHP 1 and 2 BbaDocument73 pagesCHP 1 and 2 BbaBarkkha MakhijaNo ratings yet

- 16 Accounting BasicsDocument3 pages16 Accounting BasicsSaurabh SinghNo ratings yet

- Accounting BasicsDocument13 pagesAccounting BasicsJerusa May CabinganNo ratings yet

- Basis of Debit and CreditDocument17 pagesBasis of Debit and CreditBanaras KhanNo ratings yet

- Imp Accounts KnowledgeDocument17 pagesImp Accounts KnowledgenomanshafiqueNo ratings yet

- Accounting - Basic Accounting: General LedgerDocument10 pagesAccounting - Basic Accounting: General LedgerEstelarisNo ratings yet

- Book Keeping PGDMDocument2 pagesBook Keeping PGDMShagufta AliNo ratings yet

- Chapter 2 Debits - CreditsDocument3 pagesChapter 2 Debits - CreditsMah NoorNo ratings yet

- Accounting BasicsDocument30 pagesAccounting BasicsAsciel Hizon MorcoNo ratings yet

- Journal and LedgerDocument15 pagesJournal and LedgerTophe ProvidoNo ratings yet

- Accounting Manual On Double Entry System of AccountingDocument12 pagesAccounting Manual On Double Entry System of AccountingGaurav TrivediNo ratings yet

- ACNT1303lecture NotesDocument16 pagesACNT1303lecture NotesgrunebodNo ratings yet

- Debit Credit 4Document23 pagesDebit Credit 4Neema EzekielNo ratings yet

- Debit Credit Chart PDFDocument7 pagesDebit Credit Chart PDFdbistaNo ratings yet

- 2 Debits and CreditsDocument16 pages2 Debits and Creditswannisa maheswari100% (1)

- General LedgerDocument9 pagesGeneral Ledgerananth-jNo ratings yet

- Basics of AccountingDocument20 pagesBasics of AccountingvirtualNo ratings yet

- Chapter 4 AccountingDocument22 pagesChapter 4 AccountingChan Man SeongNo ratings yet

- HowtosolveDocument2 pagesHowtosolveShevina MaghariNo ratings yet

- Principles of Book-Keeping: Accounting EntriesDocument42 pagesPrinciples of Book-Keeping: Accounting EntriesJanine padronesNo ratings yet

- Debit and CreditDocument3 pagesDebit and CreditGretchel Jane MagduraNo ratings yet

- Accounting Prepare A Trial BalanceDocument7 pagesAccounting Prepare A Trial BalanceMeynard BatasNo ratings yet

- Chart of AccountsDocument35 pagesChart of AccountsbatowiiseNo ratings yet

- To Enter A Deposit or WithdrawalDocument4 pagesTo Enter A Deposit or WithdrawalDereje mathewosNo ratings yet

- Omitted in Actual Practice. They Are Shown Here For Illustrative Purposes, So The Student Can See How The Chart ofDocument10 pagesOmitted in Actual Practice. They Are Shown Here For Illustrative Purposes, So The Student Can See How The Chart ofashishyadukaNo ratings yet

- Debits and CreditsDocument14 pagesDebits and CreditsLyca SorianoNo ratings yet

- Accountancy/Introduction To AccountancyDocument16 pagesAccountancy/Introduction To AccountancyfaceandmaskNo ratings yet

- Accounting Journal EntriesDocument9 pagesAccounting Journal EntriesadnanNo ratings yet

- Engineering Economics: Ali SalmanDocument13 pagesEngineering Economics: Ali SalmanJunaid YNo ratings yet

- An Accounting Expression Starts WithDocument2 pagesAn Accounting Expression Starts WithChand .TandonNo ratings yet

- ACCT Accounting Chapter 2Document5 pagesACCT Accounting Chapter 2Lemopi Emelda MandiNo ratings yet

- 1 Debit and Credit in AccountingDocument3 pages1 Debit and Credit in AccountingmamakamilaikasiNo ratings yet

- Rules of Debits and CreditsDocument2 pagesRules of Debits and CreditsRadhika PatkeNo ratings yet

- Accounting BasicsDocument3 pagesAccounting BasicsJereen PerpetuaNo ratings yet

- Accounting KnowledgeDocument6 pagesAccounting KnowledgeAung TikeNo ratings yet

- O Levels Accounting NotesDocument10 pagesO Levels Accounting Notesoalevels90% (20)

- Assets Liabilities + Owner's EquityDocument17 pagesAssets Liabilities + Owner's Equityapi-302931669No ratings yet

- Mba AssignmentsDocument8 pagesMba AssignmentsRamani RajNo ratings yet

- Accounting in BanksDocument27 pagesAccounting in BankssaktipadhiNo ratings yet

- Accounting Study Guide #1Document16 pagesAccounting Study Guide #1j_rapps100% (1)

- Accounting in BanksDocument27 pagesAccounting in BankssaktipadhiNo ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- Bookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)From EverandBookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)No ratings yet

- Decision 120 Factoring) enDocument9 pagesDecision 120 Factoring) enKailash KhatriNo ratings yet

- Pob SbaDocument21 pagesPob SbaDaniel DowdingNo ratings yet

- Implementation Docu SAP S4HANA Loc Extension Belarus EPAM ENDocument31 pagesImplementation Docu SAP S4HANA Loc Extension Belarus EPAM ENksoleti8254No ratings yet

- ADILI LOANPOLICY OperationDocument20 pagesADILI LOANPOLICY OperationPaschal KunambiNo ratings yet

- Advantages of AuditingDocument3 pagesAdvantages of AuditingNikita ChavanNo ratings yet

- Sri Varsha Food Products India Limited RRDocument8 pagesSri Varsha Food Products India Limited RRlucky goudNo ratings yet

- One Stop Solution Business PlanDocument30 pagesOne Stop Solution Business Planshweta_narkhede01No ratings yet

- AX2012 HRMDocument12 pagesAX2012 HRMShailendra Kumar RajputNo ratings yet

- Term-Paper On Marketing Strategy of PRAN, A Fast Food ChainDocument10 pagesTerm-Paper On Marketing Strategy of PRAN, A Fast Food ChainMollah Md Naim100% (3)

- 12-ACCA-FA2-Chp 12Document26 pages12-ACCA-FA2-Chp 12SMS PrintingNo ratings yet

- New Thesis 2078.08.13Document41 pagesNew Thesis 2078.08.13MADHU KHANALNo ratings yet

- Quiz Corporation Law May 11 2020Document2 pagesQuiz Corporation Law May 11 2020Mark Anthony Ruiz DelmoNo ratings yet

- Rezy Pablio Mabao - SAS 3Document7 pagesRezy Pablio Mabao - SAS 3Reymark BaldoNo ratings yet

- Google Sheets - Transaction Analysis SheetDocument3 pagesGoogle Sheets - Transaction Analysis Sheetramenr227No ratings yet

- Jollibee: HistoryDocument10 pagesJollibee: HistoryDodi TeodoroNo ratings yet

- (External) Blume Ventures EdTech Market SizingDocument32 pages(External) Blume Ventures EdTech Market Sizingbhanu64No ratings yet

- Decathlon India: My Responsibilities As A Retail LogisticianDocument2 pagesDecathlon India: My Responsibilities As A Retail LogisticianRahul RajeevanNo ratings yet

- Purchasing and Supply Management 16Th Edition Johnson Solutions Manual Full Chapter PDFDocument43 pagesPurchasing and Supply Management 16Th Edition Johnson Solutions Manual Full Chapter PDFkennethwolfeycqrzmaobe100% (11)

- Project Report Balaji WafersDocument30 pagesProject Report Balaji WafersDev Dev27% (11)

- Bank of England Iso 20022 Consultation PaperDocument65 pagesBank of England Iso 20022 Consultation PaperCrowdfundInsider100% (1)

- Postage and Courier Exp ChecklistDocument2 pagesPostage and Courier Exp ChecklistMichelle Domanacal UrsabiaNo ratings yet

- 1.5.3 Business ObjectivesDocument29 pages1.5.3 Business Objectivesmohammedabunaja10No ratings yet

- Basundhara Wet Tisu MKT PlanDocument15 pagesBasundhara Wet Tisu MKT PlanNiaz FerdousNo ratings yet