Professional Documents

Culture Documents

Technical Report 27th February 2012

Technical Report 27th February 2012

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Report 27th February 2012

Technical Report 27th February 2012

Uploaded by

Angel BrokingCopyright:

Available Formats

Technical Research | February 27, 2012

Daily Technical Report Sensex (17924) / NIFTY (5429)

On Friday, markets opened on a negative note and strong selling pressure in the later half led indices to close deep in red. On the sectoral front, Capital Goods, Realty and Banking counters were among the major losers, whereas Metal and Teck sectors ended on a gaining side. The advance to decline ratio was strongly in favor of declining counters. (A=1085 D=1820) (Source -www.bseindia.com)

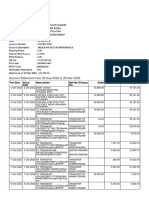

Exhibit 1: Nifty Daily Chart

Formation:

The 200-day SMA and 20-day EMA have now shifted to 17200 / 5170 and 17720 / 5370, respectively. The RSI-Smoothened oscillator and 3 & 8 EMA on the daily chart have given a negative crossover. The weekly Stochastic oscillator is negatively poised. The 61.8% Fibonacci retracement level of the fall 21109 / 6339 (November 5, 2010) to 15135 / 4531 (December 23, 2011) is around 18827 / 5645.

Source: Falcon

Trading strategy:

Last week indices corrected after nearing their resistance zone of 18756 / 5645. We are now observing that this resistance zone almost coincides with the 61.8% Fibonacci Retracement level of the fall from 21109 / 6339 (November 5, 2010) to 15135 / 4531 (December 23, 2011). Further, we are observing a negative placement of Daily RSISmoothened, 3 & 8 daily EMA and Weekly Stochastic oscillators. This indicates possibility of a further correction or consolidation. At present, indices have a decent support zone around its Daily 20-EMA level of 17720 / 5370. The negative impact of above mentioned technical observations will be seen only if indices sustain below 17720 / 5370 level. In this scenario, the possibility of testing 17500 17200 / 5300 5200 levels cannot be ruled out.

Actionable points:

View Resistance Levels Support levels Neutral 5522 5561 5405 5370 5300

Conversely, the immediate resistance is at 18200 / 5522 level. A move beyond this level may push indices higher to test 18293 18524 / 5561 5630 levels. In the short term, markets have a stiff resistance zone of 18756 18524 / 5645 5630 levels. If indices manage to cross this resistance zone then they are likely to test important resistance of 18945 / 5702 level. We reiterate that traders should adopt approach and trade with strict stop-loss. cautious

For Private Circulation Only |

Technical Research | February 27, 2012

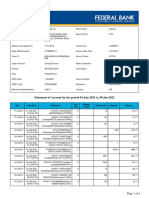

Bank Nifty Outlook - (10507)

On Friday, Bank Nifty opened flat but traded with negative bias throughout the day to close in red. Selling pressure intensified below the mentioned support of 10630 and Bank Nifty ended with a loss of almost 2%. On the Daily chart, we are witnessing negative crossover of 3 & 8 EMA which suggests the correction could continue. However, the 20 Day EMA placed at 10390 could act as a crucial support for the index. Therefore, only if Bank Nifty sustains below 10390 then we may witness further selling pressure till 10340 10220 levels. On the upside, 10590 10680 levels could act as resistance for the day. Exhibit 2: Bank Nifty Daily Chart

Actionable points:

View Expected Target Resistance Levels Bearish below 10390 10340 10220 10590 10680

Source: Falcon

For Private Circulation Only |

Technical Research | February 27, 2012

Positive Bias:

Expected Target 1115

Stock Name COLPAL

CMP 1056.5

5 Day EMA 1028.3

20 Day EMA 1010

Remarks View will change below 1010

For Private Circulation Only |

Technical Research | February 27, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS SENSEX NIFTY BANKNIFTY ACC AMBUJACEM AXISBANK BAJAJ-AUTO BHARTIARTL BHEL BPCL CAIRN CIPLA COALINDIA DLF DRREDDY GAIL HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RCOM RELIANCE RELINFRA RPOWER SAIL SBIN SESAGOA SIEMENS STER SUNPHARMA SUZLON TATAMOTORS TATAPOWER TATASTEEL TCS WIPRO S2 17,641 5,337 10,244 1,217 156 1,132 1,718 334 291 635 370 309 316 216 1,605 369 474 645 505 2,028 143 380 905 132 2,898 207 595 72 529 1,292 711 1,268 61 274 923 112 413 89 798 556 113 102 2,127 218 264 114 532 25 258 109 460 1,246 428 S1 17,782 5,383 10,375 1,243 158 1,158 1,741 338 298 645 376 312 322 221 1,617 372 484 661 515 2,050 146 383 919 136 2,923 208 604 73 540 1,320 720 1,277 122 279 944 113 421 91 809 570 116 104 2,166 222 528 116 540 26 262 111 468 1,258 433 PIVOT 17,990 5,452 10,567 1,281 161 1,202 1,775 343 308 657 383 315 326 231 1,634 376 492 673 525 2,080 148 387 931 142 2,949 210 611 75 558 1,369 730 1,287 61 287 982 114 433 95 825 592 119 105 2,235 228 264 119 546 27 267 113 474 1,269 440 R1 18,132 5,499 10,699 1,307 163 1,228 1,798 347 314 668 389 318 332 236 1,646 379 501 689 535 2,102 151 390 944 146 2,974 211 620 76 569 1,397 740 1,295 122 292 1,003 115 440 97 836 607 122 107 2,274 232 528 121 554 28 270 116 482 1,281 445 R2 18,339 5,568 10,891 1,345 166 1,272 1,832 352 324 680 397 321 336 245 1,663 383 509 701 545 2,131 154 393 957 151 2,999 212 628 78 587 1,446 749 1,305 61 299 1,041 117 452 100 853 629 125 108 2,343 238 264 123 560 29 275 117 489 1,293 453

Technical Research Team

For Private Circulation Only |

Technical Research |Technical27, 2012 February Report

RESEARCH TEAM

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Mehul Kothari Ankur Lakhotia Head - Technicals Technical Analyst Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to sameet.chavan@angelbroking.com Research Team: 022-3952 6600 Website: www.angelbroking.com

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not

be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals. We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions. Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past.

Sebi Registration No : INB 010996539

For Private Circulation Only |

You might also like

- CFA Level 1 Quantitative Analysis E Book - Part 1Document26 pagesCFA Level 1 Quantitative Analysis E Book - Part 1Zacharia VincentNo ratings yet

- An Alternative To Conventional Bond-Swap Curve PositionsDocument45 pagesAn Alternative To Conventional Bond-Swap Curve PositionsJay Prakash SavageNo ratings yet

- Technical Report 28th February 2012Document5 pagesTechnical Report 28th February 2012Angel BrokingNo ratings yet

- Technical Report 24th February 2012Document5 pagesTechnical Report 24th February 2012Angel BrokingNo ratings yet

- Technical Report 20th March 2012Document5 pagesTechnical Report 20th March 2012Angel BrokingNo ratings yet

- Technical Report 2nd March 2012Document5 pagesTechnical Report 2nd March 2012Angel BrokingNo ratings yet

- Technical Report 29th February 2012Document5 pagesTechnical Report 29th February 2012Angel BrokingNo ratings yet

- Technical Teport 2nd February 2012Document5 pagesTechnical Teport 2nd February 2012Angel BrokingNo ratings yet

- Technical Report 20th April 2012Document5 pagesTechnical Report 20th April 2012Angel BrokingNo ratings yet

- Technical Report 5th March 2012Document5 pagesTechnical Report 5th March 2012Angel BrokingNo ratings yet

- Technical Report 7th March 2012Document5 pagesTechnical Report 7th March 2012Angel BrokingNo ratings yet

- Technical Report 23rd April 2012Document5 pagesTechnical Report 23rd April 2012Angel BrokingNo ratings yet

- Technical Report 16th April 2012Document5 pagesTechnical Report 16th April 2012Angel BrokingNo ratings yet

- Technical Report 15th February 2012Document5 pagesTechnical Report 15th February 2012Angel BrokingNo ratings yet

- Technical Report 13th February 2012Document5 pagesTechnical Report 13th February 2012Angel BrokingNo ratings yet

- Technical Report 21st February 2012Document5 pagesTechnical Report 21st February 2012Angel BrokingNo ratings yet

- Technical Report 3rd February 2012Document5 pagesTechnical Report 3rd February 2012Angel BrokingNo ratings yet

- Technical Report 10th April 2012Document5 pagesTechnical Report 10th April 2012Angel BrokingNo ratings yet

- Technical Report 8th February 2012Document5 pagesTechnical Report 8th February 2012Angel BrokingNo ratings yet

- Technical Report 9th February 2012Document5 pagesTechnical Report 9th February 2012Angel BrokingNo ratings yet

- Technical Report 30th January 2012Document5 pagesTechnical Report 30th January 2012Angel BrokingNo ratings yet

- Technical Report 26th March 2012Document5 pagesTechnical Report 26th March 2012Angel BrokingNo ratings yet

- Technical Report 12th April 2012Document5 pagesTechnical Report 12th April 2012Angel BrokingNo ratings yet

- Technical Report 6th February 2012Document5 pagesTechnical Report 6th February 2012Angel BrokingNo ratings yet

- Daily Technical Report: FormationDocument5 pagesDaily Technical Report: FormationAngel BrokingNo ratings yet

- Technical Report 12th March 2012Document5 pagesTechnical Report 12th March 2012Angel BrokingNo ratings yet

- Technical Report 7th February 2012Document5 pagesTechnical Report 7th February 2012Angel BrokingNo ratings yet

- Technical Report 21st March 2012Document5 pagesTechnical Report 21st March 2012Angel BrokingNo ratings yet

- Technical Report 24th April 2012Document5 pagesTechnical Report 24th April 2012Angel BrokingNo ratings yet

- Technical Report 9th April 2012Document5 pagesTechnical Report 9th April 2012Angel BrokingNo ratings yet

- Technical Report 1st March 2012Document5 pagesTechnical Report 1st March 2012Angel BrokingNo ratings yet

- Technical Report 22nd March 2012Document5 pagesTechnical Report 22nd March 2012Angel BrokingNo ratings yet

- Technical Report 17th February 2012Document5 pagesTechnical Report 17th February 2012Angel BrokingNo ratings yet

- Technical Report 27th March 2012Document5 pagesTechnical Report 27th March 2012Angel BrokingNo ratings yet

- Technical Report 25th April 2012Document5 pagesTechnical Report 25th April 2012Angel BrokingNo ratings yet

- Technical Report 4th April 2012Document5 pagesTechnical Report 4th April 2012Angel BrokingNo ratings yet

- Daily Technical Report: FormationDocument5 pagesDaily Technical Report: FormationAngel BrokingNo ratings yet

- Technical Report 22 ND February 2012Document5 pagesTechnical Report 22 ND February 2012Angel BrokingNo ratings yet

- Technical Report 27th April 2012Document5 pagesTechnical Report 27th April 2012Angel BrokingNo ratings yet

- Technical Report 29th March 2012Document5 pagesTechnical Report 29th March 2012Angel BrokingNo ratings yet

- Technical Report 23rd January 2012Document5 pagesTechnical Report 23rd January 2012Angel BrokingNo ratings yet

- Technical Report 26th April 2012Document5 pagesTechnical Report 26th April 2012Angel BrokingNo ratings yet

- Technical Report 23rd February 2012Document5 pagesTechnical Report 23rd February 2012Angel BrokingNo ratings yet

- Technical Report 28th March 2012Document5 pagesTechnical Report 28th March 2012Angel BrokingNo ratings yet

- Technical Report 13th March 2012Document5 pagesTechnical Report 13th March 2012Angel BrokingNo ratings yet

- Technical Report 30th March 2012Document5 pagesTechnical Report 30th March 2012Angel BrokingNo ratings yet

- Technical Report 9th March 2012Document5 pagesTechnical Report 9th March 2012Angel BrokingNo ratings yet

- Technical Report 19th March 2012Document5 pagesTechnical Report 19th March 2012Angel BrokingNo ratings yet

- Technical Report 20th December 2011Document5 pagesTechnical Report 20th December 2011Angel BrokingNo ratings yet

- Technical Report 1st November 2011Document5 pagesTechnical Report 1st November 2011Angel BrokingNo ratings yet

- Technical Report 2nd November 2011Document5 pagesTechnical Report 2nd November 2011Angel BrokingNo ratings yet

- Technical Report 16th March 2012Document5 pagesTechnical Report 16th March 2012Angel BrokingNo ratings yet

- Technical Report 14th February 2012Document5 pagesTechnical Report 14th February 2012Angel BrokingNo ratings yet

- Technical Report 17th April 2012Document5 pagesTechnical Report 17th April 2012Angel BrokingNo ratings yet

- Technical Report 27th January 2012Document5 pagesTechnical Report 27th January 2012Angel BrokingNo ratings yet

- Technical Report 4th November 2011Document5 pagesTechnical Report 4th November 2011Angel BrokingNo ratings yet

- Technical Report 31st January 2012Document5 pagesTechnical Report 31st January 2012Angel BrokingNo ratings yet

- Technical Report 14th March 2012Document5 pagesTechnical Report 14th March 2012Angel BrokingNo ratings yet

- Technical Report 16th February 2012Document5 pagesTechnical Report 16th February 2012Angel BrokingNo ratings yet

- Technical Report 25th October 2011Document5 pagesTechnical Report 25th October 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (17214) / NIFTY (5227)Document4 pagesDaily Technical Report: Sensex (17214) / NIFTY (5227)Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Ambit Capital Financial Shenanigans Detection Methods - JUNE 2017 - V3Document27 pagesAmbit Capital Financial Shenanigans Detection Methods - JUNE 2017 - V3me_girish_deshpande100% (1)

- Module 6 IRR and Payback PeriodDocument13 pagesModule 6 IRR and Payback PeriodRhonita Dea AndariniNo ratings yet

- CH 13b BASICS OF CAPITAL BUDGETINGDocument2 pagesCH 13b BASICS OF CAPITAL BUDGETINGSadia YasmeenNo ratings yet

- N I Act 1881Document42 pagesN I Act 1881Hemendra GuptaNo ratings yet

- Mcom Sem IV SyllabusDocument4 pagesMcom Sem IV Syllabuspratik upaseNo ratings yet

- Golden Star Resource Limited Financial Statements AnalysisDocument9 pagesGolden Star Resource Limited Financial Statements AnalysisTetteh Mensah SolomonNo ratings yet

- ACC 106 - Table of Specifications Final Exam CoverageDocument1 pageACC 106 - Table of Specifications Final Exam CoverageEunice Lyafe PanilagNo ratings yet

- Research Paper On FCIDocument12 pagesResearch Paper On FCIAnkit RastogiNo ratings yet

- Manulife SmartRetire (II) English BrochureDocument2 pagesManulife SmartRetire (II) English BrochurePhan Gia HuấnNo ratings yet

- Business Correspondence ModelDocument85 pagesBusiness Correspondence ModelAmruta Patil100% (1)

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsJustine VeralloNo ratings yet

- StatementXXXXXXXXX1798 PragatikumariDocument5 pagesStatementXXXXXXXXX1798 PragatikumariAdventurous FreakNo ratings yet

- Macroeconomics - Session 10Document13 pagesMacroeconomics - Session 10Plok TingNo ratings yet

- Cambridge O Level: Accounting 7707/13Document12 pagesCambridge O Level: Accounting 7707/13Geerish BissessurNo ratings yet

- JAIIB Paper 4 Module A Unit 1 Retail Banking Introduction (RBWM) - B7e20c2b Bf12 4775 9290 Ec32fd5f6314Document5 pagesJAIIB Paper 4 Module A Unit 1 Retail Banking Introduction (RBWM) - B7e20c2b Bf12 4775 9290 Ec32fd5f6314sushant gawdeNo ratings yet

- Mbe SyllabusDocument47 pagesMbe SyllabussanyasamNo ratings yet

- U6Document10 pagesU6Lê ThưNo ratings yet

- Form PDF 250740030290722Document9 pagesForm PDF 250740030290722ANSH FFNo ratings yet

- Boost Africa TradersDocument14 pagesBoost Africa TradersDesire JoshuaNo ratings yet

- Project FinanceDocument3 pagesProject FinanceSonam GoyalNo ratings yet

- Forum R. Chudasama, MFM Batch Roll No. 215, Assignment 1: ServicesDocument5 pagesForum R. Chudasama, MFM Batch Roll No. 215, Assignment 1: Servicesrohit kanojiaNo ratings yet

- (Factsheet) MBBT-19110014Document4 pages(Factsheet) MBBT-19110014Zen LohNo ratings yet

- Internship Report EBLDocument144 pagesInternship Report EBLaareef37No ratings yet

- Role of TaxationDocument5 pagesRole of TaxationCarlo Francis Palma100% (1)

- Statement of Account For The Period 01-Jun-2021 To 30-Jun-2021Document4 pagesStatement of Account For The Period 01-Jun-2021 To 30-Jun-2021Vicky GunaNo ratings yet

- Sample Problems Solutions Sections 2.3 & 2.4.: R P P M A R MDocument5 pagesSample Problems Solutions Sections 2.3 & 2.4.: R P P M A R MTerry Clarice DecatoriaNo ratings yet

- Cash Handling Charges Waiver ProposalDocument3 pagesCash Handling Charges Waiver ProposalSS DA BANKERNo ratings yet