Professional Documents

Culture Documents

Pset 4

Pset 4

Uploaded by

earlstOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pset 4

Pset 4

Uploaded by

earlstCopyright:

Available Formats

MIT OpenCourseWare http://ocw.mit.

edu

6.00 Introduction to Computer Science and Programming

Fall 2008

For information about citing these materials or our Terms of Use, visit: http://ocw.mit.edu/terms.

6.00: Introduction to Computer Science and Programming

Problem Set 4

Handed out: Tuesday, September 24, 2008.

Due: 11:59pm, Tuesday, September 30, 2008.

Introduction

This problem set will introduce you to using successive approximation, as well as data structures such as tuples and lists.

Collaboration

You may work with other students. However, each student should write up and hand in his or her assignment separately. Be sure to indicate with whom you have worked. For further detail, please review the collaboration policy as stated in the syllabus.

Submission

This problem set, and future ones, will be auto-graded by a test harness. The test harness will expect your files to include just function definitions, with no executable code outside the function definitions. All your testing code should be in the appropriate test function, which is provided in the template; for example, the testing code for the futureRetire() problem should be in testFutureRetire(). Be sure to add test cases to these test functions beyond what is provided in the template!

Planning for the future

Recent events in the stock market may seem remote to you, but they underscore the uncertainty of planning for the future. People who had been thinking of retiring in the next year or so may have to rethink those plans, as the value of their 401K accounts drops noticeably. Although retirement may seem a long way off for you, we are going to explore some simple ideas in accruing funds. Along the way, we are going to explore the use of successive approximation methods, as well as the use of some simple data structures, like lists. We are going to start with a simple model of saving for retirement. Many employers will contribute the equivalent of 5% of your salary to a retirement fund, and then will match any contribution that you add, dollar for dollar, up to an additional 5%. Thus you can salt away up to 15% of your salary into a retirement account (10% of which comes as a bonus from your employer). We can model a retirement fund with some simple equations. Assume your starting salary is represented by salary; that the percentage of your salary you put into a retirement fund is save; and that the annual growth percentage of the retirement fund is growthRate. Then your retirement fund, represented by the list F, should increase as follows:

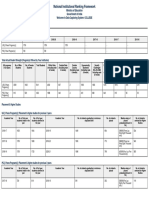

Retirement fund End of year 1 F[0] = salary * save * 0.01 End of year 2 F[1] = F[0] * (1 + 0.01 * growthRate) + salary * save * 0.01 End of year 3 F[2] = F[1] * (1 + 0.01 * growthRate) + salary * save * 0.01 This process continues each year, with your retirement fund growing both by new contributions and by growth of the principal. Throughout this problem set, growth rates will always be positive (this is not true in the real world, alas!). Problem 1. Write a function, called nestEggFixed, which takes four arguments: a salary, a percentage of your salary to save in an investment account, an annual growth percentage for the investment account, and a number of years to work. This function should return a list, whose values are the size of your retirement account at the end of each year, with the most recent years value at the end of the list. Complete the implementation of: def nestEggFixed (salary, save, growthRate, years): Write your code in the appropriate place in the ps4.py template. To test your function, run the test cases in the test function testNestEggFixed(). You should add additional test cases to this function to further test your code. This first model is pretty simple. Clearly, the market does not grow at a constant rate. So a better model would be to account for variations in growth percentage each year. Problem 2. Write a function, called nestEggVariable, which takes three arguments: a salary (salary), a percentage of your salary to save (save), and a list of annual growth percentages on investments (growthRates). The length of the last argument defines the number of years you plan to work; growthRates[0] is the growth rate of the first year, growthRates[1] is the growth rate of the second year, etc. (Note that because the retirement funds initial value is 0, growthRates[0] is, in fact, irrelevant.) This function should return a list, whose values are the size of your retirement account at the end of each year. Complete the implementation of: def nestEggVariable(salary, save, growthRates): Write your code in the appropriate place in the ps4.py template. To test your function, run the test cases in the test function testNestEggVariable(). You should add additional test cases to this function to further test your code. Of course, once you retire you will want to be able to withdraw some amount of money each

year for living expenses. You can use your previous code to get the size of your retirement fund when you stop working. Now we want to model how much you can withdraw to spend each year after retirement. Suppose that, after retirement, your retirement fund continues to grow according to a list of annual growth percentages on investments ( growthRates ), while your annual expenses are constant (wouldnt zero percent inflation be nice?), called expenses. To see how your retirement fund will change after retirement, we can use the following chart, where we let F represent the size of the retirement fund at the time of retirement, and we let expenses represent the amount of money we withdraw in the first year to cover our living costs: Retirement fund End of year 1 F[0] = savings * (1 + 0.01 * growthRates[0]) expenses End of year 2 F[1] = F[0] * (1 + 0.01 * growthRates[1]) expenses End of year 3 F[2] = F[1] * (1 + 0.01 * growthRates[2]) expenses Problem 3. Write a function, called postRetirement, which takes three arguments: an initial amount of money in your retirement fund (savings), a list of annual growth percentages on investments while you are retired (growthRates), and your annual expenses (expenses). Assume that the increase in the investment account savings is calculated before subtracting the annual expenditures (as shown in the above table). Your function should return a list of fund sizes after each year of retirement, accounting for annual expenses and the growth of the retirement fund. Like problem 2, the length of the growthRates argument defines the number of years you plan to be retired. Note that if the retirement fund balance becomes negative, expenditures should continue to be subtracted, and the growth rate comes to represent the interest rate on the debt (i.e. the formulas in the above table still apply). Complete the definition for: def postRetirement(savings, growthRates, expenses): Write your code in the appropriate place in the ps4.py template. To test your function, run the test cases in the test function testPostRetirement(). You should add additional test cases to this function to further test your code. Suppose you would like to budget your annual expenses such that by the time you pass on, you will have no retirement funds left (you plan to follow the Andrew Carnegie model and leave no money for your children). One way to determine what your expense budget should be is to try feeding different values of expenses to postRetirement(). You can automate this by using the idea of successive approximation introduced in lecture. Remember that in lecture, we saw the idea of binary search. In that example, we were trying to find the square root of a number, and we did this by picking a high and low value that we knew bounded the answer (i.e. the answer lay between low and high), and then testing the average of high and low to see how close it was to the right answer (within epsilon absolute difference). If it was close enough, we stopped; if not, we changed the range of values, either making our new low value be the average of the previous low and high, and keeping the old

high, or making our new high value the average of the previous low and high, and keeping the old low, depending on the result of our test. You can use the same idea here. Problem 4. Write a function, called findMaxExpenses, which takes five arguments: a salary (salary), a percentage of your salary to save (save), a list of annual growth percentages on investments while you are still working (preRetireGrowthRates), a list of annual growth percentages on investments while you are retired (postRetireGrowthRates), and a value for epsilon (epsilon). As with problems 2 and 3, the lengths of preRetireGrowthRates and postRetireGrowthRates determine the number of years you plan to be working and retired, respectively. Use the idea of binary search to find a value for the amount of expenses you can withdraw each year from your retirement fund, such that at the end of your retirement, the absolute value of the amount remaining in your retirement fund is less than epsilon (note that you can overdraw by a small amount). Start with a range of possible values for your annual expenses between 0 and your savings at the start of your retirement (HINT #1: this can be determined by utilizing your solution to problem 2). Your function should print out the current estimate for the amount of expenses on each iteration through the binary search (HINT #2: your binary search should make use of your solution to problem 3), and should return the estimate for the amount of expenses to withdraw. (HINT #3: the answer should lie between zero and the initial value of the savings + epsilon.) Complete the implementation of: def findMaxExpenses(salary, save, preRetireGrowthRates, postRetireGrowthRates, epsilon): Write your code in the appropriate place in the ps4.py template. To test your function, run the test cases in the test function testFindMaxExpenses(). You should add additional test cases to this function to further test your code.

Hand-In Function

1. Save

Save your code in the specific file name indicated for each problem. Do not ignore this step or save your file(s) with different names.

2. Time and Collaboration Info

At the start of each file, in a comment, write down the number of hours (roughly) you spent on the problems in that part, and the names of the people you collaborated with. For example:

# Problem Set 4

# Name: Jane Lee

# Collaborators: John Doe

# Time: 1:30 # ... your code goes here ...

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Periodic Inventory MethodDocument13 pagesPeriodic Inventory Methodthegianthony100% (1)

- Kohler Co. (A)Document18 pagesKohler Co. (A)Juan Manuel GonzalezNo ratings yet

- Acc 211 MidtermDocument8 pagesAcc 211 MidtermRinaldi Sinaga100% (2)

- merchandisingBusinessAccounting PDFDocument106 pagesmerchandisingBusinessAccounting PDFMargarete Delvalle100% (1)

- ENTREP 3 QUARTER 4 MODULE 2WEEK 4 6passed No AkDocument25 pagesENTREP 3 QUARTER 4 MODULE 2WEEK 4 6passed No Akmork leeNo ratings yet

- MCYM BylawsDocument11 pagesMCYM BylawsARUNNo ratings yet

- Chapter 10: Lessee Accounting: IFRS 16: New Lease Standard P Resent ValueDocument5 pagesChapter 10: Lessee Accounting: IFRS 16: New Lease Standard P Resent ValueCzar RabayaNo ratings yet

- Valuation of Keya Cosmetics Ltd.Document74 pagesValuation of Keya Cosmetics Ltd.Anwar Hossain JewelNo ratings yet

- Old Pfrs For SmesDocument12 pagesOld Pfrs For SmesDennis VelasquezNo ratings yet

- Exercise AKM Chapter 3 Kelompok 2Document34 pagesExercise AKM Chapter 3 Kelompok 2RizalMawardiNo ratings yet

- Vogele Paver-2 Insurance PDFDocument11 pagesVogele Paver-2 Insurance PDFrahul saiNo ratings yet

- Bid Letter - Micro Inks PDFDocument18 pagesBid Letter - Micro Inks PDFGaneshNo ratings yet

- Answers, Solutions and Clarifications FileDocument3 pagesAnswers, Solutions and Clarifications FileAnnie LindNo ratings yet

- SAMPLE - Depreciation Problems AnswersDocument2 pagesSAMPLE - Depreciation Problems AnswersSheinna Mae Von CalupigNo ratings yet

- PWC WWTS - Corporate Taxes 2012-13Document2,178 pagesPWC WWTS - Corporate Taxes 2012-13pnrahmanNo ratings yet

- Sindh ABS 0910Document86 pagesSindh ABS 0910Wajiha SaeedNo ratings yet

- Demo 04 - Journal Entries & Ledger Posting & T.B. - Rizvi Co (Compatibility Mode)Document31 pagesDemo 04 - Journal Entries & Ledger Posting & T.B. - Rizvi Co (Compatibility Mode)Evergreen FosterNo ratings yet

- CH 4 - SolnDocument126 pagesCH 4 - SolnMuhammad RehmanNo ratings yet

- CFAB Accounting Chapter 9. Accruals and PrepaymentsDocument33 pagesCFAB Accounting Chapter 9. Accruals and PrepaymentsVânAnh NguyễnNo ratings yet

- St. Wilfred's P. G. College NirfDocument10 pagesSt. Wilfred's P. G. College NirfRahul ChoudharyNo ratings yet

- Assignment:1: Comsats Institute of Information TechnologyDocument4 pagesAssignment:1: Comsats Institute of Information TechnologyKhalil Ahmed100% (1)

- Aqa 1121 Accn1 W MS Jan 12Document11 pagesAqa 1121 Accn1 W MS Jan 12NinjehPandehNo ratings yet

- Act 202 Group ProjectDocument6 pagesAct 202 Group ProjectAsrafia Mim 1813026630No ratings yet

- Food Processing Industry - Cost AnalysisDocument5 pagesFood Processing Industry - Cost AnalysisSURABHI TIWARYNo ratings yet

- Chapter 20Document56 pagesChapter 20insyed9No ratings yet

- FR Revision NotesDocument340 pagesFR Revision NotesAashika SamaiyaNo ratings yet

- Pricing Model For Expense OptimizationDocument4 pagesPricing Model For Expense OptimizationSrikant RajanNo ratings yet

- Conceptual Framework & Accounting StandardsDocument30 pagesConceptual Framework & Accounting StandardsAndrea Nicole De Leon100% (1)

- Questions With Bullet Point AnswersDocument33 pagesQuestions With Bullet Point AnswersSomnath MukherjeeNo ratings yet

- Project Report On Garment BusinessDocument2 pagesProject Report On Garment BusinessAnupNo ratings yet