Professional Documents

Culture Documents

Goodyear Result Updated

Goodyear Result Updated

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Goodyear Result Updated

Goodyear Result Updated

Uploaded by

Angel BrokingCopyright:

Available Formats

Company Update | Automobile

February 27, 2012

Goodyear India

Performance Highlights

Y/E December (` cr) Net sales EBITDA EBITDA margin (%) Adjusted PAT

Source: Company, Angel Research

BUY

CMP Target Price

% chg (yoy) 16.0 16.9 7bp (9.7) 3QCY11 395 28 7.1 16 % chg (qoq) 0.1 22.5 159bp 27.2

`358 `484

12 Months

4QCY11 395 34 8.7 20

4QCY10 341 29 8.6 22

Investment Period

Stock Info Sector Market Cap (Rs cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (Rs) BSE Sensex Nifty Reuters Code Bloomberg Code Automobile 825 0.7 376 / 216 24,452 10 17,731 5,376 GDYR.BO GDYR IN

For 4QCY2011, Goodyear India Ltd. (GIL) reported lower-than-expected top line at `395cr as against our expectation of `441cr. However, the companys EBITDA margin remained flat on a yoy basis despite higher raw-material cost, which was offset by lower other expenses. Net profit for the quarter came in at `20cr, 8.8% lower than our estimate of `22cr. We maintain our Buy view on the stock. Branded business and tractor tyre demand to drive future growth: GIL is a market leader in the tractor tyre industry. Tractor tyres accounted for ~60% of the companys tonnage offtake in CY2010. The tractor industry witnessed growth of 27% in 2010 and is expected to grow at the same pace going forward, helping the company to register a ~17% CAGR in revenue over CY2011-13E. Moreover, GIL caters to high-end brands such as Audi, BMW, Land Rover, Mitsubishi and Porsche and has a brand name in the commodity business with stupendous ROIC of 1,022.7% for CY2011 in comparison to less than 30% of other listed peers. Furthermore, the company is debt free with cash reserves of `249cr for CY2011. Outlook and valuation: We expect GILs revenue to post a 17.2% CAGR over CY2011-13E along with a 239bp expansion in its EBITDA margin on account of easing rubber prices, which is evident from a 29% decline from the high of `243/kg in April 2011 to `188 as on February 27, 2012. In addition, we expect the companys net profit to witness a 37.5% CAGR over CY2011-13E to `122cr. At `358, the stock is trading at PE of 6.8x its CY2013E earnings. We maintain our Buy recommendation on the stock with a revised target price of `484, based on a target P/E of 8.0x for CY2013E earnings.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 74.0 6.3 4.4 15.3

Abs. (%) Sensex Goodyear

3m 9.7 26.9

1yr

3yr

(0.5) 106.0 59.6 438.9

Key financials

Y/E December (` cr) Net Sales % chg Net Profit % chg EBITDA (%) EPS (Rs) P/E (x) P/BV (x) RoE (%) RoIC (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

CY2010 1297 27.6 75 2.3 8.7 32.4 11.0 3.0 30.8 412.8 0.5 5.4

CY2011 1516 16.9 65 (13.7) 7.4 28.0 12.8 2.6 22.0 1022.7 0.4 5.1

CY2012E 1780 17.4 88 35.6 8.5 38.0 9.4 2.2 25.0 844.2 0.3 3.5

CY2013E 2082 17.0 122 39.4 9.8 52.9 6.8 1.7 28.2 645.3 0.2 2.1

Shareen Batatawala

+91- 22- 3935 7800 Ext: 6849 shareen.batatawala@angelbroking.com

Please refer to important disclosures at the end of this report

Goodyear | Company Update

Exhibit 1: 4QCY2011 performance

Y/E December (` cr) Net Sales Net raw material (% of Sales) Staff Costs (% of Sales) Other Expenses (% of Sales) Total Expenditure Operating Profit OPM Interest Depreciation Other Income PBT (% of Sales) Tax (% of PBT) Reported PAT PATM Equity capital (cr) EPS (`)

Source: Company, Angel Research

4QCY11 395 291 73.6 20 5.0 50 12.7 361 34 8.7 2 5 2.7 30 7.6 10 32.7 20 5.1 23 8.8

4QCY10 341 244 71.7 15 4.5 52 15.2 311 29 8.6 1 4 8.5 33 9.5 10 30.9 22 6.6 23 9.7

yoy chg (%) 16.0 19.0 29.7 (2.9) 15.9 16.9 26.0 30.6 (68.0) (7.2) (1.7) (9.7)

3QCY11 395 294 74.4 18 4.6 55 13.8 367 28 7.1 2 5 2.6 24 6.0 8 32.4 16 4.0 23

qoq chg (%) 0.1 (1.0) 7.7 (8.2) (1.6) 22.5 (16.7) 4.3 6.3 27.7 28.9 27.2

CY2011 1516 1131 74.6 73 4.8 200 13.2 1404 112 7.4 5 20 9 96 6.3 32 32.9 65 4.3 23

CY2010 1297 942 72.6 56 4.3 186 14.4 1184 113 8.7 4 15 17 111 8.6 36 32.6 75 5.8 23 32.4

% chg 16.9 20.1 30.9 7.1 18.6 (0.5) 37.8 28.4 (48.6) 12.6 (12.4) (13.7)

(9.7)

6.9

27.2

28.0

(13.7)

Exhibit 2: Actual vs. estimates (4QCY2011)

Actual (` cr) Total Income PBIDT PBIDTA margin (%) Adjusted PAT

Source: Company, Angel Research

Estimate (` cr) 441 33 7.4 22

Var (%) (10.4) 4.8 126bp (8.8)

395 34 8.7 20

Below-expectation top line and bottom line

For 4QCY2011, GIL reported 16% yoy growth in its revenue to `395cr, 10.4% lower than our estimate of `441cr. Higher raw-material cost during 4QCY2011 vis--vis 4QCY2010 was offset by lower other expenses, thus leading to unchanged EBITDA margin for the quarter at 8.7%. Net profit for the quarter came in at `20cr, down 9.7% yoy.

February 27, 2012

Goodyear | Company Update

Investment rationale

Dominant player in the tractor tyre segment

GIL is the market leader in the tractor tyre segment, with a market share of ~22.3% in the tractor front tyres segment and ~35.9% in the tractor rear tyres segment. Tractor tyres accounted for ~60% of the companys tonnage offtake in CY2010, followed by passenger car radials, which accounted for 33% of the total offtake. As per Tractor Manufacturers Association (TMA), the tractor industry grew by 25% and 27% in CY2009 and CY2010, respectively. We expect demand for tractors to grow robustly in future, given the governments thrust on improving farm output and higher planned expenditure for the same in the budget. Moreover, increasing awareness regarding the use of modern techniques of farming among farmers is expected to trigger tractor sales in the years to come. We estimate tractor sales to register an 8-10% CAGR over FY2011-13E. Being a market leader in this segment, we expect GIL to benefit immensely and estimate the company to register a sales CAGR of 17.2% over CY2011-13E.

Exhibit 3: Product mix (CY2010)

Tractor rear 49%

Exhibit 4: Market leader in the tractor tyre segment

40 35

Market Share (%)

35.9

Tractor front 11%

30 25 20 15 10 5 0 0.3 MHCV Passenger cars 2008 Tractor Front 2009 2010 Tractor Rear 13.4 22.3

MHCV 5% OTR 2% Passenger cars 33%

Source: Company, CRISIL Research, Angel Research

Source: Company, CRISIL Research, Angel Research

Branded business in the commodity industry

GIL caters to high-end brands such as Audi, BMW, Land Rover, Mitsubishi and Porsche and has a brand name in the commodity business with stupendous ROIC of 1,022.7% for CY2011 in comparison to less than 30% of other listed peers.

February 27, 2012

Goodyear | Company Update

Focus on the replacement market to improve EBITDA margin

The replacement segment contributes ~63% to the total tyre industry and absorbs ~57% of total tyre production (in tonnage terms) in India. In addition, price realizations are the highest in the replacement market, followed by the export market and the OE segment. Since the company majorly caters to the tractor tyre market, where replacement demand is high, GIL has charted out an aggressive plan to expand its network of retail outlets in an attempt to garner a larger share of the replacement market. The company increased its outlets in 16 more cities during CY2010, taking the total count to 36 cities. We believe higher contribution from the replacement market will help GIL report superior EBITDA margin going forward.

Land sale: An upside trigger

GIL had made an announcement in June 2011 to the BSE for the sale of a piece of land located in Ballabgarh, Faridabad, after it obtains necessary approvals. With regards to the above announcement, the company has updated that the governments approval is still pending. Any progress on the same may give an upside trigger to the stock.

February 27, 2012

Goodyear | Company Update

Financial performance

Exhibit 5: Key assumptions

CY2012E Change in tyre realization Change in rubber price

Source: Angel Research

CY2013E 3.0 2.0

2.0 1.0

Exhibit 6: Change in estimates (CY2012E)

Y/E December Net sales (` cr) EBITDA (` cr) EBITDA margin (%) PAT (` cr) EPS (`)

Source: Angel Research

Earlier estimates 1835 150 8.2 91.7 39.8

Revised estimates 1780 150 8.5 87.6 38.0

% chg (3.0) 0.2 27bp (4.5) (4.5)

Revenue to post a 17.2% CAGR over CY2011-13E

We expect GIL to post a revenue CAGR of 17.2% over CY2011-13E, from `1,516cr in CY2011 to `2,082cr in CY2013E, on account of improved volumes for manufactured as well as traded tyres.

Exhibit 7: Revenue growth driven by tyre volumes

2500 2000 30 25 20 15 1000 500 0 CY2009 CY2010 Revenue (LHS)

Source: Company, Angel Research

(` cr)

1500

10 5 0 CY2011 CY2012E CY2013E Revenue growth (RHS)

February 27, 2012

(%)

Goodyear | Company Update

EBITDA margin expansion to aid net profit growth

For CY2012, GILs EBITDA margin contracted by 130bp from 8.7% in CY2010 to 7.4% in CY2011 on the back of increased raw-material prices. Rubber prices have seen a 29% decline in the past eight months to `188/kg in February 2012. We expect the companys EBITDA margin to expand by 239bp over CY2011-13E on account of stable rubber prices and consequently decreasing raw-material cost. As a result, we expect net profit to post a 37.5% CAGR over CY2011-13E.

Exhibit 8: EBITDA margin to bounce back

250 200 150 8 100 50 0 CY2009 CY2010 EBITDA (LHS) CY2011 CY2012E CY2013E EBITDA margin (RHS) 4 16

Exhibit 9: Profit growth on an uptrend

150 120 90

(` cr)

150

12

(%)

100

(` cr)

60 30 0 CY2009 CY2010 PAT (LHS) CY2011 CY2012E CY2013E PAT growth (RHS) 0

(50)

Source: Company, Angel Research

Source: Company, Angel Research

Outlook and valuation

We have incorporated CY2013E in our model and revised our revenue and earnings estimates for CY2012E slightly downwards. At current levels, the stock is trading at PE of 6.8x CY2013E and P/B of 1.7x for CY2013E. We maintain our Buy recommendation on the stock with a revised target price of `484, based on a target P/E of 8.0x for SY2013E.

Exhibit 10: One-year forward P/E

15,000 12,000 9,000

(`)

6,000 3,000 0 Feb-07

Feb-08 Price

Feb-09 2x 5x

Feb-10 8x

Feb-11 11x

Feb-12

Source: Company, Angel Research

February 27, 2012

(%)

50

Goodyear | Company Update

Exhibit 11: Relative valuation

Year end Apollo MRF Goodyear

Source: Company

FY2013E SY2013E CY2013E

Sales (` cr) 13580 13710 2082

OPM (%) 10.2 10.1 9.8

PAT (` cr) 556 534 122

EPS (`) 11.0 1260.3 52.9

ROE (%) 12.9 17.3 28.2

P/E (x) 7.5 7.7 6.8

P/BV (x) 1.3 1.3 1.7

EV/EBITDA (x) 4.8 5.3 2.1

EV/Sales (x) 0.5 0.5 0.2

Risks

Volatile rubber prices: Rubber is the major raw material used in the manufacture of tyres and constitutes ~65% of the total raw-material cost. Rubber price was at a high of `243/kg in April 2011; however, prices have come down to `188/kg as on February 27, 2012. Increased volatility in rubber prices would have a direct impact on the companys EBITDA margin and consequently its profit. Exhibit 12: Rubber price trend

300 250 200 12 9 6

(`/kg)

150 100 50 0

0 (3) (6) (9)

Rubber price

Source: Rubber Board (*MTD)

Change in price (%)

February 27, 2012

*Feb-12

Mar-11

Aug-11

May-11

Nov-11

Dec-11

Apr-11

Jul-11

Feb-11

Sep-11

Oct-11

Jun-11

Jan-12

(%)

Goodyear | Company Update

Indian tyre industry Demand, a growth driver

The Indian tyre industry has a size of `30,000cr (as of September 2011), of which exports contribute `3,600cr. The industry is classified into commercial vehicle tyres (71%) and passenger vehicle tyres (22%). Commercial vehicle tyres include medium and heavy commercial vehicles (MHCV, 55%), light commercial vehicles (LCV, 8%) and tractors (8%). Passenger vehicle tyres include passenger cars and MUVs (12%), motorcycles (7%) and scooters (3%). The three major segments of the tyre industry are original equipment (OE, 26%), replacement (63%) and exports (11%). The performance of the industry is influenced by the replacement segment due to a larger share of truck tyres (71%) in the product mix. The industry is a raw-material intensive industry, with raw material constituting about 66% of sales turnover and 70% of operational cost.

Exhibit 13: Tyre industrys statistics

FY2011

Current capacity (MT/day) Current capacity (MT/year) Current sales (` cr) Revenue per MT (`) Investment per TPD (` cr) FY201114E CAGR for volume sales Total capacity by FY2014E (MT) Capacity added (MT) Total investment (` cr) Debt (` cr) Equity (` cr) Net profit in FY2011E (` cr) Net profit in FY2014E (` cr) Market capitalisation* (` cr) PE for FY2014E (x) 9% 2,930,466 667,608 11,569 5,785 7,231 950 2,410 9,711 4.0

@

6,429 2,262,857 59,507 262,972 6.1

Source: Angel Research; Note: Industry includes Apollo Tyres, MRF, Goodyear India, JK Tyre and CEAT, @TPD stands for tonne per day, *As on February 27, 2012

The current capacity of the tyre industry in India is ~22.6lakh MTPA with an assumption of 352 working days, thus leading to revenue per MT of `2.6lakh. Assuming a 9% CAGR for the next three years, the capacity is expected to increase by ~6.7lakh tonnes to ~29.3lakh tonnes in FY2014E. Currently, investment for expansion of one TPD is `6.1cr, of which `5cr is capex requirement and `1.1cr is working capital requirement. Hence, the total investment required for the next three years is `11,569cr. With the assumption of 1:1 debt-equity ratio and 20% dividend payout for the next three years, net profit for FY2014E is expected to stand at `2,410cr, resulting in PE of 4.0x its earnings.

February 27, 2012

Goodyear | Company Update

The company

GIL is a subsidiary of Goodyear Tire and Rubber Company, USA, which holds a 74% stake in the company. GIL is the sixth largest tyre manufacturing company in India, with an overall market share of 5.5%.

Exhibit 14: Market share (India)

25 20 15

(%)

10 5 0 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 Apollo tyres MRF Ltd JK tyres Ceat tyres Goodyear Tyres

Source: Industry, CRISIL Research

The company majorly caters to the tractor tyre segment, with a market share of ~22.3% in tractor front tyres and 35.9% in tractor rear tyres. In the passenger car tyres segment, which is the second major revenue contributor, GIL has a market share of 13.4%. GIL is in an offtake agreement (on a non-exclusive basis and can be terminated by either party with a four-month notice) with Goodyear South Asia Tyres Pvt. Ltd., from which it procures tyres. This constituted about 23% of net sales in CY2010.

February 27, 2012

Goodyear | Company Update

Profit & Loss Statement

Y/E December (` cr) Gross sales Less: Excise duty Net Sales Other operating income Total operating income % chg Net Raw Materials Other Mfg costs Personnel Other Total Expenditure EBITDA % chg (% of Net Sales) Depreciation EBIT % chg (% of Net Sales) Interest & other charges Other Income (% of sales) PBT % chg Tax (% of PBT) PAT (reported) Extraordinary (Exp)/Inc. ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg CY2008 CY2009 CY2010 1,002 82 920 920 3.4 707 49 42 69 867 53 (25.8) 5.8 11 42 (30.2) 4.6 3 14 1.5 52 (19.2) 20 38.5 32 32 (18.9) 3.5 14.0 14.0 (18.9) 1,069 52 1,016 1,016 10.5 696 46 49 103 893 123 131.6 12.1 13 110 163.3 10.9 4 5 0.5 111 112.9 38 34.4 73 73 127.0 7.2 31.7 31.7 127.0 1,377 81 1,297 1,297 27.6 942 48 56 139 1,184 113 (8.2) 8.7 15 98 (11.6) 7.5 4 17 1.3 111 (0.4) 36 32.6 75 75 2.3 5.8 32.4 32.4 2.3 CY2011 1,610 94 1,516 1,516 16.9 1,131 50 73 150 1,404 112 (0.5) 7.4 20 93 (5.1) 6.1 5 9 0.6 96 (13.2) 32 32.9 65 65 (13.7) 4.3 28.0 28.0 (13.7) CY2012E CY2013E 1,890 111 1,780 1,780 17.4 1,293 66 89 182 1,629 150 33.9 8.5 22 128 38.3 7.2 6 9 0.5 131 35.8 43 33.0 88 88 35.6 4.9 38.0 38.0 35.6 2,212 129 2,082 2,082 17.0 1,489 77 104 208 1,878 204 35.7 9.8 24 180 40.2 8.6 8 10 0.5 182 39.4 60 33.0 122 122 39.4 5.9 52.9 52.9 39.4

February 27, 2012

10

Goodyear | Company Update

Balance Sheet

Y/E December (` cr) SOURCES OF FUNDS Equity Share Capital Preference Capital Reserves& Surplus Shareholders Funds Minority Interest Total Loans Deferred Tax Liability 23 138 161 11 23 192 215 11 23 248 271 10 23 293 317 23 360 383 23 460 483 CY2008 CY2009 CY2010 CY2011 CY2012E CY2013E

Total Liabilities

APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Current Assets Cash Loans & Advances Inventory Debtors Current liabilities Net Current Assets Mis. Exp. not written off

172

264 149 115 13 240 55 12 71 102 196 44 -

226

277 157 120 36 325 159 16 52 99 257 69 -

281

304 166 139 59 395 218 18 61 98 312 83 -

317

337 185 151 59 487 249 22 86 131 382 106 -

383

370 208 163 59 589 301 28 89 171 429 160 -

483

407 232 175 59 737 390 33 102 211 489 248 -

Total Assets

172

226

281

317

383

483

February 27, 2012

11

Goodyear | Company Update

Cash Flow Statement

Y/E December (` cr) Profit before tax Depreciation Change in Working Capital Other income Direct taxes paid Cash Flow from Operations (Inc.)/Dec. in Fixed Assets (Inc.)/Dec. in Investments Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances CY2008 CY2009 CY2010 CY2011 CY2012E CY2013E 52 11 (15) 2 (20) 30 (20) (1) (21) (14) (5) (18) (9) 65 55 111 13 79 (20) (38) 145 (37) 15 (22) (16) (3) (19) 104 55 159 111 15 45 10 (36) 146 (50) (15) (65) (19) (3) (21) 59 159 218 96 20 8 (19) (32) 74 (32) 9 (24) (19) (19) 31 218 249 131 22 (3) (9) (43) 98 (34) 9 (25) (21) (21) 52 249 301 182 24 2 (10) (60) 138 (37) 10 (27) (21) (21) 90 301 390

February 27, 2012

12

Goodyear | Company Update

Key Ratios

Y/E December (` cr) Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover Inventory / Sales (days) Receivables (days) Payables (days) WC (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage CY2008 CY2009 CY2010 CY2011 CY2012E CY2013E

25.6 19.0 5.1 1.7 0.8 14.5 4.3 14.0 14.0 18.8 6.0 69.7 4.6 0.6 9.3 26.0 (0.3) 17.1 24.6 42.3 21.1 3 28 40 83 (4.4) (0.3) (1.0) 13.1

11.3 9.6 3.8 2.0 0.7 5.4 2.9 31.7 31.7 37.2 7.0 93.1 10.9 0.7 13.7 97.9 (0.7) 25.6 53.8 149.2 39.0 4 19 35 105 (32.2) (0.7) (1.3) 28.2

11.0 9.2 3.0 2.3 0.5 5.4 2.1 32.4 32.4 39.1 7.0 117.4 7.5 0.7 54.8 278.4 (0.8) 54.3 37.6 30.8 4 17 27 96 (38.0) (0.8) (1.9) 25.8

12.8 9.8 2.6 2.3 0.4 5.1 1.8 28.0 28.0 36.5 7.0 137.2 6.1 0.7 167.3 686.4 (0.8) 146.2 30.7 22.0 5 21 31 99 (34.5) (0.8) (2.2) 17.8

9.4 7.5 2.2 0.1 0.3 3.5 1.4 38.0 38.0 47.6 8.0 165.9 7.2 0.7 79.4 383.3 (0.8) 36.7 844.2 25.0 5 18 35 96 (28.8) (0.8) (2.0) 20.0

6.8 5.6 1.7 0.1 0.2 2.1 0.9 52.9 52.9 63.5 8.0 209.5 8.6 0.7 62.6 361.8 (0.8) 41.5 645.3 28.2 5 18 37 95 (24.9) (0.8) (1.9) 22.7

412.8 1,022.7

February 27, 2012

13

Goodyear | Company Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Goodyear India No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

February 27, 2012

14

You might also like

- Kohler DCF Control Prem and DiscDocument6 pagesKohler DCF Control Prem and Discapi-239586293No ratings yet

- Appendix F: Accounting For PartnershipsDocument17 pagesAppendix F: Accounting For PartnershipsDerian Wijaya100% (1)

- Essay QuestionsDocument16 pagesEssay Questionssheldon100% (1)

- Illustration - Chapter 2Document2 pagesIllustration - Chapter 2Jahzceel CecelNo ratings yet

- Goodyear India: Performance HighlightsDocument12 pagesGoodyear India: Performance HighlightsAngel BrokingNo ratings yet

- FAG Bearings Result UpdatedDocument10 pagesFAG Bearings Result UpdatedAngel BrokingNo ratings yet

- Rallis India: Performance HighlightsDocument10 pagesRallis India: Performance HighlightsAngel BrokingNo ratings yet

- Ceat Result UpdatedDocument11 pagesCeat Result UpdatedAngel BrokingNo ratings yet

- Greenply Result UpdatedDocument10 pagesGreenply Result UpdatedAngel BrokingNo ratings yet

- Rallis India Result UpdatedDocument9 pagesRallis India Result UpdatedAngel BrokingNo ratings yet

- Graphite India: Performance HighlightsDocument11 pagesGraphite India: Performance HighlightsAngel BrokingNo ratings yet

- Exide Industries: Performance HighlightsDocument12 pagesExide Industries: Performance HighlightsAngel BrokingNo ratings yet

- Hitachi Home & Life Solutions: Performance HighlightsDocument13 pagesHitachi Home & Life Solutions: Performance HighlightsAngel BrokingNo ratings yet

- FAG Bearings: Performance HighlightsDocument10 pagesFAG Bearings: Performance HighlightsAngel BrokingNo ratings yet

- Hero MotocorpDocument11 pagesHero MotocorpAngel BrokingNo ratings yet

- Abbott India: Performance HighlightsDocument13 pagesAbbott India: Performance HighlightsAngel BrokingNo ratings yet

- Graphite India: Performance HighlightsDocument11 pagesGraphite India: Performance HighlightsAngel BrokingNo ratings yet

- Taj GVKDocument11 pagesTaj GVKAngel BrokingNo ratings yet

- Performance Highlights: Company Update - AutomobileDocument13 pagesPerformance Highlights: Company Update - AutomobileZacharia VincentNo ratings yet

- Amara Raja Batteries: Performance HighlightsDocument11 pagesAmara Raja Batteries: Performance HighlightsAngel BrokingNo ratings yet

- Ashok Leyland Result UpdatedDocument13 pagesAshok Leyland Result UpdatedAngel BrokingNo ratings yet

- Siyaram Silk Mills Result UpdatedDocument9 pagesSiyaram Silk Mills Result UpdatedAngel BrokingNo ratings yet

- Bhel 4qfy2012ru 240512Document12 pagesBhel 4qfy2012ru 240512Angel BrokingNo ratings yet

- Bajaj Auto: Performance HighlightsDocument13 pagesBajaj Auto: Performance HighlightsAngel BrokingNo ratings yet

- Rallis India: Performance HighlightsDocument10 pagesRallis India: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: 2QFY2012 Result Update - Oil & GasDocument10 pagesPerformance Highlights: 2QFY2012 Result Update - Oil & GasAngel BrokingNo ratings yet

- Neutral: Performance HighlightsDocument10 pagesNeutral: Performance HighlightsAngel BrokingNo ratings yet

- Bosch: Performance HighlightsDocument11 pagesBosch: Performance HighlightsAngel BrokingNo ratings yet

- Colgate: Performance HighlightsDocument9 pagesColgate: Performance HighlightsAngel BrokingNo ratings yet

- Tech Mahindra: Performance HighlightsDocument13 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- TVS Srichakra Result UpdatedDocument16 pagesTVS Srichakra Result UpdatedAngel Broking0% (1)

- Cairn India Result UpdatedDocument11 pagesCairn India Result UpdatedAngel BrokingNo ratings yet

- Reliance Industries Result UpdatedDocument13 pagesReliance Industries Result UpdatedAngel BrokingNo ratings yet

- Reliance Industries Result UpdatedDocument14 pagesReliance Industries Result UpdatedAngel BrokingNo ratings yet

- MOIL Result UpdatedDocument10 pagesMOIL Result UpdatedAngel BrokingNo ratings yet

- Indraprasth Gas Result UpdatedDocument10 pagesIndraprasth Gas Result UpdatedAngel BrokingNo ratings yet

- Performance Highlights: Company Update - Capital GoodsDocument13 pagesPerformance Highlights: Company Update - Capital GoodsAngel BrokingNo ratings yet

- Igl 4Q Fy 2013Document10 pagesIgl 4Q Fy 2013Angel BrokingNo ratings yet

- Balkrishna Industries (BALIND) : Margins vs. Guidance! What Do You Prefer?Document9 pagesBalkrishna Industries (BALIND) : Margins vs. Guidance! What Do You Prefer?drsivaprasad7No ratings yet

- Ril, 4Q Fy 2013Document14 pagesRil, 4Q Fy 2013Angel BrokingNo ratings yet

- Tech Mahindra: Performance HighlightsDocument11 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Rallis India Result UpdatedDocument10 pagesRallis India Result UpdatedAngel BrokingNo ratings yet

- Performance Highlights: CMP '203 Target Price '248Document10 pagesPerformance Highlights: CMP '203 Target Price '248Angel BrokingNo ratings yet

- Relaxo Footwear 1QFY2013RU 070812Document12 pagesRelaxo Footwear 1QFY2013RU 070812Angel BrokingNo ratings yet

- Mahindra and Mahindra Q1FY13Document4 pagesMahindra and Mahindra Q1FY13Kiran Maruti ShindeNo ratings yet

- Moil 2qfy2013Document10 pagesMoil 2qfy2013Angel BrokingNo ratings yet

- Tech Mahindra Result UpdatedDocument12 pagesTech Mahindra Result UpdatedAngel BrokingNo ratings yet

- Tech Mahindra: Performance HighlightsDocument11 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument17 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Performance Highlights: NeutralDocument13 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- Punj Lloyd Result UpdatedDocument10 pagesPunj Lloyd Result UpdatedAngel BrokingNo ratings yet

- DB Corp: Performance HighlightsDocument11 pagesDB Corp: Performance HighlightsAngel BrokingNo ratings yet

- Indraprastha GasDocument11 pagesIndraprastha GasAngel BrokingNo ratings yet

- Colgate: Performance HighlightsDocument10 pagesColgate: Performance HighlightsAngel BrokingNo ratings yet

- Vesuvius India: Performance HighlightsDocument12 pagesVesuvius India: Performance HighlightsAngel BrokingNo ratings yet

- Bajaj Electricals: Performance HighlightsDocument10 pagesBajaj Electricals: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: 2QFY2013 Result Update - Auto AncillaryDocument11 pagesPerformance Highlights: 2QFY2013 Result Update - Auto AncillaryAngel BrokingNo ratings yet

- GAIL India: Performance HighlightsDocument12 pagesGAIL India: Performance HighlightsAngel BrokingNo ratings yet

- Dishman Pharmaceuticals: Performance HighlightsDocument10 pagesDishman Pharmaceuticals: Performance HighlightsAngel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: ReduceDocument12 pagesPerformance Highlights: ReduceAngel BrokingNo ratings yet

- Automotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandAutomotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Ignition Coils, Distributors, Leads & Associated Parts (Car Aftermarket) Distribution World Summary: Market Values & Financials by CountryFrom EverandIgnition Coils, Distributors, Leads & Associated Parts (Car Aftermarket) Distribution World Summary: Market Values & Financials by CountryRating: 5 out of 5 stars5/5 (1)

- Carburettors, Fuel Injection & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandCarburettors, Fuel Injection & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Determinants of Stock Price With Dividend Policy As A Moderator Variable A Study of Listed Companies at The Jakarta Islamic IndexDocument9 pagesDeterminants of Stock Price With Dividend Policy As A Moderator Variable A Study of Listed Companies at The Jakarta Islamic IndexInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- ENVIRONMENTAL, SOCIAL AND GOVERNANCE ESG Strategy Pathway For SustainableDocument3 pagesENVIRONMENTAL, SOCIAL AND GOVERNANCE ESG Strategy Pathway For SustainablevinayaikNo ratings yet

- Accounts Project NestleDocument23 pagesAccounts Project NestleDhanshree KhupkarNo ratings yet

- Cash Flow Statement N ProblemsDocument30 pagesCash Flow Statement N ProblemsNaushad GulNo ratings yet

- Class Feb 2024 S4hanaDocument15 pagesClass Feb 2024 S4hanaSalauddin Kader ACCANo ratings yet

- NBK Capital-Qatar National Cement Initiation-19Jan2010Document24 pagesNBK Capital-Qatar National Cement Initiation-19Jan2010Daniel Pandapotan MarpaungNo ratings yet

- UBI230110110 Industry CompetitorAnalysis 20180314222113Document8 pagesUBI230110110 Industry CompetitorAnalysis 20180314222113DamTokyoNo ratings yet

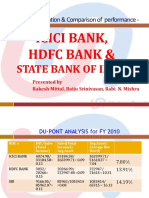

- Icici Bank, HDFC Bank &: Evaluation & Comparison of PerformanceDocument7 pagesIcici Bank, HDFC Bank &: Evaluation & Comparison of PerformanceNabarun MajumderNo ratings yet

- Working Capital ManagementDocument30 pagesWorking Capital ManagementInayah Chintaki Makmur ZainuddinNo ratings yet

- Depreciation and DepletionDocument7 pagesDepreciation and DepletionLoi GachoNo ratings yet

- Caspo Hotmail CorpDocument24 pagesCaspo Hotmail CorpDiego SerranoNo ratings yet

- Case StudyDocument7 pagesCase StudyAli RazaNo ratings yet

- Week11 CH5 SeminarAssignmentDocument10 pagesWeek11 CH5 SeminarAssignmentbhattfenil29No ratings yet

- KVS Jaipur XII ACC QP & MS (2nd PB) 23-24 (SET-3) - 1-9Document9 pagesKVS Jaipur XII ACC QP & MS (2nd PB) 23-24 (SET-3) - 1-9im subbing to everyone subbing to meNo ratings yet

- Investment in Equity SecuritiesDocument19 pagesInvestment in Equity SecuritiesNicholai NonanNo ratings yet

- Financial Crime Dissertation TopicsDocument4 pagesFinancial Crime Dissertation TopicsWriteMyPaperApaFormatCanada100% (1)

- Mida InfoDocument12 pagesMida InfoMuhammad AdnanNo ratings yet

- Esperenza Bakeshop, IncDocument3 pagesEsperenza Bakeshop, IncKizziah ClaveriaNo ratings yet

- Zam Bank CaseDocument3 pagesZam Bank Casepallavi thakurNo ratings yet

- Assignment Print ViewDocument103 pagesAssignment Print ViewHARISHPBSNo ratings yet

- AFM Lecture 11Document24 pagesAFM Lecture 11Alseraj TechnologyNo ratings yet

- ADBL 15th 2078 Compressed P2OUORhDocument132 pagesADBL 15th 2078 Compressed P2OUORhManish BhattNo ratings yet

- From The President's Desk May - 2015: Private Circulation Only Issue - 96Document8 pagesFrom The President's Desk May - 2015: Private Circulation Only Issue - 96umeshNo ratings yet

- Study of Cash Flow ManagementDocument14 pagesStudy of Cash Flow Managementsujjish0% (2)

- Retained EarningsDocument3 pagesRetained EarningsKyla RequironNo ratings yet

- Basic Accounting Prequalifying SolManDocument12 pagesBasic Accounting Prequalifying SolManAnj SueloNo ratings yet