Professional Documents

Culture Documents

Federal Reservve Lending Programs

Federal Reservve Lending Programs

Uploaded by

USLaw.comOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Federal Reservve Lending Programs

Federal Reservve Lending Programs

Uploaded by

USLaw.comCopyright:

Available Formats

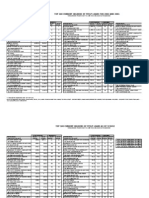

Federal Reserve Bank of New York

October 2008

Forms of Federal Reserve Lending to Financial Institutions

Term Discount ABCP Money Term Securities

Single-Tranche Term Auction Primary Dealer Transitional Credit Term Securities

Discount Window Program Market Fund Securities Lending Facility

OMO Program Facility Credit Facility Extentions Lending Facility

Regular OMOs Window1 Liquidity Facility Lending Options Program3

(announced (announced (announced (announced (announced (announced

(announced (announced

March 7, 2008) August 17, 2007) December 12, 2007) March 16, 2008)2 September 21, 2008) March 11, 2008)2

September 19, 2008) July 30, 2008)

U.S. and London broker- Despository institutions,

Who can Depository Primary credit-eligible Primary credit-eligible dealer subsidiaries of bank holding companies,

borrow? Primary dealers Primary dealers Primary dealers Goldman Sachs, Morgan U.S. branches and agencies Primary dealers Primary dealers Primary dealers

institutions depository institutions depository institutions

Stanley, Merrill Lynch of foreign banks

What are they

Funds Funds Funds Funds Funds Funds Funds Funds U.S. Treasuries U.S. Treasuries U.S. Treasuries

borrowing?

U.S. Treasuries, Full range of Schedule 1: U.S. Treasuries,

U.S. Treasuries, agencies, Full range of Full range of Full range of Full range of Discount Window agencies, agency MBS

What collateral Schedule 2

agencies, agency MBS, Discount Window Discount Window Discount Window tri-party repo collateral First-tier ABCP U.S. Treasuries

can be pledged? Schedule 2: Schedule 1 plus all TSLF collateral

agency MBS4 but typically collateral collateral collateral system collateral5,6 and tri-party repo

invesment grade debt securities5

agency MBS system collateral6

Is there a No (loans are No (loans are No (loans are

Yes Yes Yes Yes Yes Yes Yes Yes

reserve impact? bond-for-bond) bond-for-bond) bond-for-bond)

Typically overnight,

What is the Typically, term is Typically

28 days8 but up to Up to 90 days10 28 days or 84 days8,11 Overnight Overnight ABCP maturity date12 Overnight 28 days8

term of loan? overnight–14 days7 2 weeks or less13

several weeks9

Is prepayment

allowed if term

No No Yes Yes No N/A N/A No N/A No No

is greater than

overnight?

Which Reserve

Banks conduct FRBNY FRBNY All All All FRBNY FRBNY FRB Boston FRBNY FRBNY FRBNY

operations?

How frequently Schedule 1: Every other

Typically once As requested As requested Every other week, As requested As requested As requested week

is the program Typically weekly Daily As necessary14

or more daily (standing facility) (standing facility) or as necessary11 (standing facility) (standing facility) (standing facility) Schedule 2: Weekly

accessed?

Term securities Term securities

Where are Temporary Temporary H.4.1 - Factors H.4.1 - Factors H.4.1 - Factors H.4.1 - Factors H.4.1 - Factors

TAF Activity 15 Securities lending lending facility lending facilty

statistics reported OMO activity15 OMO activity15 Affecting Reserve Affecting Reserve Affecting Reserve Affecting Reserve Affecting Reserve

activity activity15 options program

publicly? Balances16 Balances16 Balances16 Balances16 Balances16

activity15

1

Discount Window includes primary, secondary and seasonal credit programs. 7

Open market operations are authorized for terms of up to 65 business days. 12

AMLF term has 270-day maximum.

2

The PDCF and TSLF will remain in operation through January 30, 2009 as 8

28-day and 84-day terms may vary slightly to account for maturity dates that fall on Bank holidays. 13

Loans are targeted to span potentially stressed financing dates, such as quarter-ends.

announced on July 30, 2008. 9

Primary credit loans are generally overnight. Loans may be granted for term beyond a 14

TOP auctions may be conducted on multiple dates for a single loan and may be conducted well in

3

TOP auctions are sales of options granting the right to enter into TSLF borrowing. few weeks to small banks, subject to additional administration. advance of a loan period.

4

Reverse repos are collateralized with U.S. Treasuries.

10

Maximum maturity of term increased from overnight to 30 days on August 17, 2007, 15

Data only available on days when operations are conducted.

5 and to 90 days on March 16, 2008. 16

Data published on Thursday, as of close of business on Wednesday.

PDCF and TSLF collateral expanded on September 14, 2008. 11

Foward selling TAF auctions announced on �September 29, 2008 will be conducted in

6

Includes non-U.S. dollar denominated securities.

November with terms targeted to provide funding over year-end.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- CC Check 25-11Document4 pagesCC Check 25-11marisabel guzman100% (9)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Fortune 500 US List 2022 Someka Excel Template V2 Free VersionDocument8 pagesFortune 500 US List 2022 Someka Excel Template V2 Free Versionweekend politicsNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Assignment 2 - Scenario-LupineDocument13 pagesAssignment 2 - Scenario-LupineGabi Cristina0% (1)

- Fortune 500 US List 2021 Someka V2Document7 pagesFortune 500 US List 2021 Someka V2Vicky DaswaniNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- About ITINsDocument4 pagesAbout ITINsCall Me Mega100% (1)

- MD Resident Tax Booklet 2009Document32 pagesMD Resident Tax Booklet 2009galaxianNo ratings yet

- Membership List: Russell 3000® IndexDocument33 pagesMembership List: Russell 3000® IndexJordi Oller SánchezNo ratings yet

- Bronstein Family V State of California Et Al ("White Georoge Floyd" Lawsuit)Document27 pagesBronstein Family V State of California Et Al ("White Georoge Floyd" Lawsuit)USLaw.comNo ratings yet

- Michael Jackson Last Will and TestamentDocument5 pagesMichael Jackson Last Will and Testamentfrajam79100% (6)

- NYPD May Day Event Advisory Bulletin 04/29/12Document6 pagesNYPD May Day Event Advisory Bulletin 04/29/12USLaw.comNo ratings yet

- Court Rules No Camping in Zuccotti ParkDocument4 pagesCourt Rules No Camping in Zuccotti Parkljohnston3800No ratings yet

- Federal Reserve Monthly Report For JuneDocument24 pagesFederal Reserve Monthly Report For JuneFOXBusiness.com100% (1)

- Wrotnowski v. Bysiewicz - Application For StayDocument36 pagesWrotnowski v. Bysiewicz - Application For StayGeorgetownJDNo ratings yet

- DHS: Rightwing Extremism ReportDocument10 pagesDHS: Rightwing Extremism ReportTucsonSentinel50% (2)

- Obama Keyes WritDocument19 pagesObama Keyes WritUSLaw.comNo ratings yet

- SEB's Emerging Markets Explorer October 2013Document40 pagesSEB's Emerging Markets Explorer October 2013SEB GroupNo ratings yet

- Casino SummaryDocument1 pageCasino SummaryAnn DwyerNo ratings yet

- 2007 Foreign National Checklist FINALDocument5 pages2007 Foreign National Checklist FINALcglaskoNo ratings yet

- Measuring The Fdi Attractiveness in The Eap Countries From An Institutional PerspectiveDocument10 pagesMeasuring The Fdi Attractiveness in The Eap Countries From An Institutional Perspectivefaq111No ratings yet

- Your Paycheck Statement At-a-Glance: SampleDocument1 pageYour Paycheck Statement At-a-Glance: SampleGeorge J AlexNo ratings yet

- Lehman Bankruptcy DocketDocument2,480 pagesLehman Bankruptcy Docketpowda1120No ratings yet

- 2316Document1 page2316EmmanuelClementCastilloTalimoroNo ratings yet

- Altair 2015 Relocation Tax Issues & AnswersDocument40 pagesAltair 2015 Relocation Tax Issues & AnswersHenry MajorosNo ratings yet

- Task 7 RefDocument25 pagesTask 7 Refsreejith emNo ratings yet

- OdunDocument3 pagesOdunLoco CocoNo ratings yet

- SP 500 SlogansDocument21 pagesSP 500 SlogansGoufran AlnoufiNo ratings yet

- Description: Tags: Top 100 Current Holders Cor Vers1Document4 pagesDescription: Tags: Top 100 Current Holders Cor Vers1anon-20972No ratings yet

- Economic CartoonsDocument39 pagesEconomic CartoonsPriscilla SamaniegoNo ratings yet

- Global Environment Unit 2Document13 pagesGlobal Environment Unit 2Se SathyaNo ratings yet

- US Tax ReturnDocument13 pagesUS Tax Returnjamo christineNo ratings yet

- International Economics FinalDocument83 pagesInternational Economics FinalMikylla Rodriguez VequisoNo ratings yet

- Santander BankDocument4 pagesSantander Bankphilip shternNo ratings yet

- Apple Broached Time Warner Bid As Growth Hunt Turns To ContentDocument24 pagesApple Broached Time Warner Bid As Growth Hunt Turns To ContentstefanoNo ratings yet

- Payroll Setup ChecklistDocument4 pagesPayroll Setup ChecklistcaliechNo ratings yet

- Tax Complete Physical MailDocument3 pagesTax Complete Physical MailSafeBit ProsNo ratings yet

- The RC ExcelDocument12 pagesThe RC ExcelGorang PatNo ratings yet

- RMC 13-80Document2 pagesRMC 13-80matinikkiNo ratings yet

- Essentials of Federal Taxation Chapyter5-8Document16 pagesEssentials of Federal Taxation Chapyter5-8Amanda_CChenNo ratings yet