Professional Documents

Culture Documents

Market Outlook 6th March 2012

Market Outlook 6th March 2012

Uploaded by

Angel BrokingCopyright:

Available Formats

You might also like

- TCS - Relieving LetterDocument1 pageTCS - Relieving LettersperoNo ratings yet

- Ajeet Business Tracker Aug 20221234Document14 pagesAjeet Business Tracker Aug 20221234Gaurav SinghNo ratings yet

- Indian Stock Market: A Study OnDocument16 pagesIndian Stock Market: A Study OnMohmmedKhayyum100% (3)

- FMCG Industry AnalysisDocument20 pagesFMCG Industry AnalysisAshish Kumar82% (33)

- Finance Interview Questions: Infosys Brigade Genpact Icici Karvy Capital-IQDocument9 pagesFinance Interview Questions: Infosys Brigade Genpact Icici Karvy Capital-IQdasrashmiNo ratings yet

- Market Outlook 21st March 2012Document3 pagesMarket Outlook 21st March 2012Angel BrokingNo ratings yet

- Market Outlook 29th November 2011Document3 pagesMarket Outlook 29th November 2011Angel BrokingNo ratings yet

- Market Outlook 9th April 2012Document3 pagesMarket Outlook 9th April 2012Angel BrokingNo ratings yet

- Market Outlook 24th August 2011Document4 pagesMarket Outlook 24th August 2011Angel BrokingNo ratings yet

- Market Outlook 12th October 2011Document4 pagesMarket Outlook 12th October 2011Angel BrokingNo ratings yet

- Market Outlook 6th September 2011Document4 pagesMarket Outlook 6th September 2011Angel BrokingNo ratings yet

- Market Outlook 5th September 2011Document4 pagesMarket Outlook 5th September 2011Angel BrokingNo ratings yet

- Market Outlook 26th September 2011Document3 pagesMarket Outlook 26th September 2011Angel BrokingNo ratings yet

- Market Outlook 28th September 2011Document3 pagesMarket Outlook 28th September 2011Angel BrokingNo ratings yet

- Market Outlook 10th April 2012Document3 pagesMarket Outlook 10th April 2012Angel BrokingNo ratings yet

- Market Outlook 9th January 2012Document3 pagesMarket Outlook 9th January 2012Angel BrokingNo ratings yet

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingNo ratings yet

- Market Outlook 14th September 2011Document4 pagesMarket Outlook 14th September 2011Angel BrokingNo ratings yet

- Market Outlook 23rd August 2011Document3 pagesMarket Outlook 23rd August 2011angelbrokingNo ratings yet

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingNo ratings yet

- Market Outlook 29th March 2012Document3 pagesMarket Outlook 29th March 2012Angel BrokingNo ratings yet

- Market Outlook 27th September 2011Document3 pagesMarket Outlook 27th September 2011angelbrokingNo ratings yet

- Market Outlook 19th August 2011Document3 pagesMarket Outlook 19th August 2011Angel BrokingNo ratings yet

- Market Outlook 22nd August 2011Document4 pagesMarket Outlook 22nd August 2011Angel BrokingNo ratings yet

- Market Outlook 29th September 2011Document3 pagesMarket Outlook 29th September 2011Angel BrokingNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument4 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 16th February 2012Document4 pagesMarket Outlook 16th February 2012Angel BrokingNo ratings yet

- Market Outlook 13th March 2012Document4 pagesMarket Outlook 13th March 2012Angel BrokingNo ratings yet

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingNo ratings yet

- Market Outlook 2nd April 2012Document4 pagesMarket Outlook 2nd April 2012Angel BrokingNo ratings yet

- Market Outlook 28th March 2012Document4 pagesMarket Outlook 28th March 2012Angel BrokingNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument3 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 26th March 2012Document4 pagesMarket Outlook 26th March 2012Angel BrokingNo ratings yet

- Market Outlook 1st March 2012Document4 pagesMarket Outlook 1st March 2012Angel BrokingNo ratings yet

- Market Outlook 7th September 2011Document3 pagesMarket Outlook 7th September 2011Angel BrokingNo ratings yet

- Market Outlook 29th December 2011Document3 pagesMarket Outlook 29th December 2011Angel BrokingNo ratings yet

- Market Outlook 23rd December 2011Document4 pagesMarket Outlook 23rd December 2011Angel BrokingNo ratings yet

- Market Outlook 5th January 2012Document3 pagesMarket Outlook 5th January 2012Angel BrokingNo ratings yet

- Market Outlook 20th March 2012Document3 pagesMarket Outlook 20th March 2012Angel BrokingNo ratings yet

- Market Outlook 20th September 2011Document4 pagesMarket Outlook 20th September 2011Angel BrokingNo ratings yet

- Market Outlook 30th Decmber 2011Document3 pagesMarket Outlook 30th Decmber 2011Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Technical Format With Stock 13.09Document4 pagesTechnical Format With Stock 13.09Angel BrokingNo ratings yet

- Market Outlook 17.11.11Document3 pagesMarket Outlook 17.11.11Angel BrokingNo ratings yet

- Market Outlook 23rd September 2011Document4 pagesMarket Outlook 23rd September 2011Angel BrokingNo ratings yet

- Market Outlook 13th September 2011Document4 pagesMarket Outlook 13th September 2011Angel BrokingNo ratings yet

- Market Outlook 30th March 2012Document3 pagesMarket Outlook 30th March 2012Angel BrokingNo ratings yet

- Market Outlook 18th August 2011Document3 pagesMarket Outlook 18th August 2011Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument5 pagesMarket Outlook: Dealer's DiaryVaibhav BhadangeNo ratings yet

- Daily Technical Report: Sensex (16913) / NIFTY (5114)Document4 pagesDaily Technical Report: Sensex (16913) / NIFTY (5114)Angel BrokingNo ratings yet

- Market Outlook 28th December 2011Document4 pagesMarket Outlook 28th December 2011Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 12th March 2012Document4 pagesMarket Outlook 12th March 2012Angel BrokingNo ratings yet

- Market Outlook 24th November 2011Document3 pagesMarket Outlook 24th November 2011Angel BrokingNo ratings yet

- Market Outlook 2nd January 2012Document3 pagesMarket Outlook 2nd January 2012Angel BrokingNo ratings yet

- Market Outlook 07.07Document3 pagesMarket Outlook 07.07Nikhil SatamNo ratings yet

- Market Outlook 9th March 2012Document4 pagesMarket Outlook 9th March 2012Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16649) / NIFTY (5050)Document4 pagesDaily Technical Report: Sensex (16649) / NIFTY (5050)Angel BrokingNo ratings yet

- Market Outlook 11th August 2011Document4 pagesMarket Outlook 11th August 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16897) / NIFTY (5121)Document4 pagesDaily Technical Report: Sensex (16897) / NIFTY (5121)Angel BrokingNo ratings yet

- Market Outlook 27th December 2011Document3 pagesMarket Outlook 27th December 2011Angel BrokingNo ratings yet

- Market Outlook 4th August 2011Document4 pagesMarket Outlook 4th August 2011Angel BrokingNo ratings yet

- Market Outlook 8th September 2011Document4 pagesMarket Outlook 8th September 2011Angel BrokingNo ratings yet

- Technical Format With Stock 11.09Document4 pagesTechnical Format With Stock 11.09Angel BrokingNo ratings yet

- Medical Equipment Rental & Leasing Revenues World Summary: Market Values & Financials by CountryFrom EverandMedical Equipment Rental & Leasing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- DIATM Placement 2011Document5 pagesDIATM Placement 2011Sudipta DasNo ratings yet

- Impact of Macroeconomic Indicators On Stock MarketsDocument84 pagesImpact of Macroeconomic Indicators On Stock MarketsKishore GowdaNo ratings yet

- SBI Roll No38x25 - EngDocument6 pagesSBI Roll No38x25 - Enganon-625509No ratings yet

- Small-Caps The New Big Bets of D-Street: % ReturnDocument4 pagesSmall-Caps The New Big Bets of D-Street: % ReturnDynamic LevelsNo ratings yet

- OpTransactionHistoryTpr18 03 2021Document6 pagesOpTransactionHistoryTpr18 03 2021Tanisha GuptaNo ratings yet

- A Comparative Study On Share Price Project ReportDocument53 pagesA Comparative Study On Share Price Project Reportcity cyberNo ratings yet

- FHPL Hospital ListDocument4 pagesFHPL Hospital ListSimranjeet SinghNo ratings yet

- HUL DC PricingDocument14 pagesHUL DC PricingMeenakshi RamamoorthyNo ratings yet

- Service Provider: Bharti Airtel Ltd. (Mobile Services)Document4 pagesService Provider: Bharti Airtel Ltd. (Mobile Services)amitkurhekarNo ratings yet

- Script Nifty IndexDocument2 pagesScript Nifty IndexRaghavendra NetalkarNo ratings yet

- Businessstandardpaper PDFDocument18 pagesBusinessstandardpaper PDFaashaNo ratings yet

- Morning Cuppa 21-NovDocument2 pagesMorning Cuppa 21-NovSarvjeet KaushalNo ratings yet

- Saral Gyan Stocks Past Performance 050113Document13 pagesSaral Gyan Stocks Past Performance 050113saptarshidas21No ratings yet

- THE Complete Beginner'S Guide: Simple StockmarketDocument37 pagesTHE Complete Beginner'S Guide: Simple StockmarketDharshiniNo ratings yet

- Case Study On Karvy 0910Document66 pagesCase Study On Karvy 0910Sanju Reddy100% (2)

- Finance ProjectDocument71 pagesFinance ProjectPrithviraj KumarNo ratings yet

- Centrum Wealth - India Investment Strategy - 24 August 2013Document61 pagesCentrum Wealth - India Investment Strategy - 24 August 2013Davuluri OmprakashNo ratings yet

- S.No. Name P/E CMP Rs. Mar Cap Rs - CRDocument4 pagesS.No. Name P/E CMP Rs. Mar Cap Rs - CRCogniZanceNo ratings yet

- Balance SheetDocument55 pagesBalance SheetKumarVelivelaNo ratings yet

- I QQRG Ebql EHw LD WXDocument6 pagesI QQRG Ebql EHw LD WXPraveenNo ratings yet

- Indian Capital MarketsDocument26 pagesIndian Capital MarketsMANJUNATHA SNo ratings yet

- Market Outlook For 29 Dec - Cautiously OptimisticDocument5 pagesMarket Outlook For 29 Dec - Cautiously OptimisticMansukh Investment & Trading SolutionsNo ratings yet

- 134 135 Keshav Garg Rosy KalraDocument12 pages134 135 Keshav Garg Rosy KalraJosep CorbynNo ratings yet

- Stock Market IndicesDocument2 pagesStock Market IndicesbijubodheswarNo ratings yet

Market Outlook 6th March 2012

Market Outlook 6th March 2012

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Outlook 6th March 2012

Market Outlook 6th March 2012

Uploaded by

Angel BrokingCopyright:

Available Formats

Market Outlook

India Research

March 6, 2012

Dealers Diary

The Indian markets are expected to open in red taking cues from negative opening in most of the Asian markets. Indian markets fell sharply yesterday as caution prevailed ahead of the election results from five states due today. Globally, most of the US and European markets ended lower on Monday pressured by weakness in the euro, data showing a modest dip in the services sector growth rate last month in Eurozone and weak global cues on concerns over slowing growth in China dented investor sentiment. China has cut its outlook for GDP growth in 2012 to 7.5% from earlier estimate of 8.0%, raising concerns about demand in the world's second largest economy. Meanwhile, US non-manufacturing index rose to 57.3 in February from 56.8 in January, with a reading above 50 indicating growth in the service sector. The markets today will closely watch out for UP state election results due to be released today. Also, 4QCY2011 GDP growth data of Eurozone (Bloomberg estimate 0.7% yoy) will be on radar.

Domestic Indices BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei Hang Seng Straits Times Shanghai Com

Chg (%)

(Pts)

(Close)

(1.6) (274.1) 17,363 (1.5) (1.4) (1.0) (0.9) (79.1) (88.1) (65.4) (54.2) 5,280 6,271 6,788 6,351 7,564 9,832 8,487 6,051

(Close)

(1.8) (134.4) (0.3) (28.2)

(2.6) (315.2) 11,707 (3.1) (365.9) 11,603 (1.4) (120.5) (1.1)

Chg (%)

(67.2)

(Pts)

(0.1) (0.9) (0.6) (0.8) (0.1) (0.6)

Chg (%)

(14.8) 12,963 (25.7) (36.3) (78.4) (1.7) (15.7)

(Pts)

2,950 5,875 9,699 2,992 2,445

(Close)

Markets Today

The trend deciding level for the day is 17,422 / 5,297 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 17,531 17,699 / 5,328 5,376 levels. However, if NIFTY trades below 17,422 / 5,297 levels for the first half-an-hour of trade then it may correct up to 17,254 17,144 / 5,249 5,218 levels.

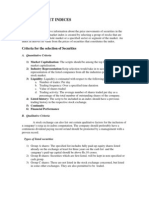

Indices SENSEX NIFTY S2 17,144 5,218 S1 17,254 5,249 PIVOT 17,422 5,297 R1 17,531 5,328 R2 17,699 5,376

(1.4) (297.0) 21,265

Indian ADRs Infosys Wipro ICICI Bank HDFC Bank

(1.1) (1.4) (2.7) (0.4)

(0.6) (0.2) (1.0) (0.1)

BSE

$57.1 $10.9 $35.6 $34.1

NSE

News Analysis

Refer detailed news analysis on the following page

RCom wins contract for Aadhaar project valued upto `300cr JSW Steels February crude steel production grows by 13%

Advances / Declines Advances Declines Unchanged

952 1,898 107

412 1,044 52

Net Inflows (March 02, 2012)

` cr FII MFs Purch 2,385 408 Sales 1,783 666 Net 602 (257) MTD 878 (257) YTD 37,176 (4,284)

Volumes (` cr) BSE NSE

2,456 10,760

FII Derivatives (March 05, 2012)

` cr

Index Futures Stock Futures

Purch 1,750 1,517

Sales 1,618 1,551

Net 132 (34)

Open Interest 12,744 28,152

Gainers / Losers

Gainers Company

Reliance Infra Reliance Power Zee Entertaintment Syndicate Bank Castrol India

Losers Company

United Spirits Sintex Industries EIH Hindustan Copper Pantaloon Retail

Price (`)

656 135 141 113 507

chg (%)

5.5 5.0 4.0 3.4 3.3

Price (`)

521 79 92 284 173

chg (%)

(6.8) (6.8) (6.7) (6.3) (6.2)

Please refer to important disclosures at the end of this report

Sebi Registration No: INB 010996539

Market Outlook | India Research

RCom wins contract for Aadhaar project valued upto `300cr

As per media reports, Reliance Communications (RCom) has won the network and telecom subscriber contract for Aadhaar, the governments ambitious national identity card program. RCom, an ADAG company, is part of a consortium led by HCL Infosystems that has won number repository and infrastructure contracts for Aadhaar. While the size of the contract won by the consortium is about `2,200cr, RComs share will be `200cr-300cr. We maintain our Neutral view on the stock.

JSW Steels February crude steel production grows by 13%

JSW Steels February 2012 crude steel production grew by 13% yoy to 0.6mn tonnes. However, growth was affected due to non-availability of high-grade iron ore. The quantity of iron ore sold via e-auction was 1.2mn tonnes compared to industry requirement of 3.0mn tonnes during the month. Central Empowered Committee (CEC), in its report, had recommended clean mines (category A) to restart their operations. However, Supreme Court hearing has been delayed several times and, as such, the steel industry continues to face shortage of good-quality iron ore despite paying higher prices. We believe sustaining steel production at current levels from the next quarter would remain a challenge for JSW Steel until the mining ban is lifted in Karnataka. We maintain our Neutral view on the stock.

Economic and Political News

Coffee exports up by 13% in February 2012 EGoM decides to free 700 MHz spectrum band for 4G Government may soon issue notices to companies on idle coal blocks Panel for delinking license and spectrum in FM Radio

Corporate News

Adani in pact to provide 4 MT coal to NTPC LIC bought 157mn ONGC shares in run-up to auction, raised stake to 9.5% Lupin gets US nod for generic schizophrenia capsules Patel Engg wins `377cr urban infra projects Suzlon arm wins `367cr deal to supply wind tower equipment Tata Power to set up JV with South Africa's Exxaro

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

March 6, 2012

Market Outlook | India Research

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

March 6, 2012

You might also like

- TCS - Relieving LetterDocument1 pageTCS - Relieving LettersperoNo ratings yet

- Ajeet Business Tracker Aug 20221234Document14 pagesAjeet Business Tracker Aug 20221234Gaurav SinghNo ratings yet

- Indian Stock Market: A Study OnDocument16 pagesIndian Stock Market: A Study OnMohmmedKhayyum100% (3)

- FMCG Industry AnalysisDocument20 pagesFMCG Industry AnalysisAshish Kumar82% (33)

- Finance Interview Questions: Infosys Brigade Genpact Icici Karvy Capital-IQDocument9 pagesFinance Interview Questions: Infosys Brigade Genpact Icici Karvy Capital-IQdasrashmiNo ratings yet

- Market Outlook 21st March 2012Document3 pagesMarket Outlook 21st March 2012Angel BrokingNo ratings yet

- Market Outlook 29th November 2011Document3 pagesMarket Outlook 29th November 2011Angel BrokingNo ratings yet

- Market Outlook 9th April 2012Document3 pagesMarket Outlook 9th April 2012Angel BrokingNo ratings yet

- Market Outlook 24th August 2011Document4 pagesMarket Outlook 24th August 2011Angel BrokingNo ratings yet

- Market Outlook 12th October 2011Document4 pagesMarket Outlook 12th October 2011Angel BrokingNo ratings yet

- Market Outlook 6th September 2011Document4 pagesMarket Outlook 6th September 2011Angel BrokingNo ratings yet

- Market Outlook 5th September 2011Document4 pagesMarket Outlook 5th September 2011Angel BrokingNo ratings yet

- Market Outlook 26th September 2011Document3 pagesMarket Outlook 26th September 2011Angel BrokingNo ratings yet

- Market Outlook 28th September 2011Document3 pagesMarket Outlook 28th September 2011Angel BrokingNo ratings yet

- Market Outlook 10th April 2012Document3 pagesMarket Outlook 10th April 2012Angel BrokingNo ratings yet

- Market Outlook 9th January 2012Document3 pagesMarket Outlook 9th January 2012Angel BrokingNo ratings yet

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingNo ratings yet

- Market Outlook 14th September 2011Document4 pagesMarket Outlook 14th September 2011Angel BrokingNo ratings yet

- Market Outlook 23rd August 2011Document3 pagesMarket Outlook 23rd August 2011angelbrokingNo ratings yet

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingNo ratings yet

- Market Outlook 29th March 2012Document3 pagesMarket Outlook 29th March 2012Angel BrokingNo ratings yet

- Market Outlook 27th September 2011Document3 pagesMarket Outlook 27th September 2011angelbrokingNo ratings yet

- Market Outlook 19th August 2011Document3 pagesMarket Outlook 19th August 2011Angel BrokingNo ratings yet

- Market Outlook 22nd August 2011Document4 pagesMarket Outlook 22nd August 2011Angel BrokingNo ratings yet

- Market Outlook 29th September 2011Document3 pagesMarket Outlook 29th September 2011Angel BrokingNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument4 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 16th February 2012Document4 pagesMarket Outlook 16th February 2012Angel BrokingNo ratings yet

- Market Outlook 13th March 2012Document4 pagesMarket Outlook 13th March 2012Angel BrokingNo ratings yet

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingNo ratings yet

- Market Outlook 2nd April 2012Document4 pagesMarket Outlook 2nd April 2012Angel BrokingNo ratings yet

- Market Outlook 28th March 2012Document4 pagesMarket Outlook 28th March 2012Angel BrokingNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument3 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 26th March 2012Document4 pagesMarket Outlook 26th March 2012Angel BrokingNo ratings yet

- Market Outlook 1st March 2012Document4 pagesMarket Outlook 1st March 2012Angel BrokingNo ratings yet

- Market Outlook 7th September 2011Document3 pagesMarket Outlook 7th September 2011Angel BrokingNo ratings yet

- Market Outlook 29th December 2011Document3 pagesMarket Outlook 29th December 2011Angel BrokingNo ratings yet

- Market Outlook 23rd December 2011Document4 pagesMarket Outlook 23rd December 2011Angel BrokingNo ratings yet

- Market Outlook 5th January 2012Document3 pagesMarket Outlook 5th January 2012Angel BrokingNo ratings yet

- Market Outlook 20th March 2012Document3 pagesMarket Outlook 20th March 2012Angel BrokingNo ratings yet

- Market Outlook 20th September 2011Document4 pagesMarket Outlook 20th September 2011Angel BrokingNo ratings yet

- Market Outlook 30th Decmber 2011Document3 pagesMarket Outlook 30th Decmber 2011Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Technical Format With Stock 13.09Document4 pagesTechnical Format With Stock 13.09Angel BrokingNo ratings yet

- Market Outlook 17.11.11Document3 pagesMarket Outlook 17.11.11Angel BrokingNo ratings yet

- Market Outlook 23rd September 2011Document4 pagesMarket Outlook 23rd September 2011Angel BrokingNo ratings yet

- Market Outlook 13th September 2011Document4 pagesMarket Outlook 13th September 2011Angel BrokingNo ratings yet

- Market Outlook 30th March 2012Document3 pagesMarket Outlook 30th March 2012Angel BrokingNo ratings yet

- Market Outlook 18th August 2011Document3 pagesMarket Outlook 18th August 2011Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument5 pagesMarket Outlook: Dealer's DiaryVaibhav BhadangeNo ratings yet

- Daily Technical Report: Sensex (16913) / NIFTY (5114)Document4 pagesDaily Technical Report: Sensex (16913) / NIFTY (5114)Angel BrokingNo ratings yet

- Market Outlook 28th December 2011Document4 pagesMarket Outlook 28th December 2011Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 12th March 2012Document4 pagesMarket Outlook 12th March 2012Angel BrokingNo ratings yet

- Market Outlook 24th November 2011Document3 pagesMarket Outlook 24th November 2011Angel BrokingNo ratings yet

- Market Outlook 2nd January 2012Document3 pagesMarket Outlook 2nd January 2012Angel BrokingNo ratings yet

- Market Outlook 07.07Document3 pagesMarket Outlook 07.07Nikhil SatamNo ratings yet

- Market Outlook 9th March 2012Document4 pagesMarket Outlook 9th March 2012Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16649) / NIFTY (5050)Document4 pagesDaily Technical Report: Sensex (16649) / NIFTY (5050)Angel BrokingNo ratings yet

- Market Outlook 11th August 2011Document4 pagesMarket Outlook 11th August 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16897) / NIFTY (5121)Document4 pagesDaily Technical Report: Sensex (16897) / NIFTY (5121)Angel BrokingNo ratings yet

- Market Outlook 27th December 2011Document3 pagesMarket Outlook 27th December 2011Angel BrokingNo ratings yet

- Market Outlook 4th August 2011Document4 pagesMarket Outlook 4th August 2011Angel BrokingNo ratings yet

- Market Outlook 8th September 2011Document4 pagesMarket Outlook 8th September 2011Angel BrokingNo ratings yet

- Technical Format With Stock 11.09Document4 pagesTechnical Format With Stock 11.09Angel BrokingNo ratings yet

- Medical Equipment Rental & Leasing Revenues World Summary: Market Values & Financials by CountryFrom EverandMedical Equipment Rental & Leasing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- DIATM Placement 2011Document5 pagesDIATM Placement 2011Sudipta DasNo ratings yet

- Impact of Macroeconomic Indicators On Stock MarketsDocument84 pagesImpact of Macroeconomic Indicators On Stock MarketsKishore GowdaNo ratings yet

- SBI Roll No38x25 - EngDocument6 pagesSBI Roll No38x25 - Enganon-625509No ratings yet

- Small-Caps The New Big Bets of D-Street: % ReturnDocument4 pagesSmall-Caps The New Big Bets of D-Street: % ReturnDynamic LevelsNo ratings yet

- OpTransactionHistoryTpr18 03 2021Document6 pagesOpTransactionHistoryTpr18 03 2021Tanisha GuptaNo ratings yet

- A Comparative Study On Share Price Project ReportDocument53 pagesA Comparative Study On Share Price Project Reportcity cyberNo ratings yet

- FHPL Hospital ListDocument4 pagesFHPL Hospital ListSimranjeet SinghNo ratings yet

- HUL DC PricingDocument14 pagesHUL DC PricingMeenakshi RamamoorthyNo ratings yet

- Service Provider: Bharti Airtel Ltd. (Mobile Services)Document4 pagesService Provider: Bharti Airtel Ltd. (Mobile Services)amitkurhekarNo ratings yet

- Script Nifty IndexDocument2 pagesScript Nifty IndexRaghavendra NetalkarNo ratings yet

- Businessstandardpaper PDFDocument18 pagesBusinessstandardpaper PDFaashaNo ratings yet

- Morning Cuppa 21-NovDocument2 pagesMorning Cuppa 21-NovSarvjeet KaushalNo ratings yet

- Saral Gyan Stocks Past Performance 050113Document13 pagesSaral Gyan Stocks Past Performance 050113saptarshidas21No ratings yet

- THE Complete Beginner'S Guide: Simple StockmarketDocument37 pagesTHE Complete Beginner'S Guide: Simple StockmarketDharshiniNo ratings yet

- Case Study On Karvy 0910Document66 pagesCase Study On Karvy 0910Sanju Reddy100% (2)

- Finance ProjectDocument71 pagesFinance ProjectPrithviraj KumarNo ratings yet

- Centrum Wealth - India Investment Strategy - 24 August 2013Document61 pagesCentrum Wealth - India Investment Strategy - 24 August 2013Davuluri OmprakashNo ratings yet

- S.No. Name P/E CMP Rs. Mar Cap Rs - CRDocument4 pagesS.No. Name P/E CMP Rs. Mar Cap Rs - CRCogniZanceNo ratings yet

- Balance SheetDocument55 pagesBalance SheetKumarVelivelaNo ratings yet

- I QQRG Ebql EHw LD WXDocument6 pagesI QQRG Ebql EHw LD WXPraveenNo ratings yet

- Indian Capital MarketsDocument26 pagesIndian Capital MarketsMANJUNATHA SNo ratings yet

- Market Outlook For 29 Dec - Cautiously OptimisticDocument5 pagesMarket Outlook For 29 Dec - Cautiously OptimisticMansukh Investment & Trading SolutionsNo ratings yet

- 134 135 Keshav Garg Rosy KalraDocument12 pages134 135 Keshav Garg Rosy KalraJosep CorbynNo ratings yet

- Stock Market IndicesDocument2 pagesStock Market IndicesbijubodheswarNo ratings yet