Professional Documents

Culture Documents

Q3 Results 201112

Q3 Results 201112

Uploaded by

Bishwajeet Pratap SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q3 Results 201112

Q3 Results 201112

Uploaded by

Bishwajeet Pratap SinghCopyright:

Available Formats

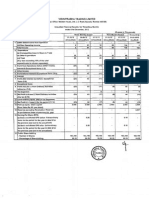

ASHOK LEYLAND LIMITED Regd.

Office :1 Sardar Patel Road, Guindy, Chennai -600 032

FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED 31-12-2011 THREE MONTHS ENDED 31.12.2011 Unaudited 1. 2. Net Sales / Income from operations Expenditure a. (Increase) / decrease in value of stock of finished / trading goods b. Consumption of raw materials and movement in work-in-progress c. Purchase of trading goods d. Employees cost e. Depreciation f. Other expenditure 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. g. Total Profit from operations before other income, financial expenses and exceptional item (1-2) Other income Profit before financial expenses and exceptional item (3+4) Financial expenses - net Profit after financial expenses but before exceptional item (5-6) Exceptional item Profit from ordinary activities before tax (7+8) Tax expense - Income tax Net Profit from ordinary activities after tax (9-10) Extraordinary item (net of tax) Net profit for the period (11-12) Paid-up equity share capital (Face value per share Re.1) Reserves excluding Revaluation reserve Basic earnings per Share (EPS) (Rs.) (post bonus) Dividend per share (Rs.) Public shareholding - Number of shares - Percentage of shareholding 19. Promoter shareholding a. Pledged / Encumbered Number of shares - Percentage of promoter shareholding - Percentage of total share capital b. Non-encumbered Number of shares - Percentage of promoter shareholding - Percentage of total share capital 1,119,385,462 82.52 42.07 1,119,385,462 82.52 42.07 441,166,680 65.05 33.16 1,119,385,462 82.52 42.07 441,166,680 65.05 33.16 441,166,680 65.05 33.16 .2 237,052,102 17.48 8.91 237,052,102 17.48 8.91 237,052,102 34.95 17.82 237,052,102 17.48 8.91 237,052,102 34.95 17.82 237,052,102 34.95 17.82 1,304,239,070 49.02 1,304,239,070 49.02 652,119,535 49.02 1,304,239,070 49.02 652,119,535 49.02 652,119,535 49.02 0.25 0.58 0.17 1.15 1.25 207,566.78 15,647.45 27,232.20 8,662.86 26,834.51 275,605.38 12,374.32 323.25 12,697.57 5,501.23 7,196.34 7,196.34 506.00 6,690.34 6,690.34 26,606.80 202,032.69 9,246.94 25,151.35 8,593.25 23,616.67 284,934.82 24,522.26 1,032.70 25,554.96 6,269.78 19,285.18 19,285.18 3,877.00 15,408.18 15,408.18 26,606.80 171,785.99 6,090.11 24,392.33 6,469.08 18,858.26 212,656.24 10,068.27 232.64 10,300.91 4,748.10 5,552.81 5,552.81 1,216.00 4,336.81 4,336.81 13,303.42 605,662.77 32,408.93 77,357.46 25,721.99 70,755.31 794,094.73 52,892.65 1,767.72 54,660.37 17,105.55 37,554.82 37,554.82 6,831.00 30,723.82 30,723.82 26,606.80 550,737.48 20,899.08 65,790.62 19,021.89 56,478.66 677,378.67 51,539.10 1,329.40 52,868.50 11,858.39 41,010.11 41,010.11 7,703.00 33,307.11 33,307.11 13,303.42 809,676.87 27,336.97 95,971.63 26,743.10 82,253.56 1,017,085.51 94,685.39 1,860.68 96,546.07 16,366.14 80,179.93 80,179.93 17,050.00 63,129.93 63,129.93 13,303.42 252,365.19 2.37 2.00 (10,338.42) 16,293.92 (14,939.53) (17,811.73) (35,549.06) (24,896.62) 287,979.70 30.09.2011 Unaudited 309,457.08 31.12.2010 Unaudited 222,724.51 NINE MONTHS ENDED 31.12.2011 Unaudited 846,987.38 31.12.2010 Unaudited 728,917.77 Rs. Lakhs YEAR ENDED 31.03.2011 Audited 1,111,770.90

-21. The above financial results were reviewed by the Audit committee and then approved by the Board of Directors at its meeting held on February 1, 2012. 2. The statutory auditors have conducted a limited review of the above results. 3. Pursuant to the approval of the shareholders at the Annual General Meeting held on July 19, 2011, the Company issued 1,33,03,38,317 equity shares of Re 1 each as fully paid bonus shares in the ratio of 1(one) equity share for every existing equity share held by the equity shareholders on the record date, i.e. August 3, 2011, by capitalizing an amount of Rs 13,303.38 lakhs from the Securities Premium account. Consequently the Earnings per Share (EPS) has been adjusted, for all periods, in the above statements as required under AS 20 Earnings per Share. 4. The Government of India, Ministry of Corporate Affairs has issued Notification No. G.S.R. 913 (E) dated December 29, 2011, amending the Companies (Accounting Standard) Rules, 2006 in respect of the exchange differences arising (effective from April 1, 2011) on reporting of long-term foreign currency monetary items, by extending the time period for the amortization of the said differences from upto March 31, 2012 to upto March 31, 2020. The unamortised net exchange difference on account of the above is a gain of Rs 461.17 lakhs as at December 31, 2011 (September 30, 2011: Net loss of Rs 36.68 lakhs, December 31, 2010: Net loss of Rs 259.68 lakhs and March 31, 2011: Nil) The impact of adopting the above Notification on the results for the nine months ended December 31, 2011 is that there has been a net cumulative higher charge of Rs 290.23 lakhs (comprising a net gain of Rs 0.06 lakhs for the quarter ended June 30, 2011 and a net charge of Rs 228.76 lakhs and Rs 61.53 lakhs for the quarters ended September 30, 2011 and December 31, 2011 respectively). 5. The Company has adopted the principles of Accounting Standard 30 Financial Instruments: Recognition and measurement, issued by Institute of Chartered Accountants of India, with effect from April 1, 2008, in respect of forward contracts for firm commitment and highly probable forecast transaction meeting the criteria of Cash flow hedges. The gains and losses on effective cash flow hedges are recognized in Hedge Reserve Account till the underlying forecast transaction occurs. 6. The Company has, during the quarter ended June 30, 2011, modified the method of amortization of value of leasehold land from lower of 40 years and the period of lease, to the period of lease, so as to provide a more appropriate presentation of the working results and financial position. The impact of the said modification effected under Other Expenditure is a write back of Rs 946.03 lakhs pertaining to the period upto March 31, 2011 and a lower charge for the relevant periods as tabulated below: Rs. Lakhs Nine Months For Quarters ended ended Description 30.06.2011 30.09.2011 31.12.2011 31.12.2011 Lower charge pursuant to change 50.33 63.82 58.90 173.05 in method of amortization

-37. Current tax expenses are after considering Minimum Alternate Tax (MAT) credit under Section 115JAA (1A) of the Income tax Act, 1961 for relevant periods as tabulated below: Rs. Lakhs Description MAT Credit considered Three Months ended 31.12.2011 1,361.79 30.09.2011 1,182.16 31.12.2010 1,390.13 Nine Months ended 31.12.2011 3,075.32 31.12.2010 5,811.21 Year Ended 31.03.2011 4,855.90

8. The companys primary segment is identified as business segment based on nature of products, risks, returns and the internal business reporting system viz. Commercial Vehicles and related components. The secondary segment is identified based on the geographical location of the customers as per Accounting Standard 17. 9. Number of Investor complaints: at the beginning of the quarter 13, received during the quarter 169, disposed off during the quarter 182 and unresolved at the end of the quarter Nil. 10. Figures for the previous periods are regrouped / amended wherever necessary.

Place: Chennai Date : February 1, 2012.

VINOD K DASARI Managing Director

You might also like

- Edexcel IGCSE Economics Official GlossaryDocument9 pagesEdexcel IGCSE Economics Official GlossaryAshley Lau100% (2)

- Quantitative Economics With Python PDFDocument945 pagesQuantitative Economics With Python PDFcarlos ortizNo ratings yet

- Ashok Leyland Limited Regd. Office:1 Sardar Patel Road, Guindy, Chennai - 600 032Document2 pagesAshok Leyland Limited Regd. Office:1 Sardar Patel Road, Guindy, Chennai - 600 032Kumaresh SalemNo ratings yet

- BHL Fin Res 2011 12 q1 MillionDocument2 pagesBHL Fin Res 2011 12 q1 Millionacrule07No ratings yet

- Consolidated AFR 31mar2011Document1 pageConsolidated AFR 31mar20115vipulsNo ratings yet

- Result Q-1-11 For PrintDocument1 pageResult Q-1-11 For PrintSagar KadamNo ratings yet

- Pakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)Document8 pagesPakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)mohammadtalhaNo ratings yet

- Balance Sheet As at 31 March, 2011: ST STDocument14 pagesBalance Sheet As at 31 March, 2011: ST STLambourghiniNo ratings yet

- Audited Results 31.3.2012 TVSMDocument2 pagesAudited Results 31.3.2012 TVSMKrishna KrishnaNo ratings yet

- GTL Fin Q4 FY 10-11MDocument4 pagesGTL Fin Q4 FY 10-11MAnantmmNo ratings yet

- Abbott UnauditedFinancialMar2011Document2 pagesAbbott UnauditedFinancialMar2011Ghanshyam AhireNo ratings yet

- MRF PNL BalanaceDocument2 pagesMRF PNL BalanaceRupesh DhindeNo ratings yet

- KFA Published Results March 2011Document3 pagesKFA Published Results March 2011Abhay AgarwalNo ratings yet

- SL No Year Ended 30.6.2011 (Reviewed) 30.6.2010 (Reviewed) 31.3.2011 (Audited) Particulars Quarter EndedDocument4 pagesSL No Year Ended 30.6.2011 (Reviewed) 30.6.2010 (Reviewed) 31.3.2011 (Audited) Particulars Quarter EndedZhang Jing CarrieNo ratings yet

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Document1 pageIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Bil Quarter 2 ResultsDocument2 pagesBil Quarter 2 Resultspvenkatesh19779434No ratings yet

- Reference Form (Free Translation of Formulário de Referência)Document197 pagesReference Form (Free Translation of Formulário de Referência)MillsRINo ratings yet

- Gujarat State Petronet LimitedDocument13 pagesGujarat State Petronet LimitedAmrita Rao Bhatt100% (1)

- UntitledDocument197 pagesUntitledMillsRINo ratings yet

- SP Setia Annual Report 2005Document13 pagesSP Setia Annual Report 2005Xavier YeohNo ratings yet

- UntitledDocument193 pagesUntitledMillsRINo ratings yet

- LGE 2010 4Q ConsolidationDocument89 pagesLGE 2010 4Q ConsolidationSaba MasoodNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument15 pagesPak Elektron Limited: Condensed Interim FinancialImran RjnNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Reference Form (Free Translation of Formulário de Referência)Document195 pagesReference Form (Free Translation of Formulário de Referência)MillsRINo ratings yet

- 18 Financial StatementsDocument35 pages18 Financial Statementswsahmed28No ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Reference Form (Free Translation of Formulário de Referência)Document192 pagesReference Form (Free Translation of Formulário de Referência)MillsRINo ratings yet

- UntitledDocument192 pagesUntitledMillsRINo ratings yet

- Reference Form (Free Translation of Formulário de Referência)Document193 pagesReference Form (Free Translation of Formulário de Referência)MillsRINo ratings yet

- Shell Pakistan Limited Condensed Interim Financial Information (Unaudited) For The Half Year Ended June 30, 2011Document19 pagesShell Pakistan Limited Condensed Interim Financial Information (Unaudited) For The Half Year Ended June 30, 2011roker_m3No ratings yet

- Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Document1 pageUnaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Amar Mourya MouryaNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- AuditedStandaloneFinancialresults 31stmarch, 201111121123230510Document2 pagesAuditedStandaloneFinancialresults 31stmarch, 201111121123230510Kruti PawarNo ratings yet

- EMSCFIN-FARDocument37 pagesEMSCFIN-FARPuwanachandran KaniegahNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- FinancialResult 30062012Document3 pagesFinancialResult 30062012Raghu NathNo ratings yet

- Audited Result 2010 11Document2 pagesAudited Result 2010 11Priya SharmaNo ratings yet

- NFL Results March 2010Document3 pagesNFL Results March 2010Siddharth ReddyNo ratings yet

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- Signed LGE FY16 Q1 English Report Separate PDFDocument62 pagesSigned LGE FY16 Q1 English Report Separate PDFvinodNo ratings yet

- Symc (2011 2Q) PDFDocument59 pagesSymc (2011 2Q) PDFNitesh ChauhanNo ratings yet

- IFCI Dec09Document3 pagesIFCI Dec09nitin2khNo ratings yet

- Q2 Fy2011-12 PDFDocument2 pagesQ2 Fy2011-12 PDFTushar PatelNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- HCL Technologies LTD 170112Document3 pagesHCL Technologies LTD 170112Raji_r30No ratings yet

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Document1 pagePDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Sbi Mutual Funds (Analysis of Financial Stastement)Document4 pagesSbi Mutual Funds (Analysis of Financial Stastement)Krishna Prasad GaddeNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- The Siam Cement Public and Its Subsidiaries: Company LimitedDocument73 pagesThe Siam Cement Public and Its Subsidiaries: Company LimitedMufidah 'mupmup'No ratings yet

- Annual Report OfRPG Life ScienceDocument8 pagesAnnual Report OfRPG Life ScienceRajesh KumarNo ratings yet

- Manac-1: Group Assignment BM 2013-15 Section ADocument12 pagesManac-1: Group Assignment BM 2013-15 Section AKaran ChhabraNo ratings yet

- Sebi MillionsDocument3 pagesSebi MillionsShubham TrivediNo ratings yet

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Diesel HFT Fuel PumpDocument2 pagesDiesel HFT Fuel PumpBishwajeet Pratap SinghNo ratings yet

- Rotary PumpDocument8 pagesRotary PumpBishwajeet Pratap SinghNo ratings yet

- TheGreat Indian Retail StoryDocument28 pagesTheGreat Indian Retail StoryBishwajeet Pratap SinghNo ratings yet

- Dupont Analysis: Analysis of Return On Stockholders' Equity (Roe)Document9 pagesDupont Analysis: Analysis of Return On Stockholders' Equity (Roe)Bishwajeet Pratap SinghNo ratings yet

- Mining Valuation: Three Steps Beyond A Static DCF Model: FeatureDocument4 pagesMining Valuation: Three Steps Beyond A Static DCF Model: Feature2fercepolNo ratings yet

- Costing T Ch8Document40 pagesCosting T Ch8FarrukhsgNo ratings yet

- Bank StatementDocument8 pagesBank StatementKayla McKnightNo ratings yet

- Clean Institutional OwnershipDocument96 pagesClean Institutional Ownershippoutsos1984No ratings yet

- Dlp-Epp 6 - Week 1 - Day 4 - 3rd QuarterDocument1 pageDlp-Epp 6 - Week 1 - Day 4 - 3rd QuarterSHARON MAY CRUZNo ratings yet

- Assignment 1: Topic: Marketing Mix and 7 PsDocument7 pagesAssignment 1: Topic: Marketing Mix and 7 Psfatima tariq100% (2)

- Aggregate Planning Example SolvedDocument16 pagesAggregate Planning Example SolvedAbdullah ShahidNo ratings yet

- Family BudgetDocument3 pagesFamily BudgetThuoNo ratings yet

- Environmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForDocument13 pagesEnvironmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForLaichul MachfudhorNo ratings yet

- CH 18Document9 pagesCH 18MBASTUDENTPUPNo ratings yet

- CPEC, SignificanceDocument10 pagesCPEC, SignificanceEmoo MehrunisahNo ratings yet

- Enhancing Malaysian Public Sector Transparency and Accountability Lessons and IssuesDocument14 pagesEnhancing Malaysian Public Sector Transparency and Accountability Lessons and IssuesSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- QUESTIONNAIREDocument5 pagesQUESTIONNAIREMuneebVpMuniCholayilNo ratings yet

- GST Issues For Works Contract CA Yashwant Kasar - 31st July 2021Document73 pagesGST Issues For Works Contract CA Yashwant Kasar - 31st July 2021fintech ConsultancyNo ratings yet

- Cheque Account Statement: Postnet Suite 86 P Bag X103 Mtubatuba 3935Document6 pagesCheque Account Statement: Postnet Suite 86 P Bag X103 Mtubatuba 3935MarkNo ratings yet

- Project Report For InternshipDocument58 pagesProject Report For InternshipAnkita SharmaNo ratings yet

- A Case Study Report On Plastic Industries IncDocument8 pagesA Case Study Report On Plastic Industries IncShraddha SharmaNo ratings yet

- Akun Impor Ud BuanaDocument1 pageAkun Impor Ud BuanaYusnita dwi kartikaNo ratings yet

- Agricultural and Rural Sociology Quiz 13 Des 2021 - Shafiyyah Ramadhani Arafa - 205040100111013Document5 pagesAgricultural and Rural Sociology Quiz 13 Des 2021 - Shafiyyah Ramadhani Arafa - 205040100111013Shafiyyah Ramadhani ArafaNo ratings yet

- GXX - 0002 TableDocument63 pagesGXX - 0002 TableSupratim RayNo ratings yet

- ACCT 220-Corporate Financial Reporting-I-Samia AliDocument9 pagesACCT 220-Corporate Financial Reporting-I-Samia Alinetflix accountNo ratings yet

- Part A. Money and Banking: B. Central Bank of The Philippines C. Greater D. Medium of Exchange Checkable DepositsDocument3 pagesPart A. Money and Banking: B. Central Bank of The Philippines C. Greater D. Medium of Exchange Checkable DepositsLovely De CastroNo ratings yet

- 1-A) 5 Marks 1-b) 5 Marks 2-A) 5 Marks 2-b) 5 Marks: 1 Group Assignment 2Document5 pages1-A) 5 Marks 1-b) 5 Marks 2-A) 5 Marks 2-b) 5 Marks: 1 Group Assignment 2Pravina Moorthy100% (1)

- 2.1 7.2. Imbalance and ManipulationDocument6 pages2.1 7.2. Imbalance and ManipulationJardel QuefaceNo ratings yet

- F8 BankDocument78 pagesF8 BankThanh Phạm100% (1)

- Project On Effectiveness of Training Program OF Grasim Industries Limited Staple Fibre DivisionDocument52 pagesProject On Effectiveness of Training Program OF Grasim Industries Limited Staple Fibre Divisiondave_sourabhNo ratings yet

- The Financial Management Practices of Small To Medium EnterprisesDocument22 pagesThe Financial Management Practices of Small To Medium EnterprisesalliahnahNo ratings yet

- Credit RatingDocument2 pagesCredit RatingSumesh MirashiNo ratings yet