Professional Documents

Culture Documents

Basics - Formation, Planning, Representing, Documents Constituents

Basics - Formation, Planning, Representing, Documents Constituents

Uploaded by

egiarelliCopyright:

Available Formats

You might also like

- Pli Mpre Exam 1 2003Document16 pagesPli Mpre Exam 1 2003thanhdra0% (2)

- Corporations Outline Partnoy PalmiterDocument20 pagesCorporations Outline Partnoy PalmiterMatt ToothacreNo ratings yet

- Pepsi CoDocument3 pagesPepsi CoCH Hanzala AmjadNo ratings yet

- Marshall Chapter 3 Case StudyDocument2 pagesMarshall Chapter 3 Case Studyapi-3173686540% (1)

- Torts OutlineDocument16 pagesTorts OutlineHenryNo ratings yet

- Corporations, Kraakman, Fall 2012Document61 pagesCorporations, Kraakman, Fall 2012Chaim SchwarzNo ratings yet

- HypotheticalsDocument20 pagesHypotheticalsCory BakerNo ratings yet

- Contracts II OutlineDocument79 pagesContracts II Outlinenathanlawschool100% (1)

- Armour - Corporations - 2009F - Allen Kraakman Subramian 3rdDocument153 pagesArmour - Corporations - 2009F - Allen Kraakman Subramian 3rdSimon Hsien-Wen HsiaoNo ratings yet

- Torts Outline Mortazavi 2013Document19 pagesTorts Outline Mortazavi 2013deenydoll4125No ratings yet

- Transformational Company GuideDocument109 pagesTransformational Company Guidesukush100% (1)

- Case Study Corwin CorporationDocument13 pagesCase Study Corwin CorporationChirag Shah100% (1)

- Executive SummaryDocument15 pagesExecutive SummaryNattNo ratings yet

- IL Corporations Bar OutlineDocument8 pagesIL Corporations Bar OutlineJulia NiebrzydowskiNo ratings yet

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10From EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10No ratings yet

- Student Supplementary Materials Answers To Test Yourself QuestionsDocument118 pagesStudent Supplementary Materials Answers To Test Yourself Questionsmilk teaNo ratings yet

- Torts OutlineDocument15 pagesTorts OutlineMichael SantosNo ratings yet

- Business Associations Outline I. Entity Forms 1. S P O ODocument29 pagesBusiness Associations Outline I. Entity Forms 1. S P O OMattie ParkerNo ratings yet

- Constitutional Law I Funk 2005docDocument24 pagesConstitutional Law I Funk 2005docLaura SkaarNo ratings yet

- Family Law OutlineDocument18 pagesFamily Law OutlineBill TrecoNo ratings yet

- I. The Supreme Court Rises: (Conservative)Document8 pagesI. The Supreme Court Rises: (Conservative)izdr1No ratings yet

- Contracts 2 Outline Spring20Document66 pagesContracts 2 Outline Spring20Amelia PooreNo ratings yet

- Biz Orgs Outline: ÑelationshipsDocument26 pagesBiz Orgs Outline: ÑelationshipsTyler PritchettNo ratings yet

- Analysis Under The State Action DoctrineDocument2 pagesAnalysis Under The State Action Doctrinejdav456No ratings yet

- Civil Procedure Outline Part VI: Erie DoctrineDocument6 pagesCivil Procedure Outline Part VI: Erie DoctrineMorgyn Shae CooperNo ratings yet

- Chapter 1: The Federal Judicial Power A. The Authority For Judicial ReviewDocument28 pagesChapter 1: The Federal Judicial Power A. The Authority For Judicial ReviewNicole AmaranteNo ratings yet

- Business Associations OutlineDocument52 pagesBusiness Associations OutlineChi Wen YeoNo ratings yet

- Business OrganizationsDocument71 pagesBusiness Organizationsjdadas100% (2)

- Labor LawDocument91 pagesLabor Lawmaxcharlie1100% (1)

- Estates QuizDocument2 pagesEstates Quizasebeo1No ratings yet

- Torts OutlineDocument78 pagesTorts Outlineblair_bartonNo ratings yet

- Conflicts of Laws OutlineDocument56 pagesConflicts of Laws Outlinekristin1717No ratings yet

- Agencyandpartnership 12712275603502 Phpapp01Document48 pagesAgencyandpartnership 12712275603502 Phpapp01Atif AshrafNo ratings yet

- Con Law OutlineDocument18 pagesCon Law OutlineJane MullisNo ratings yet

- Con OutlineDocument98 pagesCon OutlineRick CoyleNo ratings yet

- Ethics OutlineDocument35 pagesEthics OutlinePaul UlitskyNo ratings yet

- Rincipal Gent Iability IN ORT: UnlessDocument4 pagesRincipal Gent Iability IN ORT: UnlessLaura CNo ratings yet

- Con Law Short OutlineDocument17 pagesCon Law Short OutlineJennifer IsaacsNo ratings yet

- First Amendment: Is There State Action Regulating Speech?Document1 pageFirst Amendment: Is There State Action Regulating Speech?rhdrucker113084No ratings yet

- Constitutional Law OutlineDocument41 pagesConstitutional Law OutlineLaura SkaarNo ratings yet

- Business Associations I - Preliminary VersionDocument10 pagesBusiness Associations I - Preliminary Versionlogan doopNo ratings yet

- Professional Responsibility MaymesterDocument64 pagesProfessional Responsibility MaymesterSierra ChildersNo ratings yet

- Professional Responsibility OutlineDocument38 pagesProfessional Responsibility Outlineprentice brown50% (2)

- Hybrid OutlineDocument24 pagesHybrid OutlineAaron FlemingNo ratings yet

- Con Law Outline - Fall 2011 SeamanDocument30 pagesCon Law Outline - Fall 2011 Seamanzoti_lejdi100% (1)

- Civil Procedure OutlineDocument25 pagesCivil Procedure OutlineElNo ratings yet

- Con Law OutlineDocument48 pagesCon Law OutlineSeth WalkerNo ratings yet

- Really Good Prop OutlineDocument60 pagesReally Good Prop OutlineJustin Wilson100% (3)

- Biz Orgs OutlineDocument74 pagesBiz Orgs OutlineRonnie Barcena Jr.No ratings yet

- Domestic Relations - OutlineDocument15 pagesDomestic Relations - Outlinejsara1180No ratings yet

- CivPro OutlineDocument238 pagesCivPro OutlineNoam LiranNo ratings yet

- Accomplice Common LawDocument1 pageAccomplice Common LawLiliane KimNo ratings yet

- Family Law - Stein Fall 2011 Outline FINALDocument93 pagesFamily Law - Stein Fall 2011 Outline FINALbiglank99No ratings yet

- BA Outline - OKellyDocument69 pagesBA Outline - OKellylshahNo ratings yet

- Con Question OutlineDocument5 pagesCon Question OutlineKeiara PatherNo ratings yet

- Con Law Outline-29Document41 pagesCon Law Outline-29Scott HymanNo ratings yet

- Con Law I Final Cheat SheetDocument3 pagesCon Law I Final Cheat SheetKathryn CzekalskiNo ratings yet

- Prop I Attack Outline Ehrlich 2014Document6 pagesProp I Attack Outline Ehrlich 2014superxl2009No ratings yet

- Con Law II Outline PKDocument106 pagesCon Law II Outline PKSasha DadanNo ratings yet

- Con Law OutlineDocument72 pagesCon Law OutlineAdam DippelNo ratings yet

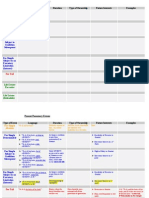

- Entity ComparisonDocument3 pagesEntity Comparisoncthunder_1No ratings yet

- Fall 2011 Exam Model Answers and Feedback MemoDocument47 pagesFall 2011 Exam Model Answers and Feedback MemotcsNo ratings yet

- Property Law Model AnswersDocument12 pagesProperty Law Model AnswersAlexNo ratings yet

- Mortgages OutlineDocument54 pagesMortgages OutlineJames HrissikopoulosNo ratings yet

- MPRE Unpacked: Professional Responsibility Explained & Applied for Multistate Professional Responsibility ExamFrom EverandMPRE Unpacked: Professional Responsibility Explained & Applied for Multistate Professional Responsibility ExamNo ratings yet

- Chapter 2 Business EthicsDocument36 pagesChapter 2 Business EthicsnayabNo ratings yet

- Project Management For ManagersDocument22 pagesProject Management For ManagersBiswanathMudiNo ratings yet

- ByeDocument12 pagesByeRaprap FernandezNo ratings yet

- Manage Platform DemandDocument18 pagesManage Platform DemandNoorNo ratings yet

- CFAP 3 - Study Manual (Final)Document243 pagesCFAP 3 - Study Manual (Final)danishjaved133841No ratings yet

- Strategic Management: Fall 2020 Lecture 11 02 December Associate Professor Nazlee Siddiqui North South UniversityDocument17 pagesStrategic Management: Fall 2020 Lecture 11 02 December Associate Professor Nazlee Siddiqui North South UniversityRedwan RahmanNo ratings yet

- Project Based OrganizationsDocument6 pagesProject Based OrganizationsClaudia TomaNo ratings yet

- Carporate Social ResponsibilityDocument58 pagesCarporate Social ResponsibilitySri KamalNo ratings yet

- Scheme of Work: Cambridge IGCSE / Cambridge IGCSE (9 1) Business Studies 0450 / 0986Document45 pagesScheme of Work: Cambridge IGCSE / Cambridge IGCSE (9 1) Business Studies 0450 / 0986Rico C. FranszNo ratings yet

- Barclays 2007Document79 pagesBarclays 2007Cetty RotondoNo ratings yet

- C01 Mini Case Porsche 1Document17 pagesC01 Mini Case Porsche 1c3564430No ratings yet

- Assist. Ph.D. Student Bocean Claudiu University of Craiova Faculty of Economics and Business Administration Craiova, RomaniaDocument6 pagesAssist. Ph.D. Student Bocean Claudiu University of Craiova Faculty of Economics and Business Administration Craiova, RomaniaDana MoraruNo ratings yet

- Unit 1 Introduction To EthicsDocument54 pagesUnit 1 Introduction To EthicsDivya NabarNo ratings yet

- Understanding Management'S Context: Constraints and ChallengesDocument23 pagesUnderstanding Management'S Context: Constraints and ChallengesMehranisLiveNo ratings yet

- Managing Within The Dynamic Business Environment: Taking Risks and Making ProfitsDocument20 pagesManaging Within The Dynamic Business Environment: Taking Risks and Making ProfitsRafayet Omar Shuvo100% (1)

- Four Faces of Corporate CitizenshipDocument7 pagesFour Faces of Corporate CitizenshipAbbey ZhangNo ratings yet

- Enron Case Study Questions PDFDocument6 pagesEnron Case Study Questions PDFSree Mathi SuntheriNo ratings yet

- Managing For StakeholdersDocument58 pagesManaging For StakeholdersNicacio LucenaNo ratings yet

- MiM Thesis 2017 - Alexia Twingler and PriscillDocument64 pagesMiM Thesis 2017 - Alexia Twingler and PriscillPierre WoodmanNo ratings yet

- CDI-T 5th Management (1-12)Document124 pagesCDI-T 5th Management (1-12)Felipe CamposNo ratings yet

- Flyer Triplet A4 V3Document2 pagesFlyer Triplet A4 V3Gisela GoncalvesNo ratings yet

- Corporate Social ResponsibilityDocument26 pagesCorporate Social ResponsibilityIfemideNo ratings yet

- The CEO Report v2 PDFDocument36 pagesThe CEO Report v2 PDFplanet_o100% (1)

- SM Quiz1Document4 pagesSM Quiz1Ah BiiNo ratings yet

- Project Stakeholders ManagementDocument24 pagesProject Stakeholders ManagementmukhlisNo ratings yet

Basics - Formation, Planning, Representing, Documents Constituents

Basics - Formation, Planning, Representing, Documents Constituents

Uploaded by

egiarelliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basics - Formation, Planning, Representing, Documents Constituents

Basics - Formation, Planning, Representing, Documents Constituents

Uploaded by

egiarelliCopyright:

Available Formats

BASICS FORMATION, PLANNING, REPRESENTING, DOCUMENTS CONSTITUENTS 1. CHARACTERISTICS OF CORPORATIONS a. Separate entity b. Perpetual existence c. Limited liability d.

. Centralized management/separated s/h and ownership interests e. transferability of ownership interests, market for corporate control 2. TYPES OF ORGANIZATIONS a. Public stocks traded, governance separates ownership from control, usually no active management by shareholders b. Close different rules. No market for securities. Overlap of management and ownership. Shareholders also officers, operates like partnership. c. Non Corporate i. General Partnership contract based. Each members joint & severally liable. ii. LLP GPs are joint & severally liable. Limited partners are not. iii. LLC LL of corporation with tax advantages of partnership. 1. Corporations pay tax on net income, or has loss. Partnership pays no tax on net income after salary payments, but corporation does. So, If you expect a business to run loss for the first few years, might want a partnership, because individual income taxes will be lower. 3. FORMATION a. MBCA 2.01 2.07 illustrates procedures generally required i. Organization is carried out by incorporator who plays no role in resulting corp. ii. Incorporator files documents & signs them iii. Filing is accompanied by payment of fee (usually calculated by # of authorized shares or aggregate legal capital) b. When does corporate life begin? i. In MBCA jurisdictions, corporate existence commences w/filing of articles ii. In some other states, existence commences when Sec of State or other official issues a certificate c. First Acts After corporation comes into existence, first meeting must be held i. Either by incorporators, who select BOD, or where BOD is named by articles, by Bd members themselves ii. Tasks: elect additional directors, adopt by-laws, appoint officers, adopt a corporate seal, designate bank for corporate funds, sell of stock to s/h 4. PLANNING CONCERNS a. Three sets of issues: i. How do different forms handle majority and minority interests? ii. How does the choice of form affect the ability to raise capital? iii. What are the tax implications of each form?

b. Majority/Minority Interests (extent to which form deals with opportunistic behavior) i. Corporation favors interests of majority s/h. Board decisions that advance the majority interest are insulated unless they do not pass the BJR. 1. Some states allow minority s/h to seek a judicial order ii. General Partnership default rule allowing at-will dissolution is critical. Majority can bring about needed changes that otherwise would require unanimous consent. (If partnership isnt working, partners can dissolve, fix the problem, and then reorganize) 1. Minority partner can prevent unjustified squeeze-out by proving that the majority did not act in good faith, or can use at-will dissolution opportunistically to deal w/majority. 2. To deal with this problem, partnerships can draft provisions that reduce the risk of opportunism by calling for specified undertakings or terms or permit expulsion without dissolution in certain sets of circumstances w/payment dictated by the agreement. c. Ability to Raise Capital i. B/c they have limited liability, corps. find it easier to raise capital than partnerships ii. LLCs = best of both worlds they have limited liability, but they also allow the entity to be structured as a partnership and to be taxed like a partnership. 5. LEGAL CONCERNS who is the client? (AMA Model Rule 1.13) a. Entity Theory retroactive. Pre-incorporation representation is deemed to be corporate representation. (Danforth) i. If you help set up a corp., you are & always have been the corps lawyer, even if you were working on project before the corp. legally came into existence b. Aggregate Theory Represent both corporation and individuals as joint clients. i. Giles v. Davison (lawyer represents multiple co-clients during formation. Once entity is formed, clients decide whether lawyer will continue to represent (a) constituents AND entity, or (b) JUST the entity.) ii. Opdyke v. Kent Liquor Mart ((lawyer had breached duty to plaintiff (an original s/h) when he purchased stock in the company he helped incorporate although he knew that plaintiff wanted to purchase it himself) c. Reasonable Expectations Test what were the reasonable expectations of the client/clients? i. Westinghouse Elec. Corp (7th Cir. 1978) ((1) if an attorney leads an individual or entity to believe that they are a client, (2) and the belief is reasonable under the circumstances attorney-client relationship is created, regardless of whether client enters into a formal retainer agreement.) ii. Rosman v. Shapiro (S.D.N.Y. 1987) (reasonable expectations test to disqualify corporate counsel in a litigation. The only 2 s/h reasonabl*y+ . . . believe[d] that the corporate counsel [was] in effect his own individual attorney.) 1. Relied on evidence showing that both s/h consulted with attorney for legal advice concerning the creation of the corporation d. Hazard, Ethics in the Practice of Law lawyering for the situation i. Lawyer is a nonpartisan observer when clients clash: can assess the situation objectively, is an interpreter of facts and precedent, can discourage escalation of conflict and recruitment of outside allies, articulate general principles and common custom and help the parties assess their claims

6. BASIC DOCUMENTS a. Articles of Incorporation i. MBCA 2.02; DGCL 102(a) - AoI must set forth specific things (name of corp) ii. MBCA 10.03; DGCL 242(b)(1) Amendment by having directors adopt submitting so s/h for approval. At special or regular meeting. 1. Difference in power Amendments have to go through BoD. S/h can't initiate change; can only approve b. Bylaws i. MBCA 10.20 - can be amended by either s/h or BoD ii. DGCL 109(a) - only s/h granted authority to amend bylaws 1. BUT does say that can give that power to BoD if want to 1. CONSTITUENTS: a. Shareholders right to vote on major transactions. Residual financial interest. b. Board of directors ultimate legal authority to run a corporation. elected by stock holders. Responsible for managing/supervising corporation. Inside/Outside. i. MBCA 801(b); DGCL 141- all corporate powers shall be exercised or under Board authority c. Committees (nominating, compensation, audit, etc.) i. Board can delegate full authority to a committee on a particular subject (e.g. whether to bring suit) ii. Importance of independent committees in evaluating takeovers and offers. d. Officers CEO, President, Vice Presidents, Secretary, Treasurer e. Other Corporate Actors (Stakeholders) i. Creditors protect themselves in contracts, not by fiduciary duties ii. Employees protected by employment Ks, common law, OSHA, discrim. statutes, labor laws. iii. Customers, Suppliers, Community THEORY VIEWS OF THE CORPORATION, CORPORATE SOCIAL RESPONSIBILITY 1. THEORIES OF THE FIRM a. Private Property i. Berle-Means enhance s/h voice to improve relationship, but keep directors and s/h separate ii. Contractarian group of people who contract to engage in economic activity. mkt for corporate control to take care of agency problems. discredited iii. Director Primary (Bainbridge) directors should be given wide discretion b/c they have expertise & managerial skill. Letting them run things is an efficient division of labor. b. Social Institution i. Team production board discretion, w/input from s/h. Board can have ultimate say. ii. Shareholder Primacy b/c is a means to the end of advancing the larger social interest of the shareholders, not b/c of property rights. iii. Political Product public co. is the product of a combination of political/economic forces c. Way to reconcile: short-term and long-term welfare

i. Enlightened view of self-interest allows s/h and stakeholders to both have their interests served ii. Example: e.g. CTO to purchase company at a 50% premium and then cut the workforce by 50%. Great for current s/h, not for stakeholders. obligations diverge. 1. Property: S/h obligation is to accept. Stakeholders obligation is to accept & not make it hard for s/h to accept. (voice option) 2. Institutional: s/h and stakeholders have an obligation to the entity at a whole. Balance welfare. (exit option) 2. SOCIAL RESPONSIBILITY a. Dodge v. Ford: Acorporation is organized and carried on primarily for the profit of the stockholders. The powers of the directors are supposed to be exercised for that end. They have the authority to choose the means, but not another objective. i. What does it prove? some scholars cite this case to prove that sole (legal or normative) duty of directors is to maximize s/h profits . . . this is not strictly true. 1. Court noted that an incremental humanitarian expenditure for the benefit of employees is permissible 2. Close reading suggests that case is more concerned with majority s/h oppressing minority than with broader question of duty to maximize s/h wealth. ii. Conclusion: Ford stands for the proposition that as long as the goal of the corporation is profitmaximization, Ds have discretion to choose strategy (BJR) b. Must a director maximize s/h welfare in all cases? (DE) i. No. Unocal and Time v. Paramount establish that directors have discretion to take into account various stakeholder interests, and are not limited strictly to pursuing short-term shareholder profit. c. Different Theories of Firm have different Conceptions i. Berle only for ratable benefit of s/h (Milton Freidman) ii. Dodd business corporation has economic, social, profit functions iii. Davis large corps. provide social benefits BY seeking profit. (R&D, etc.) iv. ALI reconciling both to promote optimal outcomes. May devote effort to public welfare, depart from short-term profit to realize long-term. d. Theodora Holding Corp (reasonableness standard for corporate contributions/donations.) i. Rule: within reasonable limits both as to amount and purpose ii. Comes from IRC, which says that business donations are limited to 5% of revenue of corporation. If < 5%, per se reasonable) MONEY SECURITIES, ACCOUNTING 1. Corporate Securities a. Debt options, bonds, debentures, notes. SAFE & secure, but exercise no control i. Debt claims subordinate equity claims ii. Options: right to buy future stock. Can be issued by one person. (DGCL 157(c)) 1. Backdating (awarding @ lowest cost) misleading b/c company is not deducting every expense its supposed to)

2. Call option: right to buy shares. 3. Put option: right to sell shares (uncommon) 4. Strike price/exercise price: price specified in option k 5. Maturity date/expiation date: date specified in option K 6. Warrant: stock option issued to public iii. Bonds: fully contractual indentures, issued w/o shareholder approval. No vote. 1. Requiring corp. to pay fixed amount at maturity, interest throughout. 2. If default acceleration, entire amount due immediately 3. Convertible debenture bonds convert to common stock. Way to hedge guarantee if company suddenly booms. 4. Callable at fixed price @ option of borrower. Valuable if interest rates decline. Price often set at higher than K price. b. Equity common, preferred, riskiest, but exercise control. i. Until sold: authorized, but unissued ii. Authorizing more shares requires an articles amendment iii. When sold: authorized, issued or authorize, outstanding iv. If bought back by corporation: authorized and issued, but not outstanding. (Treasury shares) v. How many shares to issue? 1. issuing only limited number preserves voting rights. 2. MBCA 6.21(f): s/h retain power over issuance of additional shares of authorized stock approval is needed if corporation issues shares with voting power equal to more than 20% of voting power outstanding immediately before transaction (unless cash) vi. Preemptive rights: To prevent share dilution. If new shares issued, current s/h get first dibs. Today, most corps. have an opt-in approach. 1. Must include provision in articles of incorporation. 2. Only small corporations adhere to the doctrine of preemptive rights. 3. MBCA 6.30(b) addresses problems that arise when s/h have preemptive rights a. Unless articles provide otherwise, no preemptive rights exist b. are limited in corps with multiple classes of stock. c. Tax Considerations favor debt in capital structure i. Allows corps to deduct from taxable income interest paid on issued bonds. 1. Repayment on principle (bond) typically treated as tax-free return on capital. ii. Does not allow corps. to deduct from taxable income dividends paid on stock. iii. So why not always bonds instead of preferred stock? 1. Preferred stock is more flexible directors dont have to pay preferred dividends but do have to make regular payments on all debts. 2. company w/low debt:equity ratio is unattractive to investors d. When is debt really debt? (Slappey Factors)

Names given to certificates Presence of absence of fixed maturity date Source of payments Right to enforce payment of principal and interest Participation in management flowing as a result Status of contribution w/r/t regular corporate creditors

Intent of the parties thin or adequate capitalization identity of interest between creditor and stockholder source of interest payments ability of corporation to obtain loans from outside lenders extent to which advance was used to acquire capital assets failure of debtor to repay or seek postpone due date

e. Leveraging/Undercapitalization DEEP ROCK DOCTRINE (Taylor) i. courts have exercised equity jurisdiction to subordinate claims of s/h creditors to those of other creditors when they conclude that s/h creditors have not invested adequate equity capital into the corporation to keep it running. ii. Issue in applying: determining whether the company has deceived lenders into thinking the company is more creditworthy than it is. 1. If no deception: high leverage alone not a problem, and courts suggests that if lenders know the facts about high leverage, they can make informed decisions and can bargain for higher interest rates or more collateral to cover their risks. 2. If deception: more likely to invoke Deep Rock Doctrine and subordinate the claims of the purported debtholders to those of the real debtholders f. Equity Link Investors (duty to prefer interests of common stock over preferred (in good faith) when there is conflict.) i. Rationale: common s/h are the residual owners. They are the ones who get what's left after all the debt is paid off. They are taking the most risk, and are the most sensitive to fluctuations in the company. 2. Financial Accounting a. Assets = Equities + Liabilities i. Asset = property, tangible or intangible. (cash, marketable securities, accounts rec., notes/loans rec., inventory, prepaid expenses, deferred charges, fixed assets [depreciate , charged against revenue], intangible assets. 1. Different ways to report (check chart) ii. Liabilities = debts firm owes to others 1. Current: < 1 year until due 2. Long term: due > 1 year from balance sheet date (mortgage, bonds, off balance sheet, loan guarantees, warranty obligations, claims by civil plaintiffs) iii. Equity = paid in capital iv. Example: You buy something for $1000. You borrowed $300, plus paid $700 from your savings. Assets = $1000, liabilities = $300, equity = $700. b. Balance Sheet Analysis i. Liquidity = does firm have cash to meet obligations? 1. Liquidity ratio (cash + mktbl. securities + AR)/ current liabilities 2. Working capital (current assets current liabilities)

3. Current ratio (current asset / current liabilities) a. Analysts prefer 2:1, although some firms work well w/less, and any growth of this ratio is good. ii. Debt-equity (LT Notes Payable/ total equity) 1. Indicates long-term capitalization. 2. > 1:1 = living on borrowed capital iii. Interest coverage (annual earnings/annual interest on LTD) 1. Whether firm would be able to service debt. c. Income Statement (accrual accounting) i. Realization recognize revenue in period that services were rendered or goods shipped, even if payment not received in that period. ii. Matching allocate to the period in which revenues are recognized the expenses company incurred generating those revenues. iii. Gross Profit = Net Sales COGS iv. Net Income = everything (positive net income = retained earnings) v. Operating Income = Gross Profit Operating Costs vi. EBIT = before interest & tax vii. EBITDA = before interest, tax, depreciation & amortization. viii. Pretax Income = Operating Income Interest Expenses ix. Return on Equity = Net Income / Equity at end of previous year 1. Compare to % return on alternative investments. If better return on risk-free investment, firms not worth book value. d. Statement of Cash Flows i. Operating activities (important) ii. Investing Activities iii. Financing Activities iv. Structure: starts with net income, then corrects for non-cash changes. If firm had X income in inventory (non-cash), would have to correct cash flows by X. v. Relationship between income & cash flow: 1. Cash flow lagging: rapid growth? Need additional funding? 2. Increases in inventory = Long term growth or short term pumping? 3. if inventory decreases, is firm petering out? 3. Process of Accounting a. Recording & controls takes down info. concerning every transaction b. Audits company verifies the accuracy of the recorded information c. Accounting classifies & analyzes audited info. Presents it statements. (GAAP) d. GAAP Assumptions i. Business is an accounting unit separate from its owners, whether or not it has a separate legal existence ii. Business = going concern (will operate for foreseeable future)

iii. Firm is required to apply same accounting concepts and procedures from one period to the next iv. Firms must disclose all material information v. Firms must follow a conservatism principle that profits not be anticipated and that probable losses be recognized ASAP e. Outside audit examining, on a test basis, evidence supporting amounts & disclosures in financial statements. i. If everything compiles with GAAP, issue unqualified or clean opinion, but compliance with GAAP does not guarantee that statements present information fairly. f. Audit Committee must be independent Ds under Sarbanes-Oxley i. Sends to CEO/CFO who must personally certify that statements present fairly in all material respects the condition of the company. CORPORATE GOVERNANCE IAD, BOARD AUTHORITY, SHAREHOLDER AUTHORITY, ALTERING S/H VOTING 1. CHOICE OF LAW INTERNAL AFFAIRS DOCTRINE a. DELAWARE: Law of state of incorporation governs internal affairs (McDermott panama case) i. Internal affairs = relationships between constituents (voting, rights to distribution of dividends, information rights) 1. Vantage Point v. Examen DE defining internal affair. Holding Wilson v. Louisiana Pacific unconstitutional. ii. External affairs governed by law of the state in which activities occur and by federal/state regulatory statutes. (E.g. minimum wage, tax, tort) b. NY & CALI: Jurisdiction over pseudo-foreign companies. Majority of business = states doctrine applies. Applies to in-state & out of state equally, so no DCC. Must be > 50%, so no DPC conflict. (Wilson v. Louisiana-Pacific) c. Both internal/external rules Right to merge and procedure to be followed d. Benefits of IADII: Predictability in business relationships, Constitutional foundation e. Constitutional Principle (A.14) i. Excluding out-of-state corps unconstitutional unless discrimination . . . bears a rational relation to a legitimate state purpose. (Western & Southern Life) ii. Dormant Commerce State statute violates constitution if it either (1) treated domestic and foreign corporations differently or (2) ran the risk of generating multiple and conflicting standards that would burden interstate commerce. iii. Also see CTS, Ananda. Anti-takeover statutes are constitutional, if unwise. 2. BOARD AUTHORITY a. Board has plenary authority, subject to limitations in the Articles. i. Issue: the extent to which articles can be amended to constrain the board. 1. MBCA 8.01, DE 141) core of director responsibilities that cannot be abridged. b. Board Meetings i. (DE 141: must be by vote of majority members at a meeting at which theres a quorum (majority of the board))

ii. types of meetings 1. regular (scheduled, can be held w/out notice of time, place) 2. special (have to be preceded by @ least 2 days notice) c. Notice i. MCBA 8.22(b) requires two days notice of date, time, and place for special meetings 1. But see MCBA 822(a) for regular meetings, does not require notice (assumption that board knows schedule) ii. MCBA 8.23(a) any director who does not receive notice may waive notice by signing a waiver before or after the meeting, or by attending and participating and not protesting the absence of notice. MCBA 8.23(b). 1. But If you attend solely to protest, have not waived notice. ( 8.23(b)) d. Quorum precludes action by a minority of directors i. Statutory norm for quorum: majority of the total number of directors. Although by statute this can be reduced to no less than of directors. e. Action At A Meeting Each director has 1 vote may not vote by proxy i. Vote of majority (when there is a quorum) is necessary to pass a resolution 1. Meeting rule (Baldwin v. Canfield): all Ds had signed a deed, but board never met, deed was held invalid, because they must act as a board, not as individuals who are all on the board. Ensures common understanding of goals, terms, conditions, concerns. ii. Binding boards to things not agreed up on per the meeting rule 1. Unanimous action they all would have agreed anyway, for their own separate reasons, and wouldnt have discussed it. 2. Emergency if impossible to convene, corp. must proceed on the opinions of whatever Ds can be gotten to deliberate 3. Unanimous s/h approval if all s/h meet, result they reach will bind the BOD. Meeting rule is a hardship as applied to large # of parties. 4. Majority shareholder-director approval if directors who participate in informal actions are a majority, and also own a majority of the corporations outstanding issued and outstanding shares corporation is BOUND by that action. f. Informal Director Actions i. MCBA 8.21 allows board action to be taken w/out a meeting with unanimous written consent of directors. ii. MBCA 8.20(b) permits board to conduct a meeting by any means of communication by which all directors participating may simultaneously hear each other during the meeting (e.g. Skype call). Official comment: the advantage of traditional meeting is interchange this is also permitted by conference call. g. Unauthorized Meetings i. OPEN: Presence of enumerated exceptions leads some courts to take a harder stance on corporations who hold unauthorized meetings

1. Village of Brown Deer (Wisc.) corporate pres & majority s/h who had customarily made decisions without the BOD, signed a petition on the corps behalf for annexation of land. (since board can act w/unanimous written consent w/out a meeting, petition lacked authority because president made the action WITHOUT that required consent.) ii. CLOSE: Upholding even though not in compliance with statute 1. White v. Thatcher Financial (Colo.) 2 Ds approved payments to outgoing president. Although statute required board have a minimum of 3 Ds, vacancies had gone unfilled for several years, and there were only 2 members. Court pointed out that these 2 directors constituted a quorum of the minimum and upheld the validity of the payments, remarking that permitting reliance on the custom and practice of a board (like a board w/only 2 members) protected innocent third parties in dealing with a close corporation. h. Grants of Authority to Directors i. Officers receive their authority via delegation from directors. Their power comes directly from Director plenary authority within the corporation. ii. Agency - consensual relationship between a principal & agent, by which agents actions can obligate the principal. Agent is a fiduciary of the principal iii. Actual authority (Express/implied) assume general 1. Summit Properties: Persons dealing with a known agent have the right to assume, in the absence of information to the contrary, that the agency is general, not subject to specific restrictions. iv. Apparent authority (can run contrary to actual intentions of Principal) 1. vests in an agent when a third party reasonably believes the actions of the principal instilled such authority in the agent v. Inherent agency power (Menard purchase of property by president) 1. A question of reasonable belief in the circumstances. 2. How to show: provisions of laws, art. of incorporation, bylaws, resolution of BOD, evidence that corp. has allowed the officer to act in similar matters and has recognized, approved, or ratified actions a. In Menard, signing the purchase agreement was within the normal scope of Sterling's duties as president, and sufficient to establish Menard's reasonable belief that Sterling possessed necessary authority. vi. Ratification of the act of another 1. Summit Properties (ratification through acquiescence. COO publishes news about purchase, then tries to argue seller didnt have agency) 3. BOARD ALTERING S/H VOTING RIGHTS (requires compelling justification e.g. structural coercion) a. Blasius. (Del.): When the board acts for the primary purpose of interfering with the exercise of the s/h vote, the board must have a compelling justification. Reappears in takeover defense measure cases. i. Triggers Blasius 1. Preclusion (not preventing, cf. Stahl), makes s/h approval not realistically attainable (Chesepeake), dilution representation on the board (Liquid Audio)

2. Coercion (interferes with shareholder ability to decide whether to agree to the transaction on the merits, as opposed to a fear of some threat that will materialize) ii. Compelling justification 1. Gridlock: no (Liquid Audio) 2. Inadequate price: no 3. Structural coercion: yes 4. Substantive coercion: yes, if well established evidence 5. Policy, culture, community: probably not b. Stahl (reconciling Schnell, Blasius, and other DE decisions involving this issue) i. where corporate directors exercise their legal powers for an inequitable purpose their action may be rescinded or nullified . . . at the instance of an aggrieved shareholder. . . . under this test the court asks the question whether the directors purpose is inequitable. ii. In Stahl, the election process is not being foreclosed, its just being delayed. Whenever the board calls a meeting the vote will take place. This is not preventing anybody from exercising his vote. Stahl has no right in law or equity to compel a meeting. c. Liquid Audio (Del.): defensive action by Ds (increasing board size on the eve of a contested election w/ motive of diluting the influence of the new directors) compromised the role of corporate democracy in maintaining proper allocation of power between the s/h and the board i. Since the Ds didnt demonstrate a compelling justification under Blasius, bylaw amendment that expanded the board size was invalid. 4. BOARD CONSTRAINING ITSELF (only if in articles of incorporation) a. Quickturn (poison pill Rights Plan is invalid under DGCL 141(a), because any limitation on the boards authority must be set out in the certificate of incorporation.) 5. SHAREHOLDER AUTHORITY a. Approve fundamental transactions i. sale of all or substantially all of a corp.s assets ii. dissolution iii. statutory merger (targets s/h will have to approve) 1. MBCA 6.21(f) says that purchasers s/h will get to vote if the merger will result in a dilution of their shares by 20% or more 2. DGCL 251 says that purchasers s/h only get to vote if its a formal merger) iv. triangular merger 1. DGCL says that purchasers s/h wont get to vote at all 2. MBCA and NYSE says they will if their shares are diluted). b. Make recommendations (Auer v. Dessel) c. Amend bylaws (Teamsters v. Fleming) i. MBCA articles may give them exclusive authority to do so. ii. DGCL s/h have default ability to amend bylaws, directors can be given it. d. Elect directors, increase # of directors e. Remove directors with or without cause. (Campbell removal is implicit in power to elect)

i. Articles can specify only for-cause removal. If articles so provide, usually define cause as a high bar . . . illegal behavior, abuse of power, etc. not bad business judgment ii. S/h must provide cause & notice of hearing at start of proxy solicitation process. f. Are not permitted to: i. Amend the articles. Can only vote on amendments. ii. Make decisions about business operations of company 1. Auer cant require reinstatement of president, because thats a business decision iii. Compel directors to take action (Auer hire back prez) FIDUCIARY DUTIES BJR, CARE, GOOD FAITH, LOYALTY (conflicts, cleansing), EXCULPATION 1. THE BUSINESS JUDGMENT RULE a. Elements i. Informed (to rebut, show uninformed/gross negligence/inability to be coherently explained (E.g. Selheimer. (pouring money into construction of a plant, knowing it could never be operational or profitable) ii. Rational business purpose (to rebut, show waste. If what the corporation has received is so inadequate in value that no person of ordinary, sound business judgment would deem it worth that which the corporation has paid. Grobow) iii. Disinterested (to rebut, show personal interest) (Disney) iv. Independent (to rebut, show domination) b. If the rule does not apply, courts scrutinize decision as to intrinsic fairness to the corporation and the minority shareholders. (fair process + fair price) i. If informed prong is rebutted fair process prong of entire fairness is invalidated. ii. If rational business purpose prong is rebutted fair price prong is invalidated iii. Burden then shifts to corp. to prove NO HARM c. Aaronson v. Lewis (Del. 1984) : the business judgment rule is . . . a presumption that in making a business decision the directors . . . acted on an informed basis, in good faith and in the honest belief that the action taken was in the best interests of the company. Absent an abuse of discretion, that judgment will be respected by the courts. The burden is on the party challenging the decision to establish facts rebutting the presumption. d. Business Judgment Rule and Negligence i. NEW MBCA: gross negligence Discharge their duties with the care that a person in a like position would reasonably believe appropriate under similar circumstances. (8.30(b)) e. Policy for the BJR (Joy v North) i. Shareholders voluntarily undertake the risk of bad business judgment. Because potential profit often corresponds to potential risk, it is in the interest of s/h that the law not make investors too risk-averse. 2. DUTY OF CARE act in the corporations best interests and to exercise reasonable care in overseeing corporations affairs/making business decisions a. Functions & Related Duties

i. oversight function (ongoing supervision and monitoring of the corp.; directors have a duty of attention/cant be asleep at the switch) ii. decision-making (discrete acts by board that are under scrutiny; MBCA says that D must get all reasonably available and relevant info). iii. Duty to become informed (Van Gorkam/Trans Union Case - failing to apprise itself of all information reasonably available and relevant, failing to disclose all material information such as a reasonable stockholder would consider important in the situation at hand) b. OVERSIGHT: substance based decision. breach of this duty = breach of the duty of loyalty, because directors put their own interests over necessity of doing whats best for the corporation. i. MBCA 8.01(c) lists sorts of matters to which oversight applies: corporate/legal compliance, preparation of financial statements ii. MBCA 8.31: sustained failure to devote attn. to ongoing oversight, becoming aware of info that a reasonable director should recognize is problematic triggers the duty to inquire further. hindsight in real time. iii. DE: Caremark (Del.) (Breach when (1) Ds utterly failed to implement any reporting or information system or controls OR (2) having implemented such a system or controls, consciously failed to monitor/oversee its operations, disabling themselves from being informed of risks/problems, and (3) a showing that directors knew they were not discharging fiduciary obligations) 1. compare w/Stone v. Ritter & LOYALTY breach for total failure to implement. iv. Courts other than DE let oversight claims progress 1. McCall v. Scott (6th Cir) (Ds held liable for failing to monitor and prevent management from engaging in fraud. Either recklessly or intentionally disregarded red flags and failed to act. 2. Abbot Labs (7th Cir.) (directors breached a duty by failing to provide appropriate oversight to prevent findings of violations of FDA rules. Board members were aware of FDA violations, and took no corrective measures) c. DECISION MAKING BJR comes into play. Process-based decision. i. Overcoming the BJR: Irrationality, unreasonable process, bad faith, conflict of interest, waste 1. Waste (lacking RBP): If what the corporation has received is so inadequate in value that no person of ordinary, sound business judgment would deem it worth that which the corporation has paid. Grobow v. Peroti (Del) ii. Shelinsky v. Wrigley (1968) (Cubs night ball? Not best choice, but court will not interfere with an honest business judgment absent a showing of fraud, illegality or conflict of interest. Decisions should not be disturbed just b/c there is a good case that the policy chosen may not be wisest) d. DUTY TO BECOME INFORMED i. THE TRANS UNION CASE: Smith v. Van Gorkom (Del) (duty to become informed - "Under the BJR there is no protection for directors who have made an unintelligent or unadvised judgment. Liability for failing to inform itself of all information reasonably available and relevant to their decision to recommend the merger, and by failing to disclose all material information such as a reasonable stockholder would consider important in deciding whether to approve the merger.

1. Holding. Ds were grossly negligent because they approved a controversial merger (turned out to be low price) without substantial inquiry or any expert advice into the terms of the transaction. 2. Importance: stands for the importance of a thorough and thoroughly documented deliberation process. Directors have to be given info, take the time to consider it, and ask questions. 3. EXCULPATION a. Exculpation clauses (affirmative defense) - allowed for DUTY OF CARE only. i. DGCL 102(b)(7) (not self-executing requires s/h to adopt affirmatively) 1. Available: breach of the duty of care (oversight unless total failure, decision-making & BJR, duty to become informed, Revlon duties unless total failure) 2. Unavailable: breaches of the duty of loyalty, acts or omissions in bad faith, intentional misconduct, knowing violations of law, and/or transactions in which the director received an improper personal benefit (i.e. insider trading) ii. MBCA 202(b)(4) 1. Available: breaches of the duty of care, bad-faith omissions (b/c ABA Committee thought that otherwise it would be too vague a standard) 2. Unavailable: improperly received financial benefits, infliction of harm on corporation or s/h, intentional violations of criminal law, bad faith acts, unlawful distributions of assets. b. Indemnify (reimburse) directors in certain circumstances i. MBCA 8.51: MAY indemnify against liability incurred in certain proceedings. Liability incurred means judgment, settlement, penalty, or fine, or reasonable expenses incurred (costs vs. expensescosts are things like judgments, expenses are things like atty.s fees). 1. Non-derivative suits: costs + expenses as long as D acted in good faith and reasonably believed that conduct was in corps best interests, or at least not opposed to the corp.s interests (subjective standard). 2. Criminal if D had no reason to think conduct was unlawful. 3. Derivatives suits: can only indemnify Ds for expenses (requires (1) good faith (2) reasonable belief of best interests of corporation) 4. Officers: MBCA 8.56: a corp. can indemnify officers to the same extent as directors. ii. Delaware (DGCL 145) 1. Non-derivatives: indemnify costs and expenses if the D acted in good faith/with reasonable belief. 2. Derivatives: indemnify expenses only if the director hasnt been judged liable (so indemnification can only happen if the case is settled) 3. Criminal if D had no reason to think conduct was unlawful. iii. Who determines whether the standard for indemnification has been met? 1. 1994 MBCA amendments permit decision to be made though a majority of disinterested directors. 8.50 defines disinterested director: (i) not a party to the proceeding, (ii) does not have a familiar, financial, professional, or employment relationship with the director

c. D&O insurance MBCA 8.57 and DGCL 145(g) authorize cos. to purchase it for their directors & officers, regardless of whether theyd qualify for indemnification. 4. DUTY OF LOYALTYplace best interests of corporation above personal interests. Underlying duty of good faith. a. Bayer v. Beran (radio station & singer wife) interested D shifts burden to board to prove entire fairness b. Good Faith i. Definition: fiduciary intentionally acts with a purpose other than that of advancing the best interests of corp., with the intent to violate applicable positive law, or intentionally fails to act in the face of a known duty to act, demonstrating a conscious disregard for duties (oversight). ii. failure to act in good faith more egregious than breach of duty of care. (Disney) iii. Good faith upheld, duty of oversight: Stone v. Ritter (Del.) (no breach of good faith when board had put in place a number of procedures & systems/there was no conscious disregard of their obligations) 1. No reporting system at all breach of the duty of loyalty, because youre not acting in good faith to carry out your responsibilities. 2. System in place you can breach your duty of care by not responding to a specific report of wrongdoing or by not revising the reporting system when theres evidence of its failure. iv. Araneta (Del.) (Breached f duty of loyalty when Araneta stripped the co. of its major asset and transferred it to his family (subordinated co.s interests to his own). Also found that 2 directors breached their duty of loyalty by acting as Aranetas stooges) c. CONFLICTS OF INTEREST (are transaction-specific) i. Questions to ask 1. Is there a director with a personal interest in the transaction? 2. If yes, are any of the other directors beholden to that director in a way that could compromise their judgment? ii. What does it mean to have an interest in a decision? 1. Personal interest 2. Self-dealing: director is on both sides of the transaction. (Benihana) 3. Compromised judgment: decision clouded by interest in reaping personal benefits 4. Beneficiary independence compromised by being beholden to another director who does have a personal interest in the decision. iii. What does it mean not to be independent? 1. Challenging- degrees of relationships between interested and non-interested directors. 2. NYSE NYSE affirmatively deemed to have no material connection to company whose board hes on. Not independent if: employment in past 3 years, > $120k in compensation to D or immediate family member. iv. When do you consider independence? 1. Shifting the burden to the challenging s/h in transactions involving management contracts, approval of settlement of derivative suit, demand futility, dismissal of suit by SLC, to uphold anti-takeover and deal protection measures (IC to bolster Unocal) d. CLEANSE (once cleansed & BJR satisfied, all you can do is challenge on DUTY OF CARE grounds) i. DGCL 144 can challenge for any conflicting interest, not just financial. (e.g. familial, Stanford)

1. Whose conflicts are imputed: unspecified. 2. Cleanse by: (1) disclosure & approval by a majority of the disinterested, independent, informed Ds, or (2) a majority of disinterested, independent, informed s/h OR inherent fairness 3. Interested Ds can be counted in a quorum, deliberate, vote on transaction. 4. Once cleansed, Board gets the benefit of the BJR. (Benihana) ii. MBCA 8.62 only a financial DCIT subject to challenge. Other interests (personal) dont count. 1. Whose conflicts are imputed (8.60): spouse, family member, person living in same home, entity owned by director, entity that director serves or is trustee, guardian, representative, or fiduciary. Directors employers. 2. Cleanse by: (1) authorizing by a vote of a majority of qualified Ds who voted on the transaction, (2) authorizing by a committee, as long as members are qualified or members were appointed by majority of qualified Ds, (3) authorizing by a vote of qualified (disinterested, independent) shares 3. Interested Ds cannot deliberate, participate, or vote iii. DISINTERESTED DIRECTOR APPROVAL 1. Walt Disney (determining independence. Matter of relationship, degree.) 2. Ebay (whether, in a s/h derivative suit, the s/h have to make a demand on the Board to ask it to bring suit against directors, or whether s/h can file directly. If directors cannot make a disinterested decision about whether to bring suit, claim is futile) 3. Oracle (court has already ruled that demand is futile, but court gives a last shot at litigation by establishing a SCL board is THAT board independent?) iv. RATIFY/SHAREHOLDER APPROVAL 1. Lewis v. Vogelstein (legal effects & nature of shareholder ratification) 2. Lewis v. Vogelstein II (waste must be ratified by unanimous vote) 3. Harbor Finance (Del.) (if theres effective s/h ratification, complaint should be dismissed outright Ps shouldnt be allowed to try to prove waste.) 4. Gantler v. Stephens (Del.) (s/h can only ratify director action when specifically asked to approve, not transactions that they inherently must approve anyway) v. INHERENT FAIRNESS to the corporation (both MBCA and DGCL) 1. Substantive = Terms of the transaction are such as to be comparable to those of an armslength transaction in the market. 2. Depends mainly on whether its a fair price there is a range of fair prices. 3. Also require harm vi. Summary: 1. duty of loyalty raises the question of whether directors are both disinterested (no prospect of personal gain from the transaction) and independent (arent beholden to any interested party). 2. Cleanse (Ratify, S/H Approval, Inherent Fairness)

3. If a transaction is upheld/cleansed duty of loyalty challenge is not possible, and only possible to bring a case based in duty of care a. Duty of care = BJR, and exculpation provisions. Much more difficult. CLOSE CORPORATIONS PLANNING, LEGAL TREATMENT, OPPRESSION 1. LEGAL TREATMENT a. At time of formation, must elect to be treated as a Close Corporation. b. Problem: s/h of a CC may find that the rules of centralized mgmt. and majority control are at odds with their expectations of decentralized equality. i. In a close corp., s/h want some voice in mgmt. to protect their interests, and the parties v. much rely on particular individuals who are involved in the co. ii. S/h who are in a close corp. who dont have voice are subject to exploitation, cant exit. iii. The standard rules that apply to corps. (straight voting, free transferability of shares, separation of ownership from mgmt.) generally are problematic in close corps. iv. Courts have become more realistic about the special demands of a close corp. and have become far more tolerant of departures from the norm. . c. Legislative response: i. Common statutory approach presume that all corps. are alike but expressly authorize close corps. to adopt governance structures that vary from traditional model (MBCA 732, 801(b)). ii. A second approach is the comprehensive close corp. statute, which allows the corp. to elect treatment under a special statutory regime (DGCL- have to formally elect treatment before shareholders can deviate from the standard corporate model). d. Tailoring Governance System - VOTING: i. Cumulative Voting aggregate all of your shares/take the # of shares youve got times the # of positions to be filled- can cast all your votes for 1 candidate. (available if articles provide) 1. Ensures that every s/h can have their choice of @ least one Director. X = (s * d/D+1) + 1 a. s = number of share represented at meeting b. d = Number of directors desired to elect c. D = Total number of directors to elect d. X = number of votes needed to elect D number of directors ii. Class voting- divide common shares into 2 or more classes, and specify that ea. class gets to elect a certain # of directors. Not tinkering with capital structure as much as cumulative. iii. Voting Trusts (convey legal title to a trustee to vote your shares; courts have traditionally resisted them because youre potentially granting authority to a party who has no economic stake in the enterprise- potential for misalignment of interests) 1. Contradiction because Board cant be a board trust who promises to appoint each other. iv. Vote pooling agreements (a K that binds the s/h to vote together on certain or all questions. (MBCA 7.31(a) and (b)) e. Modifying Governance Rules

i. Triggs v. Triggs: father and son entered into a share purchase agreement and an agreement to elect the father as chairman and the son as president at guaranteed salaries. 1. Rule (from Fuchsberg dissent): s/h in a close corp. are allowed to agree among themselves on how to allocate authority as long as theres no intent to defraud other s/h or creditors; majority s/h do owe fiduciary duties to minority. ii. MBCA 7.32(a) permits s/h agreements that restrict the discretion of the board or eliminate the board altogether (so that s/h run the co.). 1. Must be in bylaws/written agreement + approved by all shareholders. iii. DGCL 350: written agreement of a majority of the s/h can restrict board auth. iv. DGCL 351: majority vote can provide that corp. will be managed by s/h rather than board. v. High voting/supermajority requirements MBCA 7.27(a), DGCL 141(b) and 216). 1. risk might result in deadlock, because theyre designed to give veto power on all board decisions or certain significant decisions 2. to reduce risk restrict classes of decisions to which supermajority requirement will apply vi. Fiduciary duties in exercising veto rights: some statutes impose duties on s/h who assume mgfopmt. functions or acquire veto rights under a shareholders agreement (MBCA 7.32(e)). 1. Donohue, cited in Smith v. Atlantic Properties (Mass.) (imposing duties of good faith & utmost loyalty on s/h in close corp who created a supermajority system & then deadlocked each other D had his own interests in mind, not corporations. Should act like partners.) vii. Contractual transfer provisions: 1. S/h agreements that limit ability of a s/h to transfer shares to others. It matters that there are particular people involved/shareholding isnt regarded as a fungible economic interest. 2. Mechanism must address how purchase will be funded and how a price for the stock will be established. MBCA 6.27 and DGCL 202 expressly authorize transfer restrictions. 3. Examples of restrictions: a. right of first refusal, required consent of the other shareholders. 4. How shares might be valued: book value, appraisal, mutual agreement. In Concord Auto Auction v. Rustin (1 s/h died, shares were worth twice as much in repurchase agreement, but court enforced price in transfer provision anyway b/c of CONTRACT) 2. OPPRESSION IN CLOSE CORPORATIONS a. Rule: whoever makes up the majority on an issue has a duty not to oppress those in the minority i. If somebody holds a majority of shares, then that person is easy to identify all the time. If not, shifting coalitions depending upon the issue at hand. b. Test for Oppressive Conduct (Wilkes firing & termination of stipend meant to freeze-out Wilkes) i. Significant frustration of a reasonable expectation ii. No legitimate business purpose iii. If majority can establish LBP, minority can rebut by demonstrating that there was a less harmful alternative that could have accomplished the same purpose. iv. In re Kemp & Beatley (oppressive conduct = "conduct that substantially defeats the reasonable expectations held by minority s/h in committing their capital to the particular enterprise.")

c. Types of Oppression i. Majority cut off minority stockholders from return, thus leaving them holding illiquid stock that generates no current income ii. Majority exercise control to frustrate preferences of the minority d. How Courts Respond i. Donohue reasonable expectation frustrated. ii. Wilkes v. Springside Nursing Home (partnership view of CCs - test for close corporations should be whether decision that severely frustrates a minority owner has a legitimate business purpose.) iii. BUT Nixon v. Blackwell (DE) company that does not specifically elect to be treated as a CC in its articles is not treated as one. e. Statutory Remedies i. MCBA 14.30(2) grants court power the dissolve the corporation if 1. Directors are deadlocked and deadlock cannot be broken by s/h and is injuring the corporation or impairing its business conduct 2. S/h are deadlocked and have not been able to elect a D for 5 years 3. Corporate assets are being wasted 4. Those in control of the corporation are acting in a manner that is illegal, oppressive, or fraudulent 5. Comment: courts should be careful in using this so as to limit cases to genuine abuse rather than a weapon. Shield, not sword. ii. MCBA 14.34 authorizes any CC or any s/h of a CC to purchase all shares owned by the petitioning s/h at fair value within 90 days after a petition is filed under MCBA 14.30. 1. Three important questions a. What is oppressive conduct? b. When a court finds oppression, which remedy? (Buy out or dissolution?) c. Where a corporation of s/h elects to exercise buy-out rights under 14.34, how is Fair value determined? f. Dissolution sell off assets, pays creditors, and distributes the balance to s/h i. threat of dissolution from minority s/h can leverage a better price for her ii. If a business derives its value primarily from tangible assets, s/h who wish to continue to operate the business will probably have to pay fair market value for those assets, since other purchasers could use them to equally valuable effect. iii. Risks: Can be time-consuming, expensive, risky. Involuntary dissolution threats with this kind of capital structure credible iv. However, if the business derives most of its value from the goodwill supplied by the majority, dissolution will not serve minority interests, b/c majority might be able to purchase tangible assets for fair market price and capture the associated goodwill at no extra cost. g. Oppression of Shareholder-Employee investment model of oppression i. S/h oppression doctrine is at odds with the at-will doctrine of employment law.

ii. Moll: Investment model of oppression when a minority s/hs investment includes expectation of employment (and benefits) these expectations can be protected by the oppression doctrine without running afoul of the at-will law. iii. Bonavita v. Corbo (investment model Even if oppression is not wrongful or illegal, remedy OK if behavior had the practical effect of destroying any reasonable expectation that the employee/shareholder had in his investment.) h. Non-Dissolution Remedies i. Buyout at fair value Majority has call right to minoritys shares 1. Purpose: to prevent strategic abuse of dissolution procedures. 2. s/h who elect to purchase must a. b. give notice to court w/in 90 days then negotiate w/ petitioning s/h

c. If negotiations fail, court must order a buyout, determine fair value d. If petitioner had probable grounds for relief under misconduct provisions of the involuntary dissolution statute, this can include attorneys fees. ii. Mullenberg v. Bikon (oppression at a meeting that minority failed to attend. At the meeting, majority voted to declare dividend, to retain an outside accountant, etc. Actions were in response to disputes between majority and minority s/h. Focused on reasonable expectations- minority would expect that having given up his other business to start this company, he would be given sizeable management role) REMEDY: ORDERED TO MAJORITY TO SELL OUT TO MINORITY iii. Kelley v. Axelsson (refusing to find oppression when majority s/h stopped paying dividends to the minority s/h who inherited from corps co-founders.) 1. Since minority was never active in management, their only reasonable expectation was that dividends would continue to be paid on stock if funds were reasonably available. PROXY VOTES REGULATION, DISCLOSURE REQUIREMENT 1. FEDERAL REGULATION OF PROXY SOLICITATIONS State law authorizes s/h to vote by proxy, but federal law regulates the process by which proxy solicitation occurs. a. Management Solicitations i. Before soliciting proxies, mgmt. must prepare a proxy statement (detailed disclosure documentSchedule 14A specifies what has to go in it) and a form of proxy (contains instructions that specify how s/h want their shares to be voted). Both must be reviewed by the SEC. ii. 14a-9: no proxy statement can contain any statement thats false or misleading with respect to any material fact, or which fails to state a material fact 1. Rule: management must disclose both the negative and positive aspects of any proposal; only including arguments for would be a material omission. iii. 14a-1 (Lilco): solicitation = any request for proxy, or furnishing of a form of proxy or other communication intended or reasonably calculated to result in someone giving a proxy. iv. Long Island Lighting Co.: citizens published a newspaper ad accusing the co. of mismgmt. and urging support for political candidates campaign that govt. acquire the co. Co. claimed the ad was unlawful

because it constituted a proxy solicitation for which no proxy statement had been filed with the SEC, and that it was false/misleading. What matters isnt whether its directly addressed to the s/, but whether the challenged communication, seen in the totality of the circumstances, is reasonably calculated to influence the s/h votes. You dont have to be confined to the corporate arena to be engaged in a proxy solicitation/be subject to SEC rules. 1. Winters dissent: test is too broad. Would interfere with the exercise of 1st Amendment rights. SEC subsequently adopted his approach, exempting any solicitation that doesnt seek proxy voting authority and that doesnt provide the shareholder with a form of proxy to confer that authority. Rule 14a-2. However, this exemption doesnt apply to mgmt./the co. whose shares are involved in the controversy. b. Shareholder Proposals i. 14a-8: any s/h who meets ownership requirements of the rule (1% or $2k worth of the co.s shares for at least 1 yr.) and submits a proposal in a timely fashion and in proper form can have the proposal included in the co.s proxy materials for a vote at the annual meeting. Compels co. and other s/h to subsidize s/h proposals ii. Exceptions. Corporation may proxy statement if exclude if 1. (i)(1) improper under state law 2. (i)(2) violation law 3. (i)(3) false or misleading 4. (i)(4) personal grievance, special interest 5. (i)(5) relates to ops. that account for < 5% of co.s total assets and < 5% of its earnings or sales, & is not otherwise significantly related to the co.s biz, it can be excluded. a. Standard of relatedness: see Lovenheim, Medical Committee (public policy) b. Evolution of significantly related Cracker Barrel case 6. (i)(6) Absence of power/authority 7. (i)(7) management functions (deals w/ordinary business operation) a. Cracker Barrel Case (SEC said co need not incl s/h proposal to end co policy to fire gays, under "ordinary business" exception upheld SEC changed mind) 8. (i)(8) relates to an election of the board 9. (i)(9) conflicts with the companys own proposal c. Shareholder Nomination of Directors (related to general/procedural, or specific) i. AFSCME: proposal to amend bylaws to require that the corp. include in its proxy materials the name of the nominee of any s/h who had held at least 3% of the co.s stock for at least 1 yr questioning whether 14(a)(i)(8) applies to procedural relationship to election of board. 1. S/h argued that an election is intended to relate to proposals that address particular elections, instead of elections generally. 2. Court said that they interpreted the election exclusion as applying to s/h proposals that relate to a particular election, and not to proposals that would establish the procedural rules governing elections generally. Also told the SEC to come up with a coherent pronouncement. ii. SEC has issued 2 proposals for comments:

1.

(8) includes proposals for process by which Ds are nominated/elected. S/h should be able to put proposals on the ballot that relate to the process of nominating directors a. nce they do that, are subject to a specific disclosure regime

2. ADD (17) (8) would cease to exist a. (17) significant expansion of s/h power. 2. DISCLOSURE DUTIES = MATERIALITY + CAUSATION a. Implied private right of action under 14(a)(9) (Borak). i. If youre a s/h who believes that the solicitation of your proxy occurred through distribution of materially misleading information right to sue the directors for proxy fraud. ii. You dont attack the terms of the transaction under federal law, thats a state law issue. Only thing you can attack under federal law is process by which corp. conducted solicitation. b. (1) MATERIALITY substantial likelihood that the disclosure of the omitted fact wouldve been viewed by the reasonable investor as having significantly altered total mix of the info made available. i. MBCA: TSC Industries - proxy solicitation for merger approval failed to disclose that bidder exercised influence over TSC board ii. DE: Gantler v. Stephens once you discuss something, you have to make full and fair disclosures iii. Speculative or contingent benefit: depends on a balancing of the indicated probability that event will occur against magnitude of the event in light of the totality of co. activity. (Basic). iv. Statement of fact about actual reason the Ds urged adoption of the proposal can be a fact 1. Test: (1) maker of the statement couldnt have reasonably believed it was true, (2) Statement was actually false (ie. Said fair price, but it wasnt) (Virginia Bankshares) v. Omitted information can be material even if not financially so. (Huntington Bankshares --accounting misstatements were immaterial financially but material to s/h because they demonstrated boards lack of integrity) vi. Fairness of price alone is not materiality (Santa Fe) c. (2) CAUSATION an essential link in the solicitation. (Virginia Bankshares) i. When required solicitation: causation. 1. Mills v. Electric Auto-Lite misleading because s/h werent told that 11 of the one co.s directors had been nominated by the other co. (boards recommendation of the merger wasnt disinterested). If the proxy solicitation was necessary in order to gain approval of the transaction (an essential link), then you have causation. ii. When solicitation not legally required: 1. Virginia Bankshares left open possibility that even if your shares arent necessary to gain approval/the proxy solicitation isnt an essential link, you may still have a cause of action if you lost your ability to challenge the transaction under state law. The injury isnt that the transaction was approved, its that you lost your ability to challenge/get appraisal. 2d Cir. has adopted this position. 3. STATE LAW DUTIES OF DISCLOSURE a. Duty of fair disclosure = application in a specific context of the duties of care, loyalty, and good faith. Its not a freestanding fiduciary duty.

b. Duties of care and loyalty i. require that when directors are speaking to s/h, they have to be honest and candid. c. DEs duty of disclosure applies to officers, directors, and controlling s/h in their communications with s/h. i. Malone v. Brincat: directors who knowingly disseminate false info or make material omissions that results in corporate injury or damage to an individual s/h violate their fiduciary duty and may be held accountable. 1. However, 3rd party tender offerors dont have such a duty. 2. Line between the duty of care and the duty of loyalty is often blurry. 3. How a duty is described matters- can determine whether the BJR applies and whether a corp. is permitted to limit a directors liability (only with duty of care). DUTIES OF CONTROLLING S/h Cash Out, Short-Form, Tender Offers, Duty of Care, Sale of Office 1. FIRST ESTABLISH CONTROL a. Question is whether non-dominant s/h controls through significant power over decisions. b. Presumption is that non-majority s/h are not dominant. Plaintiff must prove domination. c. De jure absent special rules, owner of 50+% of shares controls d. De facto owner of significant stock. (in a public corp. w/dispersed shares, 20% or more controls) (Lynch, Essex) e. Incumbency in public corps. w/fragmented ownership, incumbent usually possess de facto control b/c of power to nominate management candidates and use company resources to support them. 2. CORPORATE GROUPS a. Sinclair Oil - But, if the parent and the minority s/h get the same benefit, the BJR applies. RULE: Parent can use subsidiary as it sees fit, as long as it doesnt exploit it and theres a rational business purpose) i. if transaction is at the expense of subsidiary establish entire fairness. 3. CASH-OUT TRANSACTIONS a. DELAWARE: Weinberger entire fairness = Fair dealing + fair price i. First establish CONTROL ii. Fair dealing = recreate an arms length transaction. Structure & timing. (Lynch II) iii. Fair price = determined based on totality of circumstances iv. Burden on Ds, unless approval by an IC or a majority of minority s/h who are. 1. independent and disinterested 2. fully informed 3. If so, then burden of proof shifts to the plaintiff. Remedy is judicial appraisal v. Unless fraud, misrepresentation, self-dealing, deliberate waste, or gross and palpable overreaching vi. Lynch I relationship between fair dealing & fair price. IC usually evidence of fair dealing, but when not independent enough, can still violate entire fairness standard. 1. Before burden shifts to plaintiff, must determine a. whether majority dictated terms of the merger b. whether the IC had real bargaining power.

vii. Lynch II (predation) controlling s/h permitted to act in own interest and using its superior bargaining power, as long as it doesnt gain a benefit at the expense of the minority. b. ELSEWHERE: Business Purpose Test (illegal to merge for sole purpose of eliminating minority shareholders) i. Alpert (NY. 1984) (legitimate business purpose existed when company needed to get additional outside capital only available if the minority s/h interest were eliminated) ii. Coggins (Mass. 1986) (no legitimate business purpose when merger was consummated only for purpose of gaining access to corporate assets to pay personal debts) iii. SEC Rule 13e-3 requires disclosure of reasons for cash-out transactions for mergers involving public corporations. 4. DIRECTOR LIABILITY IN CASH-OUT a. Emerging Communications (2004) (liability of outside directors can vary depending on level of expertise director on negotiating committee who had financial expertise had special responsibility to respond to price unfairness, compared to outside directors) i. Exculpation only in the case of gross negligence, not bad faith, conflicts.) b. Fertitta (Del. Ch. 2009) (board breached its duty of care by committing corporate waste when it cancelled a transaction, incurring a RT fee, without legitimate business purpose) 5. SHORT-FORM MERGER (DGCL 253) a. if bidder owns 90%+ of co. stock, can merge in a procedure that requires only approval of Board, not s/h) i. statute authorizes unilateral act, so no entire fairness standard. That wouldnt make sense. ii. Basis for obligation of candor, disclosure is state law. b. Glassman (Del. 2001) (appraisal is sole remedy in the case of an unfair short-form merger) i. By definition involves self-dealing. Entire fairness standard does not apply - EXCLUSIVE remedy is appraisal, absent fraud of illegality. c. Berger v. Pubco Corp (Del. 2009) (remedy for minority s/h in a short-form merger in which parent company breached its duty of disclosure is quasi appraisal: minority s/h automatically become members of a class and are not required to escrow a portion of the proceeds they received) 6. TENDER OFFER SHORT FORM MERGER (DGCL 253) a. bidder corporation (sometimes already w/controlling interest) makes a tender offer conditioned on acquiring 90%+ of stock. If successful, bidder mergers in a way that requires only approval of the Board.) b. Test for Coercive Tender Offer (Pure Resources does not require fair price, only the following) i. subject to a non-waivable majority of the minority tender condition ii. controlling s/h promises to do a short-form merger @ same price if it gets 90% or more iii. controlling stockholder has made no retributive threats against minority iv. same price to all shareholders (otherwise structural coercion) c. Solomon v. Pathe Communications (Del. 1996) (in the case of totally voluntary tender offers, courts do not impose any right of the s/h to receive a particular price . . . the determinative factor as to voluntariness if whether coercion is present, or whether full disclosure has been made.) 7. SALE OF A CONTROLLING INTEREST a. Control premium controlling s/h command a premium when they sell their shares b/c it carries the power to exercise dominion over corporations assets.