Professional Documents

Culture Documents

Vijay Mallya: Fresh Woes For Kingfisher, Govt Rules Out Bailout

Vijay Mallya: Fresh Woes For Kingfisher, Govt Rules Out Bailout

Uploaded by

Pritam SahaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vijay Mallya: Fresh Woes For Kingfisher, Govt Rules Out Bailout

Vijay Mallya: Fresh Woes For Kingfisher, Govt Rules Out Bailout

Uploaded by

Pritam SahaCopyright:

Available Formats

Beleaguered Kingfisher Airlines' promoter Vijay Mallya said tonight that he will not shut down the private

carrier which struggled to stay afloat after further large-scale flight disruptions and resignation of pilots. "Closing down is not an option. It will not happen. Government does not want it to happen. It is not in national interest," Mallya said in his first public reaction to the latest crisis that has gripped his cash-strapped airline. "Why should we give up as long as we get help. Help is not bailout. We have asked banks to consider our proposal to provide more working capital," he said, making it clear that the airline has never asked for a bailout from the government. In the context of getting help, the liquor baron referred to the government's decision to allow direct jet fuel imports by the airlines and permit foreign carriers to pick up stake in them. He had lobbied hard with the government on both these issues. Mallya claimed that the entire issue of bailout was of "media making". Asked about sudden disruption in Kingfisher flights, the UB Group chief said the bank accounts of the airline were frozen "very suddenly" by the Income Tax authorities over non-payment of tax dues. "The abrupt disruption was unfortunate because our bank accounts were suddenly frozen by tax authorities. I don't deny we have taxes due. The bottom line is we requested for time to pay these dues," Mallya said. "It was the very sudden attachment of our accounts that obviously crippled us," he said. Kingfisher, which suffered a loss of Rs 1,027 crore in 2010-11 and has a debt of Rs 7,057.08 crore, posted a Rs 444 crore loss in third quarter this fiscal. Maintaining that Kingfisher's financial crunch was reflective of the prevailing state of the aviation industry, Mallya said "we have to make payments every day. Payments are to be made for spare parts, to customs, fuel dues, airport dues. So the ability to operate the bank account is critical". "Once we are choked, we obviously have problems. I tried to resolve and negotiate with the tax authorities and tried to agree on a payment plan which is comfortable for both. Our accounts should be de-frozen so that we can continue normal operations. We have the money in the accounts and money is flowing in," Mallya said. Asked why the airline did not inform aviation regulator DGCA about flight cancellations, he said "if your bank account is frozen suddenly, obviously you don't have advance notice by which to notify DGCA. It is self-explanatory. "With the accounts frozen, the problem started then and there. We didn't have time to notify anyone. It was only subsequently that we notified the DGCA. We conveyed to DGCA defining the circumstances we were having to suffer," he said. Almost 40 flights were cancelled by the airline, including those to Bangkok, Singapore,Kathmandu and Dhaka, leaving hundreds of passengers stranded at various airports across the country. The cancellations included 14 flights from Mumbai, seven from Kolkata and six from Delhi. Fresh woes for Kingfisher, govt rules out bailout Wobbling on top of large-scale flight disruptions, beleaguered Kingfisher Airlines faced further problems with 34 pilots quitting and a large number of staff being put on notice even as the

government today ruled out any bailout for the airline. The resignation of the pilots have taken the total number of those who have quit to about 80 since last October, industry sources said today. Reports also suggested that a large number of ground staff, mostly on contract, were also put on notice by the cash-strapped carrier and their contracts not renewed. However, there was no confirmation from the airline about these resignations. Kingfisher has been suffering from a severe cash crunch that has culminated into the Income Tax authorities freezing its bank accounts last week on grounds of non-payment of tax dues. Meanwhile ruling out any bailout, civil aviation minister Ajit Singh told reporters here, "Government cannot go around asking banks to lend money (for private airlines)". "No, government is not going to have any bailout," he added. "As far as Kingfisher or any other private airline is concerned, they have to present their business plan to the banks and if they (banks) are satisfied with that, and if it is within RBI guidelines, then they will lend money," he said. Over 30 flights were cancelled today, including those to Bangkok, Singapore, Kathmandu and Dhaka, leaving hundreds of passengers stranded at various airports across the country. Today's cancellations included 14 flights from Mumbai, seven from Kolkata and six from Delhi. Concerned over the sudden cancellations and passenger inconvenience, aviation regulator DGCA summoned the airline's CEO Sanjay Agarwal and top officials to appear before them tomorrow to explain the large-scale disruptions in the operations and the reasons.

Sort by:Newest|Oldest|Recommended (43)|Most Discussed|Agree|Disagree|Logged in Comments Laxman Chef (Udaipur, Rajasthan) 21 Feb, 2012 10:19 PM i am with Vijay Maliya . It's easy to say and comment , first feel what these people like Maliya Sir has done to thier Sector . Level what they reached . Profit and Loss in Business is Common and Allwhere Happening , This is a Time where we See who is with Us and Who is Not . I am with Kingfisher they will again get a Good Place .

Agree (3)Disagree (1)Recommend (1)Offensive

Kalra (Delhi) replies to Laxman Chef 22 Feb, 2012 09:11 PM Either you are not tax payer or you are on his pay roll/ a stake holder. Asking for dole from tax payer's money is not only unethical but also criminal.

Agree (1)Disagree (1)Recommend (0)Offensive

rachayya (gulbarga) 21 Feb, 2012 05:02 PM sir you can do it because nothing is impossible. give one kingfisher bottle to minister every thing will be all right.

Agree (0)Disagree (1)Recommend (0)Offensive

Vijay Budhiraja (delhi) 21 Feb, 2012 09:02 AM Mallaya was aware of the proceedings regarding the tax deptt.'s move to freeze his accounts ...... this was reported in the press sometime in Nov. / Dec.... as for his refusal to shut shop ..... how can a colorful Mallaya let go of all those beautiful air hostesses .... he has been living this teenage fantasy right from his days when his dad bankrolled his infatuations .... in fact he even married one air hostess .... son following suit .....

Agree (5)Disagree (2)Recommend (1)Offensive

gilles (louisville) replies to Vijay Budhiraja 21 Feb, 2012 10:45 PM which country ask you taxes when u are running in loss beats me,MERA BHARAT MAHAN.

Agree (0)Disagree (1)Recommend (0)Offensive

Ashok Kumar Puri (CUTTACK) 21 Feb, 2012 02:37 AM We dont find any sense as to why Govt is bent on keeping the behemoth i.e. Air India everytime despite its such poor performance? It simply sucks enormous funds while enterprising operators who showed promise made to suffer! The days of JRD Tata and Mharaja hv bn over bt not our Policyplanner and Aviation Ministry, it seems has an axe to grind with keeping the unproductive men and machines in operation with us people paying taxes. After long deliberation it was tho allowed by them for the new operator to team with Big outside operators; yet this dispensatrion is seen being blocked by the Govt itself. It is beyond comprehension of the ordinary to get to understand such a policy that is killing our private initiative and with banks falling that very line of Govt policy which kills such initiative. It is simply beyond comprehension. Why does Govt hv to put a spanner in our enterpreneurs initiaves while they talk of promoting them at first stage and them choking them later through various regulations? Do they want that we be subserviet to foreign airlines? They allow lot of concessions to the foregn operatoras but when it comes to home initatives they show lackdaisacical approach, why? I tis not going down our throat. They may come out with their ccoked up reply that it is not bringing them an efficient service. But it is our observation that the home initiative, say, Maalyas' liquor business has no parlell in the world yet they are undermined when it comes to give them facility such as various concessions such as ones ejoyed by the foregn counterpart are denied to them. It not that we lack initiative or efficient it rather our Govt's policy of appeasement of foregn players at the cost of home initiative that weighs them down. The Govt is being oberved by us people consistently building a case for the foreign players and painting our home initiatives in black. May We Ask Why? What Fault Did They Commit? Do Answer Us in The Face Of Our Air India that they Give Bail Out Everytime At the Drop of the Hat? This act to us kind seems Highly Deoprorable. We can cite many stats in this connexion, so beware! The Media watches Your Action Closely, Sir! Come Out with Your Transparency which is at Stake! We smell a Rat in the Whole Exercise. Unless Explained with Proper and Plausible Justification, We are Afraid, We Doubt your Very Intention! Mend It or Bend it- We Watch you. You are under Scanner! Hope the Point is Made Clear. Tk Cr.

Agree (3)Disagree (0)Recommend (1)Offensive

Kalra (Delhi) replies to Ashok Kumar Puri 22 Feb, 2012 09:20 PM Business is Buisness, misuse of TAX PAYER"S money must stop irrespective of buisness be of PRIVATE or PUBLIC SECTOR. The politicians want to keep AIR INDIA under their THUMB for vested interests and this must cease. Public Sectors must not not become personal property of politicians. It is we who have to awaken the masses.

Agree (2)Disagree (0)Recommend (0)Offensive

raamkishore (Hyderabad Deccan) 21 Feb, 2012 02:09 AM Mr.Mallya conveniently put the blame on I-Tax people without admitting his mistake in not paying the taxes when it was due in the earlier years. If he had paid the taxes on time today they would not have frozen his accounts. Now he should find a way to sell the IPL team and divert the funds to save the Airlines. Mr.Mallya has no business brain like Capt. Gopinath. He only wanted to make the best of the economic boom in the country without foreseeing the troubles we may face due to Economic slowdown in the west. If at all the Govt. has to interfere it should be done for the entire Aviation industry but not just Kingfisher.

Agree (4)Disagree (1)Recommend (0)Offensive

shub (New York, US) 21 Feb, 2012 01:56 AM Bravo Sir!

Agree (0)Disagree (1)Recommend (0)Offensive

Murli. K. (Nasik.) 21 Feb, 2012 01:42 AM Nothing but a cheap trick played by the Govt, Mallaya and others to bring in FDI. What a joke, some time back we used to get flight tickets for as less as Rs. 500/- which I think was even less than equivalent train tickets. What was the Govt. doing at that time. Now when these airlines are doing great losses, the Govt. wants FDI to be brought in or bail out the airlines with taxpayers money. I feel the Govt. has to stop playing such cheap tricks and let the airlines on its own. Whether they make profits or losses its their call.

Agree (5)Disagree (0)Recommend (0)Offensive

hiren (glasgow) 21 Feb, 2012 01:16 AM Mallya jee, Ouick way to get the KF airlines up and running is to publish spl edition of king fisher airlines calender with nice girls on every seats :-)

Agree (4)Disagree (1)Recommend (1)Offensive

TelliameD (USA) 21 Feb, 2012 01:12 AM If KingFisher Airlines has been running losses all the time, what taxes are they talking about? Do businesses in India have to pay taxes even when they are losing money? Can someone someone please clarify what these taxes are?

Agree (5)Disagree (3)Recommend (2)Offensive

Manohar prabhu (Bangalore) 21 Feb, 2012 01:07 AM Vijay mallya sir, i m a big fan of yours..i m also a GSB like u..and GSB s never loose...he he

Agree (0)Disagree (3)Recommend (0)Offensive

Senthil (India) 21 Feb, 2012 01:05 AM Which owner will say that they will shut down the business when they are expecting a loan from Banks?!!!..Obviously... at this current Situation he will say "I will not shut down Kingfisher Airlines". . Tomorrow he might shut down and say he could not mobilize money as expected... Done.. Its Business man's Business

Agree (6)Disagree (0)Recommend (1)Offensive

King of Bad times (West India) 21 Feb, 2012 01:04 AM Olla laa laa laa olleee Oooo... Ullaaaa laaaa laaa laaa aaayeee Oooo... Mallya Daruu peeleee aur mast hojaaa... Olla laa laa laa olleee Oooo... Ullaaaa laaaa laaa laaa aaayeee Oooo...

Agree (1)Disagree (2)Recommend (0)Offensive

vijay Malaya (Canada ) 21 Feb, 2012 01:01 AM He just want to continue to siphon off the bank's money into his own pocket till the company does down completely. Ultimately he is the gainer and public money and taxpayer is the loser. This is how these people become rich.

Agree (0)Disagree (6)Recommend (0)Offensive

qwkqwkqwkqwk (Delhi) 21 Feb, 2012 12:54 AM you @SShole stop dreaming being an Indian RICHARD BRENSON, if you and your disgusting son not going to change your behave then time is near when both of you will be producing desi daru

Agree (8)Disagree (0)Recommend (3)Offensive

Manager :Fosters (Bangalore) 21 Feb, 2012 12:53 AM Mr Mallya. Simply keep away Deepika Padukone away from your son, she is apshagun and her presence in your family bringing misfortune to you and your company.

Agree (12)Disagree (3)Recommend (5)Offensive

vishal agrawal (mumbai) 21 Feb, 2012 12:49 AM He knows that all the politicians he has funded all his life will finally bail him out.

Agree (7)Disagree (0)Recommend (4)Offensive

X (y) 21 Feb, 2012 12:43 AM Good thing to hear really feels great.

Agree (3)Disagree (0)Recommend (0)Offensive

Xpressmyself (Timbaktu) 21 Feb, 2012 12:40 AM It is time Vijay Mallya come down to the ground from his fancy hypocratic world of imagination and lavish liviing. Sell out the Royal Challengers IPL Team, Royal Salute Company, his big Mansion/Cars and pay the ordinary employees of his Airline so that the family can have food and shelter. Their blessing alone can save him and the airline!!! He has been in the busiiness of selling spirit (liquor) for all these years there by killing many many people over the years and brininging their family to roads.......he is paying for all these for his personal interest. This is just the beginning Mr. Mallya !

Agree (7)Disagree (7)Recommend (2)Offensive

lucky (Delhi) 21 Feb, 2012 12:40 AM A suave businessman has to suffer in this bad corrupt country, so sad

Agree (5)Disagree (10)Recommend (3)Offensive

citizen (India) 21 Feb, 2012 12:38 AM Airlines is not a profitable business. All airlines on the planet are struggling to survive. it requires great finiancial discipline and more of LUCK to run the airline. It is not a fashionable industry.Airline, Shipping industries can break a trillionaire into a bankrupt individual. Dangerous industry verticals. If Kingfisher gets into food market, it will make profit rather than airline industry

Agree (4)Disagree (3)Recommend (0)Offensive

abcd123 (india) 21 Feb, 2012 12:35 AM He won't shut down because he wants people to face the agony of a missed flight pain of a patient who missed his surgery, frustration of a groom who missed his marriage, tears of a son who missed his mother's funeral and failure of a candidate who missed his interview. VM we don't need u. U be happy with ur KF brand and the calender girls. Be happy with ur IPL team and pricess yatch. Be happy with that.... Parting gift: FO..

Agree (9)Disagree (2)Recommend (6)Offensive

King of Bad Times (West Indies) 21 Feb, 2012 12:35 AM Olla laa laa laa olleee Oooo... Ullaaaa laaaa laaa laaa aaayeee Oooo...

Agree (6)Disagree (0)Recommend (3)Offensive

Rizwan Mujawar (Uran) 21 Feb, 2012 12:33 AM its easy to say shut your airline, but the consequences will be disastrous... with just flight cancellations the other airlines quickly raise the prices of tickets. imagine what happens when kingfisher is shut. the common man can forget flying for years to come, and even after paying through your nose you will be flying in AIR INDIA... out of the world service... awaiting...

Agree (4)Disagree (2)Recommend (2)Offensive

Kalra (Delhi) replies to Rizwan Mujawar 22 Feb, 2012 10:11 AM Do not agree that prices will go up. Airlines like Indigo will do well.

Agree (0)Disagree (0)Recommend (0)Offensive

Jay (USA) 21 Feb, 2012 12:33 AM Just an eye-opener. This is what happens when you watch cricket and have fun during your commited business time or job time. But... what do I know about business.

Debt-ladden Kingfisher Airlines has received recapitalisation offers worth Rs 8 billion from two Indian investors, the Times of India said on Saturday, citing the carrier's Chairman Vijay Mallya. The investors would get a combined 24% stake in the airline if the deal succeeds, the report said citing Mallya. Desperately strapped for cash, Kingfisher stands on the brink of collapse after nearly a week of flight cancellations and resignations by dozens of its pilots. Kingfisher has not turned a profit since it was founded in 2005 and is carrying a debt burden of at least USD 1.3 billion. Its revenue has been in decline since the end of last year. Staff are not being paid and tax bills remain outstanding. "There's a deal offer from two Indian investors to recapitalise. We have their termsheets," the report quoted Mallya as saying. "They are large investors and I would leave it there." Valued about USD 245.4 million by the stock market, shares in Kingfisher Airlines fell 4.35% on Friday to Rs 24.20 in a weak Mumbai market.

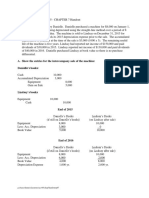

Kingfisher is fast becoming India's version of too big to fail. The company hasn't been able to pay its staff, taxes and now can't pay for fuel. But it's not just Vijay Mallya's money that's going down. Banks have lent over nearly Rs 7,000 crore in loans and hold a chunk of the company shares. CNBC-TV18's special show Indianomics discusses if is it time banks walk into the boardroom and force a new management? Panelists include Former SBI Chairman, AK Purwar, Ashvin Parekh, partner of E&Y, and B D Narang, Former Chairman and Managing Director of Oriental Bank. But before that an outline of the problem from Gopika Critics and columnists are writing Kingfisher's obituary. The company seems to be hurtling towards its end. Lenders are not ready to put in good money. Already Rs 7,000 crore of banks' money is stuck with Kingfisher. 8 out of 18 lenders have classified the account as non-performing loan in the third quarter. Lenders are now insisting that the company clear off all the interest dues before they even consider disbursing fresh loans. Vijay Mallya may have committed to repay all over dues by March end, but how will Mallya raise this money? According to Veritas investment research firm, Mallya has very few options available both within Kingfisher and outside. The cash starved airline company reported a loss of Rs 1700 crore for the 9 month period as against Rs 1006 crore in the same period last year. In Q3 alone, the losses amounted to Rs 444 crores. The company does not have any assets to raise funds as it is already pledged with banks. Among group companies, Mallya could look at selling the remaining 55 lakh treasury shares in United Spirits. But that again will be difficult as it will dilute the promoter shareholding in the company which currently stands only at 28%. Vijay Mallya is desperately looking for equity and is in serious talks with some big investors, meanwhile lenders who have not classified Kingfisher as non performing assets could also throw in a lifeline. Here is an edited transcript interview. Also watch the accompanying videos. Q: First let me get the legal issue out of the way. Under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act and other DRT notifications is it legally possible for the bankers to walk into the boardroom and say, I want another manager? Parekh: There are two parts to this; when the MS Verma Committee was constituted which in fact created some kind of a blueprint for SARFAESI Act, at that point in time five methods of asset reconstruction were actually evaluated and different methods under which asset reconstruction can be carried out by the lenders, by banking companies was envisaged.

When the SARFAESI Act was enacted it very clearly gave the authority to the regulator that is the RBI to work out the regulations associated with each method of asset reconstruction. Now change of management according to both the SARFAESI Act was envisaged and later on when RBI clarified on this position, has several other legal connotations. There can be recourse available to the management, judiciary intervention and a forced change in the management. After keeping that into consideration the RBI has actually formed regulations with other methods of asset reconstruction but there is no clear regulation associated with the change of management. If the management participates in such a programme with the lender, if the management agrees to work with the lender then of course you have a way out and it is not exactly legal. Then it is more business approach in which case the borrower readily agrees that if someone else were to run that business on his behalf there is a better chance, some order of governance can be put out but legally that's a position at this point in time. Q: You are apprised of the problem itself since it hitting us in the form of daily headlines. Can a banker just walk into the boardroom and say I want a change in management; this is not working assuming of course options are available but can he do it? Purwar: Actually I have not seen such a single case. We had a very well experience in the banking sector. Some of the section of accounts were sick but then unless and until management is with you and is agreeable to go long with you it represents the scheme of the things becomes extremely difficult. Let me go back little to the sickness side of it, in the existing scheme of things we have SARFAESI but there is sick units, Board for Industrial and Financial Reconstruction (BIFR), as an institution. This corporate debt restructuring mechanism which is run by IDBI and my assessment has been that CDR mechanism by way of rehabilitation of sick units has worked far better and much more effectively and fruitfully then the system which is run by IDBI. These existing institutions, their efficacy also needs to be seen but the present scheme of things its just corporation of existing management is vital for any tough decisions to be taken in respect of sick terms. Q: I have spoken to bankers on the matter, they refuse to come of record because it is an ongoing problem and they do not want to aggravate by shooting their mouth as they put it but the airline sector itself is in quite a mess. None of the players are really working at a profit. Some of them are making minimal losses and maybe in some quarters they are making profit but otherwise it is quite a huge mess. Do you think in a situation like this the government itself has to intervene. Are we looking like a Satyam kind of a situation here where the government or CLB or the ministry of company affairs sits in with the bankers? Narang: First I will address your first question legal position. Under the SARFESI Act RBI was supposed to have issued rules to change the management but they never finalised the rules so far. There were in fact consultations when the management can be changed, in those consultations we did make it clear that there should be a provision to change the management particularly under certain known conditions. My comments are only pertaining to large corporates not to SMEs. That is if there is a serious diversion of funds. Secondly, at times promoters themselves are fighting with each other and not allowing the company to function. Three, there are serious cases of inside trading for which the company has come to trouble. But if it is a normal routine but RBI has so far not made up their mind. They have not come out with clear rules for the change of management. In one of the cases where we were 100% lenders and we have taken the physical possession we did move for the change of management but the promoter got stay from the Chandigarh High Court. I have a clear example, that this particular case, industry they have been fighting with each other. In fact they have been trying to under price their products to win over the customer base. All such activities they cannot be funded by bankers itself. Funds for acquisition of customers in a loss making activity have to necessarily come from equity. All such people have been primarily funded by the equity and to small extent by the lenders. Unless they

change the very business model and the overhead structure cost, overhead structure tax, overhead structure change they can never make serious money. At least in half a dozen occasions on various public forum I have found all the promoters admitting that they don't hope to make money for a considerably long time to come. I don't know why the bankers didn't pick it up. This money had it come from the private equity by now the problem would have been reduced to one third. I felt that at this stage you change a management it does not bring results because the promoter himself as a credibility. If he goes to the market he can still use his contacts and bring in some equity. I must say that I don't think Mallya is a wrong face to call for equity, in fact he is the right face. In this particular case you do not built up a good case to forcibly to change the management. Maybe if the contacts were that of Satyam one could argue that change of management will bring equity player but not in this particular case. Q: Do you think that the law needs to be fashioned or at least the bankers needs to be empowered in such a manner that change of management is more effective. What is the process for change of management, is it just a 90 day notice or is it much worse? Parekh: No, it is much worse. The first thing that will happen as Narang said is the borrower will immediately obtain a stake for example from the court. If he is got convinced to begin with that there will be any value addition on account of that change how will the bank be able to run it. So unless the bank puts up a convincing story to say that this is a programme on part of the lender to really work out a management programme or a change in management programme he has the judicial system available to him basically. Q: What is the option in the existing case only by way of example bankers or public money, depositor's money is Rs 7,000 crore and 58% of what it be say Rs 500 crore capital. Mallya's money is about less than Rs 300 crore. There is no justice that bankers should not effect the management when they have put in so much money, but what is the hurdle then? Purwar: First of all let us look at the industry and then the management side. If we think of changing the management, first do we have the legal tools to do so, I have my own serious doubts about it, we do not have legal tools to do so. The second question is even if you have legal tools to do so is it correct to do it. I think that in itself will be debatable in the context to what Mr. Narang said, but the basic point remain that is it necessary as a tool for the bankers to have it, I absolutely think rocess should be laid down that the money has been diverted or the industry has become irrevocably sick for whatever reasons. Bankers and lenders as a community should have powers to effect changes. Let me give you a simple example that when the steel sector was in a very bad shape and there were certain players who were very good and they were very keen to acquire these companies to scale up the capability and they had necessary capability to make it happen. However, they just couldn't affect this change, but the laws of the land were such that we were not having any option to do so. Q: Any specific change you would suggest Mr. Narang, assuming you are agreeing with what Mr. Purwar says? Narang: I do not know a single businessman on the earth who has not come to bad times. I do not know a single business on the earth, which has not come to bad times. And in difficult situations I find the companies are leveraged as many 20 times than their net worth. Why should the management not be changed? There could be an argument that this was of no fault of the entrepreneur, this was extraneous considerations. I will say that let the RBI or let the Ministry of Corporate Affairs lay down the clear rules that wherever the grounds of difficult situation are fraud, are based on dispute or inside trading or any other such objectionable. After fulfilling following conditions the banks, maybe 75% of them if they vote together they should be able to change the management. Why should there not be rules, there must be rules for change of management. This itself will curb adventurism.

Q: What is the way out now? Is it that you should have the government step in? Purwar: The point is that maybe I maybe wrongly believing it, but what I believe in is that government should try to keep away from business as much as possible. Secondly let us look at present structure of restructuring and rehabilitation, which are available in the system. I had a very great experience in curbing debt restructuring mechanism, which is run by IDBI and I have seen it's success in very large number of cases. Q: He has gone through CDR, I mean not exactly CDR but a debt revamp is over and done. Purwar: There is the difference between a debt revamp and a compressive corporate debt restruction mechanism which imposes a lot of discipline on lenders, a huge amount of discipline on the part of the promoters. Most importantly in my view Kingfisher today requires huge amount of equity infusion. Equity infusion whether its government, private sector, private equity or foreign airlines would like to do it. I think these questions need to be thoroughly examined enabling legal mechanism or enabling mechanism need to be put in place. Q: I take Mr. Purwar's point that government should stay off as much as possible but in the extra ordinary circumstances where the government has intervened through some technocrat like in the case of Satyam where they got in Mr. Achuthan and Deepak Parekh and Karnik, it worked very well. So in this specific case since there is no fraud involved but probably wrong pricing and wrongly run company. Wouldn't you say that bankers are not empowered to take certain decisions. Some extra ordinarily legal munificence has to be shown that can be shown only by government. I am only asking you for options out of this mess. Narang: There are three options available. 20 years ago when I used to travel from Delhi to Mumbai the ticket was Rs 5300. Today again the ticket is available for Rs 6000. Something wrong has gone somewhere; meanwhile petrol prices are gone up by almost 60 times, labour prices have gone up double and now we have landing charges which are troubling. This is across the board, now to that extent the problems can be identified across the board; some sort of government intervention could be helpful. You can't kill the whole industry. Second part is the under pricing part still, why should the government expect the ticket to be available at Rs 5300 and why should it not be made available at a market price. So they should be first, I know I am working with 8 or 10 private equity people and I know the rigorous scrutiny they do. This is a clear case that there has to be some check on the management on various pricing issues. If bankers have to put in money, I'll say they should insist equity participation by the private equity before they put in their further money. Because if they can't step in at least other professionally trained people can step in who can keep a control on the various operating efficiencies of the company.

Kingfisher Airlines is an airline group based in India. Its head office is The Qube in Andheri (East), Mumbai and Registered Office in UB City,Bangalore.[4][5] Kingfisher Airlines, through its parent company United Breweries Group, has a 50% stake in low-cost carrier Kingfisher Red. The airline has been facing financial issues for many years.[6] Until December 2011, Kingfisher Airlines had the second largest share in India's domestic air travel market. However due to the severe financial crisis faced by the airline, it has the fifth largest market share currently, only above GoAir.[7] Kingfisher Airlines is one of the only seven airlines awarded 5-star rating by Skytrax along with Cathay Pacific, Qatar Airways, Asiana Airlines, Malaysia Airlines, Singapore Airlines, and Hainan Airlines[8] Kingfisher operates 250 daily flights with regional and long-haul international services.[1] In May 2009, Kingfisher Airlines carried more than 1 million passengers, giving it the highest market share among airlines in India.[9] Kingfisher also owns the Skytraxaward for India's best airline of the year 2011. Kingfisher Airlines is also the sponsor of F1 racing outfit, Force India, which Vijay Mallya also owns.[10]

0 inShare

Hoping to resolve the crisis facing Kingfisher Airlines early next week, Vijay Mallya today said he has organised funds to pay "seriously overdue salaries" to the employees. Mallya gave no details about the funding but said the airline promoters have converted their loans for an additional five per cent equity last week. In a letter to the employees, Mallya also lashed out at "Indian and 'paid' media" for their reports on the cash- strapped carrier, saying they would do whatever it takes to achieve their "sensationalist objectives". "The Indian media and the 'paid' media that even thePrime Minister referred to are unscrupulous and they will do whatever it takes, part fact or fiction, part true or untrue to achieve their sensationalist objectives," he said while referring to the "media frenzy" on the recent developments in the airlines. "I have organised funding so that we can pay your seriously overdue salaries which is a source of great personal sorrow for me. We are currently handicapped as our bank accounts are frozen by the tax authorities," Mallya said.

"I have been working tirelessly to urgently resolve this issue through negotiation and I hope that these efforts will be successful early next week. We fully intend to pay our tax dues as much as we commit to paying your salaries," he said. According to latest figures, Kingfisher has suffered a loss of Rs 1,027 crore in 2010-11 and has a debt of Rs 7,057.08 crore. Struggling with fewer flights, unpaid salaries and outstanding dues to oil companies, the ailing carrier has posted a Rs 444 crore loss for the third quarter. Mallya said that Kingfisher promoters, the UB Group and its associates have converted its loans for an additional five per cent equity in the airlines last week. "This is the maximum permitted under law in any one financial year but clearly demonstrates the faith that I have in all of you and in our company," he said. (more)

You might also like

- Mayo - CitibankDocument23 pagesMayo - CitibankHolsk Nyberg100% (1)

- DAIBB SME SolutionsDocument29 pagesDAIBB SME SolutionsShafiul Azam100% (3)

- Quindell PLC: A Country Club Built On QuicksandDocument74 pagesQuindell PLC: A Country Club Built On Quicksandgothamcityresearch80% (10)

- IgniteDocument4 pagesIgniteTarunVarmaNo ratings yet

- Apache Case StudyDocument15 pagesApache Case Studyadrian_lozano_zNo ratings yet

- The Boeing 7E7Document8 pagesThe Boeing 7E7AmandaNo ratings yet

- GannDocument11 pagesGannrajivnk100% (1)

- Case Study Q4 - Hill Country Snack FoodsDocument2 pagesCase Study Q4 - Hill Country Snack FoodsSpencer1234556789No ratings yet

- Corporate Finance ExercisesDocument14 pagesCorporate Finance ExercisesMatteoNebiolo100% (1)

- Business STD 11th Set ADocument5 pagesBusiness STD 11th Set AjashanjeetNo ratings yet

- Mcqs Based & Very Short Answer Type QuestionsDocument5 pagesMcqs Based & Very Short Answer Type QuestionsjashanjeetNo ratings yet

- Q. Should Goverment Bailout Kingfisher?Document7 pagesQ. Should Goverment Bailout Kingfisher?rishigandhi3No ratings yet

- (Economy) SEBI-Sahara OFCD Case - Optionally Fully-Convertible Debentures - Meaning Explained MrunalDocument6 pages(Economy) SEBI-Sahara OFCD Case - Optionally Fully-Convertible Debentures - Meaning Explained MrunalBhaiya KamalenduNo ratings yet

- Vishal MewadaDocument3 pagesVishal MewadaSunil MewadaNo ratings yet

- Economy) SEBI-Sahara OFCD Case: Optionally Fully-Convertible Debentures-Meaning ExplainedDocument19 pagesEconomy) SEBI-Sahara OFCD Case: Optionally Fully-Convertible Debentures-Meaning ExplainedKps Brar HarryNo ratings yet

- (Economy) GMR-Maldives Airport Controversy, IFC, AAI: Meaning, Reason, Implications, ExplainedDocument8 pages(Economy) GMR-Maldives Airport Controversy, IFC, AAI: Meaning, Reason, Implications, ExplainedKelly WallsNo ratings yet

- IDBI FEDERAL ProjectDocument15 pagesIDBI FEDERAL ProjectManisha KumariNo ratings yet

- Mental Accounting: From The Desk of Editor in ChiefDocument4 pagesMental Accounting: From The Desk of Editor in ChiefSoobian AhmedNo ratings yet

- Budget 2012-13: Pragmatism Must Dictate: by Abu Yousuf Md. Abdullah, PHDDocument4 pagesBudget 2012-13: Pragmatism Must Dictate: by Abu Yousuf Md. Abdullah, PHDAshfaqul Haq ChowdhuryNo ratings yet

- India Difficult For BusinessDocument2 pagesIndia Difficult For BusinessAndy YongNo ratings yet

- Jaiswal Slams Opposition On FDI Issue - The Economic TimesDocument4 pagesJaiswal Slams Opposition On FDI Issue - The Economic Timesdilip_scribdNo ratings yet

- Accounting DPEDocument16 pagesAccounting DPEubaidNo ratings yet

- Subscribe Search E-Paper New Podcasts New Notifications: Rajesh KumarDocument11 pagesSubscribe Search E-Paper New Podcasts New Notifications: Rajesh KumarpratikshaNo ratings yet

- Opinion Disclaimer Internal Auditor External Auditor Audit Evaluation Legal Entity AssuranceDocument4 pagesOpinion Disclaimer Internal Auditor External Auditor Audit Evaluation Legal Entity AssurancesanahbijlaniNo ratings yet

- Press Articles From Defi Quotidien E-Newspaper of 8.4.2020Document4 pagesPress Articles From Defi Quotidien E-Newspaper of 8.4.2020Rit ESh BujunNo ratings yet

- What Public Sector CEOs Like To Tell PM - Please Do Not Use Us As Dogs 231012Document8 pagesWhat Public Sector CEOs Like To Tell PM - Please Do Not Use Us As Dogs 231012Babubhai Dhudabhai VaghelaNo ratings yet

- How Businesses Can Get Legal Formalities Done During The PandemicDocument12 pagesHow Businesses Can Get Legal Formalities Done During The PandemicManoj Kumar MannepalliNo ratings yet

- France Revises Down 2013 Growth FigureDocument4 pagesFrance Revises Down 2013 Growth FiguresachinshirnathNo ratings yet

- Timeline Photos: Search For People, Places and ThingsDocument7 pagesTimeline Photos: Search For People, Places and ThingsVishal KalraNo ratings yet

- Telecom Subscriber Rankings Throw Up Surprises, Worries: Govt, Vodafone Likely To Resolve Tax IssueDocument1 pageTelecom Subscriber Rankings Throw Up Surprises, Worries: Govt, Vodafone Likely To Resolve Tax IssueVishnu PirakashNo ratings yet

- 27.09.22 - Morning Financial News UpdatesDocument5 pages27.09.22 - Morning Financial News UpdatesLakshmi ThiagarajanNo ratings yet

- Finance Bulletin Sep2013 1Document3 pagesFinance Bulletin Sep2013 1Naga NagendraNo ratings yet

- Tax SecretsDocument16 pagesTax SecretsVenkat SairamNo ratings yet

- Flash NewsDocument3 pagesFlash Newslingesh1892No ratings yet

- Economyria: Home Start Here Contact /suggest A Topic About UsDocument5 pagesEconomyria: Home Start Here Contact /suggest A Topic About Ustitiksha jewrajkaNo ratings yet

- Article On Regulatory LawDocument17 pagesArticle On Regulatory Lawmohit33033No ratings yet

- Press Release AIBOC-December 26, 2018Document2 pagesPress Release AIBOC-December 26, 2018KUMAR PNo ratings yet

- Case 1: Question: Do The SWOT Analysis of DD and Analyse All Three AlternativesDocument2 pagesCase 1: Question: Do The SWOT Analysis of DD and Analyse All Three AlternativesDhruti PandyaNo ratings yet

- Economic Survey Ch2Document12 pagesEconomic Survey Ch2sunkkkNo ratings yet

- Can You Plan For Indirect TaxDocument3 pagesCan You Plan For Indirect TaxabhaybittuNo ratings yet

- 2016 04 29 - Mdca - FinalDocument40 pages2016 04 29 - Mdca - FinalgothamcityresearchNo ratings yet

- BASIC Promotion 2011Document119 pagesBASIC Promotion 2011tanviriubdNo ratings yet

- Media Release CDSL Slashes Pledge/ Repledged Rates For Margin Transactions Up To 91%Document2 pagesMedia Release CDSL Slashes Pledge/ Repledged Rates For Margin Transactions Up To 91%Durgaprasanna BeheraNo ratings yet

- 5 6172620504097096522Document6 pages5 6172620504097096522Pushpinder KumarNo ratings yet

- Falling Rupee To Bring Windfall For Some, Companies With Overseas Arms To Get More Money - The Economic TimesDocument5 pagesFalling Rupee To Bring Windfall For Some, Companies With Overseas Arms To Get More Money - The Economic TimesRavi Prakash MehtaNo ratings yet

- Eco AssignmentDocument8 pagesEco AssignmentTushar BansalNo ratings yet

- India's Structural Economic SlowdownDocument7 pagesIndia's Structural Economic SlowdownNova MenteNo ratings yet

- Promotion Test Questions (2012-14)Document12 pagesPromotion Test Questions (2012-14)apatra01714No ratings yet

- HTTP WWW - Business-StandardDocument2 pagesHTTP WWW - Business-StandardShankar JhaNo ratings yet

- Share Sansar Samachar of 08 September' 2011Document3 pagesShare Sansar Samachar of 08 September' 2011sharesansarNo ratings yet

- Brsrse2023Document34 pagesBrsrse2023suprithas946No ratings yet

- Kotak Mahindra Bank Q4 FY20 Earnings Conference CallDocument29 pagesKotak Mahindra Bank Q4 FY20 Earnings Conference Calldivya mNo ratings yet

- Research For VBSDocument9 pagesResearch For VBSNISHANT395No ratings yet

- Capital Market-15th MarchDocument28 pagesCapital Market-15th MarchVenkat Narayan RavuriNo ratings yet

- Bafs QuizDocument7 pagesBafs Quizle2ztungNo ratings yet

- Bumpy Road Ahead For Infrastructure Sector H2 Outlook Negative - Report - Economic TimesDocument3 pagesBumpy Road Ahead For Infrastructure Sector H2 Outlook Negative - Report - Economic TimessaadsaaidNo ratings yet

- Moral Hazards and Their Alternatives of BanksDocument3 pagesMoral Hazards and Their Alternatives of BanksAbdul SattarNo ratings yet

- Sun Zi Final AssignmentDocument9 pagesSun Zi Final Assignment摩羯座No ratings yet

- Reasons Behind Failures of Msmes & Measures Taken To Promote Indian MsmesDocument3 pagesReasons Behind Failures of Msmes & Measures Taken To Promote Indian MsmesPALASH SAROWARENo ratings yet

- Bls International Annual RPTDocument186 pagesBls International Annual RPTJeet SinghNo ratings yet

- IDFC Bonds Issue Draft Shelf ProspectuslDocument207 pagesIDFC Bonds Issue Draft Shelf ProspectuslzubermohammedNo ratings yet

- 2015 05 05 - Eigi - Adjusted EBITDA Is A Meaningless Metric, As It Does Not Correlate With Free Cash Flow - 4 Questions All Analyst Should Ask EIGIDocument8 pages2015 05 05 - Eigi - Adjusted EBITDA Is A Meaningless Metric, As It Does Not Correlate With Free Cash Flow - 4 Questions All Analyst Should Ask EIGIgothamcityresearchNo ratings yet

- No HandoutDocument7 pagesNo HandoutDarrell R. DeQuichiNo ratings yet

- Election in 4 States Expectations From The GovernmentDocument8 pagesElection in 4 States Expectations From The GovernmentNehaNo ratings yet

- NTPC Prospectus November25 2013Document638 pagesNTPC Prospectus November25 2013marinedgeNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- Devoir de Contrôle N°1 - Anglais - 2ème Economie & Gestion (2012-2013) Mme Salwa LabidiDocument2 pagesDevoir de Contrôle N°1 - Anglais - 2ème Economie & Gestion (2012-2013) Mme Salwa LabidiBrahim SalemNo ratings yet

- 08 Investmentquestfinal PDFDocument13 pages08 Investmentquestfinal PDFralphalonzo0% (1)

- PS1Document5 pagesPS1faiqsattarNo ratings yet

- Accounts PayableDocument5 pagesAccounts Payablesamsam9095No ratings yet

- Thomson ReutersDocument6 pagesThomson ReutersJade FajardoNo ratings yet

- Smith V Van GorkomDocument21 pagesSmith V Van GorkomjfgoetzNo ratings yet

- RATIOS MEANING A Ratio Shows The Relationship Between Two Numbers.Document15 pagesRATIOS MEANING A Ratio Shows The Relationship Between Two Numbers.shru44No ratings yet

- List of Assets & Liabilities and Business Interests As On 31St March, 2011Document35 pagesList of Assets & Liabilities and Business Interests As On 31St March, 2011Ruchira SinghNo ratings yet

- CSR of Banking IndustryDocument2 pagesCSR of Banking Industryzany_sNo ratings yet

- Chapter 7 Handout Solution - Accounting 405-1Document5 pagesChapter 7 Handout Solution - Accounting 405-1Bridget ElizabethNo ratings yet

- Customer Percep-Tion Towards Mutual Fu-Nds in SBIDocument76 pagesCustomer Percep-Tion Towards Mutual Fu-Nds in SBIRahul GuptaNo ratings yet

- Regulatory FrameworkDocument10 pagesRegulatory FrameworkkingjaspeNo ratings yet

- BUS 330 Exam 1 - Fall 2012 (B) - SolutionDocument14 pagesBUS 330 Exam 1 - Fall 2012 (B) - SolutionTao Chun LiuNo ratings yet

- Seminar 8 - AnswersDocument4 pagesSeminar 8 - AnswersSlice LeNo ratings yet

- Multi Pinbar Hunter ReferenceDocument34 pagesMulti Pinbar Hunter Referencerogerrod61No ratings yet

- Efficient FrontiersDocument7 pagesEfficient FrontiersintercontiNo ratings yet

- HZLDocument57 pagesHZLricha_star13No ratings yet

- 15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDDocument1 page15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDapi-25889552No ratings yet

- IT - InET Nordic - Introduction of New Manual Trade TypesDocument3 pagesIT - InET Nordic - Introduction of New Manual Trade TypesWillianSantosNo ratings yet

- BDA Advises Ant Capital Partners On Sale of Apple World To ZIGExNDocument3 pagesBDA Advises Ant Capital Partners On Sale of Apple World To ZIGExNPR.comNo ratings yet

- Capital Gain TaxDocument3 pagesCapital Gain TaxvanvunNo ratings yet

- Finolex Industries - 2QFY18 - HDFC Sec-201711132222474829691Document10 pagesFinolex Industries - 2QFY18 - HDFC Sec-201711132222474829691Anonymous y3hYf50mTNo ratings yet

- Bonds Payable and Investments in Bonds: Question InformationDocument46 pagesBonds Payable and Investments in Bonds: Question InformationOKTAVIANAHURINGNo ratings yet

- The EVCA Yearbook 2011Document7 pagesThe EVCA Yearbook 2011Justyna GudaszewskaNo ratings yet