Professional Documents

Culture Documents

Daily Currency Report: Market Recap

Daily Currency Report: Market Recap

Uploaded by

dreamz_blogsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Currency Report: Market Recap

Daily Currency Report: Market Recap

Uploaded by

dreamz_blogsCopyright:

Available Formats

23 Nov 2011

Daily Currency Report

Market Recap

Emerging Asian currencies fell today as investors kept cutting risk assets on increasing worries about the euro zone and the global economy though some regional currencies were pulled higher by central bank intervention.A preliminary survey on Chinese manufacturing renewed worries of a hard landing for the world's second-largest economy boosting global recession fears pushing down emerging Asian currencies more.

Asian shares, US futures as a weak Chinese manufacturing survey renewed fears of a hard landing for the world's No. 2 economy exacerbating worries about faltering global growth following a downward revision of US GDP data.Euro also fell, after a report in a Belgian newspaper that the Franco-Belgium bailout of Dexia bank, the first casualty of the euro zone sovereign debt crisis was on the verge of a collapse.

Australian and New Zealand dollars fell sharply today as a shockingly weak reading on China's manufacturing activity dealt a body blow to risk sentiment sending stocks and commodities reeling.

People's Bank of China fixed the yuan's mid-point against the dollar at 6.3498 firm than the previous fixing level of 6.3555. Indian Rupee opened weak and made a low of 52.73 due to weak asian currencies and equity markets.Frim dollar movement and dollar demand from oil companies also weighed on the rupee.However dollar selling due to retracement in dollar strength and equity markets helped rupee to recoup most of its losses.Suspected central bank selling was also seen weighing positively on the rupee.Rupee closed at 52.2950 weaker than its previous close of 52.16.It is expected to open weak today due to weak asian currencies & equity markets.However fears of central bank intervention will be supportive for the rupee.

Geojit Comtrade Ltd.

704 Dev Plaza Opp Irla Fire Brigade S.V Road, Andheri ( West ) Mumbai - 400058

Geojit Comtrade Ltd.

23 Nov 2011

Technical Level & Trade Recommendation

Currency USD/INR EUR/USD GBP/USD USD/JPY S1 52.14 1.3462 1.5583 76.73 S2 51.99 1.3414 1.5527 76.5 Pivot 52.43 1.3515 1.5637 77.02 R1 52.59 1.3563 1.5693 77.25 R2 52.87 1.3616 1.5747 77.54 14DMA 50.56 1.3597 1.5856 77.33 21DMA 50.13 1.37 1.5915 77.29 50DMA 49.37 1.3661 1.5768 76.92

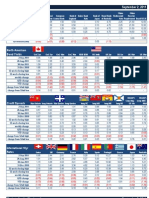

Currency wise Summary -22/11/2011

MCX-SX No. of Total Contracts Traded Traded Value (Rs. In Crs.) 3582474 18,843.68 39025 277.20 16056 132.19 18708 127.82 NSE No. of Total Contracts Traded Traded Value (Rs. In Crs.) 3184315 16759.7 36762 261.38 10372 85.35 12229 83.55

Symbol

Open Interest (Qty.) 1240601 31172 22449 20227

Symbol

Open Interest (Qty.) 2803377 50362 12378 14795

USDINR EURINR GBPINR JPYINR

USDINR EURINR GBPINR JPYINR

Recommendation

Rally in USD/INR towards 52.58 is a good selling level with a stop of 52.75 for a target of 52.10. Dip in EUR/USD towards 1.3450 is a good buying level with a stop of 1.3415 for a target of 1.3530. Dip in GBP/USD towards 1.5598 is a good buying level with a stop of 1.5570 for a target of 1.5665. Rally in USD/JPY towards 77.31/42 is a good selling level with a stop of 77.72 for a target of 76.89.

Geojit Comtrade Ltd.

23 Nov 2011 TECHNICAL UPDATE

USD/INR ( 52.1950 )

4 Hours QINR=IN

BarOHLC, QINR=IN, Bid 07:00 23/11/2011, 52.575, 52.575, 51.75, 52.195 SMA, QINR=IN, Bid(Last), 14 07:00 23/11/2011, 51.6177 11:00 01/06/2011 - 11:00 01/12/2011 (GM T) Price

51

50

49 48 47 46 45 44 .1234 MACD, QINR=IN, Bid(Last), M ACD 12, 26, 9, Simple 07:00 23/11/2011, 0.6313 MACD, QINR=IN, Bid(Last), M ACD Signal Line 12, 26, 9, Simple 07:00 23/11/2011, 0.5423 StochS, QINR=IN, Bid, Stochastics-Slow %K 8, 3, Simple, 3 07:00 23/11/2011, 74.166 StochS, QINR=IN, Bid, Stochastics-Slow %D 8, 3, Simple, 3 07:00 23/11/2011, 83.601 03 07 09 13 1517 2123 2729 01 05 07 11 13 1519 21 25 27 29 02 04 08 10 12 16 18 2224 26 30 01 05 07 09 13 1519 2123 27 29 04 06 10 12 14 18 20 24 26 28 01 03 08 11 15 17 2123 2529 Value .1234 Value .123

June 2011

July 2011

August 2011

September 2011

October 2011

November 2011

USD/INR: Pair closed at 52.2950 weaker than its previous close of 52.16.Rupee opened weak and made a low of 52.73 due to weak asian currencies and equity markets.Firm dollar movement and dollar demand from oil companies also weighed negatively on the rupee.However dollar selling due to retracement in dollar strength and equity markets helped rupee to recoup most of its intraday losses and close marginally weak.Stochastic on Daily charts is into overbought zone and MACD continues to be into buy zone & Stochastic on 4 hourly charts is heavily into overbought zone so a correction can be expected.Near term support is at 52.10 & 51.75 & resistance is at 52.58 & 52.73.

EUR/USD ( 1.3461 )

4 Hours QEUR=

BarOHLC, QEUR=, Bid 08:00 23/11/2011, 1.3468, 1.3477, 1.3455, 1.3461 SMA, QEUR=, Bid(Last), 14 08:00 23/11/2011, 1.3494 20:00 14/09/2011 - 04:00 28/11/2011 (GMT) Price USD

1.4

1.39 1.38 1.37 1.36 1.35 1.34 1.33 1.32 .1234

MACD, QEUR=, Bid(Last), MACD 12, 26, 9, Simple 08:00 23/11/2011, -0.0012 MACD, QEUR=, Bid(Last), MACD Signal Line 12, 26, 9, Simple 08:00 23/11/2011, -0.0012

Value USD .1234

Value StochS, QEUR=, Bid, Stochastics-Slow %K 8, 3, Simple, 3 08:00 23/11/2011, 25.784 USD StochS, QEUR=, Bid, Stochastics-Slow %D 8, 3, Simple, 3 .123 08:00 23/11/2011, 38.579 15 16 18 20 21 22 23 25 27 28 29 30 02 04 05 06 07 09 11 12 13 14 16 18 19 20 21 23 25 26 27 28 30 01 02 03 04 06 08 09 10 11 13 15 16 17 18 20 22 23 24 25 27

September 2011

October 2011

November 2011

EUR/USD: Euro moved lower from the high of 1.3568 and made a low of 1.3450 before retracing back towards 1.3461.Stochastic on Daily charts is into oversold zone, however MACD continues to be in sell zone & Stochastic on 4 hourly charts is trending lower so a correction can be expected.Resistance is at 11.3531 & 1.3568 and support at 1.3450 & 1.3420.Dip towards 1.3450 will be a good buying level for a target of 1.3530 with a stop of 1.3415.

Geojit Comtrade Ltd.

23 Nov 2011 TECHNICAL UPDATE

GBP/USD ( 1.5618 )

4 Hours QGBP=

BarOHLC, QGBP=, Bid 08:00 23/11/2011, 1.5613, 1.5623, 1.5607, 1.5608 SMA, QGBP Bid(Last), 14 =, 08:00 23/11/2011, 1.5653 16:00 26/08/2011 - 12:00 28/11/2011 (GM T) Price USD 1.63 1.62 1.61

1.6

1.59 1.58 1.57 1.56 1.55 1.54 1.53 .1234 MACD, QGBP Bid(Last), MACD 12, 26, 9, Simple =, 08:00 23/11/2011, -0.005 MACD, QGBP Bid(Last), MACD Signal Line 12, 26, 9, Simple =, StochS, QGBP=, Bid, Stochastics-Slow %K 8, 3, Simple, 3 08:00 23/11/2011, 36.97 StochS, QGBP=, Bid, Stochastics-Slow %D 8, 3, Simple, 3 08:00 23/11/2011, 41.589 28 3031 02 04 06 08 09 11 1314 16 18 20 22 23 25 27 29 Value USD .1234 Value USD .123 02 04 06 09 11 13 16 18 20 23 25 27 28 30 0102 04 06 08 10 11 13 15 16 18 20 22 24 25 27

September 2011

October 2011

November 2011

GBP/USD: GBP moved lower from the high of 1.5691 and made a low of 1.5581 before retracing back towards 1.5618.Stochastic on Daily charts is into oversold zone, however MACD is also into sell zone & Stochastic on 4 hourly charts have turned lower so a correction can be expected.Resistance is at 1.5668/91 & 1.5747 & Support at 1.5598 & 1.5581.Dip towards 1.5598 will be good buying level for a target of 1.5665 with a stop of 1.5570.

USD/JPY ( 77 )

4 Hours QJPY=

BarOHLC, QJPY=, Bid 08:00 23/11/2011, 77, 77.07, 76.97, 77 SMA, QJPY=, Bid(Last), 14 08:00 23/11/2011, 76.93 12:00 22/08/2011 - 12:00 28/11/2011 (GMT) Price USD 79.5 79 78.5 78 77.5 77 76.5 76 .12 MACD, QJPY=, Bid(Last), MACD 12, 26, 9, Simple 08:00 23/11/2011, 0 MACD, QJPY=, Bid(Last), MACD Signal Line 12, 26, 9, Simple StochS, QJPY=, Bid, Stochastics-Slow %K 8, 3, Simple, 3 08:00 23/11/2011, 38.462 StochS, QJPY=, Bid, Stochastics-Slow %D 8, 3, Simple, 3 08:00 23/11/2011, 38.522 23 25 28 30 01 04 06 08 11 13 15 18 20 22 25 27 Value USD .12 Value USD .123 29 02 04 06 09 11 13 16 18 20 23 25 27 30 01 03 06 08 10 13 15 17 20 22 24 27

August 2011

September 2011

October 2011

November 2011

USD/JPY: Pair moved lower from the high of 77.31 and made a low of 76.79 before retracing back towards 77.Stochastic on Daily charts have turned higher from oversold zone and the MACD is still into sell zone & Stochastic on 4 hourly charts is also trending lower so a correction can be expected.Resistance is at 77.31/42 & 77.72 and support at 76.71/79 & 76.46.Rally towards 77.31/42 will be a good selling level for a target of 76.79 with a stop of 77.72.

Geojit Comtrade Ltd.

23 Nov 2011 TECHNICAL UPDATE

USD Index ( 78.45 )

4 Hours Q=USD

BarOHLC, Q=USD, Last Trade 02:59 23/11/2011, 78.452, 78.549, 78.405, 78.454 SMA, Q=USD, Last Trade(Last), 14 02:59 23/11/2011, 78.273 02:59 25/08/2011 - 22:59 28/11/2011 (NYC) P rice 79 78.5 78 77.5 77 76.5 76 75.5

75

74.5 74 73.5 .123 MACD, Q=USD, Last Trade(Last), M ACD 12, 26, 9, Simple 02:59 23/11/2011, 0.109 MACD, Q=USD, Last Trade(Last), M ACD Signal Line 12, 26, 9, Simple 02:59 23/11/2011, 0.11 StochS, Q=USD, Last Trade, Stochastics-Slow %K 8, 3, Simple, 3 02:59 23/11/2011, 72.535 StochS, Q=USD, Last Trade, Stochastics-Slow %D 8, 3, Simple, 3 26 3031 0205 06 08 09 13 14 16 19 21 22 23 27 28 30 03 Value .123 Value .123 05 06 09 1112 1417 1920 23 25 2728 31 02 03 06 08 10 11 15 16 17 20 22 24 25

September 2011

October 2011

November 2011

USD Index: Index moved higher from the low of 77.98 and made a high of 78.55 before retracing back towards 78.45.Stochastic on Daily charts is into overbought zone, however MACD continues to be in the buy zone & Stochastic on 4 hourly charts is trending higher so a further pullback can be expected.Resistance is at 78.52/55 & 78.86 and support at 77.98 & 77.54.Rally towards 78.52 will be a good selling level with a stop of 78.86 for a target of 77.92.

Geojit Comtrade Ltd.

23 Nov 2011

Research Department - Institutional Desk

Hemal Doshi hemal@geojitcomtrade.com Contact: 022-61312119

Geojit Comtrade Ltd.

704 Dev Plaza, Opp Irla Fire Brigade, S.V Road, Andheri ( West ), Mumbai - 400058.

Disclaimer:

The information contained here was gathered from sources deemed reliable; however, no claim is made as to accuracy or content. This does not contain specific recommendations to buy or sell at particular prices or time, nor should any examples presented be deemed as such. There is a risk of loss in commodity trading and commodity options and you should carefully consider your financial position before making a trade. This is not, nor is it intended, to be a complete study of chart patterns or technical analysis and should not be deemed as such. Geojit Comtrade Ltd. does not guarantee that such information is accurate or complete and it should not be relied upon as such. Any opinions expressed reflect judgements at this date and are subject to change without notice. For use at the sole discretion of the investor without any liability on Geojit Comtrade Ltd.

Geojit Comtrade Ltd.

You might also like

- My Payslips 2022-11-07Document16 pagesMy Payslips 2022-11-07Ildikó Pető-Jánosi0% (1)

- FinDocument4 pagesFinTintin Brusola Salen67% (3)

- Currency Daily Report November 21Document4 pagesCurrency Daily Report November 21Angel BrokingNo ratings yet

- Currency Daily Report November 22Document4 pagesCurrency Daily Report November 22Angel BrokingNo ratings yet

- Currency Daily Report November 9Document4 pagesCurrency Daily Report November 9Angel BrokingNo ratings yet

- Currency Daily Report August 22Document4 pagesCurrency Daily Report August 22Angel BrokingNo ratings yet

- Focus: Colombo Stock ExchangeDocument24 pagesFocus: Colombo Stock ExchangeLBTodayNo ratings yet

- Currency Daily Report August 23Document4 pagesCurrency Daily Report August 23Angel BrokingNo ratings yet

- Cross Asset Technical VistaDocument20 pagesCross Asset Technical VistaanisdangasNo ratings yet

- Currency Daily Report October 25Document4 pagesCurrency Daily Report October 25Angel BrokingNo ratings yet

- Currency Daily Report September 27Document4 pagesCurrency Daily Report September 27Angel BrokingNo ratings yet

- Currency Daily Report August 29Document4 pagesCurrency Daily Report August 29Angel BrokingNo ratings yet

- HSL PCG "Currency Daily": 05 January, 2017Document6 pagesHSL PCG "Currency Daily": 05 January, 2017arun_algoNo ratings yet

- Currency Daily Report November 6Document4 pagesCurrency Daily Report November 6Angel BrokingNo ratings yet

- Analisis Teknikal: Stock PickDocument4 pagesAnalisis Teknikal: Stock PickGoBlog NgeblogNo ratings yet

- Currency Daily Report November 12Document4 pagesCurrency Daily Report November 12Angel BrokingNo ratings yet

- Currency Daily Report November 8Document4 pagesCurrency Daily Report November 8Angel BrokingNo ratings yet

- Currency Daily Report October 30Document4 pagesCurrency Daily Report October 30Angel BrokingNo ratings yet

- Currency Daily Report November 20Document4 pagesCurrency Daily Report November 20Angel BrokingNo ratings yet

- Currency Daily Report October 12Document4 pagesCurrency Daily Report October 12Angel BrokingNo ratings yet

- Currency Daily Report November 16Document4 pagesCurrency Daily Report November 16Angel BrokingNo ratings yet

- Cross Asset Technical VistaDocument21 pagesCross Asset Technical VistaanisdangasNo ratings yet

- Currency Daily Report September 11Document4 pagesCurrency Daily Report September 11Angel BrokingNo ratings yet

- Currency Daily Report October 10Document4 pagesCurrency Daily Report October 10Angel BrokingNo ratings yet

- Currency Daily Report December 10Document4 pagesCurrency Daily Report December 10Angel BrokingNo ratings yet

- Daily Market Report: September 15, 2011Document1 pageDaily Market Report: September 15, 2011ریحان خالدNo ratings yet

- Currency Daily Report October 23Document4 pagesCurrency Daily Report October 23Angel BrokingNo ratings yet

- 2011 12 09 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 09 Migbank Daily Technical Analysis ReportmigbankNo ratings yet

- Cross Asset Technical VistaDocument21 pagesCross Asset Technical VistaanisdangasNo ratings yet

- Daily Trade Journal - 31.12Document14 pagesDaily Trade Journal - 31.12ran2013No ratings yet

- Currency Daily Report August 31Document4 pagesCurrency Daily Report August 31Angel BrokingNo ratings yet

- Currency Daily Report October 16Document4 pagesCurrency Daily Report October 16Angel BrokingNo ratings yet

- Daily Metals and Energy Report November 26Document6 pagesDaily Metals and Energy Report November 26Angel BrokingNo ratings yet

- Currency Daily Report September 12Document4 pagesCurrency Daily Report September 12Angel BrokingNo ratings yet

- 2011 08 05 Migbank Daily Technical Analysis Report+Document15 pages2011 08 05 Migbank Daily Technical Analysis Report+migbankNo ratings yet

- ReportHistory 745520Document3 pagesReportHistory 745520SumirJosanNo ratings yet

- Apl International Incorporated LTDDocument10 pagesApl International Incorporated LTDphunguyenframasNo ratings yet

- Currency Daily Report August 14Document4 pagesCurrency Daily Report August 14Angel BrokingNo ratings yet

- Currency Daily Report November 5Document4 pagesCurrency Daily Report November 5Angel BrokingNo ratings yet

- Currency Daily Report October 18Document4 pagesCurrency Daily Report October 18Angel BrokingNo ratings yet

- Currency Daily Report December 7Document4 pagesCurrency Daily Report December 7Angel BrokingNo ratings yet

- Morning Report 30oct2014Document2 pagesMorning Report 30oct2014Joseph DavidsonNo ratings yet

- Currency Daily Report November 15Document4 pagesCurrency Daily Report November 15Angel BrokingNo ratings yet

- Currency Daily Report August 21Document4 pagesCurrency Daily Report August 21Angel BrokingNo ratings yet

- Treasury ManagementDocument36 pagesTreasury ManagementParth PobariNo ratings yet

- NSE - Review Week Ended 12 Oct 2012Document5 pagesNSE - Review Week Ended 12 Oct 2012kelanio2002780No ratings yet

- Currency Daily Report December 03Document4 pagesCurrency Daily Report December 03Angel BrokingNo ratings yet

- Daily I Forex Report: WWW - Epicresearch.CoDocument15 pagesDaily I Forex Report: WWW - Epicresearch.Coapi-211507971No ratings yet

- Currency Daily Report August 10Document4 pagesCurrency Daily Report August 10Angel BrokingNo ratings yet

- Markets For The Week Ending September 2, 2011: Monetary PolicyDocument8 pagesMarkets For The Week Ending September 2, 2011: Monetary PolicymwarywodaNo ratings yet

- Cross Asset Technical VistaDocument21 pagesCross Asset Technical VistaanisdangasNo ratings yet

- EGX (30) Index: Trend Close CHG % CHG S/L 11-Dec-13Document3 pagesEGX (30) Index: Trend Close CHG % CHG S/L 11-Dec-13api-237717884No ratings yet

- NSE - Review Week Ended 24 Oct 2012Document5 pagesNSE - Review Week Ended 24 Oct 2012kelanio2002780No ratings yet

- Daily Market Note: EquitiesDocument7 pagesDaily Market Note: Equitiesapi-166532035No ratings yet

- EGX (30) Index: Trend Close CHG % CHG S/L 07-Oct-13Document3 pagesEGX (30) Index: Trend Close CHG % CHG S/L 07-Oct-13api-237717884No ratings yet

- Currency Daily Report August 13Document4 pagesCurrency Daily Report August 13Angel BrokingNo ratings yet

- Weekly Market Monitor - No. 34/2012: Genghis Capital Research: Equities, Fixed Income, Currency, CommoditiesDocument13 pagesWeekly Market Monitor - No. 34/2012: Genghis Capital Research: Equities, Fixed Income, Currency, Commoditiesapi-166532035No ratings yet

- Currency Daily Report, June 27 2013Document4 pagesCurrency Daily Report, June 27 2013Angel BrokingNo ratings yet

- EGX (30) Index: Trend Close CHG % CHG S/L 29-Oct-13Document3 pagesEGX (30) Index: Trend Close CHG % CHG S/L 29-Oct-13api-237717884No ratings yet

- Boe and Ecb On Hold Today: Morning ReportDocument3 pagesBoe and Ecb On Hold Today: Morning Reportnaudaslietas_lvNo ratings yet

- Currency Daily Report Dec 13Document4 pagesCurrency Daily Report Dec 13Angel BrokingNo ratings yet

- Kase on Technical Analysis Workbook: Trading and ForecastingFrom EverandKase on Technical Analysis Workbook: Trading and ForecastingNo ratings yet

- Eur/Usd Daily Technical Chart: November 23, 2011Document4 pagesEur/Usd Daily Technical Chart: November 23, 2011dreamz_blogsNo ratings yet

- Way 2 Wealth Weekly Currency 21nov11Document6 pagesWay 2 Wealth Weekly Currency 21nov11dreamz_blogsNo ratings yet

- LeaseDocument51 pagesLeasedreamz_blogsNo ratings yet

- Does The Stock Market in India Move With Asia?: A Multivariate Cointegration-Vector Autoregression ApproachDocument19 pagesDoes The Stock Market in India Move With Asia?: A Multivariate Cointegration-Vector Autoregression Approachdreamz_blogsNo ratings yet

- Corporate PPT - Nucleus SoftwareDocument13 pagesCorporate PPT - Nucleus SoftwarePriyanshu AggarwalNo ratings yet

- Chapter 8 - Fundamental AnalysisDocument8 pagesChapter 8 - Fundamental AnalysisKhwezi LungaNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument39 pagesFinancial Statement Analysis: K R Subramanyam John J WildGilang W Indrasta0% (1)

- Intellect Design Arena Visit Note SPA Sec 110716181502Document3 pagesIntellect Design Arena Visit Note SPA Sec 110716181502Anonymous 61kSe1MNo ratings yet

- Application Checklist (7 Aug 2012)Document6 pagesApplication Checklist (7 Aug 2012)iskandar027No ratings yet

- A Study On Systematic Investment Plan in Mutual FundDocument43 pagesA Study On Systematic Investment Plan in Mutual FundParag JagtapNo ratings yet

- What Is NPA?: Banking Businesses Is Mainly That of Borrowing From The Public and LendingDocument5 pagesWhat Is NPA?: Banking Businesses Is Mainly That of Borrowing From The Public and LendingbhagatamitNo ratings yet

- MAIN PPT Stock Exchange of India - pptmATDocument42 pagesMAIN PPT Stock Exchange of India - pptmATAnkit Jain100% (1)

- Bond ValuationDocument15 pagesBond ValuationSoumili MukhopadhyayNo ratings yet

- HSBC v. CIRDocument11 pagesHSBC v. CIRArvin Antonio OrtizNo ratings yet

- FDI and IndiaDocument57 pagesFDI and IndiaParul TandanNo ratings yet

- Aurora PaperDocument6 pagesAurora PaperZhijian Huang100% (1)

- Australia - BNA Country TP Portfolios - Analysis - As of 14 October 2022 - Transfer - Pricing - Portfolios - Se PDFDocument196 pagesAustralia - BNA Country TP Portfolios - Analysis - As of 14 October 2022 - Transfer - Pricing - Portfolios - Se PDFmalejandrabv87No ratings yet

- CBSE Class 12 Accountancy Question Paper Solution SET 1 Series 2Document18 pagesCBSE Class 12 Accountancy Question Paper Solution SET 1 Series 2Mehul JindalNo ratings yet

- Bank Reconciliation - CE and DSE - AnswerDocument14 pagesBank Reconciliation - CE and DSE - AnswerKwan Yin HoNo ratings yet

- Bond ValuationDocument35 pagesBond ValuationVijay SinghNo ratings yet

- Account Statement Account Statement ﺣ ﺴ ﺎ ب ﺣ ﺴ ﺎ ب ﻛ ﺸ ﻒ ﻛ ﺸ ﻒDocument2 pagesAccount Statement Account Statement ﺣ ﺴ ﺎ ب ﺣ ﺴ ﺎ ب ﻛ ﺸ ﻒ ﻛ ﺸ ﻒMohammed Al-DawoudiNo ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingKamal GanugulaNo ratings yet

- Contoh Soal Uas Utm B.inggris NiagaDocument9 pagesContoh Soal Uas Utm B.inggris NiagaShelo MitaNo ratings yet

- Balance SheetDocument2 pagesBalance SheetUDAYTRSNo ratings yet

- Valuation Using MultiplesDocument21 pagesValuation Using MultiplesJithu JoseNo ratings yet

- A Study On Customer Satisfaction in HDFCDocument10 pagesA Study On Customer Satisfaction in HDFCVishnu Kanth50% (2)

- PT Bateeq CantiqDocument89 pagesPT Bateeq CantiqMuhammad Anwar Hamkan MaulanaNo ratings yet

- Articles On EconomicsDocument27 pagesArticles On EconomicsPRADEEP BARALNo ratings yet

- National Income Accounting AssignmentDocument8 pagesNational Income Accounting AssignmentNamit BhatiaNo ratings yet

- Mba 8622 - Corporation Finance: Course Syllabus Fall Semester 2003Document9 pagesMba 8622 - Corporation Finance: Course Syllabus Fall Semester 2003lilbouyinNo ratings yet

- Real Estate-1Document10 pagesReal Estate-1Peeush ShrivastavaNo ratings yet

- Ch. 4 - The Time Value of MoneyDocument46 pagesCh. 4 - The Time Value of MoneyNeha BhayaniNo ratings yet