Professional Documents

Culture Documents

Def 14a

Def 14a

Uploaded by

Anonymous Feglbx5Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Def 14a

Def 14a

Uploaded by

Anonymous Feglbx5Copyright:

Available Formats

3/25/12

DEF 14A

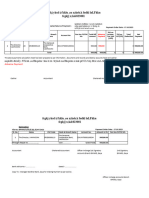

Table of Contents Summar Compensation Table The following table shows the annual and long-term compensation paid or accrued by RAI and its subsidiaries to RAI s Chief Executive Officer, Chief Financial Officer and its other three most highly compensated executive officers for the fiscal years ended December 31, 2011, 2010 and 2009. The table also includes compensation information for Ms. Ivey, who served as RAI s Chief Executive Officer until her retirement on February 28, 2011. 2011 Summar Compensation Table

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(8)

Name and Principal Position

Year

Salar ($)

Bonus ($)

Stock Awards ($)(6)

Non-Equit Incentive Plan Compensation ($)(7)

All Other Compensation ($)(9)

Total ($)

Daniel M. Delen 2011 1,000,000 President and Chief Executive 2010 870,700 Officer of RAI(1) 2009 814,600 Thomas R. Adams 2011 Executive Vice President and 2010 Chief Financial Officer of RAI 2009 Andrew D. Gilchrist President and Chief Commercial Officer of RJR Tobacco(2) 2011 688,150 546,725 533,882 508,950

0 0 0 0 0 0 0

6,176,255 2,401,124 2,001,954 1,731,926 1,345,428 1,089,089 1,273,843

1,161,000 2,716,849 2,952,720 596,152 1,503,255 983,573 375,442

0 0 0 1,845,416 1,344,383 929,464 144,035

176,567 162,999 141,855 169,016 159,909 126,453 36,920

8,513,822 6,151,672 5,911,129 5,030,660 4,899,700 3,662,461 2,339,190

Martin L. Holton III 2011 Executive Vice President, General Counsel and Assistant Secretary of RAI(3) Jeffery S. Gentry Executive Vice President Operations and Chief Scientific Officer of RJR Tobacco Susan M. Ivey Former President and Chief Executive Officer of RAI(4) 2011 2010 2009

497,650 50,000(5) 1,245,530

345,514

266,233

108,126

2,513,053

476,100 461,400 450,418

0 0 0

958,552 908,328 735,250

309,342 890,762 1,064,798

278,912 400,731 253,376

137,143 139,535 122,656

2,160,049 2,800,756 2,626,498

2011 205,500 2010 1,307,000 2009 1,270,000

0 0 0

0 7,486,609 6,241,998

238,586 7,780,696 8,504,440

3,025,466 6,989,915 227,923

309,574 3,779,126 249,595 23,813,815 198,217 16,442,578

(1) Mr. Delen became President and Chief Executive Officer of RAI on March 1, 2011, and was the President and Chief Executive Officer-Elect of RAI from January 1, 2011 to February 28, 2011. (2) Mr. Gilchrist became the President and Chief Commercial Officer of RJR Tobacco on January 1, 2011. (3) Mr. Holton became the Executive Vice President, General Counsel and Assistant Secretary of RAI on January 1, 2011. (4) Ms. Ivey retired as President and Chief Executive Officer of RAI as of the close of business on February 28, 2011. For information regarding the shares of restricted stock and performance shares Ms. Ivey forfeited as a result of her retirement, see footnote 2 to the 2011 Option Exercises and Stock Vested Table and footnotes 3 and 4 to the Outstanding Equity Awards At 2011 Fiscal Year-End Table, respectively, below. (5) This amount represents a special cash award paid to Mr. Holton in February 2011 in connection with his receipt of a Chairman s Award for significant contributions to RAI s success. (6) The amounts shown in this column for 2011 represent the grant date fair value (calculated in accordance with ASC 718) for

.sec.go /Archi es/edgar/data/1275283/000119312512128648/d320533ddef14a.htm#t 301457_53 66/105

3/25/12

DEF 14A

the stock-based long-term incentive award that was granted to each named executive officer in 2011 based on the probable outcome of the performance conditions at the time of the grant. The assumptions upon which these amounts are based are set forth in note 15 to consolidated financial 56

.sec.go /Archi es/edgar/data/1275283/000119312512128648/d320533ddef14a.htm#t 301457_53

67/105

3/25/12

DEF 14A

Table of Contents statements contained in our 2011 Annual Report on Form 10-K. For additional information on the performance shares granted under the Omnibus Plan in 2011, see the footnotes and narrative following the 2011 Grants of Plan-Based Awards Table below. Assuming that the highest level of performance conditions are achieved, the grant date fair value of the performance shares granted under the Omnibus Plan in 2011 to each named executive officer would be as follows Mr. Delen: $9,264,382; Mr. Adams: $2,597,890; Mr. Gilchrist: $1,910,782; Mr. Holton: $1,868,294; and Dr. Gentry: $1,437,845. No stock-based long-term incentive award was granted to Ms. Ivey in 2011. The amounts shown in this column do not equal the actual value that any named executive officer received in 2011 with respect to the vesting of his long-term incentive award. The actual value any named executive officer receives at the end of the performance period for his award is determined based on the specific terms of the grant documentation for the award, and such value may differ significantly from the amounts shown in this column. For the value that each of the named executive officers actually received in 2011 in connection with the vesting of certain shares of restricted stock, see the 2011 Option Exercises and Stock Vested Table below. (7) The amounts in this column for 2011 were paid to the named executive officers in the first quarter of 2012 and represent annual incentive award payments with respect to 2011 performance. For information regarding the foregoing annual incentives, see Compensation Discussion and Analysis Analysis of 2011 Compensation Decisions Annual Compensation Annual Incentive Compensation 2011 Annual Incentives above, and for further information regarding the annual incentive opportunity for each named executive officer, subject to the maximum award payout limitations established by the Compensation Committee, see the narrative following the 2011 Grants of Plan-Based Awards Table below. (8) The amounts in this column for each named executive officer for 2011 represent the total change in the actuarial present value of the executive s accumulated benefit under all defined benefit plans, including supplemental plans, for 2011. For additional information regarding the defined benefit plans in which the named executive officers participate, see the 2011 Pension Benefits Table below. (9) The amounts shown in this column for 2011 include, among other items: (a) contributions made by RAI to the named executive officers under RAI s qualified defined contribution plans, and amounts credited by RAI to the accounts of the named executive officers in RAI s non-qualified excess benefit plans (with such excess benefit plans described in greater detail in the footnotes and narrative following the 2011 NonQualified Deferred Compensation Table below), as follows:

Q ualified Plan Contribution ($) Non-Q ualified Plan Credit ($)

Name

Mr. Delen Mr. Adams Mr. Gilchrist Mr. Holton Dr. Gentry Ms. Ivey (b) the perquisites described below:

22,050 24,500 7,350 22,043 24,500 7,350

145,844 93,141 16,888 43,168 58,822 55,558

a payment of $46,300 to Mr. Adams, a payment of $38,300 to Mr. Holton, a payment of $38,300 to Dr. Gentry, and a payment of $79,000 to Ms. Ivey, in each case in lieu of such person s participation in RAI s former executive perquisites program (such payments were eliminated effective February 2012), a payment of $6,000 to Messrs. Delen and Gilchrist representing a financial planning allowance, the cost of a physical examination in the case of Ms. Ivey and Dr. Gentry, the cost of premiums paid by RAI for certain excess liability insurance covering each of the named executive officers,

.sec.go /Archi es/edgar/data/1275283/000119312512128648/d320533ddef14a.htm#t 301457_53 68/105

You might also like

- Macy's Case StudyDocument6 pagesMacy's Case StudyDestanie Jefferson-LeeNo ratings yet

- CH 02 Tool KitDocument9 pagesCH 02 Tool KitDhanraj VenugopalNo ratings yet

- Business Studies Wiley and SonsDocument534 pagesBusiness Studies Wiley and SonsNate100% (1)

- Def 14aDocument3 pagesDef 14aAnonymous Feglbx5No ratings yet

- Sec - Gov Archives Edgar Data 912183 000104746912004810 A2208902zdef14aDocument1 pageSec - Gov Archives Edgar Data 912183 000104746912004810 A2208902zdef14aAnonymous Feglbx5No ratings yet

- CompensationDocument2 pagesCompensationAnonymous Feglbx5No ratings yet

- Definitive Proxy StatementDocument2 pagesDefinitive Proxy StatementAnonymous Feglbx5No ratings yet

- Table of Content1Document3 pagesTable of Content1William HarrisNo ratings yet

- Preliminary Proxy StatementDocument2 pagesPreliminary Proxy StatementAnonymous Feglbx5No ratings yet

- LAUSDFirstInterimFinancial2011 12 OcrDocument77 pagesLAUSDFirstInterimFinancial2011 12 OcrSaveAdultEdNo ratings yet

- Toronto Shelter, Support and Housing Admin Capital Budget Analyst Notes Budget 2012Document23 pagesToronto Shelter, Support and Housing Admin Capital Budget Analyst Notes Budget 2012arthurmathieuNo ratings yet

- Compensation For The Named Executive Officers in 2011 and 2010Document1 pageCompensation For The Named Executive Officers in 2011 and 2010GeorgeBessenyeiNo ratings yet

- QP March2012 f2Document16 pagesQP March2012 f2g296469No ratings yet

- Q2 2011 Investor Call PresentationDocument17 pagesQ2 2011 Investor Call PresentationphyscdispNo ratings yet

- FXCM Q3 Slide DeckDocument20 pagesFXCM Q3 Slide DeckRon FinbergNo ratings yet

- Introductory Accounting AssignmentDocument7 pagesIntroductory Accounting AssignmentTakumi MaiNo ratings yet

- Answers March2012 f2Document10 pagesAnswers March2012 f2Dimuthu JayawardanaNo ratings yet

- Accounts 2011Document97 pagesAccounts 2011Anas KhanNo ratings yet

- GRI IndexDocument8 pagesGRI IndexTarun Majumdar100% (1)

- Bombardier Q2-C2011 Presentation 20110831Document9 pagesBombardier Q2-C2011 Presentation 20110831lgadfNo ratings yet

- Exhibit 99.1 Message To ShareholdersDocument8 pagesExhibit 99.1 Message To ShareholdersWilliam HarrisNo ratings yet

- 2011 Interaction Audited Financial StatementsDocument16 pages2011 Interaction Audited Financial StatementsInterActionNo ratings yet

- NIF 2011 Financial StatermentsDocument33 pagesNIF 2011 Financial StatermentsWeAreNIFNo ratings yet

- Briefing Note: "2011 - 2014 Budget and Taxpayer Savings"Document6 pagesBriefing Note: "2011 - 2014 Budget and Taxpayer Savings"Jonathan Goldsbie100% (1)

- Definitive Proxy StatementDocument2 pagesDefinitive Proxy StatementAnonymous Feglbx5No ratings yet

- BudgetinBrief 2011 12Document51 pagesBudgetinBrief 2011 12mrshahzad6No ratings yet

- Annual Report PPT FinalDocument23 pagesAnnual Report PPT FinalManish Jaiswal100% (1)

- 2012 Report On Salaries and Allowances PDFDocument1,050 pages2012 Report On Salaries and Allowances PDFolaydyosaNo ratings yet

- Form 11-K: United States Securities and Exchange CommissionDocument15 pagesForm 11-K: United States Securities and Exchange CommissionSurya PermanaNo ratings yet

- Ratio Analysis in Business Decisions@ Bec DomsDocument85 pagesRatio Analysis in Business Decisions@ Bec DomsBabasab Patil (Karrisatte)No ratings yet

- Reference Form 2014Document225 pagesReference Form 2014MillsRINo ratings yet

- Financial Statement Case StudyDocument11 pagesFinancial Statement Case StudyGayle Tadler50% (2)

- Pak Elektron Limited: Condensed Interim FinancialDocument15 pagesPak Elektron Limited: Condensed Interim FinancialImran RjnNo ratings yet

- The Goodyear Tire & Rubber Company: FORM 10-QDocument62 pagesThe Goodyear Tire & Rubber Company: FORM 10-Qavinashtiwari201745No ratings yet

- ADPT Corp: Quarterly Report Pursuant To Sections 13 or 15 (D) Filed On 08/09/2011 Filed Period 07/01/2011Document76 pagesADPT Corp: Quarterly Report Pursuant To Sections 13 or 15 (D) Filed On 08/09/2011 Filed Period 07/01/2011llMarsIINo ratings yet

- Toronto Employment & Social Services Capital Budget Analyst Notes 2012 BudgetDocument22 pagesToronto Employment & Social Services Capital Budget Analyst Notes 2012 BudgetarthurmathieuNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Balance Sheet As at 31 March, 2011: ST STDocument14 pagesBalance Sheet As at 31 March, 2011: ST STLambourghiniNo ratings yet

- Webster University 2011-2012 Audited Financial StatementsDocument36 pagesWebster University 2011-2012 Audited Financial StatementsWebsterJournalNo ratings yet

- Data Analysis and InterpretationDocument50 pagesData Analysis and InterpretationNazir Hussain100% (1)

- Balance Sheet: As at June 30, 2011Document45 pagesBalance Sheet: As at June 30, 2011Rana HaiderNo ratings yet

- MSF 506-Final DocumentDocument22 pagesMSF 506-Final Documentrdixit2No ratings yet

- A C V I A: Merican Ouncil For Oluntary Nternational CtionDocument16 pagesA C V I A: Merican Ouncil For Oluntary Nternational CtionInterActionNo ratings yet

- PERS: 2011 Earnings Crediting 3-22-12Document1 pagePERS: 2011 Earnings Crediting 3-22-12Statesman JournalNo ratings yet

- Ge Capital 3q11 Supplement 10212011Document42 pagesGe Capital 3q11 Supplement 10212011bainercrgNo ratings yet

- Report Arutmin Indonesia September 2011Document56 pagesReport Arutmin Indonesia September 2011Fredy Milson SimbolonNo ratings yet

- The Reserve Bank'S ACCOUNTS FOR 2010-11: IncomeDocument14 pagesThe Reserve Bank'S ACCOUNTS FOR 2010-11: IncomeNeha RaiNo ratings yet

- Form NO. Description: Disclosures - LIFE INSURANCE COMPANIES-web-siteDocument72 pagesForm NO. Description: Disclosures - LIFE INSURANCE COMPANIES-web-siteVenkata ChalamNo ratings yet

- SKJNDocument32 pagesSKJNManojit GhatakNo ratings yet

- Suggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsMdAnjum1991No ratings yet

- LG Chem.2Q ResultsDocument11 pagesLG Chem.2Q ResultsSam_Ha_No ratings yet

- Topic 3 Financial Statement and Financial Ratios AnalysisDocument23 pagesTopic 3 Financial Statement and Financial Ratios AnalysisMardi Umar100% (1)

- 2011 Cfo Comp SurveyDocument31 pages2011 Cfo Comp SurveysinarahimiNo ratings yet

- Final Budget Edition: Estimated Impacts of 2009-11 Proposed Budget(s) On State RevenuesDocument4 pagesFinal Budget Edition: Estimated Impacts of 2009-11 Proposed Budget(s) On State RevenuesJay WebsterNo ratings yet

- EAHDocument83 pagesEAHJames WarrenNo ratings yet

- Cba ExampleDocument4 pagesCba Examplelaxave8817No ratings yet

- Negros Navigation Co., Inc. and SubsidiariesDocument48 pagesNegros Navigation Co., Inc. and SubsidiarieskgaviolaNo ratings yet

- Infosys Balance SheetDocument28 pagesInfosys Balance SheetMM_AKSINo ratings yet

- Cy 2021Document1,316 pagesCy 2021Ronielle PunzalNo ratings yet

- Finanicial Analysis ThomscookDocument45 pagesFinanicial Analysis ThomscookAnonymous 5quBUnmvm1No ratings yet

- Microsoft Corporation: United States Securities and Exchange CommissionDocument75 pagesMicrosoft Corporation: United States Securities and Exchange Commissionavinashtiwari201745No ratings yet

- Compendium of Supply and Use Tables for Selected Economies in Asia and the PacificFrom EverandCompendium of Supply and Use Tables for Selected Economies in Asia and the PacificNo ratings yet

- ValeportDocument3 pagesValeportAnonymous Feglbx5No ratings yet

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocument6 pagesHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5No ratings yet

- Houston's Office Market Is Finally On The MendDocument9 pagesHouston's Office Market Is Finally On The MendAnonymous Feglbx5No ratings yet

- THRealEstate THINK-US Multifamily ResearchDocument10 pagesTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5No ratings yet

- The Woodlands Office Submarket SnapshotDocument4 pagesThe Woodlands Office Submarket SnapshotAnonymous Feglbx5No ratings yet

- Asl Marine Holdings LTDDocument28 pagesAsl Marine Holdings LTDAnonymous Feglbx5No ratings yet

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocument7 pagesUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- Greenville Americas Alliance MarketBeat Office Q32018Document1 pageGreenville Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Five Fast Facts - RIC Q3 2018Document1 pageFive Fast Facts - RIC Q3 2018Anonymous Feglbx5No ratings yet

- Final StramaDocument74 pagesFinal StramaRalphDesiEscueta94% (36)

- 02 Quiz Bee p1 and Toa Average - Doc2Document2 pages02 Quiz Bee p1 and Toa Average - Doc2Shiela Belle PoppyNo ratings yet

- Shareholder Protection and The Cost of CapitalDocument34 pagesShareholder Protection and The Cost of CapitalJuan Diego Veintimilla PanduroNo ratings yet

- Declaration On The Openness of Political Finance Systems DRAFT 2015-05-22Document5 pagesDeclaration On The Openness of Political Finance Systems DRAFT 2015-05-22Sunlight FoundationNo ratings yet

- Submitted By: Mahesh Raut IB Anand - Iim JammuDocument9 pagesSubmitted By: Mahesh Raut IB Anand - Iim JammuAnandNo ratings yet

- 251 0405Document23 pages251 0405api-27548664No ratings yet

- Synopsis For ThesisDocument8 pagesSynopsis For ThesismanojlongNo ratings yet

- The Details of Eligibility Criter'a, Key Job Roles/responsibilities, Reservation Norms and Important Instructions Are Mentioned BelowDocument21 pagesThe Details of Eligibility Criter'a, Key Job Roles/responsibilities, Reservation Norms and Important Instructions Are Mentioned BelowEr Chandan SoniNo ratings yet

- SC Credit Cards Pitchbook Verfeb22Document11 pagesSC Credit Cards Pitchbook Verfeb22Yashwant Raj VermaNo ratings yet

- 27full Download PDF of Test Bank For Money Banking and Financial Markets, 3rd Edition: Cecchetti All ChapterDocument43 pages27full Download PDF of Test Bank For Money Banking and Financial Markets, 3rd Edition: Cecchetti All Chapterparacaprogmi100% (4)

- Synopsis of Nri BankingDocument3 pagesSynopsis of Nri Bankingdarshan jainNo ratings yet

- Bipard Prashichhan (Gaya) 87 2023Document2 pagesBipard Prashichhan (Gaya) 87 2023tinkulal91No ratings yet

- Marione John Seto - Quiz in Civil Review 2Document2 pagesMarione John Seto - Quiz in Civil Review 2Marius AwriliusNo ratings yet

- 2001 Excerpt Gao-02-111 ML Efforts in The Securities IndustryDocument3 pages2001 Excerpt Gao-02-111 ML Efforts in The Securities IndustrytofumasterNo ratings yet

- Sample Assumption For Strategic Management PaperDocument2 pagesSample Assumption For Strategic Management PaperDaniela AubreyNo ratings yet

- Bogus International BankingDocument5 pagesBogus International Bankingextemporaneous100% (1)

- In Search of The Hybrid IdealDocument7 pagesIn Search of The Hybrid IdealHob DuNo ratings yet

- Chapter 6 Controlling CashDocument10 pagesChapter 6 Controlling CashyenewNo ratings yet

- SWOT Analysis of Mutual FundsDocument31 pagesSWOT Analysis of Mutual FundsALEXANDAR0% (1)

- Bearish Candle - Stick PatternDocument48 pagesBearish Candle - Stick Patternpdhamgaye49No ratings yet

- The Stock Market Crash and The Great DepressionDocument10 pagesThe Stock Market Crash and The Great DepressionJaysonNo ratings yet

- Syllabus in Business Organization II UpdatedDocument11 pagesSyllabus in Business Organization II UpdatedJel LyNo ratings yet

- Reciever Michael Doweary Says He Lost Confidence in The City's Finance and Human Resources Departments.Document5 pagesReciever Michael Doweary Says He Lost Confidence in The City's Finance and Human Resources Departments.WHYY NewsNo ratings yet

- R3 - Putting The Fin Back To FinTechDocument14 pagesR3 - Putting The Fin Back To FinTechEENo ratings yet

- Acquisition and Restructuring StrategiesDocument14 pagesAcquisition and Restructuring Strategiesvipulp_10No ratings yet

- (CFA) (2015) (L2) 03 V5 - 2015 - CFA二级强化班PPT - 经济学 - 何旋1Document98 pages(CFA) (2015) (L2) 03 V5 - 2015 - CFA二级强化班PPT - 经济学 - 何旋1Phyllis YenNo ratings yet

- Letter of Credit or Documentary Credit UCP 601Document2 pagesLetter of Credit or Documentary Credit UCP 601Sumaiya AmrinNo ratings yet

- Solution P6-2Document2 pagesSolution P6-2Frantino M Hutagaol100% (1)