Professional Documents

Culture Documents

A Re-Examination of The Sunspot-Weather-Theory of Business Cycles

A Re-Examination of The Sunspot-Weather-Theory of Business Cycles

Uploaded by

jmertesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Re-Examination of The Sunspot-Weather-Theory of Business Cycles

A Re-Examination of The Sunspot-Weather-Theory of Business Cycles

Uploaded by

jmertesCopyright:

Available Formats

A Re-examination of the Sunspot-Weather Theory of Business Cycles

Daniel Kuester and Charles R. Britton ABSTRACT The economic activity in arid/semiarid areas of the western United States would seem to be much more influenced by weather than humid/semi humid areas since they are located marginally closer to major drought conditions at any moment in time. This paper reexamines the original sunspot theory of business cycles of William Stanley Jevons, the contributions of his son H. S. Jevons, and the further extensions made by H.L. Moore. These individuals sought a causal link between meteorological conditions and economic activity through agricultural production. The authors of this paper present an analysis of the development of these theories. KEY WORDS: Business Cycles, Sunspot-Weather, W.S. Jevons PRELUDE The recent drought conditions in the U.S. along with a weakening economy have resparked an interest in the impact of weather upon the economy. Whereas the drought seems almost pervasive throughout the United States its effects are more pronounced in the arid/semiarid west where smaller deviations from normal rainfall compound into larger impacts upon the arid region in general. The inventory of water stocks is already low at a time when rainfall replacements are inadequate. (Henderson and Novack 2003) This type of situation leads to the question: What is the relationship between weather and the overall economy? This question is addressed by the authors of this paper. INTRODUCTION The National Bureau of Economic Research has a specific definition of business cycles. Business cycles are a type of fluctuation found in the economic activity of nations that organize their work mainly in business enterprises: A cycle consists of expansions occurring of about the same time in many economic activities, followed by similarly general recessions, contractions, and revivals which merge into the expansion phase of the next cycle; this sequence of changes is recurrent but not periodic (Lee, 1971) From this definition comes a major salient factor. Business cycles are fluctuations in the overall aggregate economy yet there are still cycles of particular industries within that aggregate. This paper concerns itself with the particular industries represented by agricultural production and more specifically the influence of periodic solar activities upon the agricultural industries. Of particular interest will be the development of the theory behind the causal relationship between solar activity and overall economic activity. Whereas there are numerous theories as to the causes of the business cycles (monetary overinvestment, non-

monetary overinvestment, under consumption, psychological, technological change, population change, institutional change, natural resources, and even war) the authors of the paper are concerned with the socalled Nature theory. These types of theories hypothesize a causal relationship between meteorological conditions and overall business activity with the connecting link being changes in agricultural output and income. H. L. Moores causal relationship runs between the behavior of the planet Venus to rainfall cycles to agricultural output to agricultural supportive industries to overall business activities. (Moore, 1923) A more widely accepted theory (yet still being investigated) concerns the works of William Stanley Jevons (Jevons, 1909) and his son H. Stanley Jevons (Jevons, 1910). The elder Jevons and then his son H. S. believed that cyclical behavior of solar activity cause changes in agricultural output and therefore general economic activity. This has been named the sunspot theory. Although sometimes regarded as bordering on the bizarre it is not too farfetched. Non-irrigated agrarian societies obviously would suffer pronounced effects upon agricultural production (and therefore incomes) from climatic alterations. It follows that relative large variations in agricultural production would lead to variations in supporting industries (forward linkages) and then impacts upon industrial output which use raw materials from agriculture (backward linkages) and eventually overall economic activity. AGRICULTURAL OUTPUT AND INDUSTRY ACTIVITY

The relationship between agriculture and overall business activity has been analyzed in depth in economic literature. Much of the analysis deals with the long-run or secular activity. This concept can be traced to Walter Bagehot who states that cheap corn prices helped the total economy. (Bagehot, 1887) The effect of this cheapness is great in every department of industry. The working classes, having cheaper food, need to spend so much less on that food, and have more to spend on other things. In consequence, there is a gentle augmentation of demand through almost all departments of trade. Simply put this means that decreasing food prices bring about a decreased income in the agricultural sector. But the purchasing power of the industrial sector increases since it takes less to feed urban workers. Obviously, once the general economy becomes more industrial relative to agriculture then the overall economy will expand. The relationship between efficiency gains in agriculture and therefore falling food prices relative to industry is a well recognized phenomenon. Economic growth results. Business activity increases in direct relationship with the ratio of manufactured commodities to agricultural commodities (Graue, 1930 p. 475). This is a long-run relationship however. Expanding agriculture leads to falling prices and consolidation of farms. Falling farm prices allow for a growing industrial sector. The industrial sector absorbs the surplus labor released from the agricultural sector (Lewis, 1963). The total economy expands according to the general economic growth theory. The short-run relationship is different from the long-run growth model. Cycles

in agricultural prices and therefore agricultural incomes are directly related to industrial and overall economic output. Lower agricultural incomes mean lower purchasing of industrial goods and lower overall economic activities. The declining importance of agriculture in the general economy means the business cycle is much less agriculturally related but it is still a relationship worthy of study. REAL CAUSES OF CYCLES Real causes of a business cycle include variations in weather which is what is at issue in this paper. First, agricultural output traditionally has a one year production period (excluding multiple crop situations). The question is whether there is a rhythmatic or cyclical aspect to agricultural output over the short-run (versus the long-run secular trend). Furthermore, is there a cycle to farm output caused by cyclical changes in weather (both temperature and rainfall)? Lastly, are these meteorological cycles caused by changes in other real variables such as sunspots? It is to this subject that William Stanley Jevons directed his attentions which were then continued by his son H. Stanley Jevons. The development of these sunspot or weather theories of business cycles is particularly relevant to arid lands. Nonirrigated arid and semi-arid lands always operate closer to disaster than humid/semi- humid lands. Small variations in temperature and rainfall have exaggerated effects upon weather related industries when that industry operates at marginal levels. It was pointed out to the authors that there are non-agricultural industries which are greatly also affected in arid regions.

Lack of precipitation impacts greatly upon fishing and skiing economies. What the authors wish to do in this paper is examine the weather related sunspot theory of the business cycle as developed by the Jevons.

THE SUNSPOT THEORY William Stanley Jevons summarized his thoughts on the effects of weather on economic activity in three chapters of his book Investigations in Currency and Finance (Jevons, 1910). An in-depth examination of these essays reveals some very interesting conclusions. In the first essay entitled The Solar Period and the Price of Corn (1875) he first investigates the striking similarity between the length of many historical business cycles and the length of the average length of the sunspot cycle (which is approximately eleven years). Jevons finds that the prices of most agricultural products vary dramatically over an eleven year cycle. He cites English agricultural price data from the years 1259-1400. The prices of wheat, barley, oats, beans, peas, and rye reach a relative minimum in the second year of the cycle, an absolute maximum in the fourth year of the cycle and an absolute minimum in the tenth year of the cycle before recovering in the final year of the cycle and the first year of the new cycle. There does appear to be a rather obvious and consistent trend in prices over these eleven year periods. Jevons finds that the data (English wheat prices from1595-1761) available to him in the Wealth of Nations (Smith, 1776) confirm similar although less marked trends in agricultural prices.

Jevons does not discount other significant factors that might cause the rather predictable nature of these business cycles. Technological advancements, wars, and other factors independent of agricultural and weather cycles can and do exhibit great influence over the economic well being of a nation. Also consumer confidence or a lack thereof could cause significant variations in spending and employment. However, Jevons believes that these consumer attitudes may also be related to the sunspot theory and the corresponding droughts and bumper crops which may result. If, then the English money market is naturally fitted to swing or roll in periods of ten or eleven years, comparatively slight variations in the goodness of harvests repeated at like intervals would suffice to produce those alterations of depression, activity, excitement and collapse which undoubtedly recur in well- marked succession. (Jevons, 1909a p.204) Jevons believed that if it were possible to accurately predict the sunspot cycle and the corresponding bumper crops and droughts then it would also be possible to predict impending economic crises. In the second essay The Periodicity of Commercial Crisis and Its Physical Explanation (1878) with Postscript (1882) W. S. Jevons continues his study. In this essay he attempts to find empirical evidence to support his claim that business cycles follow predictable patterns which can be tied to the length of the sunspot cycles. Jevons claims that the relationship between weather patterns and business activity display a stronger relationship in primarily agrarian societies such as India and Africa. This claim makes this subject

more meaningful in studying the relationship between weather patterns and economic activity in arid and semiarid lands. One piece of empirical evidence which W.S. Jevons believed would strengthen his sunspot business cycle theory actually has weakened this theory somewhat in retrospect. there is more or less evidence that trade reached a maximum of activity in or about the years 1701, 1711, 1721, 1732, 1742, 1753, 1763, 1772, 1783, 1793, 1805, 1815, 1825, 1837, 1847, 1857, 1866. These years marked by the bursting of a commercial panic or not, are as nearly as I can judge, corresponding years, and the intervals, vary only form nine to twelve years. There being in all an interval of one hundred and sixty five years, broken into sixteen periods, the average length of the period is about 10.3 years. (Jevons, 1909b, p. 214-5). Jevons points out that it is reasonable for the business cycles to vary somewhat in duration as it is reasonable to expect that there will be different lags between droughts and economic downturns based on inventories available and on the variations in trade patterns and ability to obtain imports quickly. Potentially the most troubling conclusion that Jevons reached was that a sunspot cycle and the corresponding changes in agricultural yield and national productivity would follow a predictable pattern of approximately 10.3 years. Most astronomers now believe that the sunspot cycle does indeed last approximately 11.11 years which is somewhat troubling and is something that Jevons son attempts to address. This potential difference in sunspot duration is a primary reason this subject

has not been studied as much as might be expected. However the findings of Garcia-Mata and Shaffner provide some credence to Jevons theory (see attached figures). Summing up, we can say that from a statistical point of view there appears to be a clear correlation between the major cycles of non-agricultural business activity in the United States and the solar cycle of 11+ years. (GarciaMata and Shaffner, 1934, p. 26). These authors also claim that it is reasonable that there could be some variation in the duration between sunspot cycles and that there is evidence that these cycles do correspond with business activity. The third essay on sunspots and the business cycle was entitled Commercial Crisis and Sun-Spots Part I (1878) and Part II (1879) completed W. S. Jevons thoughts on the relationship of weather and business activity. In this essay he continues to discuss the existence of a solar cycle of 10.45 years as being wholly consistent with his findings and being a better predictor of economic variables than the now widely used duration of 11.11 years. Despite this potentially unfortunate conclusion Jevons elaborates on the potential relationship between solar and weather cycles and economic activity. Jevons concludes that solar patterns should be studied to determine if a causal relationship does indeed exist between solar patterns and economic activity. If so, then policies should be enacted to reduce the magnitude of the contraction/recession parts of the business cycle. Jevons further elaborates on the importance of the solar cycle on consumer confidence and spending. From that sun which is truly of this great world both eye and soul we derive

our strength and our weakness, our success and our failure, our elation in commercial mania, and our despondency and ruin in commercial collapse. (Jevons, 1909d, p. 235). Jevons also finds more empirical evidence that corn prices in Delhi reach maximum and minimum in a similar eleven year pattern which has been exhibited in Europe. Once more this theory seems much more applicably to arid and semi-arid regions such as India. William Stanley Jevons son H. Stanley Jevons continued his work on sunspots and published Changes at the Suns Heat as the Cause of Fluctuations of the Activity of Trade and of Unemployment in Contemporary Review in 1909. He reissued it in a monograph entitled The Suns Heat and Trade Activity (Jevons, 1910) in which he further examined and elaborated on the subject. H. S. Jevons believed that his father had some excellent ideas in relating the sunspot theory to the length of business cycles although he does acknowledge some of the criticisms which have been leveled at the work W.S. Jevons did. He states that the suns activity has some effect on economic outcomes and while it is not the only variable which should be considered when formulating economic policy it is worth considering when formulating economic policy. H.S. Jevons acknowledges that his father was in error when he claimed that he solar cycle would only last approximately 10.45 years. He claims that W.S. Jevons attempted to oversimplify his findings and he ignored some events which created economic booms and busts which had nothing to do with arid lands agricultural

productivity. This is what led him to the false 10.45 year business cycle predictor. However he found that wheat production in the United States displayed significant variation during the nineteenth century and reached its peak approximately every 11.11 years. He found a direct relationship between solar activity and wheat production in the United States. H. S. Jevons believes that the eleven year sunspot cycle is actually a combination of three shorter sunspot cycles which were just over three years in duration. There would be a period of drought approximately every 3.5 years and a period of cold damp weather approximately every 3.5 years. This great harvest would precipitate a trade boom according to Jevons. He finds data that suggest the production of pig iron and agricultural produce in the United States were closely related and followed the sunspot cycle closely. He also states that on occasion the business cycle will only correspond with two of these shorter sunspot cycles explaining the variation in business cycles between seven and eleven years. This can explain the error that W.S. Jevons did not understand about the variation in the length of business cycles. H.S. Jevons provides several suggestions as to how this information about solar activity can be useful. He believes that if output and therefore trade can be expected to decline in the near future that there should be wage cuts to attempt to ensure full employment. This suggestion is not reasonable today but if we are going to engage in interventionary fiscal and monetary policy the potential to predict shortfalls in productivity and potentially consumer confidence can have meaningful

implications for expansionary monetary policies being enacted. This is particularly useful if there are actual psychological ties between solar activity and consumers attitudes which sounds far fetched but may occur. Jevons also recommends less domestic reliance on crops would reduce the variation in economic prosperity. While crop production is still important in many arid and semi-arid lands, this is not as meaningful to the economy as it was when Jevons wrote. SUMMARY AND CONCLUSIONS There are significant criticisms of the sunspot theory which has been the cause of this theory being largely ignored by mainstream economists. The first criticism has been mentioned that Jevons claim that these cycles occur every 10.45 years may not be consistent with astronomical data. This appears to be accurate as H.S. Jevons admits, however we have seen repeated periods of expansion and recession in the United States economy approximately every ten or eleven years even since much of this literature was written in the 1930s. This evidence may not be so easy to dismiss. There are also some criticisms that there is very little if any lag time between the actual sunspot activity and actual trade patterns. We are not certain that this is a valid criticism. Clearly because of the importance of trade and the interdependence of the worlds economies we expect to see some lag between sunspot activity and economic activity. However, the fact that this activity has had a tendency to follow a predictable eleven year pattern implies that the nature of the cycle may have more to do with agricultural productivity

and therefore economic growth than we might imagine. Also it is not absurd to consider the psychological relationship between something we have little knowledge of such as sunspot cycles and consumer confidence and spending patterns. Clearly there is a relationship between agricultural productivity and economic growth particularly in arid and semi-arid areas. The effects on consumers we would expect to be more pronounced because of the relatively inelastic demand and supply for agricultural products and therefore the relatively constant total revenue to agricultural producers even in times of relative scarcity and drought. It would be unwise to completely eliminate any potential relationship between sunspot cycles and economic prosperity simply because of the striking eleven year cycles the U.S. Economy has displayed throughout the last century. If there is indeed no causality between solar cycles and economic activity there should be significant study into what other phenomena occur with regularity approximately every eleven years and appear to coincide with economic expansions and recessions. BIBLIOGRAPHY Anderson, Montgomery. 1931. An Agricultural Theory of Business Cycles, American Economic Review. Vol 21:3, pp 427-478. Bagehot, Walter, 1887. Lombard Street. New York: pp145 146. Coase, H. and Fowler, R. F., 1937. The Pig-Cycle in Great Britain: An

Explanation, Economica. Vol. 4:13, pp 55-82. Fulmer, J. L., 1942. Relationship of the Cycle in Yields of Cotton and Apples to Solar and Sky Radiation, The Quarterly Journal of Economics. Vol 56: 3 pp 385 405. Garcia-Mata, Carlos and Shaffner, Felix I., 1934. Solar and Economic Relationships: A Preliminary Report, Quarterly Journal of Economics. XLIX: pp 545-588. Graue, Erwin, 1930. The Relationship of Business Activity to Agriculture, The Journal of Political Economy. Vol. 38:4, pp 472 -478. Henderson, Jason, and Novack, Nancy, 2003. Will Rains and a National Recovery Bring Rural Prosperity? Economic Review, Federal Reserve Bank of Kansas City, Vol. 88:1, pp. 7796. Jevons, H. Stanley, 1910. The Suns Heat and Trade Activity, London: F. S. King and Son. Jevons, H. Stanley, 1933. The Causes of Fluctuations of Industrial Activity and the Price- Level, Journal of the Royal Statistical Society. XCVI, pp 545 588 with Discussion, pp 588 605. Jevons, William Stanley, 1909a. Chapter VI, The Solar Period and the Price of Corn (1875), Investigations in Currency and Finance. London: Macmillan, pp 194-205. Jevons, William Stanley, 1909b. Chapter VII The Periodicity of Commercial Crises and Its Physical Explanation

(1878), with Postscript (1882), Investigations in Currency and Finance. London: Macmillan, pp 206 220. Jevons, William Stanley, 1909c. Chapter VII Commercial Crises and Sunspots Part I (1878), Investigations in Currency and Finance. London: Macmillan, pp 221 234. Jevons, William Stanley, 1909d. Chapter VII Commercial Crises and Sunspots Part II (1879), Investigations in Currency and Finance. London: Macmillan, pp 235 243. Lee, Maurice, 1971. Macroeconomics, Fluctuations, Growth and Stability. Homewood, Ill: Richard Irwin. Lewis, W. Arthur, 1963. The theory of Economic Growth. London: Allen and Unwin. Macfie, Alec L., 1934. Theories of the Trade Cycle. London: Macmillan. Moore, H. L., 1923. Economic Cycles: their Law and Causes. New York: Macmillan. Pigou, A. C., 1927. Industrial Fluctuations. London: Macmillan. Smith, Adam, 1776. An Inquiry into the Nature and Causes of the Wealth of Nations. New York: Modern Library.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Test Plan For Farm's Pride FarmDocument5 pagesTest Plan For Farm's Pride FarmAnuradha Marapana100% (1)

- COMPETENCY BASED LEARNING MATERIALS - VegetablesDocument56 pagesCOMPETENCY BASED LEARNING MATERIALS - VegetablesNikkita Bartolome100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Occultism Simplified - W WhiteheadDocument99 pagesOccultism Simplified - W Whiteheadjmertes100% (2)

- Research and Development Roadmap For Next-Generation AppliancesDocument75 pagesResearch and Development Roadmap For Next-Generation AppliancesjmertesNo ratings yet

- Penetrating The Secret Essence TantraDocument612 pagesPenetrating The Secret Essence Tantraaurora7755100% (3)

- Figurate NumbersDocument10 pagesFigurate Numbersjmertes100% (1)

- Images From HarmonicsDocument50 pagesImages From HarmonicsjmertesNo ratings yet

- Geometric NumbersDocument4 pagesGeometric Numbersjmertes100% (1)

- The Truth About GiantsDocument9 pagesThe Truth About Giantsjmertes100% (2)

- Don't Let Faulty Assumptions Sabotage Your Trading Career: TradersworldDocument117 pagesDon't Let Faulty Assumptions Sabotage Your Trading Career: TradersworldjmertesNo ratings yet

- Gann 50% Rule With Vidy-ADocument3 pagesGann 50% Rule With Vidy-Aalahgitateur100% (1)

- Farming CalendarDocument3 pagesFarming CalendarNkanyisoNo ratings yet

- Agrarian Reform Law Summary (Chapters 1-3)Document8 pagesAgrarian Reform Law Summary (Chapters 1-3)YuriiSison100% (1)

- Mahindra CaseDocument4 pagesMahindra CaseNitin SinghNo ratings yet

- Multiple Matching Worksheet 1: Exotic FruitDocument6 pagesMultiple Matching Worksheet 1: Exotic FruitMaitane Lopez De Abechuco AlonsoNo ratings yet

- Abaca - A Study of Reproducible Fibre Characterization and A Critical Evaluation of Existing Grading Systems PDFDocument12 pagesAbaca - A Study of Reproducible Fibre Characterization and A Critical Evaluation of Existing Grading Systems PDFlintianananNo ratings yet

- Most Important Geography MCQs Volume 1 Defense UstaadDocument126 pagesMost Important Geography MCQs Volume 1 Defense Ustaaddigukharade9848No ratings yet

- Insect Control in TobaccoDocument10 pagesInsect Control in Tobaccozahid mehmoodNo ratings yet

- LR Barley Grain Defects A4sDocument4 pagesLR Barley Grain Defects A4sstranger boyNo ratings yet

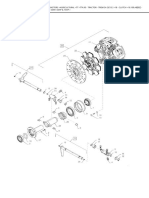

- Transmission Clutch, 55Hp, 65Hp & 75HpDocument3 pagesTransmission Clutch, 55Hp, 65Hp & 75Hpwinston sandovalNo ratings yet

- An Introduction To Basic Farm Financial Statements: Income StatementDocument11 pagesAn Introduction To Basic Farm Financial Statements: Income StatementAbdi Aliyi100% (1)

- Plough 150 B-150 S - 2012Document138 pagesPlough 150 B-150 S - 2012Jaroslav IvanNo ratings yet

- Agro 246 MCQsDocument16 pagesAgro 246 MCQscricket letestNo ratings yet

- Horticulture: DefinitionsDocument9 pagesHorticulture: Definitionssatwik bisaryaNo ratings yet

- Chapter One: 1.1 Background and JustificationDocument24 pagesChapter One: 1.1 Background and JustificationEshet ShumetNo ratings yet

- Challenges Faced in Organic FarmingDocument4 pagesChallenges Faced in Organic FarmingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Effects of Fertilizers and Pesticides in IndiaDocument21 pagesEffects of Fertilizers and Pesticides in IndiaShri Vigneshwar SNo ratings yet

- Zase BiologyDocument5 pagesZase Biologyericmuke829No ratings yet

- Isabella - EU Organic LabelDocument10 pagesIsabella - EU Organic LabelIsabella ???No ratings yet

- The Largest Bunch of GrapesDocument10 pagesThe Largest Bunch of GrapesJana SpirovskaNo ratings yet

- Spodoptera Littoralis and Spodoptera Litura: Data Sheets On Quarantine PestsDocument7 pagesSpodoptera Littoralis and Spodoptera Litura: Data Sheets On Quarantine Pestsade syahNo ratings yet

- Government and NGOs Food Security Policies.Document16 pagesGovernment and NGOs Food Security Policies.AlhajiNo ratings yet

- Influence of Improved Pastures and Grazing Animals On Nutrient Cycling Within New Zealand SoilsDocument9 pagesInfluence of Improved Pastures and Grazing Animals On Nutrient Cycling Within New Zealand SoilsRAJ KUMARNo ratings yet

- Final IRA - Mangoes From IndiaDocument174 pagesFinal IRA - Mangoes From Indiasakthi_dtsNo ratings yet

- Issues and Problems in Agricultural Development: A Study On The Farmers of West BengalDocument13 pagesIssues and Problems in Agricultural Development: A Study On The Farmers of West BengalParth PandeyNo ratings yet

- WSU Book Thesis Final Volume IIIDocument393 pagesWSU Book Thesis Final Volume IIIkassa mnilkNo ratings yet

- 082-083 - I Spy On The FarmDocument1 page082-083 - I Spy On The FarmmNo ratings yet

- E - Slip PDR Final - 0002-3-4387 PDFDocument274 pagesE - Slip PDR Final - 0002-3-4387 PDFJosephine ChirwaNo ratings yet

- Agric Science Year 7 Term 1 ExaminationDocument8 pagesAgric Science Year 7 Term 1 ExaminationPay My EveryNo ratings yet