Professional Documents

Culture Documents

Corporate Governance-Revisiting Ethics

Corporate Governance-Revisiting Ethics

Uploaded by

Usha NCopyright:

Available Formats

You might also like

- Bajaj Allianz General Insurance CompanyDocument3 pagesBajaj Allianz General Insurance Companysarath potnuri0% (1)

- Cadbury CommiteeDocument5 pagesCadbury CommiteeAnkit Raj100% (2)

- Shailesh Black BookDocument57 pagesShailesh Black Bookshailesh prajapatiNo ratings yet

- 1 Certified Promissory NoteDocument5 pages1 Certified Promissory NoteLouis100% (8)

- Corporate Governance and Combined CodeDocument9 pagesCorporate Governance and Combined CodeSiddharth NairNo ratings yet

- Preface:: Kumar Mangalam Birla CommitteeDocument4 pagesPreface:: Kumar Mangalam Birla CommitteeShainaazKhanNo ratings yet

- Corporate Governance ProjectDocument13 pagesCorporate Governance ProjectHarshSuryavanshiNo ratings yet

- Auditing and Corporate GovernanceDocument6 pagesAuditing and Corporate Governancesuraj agarwalNo ratings yet

- Hampel (Hampel Report, 1968)Document4 pagesHampel (Hampel Report, 1968)Dhruv JainNo ratings yet

- Becg Unit-4.Document12 pagesBecg Unit-4.Bhaskaran Balamurali100% (2)

- Unit - 1 - Conceptual Framework of Corporate GovernanceDocument15 pagesUnit - 1 - Conceptual Framework of Corporate GovernanceRajendra SomvanshiNo ratings yet

- 13 Dr. A. K. SharmaDocument5 pages13 Dr. A. K. SharmaRavi ModiNo ratings yet

- MBA I - 428 Business Ethics Unit - Iv: Corporate Governance MeaningDocument6 pagesMBA I - 428 Business Ethics Unit - Iv: Corporate Governance MeaningJebin JamesNo ratings yet

- Corporate GovernanceDocument10 pagesCorporate GovernancepriitiikuumariiNo ratings yet

- Corporate Governance: Constitution of CommitteeDocument26 pagesCorporate Governance: Constitution of CommitteeRajeev KambleNo ratings yet

- Corporate GovernanceDocument19 pagesCorporate GovernanceRajesh PaulNo ratings yet

- Corporate Governance 3Document4 pagesCorporate Governance 3silvernitrate1953No ratings yet

- Cadbury CommitteeDocument65 pagesCadbury CommitteeGaganNo ratings yet

- Chapter I:-: Corporate Governance:-An Introduction IntroductionDocument76 pagesChapter I:-: Corporate Governance:-An Introduction IntroductionrampunjaniNo ratings yet

- Corporate Governance FinalDocument63 pagesCorporate Governance Finalrampunjani100% (1)

- Business Ethics - Final HardDocument31 pagesBusiness Ethics - Final HardjinnymistNo ratings yet

- Corporate Governance vs. Corporate Crime: S. N. Mahapatra Sanjay PandeyDocument3 pagesCorporate Governance vs. Corporate Crime: S. N. Mahapatra Sanjay PandeyPriyanka TamhankarNo ratings yet

- Corporate Governance in India: A Legal Analysis: Prabhash Dalei, Paridhi Tulsyan and Shikhar MaraviDocument3 pagesCorporate Governance in India: A Legal Analysis: Prabhash Dalei, Paridhi Tulsyan and Shikhar MaraviManoj DhamiNo ratings yet

- 1 History and Intro To Corporate GovernanceDocument29 pages1 History and Intro To Corporate Governancearun achariNo ratings yet

- Cadbury Committee ReportDocument8 pagesCadbury Committee ReportMukesh Singh100% (1)

- Corporate Governance: Recommendations For Voluntary AdoptionDocument25 pagesCorporate Governance: Recommendations For Voluntary AdoptionVikas VickyNo ratings yet

- AssignmentDocument8 pagesAssignmentmaria saleemNo ratings yet

- Corporate Governance FrameworkDocument4 pagesCorporate Governance Frameworkvivienne mimiNo ratings yet

- Principles of Corporate Governance SeddiDocument18 pagesPrinciples of Corporate Governance SeddiLionel Itai MuzondoNo ratings yet

- CORPORATE GOVERNANCE CommiteesDocument39 pagesCORPORATE GOVERNANCE Commiteeskush mandaliaNo ratings yet

- Cadbury CommitteeDocument5 pagesCadbury CommitteeheeraNo ratings yet

- Corporate Governance Practices in IndiaDocument16 pagesCorporate Governance Practices in IndiaNur sana KhatunNo ratings yet

- Audit AssignmentDocument3 pagesAudit AssignmentHiya BhandariBD21070No ratings yet

- Corporate Governance Short NotesDocument8 pagesCorporate Governance Short NotesVivekNo ratings yet

- Prof .Sandhya Tewari AssigmentDocument21 pagesProf .Sandhya Tewari AssigmentcoolabuNo ratings yet

- Unit III Corporate GovernanceDocument20 pagesUnit III Corporate GovernanceSushant WaghmareNo ratings yet

- Corporate GovernanceDocument89 pagesCorporate GovernanceGaurav AroraNo ratings yet

- Aa l3 Ethics F 2176724 S NTBDocument84 pagesAa l3 Ethics F 2176724 S NTBvahobovabdullajon21No ratings yet

- Introduction of Corporate GovernanceDocument8 pagesIntroduction of Corporate GovernanceHasanur RaselNo ratings yet

- Corp GovernanceDocument15 pagesCorp GovernanceChirag BhuvaNo ratings yet

- Corporate Governance NotesDocument6 pagesCorporate Governance NotesSunayana GuptaNo ratings yet

- Definition of Corporate GovernanceDocument24 pagesDefinition of Corporate GovernanceNikita MaskaraNo ratings yet

- CG Assignment 1Document13 pagesCG Assignment 1arslan0989No ratings yet

- 12 - Chapter 1Document87 pages12 - Chapter 1Md sarfarajNo ratings yet

- What Is Corporate GovernanceDocument4 pagesWhat Is Corporate GovernanceKritika SinghNo ratings yet

- CG - An Overview - Article - MSME ReviewDocument7 pagesCG - An Overview - Article - MSME ReviewChaitanya ShahNo ratings yet

- Various Committees On Corporate GovernanceDocument33 pagesVarious Committees On Corporate GovernanceAarti Chavan100% (4)

- Corporate Governance LALALADocument33 pagesCorporate Governance LALALADania SoemaliNo ratings yet

- Corporate Governance Is Much Talked AboutDocument11 pagesCorporate Governance Is Much Talked AboutVaibhav GuptaNo ratings yet

- Corporate GovernanceDocument18 pagesCorporate GovernanceMuskan KhatriNo ratings yet

- CH 3 Corporate GovernanceDocument29 pagesCH 3 Corporate GovernanceMazhar IqbalNo ratings yet

- Unit 5 PDFDocument6 pagesUnit 5 PDFDarshni PriyaNo ratings yet

- SEBI Clause 49Document23 pagesSEBI Clause 49NikiNo ratings yet

- Answer Sheet Corporate Law 2 cl2Document15 pagesAnswer Sheet Corporate Law 2 cl2Muskan KhatriNo ratings yet

- Corporate GovernancefinalsDocument48 pagesCorporate GovernancefinalsGiridharManiyedathNo ratings yet

- Chapter 2 - Corporate Governance CodeDocument19 pagesChapter 2 - Corporate Governance Codekemalatha88No ratings yet

- A Presentation On Corporate Governance: Anusuya Mehra Harmeet Singh Manish Sharma Rajkumar Ranwa Roopal Jain Vijay MundelDocument26 pagesA Presentation On Corporate Governance: Anusuya Mehra Harmeet Singh Manish Sharma Rajkumar Ranwa Roopal Jain Vijay Mundelvishalbi100% (1)

- ACC 401 Lecture1 Corporate GovernanceDocument8 pagesACC 401 Lecture1 Corporate GovernanceWihemina PhoebeNo ratings yet

- Corporate Governance.....Document10 pagesCorporate Governance.....jyotsana vermaNo ratings yet

- Corporate GovernanceDocument22 pagesCorporate GovernanceRajesh sharmaNo ratings yet

- Corporate Governance in IndiaDocument22 pagesCorporate Governance in Indiaaishwaryasamanta0% (1)

- Contract Law By: Syed Aun Abbas Advocate LL.B, LL.M Discharge of ContractDocument4 pagesContract Law By: Syed Aun Abbas Advocate LL.B, LL.M Discharge of ContractAun NaqviNo ratings yet

- Abella Vs Francisco 55 Phil 447 (1931)Document1 pageAbella Vs Francisco 55 Phil 447 (1931)Benitez GheroldNo ratings yet

- UP 1990 To 2014 NIL Bar Questions With Suggested AnswersDocument22 pagesUP 1990 To 2014 NIL Bar Questions With Suggested AnswersCindy DondoyanoNo ratings yet

- LIC Market Plus 1 Was Launched On July 5Document3 pagesLIC Market Plus 1 Was Launched On July 5JAAYARAMA ASSOCIATESNo ratings yet

- Article 1186Document2 pagesArticle 1186RafiNo ratings yet

- Collaborative Research Agreement TemplateDocument12 pagesCollaborative Research Agreement TemplatenorzeNo ratings yet

- Companies ACt, 2063 Simplified 1 Day Revision BookDocument61 pagesCompanies ACt, 2063 Simplified 1 Day Revision Bookteam aspirantsNo ratings yet

- Full Download Inception Trend Fashion 2022 Rizki Yulianingrum Online Full Chapter PDFDocument66 pagesFull Download Inception Trend Fashion 2022 Rizki Yulianingrum Online Full Chapter PDFmyrahtan50f100% (6)

- Types of PatentDocument2 pagesTypes of PatentUnimarks ArvNo ratings yet

- Sale of Goods Act, 1930Document23 pagesSale of Goods Act, 1930Sunil Shaw0% (1)

- Full Case - Valarao VS CaDocument7 pagesFull Case - Valarao VS CaDaveKarlRamada-MaraonNo ratings yet

- Transfer of Property Act NotesDocument1 pageTransfer of Property Act NotesDEBDEEP SINHA0% (1)

- Group 1 First Midterm PPPDocument30 pagesGroup 1 First Midterm PPPAngelo BaguioNo ratings yet

- Time For Completion and Extensions of TimeDocument26 pagesTime For Completion and Extensions of TimeLGNo ratings yet

- Agreement 1707156786576Document7 pagesAgreement 1707156786576Shri Mani RanaNo ratings yet

- Addis Ababa University: School of Commerce: Business Law (Law3201) Group AssignmentDocument4 pagesAddis Ababa University: School of Commerce: Business Law (Law3201) Group AssignmentBlen tesfaye100% (1)

- Essential Elements of A ContractDocument5 pagesEssential Elements of A ContractSaida IslamNo ratings yet

- PRMX-2 - Leb - Mid Term-2020Document2 pagesPRMX-2 - Leb - Mid Term-2020ritesh choudhuryNo ratings yet

- Banking Law Negotiable Instruments ActDocument3 pagesBanking Law Negotiable Instruments Actrizofpicic100% (2)

- Fha Gift LetterDocument1 pageFha Gift LetterAndy ReyNo ratings yet

- What Is Commercial Insurance?Document3 pagesWhat Is Commercial Insurance?Adan HoodaNo ratings yet

- First AssignmentDocument5 pagesFirst Assignmentসায়েম উল আরাফাত প্রিতমNo ratings yet

- Capital Adequacy Presentation 1Document16 pagesCapital Adequacy Presentation 1Nafiz Imran DiptoNo ratings yet

- The Insular Life Assurance Co., LTD v. Feliciano (Sept. 1941)Document2 pagesThe Insular Life Assurance Co., LTD v. Feliciano (Sept. 1941)lealdeosaNo ratings yet

- One Wayos Employment ContractDocument6 pagesOne Wayos Employment ContractDavid Lemayian SalatonNo ratings yet

- MemoDocument6 pagesMemojissy rajishNo ratings yet

- Acceptance by IajDocument13 pagesAcceptance by IajM Raghib ZafarNo ratings yet

- General Banking Law CODALDocument13 pagesGeneral Banking Law CODALLeo Balante Escalante Jr.No ratings yet

Corporate Governance-Revisiting Ethics

Corporate Governance-Revisiting Ethics

Uploaded by

Usha NOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Governance-Revisiting Ethics

Corporate Governance-Revisiting Ethics

Uploaded by

Usha NCopyright:

Available Formats

Revisiting Ethics-the Substratum of CG

By Kautilya

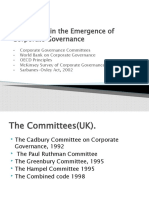

A Corporation is a congregation of various stakeholders - customers, employees, investors, vendors, partners, Government and Society. In the globalised business world it is imperative for corporations to be fair and transparent to access global pools of capital, to attract and retain best human capital, to enter into collaborations and so on. To achieve these, Corporations need to adopt internationally accepted Best Practices. This has been rephrased as the principles of Corporate Governance . Sound Corporate Governance is therefore critical to enhance and retain stakeholders trust and ethical conduct of business. Ethics is the code of values and principles that enables a person to differentiate right from wrong. In case of a corporation it is essential for the management to take ethical decisions keeping in view the expectations of stakeholders. Is Re exploring of ethics essential for Corporate Governance? Yes, Re-visiting of ethics is the ground work (substratum) for successful implementation of Corporate Governance. Why Corporate Governance? Corporate governance extends beyond Corporate Law. Its objective is not mere fulfillment of legal requirements but ensuring commitment and transparent management. Finally the key lesson is to learn that Regulations and Policies are only one part of improving Governance. Existence of a comprehensive system alone cannot guarantee ethical pursuit of stakeholder interest by Directors, officers and employees. It can be achieved by instilling the right culture work culture is most essential. Good Corporate Governance, Good Government and Good Business go hand in hand. Evolution of the concept of Corporate Governance: Relevance of Corporate Governance can be found in Second Chapter of Arthshastra, compiled by Kautilya ( Chanakya ) in Gupta dynasty. Kautilya opines - Sovereignty is practicable only with the cooperation of others and all administrative measures are to be taken after proper deliberations. Good governance is basic to the Kautilyan idea of administration which enables an economy to grow. One can draw discernible similarities between some of the provisions of the Arthashastra and the main principles of Cadbury Committee s report (1992) on financial aspects of Corporate Governance like proper managerial accountability was the key to any system of Corporate Governance. Global scenario of Contemporary Times: Post the Bretton Woods, formation of World Bank and the International Monetary Fund the economic and International Financial activities increased manifold. Stake holders developed concepts like the Best Accounting Practices, standards and benchmarks like the ISO 2000. To arrive at the best financial results there could be attempts at doing things which are verging on the illegal or unethical. The Cadbury Report (1992) simply describes Corporate Governance as the system by which companies are directed and controlled . In USA, the Sarbanes-

Oxley Act 2002 was passed to address the issues of corporate failures, achieve quality governance and restoring investor confidence. The Securities and Exchange Commission initiated action against multinational accounting firms for failure to detect violation of accounting standards. In India, Securities and Exchange Board of India (SEBI) constituted a Committee on Corporate Governance under the Chairmanship of Mr. Kumar Mangalam Birla. Bad Governance was also exemplified by allotment of promoters share at preferential prices disproportionate to market value, affecting minority holders interests. Investors grievances were not addressed. The Kumar Mangalam Committee made mandatory and non-mandatory recommendations. Based on the recommendations of this Committee, a new clause 49 was incorporated in the Stock Exchange Listing Agreements. The important aspects, in brief, are: Board of Directors are accountable to shareholders Board controls are laid down - code of conduct and accountability to shareholders Classification of non-executive directors independent and non-independent Independent directors not to have material or pecuniary relations with the Company/subsidiaries and in case they have it has to be disclosed in Annual Report. Laying emphasis on caliber of non-executive directors especially independent directors. Sufficient compensation package to attract talented non-executive directors. Optimum combination of not less than 50% of non-executive directors and of which companies with non-executive Chairman to have at least one third of independent directors and under executive Chairman at least one half of independent directors. Nominee directors to be treated on par with any other director, Qualified independent Audit committee to be setup with minimum of three all being nonexecutive directors with one having financial and accounting knowledge. Corporate governance report to be part of Annual Report and disclosure on directors remuneration etc., to be included. Narayana Murthy Committee recommendations include role of Audit Committee, Related party transactions, Risk management, and compensation to Non- Executive Directors, Whistle Blower Policy. Naresh Chandra Committee recommendations relate to the Auditor-Company relationship and the role of Auditors. Report of the SEBI Committee on Corporate Governance recommended that the mandatory recommendations on matters of disclosure of contingent liabilities, CEO/CFO Certification, definition of Independent Director, independence of Audit Committee and independent director exemptions in the report of the Naresh Chandra Committee, relating to Corporate Governance, be implemented by SEBI. Good governance and practices are synonymous to banking, banks and bankers. Trust being the foundation of banking, good governance is applicable to Banks. A code for corporate governance for public sector banks in India could be in the form of a set of prescriptions for the key decision makers of a bank -its Chairman, Executive and non-Executive Directors, institutional investors and external auditors. The Reserve Bank of India has set up various working groups to evaluate its existing corporate governance norms for banks. The Narasimham Committee I recommended a progress towards BIS norms and ending of the dual control over the sector by the RBI and the Ministry of Finance. The Narasimham Committee II (1998) recommended reducing government control and strengthening of internal controls. Dr. Patil Advisory Group and Varma Group have made recommendations on international best practices of Corporate Governance for banking companies. The report of the Consultative Group of Directors of Banks/Financial Institutions chaired by A.S. Ganguly focused on fundamental issues like the supervisory role of boards of banks and financial institutions and functioning of the boards vis--vis compliance, transparency, disclosures, audit committees etc.

You might also like

- Bajaj Allianz General Insurance CompanyDocument3 pagesBajaj Allianz General Insurance Companysarath potnuri0% (1)

- Cadbury CommiteeDocument5 pagesCadbury CommiteeAnkit Raj100% (2)

- Shailesh Black BookDocument57 pagesShailesh Black Bookshailesh prajapatiNo ratings yet

- 1 Certified Promissory NoteDocument5 pages1 Certified Promissory NoteLouis100% (8)

- Corporate Governance and Combined CodeDocument9 pagesCorporate Governance and Combined CodeSiddharth NairNo ratings yet

- Preface:: Kumar Mangalam Birla CommitteeDocument4 pagesPreface:: Kumar Mangalam Birla CommitteeShainaazKhanNo ratings yet

- Corporate Governance ProjectDocument13 pagesCorporate Governance ProjectHarshSuryavanshiNo ratings yet

- Auditing and Corporate GovernanceDocument6 pagesAuditing and Corporate Governancesuraj agarwalNo ratings yet

- Hampel (Hampel Report, 1968)Document4 pagesHampel (Hampel Report, 1968)Dhruv JainNo ratings yet

- Becg Unit-4.Document12 pagesBecg Unit-4.Bhaskaran Balamurali100% (2)

- Unit - 1 - Conceptual Framework of Corporate GovernanceDocument15 pagesUnit - 1 - Conceptual Framework of Corporate GovernanceRajendra SomvanshiNo ratings yet

- 13 Dr. A. K. SharmaDocument5 pages13 Dr. A. K. SharmaRavi ModiNo ratings yet

- MBA I - 428 Business Ethics Unit - Iv: Corporate Governance MeaningDocument6 pagesMBA I - 428 Business Ethics Unit - Iv: Corporate Governance MeaningJebin JamesNo ratings yet

- Corporate GovernanceDocument10 pagesCorporate GovernancepriitiikuumariiNo ratings yet

- Corporate Governance: Constitution of CommitteeDocument26 pagesCorporate Governance: Constitution of CommitteeRajeev KambleNo ratings yet

- Corporate GovernanceDocument19 pagesCorporate GovernanceRajesh PaulNo ratings yet

- Corporate Governance 3Document4 pagesCorporate Governance 3silvernitrate1953No ratings yet

- Cadbury CommitteeDocument65 pagesCadbury CommitteeGaganNo ratings yet

- Chapter I:-: Corporate Governance:-An Introduction IntroductionDocument76 pagesChapter I:-: Corporate Governance:-An Introduction IntroductionrampunjaniNo ratings yet

- Corporate Governance FinalDocument63 pagesCorporate Governance Finalrampunjani100% (1)

- Business Ethics - Final HardDocument31 pagesBusiness Ethics - Final HardjinnymistNo ratings yet

- Corporate Governance vs. Corporate Crime: S. N. Mahapatra Sanjay PandeyDocument3 pagesCorporate Governance vs. Corporate Crime: S. N. Mahapatra Sanjay PandeyPriyanka TamhankarNo ratings yet

- Corporate Governance in India: A Legal Analysis: Prabhash Dalei, Paridhi Tulsyan and Shikhar MaraviDocument3 pagesCorporate Governance in India: A Legal Analysis: Prabhash Dalei, Paridhi Tulsyan and Shikhar MaraviManoj DhamiNo ratings yet

- 1 History and Intro To Corporate GovernanceDocument29 pages1 History and Intro To Corporate Governancearun achariNo ratings yet

- Cadbury Committee ReportDocument8 pagesCadbury Committee ReportMukesh Singh100% (1)

- Corporate Governance: Recommendations For Voluntary AdoptionDocument25 pagesCorporate Governance: Recommendations For Voluntary AdoptionVikas VickyNo ratings yet

- AssignmentDocument8 pagesAssignmentmaria saleemNo ratings yet

- Corporate Governance FrameworkDocument4 pagesCorporate Governance Frameworkvivienne mimiNo ratings yet

- Principles of Corporate Governance SeddiDocument18 pagesPrinciples of Corporate Governance SeddiLionel Itai MuzondoNo ratings yet

- CORPORATE GOVERNANCE CommiteesDocument39 pagesCORPORATE GOVERNANCE Commiteeskush mandaliaNo ratings yet

- Cadbury CommitteeDocument5 pagesCadbury CommitteeheeraNo ratings yet

- Corporate Governance Practices in IndiaDocument16 pagesCorporate Governance Practices in IndiaNur sana KhatunNo ratings yet

- Audit AssignmentDocument3 pagesAudit AssignmentHiya BhandariBD21070No ratings yet

- Corporate Governance Short NotesDocument8 pagesCorporate Governance Short NotesVivekNo ratings yet

- Prof .Sandhya Tewari AssigmentDocument21 pagesProf .Sandhya Tewari AssigmentcoolabuNo ratings yet

- Unit III Corporate GovernanceDocument20 pagesUnit III Corporate GovernanceSushant WaghmareNo ratings yet

- Corporate GovernanceDocument89 pagesCorporate GovernanceGaurav AroraNo ratings yet

- Aa l3 Ethics F 2176724 S NTBDocument84 pagesAa l3 Ethics F 2176724 S NTBvahobovabdullajon21No ratings yet

- Introduction of Corporate GovernanceDocument8 pagesIntroduction of Corporate GovernanceHasanur RaselNo ratings yet

- Corp GovernanceDocument15 pagesCorp GovernanceChirag BhuvaNo ratings yet

- Corporate Governance NotesDocument6 pagesCorporate Governance NotesSunayana GuptaNo ratings yet

- Definition of Corporate GovernanceDocument24 pagesDefinition of Corporate GovernanceNikita MaskaraNo ratings yet

- CG Assignment 1Document13 pagesCG Assignment 1arslan0989No ratings yet

- 12 - Chapter 1Document87 pages12 - Chapter 1Md sarfarajNo ratings yet

- What Is Corporate GovernanceDocument4 pagesWhat Is Corporate GovernanceKritika SinghNo ratings yet

- CG - An Overview - Article - MSME ReviewDocument7 pagesCG - An Overview - Article - MSME ReviewChaitanya ShahNo ratings yet

- Various Committees On Corporate GovernanceDocument33 pagesVarious Committees On Corporate GovernanceAarti Chavan100% (4)

- Corporate Governance LALALADocument33 pagesCorporate Governance LALALADania SoemaliNo ratings yet

- Corporate Governance Is Much Talked AboutDocument11 pagesCorporate Governance Is Much Talked AboutVaibhav GuptaNo ratings yet

- Corporate GovernanceDocument18 pagesCorporate GovernanceMuskan KhatriNo ratings yet

- CH 3 Corporate GovernanceDocument29 pagesCH 3 Corporate GovernanceMazhar IqbalNo ratings yet

- Unit 5 PDFDocument6 pagesUnit 5 PDFDarshni PriyaNo ratings yet

- SEBI Clause 49Document23 pagesSEBI Clause 49NikiNo ratings yet

- Answer Sheet Corporate Law 2 cl2Document15 pagesAnswer Sheet Corporate Law 2 cl2Muskan KhatriNo ratings yet

- Corporate GovernancefinalsDocument48 pagesCorporate GovernancefinalsGiridharManiyedathNo ratings yet

- Chapter 2 - Corporate Governance CodeDocument19 pagesChapter 2 - Corporate Governance Codekemalatha88No ratings yet

- A Presentation On Corporate Governance: Anusuya Mehra Harmeet Singh Manish Sharma Rajkumar Ranwa Roopal Jain Vijay MundelDocument26 pagesA Presentation On Corporate Governance: Anusuya Mehra Harmeet Singh Manish Sharma Rajkumar Ranwa Roopal Jain Vijay Mundelvishalbi100% (1)

- ACC 401 Lecture1 Corporate GovernanceDocument8 pagesACC 401 Lecture1 Corporate GovernanceWihemina PhoebeNo ratings yet

- Corporate Governance.....Document10 pagesCorporate Governance.....jyotsana vermaNo ratings yet

- Corporate GovernanceDocument22 pagesCorporate GovernanceRajesh sharmaNo ratings yet

- Corporate Governance in IndiaDocument22 pagesCorporate Governance in Indiaaishwaryasamanta0% (1)

- Contract Law By: Syed Aun Abbas Advocate LL.B, LL.M Discharge of ContractDocument4 pagesContract Law By: Syed Aun Abbas Advocate LL.B, LL.M Discharge of ContractAun NaqviNo ratings yet

- Abella Vs Francisco 55 Phil 447 (1931)Document1 pageAbella Vs Francisco 55 Phil 447 (1931)Benitez GheroldNo ratings yet

- UP 1990 To 2014 NIL Bar Questions With Suggested AnswersDocument22 pagesUP 1990 To 2014 NIL Bar Questions With Suggested AnswersCindy DondoyanoNo ratings yet

- LIC Market Plus 1 Was Launched On July 5Document3 pagesLIC Market Plus 1 Was Launched On July 5JAAYARAMA ASSOCIATESNo ratings yet

- Article 1186Document2 pagesArticle 1186RafiNo ratings yet

- Collaborative Research Agreement TemplateDocument12 pagesCollaborative Research Agreement TemplatenorzeNo ratings yet

- Companies ACt, 2063 Simplified 1 Day Revision BookDocument61 pagesCompanies ACt, 2063 Simplified 1 Day Revision Bookteam aspirantsNo ratings yet

- Full Download Inception Trend Fashion 2022 Rizki Yulianingrum Online Full Chapter PDFDocument66 pagesFull Download Inception Trend Fashion 2022 Rizki Yulianingrum Online Full Chapter PDFmyrahtan50f100% (6)

- Types of PatentDocument2 pagesTypes of PatentUnimarks ArvNo ratings yet

- Sale of Goods Act, 1930Document23 pagesSale of Goods Act, 1930Sunil Shaw0% (1)

- Full Case - Valarao VS CaDocument7 pagesFull Case - Valarao VS CaDaveKarlRamada-MaraonNo ratings yet

- Transfer of Property Act NotesDocument1 pageTransfer of Property Act NotesDEBDEEP SINHA0% (1)

- Group 1 First Midterm PPPDocument30 pagesGroup 1 First Midterm PPPAngelo BaguioNo ratings yet

- Time For Completion and Extensions of TimeDocument26 pagesTime For Completion and Extensions of TimeLGNo ratings yet

- Agreement 1707156786576Document7 pagesAgreement 1707156786576Shri Mani RanaNo ratings yet

- Addis Ababa University: School of Commerce: Business Law (Law3201) Group AssignmentDocument4 pagesAddis Ababa University: School of Commerce: Business Law (Law3201) Group AssignmentBlen tesfaye100% (1)

- Essential Elements of A ContractDocument5 pagesEssential Elements of A ContractSaida IslamNo ratings yet

- PRMX-2 - Leb - Mid Term-2020Document2 pagesPRMX-2 - Leb - Mid Term-2020ritesh choudhuryNo ratings yet

- Banking Law Negotiable Instruments ActDocument3 pagesBanking Law Negotiable Instruments Actrizofpicic100% (2)

- Fha Gift LetterDocument1 pageFha Gift LetterAndy ReyNo ratings yet

- What Is Commercial Insurance?Document3 pagesWhat Is Commercial Insurance?Adan HoodaNo ratings yet

- First AssignmentDocument5 pagesFirst Assignmentসায়েম উল আরাফাত প্রিতমNo ratings yet

- Capital Adequacy Presentation 1Document16 pagesCapital Adequacy Presentation 1Nafiz Imran DiptoNo ratings yet

- The Insular Life Assurance Co., LTD v. Feliciano (Sept. 1941)Document2 pagesThe Insular Life Assurance Co., LTD v. Feliciano (Sept. 1941)lealdeosaNo ratings yet

- One Wayos Employment ContractDocument6 pagesOne Wayos Employment ContractDavid Lemayian SalatonNo ratings yet

- MemoDocument6 pagesMemojissy rajishNo ratings yet

- Acceptance by IajDocument13 pagesAcceptance by IajM Raghib ZafarNo ratings yet

- General Banking Law CODALDocument13 pagesGeneral Banking Law CODALLeo Balante Escalante Jr.No ratings yet