Professional Documents

Culture Documents

DBP Accomplishment Report

DBP Accomplishment Report

Uploaded by

RaquelSaenzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DBP Accomplishment Report

DBP Accomplishment Report

Uploaded by

RaquelSaenzCopyright:

Available Formats

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

The DBP continued to deliver a solid development performance in 2011 under the strong leadership of the Aquino administration. Mandated to accelerate growth and progress, the Bank has contributed to nation-building while generating substantial profits to sustain its operations. In September 2010, the newly-appointed Board Directors led by Chairman Jose A. Nuez, Jr. and Vice-Chairman and President/CEO Francisco F. Rosario, Jr. assumed office in DBP and crafted major thrusts and directions of the Bank, namely: to intensify financing in priority areas, enhance fund management, strengthen Bank operations, establish global presence, and promote good governance and corporate social responsibility. of Del the

On July 13 and 14, 2011, the Board of Directors formulated the 2016 DBP Strategy Roadmap, enhanced the Banks vision and strategic goals, and ensured the alignment of the Banks priority thrusts to the Philippine Roadmap for 2011-2016. I. Intensified Support to Priority Development Areas In 2011, the DBP strongly supported the priority development areas of government with loan exposure to the infrastructure and logistics sector in the amount of Php29.98 B; the social services sector in health, education and housing with total outstanding loans of Php11.26 B, the environment sector including new and renewable energy, solid waste management, and water distribution with Php7.08 B, the mSMEs that is considered the backbone of the economy with Php14.44 B; and other priority industries with Php49.85 B. This attests that DBP has been faithful in fulfilling its mandate with a development loan portfolio of Php112.61 B comprising the huge bulk or 93% of its total loan portfolio of Php120.54 B for 2011. Gross loan portfolio reached Php180.32 B, posting a 16% increase from Php155.26 B last year.

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

1. Infrastructure and Logistics DBP has rendered full commitment to the governments Public-Private Partnership (PPP) initiatives aimed at accelerating infrastructure and countryside development. More than manifesting solid assistance to the governments PPP initiatives, the Bank formally opened the PPP Center satellite office in the DBP Head Office in March 2011. Coinciding this was the launching of the first five projects under the PPP program of the National Government (NG). Supporting DBPs program for infrastructure and logistics is the Japan International Cooperation Agency (JICA)-funded Logistics Infrastructure Development Project (LIDP). The LIDP is a JPY30.38-B ODA facility that comprises two components: a) fund for relending, and b) training and technical assistance. The TA component amounts to JPY300 M. The Bank has entered into a contract for consultants services with Berkman International, Inc. on February 2011 to implement the TA component of the LIDP. Its primary objective is to render assistance to DBP and its customers thru the following activities: strategy formulation, sub-project evaluation, assessment and monitoring in order to achieve the effective utilization of the fund. As of December 2011, the Bank released Php1.707 B, under the LIDP facility, to finance the acquisition/construction of vessels, port development, cold storage facilities and farmto-market roads. In addition, there was Php7.487 B in approved projects, Php1.379 B under evaluation and almost Php1.8 B prospective projects under the LIDP. Total releases to the infrastructure and logistics sector reached Php24.79 B in 2011. Table 1. Development Impacts of LIDP Projects. Sub-Sector Road RoRo Terminal System (RRTS) Project Impacts/Indicators Increase in tonnage capacities for the shipping industry:

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

RORO 9,276 GRT Cargo vessels 4,368 GRT Tankers - 7,499 DWT Contribute a total estimated carrying capacity of 4,165 passengers for the RORO vessels. Contribute to the countrys fleet modernization through the construction of 10 units of brand new double-hulled katamaran vessels. Increase service capacity from 30,000 GWT to 50,000 GWT. Provide a storage facility for oil and other oil products that can accommodate an estimated capacity of 18 million liters to service independent oil firms. Provide poultry growers, meat processors or food manufacturers cold storage facilities that can accommodate 3.5 million kg of poultry or meat products to store their products that will preserve its quality and prolong the shelf life. Provide 210,000 kg of cold storage capacity for farmers to store their produce year long. Contribute 30.10 km of farm-to-market roads and 15.10 km of provincial roads benefitting 42 barangays and 8 municipalities in the provinces of Southern Leyte and Negros Oriental. Provide corn farmers a corn post-harvest facility capable of servicing an area of 1,000 hectares of corn that can reduced post-harvest losses from 15% to 5% and corn drying and processing costs by 50%. It serves a rated capacity of 1,375 MT. Provide adequate supply of aquaculture feeds to producers with a rated capacity of 3,600 MT of feeds per year.

Other RRTS Facilities Port/Terminal Facilities

Cold Chain

Grains Highway

On November 24, 2011, the Bank approved the Connecting Rural-Urban Infrastructure System Efficiently (CRUISE) Program. The CRUISE Program was envisioned to be the Banks umbrella program and master plan in focusing its

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

developmental initiatives for the transport and logistics sector. It is aligned with the Philippine Development Plan 2011-2016 for infrastructure investments which prioritizes the creation of an integrated and multimodal national transport and logistics system. 2. Environment In support of the national governments environmental initiatives, DBP tapped Official Development Assistance (ODA) Funds. The Environmental Development Project (EDP), a 7-year JPY25 B policy-based lending facility funded by the JICA was launched in January 2009. EDP projects cover four environmental sectors, namely: Water Supply and Sanitation, New and Renewable Energy, Industrial Pollution Prevention and Control and Solid/Health Care/Hazardous Waste Management. EDPs primary objectives are to improve the quality of the environment, enable LGUs to manage their environmental and natural resources, and establish the Philippine Water Revolving Fund (PWRF) as an innovative financing mechanism. As of December 2011, total approvals for 37 projects amounted to Php5.04 B of which Php2.62 B was released. There were 36 pipeline projects amounting to Php4.02 B. DBP also tapped the World Bank (WB) for the Rural Power Project (RPP), a credit facility of US$150-M over a period of 14 years. To introduce flexibilities, the RPP can be accessed in four Adaptable Program Loans (APLs). Initially, DBP availed of US$10-M RPP under APL I facility that became effective on May 6, 2004 and was fully disbursed on April 30, 2009 with total approvals of Php735.69 M. Since this exceeded the amount of APL I of Php516.33 M, DBP availed of the US$40-M APL I- additional financing. As of December 31, 2011, total approvals under this facility reached Php1.077 B and disbursements amounted to Php542.927 M. The DBPs Solid Waste Management Program (SWMP) on the other hand, was approved by the Board in 2004. The program was designed primarily to assist LGUs in the development and implementation of their solid waste management programs by providing financing and technical assistance. The KfWPublic Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

Credit Line for Solid Waste Management (KfW-CLSWM) is the major funding source of the program. The said credit facility was implemented for seven years funding 15 projects amounting to Php976.53 M. Full disbursement of the credit facility was in July 2010. Total loan releases to the environment sector reached Php4.35 B for the year.

Table 2. Environmental Impacts Derived from the Projects Sub-Sector Solid/Hazardous Healthcare Waste Management Industrial Pollution Prevention and Control Project Impacts/Indicators Stored/Collected/Transported 154,618.2 tons of solidwaste Diverted 19,656 tons of waste from MRF and 2,430 tons of compost Captured/recovered 18,906.048 cubic meter of landfill gas from solid waste projects Reduced air pollution with the avoidance of 36.36 ppm particulate matter or dust Reduced water pollution with the removal of 196.86 kg of organic pollution (Biochemical Oxygen Demand) Conserved 900 cubic meter of water and 203,346 MT of raw materials (equivalent market value pf Php 1.016 B) Emission of particulate matter avoided/complied with standards: SO2: 28.74 mg/Ncm vs. 340 mg/Ncm (std) NO2: 0.007 ppm vs. 0.14 ppm (std) TSP: 37.10 mg/Ncm vs. 300 mg/Ncm (std) Power consumption on cement production reduced from 42-46 kwh/ton cement to 37 kwh/ton cement Increase plant/farm production/efficiency Prevented soil erosion of 18,010 sq. m land area equivalent to a value of property savings estimated to Php 36M Help the government achieve energy independence through development of indigenous and renewable energy resources.

Public Governance Forum March 30, 2012

Renewable Energy

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

Water Supply and Sanitation

Additional power generation capacity of 125.4 MW Replace an equivalent of 44,929 barrels of crude oil/ year Reduce 14,902 tons CO2 emissions/year Result in foreign exchange savings of US$ 4.908 Million/year (@US$109.24/barrel) Help government achieve MDG to provide safe water by 2015 Provide access to adequate and potable water to additional 19,517 service connections Conserve water volume of 21,790 cu.m./day through NRW reduction Provided additional water supply amounting 40,952 cu.m./day Treated wastewater amounting to 6,500 cu.m./day Improve health and living conditions by reducing incidence of water-borne diseases

To further highlight DBPs commitment in environmental protection, DBP Management approved the Carbon Finance Program (CFP) on August 4, 2010. The CFP sets aside Php60 M of the Banks own funds to assist in the CDM registration of clients eligible projects and translation of the generated carbon credits into income. DBP is presently assisting in the development of a CDM project for an industrial company employing blast furnace, processing the registration of a bundled mini-hydropower plant projects, and developing three Programs of Activities (PoAs) covering composting, methane avoidance and promotion of micro and mini-hydro power plant projects. The CDM projects are expected to generate about 70,000 Certified Emission Reductions (CERs) per annum for a seven year registration accreditation period. As the Bank for the environment, DBP continues to develop financing program that would help protect and preserve the environment. Three (3) financing programs were launched in 2011 to support DBPs environmental thrusts, namely: a) Financing Program for the Water Sector aims to contribute in the provision of

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

safe and affordable water supply to the waterless areas. The program targets initially an estimated investment requirement of Php5 B in 5 years; b) Financing Program for the Sanitation Sector will help the National Program to address the sanitation needs of the country. The program will target sewerage and septage management investment requirements of LGUs and Water Districts estimated at Php5.43 B up to 2020; c) Green Financing Program The program is DBPs umbrella program for environmental projects supporting the Green Economy and Green Growth Strategy for both the Industries and LGUs. It institutionalizes the environment thrust of the Bank consistent with the Banks environmental policy and DBPs reputation as the Bank for the Environment. The program is designed primarily to assist the industries and LGUs in the integration of environmentally-friendly processes and technologies with the end in view of reducing environmental footprint from LGU projects and industrial operations making them globally competitive in the fast growing market. The program supports the goal of the Philippine Development Plan (PDP) 2011-2016 to improve environmental quality for a cleaner and healthier environment. The program will support environmental investment requirements for the management of pollution (air and water quality management) including cleaner alternative transport fuel implementation estimated at Php367 B. d) Tree Plantation Financing Program - The program approved in 2011 provides credit support for the expansion, harvesting, maintenance and protection of existing tree plantations of at least four years in qualified private and public land covering both low land and forest areas. Initial fund amounted to Php10 B sourced from available funds of the Bank. The program is expected to improve forest cover as mode for addressing climate change risks and reactivate wood-based industries as source of employment, income and foreign exchange. 3. Social Services

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

DBP has several programs to address the priority areas of government in health, education, housing and community development. The Banks Development of Poor Urban Communities Sector Project (DPUCSP) from Asian Development Bank (ADB) closed in April 2010. The DPUCSP registered total loan releases of Php826.48 M, yielded a total of 6,168 socialized housing units, and delivered 10,685 enterprise loans among other contributions. In order to sustain housing finance interventions started in the DPUCSP, the Bank also launched the Sustainable Shelter Development Program (SSDP) during the first quarter of 2011. The Program makes available PhP3 B for socialized and lowcost housing projects and housing microfinance, with priority financing given to projects with high positive environmental impacts. As of end 2011, approved projects will have generated 184 socialized housing units while financing for housing microfinance continues through second generation DPUCSP funds. Partnerships with the Philippine Navy, the Department of Education and the University of the Philippines are also actively pursued for government employee housing. The Sustainable Health Care Investment Program (SHCIP) is currently in place to help realize the health system targets of the Millennium Development Goals (MDGs). Particularly, SHCIP seeks to improve maternal and child health and the management of communicable diseases. As of year-end, SCHIP had 28 approved projects amounting to Php2.9 B and 14 projects in the pipeline totaling Php1.6 B. With the approved loans

that financed construction of new hospitals, a total of 722 new beds were added to the health sector.

In support of the governments drive to address chronic shortages in school facilities and improve

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

accessibility and quality of education in the country, DBP continued to promote hard and soft infrastructure development for the education sector. As of December 2011, DBP conducted technical evaluation on 28 accounts amounting to a total of Php2.76 B of which Php2.1 B was approved and in various stages of project implementation. Disbursements to the social services sector totaled Php1.71 B in 2011. Further to this, the Bank developed responsive programs in four delineated sectors, namely: housing, health care, education and basic sectors (OFWs, indigenous peoples, people with disabilities). These programs are:

a) Financing Program for Basic Education a Php-10 B financing facility

to support the funding requirements of public basic education using the Special Education Fund (SEF) as the principal source of loan repayment. The SEF is 1% of realty taxes collected by LGUs annually per Local Government Code of 1991 or RA 7160. The facility shall be available for five years starting year 2012.

b) Sustainable Shelter Development Financing Program aims to

address the shelter and tenure security needs while consciously promoting sustainable alternative construction technologies, environmental consciousness, housing microfinance, and a holistic approach to community development. This will be initially funded by Bank funds at Php3 B.

c) DBP Overseas Filipino Workers-Reintegration Program supports

OFWs going into sustainable business ventures with a Php1-B funding linked up with a Php500 M guarantee support from OWWA available in a 5-year period. 4. Micro, Small and Medium Enterprises (mSMEs) The Bank has an umbrella program for mSMEs called the DBP Sustainable Entrepreneurship Enhancement and Development (SEED) program which is comprised of two sub-programs: the Credit Surety Fund (CSF) Credit Facility and Retail

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

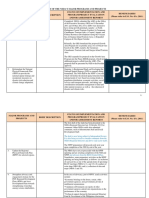

Lending for Micro and Small Enterprises (MSEs) which subsumes the One Town, One Product (OTOP). As of December 2011, approved contributions to 23 CSFs nationwide amounted to Php34.05 M. Of this, Php20.7 M was released in 13 CSFs. Since DBP kicked-off its CSF Credit Facility, it has generated a total loan portfolio of Php100.85 M; total releases amounted to Php55.29 M, while Php86.397 M is still in the pipeline. Jobs generated from this facility were estimated at 547 additional work force as of December 2011. Under the retail lending for mSMEs, a total of Php1.403 B was released as of December 31, 2011. Loan releases to support the mSMEs totaled Php3.56 B for the same period. Table 3. Loan Releases, Number of mSMEs Assisted and Jobs Generated RMC No. of Accou nts Total Approved Loan Amount Jan-Dec 2011 7 5,043.75 150.00 2 3,200.00 Total Approved Loan Amount Jan-Dec 2011 8,500.00 6 6,223.73 2 1,886.67 8,304.50 Releases No. of Jobs Generated Jan-Dec 2011 189

Northeastern Luzon Western Luzon Central Luzon RMC

40 2 11 No. of Accou nts

Jan - Dec. 2011 81,44 4.00

8,70 0.00 0 28,91 0.09 119 Releases No. of Jobs Generated Jan - Dec. 2011 29,37 2.00 33,85 3.00 23,05 8.14 41,35 8.62 Jan-Dec 2011 64 259 120 81

Metro Manila Southern Tagalog Bicol Eastern Visayas

3 25 17 7

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

4 8,660.55 1 4,900.00 2 1,540.00 2 6,400.00 1 8,335.13 9,000.00 8 9,688.80 43 1,833.13 14,94 5.00 40,15 1.30 22,55 0.00 36,64 5.00 37,29 0.00 37,14 4.95 21,35 6.00 43,69 8.80 500,476.90 0 373 67 107 39 58 43 280 1799

Central Visayas Panay Negros Northern Mindanao Northeastern Mindanao Southern Mindanao Southeastern Mindanao Western Mindanao Total Medium (Regular) RMC

16 6 7 10 10 6 23 183

No. of Accou nts

Northeastern Luzon Western Luzon RMC

9 5 No. of Accou nts 2 6

Total Approved Loan Amount Jan-Dec 2011 58 ,925.33 47 ,100.00 Total Approved Loan Amount 5,700.00 10 ,700.00

Releases

No. of Jobs Generated Jan-Dec 2011 281 82 No. of Jobs Generated

Jan - Dec. 2011 62, 433.47 13, 080.14 Releases

Central Luzon Metro Manila

94, 311.05 122,6 78.00

126 0

Page 22

Public Governance Forum March 30, 2012

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

93 ,900.00 47 ,000.00 48 ,000.00 26 ,815.00 56 ,900.00 49 ,800.00 13 ,050.00 161 ,168.24 61 9,058.57 1 ,050,892 125,3 77.38 73, 621.24 66, 880.17 82, 110.00 42, 660.00 15, 500.00 53, 925.00 45, 379.68 15, 347.75 28, 550.00 61, 660.00 903, 513.88 1, 403,991 30 105 110 94 396 197 122 95 60 84 223 2005

Southern Tagalog Bicol Eastern Visayas Central Visayas Panay Negros Northen Mindanao Northeastern Mindanao Southern Mindanao Southeastern Mindanao Western Mindanao Total Factoring Grand Total (MSME)

10 4 3 4 4 7 11 3 15 83 10 276

3804

The Bank continued to develop relevant programs for mSMEs to further boost assistance to the sector. For 2011, two programs were developed, namely: a. Agribusiness Development Program an umbrella program for all agriculture related credit facilities including those for crops, livestock and poultry, forestry and aquaculture.

b. DBP Venture Capital Program DBPs primary equity support and

non-credit financing program for mSMEs with high growth potential.

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

A Php500-M fund facility for equity investments with Php50-M piggybacked technical assistance fund. Other priority areas. To continue its strategic role as catalyst of development, DBP supported industrial progress by financing other critical sectors including manufacturing, wholesale and retail trade, and real estate amounting to Php33.76 B. The Bank also continued lending to major commercial enterprises with total loan releases of Php74.66 B. This brings total loan releases of the Bank to Php142.83 B for 2011.

II. Fund Generation and Management

The branches ensured a significant source of low cost funds for the Bank to attain a deposit level of Php70.77 B in 2011. This was 96% of the target deposit level of Php73.25 B. The Php3.0 B shortfall was accounted for by the projected deposits from the new branches that did not transpire in 2011. Only one branch was opened vs. the 10 new branches targeted for the year. On a bank-wide level, total deposits reached Php158.37 B vs. target of Php119.97 B or a realization rate of 132%. For better service delivery, several branches undertook infrastructural improvements and site relocation. The Cash Management in the Head Office, RMC-Western Mindanao and Zamboanga branches were refurbished while DBP Bogo branch was transferred to a new office. For customer convenience, 26 new ATMs were installed during the year. A total of 100 new ATMs are targeted to be installed and operational for the period 2011-2016 and the Bank is on track in this undertaking.

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

Fund Sourcing. As of end-December 2011, a total of Php36.93 B in ODA funds was made available to finance the four major thrusts of DBP which are supportive of the government programs. Total approved ODA loans to subborrowers (with pending releases) reached Php10.80 B, while pipeline projects was estimated at Php20.45 B. Total ODA disbursements to sub-loan borrowers for 2011 reached Php1.44 B. To improve disbursements, the marketing units and the Program Development departments of the Bank will work towards more effective mobilization of ODA funds for 2012. The Bank, through its Fund Sourcing department, drew a total of Php956.43 M from funders in 2011 against the targeted Php3.82 B or a realization rate of 25%. With concerted efforts in marketing the facilities, a higher RR will be attained in 2012. DBP also saw the need to diversify its foreign borrowing portfolio to compete in the industry under a low interest rate regime. The Bank made initiatives to tap non-traditional sources of funds such as the French Development Agency (AFD), German Development Aid Agency, Instituto Credito Oficial, Australian Agency for International Development, and International Commercial Bank of China. The Bank has already participated in the 1st bilateral consultation between GOP and AFD. The Bank also met with ACPC, ADCF and traditional funder WB for prospective facilities. III.Strengthened Bank Operations During the year, the DBP was able to establish robust and responsive systems and processes with the completion of the Banks Information Technologys Information Systems Strategic Plan (ISSP) with systems set up in newer platforms. The bank-wide Management Information System (MIS) is on track with its schedule of implementation. The Banks credit processes continued to be streamlined with the reduction in the number of credit policy

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

memorandums and circulars and the enterprise-wide risk management system is in place. DBP also passed the certification audit conducted on additional Quality Management System (QMS) processes for the year. IV.Global Presence The Bank continued to serve the overseas Filipino workers (OFWs) with low cost and efficient financial services, financial literacy and entrepreneurial advocacy work, and delivery of welfare services. The volume of remittances grew by almost 20% from 2010 level to reach more than 306,313 transactions amounting to inward foreign exchange equivalent to US$122.566 M. The Banks Remittance Center (RC) has a presence in 15 countries through a Hong Kong subsidiary and tie-ups in the Middle East and North America. The RCs average growth rate of remittances over the past year is 24%. In 2011, the DBP-Pangkabuhayan Para sa Pinoy raffle program (DBP-PPP) was launched as a major promotional campaign aimed to promote livelihood opportunities for OFWs. The Bank also launched the OFW Reintegration Program (DBP-OFWRP), a financing facility to support the entrepreneurial activities of overseas Filipino workers and their families.

V. Good Governance and Corporate Social Responsibility

The Bank has aligned its practices, policies and procedures with laws mandating the implementation of the Integrity Development Action Plan (IDAP), Moral Renewal Action Plan (MRAP) and Anti-Red Tape Act (ARTA/Citizens Charter). In 2011, the Bank created the Technical Working Group (TWG) on Good Governance was created, replacing the Task Force on Good Governance. This is in light of the Banks revitalized Strategic Plans and Directions for the Medium-Term 2011 to 2016. The TWG is composed of heads of all sectors of the Bank with the Office of the President and CEO, Office of the COO, Branch

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

Banking Sector, Finance Sector, Marketing Head Office Sector and Operations Sector, including the Corporate Affairs, Credit Review and Policy Supervision, Human Resource Management, Process Management and Strategic Planning and Research. The TWG was tasked to promote and inculcate integrity among the Banks constituents, and corporate governance among its leaders. The principles of good governance was aimed to be institutionalized throughout the entire organization through overseeing the Banks compliance in the implementing rules and regulations of ARTA covering the Citizens Charter, IDAP, MRAP and related programs on good governance and integrity development as required by the CSC and other enforcing agencies of the Office of the President. The Bank also offered non-loan financial assistance in the form of CSR programs. The earliest is the DBP Forest Program launched in 2005, followed by the DBP Endowment for Education Program (DEEP) in 2007. The latest involves the provision of around 15 materials recovery facilities along the Pasig River. DBP Forest. In 2005, the DBP Forest Program was launched which is a positive action to avoid the occurrence of natural disasters that cause extensive damage to communities aggravated by the wanton exploitation of natural resources, including forests. It embodies the Banks environmental advocacy aimed at assisting partner communities in establishing upland and coastal forest projects. Trees planted include fruit trees, forest species and medicinal plants for upland areas and mangrove species for coastal areas. Partner communities contribute their sweat equity and partnerships with local government units, state universities and colleges and other government agencies bring in additional technical expertise. The DBP Forest projects impact on the environment as well as in the social, economic and financial condition of the lives of people in concerned communities. The Program is hinged on the principle of partnership with communities who are the main implementers of the project.

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

As of 2011, total number of forest projects increased to 38, participated by at least 4,637 member beneficiaries and their families. Number of trees planted total to 3.7 million and DBP total released amount of Php 66.4 M. Implementing projects through community participation involves activities on organizing communities, information/ awareness program and training of members. The community gains improved awareness of the value of forest conservation, assimilate concepts governing the project and its benefits which bring about change in perception about the care and protection of the forest. Participants are given opportunity to enhance their knowledge on many areas which promote capability enhancement and technical skills development which help them gain skills in organic farming, marcotting, administrative management and others. Communities become empowered in their implementation of the projects, gain confidence in their ability to respond to concerns and resolve issues, become independent and learn to explore other opportunities for the good of the project and the community. They develop a sense of ownership and active involvement in the protection and restoration of watershed areas, patrolling, monitoring, and maintenance of the project. In the course of project implementation, they gain initiative to source out funds to further develop the project and explore potential for other sub-projects such as aqua-silviculture, culturing crablets, shrimps and other aquatic resources. They gain a sense of prestige especially when the project becomes a recipient of award on civil service or adjudged as a model agribusiness project. Members become motivated in participating in the project, and appreciative of the importance of the benefits they derive from the project. Social interaction is thus, further enhanced. Community members also serve as the workforce in implementing the project where they earn some income for their labor. Where technical expertise is provided either by DENR or state college/university in raising some seedlings or collection of propagules, farmers are the ones paid instead of procuring these from nursery suppliers. DBP Forest also encourages planting of intercrops where farmers obtain additional revenue from sale of intercrops which are harvested in short periods. Some projects already benefit from harvest of certain fruits such as rambutan, durian and cacao made into tablea and sold at Php90 to Php110 per kilo in Davao. Some farmers in the two forest projects in Cagayan Province have started harvest of mango. In Palawan, market for harvested abaca fiber and latex smoke sheath of rubber tree is being explored for good pricing. Flowering rambutan and mango trees in Sarangani are expected to be a source of revenue for the partner community members.

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

In Tagum City, potential sources of income include ecotourism project involving river cruise, floating restaurant specializing in soft shell crabs, installation of baywalk and construction of spawning ground area for crabs (for possible loan with DBP). In Quezon, collection of monthly water fee from the rehabilitated watershed becomes an income for the forest partner for the maintenance of the water system in the area. Potential income from nipa is also being explored. Vermi composting used as fertilizer to planted tree species also serves as a good source of extra income for the community. The mangrove project in Guimaras complements the seaweed farming livelihood project of the LGU. Through rehabilitation of mangrove area, an increase of caught fish and other aquatic resources has been reported which translates to more income for the fisherfolks. The DBP Forest projects promote planting of fruit trees and forest trees in open idle land which help arrest environmental degradation. Mangrove projects serve as the spawning area for aquatic resources, promote increase in aquatic biodiversity, serve as buffer zone for protection and soil erosion control. Agroforestation brings about improvement in the physical condition, species composition and microclimate condition of degraded areas as well as promote increase in forest cover, wildlife and biodiversity conservation. Soil fertility is thus enhanced. Through the forest projects, problems on kaingin, charcoal making and illegal logging tend to be minimized if not totally controlled. Planting of fruit trees in open denuded areas improves the landscape and the re-greening of the area that may prevent soil erosion and landslide. Watersheds become partly rehabilitated through planting of fruit trees and indigenous tree species which contribute to improvement of water supply and water quality. Planting trees sequesters significant amount of atmospheric carbon efficiently and once the trees grow, they transform carbon into biomass which help in mitigating global warming and climate change. DBP Endowment for Education Program. In 2007, DBP implemented the DBP Endowment for Education Program (DEEP) which is a concrete support to very poor families that have talented children to break away from the vicious cycle of poverty. The Bank allocates Php100 M yearly for a period of 10 years to support the DEEP. The DEEP has two components: the Partner School Endowment which purchases course slots for qualified scholars, thus paying for their tuition for the entire course,

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

and the Student Support that provides scholars needs including board, lodging, books and school supplies. Table 4. DEEP Courses NO. OF SCHOLARS Batch Batch Batch Batch 1 2 3 4 AY AY AY AY 20082009201020112009 2010 2011 2012 184 312 323 40 77 113 34 26 8 6 14 20 34 73 47

COURSES

TOTAL

Maritime Maritime-Short Courses* Tech Voc Nursing Forestry Agriculture Education HRM Various PGC SSP

819 133 158 113 34 26 8 6 14

62.47 10.14 12.05 8.62 2.59 1.98 0.61 0.46 1.07 100.0 0

TOTAL 113 349 392 457 1311 Partner Schools ** 7 10 13 14 28 *Maritime-short courses include Culinary & Bridging program **Partner Schools are participating in more than one academic year

The DEEP has eight courses including maritime, maritime-related short courses such as culinary and bridging program, technical vocational, nursing, forestry, agriculture, education and HRM. DEEP has turned in its fourth batch of scholars as of academic year 2011-2012. From the 120 nursing scholars in the first batch, the number of DEEP scholars reached 1,311 as of year-end 2011. Maritime accounts for 73% of total population, 9% in nursing, 12% in technical vocational courses, and 6% in the other courses. In terms of geographic location, Mindanao accounts for 45% of the scholars, followed by Luzon with 40% and Visayas with 15%. Total DEEP funds released reached Php263.05 M.

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

Recently, the Bank implemented the Industrial Guarantee and Loan Fund Student Assistance Grant for Entrepreneurship (IGLF-SAGE) which aims to enhance the student entrepreneurial development and promote enterprise. The pilot stage of IGLFSAGE is in partnership with Cebu-based universities. The expected outcome is more enrollees in entrepreneurship courses in partner schools, upgraded business plans from students or student groups and increased number of business plans pursued to commercialization. Environmental Management System True to its advocacy as a sustainable and model green bank, DBP takes pride in being the first and only Philippine bank to be ISO 14001 certified in 2002 for its successful establishment and implementation of an environmental management system (EMS). DBPs ISO 14001 certification has been upgraded/renewed from Y-2002 to Y-2011 against the requirements of the ISO 14001: 2004 standard which attested to our consistent performance under the highest standards of this international certification. DBPs ISO certification now covers the operations of the Head Office and the 15 Regional Marketing Centers (RMCs) and host branches namely: NEL/ Ilagan Branch; CL/ Pampanga Branch; WL/Dagupan Branch; Metro Manila / Commonwealth Branch; ST/ Lucena Branch; Bicol/Naga Branch; CV/ Cebu Branch; Panay /Iloilo Branch; Negros/Bacolod Branch; EV/Tacloban; NEM/ Butuan Branch; NM/ Cagayan de Oro; SM/ Gensan Branch; SEM/Davao Branch; and WM/Zamboanga Branch. The Bank will further expand the sites of its EMS implementation in all of its 67 ward branches by 2012 and 2013. Under the Banks EMS environmental objectives and targets, the performance of the DBPs environmental management programs (EMPs) in 2011 vs. 2010 showed continual improvement with the realization of the resource consumption reduction target. DBP exceeded its Bankwide reduction targets in electricity, water, paper, transport gasoline and diesel, solid waste generation and utilization of LPG fuel for the Bank transport activities. Total greenhouse gas (GHG) metric tons of CO2 emitted from electricity and fuel consumption in the bank decreased by 2.27% and 15.16% from 2010 level

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

and overall water conserved by the bank is 2,442 m3 or 1 day consumption of about 7,191 people. Materials Recovery Facilities (MRF). In April 5, 2010, DBP and ABS-CBN Foundation, Inc. (AFI) signed a Memorandum of Agreement (MOA) for the construction of Materials Recovery Facilities (MRF) in up to 15 selected project sites along the Pasig River including one resettlement area in Calauan, Laguna. This is a part of the Solid Waste Management Program of the Clean River Zones (CRZs) and to be undertaken parallel to the activities of Kapit Bisig Para sa Ilog Pasig (KBPIP) Project. The MRFs will be set up to ensure that all wastes, biodegradable and non-biodegradable, will be properly segregated, composted and recycled. The intention is to minimize waste and convert them to marketable products. The communities also stand to earn from the activities of the MRFs. Public-private partnerships will be encouraged and efforts of LGUs will be complemented in ensuring solid waste management and water pollution prevention and control. Livelihood and income opportunities for the project beneficiaries will be provided particularly the residents along the Pasig River and activities towards the rehabilitation of the Pasig River will be supported. To implement the MOA, DBP will accomplish the following: 1. Evaluate and approve project proposals submitted by AFI and provide technical and business advisory assistance in setting up MRFs in approved project sites according to the concept design of the MRF; 2. Provide financial assistance of up to Php30 million for the establishment of up to 15 MRFs, subject to availment procedures of DBP; and 3. Monitor project sites and undertake activities to effectively implement the project in coordination with AFI. At present, the MOA between DBP and AFI, Inc. will be implemented with the submission of AFI to DBP of the following: MOA between AFI and partner barangays, notarized contract between AFI and DND and Certificate of NonCoverage issued by EMD. VI.Financial Performance

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

DBP has managed to sustain its profitability throughout its 65 years of banking operations. In 2011, the Bank ended the year with a net income of Php4.02 B, exceeding income target of Php3.73 B by 8%, largely driven by an increase in loans and investments. This is the 2nd highest ever attained in its banking history. Marketing efforts were focused on the developmental priority areas of the Bank, resulting to a significant build-up of pipeline projects. Approvals on notable projects include the following:

Php1.125 B to Metropolitan Waterworks and Sewerage System (MWSS) to support improvements in water supply and sewerage infrastructure, i.e. ensuring uninterrupted and adequate supply and distribution of potable water in Metro Manila and developing new sources of water supply; Php2.0 B to Maynilad Water Services, Inc. to partially finance its nonrevenue water (NRW) recovery program and water distribution network expansion; Php4.0 B to Private Infrastructure Development Corp. to partially finance the design and operation of the Tarlac-Pangasinan-La Union Expressway (TPLEX) project, which is essential to the success of the governments economic development program in the Northern Luzon Agribusiness Quadrangle Super Region and the Luzon Urban Beltway; Php2.50 B to Manila International Airport Authority to support its general funding requirements, including payment of court rendered just compensation in the NAIA Terminal 3 expropriation; Php250 M to Boracay Island Water Co., Inc. to finance improvement of water quality through proper treatment and disposal of wastewater; Php100 M to Royale Group of Companies (Royale Fishing Corporation, Royal Cold Storage and Josefa Slipways) to support the Banks mandate of infrastructure growth thru the development of the countrys local shipping industry, modern storage and handling; Php1.0 B to Globe Telecom, Inc. to partially finance the capital expenditures needed for its growth in telecommunications and support and in the Information Technology and Communication industry; Php140 M to SL Agritech to support the National Governments goal of rice self-sufficiency thereby helping regulate price of rice with the increase in rice supply; Php30 M to J.S. Cruz Construction and Development, Inc. to partially finance its working capital as a means to contribute to the infrastructure development in the Rizal province where most of the projects are located.

Public Governance Forum March 30, 2012

Page 22

PGS Initiation Stage Revalida Presentation

[2011 DBP ACCOMPLISHMENT REPORT]

DBP also secured the following major deals in 2011, thereby confirming its reputation of stability in investment banking and capital markets: One of the Joint Issue Coordinators for the Bureau of Treasurys 13th and 14th Tranche of the Retail Treasury Bonds; One of the Joint Lead Arrangers and Book Runners of the Power Sector Assets and Liability Management Corp.s Php75-B syndicated term loan facility; Arranger for Maynilad Water Services, Inc.s Php7-B Corporate Notes Facility to finance its 5-year capital expansion program; One of the Joint Lead Arrangers for the Php77.50-B term loan facility to Private Infrastructure Development Corp. to finance the TarlacPangasinan-La Union Expressway; One of the Joint Lead Coordinators and Joint Deal Managers for the Php323.40-B Bond Exchange and Domestic Bond Consolidation Program, respectively; and One of the Joint Lead Arranger for the National Food Authoritys Php75-B syndicated term loan facility. While DBP worked towards attaining its developmental goals and targets, it has also succeeded in maintaining its self-sufficiency, viability and profitability. For the year 2011, in accordance with R.A. 7656, An Act Requiring Government-Owned and/or Controlled Corporations to Declare Dividends under certain conditions to the National Government and for other purposes stating that all GOCCs shall declare and remit at least 50% of its annual net earnings to NG, with appropriate approvals from regulatory bodies, the Bank declared a dividend payment Php4.0 B. Prior to this, the Bank has remitted total dividend payments amounting to Php31.07 B to NG, of which Php10 B are stock dividends.

Public Governance Forum March 30, 2012

Page 22

You might also like

- Bicol Regional Development PlanDocument37 pagesBicol Regional Development PlanLiz BellenNo ratings yet

- Updated - MTPDP 2004 To 2010Document315 pagesUpdated - MTPDP 2004 To 2010Ivan MagadiaNo ratings yet

- Hydrolysis of Nucleic AcidsDocument7 pagesHydrolysis of Nucleic Acidskeepersake81% (16)

- Audio Information and MediaDocument2 pagesAudio Information and Mediajosefalarka75% (4)

- Ex-Ante Evaluation: Japanese ODA LoanDocument4 pagesEx-Ante Evaluation: Japanese ODA LoanTomatoNo ratings yet

- Nia Annual Report 2010Document44 pagesNia Annual Report 2010Junior LubagNo ratings yet

- DPWH Year End Report (Final)Document37 pagesDPWH Year End Report (Final)theengineer3100% (1)

- Local Waterworks and Utilities Administration (LWUA)Document11 pagesLocal Waterworks and Utilities Administration (LWUA)Claire Maurice JuaneroNo ratings yet

- PCF 2012 - DILG MC No. 2012-68Document19 pagesPCF 2012 - DILG MC No. 2012-68DILG IV-A PDMUNo ratings yet

- ADB Loan TermsDocument5 pagesADB Loan TermsFaheem ShaukatNo ratings yet

- LLDA 2011 ReportDocument60 pagesLLDA 2011 ReportcjtamNo ratings yet

- East Asia: The People's Republic of China, MongoliaDocument8 pagesEast Asia: The People's Republic of China, MongoliaFudhi AldianoNo ratings yet

- Status of The Neda's Major Programs and ProjectsDocument6 pagesStatus of The Neda's Major Programs and Projectscarlos-tulali-1309No ratings yet

- Water Service Investment Programme 2010-2012Document68 pagesWater Service Investment Programme 2010-2012valeriobrlNo ratings yet

- IRPC Feasibility StudyDocument22 pagesIRPC Feasibility StudyPFMPC SecretaryNo ratings yet

- Sector Synthesis of Postevaluation Findings in The Irrigation and Rural Development SectorDocument19 pagesSector Synthesis of Postevaluation Findings in The Irrigation and Rural Development SectorIndependent Evaluation at Asian Development BankNo ratings yet

- Updates On Coral Triangle Initiative (CTI) Implementation and FinancingDocument20 pagesUpdates On Coral Triangle Initiative (CTI) Implementation and FinancingZeena ManglinongNo ratings yet

- Byjus Exam Prep Cna 6th Jan 2023Document15 pagesByjus Exam Prep Cna 6th Jan 2023Che GueveraNo ratings yet

- Lankbank EnvironmentalDocument6 pagesLankbank EnvironmentalNikki M. ArapolNo ratings yet

- Disclosable Version of The ISR Ethiopia Water Supply Sanitation and Hygiene Project P133591 Sequence No 13Document9 pagesDisclosable Version of The ISR Ethiopia Water Supply Sanitation and Hygiene Project P133591 Sequence No 13Abraham RayaNo ratings yet

- Laguna de Bay Masterplan - Abridge MasterplanDocument383 pagesLaguna de Bay Masterplan - Abridge MasterplanAngelo GuevarraNo ratings yet

- 11 March 2010 FINAL TORDocument8 pages11 March 2010 FINAL TORRizal OctoNo ratings yet

- UNDP - LA - GPAR - Strengtheing Capacity - 2012Document2 pagesUNDP - LA - GPAR - Strengtheing Capacity - 2012Ela MaeNo ratings yet

- Ethiopia. Privatization Technical Assistance Project - ENDocument44 pagesEthiopia. Privatization Technical Assistance Project - ENalemeNo ratings yet

- PRDP - LGU MOA - Revised June 2018Document11 pagesPRDP - LGU MOA - Revised June 2018Alorn CatibogNo ratings yet

- DILG Memo - Circular 2012110 E3ef3c4feaDocument6 pagesDILG Memo - Circular 2012110 E3ef3c4feakimberly magallanesNo ratings yet

- Madagascar - Integrated Growth Poles Project (World Bank - 2005)Document149 pagesMadagascar - Integrated Growth Poles Project (World Bank - 2005)HayZara MadagascarNo ratings yet

- C. Buentjen - ENR Sector and ADB CPSDocument16 pagesC. Buentjen - ENR Sector and ADB CPSAsian Development BankNo ratings yet

- EIB Rem Annual Report 2014 enDocument64 pagesEIB Rem Annual Report 2014 enStelios KaragiannisNo ratings yet

- Impact Evaluation Study of The Bank Assistance To The Industrial Crops and Agro-Industry Sector in Sri LankaDocument24 pagesImpact Evaluation Study of The Bank Assistance To The Industrial Crops and Agro-Industry Sector in Sri LankaIndependent Evaluation at Asian Development BankNo ratings yet

- Administrative Assistant Kemenko Marves and ToRDocument3 pagesAdministrative Assistant Kemenko Marves and ToRzulhijah basalamahNo ratings yet

- Framework Conditions For Private Sector Participation in Water Infrastructure in LebanonDocument22 pagesFramework Conditions For Private Sector Participation in Water Infrastructure in LebanonOgunyemi VictorNo ratings yet

- Bohol Water and Sanitation Project - PPP CenterDocument8 pagesBohol Water and Sanitation Project - PPP CenterFaux LexieNo ratings yet

- Zambia Small Scale Irrigation Project Propject Completion ReportDocument28 pagesZambia Small Scale Irrigation Project Propject Completion ReportengkjNo ratings yet

- Rev07 - TOR Creative Officer ADBDocument7 pagesRev07 - TOR Creative Officer ADBRaipan RIFANSYAHNo ratings yet

- Ethiopia Wash Sector Country BriefDocument9 pagesEthiopia Wash Sector Country BriefSumita SinghalNo ratings yet

- Final MOU (Lingga 2011) v3Document11 pagesFinal MOU (Lingga 2011) v3bungkaharNo ratings yet

- Country Paper: Philippines: Part 2Document6 pagesCountry Paper: Philippines: Part 2ADBI EventsNo ratings yet

- WATER Indonesia Water Investment Roadmap 2011 2014Document41 pagesWATER Indonesia Water Investment Roadmap 2011 2014Soenarto Soendjaja100% (1)

- Climate Change BC ApprevDocument48 pagesClimate Change BC Apprevkumar_shyam120No ratings yet

- Multi-Year Action Plan On Development: Annex IiDocument13 pagesMulti-Year Action Plan On Development: Annex IiInterActionNo ratings yet

- Ecotourism in BoholDocument4 pagesEcotourism in Boholjimmy_andangNo ratings yet

- UAP Executive SummaryDocument10 pagesUAP Executive SummarySham Salonga PascualNo ratings yet

- Project Name: Program Information Document (Pid) Appraisal StageDocument5 pagesProject Name: Program Information Document (Pid) Appraisal StageadjiNo ratings yet

- Optional TOR FileDocument12 pagesOptional TOR FileInam FareedNo ratings yet

- Fiji Water and Wastewater Project - EIB Environmental and Social Data Sheet - 15 Nov 2016Document3 pagesFiji Water and Wastewater Project - EIB Environmental and Social Data Sheet - 15 Nov 2016Seni Nabou0% (1)

- Integrated Safeguards Data Sheet Concept StageDocument5 pagesIntegrated Safeguards Data Sheet Concept StageDaddy MBOMBO MUKUNANo ratings yet

- Metropolitan Cebu Water Supply Project (Loans 1056-PHI (SF) &1057-PHI)Document51 pagesMetropolitan Cebu Water Supply Project (Loans 1056-PHI (SF) &1057-PHI)Independent Evaluation at Asian Development BankNo ratings yet

- 01 Nep Tacr 03Document150 pages01 Nep Tacr 03kumardaiNo ratings yet

- NMC - TOR OriginalDocument79 pagesNMC - TOR OriginalSaiful AminNo ratings yet

- 594SLWorldBank Mining StudyDocument33 pages594SLWorldBank Mining StudyMarc D'HombresNo ratings yet

- BECC Accomplishments - November 19, 2014 ENGDocument62 pagesBECC Accomplishments - November 19, 2014 ENGManuel F. Rubio GallegoNo ratings yet

- Proposal SampleDocument12 pagesProposal Samplecebu districtNo ratings yet

- Report On Agribusiness Sectors Development ProjectDocument23 pagesReport On Agribusiness Sectors Development ProjectAhm Karim100% (1)

- Chapter 15 enDocument19 pagesChapter 15 enS. M. Hasan ZidnyNo ratings yet

- ToR Program OfficerDocument11 pagesToR Program OfficerGURU HONORERNo ratings yet

- Davao City Executive Summary 2013Document6 pagesDavao City Executive Summary 2013Cristina ChiNo ratings yet

- Status of Implementation of 7th SACOSAN CommittmentsDocument5 pagesStatus of Implementation of 7th SACOSAN CommittmentsProdip RoyNo ratings yet

- Comprehensive Development Plan 2014-2016Document55 pagesComprehensive Development Plan 2014-2016Natacia Rimorin-Dizon100% (2)

- Financing Mechanisms for Wastewater and Sanitation ProjectsFrom EverandFinancing Mechanisms for Wastewater and Sanitation ProjectsNo ratings yet

- Climate-Related Financial Disclosures 2021: Progress Report on Implementing the Recommendations of the Task Force on Climate-Related Financial DisclosuresFrom EverandClimate-Related Financial Disclosures 2021: Progress Report on Implementing the Recommendations of the Task Force on Climate-Related Financial DisclosuresNo ratings yet

- Future Carbon Fund: Delivering Co-Benefits for Sustainable DevelopmentFrom EverandFuture Carbon Fund: Delivering Co-Benefits for Sustainable DevelopmentNo ratings yet

- Gill Disease in Barramundi (Lates Calcarifer)Document228 pagesGill Disease in Barramundi (Lates Calcarifer)mmsfNo ratings yet

- HD Consumer Behavior AssignmentDocument9 pagesHD Consumer Behavior AssignmentAishwaryaNo ratings yet

- Labour Law and Employment in Slovakia - 2019 GuideDocument13 pagesLabour Law and Employment in Slovakia - 2019 GuideAccaceNo ratings yet

- Ultrasonic InterferometerDocument22 pagesUltrasonic InterferometerakshatguptaNo ratings yet

- Chapter 6: The Legal and Political Environment of Global BusinessDocument25 pagesChapter 6: The Legal and Political Environment of Global BusinessMaxineNo ratings yet

- Testing ChecklistDocument3 pagesTesting ChecklistAnurag YadavNo ratings yet

- List of TradeMark Forms & Therein PDFDocument17 pagesList of TradeMark Forms & Therein PDFShreeneetRathiNo ratings yet

- Clique Student Sheet (Manteran Lamo)Document4 pagesClique Student Sheet (Manteran Lamo)Dina Rizkia RachmahNo ratings yet

- 10 Science NcertSolutions Chapter 8 ExercisesDocument4 pages10 Science NcertSolutions Chapter 8 ExercisesAnita GargNo ratings yet

- Feasibility StudyyyDocument27 pagesFeasibility StudyyyMichael James ll BanawisNo ratings yet

- Practice Questions: Musculoskeletal SystemDocument4 pagesPractice Questions: Musculoskeletal SystemSali IqraNo ratings yet

- Transistor 2n3904 DatasheetDocument2 pagesTransistor 2n3904 DatasheetAlex ZXNo ratings yet

- Revisit of Harriott's Method For Process ControlDocument3 pagesRevisit of Harriott's Method For Process ControlkiddhoNo ratings yet

- Rahmania Tbi 6 D Soe...Document9 pagesRahmania Tbi 6 D Soe...Rahmania Aulia PurwagunifaNo ratings yet

- Nemo Complete Documentation 2017Document65 pagesNemo Complete Documentation 2017Fredy A. CastañedaNo ratings yet

- Entry Level Linguist ResumeDocument4 pagesEntry Level Linguist Resumejbzhnbyhf100% (1)

- Wider World 4 Grammar Presentation 1 4Document6 pagesWider World 4 Grammar Presentation 1 4veronika rugunNo ratings yet

- 1951 1obli ChronicleDocument18 pages1951 1obli Chronicleapi-198872914No ratings yet

- General Revision For Treasury Management (Please See That You Can Answer The Following 32 Questions and The MCQS)Document14 pagesGeneral Revision For Treasury Management (Please See That You Can Answer The Following 32 Questions and The MCQS)RoelienNo ratings yet

- OptiMix - Manual - EN - Rev.03.05 (Mixer)Document89 pagesOptiMix - Manual - EN - Rev.03.05 (Mixer)Đức Nguyễn100% (2)

- Iklan Transtv - Ani, Adel, Vinda - Kelas ADocument9 pagesIklan Transtv - Ani, Adel, Vinda - Kelas ANur JamilaNo ratings yet

- Chemical Fume Hood HandbookDocument11 pagesChemical Fume Hood Handbookkumar123rajuNo ratings yet

- Machine Tool TestingDocument4 pagesMachine Tool Testingnm2007k100% (1)

- HCI 2008 Promo W SolutionDocument12 pagesHCI 2008 Promo W SolutionMichael CheeNo ratings yet

- Web Lab PDFDocument6 pagesWeb Lab PDFDevesh PandeyNo ratings yet

- UntitledDocument5 pagesUntitledGerard Phoenix MaximoNo ratings yet

- Find Me Phoenix Book 6 Stacey Kennedy Full ChapterDocument67 pagesFind Me Phoenix Book 6 Stacey Kennedy Full Chaptercatherine.anderegg828100% (21)

- 9de13c0f0c009828f703d0103efa820b.xlsDocument70 pages9de13c0f0c009828f703d0103efa820b.xlsPreeti JaiswalNo ratings yet