Professional Documents

Culture Documents

NASDAQ Market Overview

NASDAQ Market Overview

Uploaded by

sserifundOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NASDAQ Market Overview

NASDAQ Market Overview

Uploaded by

sserifundCopyright:

Available Formats

NASDAQ (New York) Market Overview Year: 2012 Week: 12

Even though the beginning of the week promised much since Jones Industrial Average Index (DJI), NASDAQ Composite (IXIC) and S&P 500 (INX) showed a modest growth rate, after the market opened on Tuesday all three indexes went downwards sharply and remained growing gradually till the end of Wednesday. Afterwards, Thursdays drop of 0.5 % performed by all 3 indexes influenced their development negatively, although they retrieved positions on Friday. S&P 500 index (INX) finished the week with 0.50% negative growth, Dow Jones Industrial Average (DJI) index decreased by 1.14% and only NASDAQ Composite index (IXIC) increased by 0.41%.

NASDAQ Composite index (IXIC), Dow Jones Industrial Average index (DJI) and S&P 500 index (INX) change during week 11. Source: google.com/finance

NASDAQ Composite index (IXIC) started the week with 3,055.26 points and finished it with 3067.92 points. The index rose sharply starting from Tuesday (March 20) and the growth after Thursdays drop in upcoming days (March 22-23) were very modest. Weekly volume in NASDAQ was 8,441,443,188 shares during week 12, which is on average 60,825,479,787 USD per day. The biggest winner of this week is Dialogic (DLGC) with its outstanding performance, which resulted in 86.30% growth. Anchor Bancorp Wisconsin (ABCW) and China Bak Battery (CBAK) showed impressive results as well resulting in 56.52% and 41.73% growth respectively. This week was very unfortunate for Dearborn Bancorp (DEAR), Cardiome Pharma (CRME) and Marina Biotech (MRNA) that saw their share price decrease by 65.71%, 59.07%, 31.19% respectively.

The best performer this week turned out to be a leading provider of communication technologies Dialogic Inc. (DLGC) showing a massive increase of 86.30%. Opening at 0.74 USD, the stock price was moving sideways and remained stable throughout the week when it suddenly burst on Friday morning, performing a jump of 88.92% in one day and closing at 1.36 USD level. The weekly status quo was broken after Dialogic Inc. had reported fourth quarter and full year 2011 financial results. According to financial statements, total revenues have increased by 5.5%

compared to the third quarter, achieving the highest non-GAAP Gross Margins and EBITDA in the companys history. These announcements have triggered new market trading activity, escorting the stock price to new heights. In the nearest future correction is expected to occur and lower the price. Afterwards, new support level should develop, which is likely to be significantly higher than the one in the beginning of the week.

Dialogic Inc. (DLGC) index change during week 12; Source: google.com/finance

Another great gainer of the week is Anchor Bancorp Wisconsin (ABCW) holding company for Anchor bank, which provides banking services to consumers and businesses in four different states of U.S. This week companys share price jumped from 0.46 USD to 0.72 USD, which is an increase of 56.52%.

Anchor Bancorp Wisconsin (ABCW) index change during week 12. Source: http://www.google.com/finance

Most probably upcoming annual financial statemests (fiscal year end at March 31) are the cause of price growth. Over the last quarter EPS incresed from -0.92 to -0.72 (21%) and according to yahoo.finance estimations next years earnings should become positive. The tendance attracted investors, who are willing to see even greater performance of the current quarter and of the fiscal year 2011, and led to the sharpe growth of the price before publishing annual report. So Anchor Bancorp Wisconsin is a good investment while seeing positive trend of earnings, even though they are negative at the moment; but one should also know if under any circumstances the annual report will indicate worse performance than the last year, the share price would decrease significantly.

China BAK Battery Inc. (CBAK), global manufacturer of lithium-based battery cells, faced an increase of 41.73% in its share price. Reason behind that is companys contract with Geely (one of the fastest-growing automakers in China and the parent company of Volvo Car Corporation) to develop battery packs for a new plug-in hybrid electric (PHEV) sedan. Furthermore, company finally reached consistent and sustainable level offinancial performance which is a great indicator for investors. Relatively low volumes might indicate that price of the share could go either direction (possibility of cerrection is not neglected), although we strongly believe that recent growth is based on strong fundamental evidences.

China BAK Battery Inc. (CBAK) index change during week 12; Source: google.com/finance

The third worst performer of the week is Marina Biotech (MRNA) with 31.19 % decrease in share price. Funny enough, last week the same company was the third largest winner (90.57 % increase in share price). Apparently, successful performance of the company (profitable license agreement with ProNAi Therapeutics) was outweighted by investorswillingness to take the profits; therefore, intense correction followed by high volumes occured in the market. Last four days of the trading week were relatively calm with slight fluctuation around 0.68 USD per share. Looking at the nearest future, companys shares might regain its attractiveness when unaudited report for the first quarter of 2012 will be published.

Marina Biotech (MRNA) index change during week 12; Source: google.com/finance

Week 12 was not very fortunate for share prices and main stock market indexes. Benchmarks struggled to find definite direction as the lack of news left them swinging between small gains and losses. The energy sector had dented the S&P 500, while Hewlett-Packard's decision of merging its printing and personal computing businesses dragged down the Dow. However, tech shares brought the Nasdaq into the positive zone. Week 13 is still under a thick layer of uncertainty. It is anticipated that indexes might continue their trend as an extention of this weeks course, although there are no conclusive evidence to support this argument. It would be right to say that slight fluctuations either up or down might not considered as a big suprsise. Review by: Tautrimas Lengvinas, Edgaras Marcinkus, Nerijus Ruginis, Kipras Kazlauskas

You might also like

- Paccar LeasingDocument11 pagesPaccar LeasingJennifer67% (3)

- Chap 018Document27 pagesChap 018Xeniya Morozova Kurmayeva100% (3)

- The Franchisor Feasibility StudyDocument12 pagesThe Franchisor Feasibility StudyLeighgendary CruzNo ratings yet

- Opm 530 - C1Document18 pagesOpm 530 - C1mamakayden100% (1)

- Nasdaq Mo Week13Document4 pagesNasdaq Mo Week13sserifundNo ratings yet

- Weekly View Feb 11, 2013Document3 pagesWeekly View Feb 11, 2013gkerschensteinerNo ratings yet

- Weekly Wrap For April 23, 2012Document1 pageWeekly Wrap For April 23, 2012Spamcko VisessNo ratings yet

- Stock Market Stages Reversal After Hot Inflation Data JPMorgan, UnitedHealth To Report - Investor's Business DailyDocument7 pagesStock Market Stages Reversal After Hot Inflation Data JPMorgan, UnitedHealth To Report - Investor's Business DailySunny YaoNo ratings yet

- Market Commentary SP Kensho New Economies 2023 q4Document12 pagesMarket Commentary SP Kensho New Economies 2023 q4kellymeinhold327No ratings yet

- Victory INTGY SMID Cap Val Fund Commentary 2022 - 4QDocument3 pagesVictory INTGY SMID Cap Val Fund Commentary 2022 - 4QAgreyes33124No ratings yet

- Market Outlook 19th April 2012Document7 pagesMarket Outlook 19th April 2012Angel BrokingNo ratings yet

- Newsletter: Latest UpdatesDocument6 pagesNewsletter: Latest Updatesapi-199476594No ratings yet

- Newsletter: Montreal Banking TourDocument7 pagesNewsletter: Montreal Banking Tourapi-199476594No ratings yet

- Einhorn Letter Q1 2021Document7 pagesEinhorn Letter Q1 2021Zerohedge100% (4)

- NASDAQ (New York) Market Overview Year: 2012 Week: 14Document4 pagesNASDAQ (New York) Market Overview Year: 2012 Week: 14sserifundNo ratings yet

- Market View: Market Is at Crucial JunctionDocument10 pagesMarket View: Market Is at Crucial JunctionJhaveritradeNo ratings yet

- ARTYX APDYX APHYX QCommentary 1Q18 VRDocument3 pagesARTYX APDYX APHYX QCommentary 1Q18 VRchicku76No ratings yet

- ValuEngine Weekly Newsletter January 27, 2012Document12 pagesValuEngine Weekly Newsletter January 27, 2012ValuEngine.comNo ratings yet

- Spring 2014 HCA Letter FinalDocument4 pagesSpring 2014 HCA Letter FinalDivGrowthNo ratings yet

- Market Overview: New York Stock Exchange (2011, wk.15)Document4 pagesMarket Overview: New York Stock Exchange (2011, wk.15)sserifundNo ratings yet

- ValuEngine Weekly Newsletter August 17, 2012Document9 pagesValuEngine Weekly Newsletter August 17, 2012ValuEngine.comNo ratings yet

- BOFA Market Outlook (2 August 2021)Document9 pagesBOFA Market Outlook (2 August 2021)Li Man KitNo ratings yet

- September 7th, 2012: Market OverviewDocument9 pagesSeptember 7th, 2012: Market OverviewValuEngine.comNo ratings yet

- ValuEngine Weekly News October 12, 2012Document11 pagesValuEngine Weekly News October 12, 2012ValuEngine.comNo ratings yet

- January February 2022 Stock Market Outlook CtaDocument52 pagesJanuary February 2022 Stock Market Outlook Ctamassimo borrioneNo ratings yet

- Assignment 3 - BAFI3192 - s3836577 Luong Quang ThoaiDocument36 pagesAssignment 3 - BAFI3192 - s3836577 Luong Quang ThoaiEnying HuoNo ratings yet

- PDFDocument12 pagesPDFSamder Singh KhangarotNo ratings yet

- Stock Market Closing Summary (Fri, Nov 3)Document3 pagesStock Market Closing Summary (Fri, Nov 3)sofian aitNo ratings yet

- Monthly Report: September 2012Document44 pagesMonthly Report: September 2012GauriGanNo ratings yet

- July August 2022 Stock Market Report CtaDocument42 pagesJuly August 2022 Stock Market Report CtaaNo ratings yet

- US Market Recap November 29Document3 pagesUS Market Recap November 29eldime06No ratings yet

- Morning Review - 081010Document11 pagesMorning Review - 081010pdoorNo ratings yet

- Victory INTGY Discovery Fund 2022 - 1QDocument3 pagesVictory INTGY Discovery Fund 2022 - 1Qag rNo ratings yet

- The Outlook: Tech KnowledgeDocument8 pagesThe Outlook: Tech KnowledgeNorbertCampeauNo ratings yet

- HammerstoneReport Closing ReCap 12/5/14Document5 pagesHammerstoneReport Closing ReCap 12/5/14TheHammerstoneReportNo ratings yet

- JPM Software Technology 2013-07-12 1161609Document24 pagesJPM Software Technology 2013-07-12 1161609Dinesh MahajanNo ratings yet

- May 22 The Small-Cap BeatDocument7 pagesMay 22 The Small-Cap BeatStéphane SolisNo ratings yet

- IBD Mon Jul 25 2001Document53 pagesIBD Mon Jul 25 2001deerfernNo ratings yet

- GI Report February 2012Document3 pagesGI Report February 2012Bill HallmanNo ratings yet

- Market During The Week: Eekly EwsletterDocument5 pagesMarket During The Week: Eekly EwsletteranushresearchNo ratings yet

- Eekly Conomic Pdate: Doug Potash PresentsDocument3 pagesEekly Conomic Pdate: Doug Potash PresentsDoug PotashNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument14 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Weekly Trends March 10, 2016Document5 pagesWeekly Trends March 10, 2016dpbasicNo ratings yet

- PHPQP WRZPDocument6 pagesPHPQP WRZPfred607No ratings yet

- Weekly View Feb 18, 2013Document3 pagesWeekly View Feb 18, 2013gkerschensteinerNo ratings yet

- BZ Pro Weekly Update 03-19-2022Document15 pagesBZ Pro Weekly Update 03-19-2022Kyle MNo ratings yet

- Month in Review:: December 2011Document8 pagesMonth in Review:: December 2011api-117755361No ratings yet

- Da Vinci Code Final ReportDocument16 pagesDa Vinci Code Final Reportthu2langaydautuanNo ratings yet

- JSTREET Volume 319Document10 pagesJSTREET Volume 319JhaveritradeNo ratings yet

- Stock Market ReportDocument5 pagesStock Market ReportPocavNo ratings yet

- HammerstoneReport Closing ReCap - 3/2/15Document4 pagesHammerstoneReport Closing ReCap - 3/2/15TheHammerstoneReportNo ratings yet

- Facebook, Inc. (FB) : Buy SellDocument17 pagesFacebook, Inc. (FB) : Buy SellalvisNo ratings yet

- HammerstoneReport Closing ReCap-5/4/15Document5 pagesHammerstoneReport Closing ReCap-5/4/15TheHammerstoneReportNo ratings yet

- Market Analysis Jan 2022Document29 pagesMarket Analysis Jan 2022Penguin DadNo ratings yet

- JPM Weekly MKT Recap 8-13-12Document2 pagesJPM Weekly MKT Recap 8-13-12Flat Fee PortfoliosNo ratings yet

- US Nonfarm Payrolls: Dow 12,092.15 +29.89 0.25% S&P 500 1,310.87 +3.77 0.29% Nasdaq 2,769.30 +15.42 0.56%Document7 pagesUS Nonfarm Payrolls: Dow 12,092.15 +29.89 0.25% S&P 500 1,310.87 +3.77 0.29% Nasdaq 2,769.30 +15.42 0.56%Andre SetiawanNo ratings yet

- Too Soon To Pivot To Tech 1668441107Document8 pagesToo Soon To Pivot To Tech 1668441107neto.miguelribeiroNo ratings yet

- Market Monitor Week Ending July 15 2011Document5 pagesMarket Monitor Week Ending July 15 2011Empire OneoneNo ratings yet

- PHPXK YO6 UDocument6 pagesPHPXK YO6 Ufred607No ratings yet

- Stock Market News Live Updates: Stocks Fall As Traders Digest Mixed November Jobs Report, Omicron UpdatesDocument5 pagesStock Market News Live Updates: Stocks Fall As Traders Digest Mixed November Jobs Report, Omicron UpdatesTingNo ratings yet

- The Global Macro Digest: Stocks Rebounded On FridayDocument3 pagesThe Global Macro Digest: Stocks Rebounded On FridayJames BoothNo ratings yet

- The Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataFrom EverandThe Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataRating: 2 out of 5 stars2/5 (1)

- Secondary Market Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSecondary Market Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Week 18Document4 pagesWeek 18sserifundNo ratings yet

- NASDAQ (New York) Market Overview Year: 2012 Week: 14Document4 pagesNASDAQ (New York) Market Overview Year: 2012 Week: 14sserifundNo ratings yet

- FTSE Week 17Document2 pagesFTSE Week 17sserifundNo ratings yet

- Week 17 RTSDocument3 pagesWeek 17 RTSsserifundNo ratings yet

- FTSE w15Document3 pagesFTSE w15sserifundNo ratings yet

- Figure 1. RTSI and RTSIN Indices, April 2, 2012 - April 6, 2012. SourceDocument4 pagesFigure 1. RTSI and RTSIN Indices, April 2, 2012 - April 6, 2012. SourcesserifundNo ratings yet

- NasdqOMX Baltic 5Document3 pagesNasdqOMX Baltic 5sserifundNo ratings yet

- Figure 1. RTSI and RTSOG Indices, April 9, 2012 - April 13, 2012. SourceDocument4 pagesFigure 1. RTSI and RTSOG Indices, April 9, 2012 - April 13, 2012. SourcesserifundNo ratings yet

- Overview London Week 13Document3 pagesOverview London Week 13sserifundNo ratings yet

- Oslo Børs (OMX Oslo) - Norwegian Market OverviewDocument4 pagesOslo Børs (OMX Oslo) - Norwegian Market OverviewsserifundNo ratings yet

- DAX w13Document2 pagesDAX w13sserifundNo ratings yet

- Market Overview No.2 Oslo BorsDocument6 pagesMarket Overview No.2 Oslo BorssserifundNo ratings yet

- Nasdaq Mo Week13Document4 pagesNasdaq Mo Week13sserifundNo ratings yet

- STO (Stockholm) - Swedish Stock Market OverviewDocument4 pagesSTO (Stockholm) - Swedish Stock Market OverviewsserifundNo ratings yet

- Week12 RTSDocument3 pagesWeek12 RTSsserifundNo ratings yet

- Gainers.: Week: 11, 12/03/2012 - 16/03/2012Document3 pagesGainers.: Week: 11, 12/03/2012 - 16/03/2012sserifundNo ratings yet

- NASDAQ OMX BALTIC Year: 2012 Week: 12: Chart 1Document3 pagesNASDAQ OMX BALTIC Year: 2012 Week: 12: Chart 1sserifundNo ratings yet

- Newsletter 8Document4 pagesNewsletter 8sserifundNo ratings yet

- Newsletter 7Document4 pagesNewsletter 7sserifundNo ratings yet

- Newsletter 5Document4 pagesNewsletter 5sserifundNo ratings yet

- Tuesday March 26 20241 53 48 Pmvacancy Notice For Various Posts On A Contract BasisDocument6 pagesTuesday March 26 20241 53 48 Pmvacancy Notice For Various Posts On A Contract BasisSonam PandeyNo ratings yet

- Mactan Cebu International Airport Vs Marcos - G.R. No. 120082. September 11, 1996Document12 pagesMactan Cebu International Airport Vs Marcos - G.R. No. 120082. September 11, 1996Ebbe DyNo ratings yet

- Quality Management System Documents: Risk Based Audit Kyuc/Mr/Rba/09Document6 pagesQuality Management System Documents: Risk Based Audit Kyuc/Mr/Rba/09Harriet AliñabonNo ratings yet

- Geogonia v. Court of Appeals DigestDocument6 pagesGeogonia v. Court of Appeals DigestJoy RaguindinNo ratings yet

- 2.0 Element of Conversion (Latest)Document5 pages2.0 Element of Conversion (Latest)b2utifulxxxNo ratings yet

- Public SectorDocument3 pagesPublic SectorAdebowaleIsmailGaniyuNo ratings yet

- Assignment On Monetary Policy in BangladeshDocument6 pagesAssignment On Monetary Policy in BangladeshAhmed ImtiazNo ratings yet

- HP 12c Platinum Financial CalculatorDocument2 pagesHP 12c Platinum Financial CalculatorRodrigoOSGNo ratings yet

- Industrial Sickness in India & Case StudyDocument35 pagesIndustrial Sickness in India & Case StudyNeha Singh100% (4)

- Aca 2024 PlannerDocument1 pageAca 2024 Planneryfarhana2002No ratings yet

- Prospectus & Shares & BorrowingsDocument40 pagesProspectus & Shares & Borrowingsmanish_sherNo ratings yet

- IT - Notes Sir OvaisDocument54 pagesIT - Notes Sir OvaisTauqeer AhmedNo ratings yet

- Kajian Kadar Batas Optimum Optimum Cut-Off Grade Pada Penambangan Nikel Laterit-with-cover-page-V2Document7 pagesKajian Kadar Batas Optimum Optimum Cut-Off Grade Pada Penambangan Nikel Laterit-with-cover-page-V2Frek.3klp5.0195 Ariestasyariah C satuNo ratings yet

- Spring 2014 Exam MLCDocument57 pagesSpring 2014 Exam MLCsteellord123No ratings yet

- It 41Document2 pagesIt 41रवींद्र वैद्यNo ratings yet

- Personal Information: Middleware & Java EngineerDocument5 pagesPersonal Information: Middleware & Java EngineerDonal GurningNo ratings yet

- Tanzim H Choudhury CVDocument2 pagesTanzim H Choudhury CVt_choudhuryNo ratings yet

- The Commencement Date Is The Start of TheDocument4 pagesThe Commencement Date Is The Start of TheArvin BhurtunNo ratings yet

- The Anjuman Wazifa DIRECTOARY1Document25 pagesThe Anjuman Wazifa DIRECTOARY1Shoaib Raza JafriNo ratings yet

- Modul Minggu Ke-2Document14 pagesModul Minggu Ke-2Sandi AdityaNo ratings yet

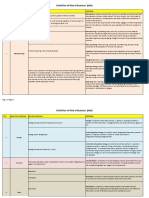

- Definition of Kind of Business (Kob)Document5 pagesDefinition of Kind of Business (Kob)yandexNo ratings yet

- Students' WorkDocument17 pagesStudents' WorkPang Fui ShihNo ratings yet

- Audit Non Conformance ReportDocument4 pagesAudit Non Conformance Reportbudi_alamsyah100% (2)

- Reply To EnquiryDocument16 pagesReply To EnquiryLalaPuspitaNo ratings yet

- Mcdonald's in IndiaDocument20 pagesMcdonald's in IndiaJeetendra TripathyNo ratings yet

- Christina M. Trujillo Proposal - RedactedDocument12 pagesChristina M. Trujillo Proposal - RedactedL. A. PatersonNo ratings yet