Professional Documents

Culture Documents

Endo Nav

Endo Nav

Uploaded by

Mark YuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Endo Nav

Endo Nav

Uploaded by

Mark YuCopyright:

Available Formats

Question1 A) The EndoNav value proposition in OTS product are Improving Ease of use: Simplify the navigation and

reduce the force required to move the

scope through the intestine. Eliminating and Reducing Sedation: Device remove sedation and in some cases if it

could not remove but reduce the sedation. That will reduce not only the complications but also the cost associated with the procedure. The device will make easy to learn the procedure. In comparison to the conventional

device that takes up to 1,000 procedures before make the physician proficient. Improve the Throughput of the procedure. Reduce the time of difficult procedures that will help health centers manage their

variability easily. B) EndoNav has not many competitors rather it has no competitor who is offering that kind of

device. Since OTS devices reduce the risk associated with the procedure that will help EndoNav in getting Regulatory approval. EndoNav has a target market of teaching hospitals, where barriers to entry are very low, where getting a feedback is easy. EndoNav also planned to target HMOS, who are early adopters of new technology. C) As far as fund raising strategy is concerned they need to focus on Pitching first then go for

business plan. They should reduce the time-to-market span. They need to focus on bootstrapping the finances required to get in to the market. So that they can go to angels rather then VCs. EndoNav need changes in its investor presentation in different aspects. One is It should not put too much information in the presentation. Dont put too much technical details in the presentation. EndoNav needs to follow 10/20/30 rule. Means ten slides, Twenty minutes and 30

point font. EndoNav should ensure that the plan is properly integrated with the real-world knowledge, with less jargons and list of potential customers to whom investors can call.

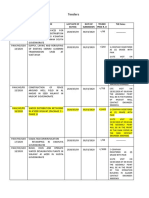

Question2 The summary of the revenue and gross margin expected for 2006-2008 are shown below.

Table1 Cost of Each Device $ Retail Price $ Number of Procedures Revenue $ COGS $ Gross Margin $ 2006 72.50 150 9444 1,416,600 684,690.00 731,910 $ $ $ $ $ 2007 72.50 150 93891 14,083,650 6,807,097.50 7,276,553 $ $ $ $ $ 2008 72.50 150 267344 40,101,600 19,382,440.00 20,719,160

Question 3. A) In order for Jaime Vargas to successfully launch the over the scope (OTS) device with funding from angel investors, he must make sure that he is making effective and efficient use of his people resources. This means that having a large staff may not be ideal, to minimize cost, Vargas may need to retain multi talented individuals that are experienced in more than one function of business operations. As a partner, Kenneth Kelley is able to bring an array of skills to the table. His previous career as a consultant at McKinsey & Company as well as his experience in dealing with biotech and medical device start ups, is going to be a key asset to the business side of EndoNav. It is also noted in his resume that he won the Finance club annual portfolio contest at Stanford's B-school. With these combined skill sets, he could temporarily be responsible for the task of Director as well as CFO. Other talents Endonav will need to retain include product engineers, quality engineers, technician and clinical coordinator all will be crucial to the eventual roll out of the OTS device. It is also mentioned in the case that

EndoNav had carefully protected its intellectual property (IP) since its inception, therefore legal counsel will continue to be a crucial part to sustaining its advantage. Assuming production of the OTS is in progress, marketing talent will need to be retained with the goal of raising awareness for the OTS with the end goal of making this device an industry standard. The required personnel mentioned is mandatory to insure the proper finished product to me introduced to the market.

B) Until the OTS device is introduced to the market and generating revenue, a portion of management can be eliminated for the initial phase. Without a revenue generating product most of management would not have business to manage. It is important that what resources the firm does have are devoted towards the manufacturing, quality control and marketing during the initial phase when the product hits market. Cutting back on management personnel will greatly enhance the firm's ability to fund other priorities since salary accounts for 20.57% of the total annual expense.

C) If funding were to be obtained through an angel investor, the case mentioned the possibility of raising up to $650,000, a substantially smaller figure than the original investment requirement of $6 million. To address the absence of skills and resources, severe cost cut backs will need to take place. Cost reduction in tooling, molds and dies as well as management will be necessary , given these are the largest expenses. As a result of cut backs, the product may take longer than expected to reach the market. D) With a $650,000 angel investment, EndoNav is unlikely going to be able to continue with operations after the first year. Making it through the first year will be a problem. We revised the projected to best fit this expense, Product development expenses were kept the same, however we cut all the other line items by 2/3, getting us to a 2004 projected expense of $568011.67 If EndoNav were to receive another round of investment from angel or venture capitalists they will need to have made progress in their market release

milestones. It will be very difficult to attract further investment by just completing the functional test stage, however there is not enough cash to burn through the second quarter with current expense projections. Following our revised plan in exhibit 11, we cutback on projected expense, capital, and human resource for each of the milestones. Assuming cut backs in all human resource functions except product design engineers we think we can support up to 4 quarters and keep up with those 4 mile stone accomplishments. By completing these first 4 mile stones, we believe we will have proven enough progress for another round of investment.

Quetsion4 a. If the company can raise $650,000 If the company can only raise 650,000, the expected timeline will be the second quarter in the first year and the milestone will be the in-vivo animal studies and 510(k) submission. However, with only 650,000 the company even cannot complete the animal study, which is one of the most important benchmarks for the business plan. Without animal study, the company will not able to do human study, not to mention the fully marketable product. b. If the company can raise $1,000,000 If the company can raise 1,000,000, the expected timeline will be the third quarter in the first year and milestone will be the pilot clinical build and 510(k) approval. With one million dollars fund, the company is able to complete animal studies and move ahead to do human studies, another important level of the business plan. But this amount of fund is still not sufficient enough to totally support the human studies. The company needs additional fund to complete the human studies, and all the other following market studies.

Question 6

Since we cant know the exactly how many shares the funder owns in the pre-money valuation stage, we use the notes from the question to calculate the ownership percentage and valuation. The funders ownership accounts 45.83% and the angel investors ownership account for 54.16%. Please see excel spread sheet. Question 7 Please refer to the attachment.

You might also like

- Customer Centre Design - Toyota WayDocument2 pagesCustomer Centre Design - Toyota Wayshakti prakash naikNo ratings yet

- New Wheels - Project - ReportDocument31 pagesNew Wheels - Project - ReportVIGNESHANo ratings yet

- BestBuy's Withdrawal From Turkish Market - Onur SakaDocument3 pagesBestBuy's Withdrawal From Turkish Market - Onur SakaOnur SakaNo ratings yet

- The Henry Ford of OphthalmologyDocument3 pagesThe Henry Ford of OphthalmologyAbdullah GhaniNo ratings yet

- Case Hardhat - Rashik, PoorviDocument6 pagesCase Hardhat - Rashik, PoorviRashik Gupta100% (1)

- Money Cash Flow - ADocument9 pagesMoney Cash Flow - Ashubham tiwari100% (1)

- Ecotripp Simulation Reflection Paper PDFDocument5 pagesEcotripp Simulation Reflection Paper PDFprabhuNo ratings yet

- RoutingDocument2 pagesRoutingCorey PageNo ratings yet

- Case Study: Corporate New Ventures at Procter and GambleDocument5 pagesCase Study: Corporate New Ventures at Procter and GambleVerVe LimNo ratings yet

- Startup Metrics For Pirates Long Version463Document20 pagesStartup Metrics For Pirates Long Version463AndryNo ratings yet

- International Marketing Failure Case:: Riasat Muhammad AmirDocument5 pagesInternational Marketing Failure Case:: Riasat Muhammad AmirAl-Rafi AhmedNo ratings yet

- Vertex Case - Team 1Document6 pagesVertex Case - Team 1heytherethereNo ratings yet

- Question 6 (5 Points - Max 150 Words) : Grading CriteriaDocument3 pagesQuestion 6 (5 Points - Max 150 Words) : Grading CriteriaroyNo ratings yet

- Tomtom Case Study AnswersDocument2 pagesTomtom Case Study AnswersSyedMuneebBukhari100% (1)

- Mba4643-Individual Project Coursework: Finance and Economics MBA4643Document19 pagesMba4643-Individual Project Coursework: Finance and Economics MBA4643Vivian VoNo ratings yet

- Crack The Case System Case BasicsDocument44 pagesCrack The Case System Case Basicsaxstar25No ratings yet

- The Deli That DidDocument2 pagesThe Deli That DidAaron MartinNo ratings yet

- Introduction To Solution Marketing For SoftwareDocument36 pagesIntroduction To Solution Marketing For Softwaresnrobins100% (2)

- Group-2 Report On L&T-Quantitative & Qualitative AnalysisDocument41 pagesGroup-2 Report On L&T-Quantitative & Qualitative AnalysisPankaj Kumar Bothra100% (1)

- IMC RoughDocument11 pagesIMC Roughrishi100% (2)

- Talks at Google - Eric Ries On The Lean StartupDocument3 pagesTalks at Google - Eric Ries On The Lean StartupKevin RoyNo ratings yet

- 3G+Way Eng Excerpt v1Document57 pages3G+Way Eng Excerpt v1kunalwarwickNo ratings yet

- Bob12 v5 Final 4 30march2014Document155 pagesBob12 v5 Final 4 30march2014api-250805028No ratings yet

- Sports Sponsorship Is It Worth ItDocument3 pagesSports Sponsorship Is It Worth Itchenneye100% (1)

- Calculation of Exchange Ratio From The Perspective of The Acquired and The Acquiring FirmDocument16 pagesCalculation of Exchange Ratio From The Perspective of The Acquired and The Acquiring FirmabhishekNo ratings yet

- Case Study 3 - A New Supply Chain Project Has Nike Running For Its LifeDocument4 pagesCase Study 3 - A New Supply Chain Project Has Nike Running For Its LifeMUHAMMAD RAFIQNo ratings yet

- The Goal Book Review-RknDocument3 pagesThe Goal Book Review-Rknrknanduri100% (1)

- Problems With Mass CustomizationDocument22 pagesProblems With Mass CustomizationmkauraNo ratings yet

- Thank You For Smoking'Document5 pagesThank You For Smoking'Molla Ashiqul HaqNo ratings yet

- Chemalite EngDocument3 pagesChemalite EngKrmn HernandezNo ratings yet

- Shegeftihaye JahanDocument267 pagesShegeftihaye JahanKhashayar ModaberiNo ratings yet

- Sample Final Exam SolutionDocument73 pagesSample Final Exam SolutionAK_ChavanNo ratings yet

- What Is Strategy? by Michael PorterDocument2 pagesWhat Is Strategy? by Michael PorterArjun Kohli100% (1)

- Syeda Warqa Zaka - AssignmentDocument13 pagesSyeda Warqa Zaka - AssignmentWarqa ZakaNo ratings yet

- HBR Apple Case AnalysisDocument5 pagesHBR Apple Case AnalysisSK (아얀)No ratings yet

- One-Plus and WaltonDocument16 pagesOne-Plus and WaltonSudipto Tahsin AurnabNo ratings yet

- Developing A Strategic Service VisionDocument18 pagesDeveloping A Strategic Service VisionadrielgwNo ratings yet

- BCG Matrix of Itc LTD v02 1222197387335911 8Document25 pagesBCG Matrix of Itc LTD v02 1222197387335911 8muntaquirNo ratings yet

- Iggy's Bread of The World - Written Analysis and CommunicationDocument3 pagesIggy's Bread of The World - Written Analysis and CommunicationAshmitaSengupta50% (2)

- Globapharm Context: Reveal AnswerDocument4 pagesGlobapharm Context: Reveal AnswerJorgePaterninaNo ratings yet

- Louis Vuitton Moet HennessyDocument7 pagesLouis Vuitton Moet HennessyPriya SarkarNo ratings yet

- KineticHonda 1Document13 pagesKineticHonda 1Sruthi MohananNo ratings yet

- OpenIDEO Case NotesDocument3 pagesOpenIDEO Case NotesShelton NazarethNo ratings yet

- Founders Dilemmas Surprising FactsDocument2 pagesFounders Dilemmas Surprising FactsKrishnan Subrahmanyam100% (2)

- Financial Model Template by SlidebeanDocument363 pagesFinancial Model Template by SlidebeanYargop AnalyticsNo ratings yet

- Invisible Advantage (Review and Analysis of Low and Kalafut's Book)From EverandInvisible Advantage (Review and Analysis of Low and Kalafut's Book)No ratings yet

- Kitty Hawk Casedoc - California Institute of TechnologyDocument6 pagesKitty Hawk Casedoc - California Institute of Technologytng8No ratings yet

- Marketing Research - Self Driving CarsDocument16 pagesMarketing Research - Self Driving CarsTeama DrockNo ratings yet

- Summary of Josh Anon & Carlos González de Villaumbrosia's The Product BookFrom EverandSummary of Josh Anon & Carlos González de Villaumbrosia's The Product BookNo ratings yet

- TECSYSDocument25 pagesTECSYSJenny QuachNo ratings yet

- GE 9 CellDocument20 pagesGE 9 CellakhilNo ratings yet

- Accenture Consulting, SC&OMDocument2 pagesAccenture Consulting, SC&OMashishshukla1989No ratings yet

- Value Merchants Anderson eDocument5 pagesValue Merchants Anderson esarah123No ratings yet

- Retail Supply Chain Transformation ReportDocument5 pagesRetail Supply Chain Transformation ReportVSCNo ratings yet

- Business Model GenerationDocument16 pagesBusiness Model Generationshahmed999100% (4)

- Innovative Training Methodologies-III Case Study Teaching and WritingDocument27 pagesInnovative Training Methodologies-III Case Study Teaching and WritingSiddharth MehtaNo ratings yet

- Marketing Strategy For Onida TVDocument7 pagesMarketing Strategy For Onida TVmith_22_nitw100% (2)

- IKEA Case Study Write-UpDocument3 pagesIKEA Case Study Write-UpkatwalkeNo ratings yet

- Fluctuations Occur When One Is Unable To Precisely Predict Events or Quantities (GoldrattDocument6 pagesFluctuations Occur When One Is Unable To Precisely Predict Events or Quantities (GoldrattVinay Dabholkar100% (1)

- Risky Business of Hiring StarsDocument1 pageRisky Business of Hiring StarsJunior CCCNo ratings yet

- Registration Update Sheet: Vision Mount Tabor Finance CorporationDocument1 pageRegistration Update Sheet: Vision Mount Tabor Finance CorporationMa. Teresa GallardoNo ratings yet

- National Union of Workers in Hotel Restaurant and Allied Industries (NUWHRAIN - APL-IUF) v. Philippine Plaza Holdings, IncDocument3 pagesNational Union of Workers in Hotel Restaurant and Allied Industries (NUWHRAIN - APL-IUF) v. Philippine Plaza Holdings, IncKobe Lawrence VeneracionNo ratings yet

- Tax Invoice / Credit Note: Simply Set Up Autopay To Effortlessly Pay For Your BillsDocument4 pagesTax Invoice / Credit Note: Simply Set Up Autopay To Effortlessly Pay For Your BillsVisnu SankarNo ratings yet

- Low Cost HousingDocument4 pagesLow Cost HousingE.m. SoorajNo ratings yet

- HP Culture OrigDocument20 pagesHP Culture Origpeacock yadavNo ratings yet

- Maxam Price ListDocument2 pagesMaxam Price Listmapyk100% (1)

- Entrepreneurship Development and InnovationDocument6 pagesEntrepreneurship Development and Innovationvamsi krishnaNo ratings yet

- Tenders: Tender No. Description Last Date of Buying Date of Submission Tender Price R. O THE NotesDocument2 pagesTenders: Tender No. Description Last Date of Buying Date of Submission Tender Price R. O THE NotesAli MustafaNo ratings yet

- FA2 Syllabus and Study Guide 2021-22Document11 pagesFA2 Syllabus and Study Guide 2021-22Aleena MuhammadNo ratings yet

- E-Commerce Website DesignDocument33 pagesE-Commerce Website Designআশরাফুল অ্যাস্ট্রো100% (1)

- Godrej Parkland Estate - First LookDocument21 pagesGodrej Parkland Estate - First LookMayank PalNo ratings yet

- Nandini (CSR)Document77 pagesNandini (CSR)vardhanbhosale52No ratings yet

- Evidencia 4: Sesión Virtual "Prepositions"Document5 pagesEvidencia 4: Sesión Virtual "Prepositions"J'uan H'ernandezNo ratings yet

- Dissertation On BrexitDocument5 pagesDissertation On BrexitWriteMyPaperCollegeUK100% (1)

- Chapter 4Document17 pagesChapter 4aurorashiva1No ratings yet

- Isaac Ramdeen - Management of Business - Internal Assessment - CAPE 2023 - Unit #1Document40 pagesIsaac Ramdeen - Management of Business - Internal Assessment - CAPE 2023 - Unit #1Isaac RamdeenNo ratings yet

- Chapter - 6: 6.1 ConclusionDocument21 pagesChapter - 6: 6.1 ConclusionTalfa ShamsiNo ratings yet

- Tutorial 8 - Stamp Duty and Leasing - 2022Document4 pagesTutorial 8 - Stamp Duty and Leasing - 2022Keat 98No ratings yet

- ITIL Process ListDocument1 pageITIL Process ListaminaNo ratings yet

- Long-Term Assets Ii: Investments and IntangiblesDocument43 pagesLong-Term Assets Ii: Investments and IntangiblesGhita Tria MeitinaNo ratings yet

- Paste Backfill - Adding Value To Underground Mining: N.M. Slade Golder Paste Technology (Europe) LTD, United KingdomDocument12 pagesPaste Backfill - Adding Value To Underground Mining: N.M. Slade Golder Paste Technology (Europe) LTD, United KingdomBakang MolefeNo ratings yet

- Ibm Spss OverviewDocument4 pagesIbm Spss Overviewapi-261191844No ratings yet

- Creating A Connection From Microstrategy To Oracle Autonomous Data WarehouseDocument7 pagesCreating A Connection From Microstrategy To Oracle Autonomous Data WarehouseramilanezNo ratings yet

- Module-3: Advanced Material Removal Processes: Lecture No-9Document6 pagesModule-3: Advanced Material Removal Processes: Lecture No-9Pradip PatelNo ratings yet

- New Installment SaleDocument20 pagesNew Installment SaleIbnu Bang BangNo ratings yet

- Januari 19 Rekor RubahDocument7 pagesJanuari 19 Rekor RubahAnisa Medical CentreNo ratings yet

- Assignment Vs Novation - Construction ContractsDocument4 pagesAssignment Vs Novation - Construction ContractsanupjpNo ratings yet

- BiniDocument13 pagesBinibiniambrhane777No ratings yet