Professional Documents

Culture Documents

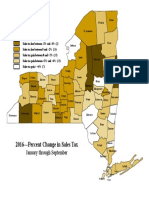

Sales Tax Document

Sales Tax Document

Uploaded by

Time Warner Cable NewsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sales Tax Document

Sales Tax Document

Uploaded by

Time Warner Cable NewsCopyright:

Available Formats

Sales and Use Tax Rates On Clothing and Footwear

Effective April 1, 2012

Publication 718C

(3/12)

Beginning April 1, 2012, clothing, footwear, and items used to make or repair exempt clothing sold for less than $110 per item or pair are exempt from the New York State 4% sales tax, the local tax in those localities that provide the exemption, and the % Metropolitan Commuter Transportation District (MCTD) tax within the exempt localities in the MCTD. The MCTD consists of the city of New York and the counties of Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester. The exemption applies only to clothing and footwear worn by humans. It also applies to most fabric, thread, yarn, buttons, snaps, hooks, zippers, and similar items that become a physical component part of exempt clothing, or that are used to make or repair exempt clothing. The following are not eligible for exemption: Clothing and footwear that sold for $110 or more per item or pair. Costumes or rented formal wear.

Items made from pearls, precious or semi-precious stones, jewels, or metals, or imitations thereof, that are used to make or repair clothing eligible for exemption. Athletic equipment. Protective devices, such as motorcycle helmets. For more information, see TSB-M-12(3)S, State Sales Tax Exemption for Clothing and Footwear Costing less than $110 is Restored Effective April 1, 2012. For a detailed list of exempt and taxable items, see TSB-M-06(6)S, Year-Round Sales and Use Tax Exemption of Clothing, Footwear, and Items Used to Make or Repair Exempt Clothing (Effective April 1, 2006). Use this publication to determine the applicable sales tax rates in each county and city that imposes sales tax. Any items changed from the previous version are noted in boldface italics.

Part 1A Jurisdictions that provided for this exemption

Sales of eligible clothing and footwear costing less than $110 in the jurisdictions below are fully exempt from all state and local sales and use tax (including the MCTD tax).

Taxing jurisdiction Chautauqua County Chenango County (outside the following) Norwich (city) Columbia County Delaware County Greene County Hamilton County Madison County (outside the city of Oneida) Tioga County Wayne County New York City

Tax rate % 0 0 0 0 0 0 0 0 0 0 0

Publication 718C (3/12) (back)

Part 2 Jurisdictions that did not provide for the local exemption

Sales of eligible clothing and footwear costing less than $110 in the jurisdictions below are subject to a local tax. Taxing jurisdiction Albany County Allegany County Broome County Cattaraugus County (outside the following) Olean (city) Salamanca (city) Cayuga County (outside the following) Auburn (city) Chemung County Clinton County Cortland County Dutchess County Erie County Essex County Franklin County Fulton County (outside the following) Gloversville (city) Johnstown (city) Genesee County Herkimer County Jefferson County Lewis County Livingston County Madison County (outside the following) see Part 1A Oneida (city) Monroe County Montgomery County Nassau County Niagara County Oneida County (outside the following) Rome (city) Utica (city) Onondaga County Ontario County Tax rate % 4 4 4 4 4 4 4 4 4 4 4 4 4 3 4 4 4 4 4 4 3 3 4 2 4 4 4 4 4 4 4 4 3 Taxing jurisdiction Orange County Orleans County Oswego County (outside the following) Oswego (city) Otsego County Putnam County Rensselaer County Rockland County St. Lawrence County Saratoga County (outside the following) Saratoga Springs (city) Schenectady County Schoharie County Schuyler County Seneca County Steuben County (outside the following) Corning (city) Hornell (city) Suffolk County Sullivan County Tompkins County (outside the following) Ithaca (city) Ulster County Warren County (outside the following) Glens Falls (city) Washington County Westchester County (outside the following) Mount Vernon (city) New Rochelle (city) White Plains (city) Yonkers (city) Wyoming County Yates County Tax rate % 4 4 4 4 4 4 4 4 3 3 3 4 4 4 4 4 4 4 4 4 4 4 4 3 3 3 3 4 4 4 4 4 4

Need help?

Visit our Web site at www.tax.ny.gov

Telephone assistance Sales Tax Information Center: To order forms and publications: (518) 485-2889 (518) 457-5431

get information and manage your taxes online check for new online services and features

Text Telephone (TTY) Hotline (for persons with hearing and speech disabilities using a TTY): If you have access to a TTY, contact us at (518) 485-5082. If you do not own a TTY, check with independent living centers or community action programs to find out where machines are available for public use.

Persons with disabilities: In compliance with the Americans with Disabilities Act, we will ensure that our lobbies, offices, meeting rooms, and other facilities are accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities, call the information center.

You might also like

- Past BillsDocument39 pagesPast BillsSal Salas100% (3)

- PastBills PDFDocument37 pagesPastBills PDFKhanhNo ratings yet

- Oct Bank - NewDocument7 pagesOct Bank - NewLisa Hester100% (1)

- Consumer Wireless 021711Document4 pagesConsumer Wireless 021711AndreHendricksNo ratings yet

- StatementDocument20 pagesStatementLevi Paul OrlickNo ratings yet

- ATT 298066469287 20140216 FebDocument10 pagesATT 298066469287 20140216 FebDixit ManishNo ratings yet

- BUS345 Midterm 1 NotesDocument31 pagesBUS345 Midterm 1 NotesՄարիա ՄինասեանNo ratings yet

- Court Documents Filed by Gary Thibodeau's AttorneysDocument192 pagesCourt Documents Filed by Gary Thibodeau's AttorneysTime Warner Cable News100% (1)

- Ils Cat II-III ChecksDocument2 pagesIls Cat II-III ChecksEnrique Corvalán HernándezNo ratings yet

- California Cities and County Sales and Use Tax Rates 2012Document23 pagesCalifornia Cities and County Sales and Use Tax Rates 2012L. A. PatersonNo ratings yet

- Sales and Use Tax Guide: February 2011Document52 pagesSales and Use Tax Guide: February 2011dinkemNo ratings yet

- Sales and Use Tax in Maryland Presentation To Legislature 20110726Document29 pagesSales and Use Tax in Maryland Presentation To Legislature 20110726Paul MastersNo ratings yet

- Filing Instructions: Please Follow These Instructions CarefullyDocument4 pagesFiling Instructions: Please Follow These Instructions CarefullyMafer ChavezNo ratings yet

- Sales Tax FormDocument4 pagesSales Tax FormzilchhourNo ratings yet

- 5891 14342821954Document16 pages5891 14342821954rachelj_85No ratings yet

- 2011 Ladonia ProfileDocument5 pages2011 Ladonia ProfileTCOG Community & Economic DevelopmentNo ratings yet

- Chris Fick League of Oregon Cities Mayors Open Forum September 27, 2012Document20 pagesChris Fick League of Oregon Cities Mayors Open Forum September 27, 2012Statesman JournalNo ratings yet

- BOE Letter To Taxpayers Informing Them of Use TaxDocument1 pageBOE Letter To Taxpayers Informing Them of Use TaxDavid DuranNo ratings yet

- California City and County Sales and Use Tax Rates: California State Board of EqualizationDocument23 pagesCalifornia City and County Sales and Use Tax Rates: California State Board of Equalizationapi-2494755100% (2)

- Fiscal Sustainability Analysis: Nassau CountyDocument22 pagesFiscal Sustainability Analysis: Nassau Countyapi-298511181No ratings yet

- Do Not Call Data: National RegistryDocument24 pagesDo Not Call Data: National RegistryMark ReinhardtNo ratings yet

- Business Permitting and Licensing SystemDocument13 pagesBusiness Permitting and Licensing SystemCharlie C. BastidaNo ratings yet

- Property Tax Reform PresentationDocument29 pagesProperty Tax Reform PresentationStatesman JournalNo ratings yet

- Map of Sales TaxDocument1 pageMap of Sales TaxrkarlinNo ratings yet

- State Tax GuideDocument158 pagesState Tax GuidecamatnguNo ratings yet

- Localsalestaxcollections0215 PDFDocument3 pagesLocalsalestaxcollections0215 PDFjspectorNo ratings yet

- FL Voluntary Disclosure ProgramDocument3 pagesFL Voluntary Disclosure Programmcampo7No ratings yet

- Utah Form TC-20 Tax Return and InstructionsDocument26 pagesUtah Form TC-20 Tax Return and InstructionsBrandonNo ratings yet

- Budget OpinionnaireDocument22 pagesBudget OpinionnaireVivek JhaNo ratings yet

- SummaryDocument2 pagesSummaryChris AlcalaNo ratings yet

- CA District TaxDocument5 pagesCA District Taxkimhoang_16927574No ratings yet

- 21 Usefulcharts 2012-13Document20 pages21 Usefulcharts 2012-13sharmaji23No ratings yet

- PPD 647 - Tax Paper - Cross Border Shopping - RaraDocument6 pagesPPD 647 - Tax Paper - Cross Border Shopping - RarararaNo ratings yet

- LGU Taxation and Revenue Practices October 2015Document46 pagesLGU Taxation and Revenue Practices October 2015Mark Lester Lee Aure100% (2)

- Envelope PDFDocument104 pagesEnvelope PDFLeonard BrownNo ratings yet

- 2011 Howe ProfileDocument5 pages2011 Howe ProfileTCOG Community & Economic DevelopmentNo ratings yet

- Dallas Garage Sales Ordinance UpdateDocument11 pagesDallas Garage Sales Ordinance UpdateRobert WilonskyNo ratings yet

- 130 UDocument2 pages130 UNoelleNo ratings yet

- Type or Print Neatly in Ink: SPV $ Appraisal Value $Document2 pagesType or Print Neatly in Ink: SPV $ Appraisal Value $uriel huertaNo ratings yet

- F 1040 VDocument2 pagesF 1040 Vhottadot730@gmail.comNo ratings yet

- 130 U 3Document2 pages130 U 3Juan Escobar JuncalNo ratings yet

- GEN 010 Lesson 1-4Document28 pagesGEN 010 Lesson 1-4Carswel Hidalgo HornedoNo ratings yet

- 2010 IRS Notifications To The City of Lauderdake LakesDocument8 pages2010 IRS Notifications To The City of Lauderdake LakesMy-Acts Of-SeditionNo ratings yet

- Data Book: For Fiscal Year 2010Document24 pagesData Book: For Fiscal Year 2010Mark ReinhardtNo ratings yet

- International Marketing 200094 Pre-Class Activities Chapters 3 & 4Document8 pagesInternational Marketing 200094 Pre-Class Activities Chapters 3 & 4Uyen Nhi LeNo ratings yet

- BIR Form 2307Document20 pagesBIR Form 2307Lean Isidro0% (1)

- UST GN 2011 - Taxation Law IndexDocument2 pagesUST GN 2011 - Taxation Law IndexGhost100% (1)

- 4 Self Contained Units (FourPlex)Document6 pages4 Self Contained Units (FourPlex)VinceNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument3 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- GT 800013Document3 pagesGT 800013Marco CorvoNo ratings yet

- US Internal Revenue Service: p1045 - 2002Document12 pagesUS Internal Revenue Service: p1045 - 2002IRSNo ratings yet

- Vin 1vxbr12excp901213Document3 pagesVin 1vxbr12excp901213Agung JackNo ratings yet

- Credit Policy Updates - May 8, 2013: Sliding Scale Maximum Loan To Value (LTV) - Conventional (1 To 4 Unit Properties)Document3 pagesCredit Policy Updates - May 8, 2013: Sliding Scale Maximum Loan To Value (LTV) - Conventional (1 To 4 Unit Properties)Mortgage ResourcesNo ratings yet

- Sales Tax: Main ArticleDocument1 pageSales Tax: Main ArticleMaika J. PudaderaNo ratings yet

- 2011 Publication BallotDocument4 pages2011 Publication BallotvaildailyNo ratings yet

- 2016 State Shared Revenue Report FinalDocument10 pages2016 State Shared Revenue Report Finalapi-243774512No ratings yet

- General Income Tax and Benefit Guide: Canada Revenue AgencyDocument63 pagesGeneral Income Tax and Benefit Guide: Canada Revenue AgencyvolvoproNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- State Sales and Use Tax ReturnDocument2 pagesState Sales and Use Tax ReturnRick JordanNo ratings yet

- AN ALTERNATIVE GOVERNMENT SYSTEM: NEW PROVISIONAL INCOME TAX SYSTEM NEW ELECTION AND VOTING SYSTEMFrom EverandAN ALTERNATIVE GOVERNMENT SYSTEM: NEW PROVISIONAL INCOME TAX SYSTEM NEW ELECTION AND VOTING SYSTEMNo ratings yet

- J.K. Lasser's Guide to Self-Employment: Taxes, Strategies, and Money-Saving Tips for Schedule C FilersFrom EverandJ.K. Lasser's Guide to Self-Employment: Taxes, Strategies, and Money-Saving Tips for Schedule C FilersNo ratings yet

- US V Sheldon Silver ComplaintDocument35 pagesUS V Sheldon Silver ComplaintNick ReismanNo ratings yet

- A Public Health Review of High Volume Hydraulic Fracturing For Shale Gas DevelopmentDocument184 pagesA Public Health Review of High Volume Hydraulic Fracturing For Shale Gas DevelopmentMatthew LeonardNo ratings yet

- Market .Impact of A Proposed Tyre, New York Casino On Turning Stone - Final.10.27.2014Document100 pagesMarket .Impact of A Proposed Tyre, New York Casino On Turning Stone - Final.10.27.2014glenncoin100% (1)

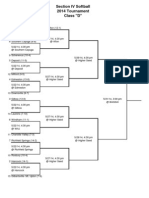

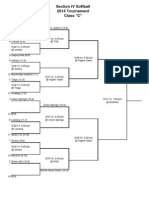

- Section IV Softball Brackets: DDocument1 pageSection IV Softball Brackets: DTime Warner Cable NewsNo ratings yet

- Eric Frein: What He Had in The HangarDocument14 pagesEric Frein: What He Had in The HangarAnonymous arnc2g2NNo ratings yet

- Judge's Ruling Dismissing Murder Charge Against Oral "Nick" HillaryDocument7 pagesJudge's Ruling Dismissing Murder Charge Against Oral "Nick" HillaryTime Warner Cable NewsNo ratings yet

- Cuomo Pens Letter To Push Quicker Action On Medical MarijuanaDocument1 pageCuomo Pens Letter To Push Quicker Action On Medical MarijuanaTime Warner Cable NewsNo ratings yet

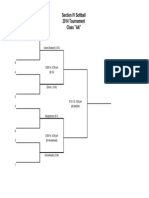

- Section IV Softball 2014 TournamentDocument5 pagesSection IV Softball 2014 TournamentTime Warner Cable NewsNo ratings yet

- Section IV Playoff Bracket: Softball ADocument1 pageSection IV Playoff Bracket: Softball ATime Warner Cable NewsNo ratings yet

- Section IV Softball 2014 Tournament Class "C"Document1 pageSection IV Softball 2014 Tournament Class "C"Time Warner Cable NewsNo ratings yet

- Baseball Brackets 2014Document6 pagesBaseball Brackets 2014Time Warner Cable NewsNo ratings yet

- Section IV Softball 2014 Tournament Class "AA"Document1 pageSection IV Softball 2014 Tournament Class "AA"Time Warner Cable NewsNo ratings yet

- Girls Lacrosse 2014 BracketsDocument3 pagesGirls Lacrosse 2014 BracketsTime Warner Cable NewsNo ratings yet

- Ffa History Lesson PlanDocument10 pagesFfa History Lesson Planapi-353178625100% (1)

- 9300.97 12-13-19 XFIIRE Models 300B - 1000B Type H & WH IPLDocument7 pages9300.97 12-13-19 XFIIRE Models 300B - 1000B Type H & WH IPLHector FajardoNo ratings yet

- Prowessiq Data Dictionary PDFDocument5,313 pagesProwessiq Data Dictionary PDFUtkarsh SinhaNo ratings yet

- ISB HandbookDocument62 pagesISB HandbookSteve RichardsNo ratings yet

- Baseball Golf OutingDocument2 pagesBaseball Golf OutingDaveNo ratings yet

- Creating Analytical Apps: Alteryx Tutorial Workshop Series 4Document19 pagesCreating Analytical Apps: Alteryx Tutorial Workshop Series 4meajagunNo ratings yet

- Ibs Kuantan Main 1 30/06/19Document1 pageIbs Kuantan Main 1 30/06/19Muhammad Zaim EmbongNo ratings yet

- Refurbishment and Subcontracting 2 Test CatalogDocument15 pagesRefurbishment and Subcontracting 2 Test CatalogmallikNo ratings yet

- Motor ProtectionDocument40 pagesMotor Protection7esabat7033No ratings yet

- SQL Top 50 Interview Questions and AnswersDocument28 pagesSQL Top 50 Interview Questions and AnswersBiplab SarkarNo ratings yet

- Exyte Malaysia - Energized Electrical Work (EEW) TrainingDocument35 pagesExyte Malaysia - Energized Electrical Work (EEW) TrainingThirumaran MuthusamyNo ratings yet

- Windows KMS Activator Ultimate 2021 5.3Document13 pagesWindows KMS Activator Ultimate 2021 5.3dadymamewa0% (1)

- Ra 11549Document6 pagesRa 11549Joemar Manaois TabanaoNo ratings yet

- Databases and Applications ProgramsDocument7 pagesDatabases and Applications ProgramsShibinMohammedIqbalNo ratings yet

- Trash Bin Monitoring SystemDocument15 pagesTrash Bin Monitoring SystemJanjie OlaivarNo ratings yet

- Riverside County FY 2020-21 First Quarter Budget ReportDocument50 pagesRiverside County FY 2020-21 First Quarter Budget ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- Multimedia Magic!: Microsoft Powerpoint) To Make BusinessDocument1 pageMultimedia Magic!: Microsoft Powerpoint) To Make BusinessfarveNo ratings yet

- Benefits of Binary MLM Plan For Network MarketingDocument4 pagesBenefits of Binary MLM Plan For Network MarketingSachin SinghNo ratings yet

- An Agent-Based Dynamic Occupancy Schedule Model For Prediction of HVAC Energy Demand in An Airport Terminal BuildingDocument10 pagesAn Agent-Based Dynamic Occupancy Schedule Model For Prediction of HVAC Energy Demand in An Airport Terminal BuildingKapil SinhaNo ratings yet

- TCB Installation Booklet HRCDocument11 pagesTCB Installation Booklet HRCAlexandre FonsecaNo ratings yet

- TicketParquesSintra 1Document3 pagesTicketParquesSintra 1hyper16No ratings yet

- Weller WCB 2 Mjerac Tempearture PDFDocument1 pageWeller WCB 2 Mjerac Tempearture PDFslvidovicNo ratings yet

- Stepsmart Assignment July 30Document15 pagesStepsmart Assignment July 30MeconNo ratings yet

- War Diary October 1943 (All) PDFDocument59 pagesWar Diary October 1943 (All) PDFSeaforth WebmasterNo ratings yet

- Grade 8 - Criteria B and C Factors Affecting Rocket Performance AssessmentDocument8 pagesGrade 8 - Criteria B and C Factors Affecting Rocket Performance Assessmentapi-291745547No ratings yet

- Makalah Bahasa InggrisDocument9 pagesMakalah Bahasa InggrisFluxNo ratings yet

- 1 - en - Print - Indd - 0014431Document261 pages1 - en - Print - Indd - 0014431Custom Case BMWNo ratings yet

- Rotary Newsletter May 4 2010Document3 pagesRotary Newsletter May 4 2010David KellerNo ratings yet

- LO 3. Control Hazards and Risks in The Workplace 3.1 Follow Consistently OHS Procedure For Controlling Hazards/risksDocument3 pagesLO 3. Control Hazards and Risks in The Workplace 3.1 Follow Consistently OHS Procedure For Controlling Hazards/risksChristine Joy ValenciaNo ratings yet