Professional Documents

Culture Documents

Allied Plywood

Allied Plywood

Uploaded by

Diarmuid McDonnellOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allied Plywood

Allied Plywood

Uploaded by

Diarmuid McDonnellCopyright:

Available Formats

Democratic Enterprise: Ethical business for the 21st century

Co-operative Education Trust Scotland operative

Case Study 6.3

Allied Plywood

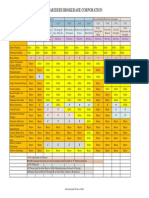

Allied Plywood is a wholesaler and manufacturer of plywood and related building materials. Established in 1951 by Ed and Phyllis Sanders, the company is now headquartered in Virginia and operates across multiple states in the south eastern states of America. It was one of the first companies to establish an ESOP and has managed to combine one hundred per cent employee ownership with a unique financial and governance participation structure. ESOP The first ESOP was established in 1977 as a means for the owners to retire from the business. Acknowledging that the employees had played a significant role in the development of the business, the owners felt strongly that the employees should be given the option to purchase the company. By 1981, the ESOP held almost fifty per cent of the companys shares. This process did . not involve the employees providing any of the funding needing to purchase the shares; a portion of the companys pre-tax profits was placed in the ESOP annually and used to purchase the shares tax used from the original owners (known as an unleveraged ESOP). In 1982, the ESOP trustees took out a bank loan and purchased the remaining shares from the owners, meaning Allied Plywood had now become one hundred per cent employee employee-owned. From 1981 onwards, the companys performance improved dramatically. Sales increased ten times while the number of employees increased seven fold. Even in 1990, a year of severe recession in the housing industry, productivity was over seventeen per cent higher than before the ESOP. Once the company repaid the loan it took out to enable the ESOP to purchase the shares in 1985, it issued new shares to the ESOP to enable current and future employees to participate in the employee ownership of the company. The net value of the equity in the company increased from The $1.3m in 1981 to $7.4m in 1995 and the benefits to employees are substantial; all employees who have been on the Allied payroll since the ESOP was installed have accumulated accounts close to or exceeding $100,000. A note on vesting Employees become eligible for shares in the ESOP from the day they are hired. Most ESOP companies have a probationary period of one year before employees are allowed participate in the scheme. Employees are not entitled to the full value of their shares immediately, however; the process of vesting occurs over a number of years.

Creative Commons 3.0 Licence

Democratic Enterprise: Ethical business for the 21st century

Co-operative Education Trust Scotland operative

ESOP accounts of those who quit or are fired before three years of service are zero per cent vested, meaning that when they leave, they forfeit all their accumulated ESOP benefits. Upon three years their of service, vesting begins at twenty per cent, with twenty per cent added each following year. In year seven, an employee's account becomes one hundred per cent vested and is no longer subject to any forfeiture. Those who reach retirement age, become disabled, or die become one hundred ure. per cent vested automatically. Combining financial reward with participation in governance Since the 1960s, the company operates a profit related pay system whereby employees a paid are less than the market rate (around twenty per cent) but are entitled to an equal share of thirty per cent of operating profit, paid monthly in arrears. This significant financial participation was coupled with a practice of sharing company performance information. There is also an annual cash performance profit distribution based on a weighted formula based on the individual performance of the employee (for example, number of days worked, peer review, and importance of the job). There is something reminiscent of a worker co-operative about Allied Plywoods profit operative profit-related pay system. The employees are motivated by individual interests (annual bonus based on performance) as well as a mutual interest in ensuring the company is profitable long long-term (boosting their ESOP accounts and the ability of future employees to participate in the ESOP). OP The company has five board members who govern the business and also act as the trustees of the ESOP. Two of the members are elected (on a one share/one vote system) by management representatives and two from worker representatives. The fifth member is an independent candidate chosen by both groups. The ESOP facilitates the sharing of risk and reward amongst the employees of the company, creating an ownership structure that allows employees to share in the employees rights and responsibilities of ownership. Source: R. Oakeshott, Jobs & Fairness: The Logic and Experience of Employee Ownership (Norwich: Michael Russell Ltd, 2000), pp 536 536-52.

Creative Commons 3.0 Licence

You might also like

- FMP Assignement Key - Cases Fall 10Document16 pagesFMP Assignement Key - Cases Fall 10ahsan_anwar_1No ratings yet

- Assignment 3Document9 pagesAssignment 3Shuhaib NabeeNo ratings yet

- Growing and Preserving Jobs by Transitioning To Employee Ownership 5.17.17Document7 pagesGrowing and Preserving Jobs by Transitioning To Employee Ownership 5.17.17crainsnewyorkNo ratings yet

- S Corporation ESOP Traps for the UnwaryFrom EverandS Corporation ESOP Traps for the UnwaryNo ratings yet

- Mcdonalds Corporation Case StudyDocument19 pagesMcdonalds Corporation Case StudyAnas Mahmood100% (1)

- 2018 Trafigura Commodities Demystified Guide Second Edition English PDFDocument84 pages2018 Trafigura Commodities Demystified Guide Second Edition English PDFAlok SinghNo ratings yet

- Roads 2000 Strategic PlanDocument117 pagesRoads 2000 Strategic PlanMarvin MessiNo ratings yet

- Joint Stock CompaniesDocument16 pagesJoint Stock CompaniesJoynul Abedin100% (8)

- PartexDocument28 pagesPartexIsa AhmedNo ratings yet

- Fifth Season Cooperative Fifth Season Cooperative: Case Study 4.4Document5 pagesFifth Season Cooperative Fifth Season Cooperative: Case Study 4.4Diarmuid McDonnellNo ratings yet

- Fenwick WeaversDocument2 pagesFenwick WeaversDiarmuid McDonnell0% (1)

- Employee Stock Ownership PlansDocument3 pagesEmployee Stock Ownership PlansmanoramanNo ratings yet

- What Is ISO?: ISO 9001 ISO 14001 BS EN 15713Document7 pagesWhat Is ISO?: ISO 9001 ISO 14001 BS EN 15713Sushant ChaurasiaNo ratings yet

- Employee Stock Ownership Plan (ESOP) - Wikipedia, The Free EncyclopDocument3 pagesEmployee Stock Ownership Plan (ESOP) - Wikipedia, The Free EncyclopmrumNo ratings yet

- ESOPDocument1 pageESOPAnkur AroraNo ratings yet

- Of The Shareholders First Since Their Remuneration Is in LineDocument4 pagesOf The Shareholders First Since Their Remuneration Is in LineWeera Soon Jin XueNo ratings yet

- Employee Ownership Occurs When A Business Is Owned in Whole or in Part by ItsDocument4 pagesEmployee Ownership Occurs When A Business Is Owned in Whole or in Part by ItsApurva PrabhudesaiNo ratings yet

- Reflection On Employee OwnershipDocument7 pagesReflection On Employee Ownershipsaurav dahalNo ratings yet

- Employee Stocks Ownership PlanDocument18 pagesEmployee Stocks Ownership Plankp2050No ratings yet

- Shaivi Shah - 203 - FYBAF - FADocument11 pagesShaivi Shah - 203 - FYBAF - FAShaiviNo ratings yet

- Growth of Esops (History) : A TrustDocument16 pagesGrowth of Esops (History) : A Trustcutiebabe1010No ratings yet

- How Esops WorkDocument10 pagesHow Esops WorkRaman DhingraNo ratings yet

- Writing Sample - The Legal Regime and Jurisprudential Issues Relating To Sweat Equity Shares and Employees Stock Option Plan - Vidhika PrasadDocument8 pagesWriting Sample - The Legal Regime and Jurisprudential Issues Relating To Sweat Equity Shares and Employees Stock Option Plan - Vidhika PrasadVid PrasadNo ratings yet

- Paper 3 Vol 1 Issue 1 Dec 2014Document6 pagesPaper 3 Vol 1 Issue 1 Dec 2014Ishan KapoorNo ratings yet

- IM Unit-03Document10 pagesIM Unit-03TharunNo ratings yet

- ESOPDocument4 pagesESOPconnerNo ratings yet

- ESOP, Sweat Equity, Right Issue-1Document6 pagesESOP, Sweat Equity, Right Issue-1Mansi SharmaNo ratings yet

- PAN African E-Network Project: Mergers and AcquisitionsDocument75 pagesPAN African E-Network Project: Mergers and Acquisitionsabdulkadir mohamedNo ratings yet

- Company ProjectDocument14 pagesCompany ProjectMayank Sahu0% (1)

- S1 Introduction To Financial ManagementDocument65 pagesS1 Introduction To Financial ManagementLili GuloNo ratings yet

- Esop FinalDocument31 pagesEsop Finalansh384100% (2)

- Klein Hall 1988Document9 pagesKlein Hall 1988Namla Elfa SyariatiNo ratings yet

- Incorporated Association:: Ans: Feature of Indian EnterprisesDocument8 pagesIncorporated Association:: Ans: Feature of Indian Enterprisesom parkash barakNo ratings yet

- Europa Science & Commerce Academy: Advantages of Joint Stock CompanyDocument4 pagesEuropa Science & Commerce Academy: Advantages of Joint Stock CompanyFaisi PrinceNo ratings yet

- Employee Stock Option Plan An OverviewDocument16 pagesEmployee Stock Option Plan An OverviewPrabhakar JagdaleNo ratings yet

- Company Law Other TopicsDocument61 pagesCompany Law Other Topicsaryan raneNo ratings yet

- Entrepreneurship: B.SC B.Ed 5th SemesterDocument9 pagesEntrepreneurship: B.SC B.Ed 5th Semesterom parkash barakNo ratings yet

- Assig 1 ACCOUNTING AND FINANCIAL MANAGEMENTDocument20 pagesAssig 1 ACCOUNTING AND FINANCIAL MANAGEMENTAnu kulethaNo ratings yet

- Additional Research On Stock Option PlanDocument4 pagesAdditional Research On Stock Option Planmvlf.rvcloNo ratings yet

- The ESOP Exit StrategyDocument11 pagesThe ESOP Exit StrategybipppNo ratings yet

- Complete Study of Employee Stock Ownership Plans Esop 1688222946Document9 pagesComplete Study of Employee Stock Ownership Plans Esop 1688222946Jayant JoshiNo ratings yet

- GreenCity WholefoodsDocument2 pagesGreenCity WholefoodsDiarmuid McDonnellNo ratings yet

- Astro Malaysia Holdings Berhad Is A Leading Integrated Consumer Media Entertainment Group in Malaysia and Southeast Asia With Operations in 4 Key Areas of BusinessDocument5 pagesAstro Malaysia Holdings Berhad Is A Leading Integrated Consumer Media Entertainment Group in Malaysia and Southeast Asia With Operations in 4 Key Areas of BusinessKasturi_1989No ratings yet

- ESOP PolicyDocument1 pageESOP PolicyshamimNo ratings yet

- Shareholder ActivismDocument7 pagesShareholder ActivismADITI YADAVNo ratings yet

- How Create ESOP Plans For Your Employer As An In-House CounselDocument15 pagesHow Create ESOP Plans For Your Employer As An In-House CounselTariq RashidNo ratings yet

- Chapter 1. The Role of Business in Social and Economic DevelopmentDocument4 pagesChapter 1. The Role of Business in Social and Economic DevelopmentArk KnightNo ratings yet

- Lesson 1 - The Nature and Forms of Business OrganizationDocument3 pagesLesson 1 - The Nature and Forms of Business OrganizationJose Emmanuel CalagNo ratings yet

- Assignment 10-19mba1039 PDFDocument1 pageAssignment 10-19mba1039 PDFswathiNo ratings yet

- ABM PrelimDocument4 pagesABM PrelimVia LiwanagNo ratings yet

- Discuss The Concept of Strategic Model. (5 PTS.) : A. Wright, Kroll and Parnell ModelDocument9 pagesDiscuss The Concept of Strategic Model. (5 PTS.) : A. Wright, Kroll and Parnell ModelMelissa Jane ViveroNo ratings yet

- Companies Act Study Cases Business LawDocument48 pagesCompanies Act Study Cases Business LawDango GamerNo ratings yet

- Corporate Law AssignmentDocument5 pagesCorporate Law AssignmentSahil AggarwalNo ratings yet

- Applied Economics Module Week 5Document5 pagesApplied Economics Module Week 5Billy Joe100% (1)

- Vesting OverviewDocument2 pagesVesting Overviewjschroeder123No ratings yet

- Intro To Corporate FinanceDocument75 pagesIntro To Corporate FinanceRashid HussainNo ratings yet

- Advantages and Disadvantages of Sole Proprietorship or Partnership Vs CorporationDocument2 pagesAdvantages and Disadvantages of Sole Proprietorship or Partnership Vs CorporationTharindu Dasun WeerasingheNo ratings yet

- National Aviation College: Graduate ProgramsDocument11 pagesNational Aviation College: Graduate Programscn comNo ratings yet

- Chapter 1 - Intro To FMDocument62 pagesChapter 1 - Intro To FMJessa RosalesNo ratings yet

- Advance Performance Management: Assignment No 04Document9 pagesAdvance Performance Management: Assignment No 04Mohammad HanifNo ratings yet

- Unit 4: Businesses 1. Types of Businesses 2. Elements of A Business 3. Corporate Social Responsibility 4. Corporate Finance 5. Business DutiesDocument6 pagesUnit 4: Businesses 1. Types of Businesses 2. Elements of A Business 3. Corporate Social Responsibility 4. Corporate Finance 5. Business DutiesBorjaNo ratings yet

- Labour Codes ApplicableDocument2 pagesLabour Codes ApplicablemanNo ratings yet

- ESOP@CompensationDocument2 pagesESOP@CompensationSikakolli Venkata Siva KumarNo ratings yet

- Concept of Self Managed TeamDocument9 pagesConcept of Self Managed TeamSammy MichuiNo ratings yet

- Partnership, Can Be Utilized. Under This Arrangement, One or More PartnersDocument7 pagesPartnership, Can Be Utilized. Under This Arrangement, One or More PartnersMahaboob HossainNo ratings yet

- West Whitlawburn Housing Co-OperativeDocument7 pagesWest Whitlawburn Housing Co-OperativeDiarmuid McDonnellNo ratings yet

- National Freight ConsortiumDocument4 pagesNational Freight ConsortiumDiarmuid McDonnellNo ratings yet

- United AirlinesDocument3 pagesUnited AirlinesDiarmuid McDonnellNo ratings yet

- Suma WholefoodsDocument2 pagesSuma WholefoodsDiarmuid McDonnellNo ratings yet

- Child BaseDocument1 pageChild BaseDiarmuid McDonnellNo ratings yet

- Rochdale PioneersDocument2 pagesRochdale PioneersDiarmuid McDonnellNo ratings yet

- GreenCity WholefoodsDocument2 pagesGreenCity WholefoodsDiarmuid McDonnellNo ratings yet

- Air Pollution Biodegradable Drought Energy-Saving Environment-Friendly Global Warming Landfill Natural Resources Toxic Chemicals Water ConsumptionDocument3 pagesAir Pollution Biodegradable Drought Energy-Saving Environment-Friendly Global Warming Landfill Natural Resources Toxic Chemicals Water ConsumptionJenny ThuNo ratings yet

- PL Repayment-TableDocument1 pagePL Repayment-Tablewong6804No ratings yet

- Coral Bay Tax DigestDocument3 pagesCoral Bay Tax DigestJonathan Dela Cruz100% (1)

- StudentMoneyReceipt 16511049Document1 pageStudentMoneyReceipt 16511049Chowdhury ImamNo ratings yet

- CIBP Projects and Working Groups PDFDocument37 pagesCIBP Projects and Working Groups PDFCIBPNo ratings yet

- Manual Invoice FormatDocument6 pagesManual Invoice FormatJunaid UsmanNo ratings yet

- PRD Spec 2 5Document6 pagesPRD Spec 2 5Cesar Orlando Laura AlipazNo ratings yet

- Engro Food STG MNGT (1) ..Document36 pagesEngro Food STG MNGT (1) ..dreamy_geminiNo ratings yet

- Business Studies Chapter 18 NotesDocument3 pagesBusiness Studies Chapter 18 NotesMuhammad Faizan RazaNo ratings yet

- TML Gasket vs. BPI Family Savings Jan 2013Document2 pagesTML Gasket vs. BPI Family Savings Jan 2013Sam LeynesNo ratings yet

- BPM Main Brochure 13286 001 (Updated 12062008)Document16 pagesBPM Main Brochure 13286 001 (Updated 12062008)CharitynNo ratings yet

- Crypto CurrencyDocument32 pagesCrypto CurrencyY Udaya ChandarNo ratings yet

- Telecom Carriers 2006Document28 pagesTelecom Carriers 2006Brian ScarellaNo ratings yet

- Indian Polymer Industry OutlookDocument9 pagesIndian Polymer Industry OutlookHappy RoxNo ratings yet

- Stanley Pierson - Leaving Marxism - Studies in The Dissolution of An Ideology (2002)Document245 pagesStanley Pierson - Leaving Marxism - Studies in The Dissolution of An Ideology (2002)Felipe RichardiosNo ratings yet

- Taxation 1 Transcript Part 4 (3 of 3) SyllabusDocument10 pagesTaxation 1 Transcript Part 4 (3 of 3) SyllabuscristiepearlNo ratings yet

- Form GST ITC 04 NewDocument2 pagesForm GST ITC 04 NewAjay DayalNo ratings yet

- Principles of ManagementDocument141 pagesPrinciples of ManagementAshmita SharmaNo ratings yet

- AlphaIndicator BONI 20181106Document11 pagesAlphaIndicator BONI 20181106Daniel WigginsNo ratings yet

- Incoterms 2011Document1 pageIncoterms 2011barath1986No ratings yet

- Mphil in Engineering For Sustainable Development BrochureDocument8 pagesMphil in Engineering For Sustainable Development BrochureDimas Haryo Adi PrakosoNo ratings yet

- From Swadeshi To Swaraj: Nation, Economy, Territory in Colonial South Asia, 1870 To 1907Document29 pagesFrom Swadeshi To Swaraj: Nation, Economy, Territory in Colonial South Asia, 1870 To 1907Agastaya ThapaNo ratings yet

- Hra Valuation Methods PDFDocument35 pagesHra Valuation Methods PDFJayashree UNo ratings yet

- Unit Price Contracts: Agreements. While A Standing Offer Can Provide For Unit Pricing, ItDocument3 pagesUnit Price Contracts: Agreements. While A Standing Offer Can Provide For Unit Pricing, ItHari PrakashNo ratings yet

- Supplementary Cause List - 16.10.2023Document7 pagesSupplementary Cause List - 16.10.2023Aamir BhatNo ratings yet

- Sem 3 - Intermediate-Macroeconomics - Part 1Document4 pagesSem 3 - Intermediate-Macroeconomics - Part 1Maverick SinghNo ratings yet