Professional Documents

Culture Documents

Bank of Baroda Transformation

Bank of Baroda Transformation

Uploaded by

Manickavasagam ValliappanCopyright:

Available Formats

You might also like

- Final Report - Bank of BarodaDocument9 pagesFinal Report - Bank of BarodaShahroz MemonNo ratings yet

- Maybank: Organisational Transformation Through Human ResourcesDocument20 pagesMaybank: Organisational Transformation Through Human ResourcesHridaya RamanarayananNo ratings yet

- Establishing A Strong Digital FootprintDocument10 pagesEstablishing A Strong Digital FootprintTANVINo ratings yet

- Leadership Code Introduction For Supervisor 2Document12 pagesLeadership Code Introduction For Supervisor 2aih cungkringNo ratings yet

- Little Blue Book On SchedulingDocument107 pagesLittle Blue Book On SchedulingScott NeillNo ratings yet

- Group Discussion: Prepared By:-Tanpreet KaurDocument24 pagesGroup Discussion: Prepared By:-Tanpreet KaurTanpreet MehndirattaNo ratings yet

- MGMT 142-Principles of Management-Muhammad AyazDocument6 pagesMGMT 142-Principles of Management-Muhammad AyazAhsan Ahmed MoinNo ratings yet

- DiruDocument84 pagesDirudhiru_hadiaNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Final Presentation BANK OF BARODA 1Document8 pagesFinal Presentation BANK OF BARODA 1Pooja GoyalNo ratings yet

- Bank of Baroda ReportDocument62 pagesBank of Baroda ReportLakshya SharmaNo ratings yet

- Customers Satisfaction in Public and Private Sector Banks in India A Comparative Study PDFDocument8 pagesCustomers Satisfaction in Public and Private Sector Banks in India A Comparative Study PDFchandra sekar genjiNo ratings yet

- Bank Merger of Bank of Baroda, Vijaya Bank & Dena Bank - Latest News Update! - Testbook BlogDocument6 pagesBank Merger of Bank of Baroda, Vijaya Bank & Dena Bank - Latest News Update! - Testbook BlogSai KiranNo ratings yet

- B B F A R: ANK OF Aroda Inancial Nalysis EportDocument31 pagesB B F A R: ANK OF Aroda Inancial Nalysis Eportlaxmi_bodduNo ratings yet

- A Comparative Study On SBI and HDFC in Ambala City Ijariie5997Document11 pagesA Comparative Study On SBI and HDFC in Ambala City Ijariie5997vinayNo ratings yet

- Kotak FinalDocument46 pagesKotak FinalRahul FaliyaNo ratings yet

- SBI Home Loan TMV BlackbookDocument106 pagesSBI Home Loan TMV Blackbookvishal birajdarNo ratings yet

- Aditya Project Work 2Document42 pagesAditya Project Work 2aditya mayukh100% (1)

- A Project Report On: "A Study On Banking Services in Bank of Baroda"Document63 pagesA Project Report On: "A Study On Banking Services in Bank of Baroda"pranoyNo ratings yet

- Kotak Mahindra Bank 121121123739 Phpapp02Document112 pagesKotak Mahindra Bank 121121123739 Phpapp02RahulSinghNo ratings yet

- Banking Sector Reforms FULL REPORT - 1 - Commerce Seminar TopicsDocument2 pagesBanking Sector Reforms FULL REPORT - 1 - Commerce Seminar TopicsAvishek NandiNo ratings yet

- Universal Banking HDFCDocument62 pagesUniversal Banking HDFCrajesh bathulaNo ratings yet

- Bank of Baroda Training and Development (Repaired)Document7 pagesBank of Baroda Training and Development (Repaired)SHANKAR PRINTINGNo ratings yet

- Final Project SBI ProductDocument56 pagesFinal Project SBI Productkunal hajareNo ratings yet

- Synopsis Tittle of The Project: A Study of Rural Banking in A State (Maharashtra)Document4 pagesSynopsis Tittle of The Project: A Study of Rural Banking in A State (Maharashtra)Rohit UbaleNo ratings yet

- Questionnaire: Analysis On Non Performing AssetsDocument4 pagesQuestionnaire: Analysis On Non Performing AssetsSimar DhillonNo ratings yet

- Retail Banking Literature ReviewDocument1 pageRetail Banking Literature ReviewAsh Jerk100% (1)

- Organization StructureDocument1 pageOrganization StructureShruti SharmaNo ratings yet

- Micro FinanceDocument30 pagesMicro FinanceSakshi BhaskarNo ratings yet

- Bba ProjectDocument47 pagesBba ProjectAayush SomaniNo ratings yet

- Sidbi 39Document43 pagesSidbi 39HARSHAL PATADENo ratings yet

- Npa of SbiDocument40 pagesNpa of SbiLOCAL ADDA WAALENo ratings yet

- Synopsis On Home LoanDocument9 pagesSynopsis On Home Loanyash jejaniNo ratings yet

- SWOT and Technical Analysis of Banks Namely ICICI, SBI, and HDFCDocument6 pagesSWOT and Technical Analysis of Banks Namely ICICI, SBI, and HDFCSailash RanaNo ratings yet

- Banking Sector ReformsDocument16 pagesBanking Sector ReformsbabuNo ratings yet

- PROJECT WORK Axis and SbiDocument54 pagesPROJECT WORK Axis and SbiSourav MandalNo ratings yet

- A Study On Customer Satisfaction Towards Banking Services of The State Bank of IndiaDocument45 pagesA Study On Customer Satisfaction Towards Banking Services of The State Bank of IndiaArchana YadavNo ratings yet

- Sip ProjectDocument77 pagesSip ProjectShivani PatelNo ratings yet

- A Study of Non Performing Assets in Bank of BarodaDocument68 pagesA Study of Non Performing Assets in Bank of BarodaSuryaNo ratings yet

- Final Presentation: On Comparative Study of Bank's Retail Loan Product at Bank of BarodaDocument11 pagesFinal Presentation: On Comparative Study of Bank's Retail Loan Product at Bank of BarodaPrgya SinghNo ratings yet

- Naziya Bank of BarodaDocument72 pagesNaziya Bank of Barodaaadil shaikhNo ratings yet

- Industry Introduction: About Bakery Food IndustryDocument22 pagesIndustry Introduction: About Bakery Food IndustryPrachi PilaniNo ratings yet

- Growth in Banking SectorDocument30 pagesGrowth in Banking SectorHarish Rawal Harish RawalNo ratings yet

- Loan & Credit Facility Provided by Different BanksDocument72 pagesLoan & Credit Facility Provided by Different Bankskaushal2442No ratings yet

- Banking Structure in IndiaDocument5 pagesBanking Structure in IndiaCharu Saxena16No ratings yet

- Iob 2Document104 pagesIob 2Krishna Kant PariharNo ratings yet

- Comparative Study On Financial Performance of State Bank of India and Bank of BarodaDocument62 pagesComparative Study On Financial Performance of State Bank of India and Bank of BarodaVIKAS MishraNo ratings yet

- ReportDocument120 pagesReportAman Prakash100% (2)

- Boi ProjectDocument133 pagesBoi ProjectrupalijaiswalNo ratings yet

- Project On Retail Assets of BOB OkDocument76 pagesProject On Retail Assets of BOB OkKanchan100% (1)

- E BankingDocument100 pagesE BankingCenu RomanNo ratings yet

- Kittur Rani Channamma Urban Credit Souharda Sahakari LTDDocument11 pagesKittur Rani Channamma Urban Credit Souharda Sahakari LTDshivaraj goudarNo ratings yet

- CENTRAL BANK OF INDIA PPT (Harshitha) 1Document27 pagesCENTRAL BANK OF INDIA PPT (Harshitha) 1Harshitha Uchil0% (1)

- Master of Commerce: "A Study On Customer Satisfaction Towards E-Banking Services With Special Reference To SBI "Document112 pagesMaster of Commerce: "A Study On Customer Satisfaction Towards E-Banking Services With Special Reference To SBI "Karthick KumaravelNo ratings yet

- Project On Modernization in Banking System in IndiaDocument81 pagesProject On Modernization in Banking System in IndiaSantosh GuptaNo ratings yet

- A Project Report - 2Document62 pagesA Project Report - 2sandhyaNo ratings yet

- Financial Analysis of Bagalkot DCC Bank, BagalkotDocument4 pagesFinancial Analysis of Bagalkot DCC Bank, BagalkotInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Analysis of Product and Services of Bank of BarodaDocument73 pagesAnalysis of Product and Services of Bank of BarodaJdeeNo ratings yet

- Retail Banking Front Office Management Activity For HDFC Bank by Nisha Wadekar This Project Is Very Useful To StudentDocument51 pagesRetail Banking Front Office Management Activity For HDFC Bank by Nisha Wadekar This Project Is Very Useful To Studentganeshkhale7052No ratings yet

- Project Study Report of Aditya KhandelwalDocument87 pagesProject Study Report of Aditya KhandelwalAditya khandelwalNo ratings yet

- Final ProjectDocument80 pagesFinal Projectjubin654No ratings yet

- Loan & Advances in BomDocument50 pagesLoan & Advances in Bomfunkisanju1100% (1)

- Project On Standard Charted BankDocument82 pagesProject On Standard Charted BankViPul82% (11)

- Banking in The New Millennium: Paradigm Changes and ChallengesDocument15 pagesBanking in The New Millennium: Paradigm Changes and ChallengesAvkash LambaNo ratings yet

- Final HRM DHAKADocument30 pagesFinal HRM DHAKAJehan MahmudNo ratings yet

- Lecture 2 Leader-Centred PerspectivesDocument24 pagesLecture 2 Leader-Centred PerspectivesLIVINGSTONE CAESARNo ratings yet

- Organizational Theory and Behaviour Course Outline 14102022 022228pmDocument13 pagesOrganizational Theory and Behaviour Course Outline 14102022 022228pmIncia HaiderNo ratings yet

- Strategic Planning Primer Higher EducDocument30 pagesStrategic Planning Primer Higher EducJrleanne Donatha100% (1)

- The Effects of A House System On School Improvement in ElementaryDocument93 pagesThe Effects of A House System On School Improvement in ElementaryZeina FarhatNo ratings yet

- The Contingency Approach - PPT B.INGGDocument6 pagesThe Contingency Approach - PPT B.INGGYustika WidhantiNo ratings yet

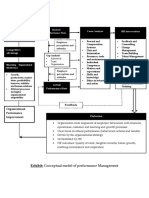

- Performance ModelDocument1 pagePerformance ModelFerdous AminNo ratings yet

- Advanced Management and Leadership Session XV Team Leadership: Coaching and Conflict ResolutionDocument26 pagesAdvanced Management and Leadership Session XV Team Leadership: Coaching and Conflict ResolutionStorai SadatNo ratings yet

- Lesson 6 Bsed At6Document4 pagesLesson 6 Bsed At6Dash GevsNo ratings yet

- Application Essay: B. PNU's Mission Is To Nurture Innovative Teachers and Education Leaders. Describe HowDocument2 pagesApplication Essay: B. PNU's Mission Is To Nurture Innovative Teachers and Education Leaders. Describe HowRanjell Allain Bayona TorresNo ratings yet

- TQMDocument25 pagesTQMFarah AJNo ratings yet

- Engineer As Manager, Consultant and LeaderDocument33 pagesEngineer As Manager, Consultant and LeaderRecall VidyanikethanNo ratings yet

- Research Paper On Organizational Behavior PDFDocument6 pagesResearch Paper On Organizational Behavior PDFafmcueagg100% (1)

- A3 Strategy ArticleDocument4 pagesA3 Strategy Articleunknown139100% (1)

- Factors Affecting The Declining Number of Enrollees in Matutum View Baptist Academy 1Document21 pagesFactors Affecting The Declining Number of Enrollees in Matutum View Baptist Academy 1Laarni D. CaraniasNo ratings yet

- Manpower Planning Work FlowDocument9 pagesManpower Planning Work FlowdeemaNo ratings yet

- The School As An Agent of Social ChangeDocument12 pagesThe School As An Agent of Social ChangeFranz Simeon Cheng100% (4)

- General Instructions: Marketing Plan GuidelinesDocument10 pagesGeneral Instructions: Marketing Plan GuidelinesaistopNo ratings yet

- Campus MoverDocument65 pagesCampus MoverAnonymous 5GWJIcgO0wNo ratings yet

- PGX B Civic EducationDocument15 pagesPGX B Civic EducationIwan Sukma NurichtNo ratings yet

- All Rights Reserved by Berkeley ResearchDocument8 pagesAll Rights Reserved by Berkeley ResearchSundeep GillNo ratings yet

- How To Write A Structured Abstract (New)Document3 pagesHow To Write A Structured Abstract (New)wulanNo ratings yet

- Quality Management Processes - DocxDocument3 pagesQuality Management Processes - DocxAhmad Syarif FaishalNo ratings yet

- Submitted By:-Abhinav Jindal 501804092 Kritika Bhatia 501804095 Tushar Aggarwal 501804131 1MB3Document7 pagesSubmitted By:-Abhinav Jindal 501804092 Kritika Bhatia 501804095 Tushar Aggarwal 501804131 1MB3Tushar AggarwalNo ratings yet

- Pengembangan Produk BaruDocument13 pagesPengembangan Produk BaruMuhammad FauziNo ratings yet

- MGNT110 - Final PresentationDocument18 pagesMGNT110 - Final PresentationToànNo ratings yet

Bank of Baroda Transformation

Bank of Baroda Transformation

Uploaded by

Manickavasagam ValliappanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank of Baroda Transformation

Bank of Baroda Transformation

Uploaded by

Manickavasagam ValliappanCopyright:

Available Formats

Human Resource Development International, Vol. 10, No.

2, 203 213, June 2007

Perspectives on Practice

Moving HRD from the Periphery to the Centre for Transformation of an Indian Public Sector Bank: Keynote Address, 4th Asian Conference of the Academy of HRD

ANIL K. KHANDELWAL

Bank of Baroda

ABSTRACT The transformation of Bank of Baroda, one of the largest commercial banks in the public sector in India, into a highly customer centric, technology driven and an innovative entity in retail and SME (small and medium enterprises) segments represents one of Indias most remarkable success stories and one of the quickest turnarounds ever in public sector banking. Known as an important player in commercial banking with international operations for several decades, the bank was gradually declining in recent years. In an environment of competition within the public sector as also due to entry of private banks with latest technology and young sta, the bank plunged into an unprecedented spiral of failing to innovate and adopt new technology. Drastic action was required to regain its leadership position in the public sector space. Over the next one and a half years, the bank was back in reckoning and was ring on all cylinders. It retained its core business on track with a bang, restored its image as the most vibrant player among public sector banks (PSBs) through wide-ranging initiatives such as a logo change, hiring a cricketing icon as brand ambassador, heightened credit growth, improving the work culture, initiating many customer-centric initiatives and restoring the customer base, derisking the treasury portfolio, and winning several accolades and awards. Today, Bank of Baroda has embarked upon more wide-ranging changes and a new vision to change the bank from a vanilla banking entity to a multi-specialist bank. The author, who joined the bank as a HR specialist and eventually rose to become CEO of the bank, extensively used his HRD knowledge and academic background to initiate changes to harness energy in the banks 40,000 sta to drive organization change. Achieving a successful outcome seems to be far more dicult for a public sector bank with a legacy culture, high degree of unionization, poor compensation and aging sta. In spite of these constraining factors, the paper argues that it is through mobilizing the passion of people that leadership can transform organizations and put them on high growth trajectory.

Correspondence Address: Dr. Anil K. Khandelwal, Chairman and Managing Director, Bank of Baroda, Baroda Corporate Centre, C-26, G-Block, Bandra-Kurla Complex, Mumbai 400 051, India. Email: cmd@bankofbaroda.com ISSN 1367-8868 Print/1469-8374 Online/07/020203-11 2007 Taylor & Francis DOI: 10.1080/13678860701347172

204

A. K. Khandelwal

The New Competitive Reality The process of liberalization initiated in the mid-1990s was followed by many reforms in the nancial sector, as a result of the recommendations of the Narasimham Committee appointed by the Government of India. Introduction of new accounting norms based on international standards, entry of private banks and deregulation of interest rates suddenly threw public sector banks from their comfort zone into a more turbulent and even traumatic realization that they needed to adapt to new realities if they wanted to remain in the business of banking. The new private and foreign banks aggressively entered the market with high technology, high marketing orientation and highly talented, qualied, well-paid and younger employees. These banks smartly leveraged the right mix of technology and manpower to gain competitive advantage from day one. The Indian customers experienced an alternate banking model based on convenience and speed with anytime anywhere banking now a reality in India. High net worth customers, both corporate and personal, were quickly opting for these new private banks. Public sector banks supported by the Government responded to the changed expectations of the customers and took some steps to become more customer-centric, eciency driven and technologically equipped. Through a Government-supported voluntary retirement scheme, PSBs were able to shed about 120,000 employees. The larger banks at least were quickly moving towards the Core Banking Solution. Between 2000 and 2005, at least four large banks initiated the Core Banking Project, and in 2005 some were already operating the Core Banking Solution. Many large banks admirably adjusted to the process of change and improved their working across several parameters such as credit growth, rise in low cost deposits, reduction in non-performing assets, increase in capital through public issues, protability, etc. In spite of some of these achievements by PSBs, the level of HRD challenge is much higher due to a unionized environment, limited freedom to hire, standardized industry-based pay scales and aging sta. Bank of Baroda The present-day Bank of Baroda is the successor of the erstwhile The Bank of Baroda Limited, founded in 1908 in Baroda, a small town in India. From its humble beginnings, the bank has grown to become a leading Indian nancial powerhouse, with a network of over 2,700 branches across the length and breadth of the country and 60 branches/oces in 21 countries across 5 continents. Today, Bank of Baroda is one of the leading public sector banks in India, with 40,000 employees, over 29 million customers and a global business size of over US$48 billion. In March 2005, when the author took over as Chief Executive of the Bank, the state of the company was broadly as follows: . . The banks rank in terms of business size had slipped from No. 1 in 2001 02 to No. 4. The banks credit growth was at its lowest level ever below 5% against the 30 % recorded by many peer banks. This was a period when the economy was booming and demand for credit was on the rise. Competition for seizing credit

Transformation of an Indian Public Sector Bank

205

. . . . .

growth opportunities was intense and innovative credit delivery models were being launched daily by smarter banks. The bank was perceived as poor in terms of technology. Its technology upgradation plans had not taken o, so much so that while many other peer banks had aggressively rolled out the Core Banking Solution (CBS), Bank of Baroda had not even taken the rst step to begin the rollout. The banks visibility was low, was largely perceived as a deposit-taking bank and was not one of the preferred choices of borrowers. The banks market share continued to dip, including in the western belt of the country that traditionally had been its stronghold. The bank was slow in responding to market changes and competitive pressures. Many analysts had recommended selling the banks shares. The overall climate among the employees of the bank was one of low motivation and low self-esteem, teamed with widespread withdrawal from market penetration strategies. Fear psychosis prevailed among managers, which hindered decision-making in the credit area.

Although Bank of Baroda had embarked on an ambitious technology-driven transformation programme in 2001 and hired one of the most well-known international consultants, the eorts could not be carried through due to employee unions protesting against the hiring of a foreign consultant and scandalizing the issue by organizing protests, issuing pamphlets and even writing to the Government. Thus, in spite of various attempts, the technology plan could not take o until late 2004 and, during this period, some leading PSBs had already implemented the CBS. This had seriously dented the banks image. On the business front, while the other competing banks were stepping up their lending activities during the economic boom and were showing about 30% growth in the area of credit, the banks credit growth in the year 2002 03 and 2003 04 was 5.01% and 0.72% respectively. Although the bank made good prots during this period, these prots came largely from treasury operations. Initial diagnosis through customer interactions revealed that they felt quite unhappy at the banks reluctance to accord timely credit and they especially resented the delays in credit-related decision making, which passed through several layers. In the above scenario, the author took over as Chairman and Managing Director of the bank in March 2005. In between, for a year, he had moved to another bank as Chairman. On his return, the twin challenges faced by him were to quickly place the bank on a high growth trajectory and move on the technology upgradation front most expeditiously. In his earlier tenure as Executive Director during 2002 and 2003, the author had rst hand experience of dealing with the unions on change management issues and had directly dealt with the resistance posed by them. The author had faced the brunt of union resistance during this period and, in the process, had developed an image of a no-nonsense manager. Soon after his appointment, a letter was sent to all 40,000 employees. The letter spoke of the strong traditions of the bank, directly shared the concerns of falling business and low technology, and gave a clarion call for rebuilding the bank. The letter also promised that a vibrant and result-oriented leadership would drive the

206

A. K. Khandelwal

transformation eorts from the front. This communication set the stage for changes to follow and in subsequent communications to employees, various developments taking place in the Bank were shared with them. As an insider, the author had the benet of knowing a large number of employees and also customers of the bank. Through constant interaction with them and other industry specialists, an agenda was developed that, amongst other things, included quickly repositioning the bank on technology, improving the response time on business matters (especially credit dispensation), reviving the banks performance on various business parameters, improving retail orientation and engaging all bank employees. Building the Top Team Immediately after taking over at a meeting of senior and top executives that included eld regional, zonal and senior management it was decided to turbocharge the transformation within the bank. Key components of such a transformation were identied as: . . . . . . . Quick decision to start the Core Banking Project and sign an agreement with a world-renowned rm with whom discussions had been ongoing for some time. Image makeover for the bank. Quick acceleration of credit portfolio. Derisking of Treasury portfolio. Turbo-charging retail portfolio. Creating alternate delivery channels rapid improvement of ATM network, etc. Internal talent identication and motivational measures.

Through successive meetings, which were brainstorming in nature, it was decided that each functional head would develop an agenda for change for his functional area and accountability for implementation would be xed. The morning meeting of General Managers was initiated to act as a forum for discussing organizational problems and sorting out inter-departmental issues of collaboration. It was decided that the bank would launch at least one product/one customer-centric initiative every month. The emphasis was always on speed and timelines were xed for implementation of various projects. Kick-starting the Core Banking Project The commencement of the Core Banking Project was perceived as the single most important initiative in the organization, as line managers felt that they were losing business because other banks had already implemented Core Banking and customers perceived Bank or Baroda as technologically backward. The image of the bank as being progressive was at stake. Therefore, technology was placed on the top of the agenda in the planned scheme of changes. The issue had been under discussion at board level for quite some time and the author laboured hard to clinch the issue with the board in 30 days of his arrival. Finally, on 15 April 2005, Bank of Baroda signed a contract with Hewlett Packard (HP) and sta were informed

Transformation of an Indian Public Sector Bank

207

about the important development. An aggressive schedule had been set for implementing the CBS and for starting new delivery channels by rapidly expanding the ATM network from the existing 150 to a respectable gure of 500 within the next 90 days. In order to send out strong signals, it was decided that the bank should launch as many as 200 ATMs on a single day. This sent out a strong message to the banks sta that they were capable of achieving a tough challenge. This achievement galvanized teams at various levels and the earlier didence in taking up dicult tasks was broken. This further reinforced self-condence in many functionaries. The project team members were recognized and made heroes. Makeover Initiatives Another people-driven initiative achieved in the shortest possible time was changing the banks 98-year-old logo and engaging a youth sporting icon, Rahul Dravid, as brand ambassador of the bank. Market research had revealed that Bank of Baroda was perceived as one of the Government banks with all the image that goes with a government organization such as bureaucratic functioning, lack of sensitivity to customers, lack of business drive, etc. The earlier logo also seemed cluttered and did not connect with customers aspirations. The banks new logo the Baroda sun in vermillion - projected the Banks new and contemporary personality. The bank also made a positioning statement, referring to itself as Indias International Bank. This statement tagged to the banks logo seeks to project the Banks global reach and its global aspirations. The banks new identity received warm reception from customers and employees along with broad attention from the print and electronic media. The brand ambassador who was known for his dependability, consistency and tenacity in the sport eld integrated well with the banks new personality and this was noticed and appreciated by the banks stakeholders. With the launch of the new logo and a pepped-up advertising campaign, Bank of Baroda re-entered the banking scene with a renewed promise to deliver. The new logo was also appreciated for easy brand recall and created a dierentiated imagery in the minds of customers and public at large. The internal climate within the bank was changing. The Chairman and Managing Director and other members of the top management team were travelling around the country and holding meetings with sta to gauge their level of motivation and to communicate the priorities of the bank. Bank employees were feeling elated and positive at the prospect of the bank getting into online mode in near future and also about the new brand identity. They seemed to accept more challenges and newer responsibilities in a changing environment. Introduction of 8 a.m. to 8 p.m. Banking and 24-hour Banking Encouraged by the new wave of enthusiasm, both within the senior and top management and down below in the frontline, we thought of extended banking hours as a follow up to fullment of our brand promise of providing greater customer convenience. Given the restrictive nature of banking hours in Indian

208

A. K. Khandelwal

banking (which operated from 10 a.m. to 5 p.m.), many in the management team were apprehensive about the resistance from employee unions and the workability of extended banking hours. I for one, thought otherwise. It was my rm belief that if the bank was to regain the condence of its customers, it had to do something unique, i.e. something which most banks were not doing. It was thought that this project should be initiated rst in Mumbai in 11 branches and gain experience from that. However, the senior management in charge of Mumbai branches was apprehensive about its success. I was convinced in my mind that we could not show a new face of the bank merely through a logo change and that we needed to introduce customer-centric initiatives. The time was ripe when the bank was put in transformation mode and employees were looking positive in their attitudes. Amidst diering opinions within management, I decided to call a meeting of all the sta (from managers to messengers) of these 11 identied branches. I shared with them the vision of the bank and the need for reaching out to the customers with demonstrated concern for their convenience. The response of the employees was instantaneous and, in the next 30 days, 8 a.m. to 8 p.m. banking in the 11 Mumbai branches became a reality. Soon we shared the Mumbai experience with other regional functionaries who were invited to see for themselves how this experiment was successfully working in Mumbai. I promised that I would personally come to inaugurate extended-hours banking in each region. The regions worked ercely to ensure a smooth start to 8 a.m. to 8 p.m. banking and, for the next couple of months, I was launching this initiative around the country. After six months, we had over 500 branches with extended-hours banking. After the rebrand launch, this was noticed by the customers and the media as the single most important and innovative initiative in the Indian banking industry. What is more, even the Finance Minister of India made a reference to this unique initiative, and in his own characteristic style exhorted other PSBs to emulate this example. The bank then became more ambitious in its customer-centric initiatives and started 24-hour human banking and happy hour banking. We became the rst bank in India to start 24-hour banking in hospitals, temples and elsewhere in the cities, where bank employees were actually working around the clock oering all normal banking services. Employee-Centric Initiatives During this period, the bank also introduced various employee-centric initiatives viz. KHOJ (Talent Identication & Development Programme), PARAMARSH (Personal counselling of employees), SAMPARK (Chairmans helpline) and IDEAONLINE (harnessing employees ideas). KHOJ The bank launched an innovative, organization-wide talent identication and development programme called KHOJ, which means search in Hindi. Through a scientic process of identication and a rigorous selection procedure (which included psychometric testing as well as knowledge testing), the bank identied around 650 employees with high potential for key business areas like credit, foreign

Transformation of an Indian Public Sector Bank

209

exchange, treasury, marketing and sales, etc., who were then put through intensive training and grooming. PARAMARSH In four major cities, the services of a professional counsellor were made available at the centre and employees could avail the counselling service free of charge for resolving any psychological problems/worries that may be disturbing their personal life and aecting their work life balance. SAMPARK The bank introduced the Chairmans helpline as a mechanism for employees to approach the Chairman and Managing Director directly in dicult and extraordinary situations, requiring immediate assistance. This cut down on procedural delays, and immediate decisions and relief could be provided to employees in acute distress. IDEAONLINE A new forum for sharing creative and innovative thoughts and ideas (ideaonline@ bankofbaroda.com) was set up. It was set up in the belief that information and creative thinking are increasingly the value drivers for the organization. Employees take great pride in being involved in the incubation and development of their idea into a workable proposition creating value for the organization. This has unleashed the power of small ideas necessary for transforming the bank into a universal nancial services organization committed to providing the best to its ever-growing customer base and to its stakeholders. These mechanisms considerably improved employee motivation, which was reected in numerous employee communications showing their appreciation and happiness at the speed of action and the concern and care shown for employees. Project Parivartan In the context of the banks ambition to regain its leadership position amongst the PSBs, a visioning exercise was undertaken that all departmental heads participated in and decided to draw an aggressive plan to reposition the bank. The main components of the visioning exercise were: . . . . . . To reclaim the leadership spot in the PSB landscape by 2009 10. To double the global business size (Deposits Advances) within the next 3 4 years and take it forward to Rs.300,000 crore (US$ 68.18 billion) by 2010. To double retail assets. To acquire at least two million new customers every year. To bring at least 300 400 of the top 500 corporates to the banks loan book. To transform the top 500 branches into best-of-the-breed Sales and Service Centres through improved ambience, processes, people and technology.

210

A. K. Khandelwal

In all these initiatives, the involvement of the frontline employees and development of new competencies in them was central. The employees enthusiastically responded to work as sales and service sta, tele-callers, etc. in the new outts. They took out rallies on their scooters and motorcycles to kick start these new initiatives. During inauguration of one of the Retail Loan Factories, one lady employee mentioned to me I am happy I had a job change before my retirement. This statement clearly indicates how much employees enjoyed working on new projects. Business Results The banks global business size (Deposits Advances) shot up from US$ 28.34 billion (Rs.124,000 crore) in March 2005 to US$ 48.08 billion (Rs.209,000 crore) in March 2007 a growth of over 70% in a span of 24 months. This translates into a business accretion of around US$ 19.55 billion (Rs.85,000 crore), i.e. almost 70% of what the business size was as on March 2005. The other highlights of business between April 2005 and March 2007 included: . . Addition of four million customers. Credit growth, a key concern of analysts, grew by around 35% during 200506 and by around 38% during 200607. As compared to the credit level of March 2005, the overall credit growth for the two-year period has been around 86%, which reects a CAGR of around 36.27%, well above the industry average. International operations of the bank shot up to a record level of 72% growth in deposits and 70% growth in advances during the year ended March 2007. As compared to business at March 2005, the growth in business during the 2-year period has been 128% (CAGR 51.75%), increasing from US$ 4.16 billion (Rs.18,224 crore) in March 2005 to US$ 9.58 billion (Rs.41,669 crore) in March 2007. Over 1000 branches made online and direct connectivity between India and some of the foreign territories such as UAE, Oman, Singapore and the UK established. Share price growth during this period peaked at around 40%. All targets under the Statement of Intent signed with the Government of India were achieved. Ratings from major equity rms changed to Outperformer with buy recommendations.

. . . .

Some Insights Relevant for HRD Function In the present transformation programme, I was able to use my extensive knowledge of people and processes associated with creating a facilitative climate. I was also able to try new experiments for engaging people about new ways of doing business. Intuitively, I always felt that employees were equally concerned as stakeholders about declining business at the bank. I also thought that they did not exactly endorse the attempts of trade unions to stymie technology or other customer-centric initiatives. It was with this belief that we reached out to 40,000 employees directly through a monthly letter and numerous employee meetings across the country sharing problems of bank business and seeking their engagement. It was also our rm belief that employees across all levels had tremendous business wisdom, which could be leveraged for taking the bank forward. I also strongly believed that we

Transformation of an Indian Public Sector Bank

211

needed to debureaucratize the decision-making process, improve eciency from the top to the lowest level and continuously demonstrate to customers that the bank is in a changed mode and it will welcome and listen to their opinions. It was clear in my mind that through eective employee engagement, the bank could rise to greater heights. All that was needed was a continuous and consistent communication line with the employees, sharing both developments and concerns on the business front and spelling out in clear terms the expectations of them. I found that when communication is clear and transparent, results were astounding. This led me further to believe that shared communication could be used as a powerful instrument for continuously raising the bar of performance. Thus, through frank and authentic communications with employees, we could engage both their minds and hearts to better serve the customers. The business milestones achieved are testimony to our belief. In the entire business transformation initiative, HRD was at the centre of our thought process. Throughout this period, the bank did not have any professionally qualied HRD chief and, compulsively, I combined within myself the HRD chief and CEO role. I used HRD values of love for employees with a CEOs concern for business performance, which I translated into my policy of tough love balancing compassion with performance. I also realized the peripheral nature of traditional HRD, which is serviceoriented, tender minded, normative, disconnected with business and focuses on a single constituency (i.e. employees). While performing the twin roles as HRD chief and CEO, I did not experience any conict or contradiction in connecting HRD values with business values. I could see the clear movement of HRD from the periphery to the centre in realizing bottom line dierences through demonstrated results for all stakeholders and through use of innovation and creativity. Creative communication and innovative methods of reaching out to people made the HRD business connection in Bank of Baroda come alive. In this sense, I strongly believe that HRD can be a key driver for business success even within a short time frame. Lessons for HRD Leadership The transformation of Bank of Baroda provided the author with a number of insights on HRD leadership: 1. In the prevailing economic situation and competitive business climate, change programmes need to implemented rapidly for organizations to show dramatic growth. In spite of all the complexities of large organizations and legacy problems, change can be driven only when there is a highly focused and negotiated agenda and the same is followed up and pursued right from the CEOs desk. In some sense, dicult deadlines need to be set and necessary resources, including personal intervention, have to be provided. The message should to be loud and clear that deadlines need to be met. Our monthly communication to employees always sets the agenda for change. 2. Collective commitment has to be created through internal communication, interweaving dierent functions and identifying the right champions to drive and deliver.

212

A. K. Khandelwal

3. In a large, geographically dispersed organization, the message has to reach the lower level functionaries and needs to be couched in actionable terms and simple language. 4. Transformation, in some sense, has to be made personal and success should be highlighted and widely celebrated. When we make the transformation meaningful to them, employees respond enthusiastically and willingly. Results can be expected when the CEO is willing to make the transformation personal, engage others openly and highlight successes as they emerge. 5. For getting successful business results, HRD has to respond to business problems and mobilize all resources to engage people on a focused agenda. Our experience at Bank of Baroda has been that the business agenda and problems have been shared with the employees on a continuous basis and they have been convinced of the need for change and high performance. 6. Employees are equally concerned about business performance and it is up to the leadership to understand their concerns and work out mechanisms to reach out to them for eective engagement. 7. Employees, by and large, naturally crave to be part of the winning team. When the CEO provides the torch to ignite their craving, employees will disregard attempts by extraneous forces to stymie transformation initiatives. 8. Major transformation of the variety that Bank of Baroda has witnessed requires extraordinary energy. Employees are encouraged to rethink fundamentally and reshape the businesses even while they continue to run them on a day-to-day basis. 9. Sharing success stories helps crystallize and reinforce the meaning of transformation and gives people condence that it will actually work. 10. Employees expect the CEO to live up to the famous edict for things to change, rst I must change. A CEO is always in front of the cameras when they speak or act. Every move he makes is visible to all; everything he says is audible to all. Therefore, the best approach is to lead by example. When the CEO becomes the organizations chief role model, the transformation story is complete. 11. When the CEO is perceived across the organization as no-nonsense, hardnosed and mission-driven, the transformation journey is smoother and the objectives of transformation are achieved with lesser turbulence. People respond when they nd authenticity and credibility in leadership for achieving results; mere sermonization will not evoke a positive response. Some Issues of Academic Research The Bank of Baroda case as presented here throws up quite a few signicant HRD issues that could have implications for research for yielding insight into the new type of HRD requirements relevant for the current economic climate. I list below some such issues: 1. Is there any conict between pursuing HRD values and achieving business excellence? Can they be part of the same coin? If yes, under what circumstances?

Transformation of an Indian Public Sector Bank

213

2. Has traditional HRD outlived itself? Is it that a new combination of roles is now emerging, like HRD with IT, HRD with Quality, HRD with Marketing, etc.? A new trend is visible in organizations where CFOs are also taking up HRD roles. Is it because HRD is important for grooming CFOs as CEOs or is it to bring business orientation to HRD functions? 3. In a competitive performance driven environment, are we creating macho HRD? . Assertive . Productivity driven . Demanding High Performance . High Task Orientation. How can the softer side of HRD and the harder side of business be integrated? What are the implications for HRD education and training? 4. Role of HRD in the success of CEOs what critical HRD role can CEOs play? What does it take to be a successful and eective HRD leader? 5. Many people still do not know what HRD can do. Therefore, it is essential that some HRD models and case studies revolving around the critical and central role that HRD has played in the turnaround/transformation/business success of an organization be brought out and show-cased. 6. Why do some HRD managers fail? Why do some succeed? What dierentiates and distinguishes a successful HRD manager from those who fail? 7. How come HRD is seen as a tender-minded function? Does it make it ineective? Why HRD managers continue to get shrouded in mushiness? What is its impact on line managers? 8. How can HRD managers and line managers work together and how can their work roles be complementary? Conclusion This paper succinctly details how organizational transformation has been brought about in a 99-year-old public sector bank in India through use of HRD values blended with business direction, and by creating and promoting a facilitative environment for turbo-charging the change process. Reaching out to people, constantly communicating and sharing with them the positives and the negatives of organization performance and re-energizing them with newer challenges are some of the specic HRD interventions used by the CEO of Bank of Baroda to turn it around in the quickest possible time. Passion for performance is no more a mere slogan, but a grounded reality that has produced tangible business results, evident from the HRD-business connection taking deep roots in the organization. This has truly been an organizational transformation covering not only business growth but also a complete business upheaval in terms of business direction, change initiatives and the intensity of change. A downswing has been converted into an upswing and, viewed alongside the enormity of change eorts and the number of changes initiated and successfully implemented, it is a classic case of an organization where human resources have been successfully harnessed and HRD has played a central role in the entire transformation exercise.

You might also like

- Final Report - Bank of BarodaDocument9 pagesFinal Report - Bank of BarodaShahroz MemonNo ratings yet

- Maybank: Organisational Transformation Through Human ResourcesDocument20 pagesMaybank: Organisational Transformation Through Human ResourcesHridaya RamanarayananNo ratings yet

- Establishing A Strong Digital FootprintDocument10 pagesEstablishing A Strong Digital FootprintTANVINo ratings yet

- Leadership Code Introduction For Supervisor 2Document12 pagesLeadership Code Introduction For Supervisor 2aih cungkringNo ratings yet

- Little Blue Book On SchedulingDocument107 pagesLittle Blue Book On SchedulingScott NeillNo ratings yet

- Group Discussion: Prepared By:-Tanpreet KaurDocument24 pagesGroup Discussion: Prepared By:-Tanpreet KaurTanpreet MehndirattaNo ratings yet

- MGMT 142-Principles of Management-Muhammad AyazDocument6 pagesMGMT 142-Principles of Management-Muhammad AyazAhsan Ahmed MoinNo ratings yet

- DiruDocument84 pagesDirudhiru_hadiaNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Final Presentation BANK OF BARODA 1Document8 pagesFinal Presentation BANK OF BARODA 1Pooja GoyalNo ratings yet

- Bank of Baroda ReportDocument62 pagesBank of Baroda ReportLakshya SharmaNo ratings yet

- Customers Satisfaction in Public and Private Sector Banks in India A Comparative Study PDFDocument8 pagesCustomers Satisfaction in Public and Private Sector Banks in India A Comparative Study PDFchandra sekar genjiNo ratings yet

- Bank Merger of Bank of Baroda, Vijaya Bank & Dena Bank - Latest News Update! - Testbook BlogDocument6 pagesBank Merger of Bank of Baroda, Vijaya Bank & Dena Bank - Latest News Update! - Testbook BlogSai KiranNo ratings yet

- B B F A R: ANK OF Aroda Inancial Nalysis EportDocument31 pagesB B F A R: ANK OF Aroda Inancial Nalysis Eportlaxmi_bodduNo ratings yet

- A Comparative Study On SBI and HDFC in Ambala City Ijariie5997Document11 pagesA Comparative Study On SBI and HDFC in Ambala City Ijariie5997vinayNo ratings yet

- Kotak FinalDocument46 pagesKotak FinalRahul FaliyaNo ratings yet

- SBI Home Loan TMV BlackbookDocument106 pagesSBI Home Loan TMV Blackbookvishal birajdarNo ratings yet

- Aditya Project Work 2Document42 pagesAditya Project Work 2aditya mayukh100% (1)

- A Project Report On: "A Study On Banking Services in Bank of Baroda"Document63 pagesA Project Report On: "A Study On Banking Services in Bank of Baroda"pranoyNo ratings yet

- Kotak Mahindra Bank 121121123739 Phpapp02Document112 pagesKotak Mahindra Bank 121121123739 Phpapp02RahulSinghNo ratings yet

- Banking Sector Reforms FULL REPORT - 1 - Commerce Seminar TopicsDocument2 pagesBanking Sector Reforms FULL REPORT - 1 - Commerce Seminar TopicsAvishek NandiNo ratings yet

- Universal Banking HDFCDocument62 pagesUniversal Banking HDFCrajesh bathulaNo ratings yet

- Bank of Baroda Training and Development (Repaired)Document7 pagesBank of Baroda Training and Development (Repaired)SHANKAR PRINTINGNo ratings yet

- Final Project SBI ProductDocument56 pagesFinal Project SBI Productkunal hajareNo ratings yet

- Synopsis Tittle of The Project: A Study of Rural Banking in A State (Maharashtra)Document4 pagesSynopsis Tittle of The Project: A Study of Rural Banking in A State (Maharashtra)Rohit UbaleNo ratings yet

- Questionnaire: Analysis On Non Performing AssetsDocument4 pagesQuestionnaire: Analysis On Non Performing AssetsSimar DhillonNo ratings yet

- Retail Banking Literature ReviewDocument1 pageRetail Banking Literature ReviewAsh Jerk100% (1)

- Organization StructureDocument1 pageOrganization StructureShruti SharmaNo ratings yet

- Micro FinanceDocument30 pagesMicro FinanceSakshi BhaskarNo ratings yet

- Bba ProjectDocument47 pagesBba ProjectAayush SomaniNo ratings yet

- Sidbi 39Document43 pagesSidbi 39HARSHAL PATADENo ratings yet

- Npa of SbiDocument40 pagesNpa of SbiLOCAL ADDA WAALENo ratings yet

- Synopsis On Home LoanDocument9 pagesSynopsis On Home Loanyash jejaniNo ratings yet

- SWOT and Technical Analysis of Banks Namely ICICI, SBI, and HDFCDocument6 pagesSWOT and Technical Analysis of Banks Namely ICICI, SBI, and HDFCSailash RanaNo ratings yet

- Banking Sector ReformsDocument16 pagesBanking Sector ReformsbabuNo ratings yet

- PROJECT WORK Axis and SbiDocument54 pagesPROJECT WORK Axis and SbiSourav MandalNo ratings yet

- A Study On Customer Satisfaction Towards Banking Services of The State Bank of IndiaDocument45 pagesA Study On Customer Satisfaction Towards Banking Services of The State Bank of IndiaArchana YadavNo ratings yet

- Sip ProjectDocument77 pagesSip ProjectShivani PatelNo ratings yet

- A Study of Non Performing Assets in Bank of BarodaDocument68 pagesA Study of Non Performing Assets in Bank of BarodaSuryaNo ratings yet

- Final Presentation: On Comparative Study of Bank's Retail Loan Product at Bank of BarodaDocument11 pagesFinal Presentation: On Comparative Study of Bank's Retail Loan Product at Bank of BarodaPrgya SinghNo ratings yet

- Naziya Bank of BarodaDocument72 pagesNaziya Bank of Barodaaadil shaikhNo ratings yet

- Industry Introduction: About Bakery Food IndustryDocument22 pagesIndustry Introduction: About Bakery Food IndustryPrachi PilaniNo ratings yet

- Growth in Banking SectorDocument30 pagesGrowth in Banking SectorHarish Rawal Harish RawalNo ratings yet

- Loan & Credit Facility Provided by Different BanksDocument72 pagesLoan & Credit Facility Provided by Different Bankskaushal2442No ratings yet

- Banking Structure in IndiaDocument5 pagesBanking Structure in IndiaCharu Saxena16No ratings yet

- Iob 2Document104 pagesIob 2Krishna Kant PariharNo ratings yet

- Comparative Study On Financial Performance of State Bank of India and Bank of BarodaDocument62 pagesComparative Study On Financial Performance of State Bank of India and Bank of BarodaVIKAS MishraNo ratings yet

- ReportDocument120 pagesReportAman Prakash100% (2)

- Boi ProjectDocument133 pagesBoi ProjectrupalijaiswalNo ratings yet

- Project On Retail Assets of BOB OkDocument76 pagesProject On Retail Assets of BOB OkKanchan100% (1)

- E BankingDocument100 pagesE BankingCenu RomanNo ratings yet

- Kittur Rani Channamma Urban Credit Souharda Sahakari LTDDocument11 pagesKittur Rani Channamma Urban Credit Souharda Sahakari LTDshivaraj goudarNo ratings yet

- CENTRAL BANK OF INDIA PPT (Harshitha) 1Document27 pagesCENTRAL BANK OF INDIA PPT (Harshitha) 1Harshitha Uchil0% (1)

- Master of Commerce: "A Study On Customer Satisfaction Towards E-Banking Services With Special Reference To SBI "Document112 pagesMaster of Commerce: "A Study On Customer Satisfaction Towards E-Banking Services With Special Reference To SBI "Karthick KumaravelNo ratings yet

- Project On Modernization in Banking System in IndiaDocument81 pagesProject On Modernization in Banking System in IndiaSantosh GuptaNo ratings yet

- A Project Report - 2Document62 pagesA Project Report - 2sandhyaNo ratings yet

- Financial Analysis of Bagalkot DCC Bank, BagalkotDocument4 pagesFinancial Analysis of Bagalkot DCC Bank, BagalkotInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Analysis of Product and Services of Bank of BarodaDocument73 pagesAnalysis of Product and Services of Bank of BarodaJdeeNo ratings yet

- Retail Banking Front Office Management Activity For HDFC Bank by Nisha Wadekar This Project Is Very Useful To StudentDocument51 pagesRetail Banking Front Office Management Activity For HDFC Bank by Nisha Wadekar This Project Is Very Useful To Studentganeshkhale7052No ratings yet

- Project Study Report of Aditya KhandelwalDocument87 pagesProject Study Report of Aditya KhandelwalAditya khandelwalNo ratings yet

- Final ProjectDocument80 pagesFinal Projectjubin654No ratings yet

- Loan & Advances in BomDocument50 pagesLoan & Advances in Bomfunkisanju1100% (1)

- Project On Standard Charted BankDocument82 pagesProject On Standard Charted BankViPul82% (11)

- Banking in The New Millennium: Paradigm Changes and ChallengesDocument15 pagesBanking in The New Millennium: Paradigm Changes and ChallengesAvkash LambaNo ratings yet

- Final HRM DHAKADocument30 pagesFinal HRM DHAKAJehan MahmudNo ratings yet

- Lecture 2 Leader-Centred PerspectivesDocument24 pagesLecture 2 Leader-Centred PerspectivesLIVINGSTONE CAESARNo ratings yet

- Organizational Theory and Behaviour Course Outline 14102022 022228pmDocument13 pagesOrganizational Theory and Behaviour Course Outline 14102022 022228pmIncia HaiderNo ratings yet

- Strategic Planning Primer Higher EducDocument30 pagesStrategic Planning Primer Higher EducJrleanne Donatha100% (1)

- The Effects of A House System On School Improvement in ElementaryDocument93 pagesThe Effects of A House System On School Improvement in ElementaryZeina FarhatNo ratings yet

- The Contingency Approach - PPT B.INGGDocument6 pagesThe Contingency Approach - PPT B.INGGYustika WidhantiNo ratings yet

- Performance ModelDocument1 pagePerformance ModelFerdous AminNo ratings yet

- Advanced Management and Leadership Session XV Team Leadership: Coaching and Conflict ResolutionDocument26 pagesAdvanced Management and Leadership Session XV Team Leadership: Coaching and Conflict ResolutionStorai SadatNo ratings yet

- Lesson 6 Bsed At6Document4 pagesLesson 6 Bsed At6Dash GevsNo ratings yet

- Application Essay: B. PNU's Mission Is To Nurture Innovative Teachers and Education Leaders. Describe HowDocument2 pagesApplication Essay: B. PNU's Mission Is To Nurture Innovative Teachers and Education Leaders. Describe HowRanjell Allain Bayona TorresNo ratings yet

- TQMDocument25 pagesTQMFarah AJNo ratings yet

- Engineer As Manager, Consultant and LeaderDocument33 pagesEngineer As Manager, Consultant and LeaderRecall VidyanikethanNo ratings yet

- Research Paper On Organizational Behavior PDFDocument6 pagesResearch Paper On Organizational Behavior PDFafmcueagg100% (1)

- A3 Strategy ArticleDocument4 pagesA3 Strategy Articleunknown139100% (1)

- Factors Affecting The Declining Number of Enrollees in Matutum View Baptist Academy 1Document21 pagesFactors Affecting The Declining Number of Enrollees in Matutum View Baptist Academy 1Laarni D. CaraniasNo ratings yet

- Manpower Planning Work FlowDocument9 pagesManpower Planning Work FlowdeemaNo ratings yet

- The School As An Agent of Social ChangeDocument12 pagesThe School As An Agent of Social ChangeFranz Simeon Cheng100% (4)

- General Instructions: Marketing Plan GuidelinesDocument10 pagesGeneral Instructions: Marketing Plan GuidelinesaistopNo ratings yet

- Campus MoverDocument65 pagesCampus MoverAnonymous 5GWJIcgO0wNo ratings yet

- PGX B Civic EducationDocument15 pagesPGX B Civic EducationIwan Sukma NurichtNo ratings yet

- All Rights Reserved by Berkeley ResearchDocument8 pagesAll Rights Reserved by Berkeley ResearchSundeep GillNo ratings yet

- How To Write A Structured Abstract (New)Document3 pagesHow To Write A Structured Abstract (New)wulanNo ratings yet

- Quality Management Processes - DocxDocument3 pagesQuality Management Processes - DocxAhmad Syarif FaishalNo ratings yet

- Submitted By:-Abhinav Jindal 501804092 Kritika Bhatia 501804095 Tushar Aggarwal 501804131 1MB3Document7 pagesSubmitted By:-Abhinav Jindal 501804092 Kritika Bhatia 501804095 Tushar Aggarwal 501804131 1MB3Tushar AggarwalNo ratings yet

- Pengembangan Produk BaruDocument13 pagesPengembangan Produk BaruMuhammad FauziNo ratings yet

- MGNT110 - Final PresentationDocument18 pagesMGNT110 - Final PresentationToànNo ratings yet