Professional Documents

Culture Documents

Synopsis Disst.

Synopsis Disst.

Uploaded by

Brijesh GandhiCopyright:

Available Formats

You might also like

- Financial Analysis of The Laxmi Bank Latest VersionDocument10 pagesFinancial Analysis of The Laxmi Bank Latest VersionMillionaire MentalityNo ratings yet

- Measuring Customer Satisfaction: Exploring Customer Satisfaction’s Relationship with Purchase BehaviorFrom EverandMeasuring Customer Satisfaction: Exploring Customer Satisfaction’s Relationship with Purchase BehaviorRating: 4.5 out of 5 stars4.5/5 (6)

- Summer Training Report Diya 1Document40 pagesSummer Training Report Diya 1navdeep2309No ratings yet

- Synopsis Customer Satisfaction in Retail BankingDocument9 pagesSynopsis Customer Satisfaction in Retail BankingRuchi KashyapNo ratings yet

- 7.hasnain Safdar Butt Final PaperDocument11 pages7.hasnain Safdar Butt Final PaperiisteNo ratings yet

- Review of Related LiteratureDocument11 pagesReview of Related LiteratureRo BinNo ratings yet

- Report First Draft-First CorrectedDocument39 pagesReport First Draft-First CorrectedPrakash KhadkaNo ratings yet

- Related Theories: and Keller 2006, 144.)Document8 pagesRelated Theories: and Keller 2006, 144.)Jiro SantiagoNo ratings yet

- Grab Food Food Panda RRL LeDocument5 pagesGrab Food Food Panda RRL LeAui PauNo ratings yet

- Chapter 1Document6 pagesChapter 1Fakir TajulNo ratings yet

- New Microsoft Word Document - OdtDocument5 pagesNew Microsoft Word Document - OdtObsetan HurisaNo ratings yet

- CHPTER2Document25 pagesCHPTER2JOEFRAN ENRIQUEZNo ratings yet

- Chapter 2 Literature ReviewDocument5 pagesChapter 2 Literature ReviewAmarnath KNo ratings yet

- KuzakDocument3 pagesKuzakAnonymous OxMAxCHNo ratings yet

- Research Proposal - BU7756Document16 pagesResearch Proposal - BU7756Yugandhar KumarNo ratings yet

- Name: Aima Shahid Roll No: 15401 Semster Submitted To: Sir ShaukatDocument11 pagesName: Aima Shahid Roll No: 15401 Semster Submitted To: Sir ShaukatAhmad MujtabaNo ratings yet

- ProjectDocument85 pagesProjectPansy ShardaNo ratings yet

- Customer Satisfaction TheoryDocument8 pagesCustomer Satisfaction TheoryFibin Haneefa100% (1)

- CultfitDocument12 pagesCultfitKS SreeragNo ratings yet

- Oriental Bank of CommerceDocument35 pagesOriental Bank of CommerceAmit Kumar ChaurasiaNo ratings yet

- Project Report On AdidasDocument33 pagesProject Report On Adidassanyam74% (38)

- Customer Satisfaction in Kancheepuram 2003Document11 pagesCustomer Satisfaction in Kancheepuram 2003Shano InbarajNo ratings yet

- Chapter 2Document22 pagesChapter 2Okorie Chinedu PNo ratings yet

- Measuring Customer Satisfaction in The Banking IndustryDocument9 pagesMeasuring Customer Satisfaction in The Banking Industrymevrick_guyNo ratings yet

- Chapter 2Document6 pagesChapter 2DivaxNo ratings yet

- 03 - Chapter 2 PDFDocument22 pages03 - Chapter 2 PDFLalajom HarveyNo ratings yet

- Review of Related Literature and StudiesDocument7 pagesReview of Related Literature and StudiesNadineNo ratings yet

- A Research ProposalDocument14 pagesA Research ProposalMIAN USMANNo ratings yet

- 1.1. Background of The StudyDocument35 pages1.1. Background of The StudyfitsumNo ratings yet

- Factors Determining Customer SatisfactionDocument24 pagesFactors Determining Customer SatisfactionAnand sharmaNo ratings yet

- Review of Related LiteratureDocument3 pagesReview of Related LiteratureAya Leah0% (1)

- Chapter One 1.1 Background of The StudyDocument23 pagesChapter One 1.1 Background of The StudyDamtewNo ratings yet

- Coca Cola ReportDocument49 pagesCoca Cola ReportBhaskarani PradeepNo ratings yet

- Dhampur Sugar MillsDocument27 pagesDhampur Sugar MillsSuneel SinghNo ratings yet

- Customer SatisfactionDocument4 pagesCustomer SatisfactionThat Pahadi GirlNo ratings yet

- Background To The StudyDocument98 pagesBackground To The StudyJehan Marie GiananNo ratings yet

- Rajeshwari Final ReportDocument53 pagesRajeshwari Final ReportLakshmi SaraswathiNo ratings yet

- Renita-Why Do Customer SwitchDocument18 pagesRenita-Why Do Customer SwitchakfaditadikapariraNo ratings yet

- MR Gowtham Aashirwad Kumar - A Study On Customer SatisfactionDocument19 pagesMR Gowtham Aashirwad Kumar - A Study On Customer SatisfactionRohit KumarNo ratings yet

- A Written PropoposalDocument7 pagesA Written Propoposalvalentina cultivo100% (1)

- Customer Satisfaction, A: Business TermDocument4 pagesCustomer Satisfaction, A: Business TermDurga Prasad KNo ratings yet

- Market Research Survey ReportDocument25 pagesMarket Research Survey ReportRahul SahuNo ratings yet

- Chapter 1 BpoDocument12 pagesChapter 1 BpogkzunigaNo ratings yet

- AbstractDocument46 pagesAbstractArpit CmNo ratings yet

- Factors Influencing Customer SatisfactioDocument8 pagesFactors Influencing Customer SatisfactioashutoshNo ratings yet

- Indiamart Internship ReportDocument94 pagesIndiamart Internship Reportdhavalshukla50% (2)

- What Is Customer SatisfactionDocument8 pagesWhat Is Customer SatisfactionDeepa .SNo ratings yet

- Relationship Between Customer Satisfaction and ProfitabilityDocument51 pagesRelationship Between Customer Satisfaction and ProfitabilityNajie LawiNo ratings yet

- Marketing: Customer Satisfaction Is A Term Frequently Used inDocument7 pagesMarketing: Customer Satisfaction Is A Term Frequently Used inLucky YadavNo ratings yet

- The Relationship Between Customer Satisfaction and Customer Loyalty in The Banking Sector in SyriaDocument9 pagesThe Relationship Between Customer Satisfaction and Customer Loyalty in The Banking Sector in Syriamr kevinNo ratings yet

- 044 Emrah CengizDocument13 pages044 Emrah CengizChiranjeevi Revalpalli RNo ratings yet

- Customer SatisfactionDocument40 pagesCustomer SatisfactionVenkata PrasadNo ratings yet

- ManuscriptDocument13 pagesManuscriptleizelNo ratings yet

- Review of Literature: SatisfactionDocument10 pagesReview of Literature: SatisfactionKing KrishNo ratings yet

- Customer SatisfactionDocument7 pagesCustomer SatisfactionSSEMATIC RAQUIBNo ratings yet

- Chapter 2 - Review of LiteratureDocument10 pagesChapter 2 - Review of LiteratureLaniNo ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewRuee TambatNo ratings yet

- Customer SatisfactionDocument5 pagesCustomer SatisfactionSalwa KamarudinNo ratings yet

- Chapter-1 Introduction and Research Design: 1.1.1 Customer SatisfactionDocument16 pagesChapter-1 Introduction and Research Design: 1.1.1 Customer SatisfactionpiusadrienNo ratings yet

- The Changing Global Marketplace Landscape: Understanding Customer Intentions, Attitudes, Beliefs, and FeelingsFrom EverandThe Changing Global Marketplace Landscape: Understanding Customer Intentions, Attitudes, Beliefs, and FeelingsNo ratings yet

- The Successful Strategies from Customer Managment ExcellenceFrom EverandThe Successful Strategies from Customer Managment ExcellenceNo ratings yet

- Suffolk Federal Credit Union, Plaintiff, vs. Federal National Mortgage Association Defendant.Document29 pagesSuffolk Federal Credit Union, Plaintiff, vs. Federal National Mortgage Association Defendant.Foreclosure FraudNo ratings yet

- Investment Banking Interview QuestionsDocument3 pagesInvestment Banking Interview QuestionsdaweiliNo ratings yet

- Credit CardDocument3 pagesCredit Cardprashant1807No ratings yet

- Challan 45005 BrilliantDocument1 pageChallan 45005 BrilliantDreamers' ProductionNo ratings yet

- Branch Banking SystemDocument16 pagesBranch Banking SystemPrathyusha ReddyNo ratings yet

- CH10 Finan Acc Long Term Liab LectDocument28 pagesCH10 Finan Acc Long Term Liab LectAbdul KabeerNo ratings yet

- AB BankDocument134 pagesAB BankENAMUL HAQUENo ratings yet

- Q2 W1 General MathematicsDocument39 pagesQ2 W1 General MathematicsSamantha ManibogNo ratings yet

- Pfi KPK FormDocument3 pagesPfi KPK FormSaud ur RehmanNo ratings yet

- What The Finance Function Is: The Determination of Fund RequirementsDocument6 pagesWhat The Finance Function Is: The Determination of Fund RequirementsAmyiel FloresNo ratings yet

- Contract in Islamic Finance and Banking.: BWSS 2093Document49 pagesContract in Islamic Finance and Banking.: BWSS 2093otaku himeNo ratings yet

- Media Lions ShortlistDocument18 pagesMedia Lions Shortlistadobo magazineNo ratings yet

- Case DigestDocument7 pagesCase DigestYolanda Janice Sayan FalingaoNo ratings yet

- SHUATS Online Application FormDocument2 pagesSHUATS Online Application FormANJALI BINDNo ratings yet

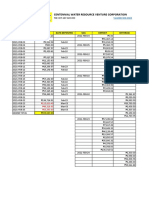

- Morong Branch: Centennial Water Resource Venture CorporationDocument10 pagesMorong Branch: Centennial Water Resource Venture CorporationChesca SantiagoNo ratings yet

- Thomson Reuters PresentationDocument19 pagesThomson Reuters PresentationSashi DandamudiNo ratings yet

- April 2019Document72 pagesApril 2019Sunil UndarNo ratings yet

- Internship Report (Sakibul Alam)Document36 pagesInternship Report (Sakibul Alam)Mohammad MamunNo ratings yet

- SummerInternships DRUCKDocument8 pagesSummerInternships DRUCKRishim90No ratings yet

- Case Study On NDB and DFCCDocument34 pagesCase Study On NDB and DFCCRantharu AttanayakeNo ratings yet

- FDIC v. Icard, Merrill, Cullis, Timm, Furen & Ginsburg, P.A., 11th Cir. (2014)Document24 pagesFDIC v. Icard, Merrill, Cullis, Timm, Furen & Ginsburg, P.A., 11th Cir. (2014)Scribd Government DocsNo ratings yet

- Money 4 LifeDocument92 pagesMoney 4 LifeDamilolaNo ratings yet

- As Cabanatuan RFO BungalowDocument1 pageAs Cabanatuan RFO BungalowMao WatanabeNo ratings yet

- The SanctuaryDocument5 pagesThe SanctuaryDaniel Charaf LossadaNo ratings yet

- Pas 24 Related Party DisclosuresDocument1 pagePas 24 Related Party DisclosuresJNo ratings yet

- AP Debt WaiverDocument10 pagesAP Debt WaiverChandra ReddyNo ratings yet

- Quiz BFDocument7 pagesQuiz BFjolinaNo ratings yet

- A Study On Customer Satisfaction at HDFC Bank, VijayapuraDocument70 pagesA Study On Customer Satisfaction at HDFC Bank, Vijayapurapatelhotel786No ratings yet

Synopsis Disst.

Synopsis Disst.

Uploaded by

Brijesh GandhiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Synopsis Disst.

Synopsis Disst.

Uploaded by

Brijesh GandhiCopyright:

Available Formats

Introduction

Banks, being service industry, they are directly related to customers. The customers are the lifeblood of their business. However, it is to be remembered by the bankers that a customer is not just money in the cash register of the banks but a human being with feelings and therefore, deserves the most courteous attention. Hence, the banks require a high-level customer interface and understanding customers requirements. The banking industry is highly competitive, in the era of competition where it is just not between the banks but non-banking institutions are also other players in the ring. Hull (2002) This study is intended to determine the gap between the services and level of satisfaction provided by Private and Public sector banks to the customers. It contains general concept of the Public sector banks, Private sector banks, Service Quality, Customer satisfaction, Comparison between Services of these Banks. Customer Satisfaction refers to the extent to which customers are happy with the products and services provided by an enterprise. Despite Extensive research in the years researchers are yet to develop a consensual definition of consumer satisfaction. Specifically, there is an overriding theme of consumer satisfaction. Cardozo (1965) For example, consumer satisfaction has been presented as an Affective Response (Halstead, Hartman, and Schmidt 1994) Overall Evaluation (Fornell 1992) Psychological State (Howard and Sheth 1969) Global Evaluative Judgment (Westbrook 1987) Summary Attribute Phenomenon (Oliver 1992) Evaluative Response (Day 1984)

Given these complexities and context-specific nature of satisfaction, it is impossible to develop a generic global definition. Rather, the definition of satisfaction must be contextually adapted. Nevertheless, customer satisfaction is an ambiguous and abstract concept and the actual state of satisfaction will vary from person to person and product/service to product/service. The state of satisfaction depends on a number of both psychological and physical variables which correlate

with satisfaction behaviors. The level of satisfaction can also vary depending on other options which the customer may have and against which the customer can compare the organization's products or services.

The Customer Satisfaction paradigm posits that Confirmed standards lead to moderate satisfaction; Positively disconfirmed (exceeded) standards lead to high Satisfaction, and Negatively disconfirmed (underachieved) standards lead to Dissatisfaction. Mackoy (1995)

Customer Satisfaction Customer

Customer is always looking for the best value for the money invested by him. Thus, lot of efforts are there by the customer to search for the least cost products and services delivering the best quality above all. (Strategic direction, 2007)

Satisfaction

Satisfaction is that state of mind which emerges from the process of considering or analyzing the things/ product /service, quality of product and service, benefits of product/service obtained against what was perceived or expected during pre-purchase decision. Fecikova (2004) y

Customer Satisfaction Level of customer satisfaction may be affected by many internal and external factors. So it is not an easy task to determine the level of customer satisfaction. Abdulla rozario Zones of Consumer Satisfaction

Wow

OK

10 9 8 7 6 5

Zone of Complete Satisfaction

Zone of Average Satisfaction

Zone of Dissatisfaction

Ouch

Adopted from- A White Paper by Paul Hague of B2B International

It is not that customer satisfaction has fallen by the wayside; rather it is that, businesses recognise that a satisfied customer isnt necessarily a loyal one. Let's think about that for a minute. Why may a satisfied customer not be loyal? There could be a number of reasons. Firstly they may not be that satisfied. In most of researches satisfaction is measured on scales and, on a scale from 1 to 10, most companies achieve a score of around 8. This is right in the middle of which is called corridor of average satisfaction which spans from 7 to 9. In other words, 8 out of 10 might sound good, but it is only OK. If you want your customers to stay loyal, you have to have scores of 9 out of 10 on the things that really matter. (A White Paper by Paul Hague of B2B International) Customer satisfaction is buzzword today, once here everyone using this customers satisfaction is affected by the importance placed by the customers on each of the attitudes of the product/ service. Customer satisfaction measurement allows an organization to understand the key drivers that create satisfaction or dissatisfaction; and what is really driving their satisfaction during a service experience. Customer satisfaction is the state of mind that customers have about a company when their expectations have been met or exceeded over the lifetime of the product or service Kevin Caciopp (1995) It is also feeling of a customer towards a product or service after the product has been used. Satisfaction also acts as link between pre-exposure and post-exposure attitudinal components. It

is a major outcome of marketing activity whereby it serves as a link between the various stages of consumer buying behavior. Jamal (2002) When customers pay money to buy a service he has some minimum expectations from the transaction. These expectations from the purchase have to be met substantially, if not entirely for the customer to become a loyal customer of the service Akbar (2009) Satisfied customers are more likely to engage relationship with their bank. Customer satisfaction has a positive impact on loyalty .Boulding (1993)

Measurement of Customer Satisfaction in Service Industry

The measurement of Customer Satisfaction (CS) in Service Industries requires special considerations due to difficulties of finding accurate Measurement Parameters comparing with manufacturing industries. There are many factors that make Customer Satisfaction (CS)-based performance measurement difficult for Service. One of the most complicated factors that make performance evaluation of service industries is the:

i.

Intangible Nature of the Services

ii.

Heterogeneity (Behavior and Expectations of the customer being served and need to customize the Service Delivery accordingly);

iii.

Human contact (Human Tendency)

iv.

Simultaneity (the difficulties of Inspection as service cannot be measured before Consumption). Arun (2006).

Factors influencing the Satisfaction Behavior

There are ten factors which influence Satisfaction behavior. Berry (1990) 1. Quality

2. Value 3. Timeliness 4. Efficiency 5. Ease of Access 6. Environment 7. Inter-departmental Teamwork 8. Front line Service Behavior 9. Commitment to the Customer 10. Innovation Thus, these factors affect the Satisfaction level of Customer at every stage of Decision making whether its Post-Purchase Behavior or Pre-Purchase Analysis. Any deficiency while delivering the committed service to customer can lead to Consequences and make him switch over to the competitors. Environment influences the most while availing the Service, if external aspects ( other customers, hygienity, Concentration of customer himself etc.) are disturbing or mood-spoiling it may lead to poor service. Berry (1990)

Some Other Factors

Customer Satisfaction is influenced by many other factors such as:

Features of Product and Service Consumer Emotions / Mood state Outcome of the Service Perception about ROI Other Consumers Family Members

Features of product/services being delivered impact the Behavior of customers, having different family background, difference in perceptions are some forces which are continuously influencing the Satisfaction Behavior. Outcome or Result and Experience of the services or goods is one of the critical factors influencing not only the satisfaction but Re-Purchase Behavior of the Customer.

(Mary jo bitner Services Marketing)

Background of the Study

It is not only satisfaction of customer which makes him take the decision of purchasing a product but Service Quality is also a player which possess the capacity to change the game of Buying and selling to a great extent. Before 1983, the definition of Quality was defined primarily based on the concept of Quality Control with corresponding standards focused completely on achieving quality.

While Juran defined quality as "Suitable use", Crosby defined it as "Consistent with needs" Later, it was realized that the service industry requires a broader definition of quality than that used by the manufacturing industry. From the customers perspective, Service Quality significantly influences Customer Satisfaction and Customer Satisfaction has direct influences on purchase intentions. Research findings indicate that Service Quality influences Purchase Intentions more than does Customer Satisfaction. It is therefore imperative on the part of bankers to stress upon both Service Quality and Customer Satisfaction, in order to raise the purchase intentions of customers. The empirical results of the present study may therefore provide improved insights on Banking Service as it seeks to simultaneously analyze Service Quality and Customer Satisfaction.

Service Quality

Service Quality and Customer Satisfaction are very critical and important aspects tied to each other in such a way that a slight stretch can lead to vicious circle of disaster or progress. Thus, Service Quality in Banking implies consistently Anticipating and Satisfying the needs and Expectations of Customers. However, evaluating Service Quality sometimes is not an easy task due to the Intangible Nature of Services.

Hence, the Present Study seeks to develop a common understanding of Service Quality in the Banking Industry across different customer segments of Public and Private Banks in Yamuna Nagar. Increase in Service Quality of the Banks can satisfy and develop attitudinal loyalty which ultimately retains valued customers. There is very strong Relationship between Quality of Service and Customer Satisfaction. Perceived service quality is viewed as the degree and direction of discrepancy or difference between customers' perceptions and desires. Parasuraman (1985)

Compliance

Assurance Service Quality Empathy

Customer Satisfaction

Representativeness

Dimensions of Service Quality

Adopted from Parasuraman (1985)

Performance

Conformance

Durability

Reliability

Empathy

QUALITY

As fig. shows, five dimensions together form the QUALITY i. Reliability Ability to perform and deliver the promised service dependably and accurately ii. iii. iv. v. Durability Life expectancy of service Performance Efficient Delivery of service Conformance Confirming to the Standards Empathy Considering the You attitude

(Zeithaml / Mary jo bitner - Services Marketing) Thus, these five dimensions when present altogether , makes the Quality. If any of the above element is absent in the Services, it takes the form of Poor Quality Service.

Some Quality Attributes

Search Quality This type of Quality is not present in Services most of the times. Experience Quality It is found in both goods and Services.

Credence Quality This Quality is Highly present in Services Technical Quality Services and goods often have this type of Quality. Functional Quality Present in Goods and Services.

(Zeithaml - Services Marketing)

Banking

Indian Banking Well developed Banking System prevails in India. These banks were founded by the Entrepreneurs in India, it was era of Pre independence when these banks used to provide financial assistance to the traders, industrialists and agriculturists and still providing solutions in context of raising funds. These banks contribute in the Economic Development by arranging finance and catering to the financial needs of industries. The globalization, liberalisation measures brought in a completely new operating environment to the banks. Any where banking telebanking , internet banking , web banking, e-banking, e business etc have become the buzz words of the day and the banks are trying to compete by offering innovation and attractive packaged technology based services to their customers. Due to the arrival of foreign banks and financial institutions setting up of a number of private banks, now the cut-throat competition emerges not only between Private and Public Sector Indian banks but also with many other financial institutions. Sharma(2009) Public Sector Banks Internet bankingfaces the significant changes in service management brought by the cybernetic service encounters. As Internet banking belongs to the group of services explicitly characterized by intangible features, technology mediated customer contact fully supported by exchanging information and know-how between the bank and its client. It is a one-to-one service where every individual bank client happens to interact with a banks web presentation. Service quality in online environments has become recognized as an important factor in determining the success or failure of electronic commerce. (2009)David

Particularly, in the banking sector ICT is one of the most important tools, because it provides many suitable alternative banking channels to the customers. It brings connivance, customer centricity, enhance service quality and cost effectiveness in the banking services. Even now, customers are evaluating their banks based on availability of high-tech services. Therefore, implementation of ICT in the banking business continues to improve the banking service. Many researchers from USA, UK, Finland, Malaysia, Taiwan, etc. have proved that the use of technology positively affects the Customers Satisfaction in Banking industry. But some researches evidenced that, technology based banking service cant satisfy the each and 1every need of the customers and each type of customers. There may be some possibilities of gaps between customers expectations and actual service perception in banking service, which leads to customer dissatisfaction. Kumbhar (2010)

Technology in the banks is presently catching up with a high level of development around the world. The gaps between the Indian banks and their counterparts in the technologically advanced countries are gradually narrowing down. The world has witnessed an information and technological revolution of late. This revolution has touched every aspect of public life including banking. Siam (2006)ss Since two decades, due to an increasingly competitive, saturated and dynamic business environment, retail banks in many countries have adopted customer-driven philosophies to address the rapid and changing needs of their customers. Walker (2008) Hence, there is a need to assess the impact of alternative banking services on customers satisfaction in Indian context to study the level of satisfaction, problems and areas of further improvements. Technological advances have changed the world radically, altering the manner in which individuals conduct their personal and business affairs. Over the past two decades in particular, the banking industry has invested substantial resources in bringing Quality Service to customers. The banking industry is undergoing through the significant technological changes; it has several impacts on customer satisfaction and loyalty. It has revolutionised every industry including banking in the world by rendering faster and cost effective delivery of products and services to the customers.Core banking solution enables banks to extend the full benefits of ATM, telebanking, mobile banking, internet banking, card banking and other multiple delivery channels to

all customers allowing banks to offer a multitude of customer-centric services on a 24x7 basis from a single location, supporting retail as well as corporate banking activities. Chakrabarty(2007) Now, Indian banks are investing heavily in the technologies such as branch automation and computerization, core banking, tele-banking, mobile banking (M-banking), internet banking, automated teller machine (ATMs), data warehousing etc. ICT innovations in the previous few years have changed the landscape of banks in India Mittal and Dhingra (2007) Today public sector and private sector banks are offering online banking services. Various alternative channels to provide easy and any where banking are properly thought of. The process of bank computerization was started since 1985 in public sector banks in India. However, some private sector banks have started computerization prior to the public sector banks in India. The banks in India are using High-Tech Services not only to improve their own internal processes but also to increase facilities and services to their customers. .

Chapter 2 Literature Review

Kumar(2005) The comparative analysis on the services among three major banking segments revealed that the foreign banks have topped the list in terms of delivering qualitative customer service. The study also revealed that the private sector banks compete successfully with foreign banks and make efforts to provide better banking services in tune with the changing global competitive scenario. Khan(2008) Implied that Indian banks should take care of the needs of customers when introducing various services to them. Their study revealed that customers of banks such as ICICI, IDBI, HDFC, PNB and SBI were either in service or self employed. Many customers of SBI and PNB were found to be retired from their respective profession. Thus they recommended that banks should envisage a strategy to serve customers with different occupations & educational backgrounds. Banks must also advance their customer-centric strategies by providing satisfaction through services leading to better relationship building and earning profits for the banks. Sudesh(2007) Revealed that poor service quality in public sector banks is mainly because of deficiency in tangibility, lack of responsiveness and empathy. Private sector banks, on the other hand, were found to be more reformed in this regards. Above all, the foreign banks were relatively close to the expectations of their customers with regard to various dimensions of service quality. Kumar(2007) Revealed that customers expectations exceeded their perceptions, with regards to various dimensions of service quality. They further claimed that perception of either positive or negative service quality was related to the customers future behavioral intentions. Therefore, if a positive quality gap exists, the customers would tend to comment positively about the service. On the contrary, a negative quality gap would result in customers complaining, switching to other service providers, commenting negatively about the provider or just decreasing the usage of the service. Hence it is recommended that the banks should continuously monitor the service quality levels so as to avoid erosion of service quality and migration or switching by customers to another bank.

McDougall A study conducted by confirmed and reinforced the idea that unsatisfactory customer service leads to a drop in customer satisfaction and willingness to recommend the service to a friendThis would in turn lead to an increase in the rate of switching by customers. Ganesh(2000) More Current research in this area found that businesses can often acquire repeat customers by providing service that surpasse their expectations . De Jong(2000) In this paper we consider a specific way in which the new tendencies influence the organization of banking transactions, namely through a more extensive use of close customer relations. Such relationships are often seen in the recent business literature as means to build valuable capabilities.

Munari(2000) The focus of this paper is on such relational contracts. Extant literature suggests that firms that adopt this type of contracts are characterized by customer-oriented internal policies and longterm relaionships .

Costa(1995) Finally, attention to customer needs and the quality of the offered services give rise to customer satisfaction and retention. In order to build potentially valuable customer relations, a customer- rather than product-centered approach is often held to be necessary, one on which the focus is on the personalized management of a certain number of accounts and not of a certain number of products .

Noteboom(2000) Relationships can be characterized in terms of their nature (strategic alliances, vertical relationships, lateral and horizontal relationships and their intensity (e.g., contact frequency and

quantity and type of the information exchanged. They can be divided into two main groups: Relationships within a firm and relationships with the external environment.

Idem(1999) Building a customer-centered approach requires certain internal competencies, and arguably also an internal organization that fosters knowledge sharing are necessary. Thus, customer satisfaction and loyalty are both a result and a source of competency creation.

Sirdeshmukh(1998) In business, trust is viewed as one of the most relevant antecedents of stable and collaborative relationships. Researchers had established that trust is essential for building and maintaining long-term relationships.

Leeds(1992) This paper Focus on the fact that Quality of service depends heavily on the Quality of its personnel. This is well documented in the study that approximately 40 percent of customers switched banks because of what they considered to be poor service. Further it states that nearly three-quarters of the banking customers mentioned Teller Courtesy as a prime consideration in choosing a bank. The study also showed that increased use of Service Quality/sales and Professional Behaviour(such as formal greetings) improved Customer Satisfaction and reduced Customer Attrition.

Walker (2008) Since two decades, due to an increasingly competitive, Saturated and Dynamic Business Environment, Retail Banks in many countries have adopted Customer-Driven philosophies to address the Rapid and Changing Needs of their Customers.

Shrotriya (2007) Customers are now looking for multiple delivery channels and flexible as well as convenient working hours neither the clock nor the geographical locations are constraints. Therefore, almost

all Indian commercial banks are providing services through the various alternative e-channels it is also called as Alternative Banking

Pairot (2008) Customers Satisfaction is something related with the Banks ability to fulfill the Business, Emotional, and Psychological Needs of its Customers. However, Customers have different levels of Satisfaction as they have different Attitudes and Experiences as perceived from the Banks.

Woodruff (1983) Brand reputation has significant impacts on Customer Satisfaction. A consumer's beliefs about these brands are derived from personal use experience, word-of-mouth endorsements/criticisms, and/or the marketing efforts of companies. MSallem (2009) This research shows that Brands that are high in brand equity are organizations powerful assets. They can lead to customer satisfaction and customer loyalty. Brand loyalty achieved through the Satisfaction with brand performance.

Kevin Cacioppo (1995) Customer satisfaction measurement allows an organization to understand the key drivers that create satisfaction or dissatisfaction; and what is really driving their satisfaction during a service experience. Customer satisfaction is the state of mind that customers have about a company when their expectations have been met or exceeded over the lifetime of the product or service.

Nasser (2002) Satisfaction is a feeling or attitude of a customer towards a product or service after it has been used. Satisfaction appears to reflect the changes between pre-exposure and post-exposure of the components of the products/services. It is a major outcome of marketing activity whereby it serves as a link between the various stages of consumer buying behavior. When customers pay money to buy a service or product he has some minimum expectations from the transaction.

Parvez (2009) Better quality for the same cost is the motto of the customers. Sometimes they are prepared to overlook inconveniences also to avail better services or product at a low cost. Various empirical researches show that there is significant and positive relationship in service quality and customer satisfaction. Parasuraman (1985) Increase in service quality of the banks can satisfy and develop attitudinal loyalty which ultimately retains valued customers. There is very strong relationship between quality of service and customer satisfaction The higher level of perceived service quality results in increased customer satisfaction.

Kour and Kour (2011) Perceived value also one of the important factors which influencing customers satisfaction in service setting. Perceived value is compression between price or charges paid for the services or product by the customer as sacrifice of the money and utility derived by service perception.

Johnson(2008) Concluded that the influence of various dissatisfaction such as inefficiency, chaos, incompetence and isolation on online banking customer satisfaction is driven by consumer performance ambiguity and consumer trust in the technology. They leads to the relationship between service quality and satisfaction.

Szymanski (2001) Some widely reported determinants of customer satisfaction include service quality, performance, desires, effect and equity which makes the Banking Industry a highly competitive industry worldwide.

Ciptono and Soviyanti (2007) Customer Service Quality (CSM) plays an important role in success and survival of a service organization like a bank. Furthermore, on the other side it is identified as the most important factor of competitive advantage.

Burch, Rogers and Underwood (1995) Gaps between customers expectation and what they perceive from services can be measured as service quality. In addition, it was found that when customers want to evaluate service quality, they count on their experience properties.

Research Methodology

Objectives of the Study

* To ascertain the perceptions of customers regarding the service quality in banks. * To analyze and compare the Level of satisfaction of the customers in private and public banks. * To identify the areas which need improvement so that the quality of service of these banks is enhanced.

Research Methodology

Research Design

Research design is a plan specifying the method and procedure for collection and analyzing needed information. The research design in this project is descriptive. Descriptive research includes surveys and fact-finding inquiries of different kinds. For this study, descriptive research design is used where the data is collected through the questionnaire. The information is gathered from the different customers of the two banks.

Data Collection Primary Data will be collected using the questionnaire and personal contact approach. The respondents will be approached personally in order to seek fair and frank responses on quality of service in both the bank customers and bank officials of (HDFC) and (PNB). Secondary data will be collected from the internet, published reports and the fact sheets of ( HDFC ) and (PNB ) Banks

Sample Design This refers to set of rules and procedures that specify how a sample is to be selected. This can be either be Probability or Non-Probability. Here, one of the technique of Probability Sampling is being used , Saample will be selected through Stratified Random Sampling.

Sample Unit This is the actual list of sampling units from which the sample, or some stage of the sample, is selected. It is simply a list of the study population. HDFC BANK and PUNJAB NATIONAL BANK are taken as representatives Units for the Study. Sample Size It signifies the number of respondents / items / units to be considered in Sample. Here, Sample Size would be of 300 Respondents.

Sampling Method Stratified Random Sampling Method is used to determine the Final Sample.

Dependent Variables

- Customer Satisfaction

Independent Variables - Bank Services primarily , Banks Physical Features , Personal

Attention given by Employees , Courtesy towards Customer , Prompt/quick Service , Convenient Operating Hours , Safety in Transactions , Fulfillment of Promises , Transparency in Services , Handling the Queries of Customers

Hypothesis The hypothesis of the study is:

H0Null Hypothesis __ There is no significant difference between the Service Quality and Customer Satisfaction of public and private sector banks. H1--__ There is significant difference between the Service Quality and Customer Satisfaction of public and private sector banks.

Questionnaire 1 Perceptions

The following statements relate to your feelings about your bank. Please show the extent to which you believe this bank has the feature described in the statement. Here, we are interested in a number from 1 to 5 that shows your Perceptions about the Bank.

You should rank each statement as follows: Strongly Strongly Agree Disagree

Statement Score

1. The bank has modern looking equipment.

2. The bank's physical features are visually appealing.

3. The bank's reception desk employees are neat appearing.

4. When the bank promises to do something by a certain time, it does so.

5. When you have a problem, the bank shows a sincere interest in solving it.

6. The bank performs the service right the first time.

7. The bank provides its service at the time it promises to do so.

8. Employees in the bank tell you exactly when the services will be performed.

9. Employees in the bank give you prompt service.

10. Employees in the bank are never too busy to respond to your request.

11. The behaviour of employees in the bank instills confidence in you.

12. You feel safe in your transactions with the bank.

13. Employees in the bank are consistently courteous with you.

14. Employees in the bank have the knowledge to answer your questions.

15. The bank gives you individual attention.

16. The bank has operating hours convenient to all its customers.

17. The bank has employees who give you personal attention.

18. The bank has your best interests at heart.

19. The employees of the bank understand your specific needs.

Questionnaire 2 - Expectations

This section of the survey deals with your opinions of banks. Please show the extent to which you think banks should posses the following features. What we are interested in here is a number that best shows you expectations about institutions offering banking services.

You should rank each statement as follows: Strongly Agree Strongly Disagree

Statement Score

1. Excellent banking companies will have modern looking equipment.

2. The physical facilities at excellent banks will be visually appealing.

3. Employees at excellent banks will be neat in their appearance.

4. When excellent banks promise to do something by a certain time, they do.

5. When a customer has a problem, excellent banks will show a sincere interest in solving it.

6. Excellent banks will perform the service right the first time.

7. Excellent banks will provide the service at the time they promise to do so.

8. Employees of excellent banks will tell customers exactly when services will be performed.

9. Employees of excellent banks will give prompt service to customers.

10. Employees of excellent banks will never be too busy to respond to customers' requests.

11. The behaviour of employees in excellent banks will instil confidence in customers

12. Customers of excellent banks will feel safe in transactions. 13. Employees of excellent banks will be consistently courteous with customers.

14. Employees of excellent banks will have the knowledge to answer customers' questions.

15. Excellent banks will give customers individual attention.

16. Excellent banks will have operating hours convenient to all their customers.

17. Excellent banks will have employees who give customers personal service.

18. Excellent banks will have their customers' best interest at heart.

19. The employees of excellent banks will understand the specific

needs of their customers.

Questionnaire 3 - Importance Weights

Listed below are the five sets of features pertaining to banks and the services they offer. We would like to know how much each of these sets of features is important to the customer.

Please allocate 100 points among the five sets of features according to how important it is to you. Make sure the points add up to 100.

Features Points

1. The appearance of the banks physical facilities, equipment, personnel and communication materials.

2. The bank's ability to perform the promised service dependably and accurately

3. The banks willingness to help customers and provide prompt service.

4. The knowledge and courtesy of the bank's employees and their ability to convey trust and confidence.

5. The caring individual attention the bank provides its customers.

Total:

100

You might also like

- Financial Analysis of The Laxmi Bank Latest VersionDocument10 pagesFinancial Analysis of The Laxmi Bank Latest VersionMillionaire MentalityNo ratings yet

- Measuring Customer Satisfaction: Exploring Customer Satisfaction’s Relationship with Purchase BehaviorFrom EverandMeasuring Customer Satisfaction: Exploring Customer Satisfaction’s Relationship with Purchase BehaviorRating: 4.5 out of 5 stars4.5/5 (6)

- Summer Training Report Diya 1Document40 pagesSummer Training Report Diya 1navdeep2309No ratings yet

- Synopsis Customer Satisfaction in Retail BankingDocument9 pagesSynopsis Customer Satisfaction in Retail BankingRuchi KashyapNo ratings yet

- 7.hasnain Safdar Butt Final PaperDocument11 pages7.hasnain Safdar Butt Final PaperiisteNo ratings yet

- Review of Related LiteratureDocument11 pagesReview of Related LiteratureRo BinNo ratings yet

- Report First Draft-First CorrectedDocument39 pagesReport First Draft-First CorrectedPrakash KhadkaNo ratings yet

- Related Theories: and Keller 2006, 144.)Document8 pagesRelated Theories: and Keller 2006, 144.)Jiro SantiagoNo ratings yet

- Grab Food Food Panda RRL LeDocument5 pagesGrab Food Food Panda RRL LeAui PauNo ratings yet

- Chapter 1Document6 pagesChapter 1Fakir TajulNo ratings yet

- New Microsoft Word Document - OdtDocument5 pagesNew Microsoft Word Document - OdtObsetan HurisaNo ratings yet

- CHPTER2Document25 pagesCHPTER2JOEFRAN ENRIQUEZNo ratings yet

- Chapter 2 Literature ReviewDocument5 pagesChapter 2 Literature ReviewAmarnath KNo ratings yet

- KuzakDocument3 pagesKuzakAnonymous OxMAxCHNo ratings yet

- Research Proposal - BU7756Document16 pagesResearch Proposal - BU7756Yugandhar KumarNo ratings yet

- Name: Aima Shahid Roll No: 15401 Semster Submitted To: Sir ShaukatDocument11 pagesName: Aima Shahid Roll No: 15401 Semster Submitted To: Sir ShaukatAhmad MujtabaNo ratings yet

- ProjectDocument85 pagesProjectPansy ShardaNo ratings yet

- Customer Satisfaction TheoryDocument8 pagesCustomer Satisfaction TheoryFibin Haneefa100% (1)

- CultfitDocument12 pagesCultfitKS SreeragNo ratings yet

- Oriental Bank of CommerceDocument35 pagesOriental Bank of CommerceAmit Kumar ChaurasiaNo ratings yet

- Project Report On AdidasDocument33 pagesProject Report On Adidassanyam74% (38)

- Customer Satisfaction in Kancheepuram 2003Document11 pagesCustomer Satisfaction in Kancheepuram 2003Shano InbarajNo ratings yet

- Chapter 2Document22 pagesChapter 2Okorie Chinedu PNo ratings yet

- Measuring Customer Satisfaction in The Banking IndustryDocument9 pagesMeasuring Customer Satisfaction in The Banking Industrymevrick_guyNo ratings yet

- Chapter 2Document6 pagesChapter 2DivaxNo ratings yet

- 03 - Chapter 2 PDFDocument22 pages03 - Chapter 2 PDFLalajom HarveyNo ratings yet

- Review of Related Literature and StudiesDocument7 pagesReview of Related Literature and StudiesNadineNo ratings yet

- A Research ProposalDocument14 pagesA Research ProposalMIAN USMANNo ratings yet

- 1.1. Background of The StudyDocument35 pages1.1. Background of The StudyfitsumNo ratings yet

- Factors Determining Customer SatisfactionDocument24 pagesFactors Determining Customer SatisfactionAnand sharmaNo ratings yet

- Review of Related LiteratureDocument3 pagesReview of Related LiteratureAya Leah0% (1)

- Chapter One 1.1 Background of The StudyDocument23 pagesChapter One 1.1 Background of The StudyDamtewNo ratings yet

- Coca Cola ReportDocument49 pagesCoca Cola ReportBhaskarani PradeepNo ratings yet

- Dhampur Sugar MillsDocument27 pagesDhampur Sugar MillsSuneel SinghNo ratings yet

- Customer SatisfactionDocument4 pagesCustomer SatisfactionThat Pahadi GirlNo ratings yet

- Background To The StudyDocument98 pagesBackground To The StudyJehan Marie GiananNo ratings yet

- Rajeshwari Final ReportDocument53 pagesRajeshwari Final ReportLakshmi SaraswathiNo ratings yet

- Renita-Why Do Customer SwitchDocument18 pagesRenita-Why Do Customer SwitchakfaditadikapariraNo ratings yet

- MR Gowtham Aashirwad Kumar - A Study On Customer SatisfactionDocument19 pagesMR Gowtham Aashirwad Kumar - A Study On Customer SatisfactionRohit KumarNo ratings yet

- A Written PropoposalDocument7 pagesA Written Propoposalvalentina cultivo100% (1)

- Customer Satisfaction, A: Business TermDocument4 pagesCustomer Satisfaction, A: Business TermDurga Prasad KNo ratings yet

- Market Research Survey ReportDocument25 pagesMarket Research Survey ReportRahul SahuNo ratings yet

- Chapter 1 BpoDocument12 pagesChapter 1 BpogkzunigaNo ratings yet

- AbstractDocument46 pagesAbstractArpit CmNo ratings yet

- Factors Influencing Customer SatisfactioDocument8 pagesFactors Influencing Customer SatisfactioashutoshNo ratings yet

- Indiamart Internship ReportDocument94 pagesIndiamart Internship Reportdhavalshukla50% (2)

- What Is Customer SatisfactionDocument8 pagesWhat Is Customer SatisfactionDeepa .SNo ratings yet

- Relationship Between Customer Satisfaction and ProfitabilityDocument51 pagesRelationship Between Customer Satisfaction and ProfitabilityNajie LawiNo ratings yet

- Marketing: Customer Satisfaction Is A Term Frequently Used inDocument7 pagesMarketing: Customer Satisfaction Is A Term Frequently Used inLucky YadavNo ratings yet

- The Relationship Between Customer Satisfaction and Customer Loyalty in The Banking Sector in SyriaDocument9 pagesThe Relationship Between Customer Satisfaction and Customer Loyalty in The Banking Sector in Syriamr kevinNo ratings yet

- 044 Emrah CengizDocument13 pages044 Emrah CengizChiranjeevi Revalpalli RNo ratings yet

- Customer SatisfactionDocument40 pagesCustomer SatisfactionVenkata PrasadNo ratings yet

- ManuscriptDocument13 pagesManuscriptleizelNo ratings yet

- Review of Literature: SatisfactionDocument10 pagesReview of Literature: SatisfactionKing KrishNo ratings yet

- Customer SatisfactionDocument7 pagesCustomer SatisfactionSSEMATIC RAQUIBNo ratings yet

- Chapter 2 - Review of LiteratureDocument10 pagesChapter 2 - Review of LiteratureLaniNo ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewRuee TambatNo ratings yet

- Customer SatisfactionDocument5 pagesCustomer SatisfactionSalwa KamarudinNo ratings yet

- Chapter-1 Introduction and Research Design: 1.1.1 Customer SatisfactionDocument16 pagesChapter-1 Introduction and Research Design: 1.1.1 Customer SatisfactionpiusadrienNo ratings yet

- The Changing Global Marketplace Landscape: Understanding Customer Intentions, Attitudes, Beliefs, and FeelingsFrom EverandThe Changing Global Marketplace Landscape: Understanding Customer Intentions, Attitudes, Beliefs, and FeelingsNo ratings yet

- The Successful Strategies from Customer Managment ExcellenceFrom EverandThe Successful Strategies from Customer Managment ExcellenceNo ratings yet

- Suffolk Federal Credit Union, Plaintiff, vs. Federal National Mortgage Association Defendant.Document29 pagesSuffolk Federal Credit Union, Plaintiff, vs. Federal National Mortgage Association Defendant.Foreclosure FraudNo ratings yet

- Investment Banking Interview QuestionsDocument3 pagesInvestment Banking Interview QuestionsdaweiliNo ratings yet

- Credit CardDocument3 pagesCredit Cardprashant1807No ratings yet

- Challan 45005 BrilliantDocument1 pageChallan 45005 BrilliantDreamers' ProductionNo ratings yet

- Branch Banking SystemDocument16 pagesBranch Banking SystemPrathyusha ReddyNo ratings yet

- CH10 Finan Acc Long Term Liab LectDocument28 pagesCH10 Finan Acc Long Term Liab LectAbdul KabeerNo ratings yet

- AB BankDocument134 pagesAB BankENAMUL HAQUENo ratings yet

- Q2 W1 General MathematicsDocument39 pagesQ2 W1 General MathematicsSamantha ManibogNo ratings yet

- Pfi KPK FormDocument3 pagesPfi KPK FormSaud ur RehmanNo ratings yet

- What The Finance Function Is: The Determination of Fund RequirementsDocument6 pagesWhat The Finance Function Is: The Determination of Fund RequirementsAmyiel FloresNo ratings yet

- Contract in Islamic Finance and Banking.: BWSS 2093Document49 pagesContract in Islamic Finance and Banking.: BWSS 2093otaku himeNo ratings yet

- Media Lions ShortlistDocument18 pagesMedia Lions Shortlistadobo magazineNo ratings yet

- Case DigestDocument7 pagesCase DigestYolanda Janice Sayan FalingaoNo ratings yet

- SHUATS Online Application FormDocument2 pagesSHUATS Online Application FormANJALI BINDNo ratings yet

- Morong Branch: Centennial Water Resource Venture CorporationDocument10 pagesMorong Branch: Centennial Water Resource Venture CorporationChesca SantiagoNo ratings yet

- Thomson Reuters PresentationDocument19 pagesThomson Reuters PresentationSashi DandamudiNo ratings yet

- April 2019Document72 pagesApril 2019Sunil UndarNo ratings yet

- Internship Report (Sakibul Alam)Document36 pagesInternship Report (Sakibul Alam)Mohammad MamunNo ratings yet

- SummerInternships DRUCKDocument8 pagesSummerInternships DRUCKRishim90No ratings yet

- Case Study On NDB and DFCCDocument34 pagesCase Study On NDB and DFCCRantharu AttanayakeNo ratings yet

- FDIC v. Icard, Merrill, Cullis, Timm, Furen & Ginsburg, P.A., 11th Cir. (2014)Document24 pagesFDIC v. Icard, Merrill, Cullis, Timm, Furen & Ginsburg, P.A., 11th Cir. (2014)Scribd Government DocsNo ratings yet

- Money 4 LifeDocument92 pagesMoney 4 LifeDamilolaNo ratings yet

- As Cabanatuan RFO BungalowDocument1 pageAs Cabanatuan RFO BungalowMao WatanabeNo ratings yet

- The SanctuaryDocument5 pagesThe SanctuaryDaniel Charaf LossadaNo ratings yet

- Pas 24 Related Party DisclosuresDocument1 pagePas 24 Related Party DisclosuresJNo ratings yet

- AP Debt WaiverDocument10 pagesAP Debt WaiverChandra ReddyNo ratings yet

- Quiz BFDocument7 pagesQuiz BFjolinaNo ratings yet

- A Study On Customer Satisfaction at HDFC Bank, VijayapuraDocument70 pagesA Study On Customer Satisfaction at HDFC Bank, Vijayapurapatelhotel786No ratings yet